Find out More from Our 2017 Annual Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

• Nos Últimos Dias, Jair Bolsonaro Intensificou a Distribuição De Material Pelo Whatsapp E Também a Presença Nas Redes Sociais

• Nos últimos dias, Jair Bolsonaro intensificou a distribuição de material pelo WhatsApp e também a presença nas redes sociais. É o candidato que mais se mexe e conta com uma estrutura cada vez mais profissional. • Os irmãos Marinho cobraram de Luciano Huck uma decisão se ele sai ou não candidato. E flertam com o ministro do STF Luís Roberto Barroso. • O PPS quer Luciano Huck, mas sofre com a escassez de dinheiro e de tempo de TV. Seu plano B se chama Cristovam Buarque, que lançou seu nome para a presidência e propõe fazer do jornalista Ricardo Noblat candidato ao Senado por Brasília. Noblat gosta da ideia de herdar a cadeira de Cristovam e tem até abril para se filiar ao PPS. • No PSB, é enorme a expectativa pela filiação do ex-ministro do Supremo Tribunal Federal (STF) Joaquim Barbosa, outro potencial candidato a presidente. Marina Silva está quieta demais. Seu partido, a Rede, não empolga, e sua saúde continua sendo um problema. Ciro Gomes (PDT) ainda não aconteceu, e Henrique Meirelles (PSD) tem mais potencial para vice do que para titular. • No PSDB, esfacelado por brigas internas, o principal nome é o do governador Geraldo Alckmin, até aqui um candidato pesado, como indicam as pesquisas. Aos 86 anos, Fernando Henrique Cardoso já dá sinais de que não acharia ruim se uma candidatura – por pura falta de opção e de preferência por aclamação – acabasse caindo no seu colo. Tanto Michel Temer quanto José Sarney anotaram essa impressão em conversas reservadas. • A candidatura de Lula tem como única proposta repetir o passado e começa a dar sinais de que pode se inviabilizar por fadiga de material. -

ANNUAL REPORT 2018 to Generate Economic and Social Value Through Our Companies and Institutions

ANNUAL REPORT 2018 To generate economic and social value through our companies and institutions. We have established a mission, a vision and values that are both our beacons and guidelines to plan strategies and projects in the pursuit of success. Fomento Económico Mexicano, S.A.B. de C.V., or FEMSA, is a leader in the beverage industry through Coca-Cola FEMSA, the largest franchise bottler of Coca-Cola products in the world by volume; and in the beer industry, through ownership of the second largest equity stake in Heineken, one of the world’s leading brewers with operations in over 70 countries. We participate in the retail industry through FEMSA Comercio, comprising a Proximity Division, operating OXXO, a small-format store chain; a Health Division, which includes all drugstores and related operations; and a Fuel Division, which operates the OXXO GAS chain of retail service stations. Through FEMSA Negocios Estratégicos (FEMSA Strategic Businesses) we provide logistics, point-of-sale refrigeration solutions and plastics solutions to FEMSA’s business units and third-party clients. FEMSA’s 2018 integrated Annual Report reflects our commitment to strong corporate governance and transparency, as exemplified by our mission, vision and values. Our financial and sustainability results are for the twelve months ended December 31, 2018, compared to the twelve months ended December 31, 2017. This report was prepared in accordance with the Global Reporting Initiative (GRI) Standards and the United Nations Global Compact, this represents our Communication on Progress for 2018. Contents Discover Our Corporate Identity 1 FEMSA at a Glance 2 Value Creation Highlights 4 Social and Environmental Value 6 Dear Shareholders 8 FEMSA Comercio 10 Coca-Cola FEMSA 18 FEMSA Strategic Businesses 28 FEMSA Foundation 32 Corporate Governance 40 Financial Summary 44 Management’s Discussion & Analysis 46 Contact 52 Over the past several decades, FEMSA has evolved from an integrated beverage platform to a multifaceted business with a broad set of capabilities and opportunities. -

Annual Report Enel Chile 2016 Annual Report Enel Chile 2016 Annual Report Santiago Stock Exchange ENELCHILE

2016 Annual Report Enel Chile 2016 Annual Report Enel Chile Annual Report Santiago Stock Exchange ENELCHILE Nueva York Stock Exchange ENIC Enel Chile S.A. was initially incorporated as Enersis Chile S.A. on March 1st, 2016 and changed to Enel Chile S.A. on October 18th, 2016. As of December 31st, 2016, the total share capital of the Company was Th$ 2,229,108,975 represented by 49,092,772,762 shares. Its shares trade on the Santiago Stock Exchange and the New York Stock Exchange as American Depositary Receipts (ADR). The main business of the Company is the development, operation, generation, distribution, transformation, or sale of energy in any form, directly or through other companies. Total assets of the Company amount to Th$ 5,398,711,012 as of December 31st, 2016. Enel Chile controls and manages a group of companies that operate in the Chilean electricity market. Net profit attributable to the controlling shareholder in 2016 reached Th$ 317,561,121 and operating income reached Th$ 457,202,938. At year-end 2016 the Company directly employed 2,010 people through its subsidiaries in Chile. Annual Report Enel Chile 2016 Summary > Letter from the Chairman 4 > Open Power 10 > Highlights 2016 12 > Main Financial and Operating Data 16 > Identification of the Company and Documents of Incorporation 20 > Ownership and Control 26 > Management 32 > Human Resources 54 > Stock Markets Transactions 64 > Dividends 70 > Investment and Financing Policy 76 > History of the Company 80 > Investments and Financial Activity 84 > Risk Factors 92 > Corporate -

BRAZILIAN POLITICS Agenda and Political Analysis for the Week – Since 1993

BRAZILIAN POLITICS Agenda and political analysis for the week – Since 1993 Arko Advice Compiled exclusively for Arko Advice clients by Scenarios Murillo de Aragão and Cristiano Noronha & Political Analysis Brasília, DF Sunday, May 7, 2006 - Year XIV – Political Atmosphere for the Week The political week will probably be one of the most agitated due to the No. 972 following events: • Silvio Pereira’s allegations regarding the monthly payoff scandal • The OAB’s (Brazilian Bar Association) decision regarding Lula’s impeachment • PMDB party convention to decide on its own candidacy • Attempt to vote provisional measures in the House and Senate • Attempt to vote the mini tax reform in the House • Interview of the new Central Bank directors by the Senate Economic Affairs Committee • PT party’s decision as to its candidate for the government of São Paulo Issues for the Week Lula’s Impeachment. This Monday, the Brazilian Bar Association (OAB) will discuss the initiation of impeachment proceedings against President Lula. Silvio Pereira’s allegations should affect the OAB’s decision, which might take a little more time to ponder the issue. Central Bank. The interviews of Mário Mesquita and Paulo Vieira da Cunha have been scheduled for Tuesday, May 9 by the Senate Economic Affairs Committee as of 10:00 a.m. Mário Mesquita was nominated as Central Bank Director of Special Studies and Paulo Vieira as Central Bank International Affairs Director. Should the nominations be approved, they will follow on to be examined by a floor session, whose agenda is currently blocked by 5 provisional measures. Until these are analyzed the Central Bank directorship nominations cannot be voted. -

Henrique Meirelles Brazilian Democratic Movement (MDB)

Henrique Meirelles Brazilian Democratic Movement (MDB) @meirelles Date of Birth: 31 August, 1945 (age 72) Hometown: Anápolis, Goiás Education: Civil Engineering, University of São Paulo; MBA, Federal University of Rio de Janiero Running mate: Paulo Rabello de Castro - Social Christian Party (PSC) Political History Although Henrique Meirelles has been a prominent voice in Brazilian politics in the past two decades, he began his career in finance, spending 28 years at the U.S.-based multinational BostonBank. In 2002, Meirelles ran successfully for federal deputy as a candidate of the Social Democracy Party (PSDB). The following year he resigned to serve as president of the Brazilian Central Bank under the newly elected President Luiz Inacio Lula da Silva, of the PSDB archrival Workers Party. During his time as the bank’s president, Brazil’s international reserves increased from $37.6 billion to $288.6 billion. Many attribute Brazil’s stability during the 2009 global recession to Meirelles’s influential role in the government. In 2012, Meirelles left government to take senior positions with both Kohiberg Kravis Roberts, a global investment firm, and J&F, a private investment holding company. However, in 2016, he returned as Minister of the Economy in Michel Temer’s newly-formed government, following the impeachment of Lula's successor, President Dilma Rousseff. In 2018, Meirelles stepped down in order to run for president. Corruption Meirelles has not been convicted of any crimes. However, he was among those mentioned in the Paradise Papers, a large set of confidential documents detailing the offshore bank activities of thousands of wealthy individuals. -

Emerging Index - QSR

2 FTSE Russell Publications 19 August 2021 FTSE RAFI Emerging Index - QSR Indicative Index Weight Data as at Closing on 30 June 2021 Index Index Index Constituent Country Constituent Country Constituent Country weight (%) weight (%) weight (%) Absa Group Limited 0.29 SOUTH BRF S.A. 0.21 BRAZIL China Taiping Insurance Holdings (Red 0.16 CHINA AFRICA BTG Pactual Participations UNT11 0.09 BRAZIL Chip) Acer 0.07 TAIWAN BYD (A) (SC SZ) 0.03 CHINA China Tower (H) 0.17 CHINA Adaro Energy PT 0.04 INDONESIA BYD (H) 0.12 CHINA China Vanke (A) (SC SZ) 0.09 CHINA ADVANCED INFO SERVICE 0.16 THAILAND Canadian Solar (N Shares) 0.08 CHINA China Vanke (H) 0.2 CHINA Aeroflot Russian Airlines 0.09 RUSSIA Capitec Bank Hldgs Ltd 0.05 SOUTH Chongqing Rural Commercial Bank (A) (SC 0.01 CHINA Agile Group Holdings (P Chip) 0.04 CHINA AFRICA SH) Agricultural Bank of China (A) (SC SH) 0.27 CHINA Catcher Technology 0.2 TAIWAN Chongqing Rural Commercial Bank (H) 0.04 CHINA Agricultural Bank of China (H) 0.66 CHINA Cathay Financial Holding 0.29 TAIWAN Chunghwa Telecom 0.32 TAIWAN Air China (A) (SC SH) 0.02 CHINA CCR SA 0.14 BRAZIL Cia Paranaense de Energia 0.01 BRAZIL Air China (H) 0.06 CHINA Cemex Sa Cpo Line 0.7 MEXICO Cia Paranaense de Energia (B) 0.07 BRAZIL Airports of Thailand 0.04 THAILAND Cemig ON 0.03 BRAZIL Cielo SA 0.13 BRAZIL Akbank 0.18 TURKEY Cemig PN 0.18 BRAZIL CIFI Holdings (Group) (P Chip) 0.03 CHINA Al Rajhi Banking & Investment Corp 0.52 SAUDI Cencosud 0.04 CHILE CIMB Group Holdings 0.11 MALAYSIA ARABIA Centrais Eletricas Brasileiras S.A. -

Annual Report 2017

Annual Report Enel Chile 2017 Santiago Stock Exchange ENELCHILE Nueva York Stock Exchange ENIC Enel Chile S.A. was initially incorporated as Enersis Chile S.A., on March 1, 2016. On October 18, of the same year, the company changed its name to Enel Chile S.A. As of December 31, 2017 the company´s total subscribed and paid capital amounted to Ch$ 4,120,836,253 represented by 49,092,772,762 shares. These shares are traded on the Santiago Stock Exchange and, as American Depository Receipts (ADR) on the New York Stock Exchange. The company’s business is to exploit, develop, operate, generate, distribute, transform and/or sell energy, in any form and nature, directly or through other companies. Total assets as of December 31, 2017, amounted to ThCh $5,694,773,008 . Enel Chile controls and manages a group of companies that operate in the Chilean electricity market. In 2017, net income attributable to the controlling shareholder reached ThCh$ 349,382,642 and operating income was ThCh $578,630,574 . At year end 2017, a total 1,948 people were directly employed by its subsidiaries in Chile. Annual Report Enel Chile 2017 2 Annual Report Enel Chile 2017 Contents > Letter from the Chairman ....................................................................4 > Open Power ........................................................................................8 > Highlights 2017 ................................................................................10 > Main financial and operating data .....................................................14 -

UN CONVENTION AGAINST CORRUPTION CIVIL SOCIETY REVIEW: PERU 2011 Context and Purpose

UN CONVENTION AGAINST CORRUPTION CIVIL SOCIETY REVIEW: PERU 2011 Context and purpose The UN Convention against Corruption (UNCAC) was adopted in 2003 and entered into force in December 2005. It is the first legally binding anti-corruption agreement applicable on a global basis. To date, 154 states have become parties to the convention. States have committed to implement a wide and detailed range of anti-corruption measures that affect their laws, institutions and practices. These measures promote prevention, criminalisation and law enforcement, international cooperation, asset recovery, technical assistance and information exchange. Concurrent with UNCAC’s entry into force in 2005, a Conference of the States Parties to the Convention (CoSP) was established to review and facilitate required activities. In November 2009 the CoSP agreed on a review mechanism that was to be “transparent, efficient, non-intrusive, inclusive and impartial”. It also agreed to two five-year review cycles, with the first on chapters III (Criminalisation and Law Enforcement) and IV (International Co-operation), and the second cycle on chapters II (Preventive Measures) and V (Asset Recovery). The mechanism included an Implementation Review Group (IRG), which met for the first time in June–July 2010 in Vienna and selected the order of countries to be reviewed in the first five-year cycle, including the 26 countries (originally 30) in the first year of review. UNCAC Article 13 requires States Parties to take appropriate measures including “to promote the active participation -

BBB#11 ÁBACO’S BRAZIL BUSINESS BULLETIN Since 1975

HIGH IMPACT IN 2016: Aug.: Rio Olympics New Economic Reality ÁBACO BBB #11 Sept.: Rio Paralympics and Policies Create Brazil Business Bulletin Bienal Art Exposition Major Market Entry Nov.: SP Fashion Week Opportunities Dec.: St. Sylvester Race POST-IMPEACHMENT, MAJOR REFORMS FOR THE BRAZILIAN ECONOMY Extensive reforms are vital to balance federal budget and resume growth. The more conservative new government of interim president Michel Temer already took first steps for an economic turnaround: Named as Finance Minister Henrique Meirelles, conservative ex-CEO of Bank of Boston, Banco Central. Meirelles in turn chose noted apolitical pros to preside Banco Central and BNDES Development Bank. Temer mounted his cabinet with legislators noted for ability to gain consensus in the congress. To cut expenses, reduced bloated ministries from 32 to 23 and vowed to oust 4000 political appointees. Signaled accelerated privatization of state properties such as airports, highways. Revealed plans to get government out of businesses, favoring private enterprise. Reversed foreign policy focus, “unfriending” populist regimes and seeking favor with main world powers. Same day impeachment of Dilma Rousseff was finalized, flew to China for G20 and trade negotiations. Temer had tacit endorsement of the Senate’s 75% that voted to impeach Dilma Rousseff (Workers Party). Brazil #4 in Diabetes Rio Olympics in Numbers 15m sufferers: Brazil trails only China, Spectators worldwide: 5,000,000,000 USA, and India. Since 2003 toll surged Tourists in Rio de Janeiro: 1,170,000 34%; 500 cases appear daily. Foreign tourists: 410,000 with largest 5m diabetics suffer complications groups from USA, Argentina, Germany and/or severe consequences: Journalists present in Rio: 26,000 blindness, amputation, kidneys Hotel occupation: 94% failure, heart attacks and strokes. -

Year Award Name Title - Organization

YEAR AWARD NAME TITLE - ORGANIZATION Innovative Leader of the Year H.E. Isabel de Saint Malo de Alvarado Vice President & Minister of Foreign Affairs, Republic of Panama 2 CEO of the Year Fabio Schvartsman CEO, Vale 0 Transformational Leader of the Eduardo Tricio Haro Chairman of the Board, Grupo Lala Year 1 Financier of the Year Eugenio von Chrismar CEO, Banco de Crédito e Inversiones (Bci) 8 Dynamic CEO of the Year Carlos Mario Giraldo Moreno CEO, Grupo Éxito Visionary Leader of the Year Patricia Menéndez-Cambó Vice Chair, Greenberg Traurig BRAVO Legacy Angel Gurría Secretary General, OECD Lifetime Achievement Horst Paulmann Chairman and Founder, Cencosud 2 CEO of the Year Fernando González CEO, CEMEX 0 Visionary CEO Leadership Andrés Conesa CEO, Aeromexico 1 Visionary CEO Leadership Ed Bastian CEO, Delta Air Lines 7 Dynamic CEO of the Year Maria Fernanda Mejia President, Kellogg Latin America Transformational Leader of the Jorge Pérez Chairman and CEO, Related Group Year Innovative Leader of the Year José Antonio Meade Secretary of Finance and Public Credit, Mexico Lifetime Achievement Ali Moshiri President, Chevron Africa and Latin America Exploration and Production 2 Company CEO of the Year Francisco Garza Egloff CEO, Arca Continental 0 Visionary CEO of the Year Marcos Galperín Founder, President and CEO, Mercado 1 Libre, Inc. Transformational City of the Year City of Medellín Accepted by Mayor of Medellín, Federico 6 Gutiérrez Civic Leader of the Year Eduardo J. Padrón President, Miami Dade College Humanitarian of the Year Patricia -

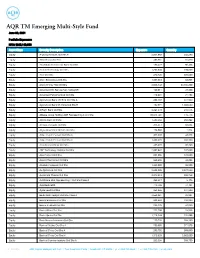

AQR TM Emerging Multi-Style Fund June 30, 2021

AQR TM Emerging Multi-Style Fund June 30, 2021 Portfolio Exposures NAV: $685,149,993 Asset Class Security Description Exposure Quantity Equity A-Living Services Ord Shs H 2,001,965 402,250 Equity Absa Group Ord Shs 492,551 51,820 Equity Abu Dhabi Commercial Bank Ord Shs 180,427 96,468 Equity Accton Technology Ord Shs 1,292,939 109,000 Equity Acer Ord Shs 320,736 305,000 Equity Adani Enterprises Ord Shs 1,397,318 68,895 Equity Adaro Energy Tbk Ord Shs 2,003,142 24,104,200 Equity Advanced Info Service Non-Voting DR 199,011 37,300 Equity Advanced Petrochemical Ord Shs 419,931 21,783 Equity Agricultural Bank of China Ord Shs A 288,187 614,500 Equity Agricultural Bank Of China Ord Shs H 482,574 1,388,000 Equity Al Rajhi Bank Ord Shs 6,291,578 212,576 Equity Alibaba Group Holding ADR Representing 8 Ord Shs 33,044,794 145,713 Equity Alinma Bank Ord Shs 1,480,452 263,892 Equity Ambuja Cements Ord Shs 305,517 66,664 Equity Anglo American Platinum Ord Shs 174,890 1,514 Equity Anhui Conch Cement Ord Shs A 307,028 48,323 Equity Anhui Conch Cement Ord Shs H 1,382,025 260,500 Equity Arab National Bank Ord Shs 485,970 80,290 Equity ASE Technology Holding Ord Shs 2,982,647 742,000 Equity Asia Cement Ord Shs 231,096 127,000 Equity Aspen Pharmacare Ord Shs 565,696 49,833 Equity Asustek Computer Ord Shs 1,320,000 99,000 Equity Au Optronics Ord Shs 2,623,295 3,227,000 Equity Aurobindo Pharma Ord Shs 3,970,513 305,769 Equity Autohome ADS Representing 4 Ord Shs Class A 395,017 6,176 Equity Axis Bank GDR 710,789 14,131 Equity Ayala Land Ord Shs 254,266 344,300 -

Informativo Bursatil

Informativo Bursátil 26 de noviembre de 2020 Año XXIX - Núm 229 • Resumen de Mercado • Resumen de Transacciones de Acciones • Presencia Bursátil de Acciones • Resumen de Transacciones de Cuotas de Fondos • Presencia Bursátil de Cuotas de Fondos • Ofertas de Compra y Venta Vigentes • Valores Extranjeros • Resumen de Transacciones de Renta Fija • Resumen de Transacciones de Intermediación Financiera • Resumen de Operaciones Simultáneas • Operaciones a Plazo Liquidadas Anticipadamente • Operaciones a Plazo Vigentes • Operaciones a Plazo Vigentes por Nemotécnico • Operaciones de Ventas Cortas • Préstamos de Acciones • Operaciones Interbolsas • Hechos Esenciales Bolsa Electrónica de Chile Huérfanos 770, Piso 14, Santiago - Chile. T + 562 - 24840100 / F + 562 - 24840101 / [email protected] / @bolchile / www.bolchile.cl Servicio al Inversionista : 800384100 / Capítulos: 522 - 523 - 147 Informativo bursátil 26 de noviembre de 2020 RESUMEN DE MERCADO PRINCIPALES ALZAS Mercado Negocios Monto ($) Acción Precio ($) Var. (%) Acciones 75 7.989.319.437 ECL 957,03 7.78 Cuotas de Fondos 17 1.524.699.722 AESGENER 137,20 2.05 Valores Extranjeros 0 0 BSANTANDER 34,26 1.81 Renta Fija 2 66.423.757 ANDINA-B 1.698,11 0.19 Intermediación Financiera 3 13.215.233.504 COLO COLO 177,00 0.00 Simultáneas 132 41.036.959.913 Dólar (US$) 1.867 1.019.070.000 ÍNDICES ACCIONARIOS PRINCIPALES BAJAS Variación (%) Acción Precio ($) Var. (%) Índices y sectores Valor Diaria Mensual Anual ENELCHILE 55,93 -3.00 Chile 65 2.313,79 -0.64 15.83 -14.95 COPEC 6.350,00 -2.56 Chileholdings 2.011,19 -0.66 3.59 -10.92 ITAUCORP 2,20 -2.44 Adrian 4.298,25 -0.57 18.50 7.87 FALABELLA 2.700,00 -1.98 Chile large cap 2.103,04 -0.74 17.49 -13.60 CENCOSUD 1.335,00 -1.85 Chile small cap 4.229,70 0.06 5.70 -20.15 Consumo-basico 2.253,89 -0.90 10.22 -20.98 Consumo-discrecional 1.872,28 -1.03 23.28 -12.13 MÁS TRANSADAS Acción Monto ($) Últ.