2008-Annual-Report.Pdf

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

TV Channel Distribution in Europe: Table of Contents

TV Channel Distribution in Europe: Table of Contents This report covers 238 international channels/networks across 152 major operators in 34 EMEA countries. From the total, 67 channels (28%) transmit in high definition (HD). The report shows the reader which international channels are carried by which operator – and which tier or package the channel appears on. The report allows for easy comparison between operators, revealing the gaps and showing the different tiers on different operators that a channel appears on. Published in September 2012, this 168-page electronically-delivered report comes in two parts: A 128-page PDF giving an executive summary, comparison tables and country-by-country detail. A 40-page excel workbook allowing you to manipulate the data between countries and by channel. Countries and operators covered: Country Operator Albania Digitalb DTT; Digitalb Satellite; Tring TV DTT; Tring TV Satellite Austria A1/Telekom Austria; Austriasat; Liwest; Salzburg; UPC; Sky Belgium Belgacom; Numericable; Telenet; VOO; Telesat; TV Vlaanderen Bulgaria Blizoo; Bulsatcom; Satellite BG; Vivacom Croatia Bnet Cable; Bnet Satellite Total TV; Digi TV; Max TV/T-HT Czech Rep CS Link; Digi TV; freeSAT (formerly UPC Direct); O2; Skylink; UPC Cable Denmark Boxer; Canal Digital; Stofa; TDC; Viasat; You See Estonia Elion nutitv; Starman; ZUUMtv; Viasat Finland Canal Digital; DNA Welho; Elisa; Plus TV; Sonera; Viasat Satellite France Bouygues Telecom; CanalSat; Numericable; Orange DSL & fiber; SFR; TNT Sat Germany Deutsche Telekom; HD+; Kabel -

40% More Gigabytes in Spite of the Pandemic

Industry analysis #3 2020 Mobile data – first half 2020 40% more gigabytes in spite of the pandemic But revenue negatively affected: -0.5% 140% Average +51% Average +54% th 120% Tefficient’s 28 public analysis on the 100% development and drivers of mobile data ranks 116 80% operators based on average data usage per 60% SIM, total data traffic and revenue per gigabyte in 40% the first half of 2020. y growth in mobile data usage data mobile in y growth - o - 20% Y The data usage per SIM grew for basically every 0% Q1 2020 Q2 2020 operator. 42% could turn -20% that data usage growth into ARPU growth. It’s a bit lower than in our previous reports and COVID-19 is to blame; many operators did report negative revenue development in Q2 2020 when travelling stopped and many prepaid subscriptions expired. Mobile data traffic continued to grow, though: +40%. Although operators in certain markets were giving mobile data away to mitigate the negative consequences of lockdowns, most of the global traffic growth is true, underlying, growth. Data usage actually grew faster in Q2 2020 than in Q1 2020 even though lockdowns mainly affected Q2. Our industry demonstrated resilience, but now needs to fill the data monetisation toolbox with more or sharper tools. tefficient AB www.tefficient.com 3 September 2020 1 27 operators above 10 GB per SIM per month in 1H 2020 Figure 1 shows the average mobile data usage for 116 reporting or reported1 mobile operators globally with values for the first half of 2020 or the full year of 2019. -

Teliasonera Acquisition of MCT Corp. Coscom in Uzbekistan Indigo and Somoncom in Tajikistan Roshan in Afghanistan Strategic Acquisition Rationale

TeliaSonera Acquisition of MCT Corp. Coscom in Uzbekistan Indigo and Somoncom in Tajikistan Roshan in Afghanistan Strategic Acquisition Rationale • TeliaSonera will be the leading operator in Central Asian markets – Now: Uzbekistan, Tajikistan and Afghanistan – Existing via Fintur: Kazakhstan, Azerbaijan , Georgia and Moldova – Existing direct & unconsolidated: Turkey (incl. Ukraine indirectly) and Russia (incl. Tajikistan indirectly) • Attractive Growth Opportunity in terms of Addressable TeliaSonera MCT Market (Scandinavia, Baltics) – 10%-20% mobile penetration Fintur Turkcell – Less than 10% Fixed Line Penetration à wireless is attractive Megafon Yoigo • Natural Addition to TeliaSonera’s Eurasian Footprint – Uzbekistan, Tajikistan and Afghanistan complement current map in Central Asia – Significant economic/cultural ties between Kazakhstan, Azerbaijan, Tajikistan and Uzbekistan • Company and Shareholders Honoring International Business Practices – Company’s operations developed by international practices: audited, subject to US rules Acquisition Cost TeliaSonera Acquisition of 100% of MCT Corp for a 100% enterprise value of approximately SEK 2.0 Sonera billion (USD 300 million) holding interest in Holding BV four Eurasian mobile operators: 100% • 99.97% interest in Uzbek-American Joint Venture “Coscom” LLC (Coscom) in MCT Corp. Uzbekistan Delaware Corporation • 60% interest in CJSC “Indigo- Tajikistan” (Indigo-Tajikistan) in Tajikistan and Venture Holdings Local Ventures • 59.4% in CJSC Joint Venture Management and MCT Dev. Corp. “Somoncom” -

(Each As Defined Below) Or (2) Non-U.S

IMPORTANT NOTICE THIS OFFERING IS AVAILABLE ONLY TO INVESTORS WHO ARE EITHER (1) QIBS THATARE QPS (EACH AS DEFINED BELOW) OR (2) NON-U.S. PERSONS OR ADDRESSEES OUTSIDE OF THE U.S. IMPORTANT: You must read the following before continuing. The following applies to the prospectus following this page (the “Prospectus”), and you are therefore advised to read this carefully before reading, accessing or making any other use of the Prospectus. In accessing the Prospectus, you agree to be bound by the following terms and conditions, including any modifications to them any time you receive any information from us as a result of such access. NOTHING IN THIS ELECTRONIC TRANSMISSION CONSTITUTES AN OFFER OF SECURITIES FOR SALE IN ANY JURISDICTION WHERE IT IS UNLAWFUL TO DO SO. THE ISSUER HAS NOT BEEN AND WILL NOT BE REGISTERED UNDER THE U.S. INVESTMENT COMPANYACT OF 1940, AS AMENDED (THE “INVESTMENT COMPANY ACT”) AND THE SECURITIES HAVE NOT BEEN, AND WILL NOT, BE REGISTERED UNDER THE U.S. SECURITIES ACT OF 1933, AS AMENDED (THE “SECURITIES ACT”), OR THE SECURITIES LAWS OFANY STATE OF THE U.S. OR OTHER JURISDICTION AND THE SECURITIES MAY NOT BE OFFERED OR SOLD WITHIN THE U.S. OR TO, OR FOR THE ACCOUNT OR BENEFIT OF, U.S. PERSONS (AS DEFINED IN REGULATION S UNDER THE SECURITIES ACT), EXCEPT PURSUANT TO AN EXEMPTION FROM, OR IN A TRANSACTION NOT SUBJECT TO, THE REGISTRATION REQUIREMENTS OF THE SECURITIES ACT AND APPLICABLE STATE OR LOCAL SECURITIES LAWS AND WHICH DOES NOT REQUIRE THE ISSUER TO REGISTER UNDER THE INVESTMENT COMPANYACT. -

Initial Market Analysis Paper

Ipsos MORI | Initial Market Analysis 1 December 2020 Initial market analysis paper Ipsos MORI Ipsos MORI | Initial Market Analysis 2 18-101398-01 | Final Version | This work was carried out in accordance with the requirements of the international quality standard for Market Research, ISO 20252, and with the Ipsos MORI Terms and Conditions which can be found at http://www.ipsos-mori.com/terms. © Department for Digital, Culture, Media and Sport 2020 Ipsos MORI | Initial Market Analysis 3 Contents 1 State aid market analysis ...................................................................................................... 4 1.1 Key terms and acronyms ......................................................................................................... 4 2 Has the aid had a material effect on the market position of the direct beneficiaries? .... 6 2.1 Key findings .............................................................................................................................. 6 2.2 Methodological approach ......................................................................................................... 7 2.3 All broadband provision ........................................................................................................... 9 2.4 NGA market ............................................................................................................................. 13 3 Is there evidence of changes to parameters of competition arising from the aid? ....... 19 3.1 Key findings ........................................................................................................................... -

2013 Ratewatcher (PDF, 875Kb)

Ratewatcher Telecom Guide VoLUME 24 | FALL 2013 A PUBLICATION OF THE MAINE OFFICE OF THE PUBLIC ADVOCATE 207-287-2445 | TTY 711 | E-MAIL [email protected] | WWW.MAINE.GOV/meopa FUNDING FOR NEW BRoaDbaND IN MAINE t’s ironic that the united states — the country that largely invented the Internet — has fallen behind much of the rest of the developed world, with re- Ispect to availability, adoption, and speed of Internet service. In terms of the percent- age of households that subscribe to a broadband service, the U. S. ranks 15th. To be fair, the U.S. is more geographically challenging for broadband deployment compared to a more compact and technologically-advanced country, such as Switzerland, which ranks number one in terms of the percentage of households with a broadband connection. But the U.S. also remains behind Canada, which ranks 11th and which shares some of the same geographic and cultural challenges faced by the U.S. Broadband speeds in the U.S. also nesses with fiber-optic cable. On the cost of building out broadband and generally lag behind those of other other hand, with respect to the total getting people to adopt it. In Maine, developed nations. Since speed number of wired broadband connec- nearly 10% of households — mostly depends on the technology of the tions, the U.S. is far ahead of the rest in rural areas — have no access to About the Office of the Public Advocate network, it is significant that the of the world, with over 90 million wired DSL or cable-modem broad- U.S. -

Current Status of Digital Broadcasting Situation in Lao PDR

Current Status of Digital Broadcasting Situation in Lao PDR Khankeo PHONHALATH Lao National TV [email protected] History of Broadcasting in Lao PDR 1983: Lao National TV established 1994: Lao National TV Ch3 Started 1998: Lao Star Channel 1998: Cable TV 2007 : Terrestrial Digital TV 2011 : Lao PSTV 2012 : MVLao 2012 : TVLao 2 Digital Broadcasting in Lao PDR Digital Satellite Television Digital Terrestrial Broadcasting Television Cable Television IPTV 3 Digital Satellite Broadcasting Television Most Lao TV station are uplink to Thaicom and LaoSAT1 satellite both c‐Band and Ku Band. TV station Thaicom Thaicom LaoSAT1 Lao national TV C‐ Band Ku band MPEG‐2 Lao National TV c‐ Band MPEG‐2 ch3 Lao Star TV c‐ Band Ku band MPG‐2 Lao PSTV C‐ Band Mpeg‐4 MVLaoTVLao HD C Band4 Ku ‐Band MPEG‐2 Digital terrestrial Broadcasting Digital terrestrial broadcasting started in 2007 Joint venture between LNTV and Yunnan TV. DTMB system ( China standard) 4000 subscribers initially 50$ per one set‐top‐box Service area was cover Vientiane capital 5 Recent digital terrestrial broadcasting Four Digital Terrestrial Broadcasting station: 1. Vientiane capital : 200000 subscribers 2. Louangphrabang : 5000 subscribers 3. Savanakhet : 7000 subscribers 4. Champasack : 8000 subscribers different program & encryption 6 Analog Terrestrial Broadcasting Lao National Television VHF band Lao National TV ch3 UHF band MVLao UHF band CCTV4&CCTV news relay station. UHF band VTV relay station. VHF band 7 Cable TV The 1st subscription Television service in Lao PDR launched in 1998 System Operators & Channels 2 System Operators as market leaders More than 50 channels About 1,5 M subscribers nationwide. -

New Simplification Rates

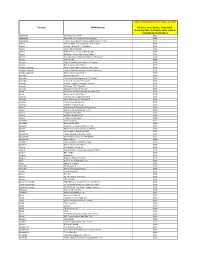

NEW VOICE RATES AS OF JULY 14, 2009 Country GSM Operator All Voice calls: Back to Canada/US, Incoming Calls, In Country Calls, Calls to International Destinations Afghanistan MTN Afganistan, "MTN" $4.00 Afghanistan Afghan Wireless Communications Company $4.00 Afghanistan Telecom Development Company Afghanistan Ltd "TDCA" $4.00 Albania Albanian Mobile Communications "A M C Mobil" $2.00 Albania Vodafone Albania Sh. A. "Vodafone" $2.00 Algeria Algerie Telecom Mobile $3.00 Algeria Orascom Telecom Algeria SPA "Djezzy" $3.00 Algeria Wataniya Telecom Algerie s.p.a."Nedjma" $3.00 Andorra Servei de Telecomunicacions d'Andorra "Mobiland" $2.00 Angola Unitel S.A.R.L. $4.00 Anguilla Cable & Wireless (West Indies) Ltd. Anguilla $3.00 Anguilla Digicel (Jamaica) Ltd "Digicel" $3.00 Antigua & Barbuda Antigua Public Utilities Authority "APUA PCS" $3.00 Antigua & Barbuda Cable & Wireless Caribbean Cellular (Antigua) Ltd. $3.00 Antigua & Barbuda Digicel (Jamaica) Ltd "Digicel" $3.00 Argentina AMX Argentina S.A. $3.00 Argentina Telefonica Moviles Argentina S.A. "Movistar" $3.00 Argentina Telecom Personal S.A. "Personal" $3.00 Armenia Armenia Telephone Company "ArmenTel" $2.00 Armenia K Telecom CJSC "Vivacell" $2.00 Armenia Karaback Telecom "K Telecom" $2.00 Aruba Servicio di Telecomunicacion di Aruba "SETAR" $3.00 Aruba Digicel (Jamaica) Ltd "Digicel" $3.00 Australia Hutchison 3G Australia Pty Limited $2.00 Australia Optus Mobile Pty Ltd. "Yes Optus" $2.00 Australia Telstra Corporation Limited $2.00 Australia Vodafone Network Pty Ltd. $2.00 Austria Orange Austria Telecommunication GmbH $2.00 Austria Hutchison 3G Austria GmbH "3 AT" $2.00 Austria T-Mobile Austria GmbH $2.00 Austria Mobilkom Austria AG "A1" $2.00 Austria T-Mobile Austria GmbH $2.00 Azerbaijan Azercell Telecom $4.00 Azerbaijan Bakcell "GSM 2000" $4.00 Bahamas Bahamas Telecommunications Co. -

Telecoms in Russia King & Spalding LLP

Telecoms in Russia King & Spalding LLP Global, Russia April 29 2019 Market spotlight Trends and developments What is the current state of the telecoms market in your jurisdiction, including any trends and recent developments/deals? The Russian telecoms market is dominated by five large companies that each hold a major share of the profits and a large subscriber base. Facing inevitable saturation, the telecoms market is generally following the global convergence trend, with Russian operators focusing on expanding the range of services offered to subscribers. Specifically, all mobile operators and some fixed-line operators have added internet protocol television or cable television services, while cable and satellite broadcasting operators have been increasingly providing additional interactive services and video-on-demand options. There is also increasing market concentration, with local, smaller-sized operators being acquired by or merged into larger, nationwide players. In terms of statutory regulations, the main trend appears to be a tightening of state control over information distribution via communications networks and the Internet, including messaging and over-the-top services and restrictions on the anonymity of communications (eg, through identification requirements for online and electronic service users). One of the most efficient and increasingly used enforcement measures (in addition to traditional penalties, such as fines) includes blocking access to certain web resources. The list of grounds for the blocking of access to a web resource is constantly expanded. This measure is performed by telecoms operators which must cover all such costs. Regulatory framework Legislation What is the primary legislation governing the telecoms market in your jurisdiction? The primary pieces of legislation governing the telecoms market are: • Federal Law 126-FZ (the Communications Law), dated July 7 2003 (as amended), which is the cornerstone regulation for all telecoms activities. -

Cellular Internet of Things (C-Iot)

Release-13 Cellular IoT Deployments – November 2019 REGION COUNTRY OPERATOR NB-IoT LTE-M Africa 1 0 South Africa Vodacom 1 Asia & Pacific 19 10 Australia Telstra 1 1 Australia Vodafone Australia 1 China China Telecom 1 China China Unicom 1 China China Mobile 1 Hong Kong China Mobile (HK) 1 India Reliance Joi Infocomm 1 Indonesia Telkomsel 1 Indonesia XL Axiata 1 Japan KDDI (au) 1 Japan DOCOMO 1 Malaysia Maxis 1 New Zealand Spark 1 New Zealand Vodafone New Zealand 1 1 Singapore M1 1 Singapore Singtel 1 1 South Korea KT Corp 1 1 South Korea LG Plus 1 South Korea SK Telecom 1 Sri Lanka Dialog Axiata 1 1 Taiwan Asia Pacific Telecom (APT) 1 1 Taiwan Far EasTone 1 Vietnam Viettel 1 Eastern Europe 15 0 Croatia A1 Croatia 1 Croatia Hrvatski Telecom 1 Czech Republic Vodafone Czech Republic 1 Estonia Elisa 1 Estonia Telia Estonia 1 Hungary Magyar Telekom 1 Kazakhstan KaR-Tel (Beeline) 1 Poland Polkomtel 1 Poland T-Mobile Poland 1 Russia Beeline (Russia) 1 Russia MegaFon 1 Movile TeleSystems Russia (MTS) 1 Slovakia Slovak Telecom 1 Slovenia A1 Slovenia 1 Ukraine Lifecell 1 Latin America & Caribbean 2 3 Argentina Movistar (Argentina) 1 1 Brazil Vivo 1 1 Mexico AT&T Mexico 1 Middle East 5 1 Qatar Vodafone Qatar 1 United Arab Emirates Du 1 United Arab Emirates Etisalat 1 1 Turkey Turkcell 1 Turkey Vodafone Turkey 1 U.S. & Canada 3 4 Canada Bell Canada 1 Canada Telus 1 United States AT&T 1 1 United States T-Mobile US 1 United States Verizon 1 1 Western Europe 17 6 Austria T-Mobile 1 Belgium Orange 1 1 Belgium Proximus 1 Belgium Telenet 1 Denmark TDC -

Network List Addendum

Network List Addendum IN-SITU PROVIDED SIM CELLULAR NETWORK COVERAGE COUNTRY NETWORK 2G 3G LTE-M NB-IOT COUNTRY NETWORK 2G 3G LTE-M NB-IOT (VULINK, (TUBE, (VULINK) (VULINK) TUBE, WEBCOMM) (VULINK, (TUBE, (VULINK) (VULINK) WEBCOMM) TUBE, WEBCOMM) WEBCOMM) Benin Moov X X Afghanistan TDCA (Roshan) X X Bermuda ONE X X Afghanistan MTN X X Bolivia Viva X X Afghanistan Etisalat X X Bolivia Tigo X X Albania Vodafone X X X Bonaire / Sint Eustatius / Saba Albania Eagle Mobile X X / Curacao / Saint Digicel X X Algeria ATM Mobilis X X X Martin (French part) Algeria Ooredoo X X Bonaire / Sint Mobiland Andorra X X Eustatius / Saba (Andorra) / Curacao / Saint TelCell SX X Angola Unitel X X Martin (French part) Anguilla FLOW X X Bosnia and BH Mobile X X Anguilla Digicel X Herzegovina Antigua and Bosnia and FLOW X X HT-ERONET X X Barbuda Herzegovina Antigua and Bosnia and Digicel X mtel X Barbuda Herzegovina Argentina Claro X X Botswana MTN X X Argentina Personal X X Botswana Orange X X Argentina Movistar X X Brazil TIM X X Armenia Beeline X X Brazil Vivo X X X X Armenia Ucom X X Brazil Claro X X X Aruba Digicel X X British Virgin FLOW X X Islands Australia Optus X CCT - Carribean Australia Telstra X X British Virgin Cellular X X Islands Australia Vodafone X X Telephone Austria A1 X X Brunei UNN X X Darussalam Austria T-Mobile X X X Bulgaria A1 X X X X Austria H3G X X Bulgaria Telenor X X Azerbaijan Azercell X X Bulgaria Vivacom X X Azerbaijan Bakcell X X Burkina Faso Orange X X Bahamas BTC X X Burundi Smart Mobile X X Bahamas Aliv X Cabo Verde CVMOVEL -

New Simplification Rates

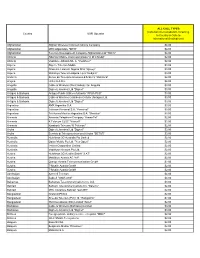

ALL CALL TYPES (Calls back to Canada/US, Incoming, Country GSM Operator In Country & Calls to International Destinations) Afghanistan Afghan Wireless Communications Company $4.00 Afghanistan MTN Afganistan, "MTN" $4.00 Afghanistan Telecom Development Company Afghanistan Ltd "TDCA" $4.00 Albania Albanian Mobile Communications "A M C Mobil" $2.00 Albania Vodafone Albania Sh. A. "Vodafone" $2.00 Algeria Algerie Telecom Mobile $3.00 Algeria Orascom Telecom Algeria SPA "Djezzy" $3.00 Algeria Wataniya Telecom Algerie s.p.a."Nedjma" $3.00 Andorra Servei de Telecomunicacions d'Andorra "Mobiland" $2.00 Angola Unitel S.A.R.L. $4.00 Anguilla Cable & Wireless (West Indies) Ltd. Anguilla $3.00 Anguilla Digicel (Jamaica) Ltd "Digicel" $3.00 Antigua & Barbuda Antigua Public Utilities Authority "APUA PCS" $3.00 Antigua & Barbuda Cable & Wireless Caribbean Cellular (Antigua) Ltd. $3.00 Antigua & Barbuda Digicel (Jamaica) Ltd "Digicel" $3.00 Argentina AMX Argentina S.A. $3.00 Argentina Telecom Personal S.A. "Personal" $3.00 Argentina Telefonica Moviles Argentina S.A. "Movistar" $3.00 Armenia Armenia Telephone Company "ArmenTel" $2.00 Armenia K Telecom CJSC "Vivacell" $2.00 Armenia Karaback Telecom "K Telecom" $2.00 Aruba Digicel (Jamaica) Ltd "Digicel" $3.00 Aruba Servicio di Telecomunicacion di Aruba "SETAR" $3.00 Australia Hutchison 3G Australia Pty Limited $2.00 Australia Optus Mobile Pty Ltd. "Yes Optus" $2.00 Australia Telstra Corporation Limited $2.00 Australia Vodafone Network Pty Ltd. $2.00 Austria Hutchison 3G Austria GmbH "3 AT" $2.00 Austria Mobilkom Austria AG "A1" $2.00 Austria Orange Austria Telecommunication GmbH $2.00 Austria T-Mobile Austria GmbH $2.00 Austria T-Mobile Austria GmbH $2.00 Azerbaijan Azercell Telecom $4.00 Azerbaijan Bakcell "GSM 2000" $4.00 Bahamas Bahamas Telecommunications Co.