JFE GROUP REPORT 2019 50 ESG Management the JFE Group CSR REPORT Web Material CSR Issues of the JFE Group

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Csr Report 2017

CSR REPORT 2 0 1 7 CSR REPORT 2017 JFE Holdings, Inc. 2-2-3 Uchisaiwaicho, Chiyoda-ku, Tokyo 100-0011, Japan www.jfe-holdings.co.jp/en Inquiries: Corporate Planning Department JFE Holdings, Inc. Tel: +81-3-3597-4321 Email: [email protected] Contents Editorial Policy This report provides stakeholders with information about JFE’s CSR activities 02 JFE CSR and elicits feedback to support further enhancement of the company’s activities and information disclosure. The 2017 report includes: 03 Message from the CEO • Material CSR issues that JFE is addressing 05 JFE in Society • Interviews of the President and CEO and Outside Directors regarding the reorganization of the Board of Directors and Audit & Supervisory Board 07 Material CSR Issues of the JFE Group • A widened scope of environmental data (e.g., Scope 3 emissions) from Group companies in Japan Management CSR Report Composition and Format 13 FEATURE 1 In the Forefront of Corporate Reader-friendly summary of CSR initiatives Governance (print and PDF) Highlights 19 Corporate Governance (brochure Detailed report on CSR activities and website) 23 CSR Management ( This report and PDF) CSR Report 24 Compliance ( This report and PDF) Extensive data to supplement 26 Risk Management detailed report (PDF) Environmental Data Book (website) Protecting the Environment Scope of Report 29 FEATURE 2 Reporting Period Creating Sustainable Societies with FY2016 (April 1, 2016 to March 31, 2017) Reports on some activities undertaken outside this period are included. World-class Technologies Organizations Covered 35 Environmental Management The report mainly covers the activities of JFE Holdings, Inc. and its three operating companies—JFE Steel Corporation, JFE Engineering Corporation 39 Main Environmental Targets and Results and JFE Shoji Trade Corporation—but it also includes reports on activities of other companies in the JFE Group (376 companies, of which 312 are 41 Material Flow consolidated subsidiaries and 64 are equity-method affiliates). -

Dimethyl Ether) and Its Application Technology†

JFE TECHNICAL REPORT No. 8 (Oct. 2006) New Direct Synthesis Technology for DME (Dimethyl Ether) and Its Application Technology† OHNO Yotaro*1 YOSHIDA Masahiro*2 SHIKADA Tsutomu*3 INOKOSHI Osamu*4 OGAWA Takashi*5 INOUE Norio*6 Abstract: during the 21st century. In realizing sustained growth in Dimethly ether (DME) is a clean fuel that does not this region in the future, energy supply and environmen- produce toxic gases or particulate matter (PM) at burn- tal problems associated with mass energy consumption ing. JFE Group develops a direct synthesis process of will be major problems. High expectations are placed on DME which has advantages in economics. Construction dimethyl ether (DME) as a new fuel which can be syn- of a demonstration plant with 100 t/d capacity was fi n- thesized from diverse hydrocarbon sources, including ished in Nov. 2003. The fi rst demonstrating operation natural gas, can be handled as easily as liquefi ed petro- (Run 100) through Dec. 2003 to Jan. 2004 and the sec- leum gas (LPG), and causes a small load on the environ- ond operation (Run 200) through June 2004 to Aug. ment. Thus, if DME can be produced and distributed 2004 were completed successfully. The conversion of at low cost and in large quantities, this fuel can make synthesis gas, the selectivity to DME and the purity of an important contribution to solving the energy supply DME reached to 96% (Target: more than 95%), 93% problems and environmental problems resulting from (Target: more than 90%) and 99.6% (Target: more than expanded energy consumption expected in Asia in the 99%), respectively. -

Itraxx Japan Series 35 Final Membership List March 2021

iTraxx Japan Series 35 Final Membership List March 2021 Copyright © 2021 IHS Markit Ltd T180614 iTraxx Japan Series 35 Final Membership List 1 iTraxx Japan Series 35 Final Membership List...........................................3 2 iTraxx Japan Series 35 Final vs. Series 34................................................ 5 3 Further information .....................................................................................6 Copyright © 2021 IHS Markit Ltd | 2 T180614 iTraxx Japan Series 35 Final Membership List 1 iTraxx Japan Series 35 Final Membership List IHS Markit Ticker IHS Markit Long Name ACOM ACOM CO., LTD. JUSCO AEON CO., LTD. ANAHOL ANA HOLDINGS INC. FUJITS FUJITSU LIMITED HITACH HITACHI, LTD. HNDA HONDA MOTOR CO., LTD. CITOH ITOCHU CORPORATION JAPTOB JAPAN TOBACCO INC. JFEHLD JFE HOLDINGS, INC. KAWHI KAWASAKI HEAVY INDUSTRIES, LTD. KAWKIS KAWASAKI KISEN KAISHA, LTD. KINTGRO KINTETSU GROUP HOLDINGS CO., LTD. KOBSTL KOBE STEEL, LTD. KOMATS KOMATSU LTD. MARUB MARUBENI CORPORATION MITCO MITSUBISHI CORPORATION MITHI MITSUBISHI HEAVY INDUSTRIES, LTD. MITSCO MITSUI & CO., LTD. MITTOA MITSUI CHEMICALS, INC. MITSOL MITSUI O.S.K. LINES, LTD. NECORP NEC CORPORATION NPG-NPI NIPPON PAPER INDUSTRIES CO.,LTD. NIPPSTAA NIPPON STEEL CORPORATION NIPYU NIPPON YUSEN KABUSHIKI KAISHA NSANY NISSAN MOTOR CO., LTD. OJIHOL OJI HOLDINGS CORPORATION ORIX ORIX CORPORATION PC PANASONIC CORPORATION RAKUTE RAKUTEN, INC. RICOH RICOH COMPANY, LTD. SHIMIZ SHIMIZU CORPORATION SOFTGRO SOFTBANK GROUP CORP. SNE SONY CORPORATION Copyright © 2021 IHS Markit Ltd | 3 T180614 iTraxx Japan Series 35 Final Membership List SUMICH SUMITOMO CHEMICAL COMPANY, LIMITED SUMI SUMITOMO CORPORATION SUMIRD SUMITOMO REALTY & DEVELOPMENT CO., LTD. TFARMA TAKEDA PHARMACEUTICAL COMPANY LIMITED TOKYOEL TOKYO ELECTRIC POWER COMPANY HOLDINGS, INCORPORATED TOSH TOSHIBA CORPORATION TOYOTA TOYOTA MOTOR CORPORATION Copyright © 2021 IHS Markit Ltd | 4 T180614 iTraxx Japan Series 35 Final Membership List 2 iTraxx Japan Series 35 Final vs. -

Research Template

Nomura Asset Management U.K. Ltd Nomura Funds August 2005 JAPAN EQUITY Investment Objective To achieve long term capital growth Fund Price Changes through investment in an actively managed portfolio of Japanese The fund outperformed the benchmark by 6 basis points from the NAV pricing point on the 27th July 2005 securities listed/dealt on Regulated to the NAV on the 31 August 2005. Since inception the fund has outperformed the benchmark by 78 basis Markets in Japan and to outperform points, delivering a performance of 9.12% verses 8.34% of the benchmark. the Benchmark [Being the Morgan Stanley Capital International Japan Total Return (Net of Tax) Index]. Performance of Net Asset Value for the Month (Yen basis) Launch date: April 2005 th rd th th th Period 27 July 3 Aug 10 Aug 17 Aug 24 Aug 31 Aug Base Currency: Japanese Yen Fund (NAVps)* 102,335 103,970 105,080 107,565 109,584 109,123 ISIN Code: LU0217998821 Index (MSCI Japan)** 101,659 102,916 104,224 106,234 108,576 108,340 *Net Asset Value per share (NAVps) is calculated by Nomura Bank (Luxembourg) S.A. according to the prospectus and market standards in Bloomberg Code: Luxembourg. **MSCI Japan is the Morgan Stanley Capital International Japan Total Return (Net of Tax) Index Source: Nomura Asset Management NOMJAEQ LX Equity DES <GO> U.K. Ltd Total Net Assets: Nomura Japan Fund vs MSCI Japan (Net Return) JPY 4,034,857,279.00 110 108 NAV Per Share: JPY 109,123.00 106 104 Fund Contact 102 12-Apr-05, Inception 100 Dt Benchmark 98 Yuhki King 96 +44 (0)20 7521 2635 94 5 5 5 5 [email protected] 5 5 5 5 0 0 0 0 5 5 5 5 5 5 5 -0 -0 -0 -0 - - 05 05 -0 -0 05 0 0 0 05 05 -0 05 05 r r r r y- y- n- n- n n n- l- l-0 l- l- g- g- g- g- p p p ay a a ay u u u u u Ap M M J J J Ju Ju Ju Ju u u ug u u -A -A -A -M -M - - -J -J - - - - - -A -A -A -A -A 0- 1- 8- 1 8 9 6 0 7 7 06 13 2 27 04 1 1 25 0 0 15 22 2 0 13 2 2 03 10 1 24 31 Trevor Langford Source: Nomura Asset Management U.K. -

Briefing for Seventh Medium‐Term Business Plan

JFE Holdings, Inc. Briefing for Seventh Medium-term Business Plan May 7, 2021 Presentation Moderator: We would like to move on to Part 2: JFE Holdings, Inc. Briefing for Seventh Medium-term Business Plan. Mr. Kakigi, Representative Director, President and CEO, will now give an explanation. Kakigi: I am Kakigi from JFE Holdings. I will begin the explanation. First of all, I would like to look back on the Sixth Medium-Term Business Plan. As you are all aware, our earnings deteriorated sharply, mainly in the steel business, mainly due to the effects of trade friction between the US and China and the spread of COVID-19. As you can see here, the steel business was the only one in a very difficult situation. However, looking back, I believe that we have done what we can to establish a foundation to some extent, and one of the things we have done is to announce our individual target of the CO₂ emissions reduction for our steel business last year. The other thing is that each company has been proactive in promoting digital transformation. By operating company, JFE Steel struggled, but it reinforced manufacturing base spending a lot of money. Then, in March last year, it decided to implement structural reform by shutting down the upper process and hot-rolling production lines at Keihin district. 1 JFE Engineering is doing relatively well, and it has expanded its operation business and conducted 2 M&A transactions. JFE Shoji acquired Cogent, a company in Canada, in order to strengthen its electrical steel sheet processing bases, and also promoted SCM* expansion. -

TOBAM Maximum Diversification All World Developed Ex North America USD

TOBAM Maximum Diversification All World Developed ex North America USD 31/12/2019 Instrument Weight BP PLC 0.10% IDEMITSU KOSAN CO LTD 0.21% INPEX HOLDINGS INC 0.07% JX HOLDINGS INC 0.09% NESTE OIL OYJ 1.16% OMV AG 0.08% SANTOS LTD 0.02% SBM OFFSHORE NV 0.05% TGS NOPEC GEOPHYSICAL CO ASA 0.02% VOPAK 0.02% WOOD GROUP (JOHN) PLC 0.02% AIR LIQUIDE 0.23% AIR WATER INC 0.02% AKZO NOBEL 0.12% ALUMINA LTD 0.03% AMCOR PLC-CDI 0.08% AVON RESOURCES LTD 0.53% BORAL LTD 0.02% CHR HANSEN HOLDING A/S 0.08% DAICEL CHEMICAL INDUSTRIES 0.02% DOWA HOLDINGS CO LTD 0.01% EMS-CHEMIE HOLDING AG-REG 0.03% FLETCHER BUILDING LTD 0.02% FORTESCUE METALS GROUP LTD 0.60% GIVAUDAN-REG 0.16% HITACHI CHEMICAL CO LTD 0.03% HUHTAMAKI OYJ 0.03% ISRAEL CHEMICALS LTD 0.02% JAMES HARDIE INDUSTRIES-CDI 0.07% JFE HOLDINGS INC 0.02% KANSAI PAINT CO LTD 0.03% KURARAY CO LTD 0.03% MITSUBISHI MATERIALS CORP 0.02% NEWCREST MINING LTD 1.35% TOBAM Maximum Diversification All World Developed ex North America USD 31/12/2019 Instrument Weight NIPPON PAINT CO LTD 0.05% NIPPON PAPER INDUSTRIES CO L 0.04% NIPPON SHOKUBAI CO LTD 0.01% NISSAN CHEMICAL INDUSTRIES 0.04% NOF CORP 0.02% NORTHERN STAR RESOURCES LTD 0.66% NOVOZYMES A/S-B SHARES 0.07% OJI PAPER CO LTD 0.03% ORICA LTD 0.02% ORORA LTD 0.02% SARACEN MINERAL HOLDINGS LTD 0.32% SMURFIT KAPPA GROUP PLC 0.04% SYMRISE AG 0.04% TAIHEIYO CEMENT CORP 0.02% TAIYO NIPPON SANSO CORP 0.02% TEIJIN LTD 0.02% THYSSENKRUPP AG 0.04% TORAY INDUSTRIES INC 0.02% WIENERBERGER AG 0.02% ADP 0.04% AENA SA 0.09% ALFA LAVAL AB 0.04% ALL NIPPON AIRWAYS CO LTD -

Portfolio of Investments

PORTFOLIO OF INVESTMENTS Variable Portfolio – Partners International Value Fund, September 30, 2020 (Unaudited) (Percentages represent value of investments compared to net assets) Investments in securities Common Stocks 97.9% Common Stocks (continued) Issuer Shares Value ($) Issuer Shares Value ($) Australia 4.2% UCB SA 3,232 367,070 AMP Ltd. 247,119 232,705 Total 13,350,657 Aurizon Holdings Ltd. 64,744 199,177 China 0.6% Australia & New Zealand Banking Group Ltd. 340,950 4,253,691 Baidu, Inc., ADR(a) 15,000 1,898,850 Bendigo & Adelaide Bank Ltd. 30,812 134,198 China Mobile Ltd. 658,000 4,223,890 BlueScope Steel Ltd. 132,090 1,217,053 Total 6,122,740 Boral Ltd. 177,752 587,387 Denmark 1.9% Challenger Ltd. 802,400 2,232,907 AP Moller - Maersk A/S, Class A 160 234,206 Cleanaway Waste Management Ltd. 273,032 412,273 AP Moller - Maersk A/S, Class B 3,945 6,236,577 Crown Resorts Ltd. 31,489 200,032 Carlsberg A/S, Class B 12,199 1,643,476 Fortescue Metals Group Ltd. 194,057 2,279,787 Danske Bank A/S(a) 35,892 485,479 Harvey Norman Holdings Ltd. 144,797 471,278 Demant A/S(a) 8,210 257,475 Incitec Pivot Ltd. 377,247 552,746 Drilling Co. of 1972 A/S (The)(a) 40,700 879,052 LendLease Group 485,961 3,882,083 DSV PANALPINA A/S 15,851 2,571,083 Macquarie Group Ltd. 65,800 5,703,825 Genmab A/S(a) 1,071 388,672 National Australia Bank Ltd. -

Trend of Ironmaking Technology in Japan After 2000

NIPPON STEEL TECHNICAL REPORT No. 123 MARCH 2020 Technical Review UDC 669 . 162 : 622 . 785 /. 788 Trend of Ironmaking Technology in Japan after 2000 Seiji NOMURA* Abstract The first two decades of the 21st century were turbulent for the steel industry. The reor- ganization of the steel industry across borders has progressed and the increased demand for steel products has caused a rise in the price of raw materials such as iron ore and metal- lurgical coal. Furthermore, more emphasis has been placed on global environmental pro- tection and carbon dioxide emission control than ever before. The ironmaking technology division in Japan has struggled to cope with these changes both at home and abroad. This report describes the trend of the development and commercial application of the ironmaking technology of Japan in the first two decades of the 21st century. 1. Introduction—Situation of Japan’s Ironmaking ply of high-quality iron ore and coking coal was suddenly consid- after 2000 ered as a bottleneck, and their market prices became highly volatile Soon after the rapid valuation of the Japanese yen brought about over the last few years depending on the supply-demand balance by the Plaza Accord in 1985, the blast furnace operators of Japan (see Fig. 1). 1) took business streamlining measures and eliminated their blast fur- In contrast, the production amounts of pig iron and crude steel of naces one after another. Then in the 1990s, the Japanese steel indus- Japan have remained substantially unchanged over the last 20 years try was forced into tough times facing sluggish demand resulting except for a temporary and significant slump in the aftermath of from the breakdown of the bubble economy and further valuation of Lehman’s fall, and owing to stagnant domestic steel consumption, the currency. -

Profile of JFE Group

Data Profile of JFE Group Holding Company As of April 1, 2012 Name: Establishment: September 27, 2002 Head Office: 2-2-3 Uchisaiwaicho, Chiyoda-ku, Paid-in Capital: 147.1 billion yen Tokyo 100-0011 Phone: +81-3-3597-4321 (main) URL: http://www.jfe-holdings.co.jp/en/ Operating and Main Group Companies As of April 1, 2012 Steel Business Engineering Business Net Sales: 2,714.4 billion yen Employees: 42,571 Net Sales: 278.7 billion yen Employees: 7,443 Head Of ce: Chiyoda-ku, Tokyo Head Of ce: Chiyoda-ku, Tokyo Group companies Yokohama Head Of ce: Yokohama Electric Furnaces and Bar/Shape Steel Group companies • JFE Bars & Shapes Corporation • JFE Kankyo Corporation • JFE Environmental Service Corporation Manufacture and Sale of Processed Steel Products, • JFE Technos Corporation Raw Materials, etc. • Asuka Soken Co., Ltd. • JFE Chemical Corporation • Japan Tunnel Systems Corporation* • JFE Metal Products & Engineering Inc. • Takeei Co., Ltd.* • JFE Galvanizing & Coating Co., Ltd. • JP Steel Plantech Co.* • JFE Container Co., Ltd. • NKKTUBES* • JFE Mineral Company, Ltd. • JFE Steel Pipe Co., Ltd. • Mizushima Ferroalloy Co., Ltd. Shipbuilding Business • JFE Pipe Fitting Mfg. Co., Ltd. Net Sales: 214.6 billion yen Employees: 3,647 • JFE Kozai Corporation • JFE Material Co., Ltd. • JFE Precision Co., Ltd. Head Of ce: Kawasaki • River Steel Co., Ltd. Group companies • JFE Electrical Steel Co., Ltd. • Universal System & Machinery Co., Ltd. • Philippine Sinter Corporation • Universal Marine Systems Corporation • Thai Coated Steel Sheet Co., Ltd. • Ariake Engineering Company • Shinagawa Refractories Co., Ltd.* • Tsu Marine Works Corporation • Nippon Chuzo K.K.* • Nippon Chutetsukan K.K.* • Dongkuk Steel Mill Co., Ltd.* LSI Business • Guangzhou JFE Steel Sheet Company Ltd.* Net Sales: 21.4 billion yen Employees: 424 • Thai Cold Rolled Steel Sheet Public Co., Ltd.* • JSW Steel Limited.* • California Steel Industries, Inc.* Head Of ce: Chiba Logistics & Warehousing, Facility Maintenance & Group companies Construction and Utilities Supply • Kawasaki Microelectronics America, Inc. -

Aqua Business Merger Between JFE Engineering Corporation and Isomura Hosui Kiko Co., Ltd

News December 5, 2013 JFE Engineering Corporation Isomura Hosui Kiko Co., Ltd. Aqua Business Merger between JFE Engineering Corporation and Isomura Hosui Kiko Co., Ltd. On 28 November, 2013, JFE Engineering Corporation (JFE Engineering) and Isomura Hosui Kiko Co., Ltd. (Isomura Hosui Kiko) have concluded the basic agreement to spin off the waterworks plant business owned by Isomura Hosui Kiko to be merged by JFE Engineering, which will take effect starting May 2014. 1. Purpose of the merger The coverage of water supply and sewerage systems in Japan have reached high levels of 98% for water supply and 76% for sewerage. However, after the Great East Japan Earthquake, many urgent issues have emerged; in particular, preparing for future seismic disasters and renewing facilities built during Japan’s postwar economic boom, which have now reached their lifespan or have become outdated. In addition, local municipalities are increasingly outsourcing the operation of water supply and sewerage systems to the private sector as a means to solve problems caused by a decrease in revenue, such as the shortage of funds and the lack of engineers. As a result, there is unprecedented demand for the overall technical competence and management skills of private corporations. Meanwhile, outside Japan, increasing the coverage of water supply and sewerage systems is an urgent issue for developing countries experiencing rapid urbanization such as those in Southeast Asia, and there is growing expectations to the technology and know-how of Japanese companies in the design, construction and operational management of water supply and sewerage infrastructure. By merging their waterworks plant business under these circumstances, where comprehensive abilities in the fields of water supply and sewerage systems are needed both in Japan and abroad, JFE Engineering and Isomura Hosui Kiko will provide total solutions throughout the entire aqua business field. -

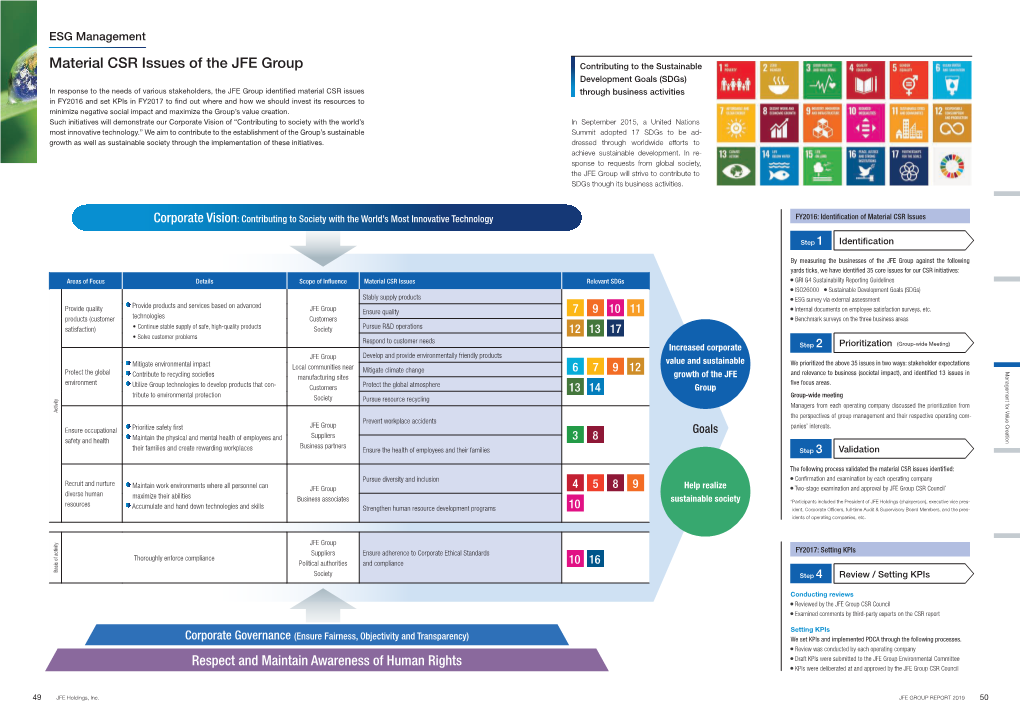

JFE GROUP REPORT 2019 — Integrated Report — Contents Value Creation Strategies to Realize Value Creation

JFE GROUP REPORT 2019 — Integrated Report — Contents Value Creation Strategies to Realize Value Creation 03 COVER STORY Management Strategies 11 Meeting Challenges throughout JFE’s 21 Message from the CEO History Financial Strategies 13 The Value of Steel 29 Message from the CFO 15 Process of Value Creation 31 Financial Highlights 17 Business Model Business Strategies Steel Business and Trading Business 33 Steel Business 19 Business Model 37 Engineering Business Engineering Business 39 Trading Business 40 Shipbuilding Business 41 Feature 01 Business Strategies for the Automotive Market Establish a strong presence through leading- edge technology and global supply network in the face of changing market needs The JFE Group will contribute to society with Corporate Management for Value Creation Vision the world’s most innovative technology. ESG Management 49 Material CSR Issues of the JFE Group 55 Non-financial Highlights 57 Feature 02 JFE Group’s Initiatives for Climate Change Issues 65 Human Resource Development for Sharing and Practicing Group Philosophy Challenging Spirit, Corporate 67 Feature 03 Outside Executives Group Values Interview Outside executives share perspectives on Flexibility & Sincerity the features and effectiveness of JFE’s governance system 76 Message from a New Executive 77 Corporate Governance 83 Thorough Compliance 84 Risk Management 85 Stakeholder Relationships 87 Management Organization Corporate Data 89 Company Profile / Share Information 91 Operating and Main Group Companies Annual Highlights Editorial Policy 93 The JFE GROUP REPORT 2019 (Integrated Report) has been created and published with the aim of having all stakeholders, including shareholders and investors, understand the medium- to long-term value creation narratives within JFE Group. -

Research Template

Nomura Asset Management U.K. Ltd Nomura Funds JAPAN EQUITY October 2006 Fund Price Changes The fund underperformed the benchmark by 78 basis points over one month from 29 September to 31 Investment Objective October 2006. Since inception the fund has underperformed the benchmark by 187 basis points, To achieve long term capital growth delivering a performance of 43.22% verses 45.09% for the benchmark. In the year to date the fund has through investment in an actively managed underperformed the benchmark by 70 basis points, delivering a performance of 1.48% versus 2.18% for portfolio of Japanese securities listed/dealt the benchmark. on Regulated Markets in Japan and to outperform the Benchmark [Being the Performance for the Fund since Inception (Yen basis) Morgan Stanley Capital International Japan Total Return (Net of Tax) Index]. 1 month 3 month 6 month 1 Year YTD Since Inception* Launch date: 12 April 2005 29/9- 31/7-31/10 30/4-30/9 31/10- 31/12- 12/4-31/10 Base Currency: Japanese Yen NAVps** % change 0.18 3.52 -5.01 19.92 1.48 43.22 ISIN Code: LU0217998821 Index (MSCI Japan)*** 0.96 3.99 -3.90 19.84 2.18 45.09 Bloomberg Code: Excess Return -0.78 -0.47 -1.12 0.08 -0.70 -1.87 NOMJAEQ LX Equity DES *Inception date: 12th April 2005. **Net Asset Value per share (NAVps) is calculated by Nomura Bank (Luxembourg) S.A. according to the prospectus and market standards in Luxembourg. ***MSCI Japan is the Morgan Stanley Capital International Japan Total Return (Net of Tax) Total Net Assets as at 31 October 06: Index Source: Nomura Asset Management U.K.