The Neo-Chartalist Approach to Money by L. Randall Wray

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Digitalisation and Monetary Policy

Does the liquidity trap exist? Lhuissier, Mojon and Rubio-Ramirez AEA Congress, 4 January 2021 The views expressed here are mine and should not be attributed to the BIS Restricted “A liquidity trap may be defined as a situation in which conventional monetary policies have become impotent, because nominal interest rates are at or near zero: injecting monetary base into the economy has no effect, because base and bonds are viewed by the private sector as perfect substitutes” Paul Krugman (1998) Restricted 2 Outline 1. Motivation 2. Literature 3. Empirical analysis 4. Results 5. Discussion Restricted 3 1. Motivation: How low can long-term rates be? Central bank balance sheets1 Share of government bonds held by central banks2 % of GDP % of GDP % Restricted 4 1. Motivation: Is there a lack of monetary policy space? • Cutting down short rates and purchasing assets to cut long rates can go only so far and • the lack of “interest rate” space is very critical in several advanced economies • However, into the medium we still need to assess whether and how much MP can do when short-term rates are near the ZLB/ELB Restricted 5 Literature: The ZLB makes MP ineffective Japan . Krugman (1998) – Coenen and Wieland (2003) “John Hicks, in introducing both the IS-LM model and the liquidity trap, identified the assumption that monetary policy is ineffective, rather than the assumed downward inflexibility of prices, as the central difference between Mr. Keynes and the classics.” US and EA, before the facts . Early Fed attemps: Furher and Madigan (97); Orphanides and Williams & Reifschneider and Williams (2000) . -

Edward S. Shaw* Simon Kuznets Remarked in His Capital in The

Edward S. Shaw* Simon Kuznets remarked in his Capital in rate. There is physical wealth, its ownership The American Economy, " ... extrapolation of represented by an homogeneous financial asset inflationary pressures over the next thirty in the form of common stock or "equity," and years raises a specter of intolerable conse there is wealth in the form of real money bal quences.... "1 Fifteen of the thirty years are ances. Accumulation of physical and monetary over, and inflation has accelerated. The central wealth derives from a constant rate of saving concern of this paper is whether Kuznets' pre for the community. Inflation occurs because the diction of "intolerable consequences" for capital growth rate of nominal money exceeds the markets and capital accumulation is on track or growth rate of real money demanded. patently wrong. 2 The inflation is immaculate because its pace Monetary theory distinguishes between "im is constant and perfectly foreseen and because maculate" inflation, "clean" inflation, and the inflation tax on real money balances is com "dirty" inflation. It is the last of these that pensated precisely by a deposit-rate of interest Kuznets dreaded and that we have endured. The on money. It is fully anticipated, and it does not first section below deals very briefly with dif impose a relative penalty on the money form of ferences between the three styles of inflation. wealth. Money-wage rates rise faster than out The second section is a catalogue of ways in put prices in the degree that labor productivity which dirty inflation may obstruct and distort is growing. -

How Goldsmiths Created Money Page 1 of 2

Money: Banking, Spending, Saving, and Investing The Creation of Money How Goldsmiths Created Money Page 1 of 2 If you want to understand money, you have got to start with its history, and that means gold. Have you ever wondered why gold is so valuable? I mean, it is a really weak metal that does not have a lot of really practical uses. Maybe it is because it reminded people of the sun, which was worshipped in ancient times, that everyone decided they wanted it. Once everyone wants it, it is capable as serving as a medium of exchange. That is, gold can be used as money, and it is an ideal commodity to serve as a medium of exchange because it’s portable, it’s durable, it’s divisible, and it’s standardizable. Everybody recognizes what they want, it can be broken into little pieces, carried around, it doesn’t rot, and it is a great thing to serve as money. So, before long, gold is circulating in the form of coins. When gold circulates as coins, it is called commodity money, that is, money that has intrinsic value made out of something people want. Now, once gold coins begin to circulate as the medium of exchange, we have got another problem. That problem is security. Imagine that you are in the ancient world, lugging around bags and bags of gold. You are going to be pretty vulnerable to bandits. So what you want to do is make sure that there is a safe place to store your gold because you can store all of your wealth in the form of this valuable commodity, but you do not want it all lying around somewhere that it is easy for somebody else to pick off. -

New Monetarist Economics: Methods∗

Federal Reserve Bank of Minneapolis Research Department Staff Report 442 April 2010 New Monetarist Economics: Methods∗ Stephen Williamson Washington University in St. Louis and Federal Reserve Banks of Richmond and St. Louis Randall Wright University of Wisconsin — Madison and Federal Reserve Banks of Minneapolis and Philadelphia ABSTRACT This essay articulates the principles and practices of New Monetarism, our label for a recent body of work on money, banking, payments, and asset markets. We first discuss methodological issues distinguishing our approach from others: New Monetarism has something in common with Old Monetarism, but there are also important differences; it has little in common with Keynesianism. We describe the principles of these schools and contrast them with our approach. To show how it works, in practice, we build a benchmark New Monetarist model, and use it to study several issues, including the cost of inflation, liquidity and asset trading. We also develop a new model of banking. ∗We thank many friends and colleagues for useful discussions and comments, including Neil Wallace, Fernando Alvarez, Robert Lucas, Guillaume Rocheteau, and Lucy Liu. We thank the NSF for financial support. Wright also thanks for support the Ray Zemon Chair in Liquid Assets at the Wisconsin Business School. The views expressed herein are those of the authors and not necessarily those of the Federal Reserve Banks of Richmond, St. Louis, Philadelphia, and Minneapolis, or the Federal Reserve System. 1Introduction The purpose of this essay is to articulate the principles and practices of a school of thought we call New Monetarist Economics. It is a companion piece to Williamson and Wright (2010), which provides more of a survey of the models used in this literature, and focuses on technical issues to the neglect of methodology or history of thought. -

Money As 'Universal Equivalent' and Its Origins in Commodity Exchange

MONEY AS ‘UNIVERSAL EQUIVALENT’ AND ITS ORIGIN IN COMMODITY EXCHANGE COSTAS LAPAVITSAS DEPARTMENT OF ECONOMICS SCHOOL OF ORIENTAL AND AFRICAN STUDIES UNIVERSITY OF LONDON [email protected] MAY 2003 1 1.Introduction The debate between Zelizer (2000) and Fine and Lapavitsas (2000) in the pages of Economy and Society refers to the conceptualisation of money. Zelizer rejects the theorising of money by neoclassical economics (and some sociology), and claims that the concept of ‘money in general’ is invalid. Fine and Lapavitsas also criticise the neoclassical treatment of money but argue, from a Marxist perspective, that ‘money in general’ remains essential for social science. Intervening, Ingham (2001) finds both sides confused and in need of ‘untangling’. It is worth stressing that, despite appearing to be equally critical of both sides, Ingham (2001: 305) ‘strongly agrees’ with Fine and Lapavitsas on the main issue in contention, and defends the importance of a theory of ‘money in general’. However, he sharply criticises Fine and Lapavitsas for drawing on Marx’s work, which he considers incapable of supporting a theory of ‘money in general’. Complicating things further, Ingham (2001: 305) also declares himself ‘at odds with Fine and Lapavitsas’s interpretation of Marx’s conception of money’. For Ingham, in short, Fine and Lapavitsas are right to stress the importance of ‘money in general’ but wrong to rely on Marx, whom they misinterpret to boot. Responding to these charges is awkward since, on the one hand, Ingham concurs with the main thrust of Fine and Lapavitsas and, on the other, there is little to be gained from contesting what Marx ‘really said’ on the issue of money. -

CR Traverse Analysis Progenitors & Pioneers

Traverse Analysis: Progenitors and Pioneers 14th History of Economic Thought Society of Australia Conference The University of Tasmania, Hobart, Australia. 11th July 2001 Colin Richardson* School of Economics University of Tasmania ABSTRACT Traverse analysis has two progenitors (David Ricardo, Karl Marx) and five pioneers: Michal Kalecki, Adolph Lowe, Joan Robinson, J.R. Hicks, and John Hicks. Defined as the dynamic disequilibrium adjustment-path that connects an initial with a different terminal state of economic growth, the traverse comes in four “flavours”. There are neoclassical (J.R. Hicks), neo-Austrian (John Hicks), observed (Ricardo, Marx, Kalecki, Robinson), and instrumental (Lowe) traverses. These terms are explained and the seven seminal contributions are summarised and commented upon in this paper. * I am indebted to Dr Jerry Courvisanos for his supervision and comments in writing this paper. Scholarship support from The University of Tasmania is also gratefully acknowledged. 2 Introduction Nobel laureate economist Robert Solow once quipped: “The traverse is the easiest part of skiing but the most difficult part of economics”. Later, Joseph Halevi and Peter Kriesler (1992, p 225) complained that “The traverse is at the same time one of the most important concepts in economic theory, and also one of the most neglected.” This paper outlines briefly the history of economic thought between 1821 and 1973 concerning this difficult, important and neglected theoretical construct. Traverse analysis has two progenitors (David Ricardo, Karl Marx) and five pioneers: Michal Kalecki, Adolph Lowe, Joan Robinson, J.R. Hicks, and John Hicks. Defined as the dynamic disequilibrium adjustment-path that connects an initial with a different terminal state of economic growth, the traverse comes in four “flavours”. -

Unemployment Did Not Rise During the Great Depression—Rather, People Took Long Vacations

Working Paper No. 652 The Dismal State of Macroeconomics and the Opportunity for a New Beginning by L. Randall Wray Levy Economics Institute of Bard College March 2011 The Levy Economics Institute Working Paper Collection presents research in progress by Levy Institute scholars and conference participants. The purpose of the series is to disseminate ideas to and elicit comments from academics and professionals. Levy Economics Institute of Bard College, founded in 1986, is a nonprofit, nonpartisan, independently funded research organization devoted to public service. Through scholarship and economic research it generates viable, effective public policy responses to important economic problems that profoundly affect the quality of life in the United States and abroad. Levy Economics Institute P.O. Box 5000 Annandale-on-Hudson, NY 12504-5000 http://www.levyinstitute.org Copyright © Levy Economics Institute 2011 All rights reserved ABSTRACT The Queen of England famously asked her economic advisers why none of them had seen “it” (the global financial crisis) coming. Obviously, the answer is complex, but it must include reference to the evolution of macroeconomic theory over the postwar period— from the “Age of Keynes,” through the Friedmanian era and the return of Neoclassical economics in a particularly extreme form, and, finally, on to the New Monetary Consensus, with a new version of fine-tuning. The story cannot leave out the parallel developments in finance theory—with its efficient markets hypothesis—and in approaches to regulation and supervision of financial institutions. This paper critically examines these developments and returns to the earlier Keynesian tradition to see what was left out of postwar macro. -

Nominality of Money: Theory of Credit Money and Chartalism Atsushi Naito

Review of Keynesian Studies Vol.2 Atsushi Naito Nominality of Money: Theory of Credit Money and Chartalism Atsushi Naito Abstract This paper focuses on the unit of account function of money that is emphasized by Keynes in his book A Treatise on Money (1930) and recently in post-Keynesian endogenous money theory and modern Chartalism, or in other words Modern Monetary Theory. These theories consider the nominality of money as an important characteristic because the unit of account and the corresponding money as a substance could be anything, and this aspect highlights the nominal nature of money; however, although these theories are closely associated, they are different. The three objectives of this paper are to investigate the nominality of money common to both the theories, examine the relationship and differences between the two theories with a focus on Chartalism, and elucidate the significance and policy implications of Chartalism. Keywords: Chartalism; Credit Money; Nominality of Money; Keynes JEL Classification Number: B22; B52; E42; E52; E62 122 Review of Keynesian Studies Vol.2 Atsushi Naito I. Introduction Recent years have seen the development of Modern Monetary Theory or Chartalism and it now holds a certain prestige in the field. This theory primarily deals with state money or fiat money; however, in Post Keynesian economics, the endogenous money theory and theory of monetary circuit place the stress on bank money or credit money. Although Chartalism and the theory of credit money are clearly opposed to each other, there exists another axis of conflict in the field of monetary theory. According to the textbooks, this axis concerns the functions of money, such as means of exchange, means of account, and store of value. -

Central Bank Digital Currency in Historical Perspective: Another Crossroad in Monetary History1

Central Bank Digital Currency in Historical Perspective: Another Crossroad in Monetary History1 Michael D. Bordo, Rutgers University, NBER and Hoover Institution, Stanford University Economics Working Paper 21113 HOOVER INSTITUTION 434 GALVEZ MALL STANFORD UNIVERSITY STANFORD, CA 94305-6010 July 14, 2021 Digitalization of Money is a crossroad in monetary history. Advances in technology has led to the development of new forms of money: virtual (crypto) currencies like bitcoin; stable coins like libra/diem; and central bank digital currencies (CBDC) like the Bahamian sand dollar. These innovations in money and finance have resonance to earlier shifts in monetary history: 1) The shift in the eighteenth and nineteenth century from commodity money (gold and silver coins) to convertible fiduciary money and inconvertible fiat money; 2) the shift in the nineteenth and twentieth centuries from central bank notes to a central bank monopoly;3) Then evolution since the seventeenth century of central banks and the tools of monetary policy. This paper makes the case for CBDC through the lens of monetary history. The bottom line is that the history of transformations in monetary systems suggests that technical change in money is inevitably driven by the financial incentives of a market economy. Government has always had a key role in the provision of outside money, which is a public good. Government has also regulated inside money provided by the private sector. This held for fiduciary money and will likely hold for digital money. CBDC could make monetary policy more efficient, and it could transform the international monetary and payments systems. Keywords: digitalization, financial innovation, evolution, central banks, monetary policy, international payments JEL Codes: E5, F4, N2. -

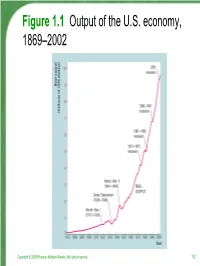

Figure 1.1 Output of the US Economy

Figure 1.1 Output of the U.S. economy, 1869–2002 Copyright © 2005 Pearson Addison-Wesley. All rights reserved. 1-2 Figure 1.2 Average labor productivity in the United States, 1900–2002 Copyright © 2005 Pearson Addison-Wesley. All rights reserved. 1-3 Figure 1.3 The U.S. unemployment rate, 1890–2002 Copyright © 2005 Pearson Addison-Wesley. All rights reserved. 1-4 Figure 1.4 Consumer prices in the United States Copyright © 2005 Pearson Addison-Wesley. All rights reserved. 1-5 Figure 1.5 U.S. exports and imports, 1869– 2002 Copyright © 2005 Pearson Addison-Wesley. All rights reserved. 1-6 Figure 1.6 U.S. Federal government spending and tax collections, 1869–2002 Copyright © 2005 Pearson Addison-Wesley. All rights reserved. 1-7 THE BIG QUESTIONS • Thinking about the economy as a whole. General equilibrium. • What determines long-run economic growth? Can government policy help to change growth rates? “Half of the population of sub-Saharan Africa lives in absolute poverty. And, uniquely, Africa is getting poorer. Average income per head is lower now than it was 30 years ago.” Tony Blair, “A year of huge challenges”, The Economist, January 1, 2005. • Why does the unemployment rate fluctuate so much? What are the causes of business cy- cles? Can government policy help to stabilize the macroeconomy? Who benefits and who loses from such policy? • What causes inflation? Who benefits and who loses from inflation? Can central banks control inflation? • What are the effects of the current huge U.S. government budget deficits? Should Social Se- curity be reformed, and if so, how? Who bene- fits and who loses from reform? • What are the effects of the current large U.S. -

The Emergence of Fiat Money: a Reconsideration

THE EMERGENCE OF FIAT MONEY: ARECONSIDERATION Kevin Dowd One of the fundamental questions in monetary economics is why fiat money has value: Why do rational agents trade real resources for intrinsically worthless pieces of paper? Monetary economists have long understood that part of the explanation relates to the superiority of a monetary equilibrium over a barter one. However, it is one thing to explain why fiat money is better than barter, and quite another to explain how fiat money actually emerges. Recognizing this point, a number of recent studies (e.g., Kiyotaki and Wright 1991, 1992, 1993; Ritter 1995; and Williamson and Wright 1995)1 have sought to explain the emergence of fiat money by means of a hypothetical direct jump from barter to a fiat money equilibrium.2 This paper suggests that these attempts are fundamentally miscon- ceived. They suffer from three main problems. The first is the “start problem”3—that is, the difficulty of ensuring an initial demand for fiat money balances. If fiat money is ever to emerge from barter, someone must be the first to exchange real goods for pieces of paper money that, by definition, do not provide any direct consumption Cato Journal, Vol. 20, No. 3 (Winter 2001). © Cato Institute. All rights reserved. Kevin Dowd is Professor of Financial Risk Management at Nottingham University Business School. He thanks Charles Goodhart and George Selgin for very helpful correspondence on the issues discussed in this paper. The usual caveat applies. 1Some of the issues raised in this literature are also discussed by Goodhart (1997) and Selgin (1993, 1994, 1997). -

Chapter 10: Money and Banking Section 1 Objectives

Chapter 10: Money and Banking Section 1 Objectives 1. Describe the three uses of money. 2. List the six characteristics of money. 3. Analyze the sources of money’s values. Chapter 10, Section 1 Copyright © Pearson Education, Inc. Slide 2 Key Terms • money: anything that serves as a medium of exchange, a unit of account, and a store of value • medium of exchange: anything that is used to determine value during the exchange of goods and services • barter: the direct exchange of one set of goods or services for another • unit of account: a means for comparing the values of goods and services • store of value: something that keeps its value if it is stored rather than spent Chapter 10, Section 1 Copyright © Pearson Education, Inc. Slide 3 Key Terms, cont. • currency: coins and paper bills used as money • commodity money: objects that have value in and of themselves and that are also used as money • representative money: objects that have value because the holder can exchange them for something else of value • specie: coined money, usually gold or silver, used to back paper money • fiat money: objects that have value because a government has decreed that they are an acceptable means to pay debts Chapter 10, Section 1 Copyright © Pearson Education, Inc. Slide 4 Introduction • How does money serve the needs of our society? – Money provides means for comparing values of goods and services. – Money also serves as a store of value. – Without money, we wouldn’t be able to get the things that we need and want. Chapter 10, Section 1 Copyright © Pearson Education, Inc.