Briefing Office Sector April 2017

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

MEDIA STATEMENT Fujian Beckons Singapore Investors As Chinese

MEDIA STATEMENT REVISED - Embargoed until 25 October 2009, 1800hrs Fujian beckons Singapore investors as Chinese Central Government makes plans for its economic transformation Organised by IE Singapore, the business mission is held in conjunction with SM Goh’s visit from 26 – 30 October 2009. MR No.: 063/09 Singapore, Sunday, 25 October 2009 1. In conjunction with Senior Minister Goh Chok Tong’s visit to Fujian province from 26 – 30 October 2009, International Enterprise (IE) Singapore is organising a mission to Xiamen and Fuzhou to help Singapore-based companies seek business opportunities in the province. Besides IE Singapore officials, the 16- strong delegation comprises representatives from 13 companies of various industries, including transport & logistics, tourism, real estate, masterplanning & consultancy, food processing and more. 2. Fujian province’s GDP grew at a stable 8.5% in the first half of this year. Its investment climate is now even more attractive with the recent announcement by the Central Government to elevate the Economic Zone of the West Coast of Taiwan Straits1 (EZWCTS)(海峡西岸经济区)as a national-level strategy. The EZWCTS is being developed to transform Fujian into an economic hub that not only connects the economic powerhouses of the Pearl River Delta and the Yangtze River Delta, but also serves as a springboard to bring overseas investments into Western and Central China. A key focus of the EZWCTS is the development of Pingtan (平潭岛), a group of islands located just 68 nautical 1 The EZWCTS consists of 21 prefecture cities, the focus of which is on the nine Fujian cities of Xiamen, Fuzhou, Quanzhou, Putian, Zhangzhou, Ningde, Sanming, Longyan and Nanping. -

Shop Direct Factory List Dec 18

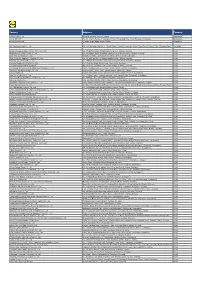

Factory Factory Address Country Sector FTE No. workers % Male % Female ESSENTIAL CLOTHING LTD Akulichala, Sakashhor, Maddha Para, Kaliakor, Gazipur, Bangladesh BANGLADESH Garments 669 55% 45% NANTONG AIKE GARMENTS COMPANY LTD Group 14, Huanchi Village, Jiangan Town, Rugao City, Jaingsu Province, China CHINA Garments 159 22% 78% DEEKAY KNITWEARS LTD SF No. 229, Karaipudhur, Arulpuram, Palladam Road, Tirupur, 641605, Tamil Nadu, India INDIA Garments 129 57% 43% HD4U No. 8, Yijiang Road, Lianhang Economic Development Zone, Haining CHINA Home Textiles 98 45% 55% AIRSPRUNG BEDS LTD Canal Road, Canal Road Industrial Estate, Trowbridge, Wiltshire, BA14 8RQ, United Kingdom UK Furniture 398 83% 17% ASIAN LEATHERS LIMITED Asian House, E. M. Bypass, Kasba, Kolkata, 700017, India INDIA Accessories 978 77% 23% AMAN KNITTINGS LIMITED Nazimnagar, Hemayetpur, Savar, Dhaka, Bangladesh BANGLADESH Garments 1708 60% 30% V K FASHION LTD formerly STYLEWISE LTD Unit 5, 99 Bridge Road, Leicester, LE5 3LD, United Kingdom UK Garments 51 43% 57% AMAN GRAPHIC & DESIGN LTD. Najim Nagar, Hemayetpur, Savar, Dhaka, Bangladesh BANGLADESH Garments 3260 40% 60% WENZHOU SUNRISE INDUSTRIAL CO., LTD. Floor 2, 1 Building Qiangqiang Group, Shanghui Industrial Zone, Louqiao Street, Ouhai, Wenzhou, Zhejiang Province, China CHINA Accessories 716 58% 42% AMAZING EXPORTS CORPORATION - UNIT I Sf No. 105, Valayankadu, P. Vadugapal Ayam Post, Dharapuram Road, Palladam, 541664, India INDIA Garments 490 53% 47% ANDRA JEWELS LTD 7 Clive Avenue, Hastings, East Sussex, TN35 5LD, United Kingdom UK Accessories 68 CAVENDISH UPHOLSTERY LIMITED Mayfield Mill, Briercliffe Road, Chorley Lancashire PR6 0DA, United Kingdom UK Furniture 33 66% 34% FUZHOU BEST ART & CRAFTS CO., LTD No. 3 Building, Lifu Plastic, Nanshanyang Industrial Zone, Baisha Town, Minhou, Fuzhou, China CHINA Homewares 44 41% 59% HUAHONG HOLDING GROUP No. -

Factory Address Country

Factory Address Country Durable Plastic Ltd. Mulgaon, Kaligonj, Gazipur, Dhaka Bangladesh Lhotse (BD) Ltd. Plot No. 60&61, Sector -3, Karnaphuli Export Processing Zone, North Potenga, Chittagong Bangladesh Bengal Plastics Ltd. Yearpur, Zirabo Bazar, Savar, Dhaka Bangladesh ASF Sporting Goods Co., Ltd. Km 38.5, National Road No. 3, Thlork Village, Chonrok Commune, Korng Pisey District, Konrrg Pisey, Kampong Speu Cambodia Ningbo Zhongyuan Alljoy Fishing Tackle Co., Ltd. No. 416 Binhai Road, Hangzhou Bay New Zone, Ningbo, Zhejiang China Ningbo Energy Power Tools Co., Ltd. No. 50 Dongbei Road, Dongqiao Industrial Zone, Haishu District, Ningbo, Zhejiang China Junhe Pumps Holding Co., Ltd. Wanzhong Villiage, Jishigang Town, Haishu District, Ningbo, Zhejiang China Skybest Electric Appliance (Suzhou) Co., Ltd. No. 18 Hua Hong Street, Suzhou Industrial Park, Suzhou, Jiangsu China Zhejiang Safun Industrial Co., Ltd. No. 7 Mingyuannan Road, Economic Development Zone, Yongkang, Zhejiang China Zhejiang Dingxin Arts&Crafts Co., Ltd. No. 21 Linxian Road, Baishuiyang Town, Linhai, Zhejiang China Zhejiang Natural Outdoor Goods Inc. Xiacao Village, Pingqiao Town, Tiantai County, Taizhou, Zhejiang China Guangdong Xinbao Electrical Appliances Holdings Co., Ltd. South Zhenghe Road, Leliu Town, Shunde District, Foshan, Guangdong China Yangzhou Juli Sports Articles Co., Ltd. Fudong Village, Xiaoji Town, Jiangdu District, Yangzhou, Jiangsu China Eyarn Lighting Ltd. Yaying Gang, Shixi Village, Shishan Town, Nanhai District, Foshan, Guangdong China Lipan Gift & Lighting Co., Ltd. No. 2 Guliao Road 3, Science Industrial Zone, Tangxia Town, Dongguan, Guangdong China Zhan Jiang Kang Nian Rubber Product Co., Ltd. No. 85 Middle Shen Chuan Road, Zhanjiang, Guangdong China Ansen Electronics Co. Ning Tau Administrative District, Qiao Tau Zhen, Dongguan, Guangdong China Changshu Tongrun Auto Accessory Co., Ltd. -

Briefing Office Sector March 2016

Savills World Research Xiamen Briefing Office sector March 2016 Image: W Square, Siming district SUMMARY In 2016, the development of the Xiamen Grade A office market will still be concentrated on Xiamen Island. The mainland market will gradually tap into its potential with the growth in construction and the urbanisation of the city. Two new projects, the Rents increased 0.6% to an Thai·Hercynian Centre in the Haicang average of RMB93.6 per sq m per district and the World Overseas month, up 0.1% YoY. “An influx of new supply is Chinese International Conference expected in 2016, and the office Center (WOCICC) in the Siming Strata-title transaction prices district, launched onto the market in increased 0.8% quarter-on-quarter stock of Xiamen will be pushed 2015, adding a total of 385,475 sq m. (QoQ) to RMB23,139 per sq m, up 0.8% YoY. up to a relatively high level. Net take-up of the Xiamen Grade A office market reached 393,507 sq Eleven projects are expected to Vacancy rates are expected to m in 2015. be launched onto the market in 2016, increase while rents will remain pushing the total stock up by 37% to Due to the considerable amount 4.83 million sq m. City-wide vacancy stable in the short term.” James of supply, city-wide vacancy rates rates are expected to go up due to fell 2.3 of a percentage point (ppt) the large amount of new supply. Macdonald, Head of Research, China. to 26.8%, down 3.6% year-on-year (YoY). -

The Research of the Constructing of the Port of Xiamen to Become a Container Pivot Port

World Maritime University The Maritime Commons: Digital Repository of the World Maritime University World Maritime University Dissertations Dissertations 2006 The eser arch of the constructing of the port of Xiamen to become a container pivot port Zui Fei Weng World Maritime University Follow this and additional works at: http://commons.wmu.se/all_dissertations Part of the Infrastructure Commons Recommended Citation Weng, Zui Fei, "The er search of the constructing of the port of Xiamen to become a container pivot port" (2006). World Maritime University Dissertations. 105. http://commons.wmu.se/all_dissertations/105 This Dissertation is brought to you courtesy of Maritime Commons. Open Access items may be downloaded for non-commercial, fair use academic purposes. No items may be hosted on another server or web site without express written permission from the World Maritime University. For more information, please contact [email protected]. WORLD MARITIME UNIVERSITY Shanghai, China The Research of the Constructing the Port of Xiamen to Become a Container Pivot Port By Weng Zui Fei China A research paper submitted to the World Maritime University in partial Fulfillment of the requirements for the award of the degree of MASTER OF SCIENCE (INTERNATIONAL TRANSPORT AND LOGISTICS) 2006 Copyright Weng Zui Fei, 2006 DECLARATION I certify that all the material in this dissertation that is not my own work has been identified, and that no material is included for which a degree has previously been conferred on me. The contents of this dissertation reflect my own personal views, and are not necessarily endorsed by the University. …………………………… (WENG ZUI FEI) …………………………… Supervised by Professor Zhong Bei Hua Shanghai Maritime University Assessor Professor Mike Ircha Newbrunswick University, Canada Co-Assessor Professor Liu Wei Shanghai Maritime University ii ACKNOWLEDGEMENT My sincere thanks will be expressed to Mr. -

COSCO Pacific Limited

THIS CIRCULAR IS IMPORTANT AND REQUIRES YOUR IMMEDIATE ATTENTION If you are in any doubt as to any aspect of this circular or as to the action to be taken, you should consult your stockbroker or other registered dealer in securities, bank manager, solicitor, professional accountant or other professional advisor. If you have sold or transferred all your shares in COSCO Pacific Limited, you should at once hand this circular to the purchaser or transferee or to the bank, stockbroker or other agent through whom the sale or transfer was effected for transmission to the purchaser or transferee. The Stock Exchange of Hong Kong Limited takes no responsibility for the contents of this circular, 14.58(1) 14.64(1) makes no representation as to its accuracy or completeness and expressly disclaims any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this circular. COSCO Pacific Limited App1B—1 (Incorporated in Bermuda with limited liability) (Stock Code : 1199) 13.51A DISCLOSEABLE TRANSACTION ESTABLISHMENT OF A JOINT VENTURE COMPANY AND ACQUISITION OF LAND USE RIGHTS AND CONSTRUCTION OF CONTAINER TERMINAL IN XIAMEN 28 November 2007 CONTENTS Page DEFINITIONS ............................................................ 1 LETTER FROM THE BOARD Introduction .......................................................... 5 The Agreements ....................................................... 5 Reasons for the formation of the joint venture company and entering into the Agreements ........................................................ -

VTS Guide (English Version Issued by Fujian MSA)

“Service Guide for VTS of Fujian Maritime Safety Administration of the P.R.C.” PREFACE This guide is compiled and based on the Safety Management Regulations of Vessel Traffic Service of the P.R.C. and the Safety Management Regulations of Vessel Traffic Service of the Fujian Maritime Safety Administration of the P.R.C. The guide is published in order to provide the users with a brief introduction to the Fujian Maritime Safety Administration of P.R.C. Vessel Traffic Service System (hereinafter referred to as Fujian VTS)and the requirement of Vessel Traffic Service Centers of Fujian Maritime Safety Administration (hereinafter referred to as VTS Center) ,so as to promote the understanding and cooperation between VTS Centers and users, to improve the safety and efficiency of navigation and to protect the marine environment. According to the coverage area, Fujian VTS is divided into Fujian Coastal VTS and Fujian Port VTS. Fujian Coastal VTS is divided into 4 Sectors, VTS centers provide information service for vessels only, organize and coordinate vessel traffic in case of maritime emergency or when necessary in Fujian Coastal VTS area. Fujian Port VTS now includes Ningde, Fuzhou, Quanzhou, Xiamen and Zhangzhou VTS area, VTS centers provide information service, navigational assistance service, traffic organization service and allied services in Fujian Port VTS area. Fujian coastal Vessel Traffic Services Guide 1. VHF Procedures 1.1 VTS area Fujian coastal water area is bounded by the following six points, except that area of ports: (1)26°30′00″N/120°03′15″E; (2)26°30′00″N/120°21′00″E; (3)25°21′16″N/120°15′00″E; (4)23°30′00″N/117°55′32″E; (5)23°30′00″N/117°14′00″E; (6)23°36′12″N/117°14′00″E。 1.2 VHF channel Fujian coastal VTS area is divided into four sectors from north to south by the following three boundaries: (1) The line joining 25°12′00″N/119°18′00″E and 25°12′00″N/120°03′22″E. -

Produzent Adresse Land

Produzent Adresse Land Durable Plastic Ltd. Mulgaon, Kaligonj, Gazipur, Dhaka Bangladesh Lhotse (BD) Ltd. Plot No. 60&61, Sector -3, Karnaphuli Export Processing Zone, North Potenga, Chittagong Bangladesh Bengal Plastics Ltd. Yearpur, Zirabo Bazar, Savar, Dhaka Bangladesh ASF Sporting Goods Co., Ltd. Km 38.5, National Road No. 3, Thlork Village, Chonrok Commune, Korng Pisey District, Konrrg Pisey, Kampong Speu Cambodia Ningbo Zhongyuan Alljoy Fishing Tackle Co., Ltd. No. 416 Binhai Road, Hangzhou Bay New Zone, Ningbo, Zhejiang China Ningbo Energy Power Tools Co., Ltd. No. 50 Dongbei Road, Dongqiao Industrial Zone, Haishu District, Ningbo, Zhejiang China Junhe Pumps Holding Co., Ltd. Wanzhong Villiage, Jishigang Town, Haishu District, Ningbo, Zhejiang China Skybest Electric Appliance (Suzhou) Co., Ltd. No. 18 Hua Hong Street, Suzhou Industrial Park, Suzhou, Jiangsu China Zhejiang Safun Industrial Co., Ltd. No. 7 Mingyuannan Road, Economic Development Zone, Yongkang, Zhejiang China Zhejiang Dingxin Arts&Crafts Co., Ltd. No. 21 Linxian Road, Baishuiyang Town, Linhai, Zhejiang China Zhejiang Natural Outdoor Goods Inc. Xiacao Village, Pingqiao Town, Tiantai County, Taizhou, Zhejiang China Guangdong Xinbao Electrical Appliances Holdings Co., Ltd. South Zhenghe Road, Leliu Town, Shunde District, Foshan, Guangdong China Yangzhou Juli Sports Articles Co., Ltd. Fudong Village, Xiaoji Town, Jiangdu District, Yangzhou, Jiangsu China Eyarn Lighting Ltd. Yaying Gang, Shixi Village, Shishan Town, Nanhai District, Foshan, Guangdong China Lipan Gift & Lighting Co., Ltd. No. 2 Guliao Road 3, Science Industrial Zone, Tangxia Town, Dongguan, Guangdong China Zhan Jiang Kang Nian Rubber Product Co., Ltd. No. 85 Middle Shen Chuan Road, Zhanjiang, Guangdong China Ansen Electronics Co. Ning Tau Administrative District, Qiao Tau Zhen, Dongguan, Guangdong China Changshu Tongrun Auto Accessory Co., Ltd. -

Vertical Facility List

Facility List The Walt Disney Company is committed to fostering safe, inclusive and respectful workplaces wherever Disney-branded products are manufactured. Numerous measures in support of this commitment are in place, including increased transparency. To that end, we have published this list of the roughly 7,600 facilities in over 70 countries that manufacture Disney-branded products sold, distributed or used in our own retail businesses such as The Disney Stores and Theme Parks, as well as those used in our internal operations. Our goal in releasing this information is to foster collaboration with industry peers, governments, non- governmental organizations and others interested in improving working conditions. Under our International Labor Standards (ILS) Program, facilities that manufacture products or components incorporating Disney intellectual properties must be declared to Disney and receive prior authorization to manufacture. The list below includes the names and addresses of facilities disclosed to us by vendors under the requirements of Disney’s ILS Program for our vertical business, which includes our own retail businesses and internal operations. The list does not include the facilities used only by licensees of The Walt Disney Company or its affiliates that source, manufacture and sell consumer products by and through independent entities. Disney’s vertical business comprises a wide range of product categories including apparel, toys, electronics, food, home goods, personal care, books and others. As a result, the number of facilities involved in the production of Disney-branded products may be larger than for companies that operate in only one or a limited number of product categories. In addition, because we require vendors to disclose any facility where Disney intellectual property is present as part of the manufacturing process, the list includes facilities that may extend beyond finished goods manufacturers or final assembly locations. -

Top Holders Snapshot - Ungrouped Composition : ES1, ES2, ES3, ORD

CHINA PUDA HIGH-TECH HOLDINGS ORDINARY FULLY PAID (TOTAL) As of 25 Oct 2013 Top Holders Snapshot - Ungrouped Composition : ES1, ES2, ES3, ORD Rank Name Address Units % of Units SEA MEADOW HOUSE, BLACKBOURNE HIGHWAY PO BOX 116, ROAD TOWN 1. CHINA PUDA INVESTMENT CO LIMITED 91,875,000 61.25 TORTOLA 999187, BRITISH VIRGIN ISLANDS SEA MEADOW HOUSE, BLACKBOURNE HIGHWAY PO BOX 116, ROAD TOWN 2. CHINA ZHENWANG INDUSTRY CO LIMITED 10,495,000 7.00 TORTOLA 999187, BRITISH VIRGIN ISLANDS 75 YONGCHENG STREET, WEST 3. MRS TINGLIN XIE DISTRICT, TAIZHONG CITY 403, 7,250,000 4.83 TAIWAN 57 YONGHE ROAD, 12TH COMMUNITY SANGONG VILLAGE, CHAOZHOU 4. MR YANG WEN-CHIH 6,300,000 4.20 TOWN, PINGDONG COUNTY 900, TAIWAN 6 LANE 73 BEISHAN ROAD, NO 2 18TH COMMUNITY, ZHONGSHAN VLLGE 5. MR CHANG SHUO-CHUN 6,090,000 4.06 LINYUAN DIST., GAOXIONG CITY 800, TAIWAN ROOM 309 BUILDING 1, HECHANG COMM. 59 FENGTIAN ROAD, FENGZE 6. MR LIAO HANCHENG 5,850,000 3.90 DISTRICT QUANZHOU CITY, FUJIAN PROVINCE 362000, CHINA ROOM 406 BUILDING 7, INTERNATIONAL GARDEN CITY, JING 7. MR KEFAN JIANG 5,555,000 3.70 DEZHEN, JIANGXI PROVINCE 333000, CHINA 6-10 HUANGHAI ROAD, 19TH 8. MR CHEN JIH-KAI COMMUNITY SHANWAI VILLAGE, JINHU 5,250,000 3.50 TOWN JINMEN COUNTY 300, TAIWAN Page 1 of 3 Rank Name Address Units % of Units HORIZON CHAMBERS, PO BOX 4622, 9. KINGBEST CAPITAL LIMITED ROAD TOWN TORTOLA 999187, 4,500,000 3.00 BRITISH VIRGIN ISLANDS ROOM 201 BUILDING 4, XIN GUIDU COMMUNITY, 2 XUZHOU ROAD 10. -

Analysis of Choice Behavior of Tourist Transportation Mode in Xiamen

E3S Web of Conferences 251, 03022 (2021) https://doi.org/10.1051/e3sconf/202125103022 TEES 2021 Analysis of Choice Behavior of Tourist Transportation Mode in Xiamen ZHENG Lin-yan Merchant Marine Department, Chengyi University College, Jimei University, Xiamen City, Fujian Province, China Abstract: Tourism transportation is the foundation and necessary condition for the development of tourism. Tourism transportation has a profound impact on the development of local tourism economy. Both sides complement each other and promote together. For one thing, a well-developed tourism transportation network can attract more tourists to visit and accelerate the development of the tourism industry. For another, the development of the tourism economy will counteract the construction of the tourism transportation network. This paper selects Zhongshan Road in Xiamen City to conduct a questionnaire survey to analyze the choice behavior of Xiamen's tourism transportation mode. kilometers, a permanent population of 4.29 million, and a registered population of 2611.0 thousand people, with a 1 Introduction permanent migrant population of 2.21 million. In 2019, With the development of the tourism industry, more and Xiamen achieved a regional GDP of 599.504 billion yuan, more people choose to travel in spare time. As one of the an increase of 7.9% over the previous year. Among them, most popular tourist attractions, Xiamen has seen an the added value of the primary industry was 2.649 billion increasing number of tourists. At the same time, the yuan, an increase of 0.7%; the added value of the negative problems brought about by tourism traffic have secondary industry was 249.399 billion yuan, an increase of 9.7%; the added value of the tertiary industry was become increasingly prominent, such as urban road [2] congestion and overloaded transportation networks. -

Profile of Xiamen Foreign Language School (XMFLS)

Profile of Xiamen Foreign Language School (XMFLS) Historical Background Xiamen Foreign Language School (XMFLS), which was established in 1981, is one of the outstanding secondary and senior high schools in the Fujian Province, China. The school has acquired the right to recommend 20% of its students for a swift admission to key universities every year, including Peking University, Tsinghua University, Beijing Foreign Studies University, China Foreign Affairs University and Shanghai International Studies University among others. XMFLS comprises the junior and the senior school campuses. They cover an area of 112,707 meters square. The junior middle school campus is located near Yuan Dang Lake and surrounded by mesmerizing scenery while the senior high school campus is situated next to the “Future Coast” in the Haicang District with an area of 81,000 meters square. Both campuses have well-equipped facilities, efficiently managed and comfortable accommodations, abundant resources, convenient grocery stores, stimulating extra-curriculum activities and family atmosphere. Vital Educational Statistics XMFLS has 86 classes, 4380 students and 356 thoroughly-selected professional teachers with impeccable credentials. The school strives to provide the highest quality of education to its students by offering a broad range of subjects. Our guiding principles are: “Focusing on Foreign Languages, Stressing both Arts and Sciences and Promoting all-round Development ”. XMFLS is running an elite program for its teaching staff. Previously, 120 teachers had attended training courses for the national, the provincial and the municipal elite levels. Among our instructors, 76 teachers hold master degrees, 69 teachers had attended non-degree postgraduate programs and 6 teachers hold PhD degrees, which led to ranking the school at the top in the Fujian Province.