Informativo Bursatil

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

ANNUAL REPORT 2018 to Generate Economic and Social Value Through Our Companies and Institutions

ANNUAL REPORT 2018 To generate economic and social value through our companies and institutions. We have established a mission, a vision and values that are both our beacons and guidelines to plan strategies and projects in the pursuit of success. Fomento Económico Mexicano, S.A.B. de C.V., or FEMSA, is a leader in the beverage industry through Coca-Cola FEMSA, the largest franchise bottler of Coca-Cola products in the world by volume; and in the beer industry, through ownership of the second largest equity stake in Heineken, one of the world’s leading brewers with operations in over 70 countries. We participate in the retail industry through FEMSA Comercio, comprising a Proximity Division, operating OXXO, a small-format store chain; a Health Division, which includes all drugstores and related operations; and a Fuel Division, which operates the OXXO GAS chain of retail service stations. Through FEMSA Negocios Estratégicos (FEMSA Strategic Businesses) we provide logistics, point-of-sale refrigeration solutions and plastics solutions to FEMSA’s business units and third-party clients. FEMSA’s 2018 integrated Annual Report reflects our commitment to strong corporate governance and transparency, as exemplified by our mission, vision and values. Our financial and sustainability results are for the twelve months ended December 31, 2018, compared to the twelve months ended December 31, 2017. This report was prepared in accordance with the Global Reporting Initiative (GRI) Standards and the United Nations Global Compact, this represents our Communication on Progress for 2018. Contents Discover Our Corporate Identity 1 FEMSA at a Glance 2 Value Creation Highlights 4 Social and Environmental Value 6 Dear Shareholders 8 FEMSA Comercio 10 Coca-Cola FEMSA 18 FEMSA Strategic Businesses 28 FEMSA Foundation 32 Corporate Governance 40 Financial Summary 44 Management’s Discussion & Analysis 46 Contact 52 Over the past several decades, FEMSA has evolved from an integrated beverage platform to a multifaceted business with a broad set of capabilities and opportunities. -

Annual Report Enel Chile 2016 Annual Report Enel Chile 2016 Annual Report Santiago Stock Exchange ENELCHILE

2016 Annual Report Enel Chile 2016 Annual Report Enel Chile Annual Report Santiago Stock Exchange ENELCHILE Nueva York Stock Exchange ENIC Enel Chile S.A. was initially incorporated as Enersis Chile S.A. on March 1st, 2016 and changed to Enel Chile S.A. on October 18th, 2016. As of December 31st, 2016, the total share capital of the Company was Th$ 2,229,108,975 represented by 49,092,772,762 shares. Its shares trade on the Santiago Stock Exchange and the New York Stock Exchange as American Depositary Receipts (ADR). The main business of the Company is the development, operation, generation, distribution, transformation, or sale of energy in any form, directly or through other companies. Total assets of the Company amount to Th$ 5,398,711,012 as of December 31st, 2016. Enel Chile controls and manages a group of companies that operate in the Chilean electricity market. Net profit attributable to the controlling shareholder in 2016 reached Th$ 317,561,121 and operating income reached Th$ 457,202,938. At year-end 2016 the Company directly employed 2,010 people through its subsidiaries in Chile. Annual Report Enel Chile 2016 Summary > Letter from the Chairman 4 > Open Power 10 > Highlights 2016 12 > Main Financial and Operating Data 16 > Identification of the Company and Documents of Incorporation 20 > Ownership and Control 26 > Management 32 > Human Resources 54 > Stock Markets Transactions 64 > Dividends 70 > Investment and Financing Policy 76 > History of the Company 80 > Investments and Financial Activity 84 > Risk Factors 92 > Corporate -

Emerging Index - QSR

2 FTSE Russell Publications 19 August 2021 FTSE RAFI Emerging Index - QSR Indicative Index Weight Data as at Closing on 30 June 2021 Index Index Index Constituent Country Constituent Country Constituent Country weight (%) weight (%) weight (%) Absa Group Limited 0.29 SOUTH BRF S.A. 0.21 BRAZIL China Taiping Insurance Holdings (Red 0.16 CHINA AFRICA BTG Pactual Participations UNT11 0.09 BRAZIL Chip) Acer 0.07 TAIWAN BYD (A) (SC SZ) 0.03 CHINA China Tower (H) 0.17 CHINA Adaro Energy PT 0.04 INDONESIA BYD (H) 0.12 CHINA China Vanke (A) (SC SZ) 0.09 CHINA ADVANCED INFO SERVICE 0.16 THAILAND Canadian Solar (N Shares) 0.08 CHINA China Vanke (H) 0.2 CHINA Aeroflot Russian Airlines 0.09 RUSSIA Capitec Bank Hldgs Ltd 0.05 SOUTH Chongqing Rural Commercial Bank (A) (SC 0.01 CHINA Agile Group Holdings (P Chip) 0.04 CHINA AFRICA SH) Agricultural Bank of China (A) (SC SH) 0.27 CHINA Catcher Technology 0.2 TAIWAN Chongqing Rural Commercial Bank (H) 0.04 CHINA Agricultural Bank of China (H) 0.66 CHINA Cathay Financial Holding 0.29 TAIWAN Chunghwa Telecom 0.32 TAIWAN Air China (A) (SC SH) 0.02 CHINA CCR SA 0.14 BRAZIL Cia Paranaense de Energia 0.01 BRAZIL Air China (H) 0.06 CHINA Cemex Sa Cpo Line 0.7 MEXICO Cia Paranaense de Energia (B) 0.07 BRAZIL Airports of Thailand 0.04 THAILAND Cemig ON 0.03 BRAZIL Cielo SA 0.13 BRAZIL Akbank 0.18 TURKEY Cemig PN 0.18 BRAZIL CIFI Holdings (Group) (P Chip) 0.03 CHINA Al Rajhi Banking & Investment Corp 0.52 SAUDI Cencosud 0.04 CHILE CIMB Group Holdings 0.11 MALAYSIA ARABIA Centrais Eletricas Brasileiras S.A. -

Annual Report 2017

Annual Report Enel Chile 2017 Santiago Stock Exchange ENELCHILE Nueva York Stock Exchange ENIC Enel Chile S.A. was initially incorporated as Enersis Chile S.A., on March 1, 2016. On October 18, of the same year, the company changed its name to Enel Chile S.A. As of December 31, 2017 the company´s total subscribed and paid capital amounted to Ch$ 4,120,836,253 represented by 49,092,772,762 shares. These shares are traded on the Santiago Stock Exchange and, as American Depository Receipts (ADR) on the New York Stock Exchange. The company’s business is to exploit, develop, operate, generate, distribute, transform and/or sell energy, in any form and nature, directly or through other companies. Total assets as of December 31, 2017, amounted to ThCh $5,694,773,008 . Enel Chile controls and manages a group of companies that operate in the Chilean electricity market. In 2017, net income attributable to the controlling shareholder reached ThCh$ 349,382,642 and operating income was ThCh $578,630,574 . At year end 2017, a total 1,948 people were directly employed by its subsidiaries in Chile. Annual Report Enel Chile 2017 2 Annual Report Enel Chile 2017 Contents > Letter from the Chairman ....................................................................4 > Open Power ........................................................................................8 > Highlights 2017 ................................................................................10 > Main financial and operating data .....................................................14 -

Year Award Name Title - Organization

YEAR AWARD NAME TITLE - ORGANIZATION Innovative Leader of the Year H.E. Isabel de Saint Malo de Alvarado Vice President & Minister of Foreign Affairs, Republic of Panama 2 CEO of the Year Fabio Schvartsman CEO, Vale 0 Transformational Leader of the Eduardo Tricio Haro Chairman of the Board, Grupo Lala Year 1 Financier of the Year Eugenio von Chrismar CEO, Banco de Crédito e Inversiones (Bci) 8 Dynamic CEO of the Year Carlos Mario Giraldo Moreno CEO, Grupo Éxito Visionary Leader of the Year Patricia Menéndez-Cambó Vice Chair, Greenberg Traurig BRAVO Legacy Angel Gurría Secretary General, OECD Lifetime Achievement Horst Paulmann Chairman and Founder, Cencosud 2 CEO of the Year Fernando González CEO, CEMEX 0 Visionary CEO Leadership Andrés Conesa CEO, Aeromexico 1 Visionary CEO Leadership Ed Bastian CEO, Delta Air Lines 7 Dynamic CEO of the Year Maria Fernanda Mejia President, Kellogg Latin America Transformational Leader of the Jorge Pérez Chairman and CEO, Related Group Year Innovative Leader of the Year José Antonio Meade Secretary of Finance and Public Credit, Mexico Lifetime Achievement Ali Moshiri President, Chevron Africa and Latin America Exploration and Production 2 Company CEO of the Year Francisco Garza Egloff CEO, Arca Continental 0 Visionary CEO of the Year Marcos Galperín Founder, President and CEO, Mercado 1 Libre, Inc. Transformational City of the Year City of Medellín Accepted by Mayor of Medellín, Federico 6 Gutiérrez Civic Leader of the Year Eduardo J. Padrón President, Miami Dade College Humanitarian of the Year Patricia -

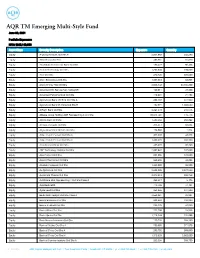

AQR TM Emerging Multi-Style Fund June 30, 2021

AQR TM Emerging Multi-Style Fund June 30, 2021 Portfolio Exposures NAV: $685,149,993 Asset Class Security Description Exposure Quantity Equity A-Living Services Ord Shs H 2,001,965 402,250 Equity Absa Group Ord Shs 492,551 51,820 Equity Abu Dhabi Commercial Bank Ord Shs 180,427 96,468 Equity Accton Technology Ord Shs 1,292,939 109,000 Equity Acer Ord Shs 320,736 305,000 Equity Adani Enterprises Ord Shs 1,397,318 68,895 Equity Adaro Energy Tbk Ord Shs 2,003,142 24,104,200 Equity Advanced Info Service Non-Voting DR 199,011 37,300 Equity Advanced Petrochemical Ord Shs 419,931 21,783 Equity Agricultural Bank of China Ord Shs A 288,187 614,500 Equity Agricultural Bank Of China Ord Shs H 482,574 1,388,000 Equity Al Rajhi Bank Ord Shs 6,291,578 212,576 Equity Alibaba Group Holding ADR Representing 8 Ord Shs 33,044,794 145,713 Equity Alinma Bank Ord Shs 1,480,452 263,892 Equity Ambuja Cements Ord Shs 305,517 66,664 Equity Anglo American Platinum Ord Shs 174,890 1,514 Equity Anhui Conch Cement Ord Shs A 307,028 48,323 Equity Anhui Conch Cement Ord Shs H 1,382,025 260,500 Equity Arab National Bank Ord Shs 485,970 80,290 Equity ASE Technology Holding Ord Shs 2,982,647 742,000 Equity Asia Cement Ord Shs 231,096 127,000 Equity Aspen Pharmacare Ord Shs 565,696 49,833 Equity Asustek Computer Ord Shs 1,320,000 99,000 Equity Au Optronics Ord Shs 2,623,295 3,227,000 Equity Aurobindo Pharma Ord Shs 3,970,513 305,769 Equity Autohome ADS Representing 4 Ord Shs Class A 395,017 6,176 Equity Axis Bank GDR 710,789 14,131 Equity Ayala Land Ord Shs 254,266 344,300 -

Enel Chile Presentación IR Enero 2018 (Inglés)

Enel Chile Electricity Generation & Distribution As of January, 2018 Chile Enel Chile Chile Agenda Project Elqui Process Overview A New Equity Story for Enel Chile Closing Remarks 2 Enel Chile Chile Current Organization Structure – Stable shareholders base Enel Chile Shareholders1 Organization Enel SpA 21,4% Chilean Pension Funds 0,5% ITALY 7,1% ADRs (Citibank N.A.) 60,6% 61% 10,4% Retail Institutional Investors Enel Chile CHILE Enel Generación Chile Shareholders1 60% 99% 17,1% Enel Chile S.A. 2,6% Chilean Pension Funds Enel Gx Chile CHILE Enel Dx Chile CHILE 3,4% ADRs (Citibank N.A.) 16,8% 60,0% Retail Institutional Investors 1. Figures as of December 31, 2017 3 Project Elqui Overview Chile Proposed transaction Enel Chile (“EC”) is lauching a transaction consisting of a corporate reorganization that would entail i) the merger of Enel Chile with EGP Latin America (“EGPL”), and ii) a Tender Offer (“TO”) launched by Enel Chile over Enel Generación Chile (“EGC”) Current situation 1 Cash & Stock(1) PTO 2 Merger EGP Chile – EC Similar 100.0% 60.6% 100.0% 60.6% Latin America Latin America Chile Chile Chile PTO 60-100.0% 100.0% 60.0% 99.1% 100.0% 75-100% 99.1% 100.0% 75-100% 99.1% Generación Distribución Generación Distribución Generación Distribución Chile Chile Chile Chile Chile Chile Merger subject to minimum PTO acceptance of more than 75% of EGC share capital 4 1. EC would pay part of the PTO price to subscribe and deliver the shares of EC to EGC shareholders Project Elqui Proposed Transaction Chile ENEL CHILE proposed transaction terms The Proposed Transaction terms: Cash ~CLP 354 60% per share • provide a fair treatment of all CLP 590 parties involved (proposed Tender Offer PTO per share terms within the ranges set by for EGC price (+20.7% vs. -

MSCI Chile Momentum Tilt Index (USD)

MSCI Chile Momentum Tilt Index (USD) The MSCI Chile Momentum Tilt Index is based on MSCI Chile Index, its parent index, which includes large and mid-cap stocks of the Chilean markets. It aims to reflect the performance of a Momentum strategy with relatively high investment capacity. The indexes are created by tilting the market capitalization weights of all the constituents in the parent index based on the Momentum scores and then re-weighting them. CUMULATIVE INDEX PERFORMANCE — NET RETURNS (USD) ANNUAL PERFORMANCE (%) (AUG 2006 – AUG 2021) MSCI Chile Year Momentum Tilt MSCI Chile 300 MSCI Chile Momentum Tilt 2020 -3.72 -5.59 MSCI Chile 2019 -19.81 -16.94 2018 -17.34 -19.65 2017 46.69 42.23 2016 13.55 15.55 2015 -16.39 -17.67 200 2014 -9.47 -13.01 2013 -20.08 -21.98 148.16 2012 10.09 7.77 128.07 2011 -20.96 -20.39 2010 58.47 44.16 100 2009 74.33 85.56 2008 -33.33 -35.79 50 2007 19.78 23.05 Aug 06 Nov 07 Feb 09 May 10 Aug 11 Nov 12 Feb 14 May 15 Aug 16 Nov 17 Feb 19 May 20 Aug 21 INDEX PERFORMANCE — NET RETURNS (%) (AUG 31, 2021) FUNDAMENTALS (AUG 31, 2021) ANNUALIZED Since 1 Mo 3 Mo 1 Yr YTD 3 Yr 5 Yr 10 Yr Dec 29, 2000 Div Yld (%) P/E P/E Fwd P/BV MSCI Chile Momentum Tilt 4.21 -4.34 22.63 -2.47 -10.94 -1.61 -4.88 6.52 2.05 16.62 12.72 1.43 MSCI Chile 4.72 -3.26 21.83 -1.14 -10.02 -2.05 -5.92 5.30 2.29 18.12 13.43 1.49 INDEX RISK AND RETURN CHARACTERISTICS (DEC 29, 2000 – AUG 31, 2021) ANNUALIZED STD DEV (%) 2 SHARPE RATIO 2 , 3 MAXIMUM DRAWDOWN TrackingTurnover Since Beta 1 3 Yr 5 Yr 10 Yr 3 Yr 5 Yr 10 Yr Dec 29, (%) Period YYYY-MM-DD Error (%) (%) 2000 MSCI Chile Momentum Tilt 0.98 3.67 63.21 30.49 27.49 23.86 -0.27 0.03 -0.12 0.32 70.54 2011-01-03—2020-03-18 MSCI Chile 1.00 0.00 6.78 29.35 26.62 24.02 -0.26 0.01 -0.16 0.27 72.03 2011-01-03—2020-03-18 1 Last 12 months 2 Based on monthly net returns data 3 Based on ICE LIBOR 1M The MSCI Chile Momentum Tilt Index was launched on Aug 27, 2015. -

Annual Report 2020

1 Cencosud Annual Report - 2020 Letter from the President Dear shareholders, It is an honor for me to be the interim replacement of my father, Horst Paulmann Kemna, creator and soul of Cencosud. Just like he taught us, we will keep his focus on Cencosud culture and the careful attention and care for details and the customer. Service, service, service. From a little restaurant to a transnational corporation, with more than 115,000 committed employees, following a path sometimes winding and no stranger to difficulties, but has been able to successfully face it with its passion, vision, and unique leadership. In that context, I present to you Cencosud's Integrated Annual Report and the Company's financial statements corresponding to the tax year 2020, as well as the challenges we had to face during this period. The year 2020 has been extremely complicated because from the very beginning we had to deal with the COVID- 19 pandemic, which is affecting virtually every person in the world and has resulted in significant changes in our daily lives. Some others, like remote working or e-commerce, already were on the horizon. However, the pandemic has accelerated their incorporation into society and these changes are here to stay. In this period, our focus was to look after the health and safety of our employees. I especially want to thank your efforts, dedication, and commitment. Without them we couldn't have kept the continuous operations of our business units and deliver essential goods to the communities we are in. While Chilean national economy shrank by 5.8% in 2020 -the biggest decrease since the crisis of 1982-, Chile had a better performance compared to her neighbor nations and, according to estimates, would be the first Latin American economy to recover. -

SANTANDER LATIN AMERICAN INVESTMENT GRADE ESG BOND Agosto 2021 Información General Política De Inversión

SANTANDER LATIN AMERICAN INVESTMENT GRADE ESG BOND Agosto 2021 Información general Política de inversión El Subfondo invertirá principalmente en bonos corporativos emitidos por emisores corporativos latinoamericanos o por empresas que obtienen más del 60% de sus ingresos de sus operaciones en la región. El Subfondo trata de mantener una puntuación ESG superior a la de su índice de referencia. Gestor Alfredo Mordezki ISIN LU2208607957 Fecha de lanzamiento 22/02/2021 Divisa de Clase USD Rentabilidad acumulada (%)¹ Aportación Mínima 500.000,00 $ Comisión de Gestión 0,25% 1M 3M 6M YTD 1Y Lanzam. Valor Liquidativo 101,79 $ Fondo 0,50 2,41 2,34 - - 2,39 Patrimonio de Fondo $32,62M Índice 0,69 2,42 2,00 - - 1,47 Número de posiciones 51 Duración Media 6,97 YTM Media 3,27% Índice100% JPM CEMBI IG Global Diversified Latam Categoría Rentabilidad anual (%)¹ Entidad gestora Santander AM Lux 2021* 2020 2019 2018 2017 2016 Fondo 2,39 - - - - - Índice 1,47 - - - - - * Desde inicio. Estadísticas* Fondo Índice Volatilidad (%) Ratio de Sharpe Volatilidad anual (%)¹ Ratio de Información Beta 2021* 2020 2019 2018 2017 2016 R2 Fondo 1,92 - - - - - Alfa (%) Índice 1,83 - - - - - Alfa de Jensen (%) * Desde inicio. Correlación Ratio de Treynor Tracking Error (%) * Menos de un año de história, imposible calcular estadísticos. Rendimiento acumulado desde lanzamiento Rentabilidad mensual (%)¹ Ene Feb Mar Abr May Jun Jul Ago Sep Oct Nov Dic Total 2021 - - -0,83 0,45 0,32 1,23 0,65 0,50 - - - - 2,39 2020 - - - - - - - - - - - - 2019 - - - - - - - - - - - - 2018 - - - - - - - - - - - - 2017 - - - - - - - - - - - - 2016 - - - - - - - - - - - - ¹ Cálculos netos de comisiones. Pág. 1 Distribución de cartera 10 principales posiciones (%) 28,47 Divisa (%) Cable Onda Sa 4.5% 30-jan-2030 3,11 USD 100,02 Banco Santander-chile 2.7% 10-jan-2025 2,89 EUR -0,02 Corporacion Lindley S.a. -

APQC MEMBER LIST by ORGANIZATION As of January 31, 2016

APQC MEMBER LIST BY ORGANIZATION as of January 31, 2016 Members of APQC represent leaders in industry, service, government, and education. These organizations come to APQC for best practices and emerging trends, networking opportunities, benchmarking training, and advisory support in their continuing efforts to become and remain world‐ class organizations. MEMBERS A.T. Kearney, Inc. Association of Management Cameco Corporation AARP Consulting Firms (AMCF) Canadian Imperial Bank of Commerce ABB Ltd. Assurant, Inc. Capgemini India Pvt. Ltd. Abbott Laboratories Auditor General of South Africa Cargill Incorporated Abbvie Inc Australia Post Caterpillar Inc. Abt Associates, Inc. Axion Energy Cementos Argos Abu Dhabi Ports BAE Systems CEMEX Research Group AG Abu Dhabi Police / Ministry of Interior Baker Hughes Inc. Cencosud Chile Accenture LLP Banco Pichincha Cenovus Energy Inc. Accident Fund Insurance Banesco Grupo Financiero Centric Consulting LLC adaQuest Internacional Chalhoub Aditya Birla Group Bank Pasargad Chazey Partners Air Liquide Bank of Canada Chesapeake Energy Corporation Airbus SAS BASF Corporation Chevron Corporation Akzo Nobel N.V. Basico Consulting Chicago Bridge & Iron Albemarle Corporation Bayer MaterialScience AG Churchill Consulting Alberta Health Services Baylor College of Medicine Church Health Center Alcoa Inc. BBVA Bancomer, S.A. Ciena Alexion Pharmaceuticals BearingPoint Cisco Systems, Inc. Allison Transmission Bechtel Group, Inc. Citizens Energy Group Alvarez & Marsal Business Consulting, Becton, Dickinson and Company City Of Edmonton LLC Belcorp Coca-Cola Hellenic Austria Alyeska Pipeline Service Company BHP Billiton Petroleum (Deepwater) COFCO Inc American International Group, Inc. Cognizant Technology Solutions India Amgen Inc. Blackbaud, Inc. Pvt Ltd Amtrak BlueCross BlueShield of TN CohnReznick, LLP Anglo American Blueshift Partners Compania Distribuidora, S.A. -

SANTANDER LATIN AMERICAN INVESTMENT GRADE ESG BOND August 2021 Fund Overview Investment Policy

SANTANDER LATIN AMERICAN INVESTMENT GRADE ESG BOND August 2021 Fund overview Investment policy This Sub-Fund will invest mainly in corporate bonds issued by Latin American corporate issuers or by companies that derive more than 60% of their revenues from their operations in the region. The Sub-Fund seeks to maintain an ESG score higher than the ESG score of its benchmark. Fund Manager Alfredo Mordezki ISIN LU2208607957 Launch Date 22/02/2021 Currency Class USD Cumulative performance (%)¹ Minimum Subscription $ 500,000.00 Management Fee 0.25% 1M 3M 6M YTD 1Y Inception NAV 101,79 $ Fund 0.50 2.41 2.34 - - 2.39 Fund AUM $32,62M BMK 0.69 2.42 2.00 - - 1.47 Number of holdings 51 Average Duration 6.97 Average YTM 3.27% BMK 100% JPM CEMBI IG Global Diversified Latam Category Annual performance (%)¹ Fund Company Santander AM Lux 2021* 2020 2019 2018 2017 2016 Fund 2.39 - - - - - BMK 1.47 - - - - - * Since inception. Fund statistics* Fund BMK Volatility (%) Sharpe Ratio Annual volatility (%)¹ Information Ratio Beta 2021* 2020 2019 2018 2017 2016 R2 Fund 1.92 - - - - - Alpha (%) BMK 1.83 - - - - - Jensen Alpha (%) * Since inception. Correlation Treynor Ratio Tracking Error (%) * History under a year, impossible to calculate statistics. Cumulative performance since launch Monthly performance (%)¹ Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Total 2021 - - -0.83 0.45 0.32 1.23 0.65 0.50 - - - - 2.39 2020 - - - - - - - - - - - - 2019 - - - - - - - - - - - - 2018 - - - - - - - - - - - - 2017 - - - - - - - - - - - - 2016 - - - - - - - - - - - - ¹ Performance calculated net of fees. Pag. 1 Portfolio breakdown Top 10 holdings (%) 28.47 Currency allocation (%) Cable Onda Sa 4.5% 30-jan-2030 3.11 USD 100.02 Banco Santander-chile 2.7% 10-jan-2025 2.89 EUR -0.02 Corporacion Lindley S.a.