Asuntos Que Se Someten a La Aprobación Del Consejo

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

NSCC Important Notice

OTC# 206 Date: October 23, 2008 To: ALL PARTICIPANTS - OTC COMPARISON SYSTEM CASHIER, MANAGER REORGANIZATION Attention: OPERATIONS PARTNER/OFFICER, MANAGER P&S DEPT. CASHIER, MANAGER REORGANIZATION, GLOSSARY DEPT UPDATES TO THE LIST OF OTC CLEARED SECURITIES From: Underwriting Subject: OTC THIS NSCC OTC IMPORTANT NOTICE IS NOW AVAILABLE ON THE NSCC WEB SITE. THE WEB SITE WWW.DTCC.COM IS PASSWORD PROTECTED AND IS OPEN TO ALL FULL-SETTLING MEMBERS OR OTHER NSCC PARTICIPANTS. FIRMS THAT WANT ACCESS TO THE NOTICES OF CHANGES TO THE LIST OF OTC CLEARED SECURITIES SHOULD CALL THEIR NSCC ACCOUNT MANAGER AT 800-422- 0582 TO OBTAIN THE APPROPRIATE INFORMATION FOR ACCESS. UPDATE CUSIP # SYMBOL NAME DATE ADD G6481L101 NWCYF NEW CITY ENERGY LTD, ST HELIER 10/23/2008 ORDINARY SHARES (JERSEY) ADD N70967117 KNLJF KONINKLIJKE DELFTSCH 10/23/2008 AARDEWERK-FABRIEK DE PORCELEYNE FLES OR ADD *** Y2560F107 FSRCF FIRST RESOURCES LTD ORDINARY 10/23/2008 SHARES (SINGAPORE) ADD 00289R102 ABGOY ABENGOA SA UNSPONSORED ADR 10/23/2008 (SPAIN) ADD 004326104 ACXIY ACCIONA SA UNSPONSORED ADR 10/23/2008 (SPAIN) ADD 00444E103 ANIOY ACERINOX SA UNSPONSORED ADR 10/23/2008 (SPAIN) ADD 019146109 AECJY ALLIED ELECTRONICS CORP LTD 10/23/2008 UNSPONSORED ADR (SOUTH AFRICA) ADD 04313V204 AKPN ARTHUR KAPLAN COSMETICS, INC. 10/23/2008 COMMON STOCK ADD 05355Q102 AVEPY AVENG LTD UNSPONSORED ADR 10/23/2008 (SOUTH AFRICA) ADD 058779109 BLHEY BALOISE HOLDING AG UNSPONSORED 10/23/2008 Non-Confidential DTCC is now offering enhanced access to all important notices via a new, Web-based subscription service. The new notification system leverages RSS Newsfeeds, providing significant benefits including real-time updates and customizable delivery. -

Spain's Multinationals: the Dynamic Part of an Ailing Economy (WP)

Spain’s Multinationals: the Dynamic Part of an Ailing Economy (WP) William Chislett Area: International Economy and Trade / Europe Working Paper 17/2011 15/9/2011 Elcano Royal Institute Madrid – Spain http://www.realinstitutoelcano.org/wps/portal/rielcano_eng 1 Spain’s Multinationals: the Dynamic Part of an Ailing Economy (WP) William Chislett * Contents (1) Summary (2) Background (3) Current Situation (4) Telecommunications: Telefónica (5) Energy: Repsol YPF and Gas Natural Fenosa (6) Banks: Santander and BBVA (7) Electricity: Iberdrola and Gamesa (8) Construction and Infrastructure: Ferrovial, Acciona, ACS, FCC, Sacyr Vallehermoso and OHL (9) Other Multinationals: Abengoa, Acerinox, CAF, Ebro Puleva, Iberostar, Indra, La Seda, Mapfre, Mondragon Cooperative Corporation, NH Hoteles, Prisa, Prosegur and Sol Meliá (10) Family‐owned Multinationals: Antolín‐Irausa, Inditex, Pronovias, Roca and Talgo (11) Brands (12) The Paradox of Exports (13) Conclusion Appendix (a) Foreign Direct Investment Outflows by Selected Country, 1990‐2010 (US$ billion) Appendix (b) Outward Stock as a percentage of GDP by Selected Country, 1990‐2010 Appendix (c) Net Foreign Direct Investment Inflows of Spain and the United States in Latin America and the Caribbean (US$ million), 2005‐10 Selective bibliography (1) Summary Spain’s outward direct investment continues to rise. At the end of 2010, it stood at US$660.1 billion, higher than Italy’s and Germany’s in GDP terms. More than 20 companies have attained leading positions in their respective fields in the global market. Meanwhile, exports have become the engine of economic growth. While the US, the UK, Germany, France and Italy have lost global market share to varying degrees over the last decade, mainly to China and other emerging countries, Spain’s share of world merchandise exports has remained virtually unchanged. -

Audit Report on Grifols, S.A. and Subsidiaries

Audit Report on Grifols, S.A. and Subsidiaries (Together with the consolidated annual accounts and consolidated directors’ report of Grifols, S.A. and subsidiaries for the year ended 31 December 2020) (Translation from the original in Spanish. In the event of discrepancy, the Spanish-language version prevails.) KPMG Auditores, S.L. Torre Realia Plaça d’Europa, 41-43 08908 L’Hospitalet de Llobregat (Barcelona) Independent Auditor’s Report on the Consolidated Annual Accounts (Translation from the original in Spanish. In the event of discrepancy, the Spanish-language version prevails.) To the Shareholders of Grifols, S.A. REPORT ON THE CONSOLIDATED ANNUAL ACCOUNTS Opinion __________________________________________________________________ We have audited the consolidated annual accounts of Grifols, S.A. (the "Parent") and subsidiaries (together the "Group”), which comprise the consolidated balance sheet at 31 December 2020, and the consolidated income statement, consolidated statement of comprehensive income, consolidated statement of changes in equity and consolidated statement of cash flows for the year then ended, and consolidated notes. In our opinion, the accompanying consolidated annual accounts give a true and fair view, in all material respects, of the consolidated equity and consolidated financial position of the Group at 31 December 2020 and of its consolidated financial performance and consolidated cash flows for the year then ended in accordance with International Financial Reporting Standards as adopted by the European Union (IFRS-EU) and other provisions of the financial reporting framework applicable in Spain. Basis for Opinion _________________________________________________________ We conducted our audit in accordance with prevailing legislation regulating the audit of accounts in Spain. Our responsibilities under those standards are further described in the Auditor’s Responsibilities for the Audit of the Consolidated Annual Accounts section of our report. -

Monthly Professional Factsheet Iberia Fund A-Euro 31 August 2021

pro.en.xx.20210831.LU0048581077.pdf Iberia Fund A-Euro For Investment Professionals Only FIDELITY FUNDS MONTHLY PROFESSIONAL FACTSHEET IBERIA FUND A-EURO 31 AUGUST 2021 Strategy Fund Facts The portfolio managers are stock pickers who follow an unconstrained bottom-up Launch date: 01.10.90 approach. They invest in companies that are trading below their intrinsic value and Portfolio manager: Karoline Rosenberg, Mac Elatab focus on those whose long-term growth potential is mispriced by the market. Their Appointed to fund: 01.03.18, 30.04.21 emphasis is on structural, rather than cyclical, drivers of growth and concentrate on Years at Fidelity: 14, 7 variables that are within the company’s control rather than dependent on external Fund size: €215m factors. Sustainability analysis is integrated in the investment process but ESG risks do Number of positions in fund*: 34 not necessarily prevent the managers from making an investment. They take a medium Fund reference currency: Euro (EUR) to long-term approach, and as a result portfolio turnover is typically low. Fund domicile: Luxembourg Fund legal structure: SICAV Management company: FIL Investment Management (Luxembourg) S.A. Capital guarantee: No Portfolio Turnover Cost (PTC): 0.01% Portfolio Turnover Rate (PTR): 18.01% *A definition of positions can be found on page 3 of this factsheet in the section titled “How data is calculated and presented.” Objectives & Investment Policy Share Class Facts • The fund aims to provide long-term capital growth with the level of income expected Other share classes may be available. Please refer to the prospectus for more details. -

Instruction Effective Date: 3 January 2018

Number: I-EX-DF-13/2018 Contract Group: Financial Derivatives Date: 28 December 2017 Instruction Effective Date: 3 January 2018 Replaces: -- Subject Liquidity Provider Program for Stock Futures Settled by Delivery. Minimum requirements to meet to be considered Liquidity Summary Provider for Stock Futures Settled by Delivery. This Instruction is published to develop the established on Circular C-EX-DF-11/2018 or any Circular which may replace it. ASSOCIATED BENEFIT TO LIQUIDITY PROVIDER PROGRAM ON STOCK FUTURES SETTLED BY DELIVERY Associated benefit to the fulfilment of the minimum requirements will be that the fee per contract paid to MEFF and BME CLEARING of every traded contract on the Member prop account on every underlying, will be of 10 cents per contract except for those contracts where maximum per transaction has been already applied. Furthermore, no minimum per transaction will be applied. Fee per contract for every contract will have a progressive reduction depending on the daily average number of credits obtained by the Member during the control period according to the following table. Fee will be applied to every contract of (traded by property account) the period and in all underlyings, even those that have not been quoted. Credits Daily Average Fees Up to 49,440 0.100 Between 49,441y 96,055 0.090 Between 96,056 y 119,363 0.085 Between 119,364 y 142,671 0.080 Between 142,672 y 165,978 0.075 Between 165,979 y 189,286 0.070 Between 189,287 y 235,900 0.060 Between 235,901 y 282,515 0.050 Between 282,516 y 329,130 0.040 Between 329,131 y 375,743 0.030 375,744 or more 0.020 MINIMUM QUOTING CONDITIONS AND DEGREE OF FULFILLLMENT MEASUREMENT a) Each Member will quote at least a minimum of 10 single stock futures. -

International Corporate Investment in Ohio Operations August 2011

Policy Research and Strategic Planning Office A State Affiliate of the U.S. Census Bureau International Corporate Investment In Ohio Operations August 2011 John R. Kasich, Governor of Ohio Christiane Schmenk, Director, Ohio Department of Development International Corporate Investment in Ohio Operations August 2011 Table of Contents Introduction and Explanations Section 1: Maps Section 2: Alphabetical Listing by Company Name Section 3: Companies Listed by Country of Ultimate Parent Section 4: Companies Listed by County Location INTERNATIONAL CORPORATE INVESTMENT IN OHIO OPERATONS ESTABLISHMENTS EMPLOYING 5 OR MORE 7-ELEVEN, INC A P Green Refractories, Inc. 1551 N High St Columbus, OH 43201 1627 Pyro Rd Oak Hill, OH 45656-9311 Employment: 50 SIC code: 5411 Employment: 60 SIC code: 3255 Grocery stores (5 sites in Ohio) Clay refractories Parent: SEVEN & I HOLDINGS CO., LTD. Parent: RHI AG Japan Austria A P L Logistics Warehouse Management Services, Inc A P L Logistics Warehouse Management Services, Inc 3240 Urbancrest Industrial Grove City, OH 43123-1768 820 Flora Ave Akron, OH 44314-1722 Employment: 15 SIC code: 4225 Employment: 8 SIC code: 4225 General warehousing and storage General warehousing and storage Parent: NOL Group Parent: NOL Group Singapore Singapore A Raymond Tinnerman Manufacturing Inc A W Faber-Castell USA, Inc 1060 W 130th St Brunswick, OH 44212-0010 9450 Allen Dr Cleveland, OH 44125-4602 Employment: 50 SIC code: 3399 Employment: 100 SIC code: 5092 Fasteners Toys and hobby goods and supplies Parent: A Raymond Et Compagnie Parent: A.W. Faber-Castell Unternehmensverwaltung GmbH & Co. France KG Germany AAP St. Marys Corp ABB Inc. -

Análisis Carteras Modelo Españolas

7-oct-14 Análisis Carteras modelo españolas La siguiente tabla ofrece la evolución de las carteras modelo Evol. C.M. 20-Ibex35 (ene.'96/oct.'14) comparadas con el Ibex 35 del 2-sep-14 al 3-oct-14: 1000% Var. Mes Var. Año Dif año Ibex35 800% CARTERA 20 VALORES Ibex35 C.Mod. Ampliada -1,3% 4,3% 1,2% C.Mod. Media -1,2% 5,4% 2,3% 600% C.Mod. Simplificada -0,7% 10,4% 7,3% 400% IBEX 35 -1,7% 3,1% n/a 200% Las tablas siguientes muestran la evolución de los valores que integran las carteras modelo españolas durante el pasado mes: 0% Cartera modelo ampliada 96 97 98 99 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 septiembre octubre CM 20 valores: Cambios octubre C. ampliada Peso % Rbd. x div C. ampliada Peso Beta Rbd. x div Entran Salen Cambian Peso (1) (1) Telefonica 5 Var.Mes-0,17% 6,2% Telefonica 5 0,889 6,3% Amadeus +5 OHL -3 Santander -2 Santander 7 -2,49% 8,1% Santander 5 1,137 8,3% Mediaset +5 Cie Automotive-5 ACS -1 Endesa 2 9,10% 0,0% Endesa 2 0,866 4,9% Arcelor Mittal -1 ACS 4 -5,91% 3,8% ACS 3 0,951 3,9% BBVA +3 ArcelorMittal 5 -6,67% 1,4% ArcelorMittal 5 0,929 1,4% Técn. Reunidas -2 BBVA 7 1,16% 3,5% BBVA 10 1,182 3,6% Iberdrola -1 Caixabank -2 Acerinox 4 -0,43% 3,9% Acerinox 4 1,249 3,9% Red Eléctrica +2 Enagas +1 Técnicas Reunidas 5 -5,25% 3,5% Técnicas Reunidas 3 0,886 3,6% CM 20 valores vs Ibex en 2014 Int. -

TD Ameritrade Spanish Financial Transactional Tax Impacted

TD Ameritrade Spanish Financial Transactional Tax-Impacted Securities PO Box 2760 Omaha, NE 68103-2760 Fax: 866-468-6268 Cusip Symbol Description Cusip Symbol Description E7390Z100 MRPRF MERLIN PROPERTIES E7366C101 SMIZF MELIA HOTELS SOCIMI S.A. EUR1 INTERNATIONAL SA COM E0304S106 CDNIF LOGISTA HOLDINGS COM E67674106 BABWF INTL CONSOL AIRLINES E526K0106 ANNSF AENA SME S.A. COM GRP SA COM E2R41M104 CLNXF CELLNEX TELECOM SAU 879382109 TEFOF TELEFONICA SA COM COM E97579192 VSCFF VISCOFAN SA COM E5R71W108 GMPUF GESTAMP AUTOMOCION E9853W160 ZRDZF ZARDOYA-OTIS COM COM 00089H106 ACSAY ACS ACTIVIDADES DE E8S56X108 PGUUF PROSEGUR CASH COM CONSTRUCCIO ADR E04648114 AMADF AMADEUS IT GROUP SA UNSPONSORED COM 00444E103 ANIOY ACERINOX SA ADR E38028135 EBRPF EBRO FOODS SA COM UNSPONSORED E11805103 BBVXF BANCO BILBAO VIZCAYA 00774W103 ANYYY AENA SME S.A. ADR ARGENTARI COM 02263T104 AMADY AMADEUS IT GROUP SA E2R23Z164 BNKXF BANKIA S.A. COM ADR UNSPONSORED E2116H880 BKIMF BANKINTER SA COM 05946K101 BBVA BANCO BILBAO VIZCAYA E15819191 BNDSF BANCO DE SABADELL SA ARGENTARI ADR COM SPONSORED E19790109 BCDRF BANCO SANTANDER SA 059568105 BNDSY BANCO DE SABADELL SA COM ADR UNSPONSORED E7S90S109 GASNF NATURGY ENERGY GROUP 05964H105 SAN BANCO SANTANDER SA S.A. COM ADR SPONSORED E5701Q116 GCNJF GRUPO CATALANA 066449109 BNKXY BANKIA S.A. ADR OCCIDENTE SA COM UNSPONSORED E6271Z155 ISMAF INDRA SISTEMAS S.A COM 066460304 BKNIY BANKINTER SA ADR E49512119 FRRVF FERROVIAL SA COM SPONSORED E52236143 FMOCF FOM CONST Y CONTRA 12803K109 CAIXY CAIXABANK SA ADR COM UNSPONSORED -

Eurex Circular 113/17

eurex circular 113/17 Date: 20 October 2017 Recipients: All Trading Participants of Eurex Deutschland and Eurex Zürich and Vendors Authorized by: Mehtap Dinc Action required Single Stock Futures: Introduction of 25 SSFs Contact: Derivatives Trading Operations, T +49-69-211-1 12 10, Nicolae Raulet, T +44-207-8 62 72 74 Content may be most important for: Attachment: Ü All departments Updated Annex A of the Contract Specifications for Futures Contracts and Options Contracts at Eurex Deutschland and Eurex Zürich Summary: The Management Board of Eurex Deutschland and the Executive Board of Eurex Zürich AG took the following decisions with effect from 25 October 2017: 1. Introduction of 25 Single Stock Futures pursuant to Annex A of the attachment. Eurex Deutschland Internet: Management Board: Börsenplatz 4 www.eurexchange.com Thomas Book, 60313 Frankfurt/Main Mehtap Dinc, Erik Tim Müller, Mailing address: Michael Peters, Randolf Roth 60485 Frankfurt/Main Germany ARBN: 101 013 361 eurex circular 113/17 Single Stock Futures: Introduction of 25 SSFs 1. Product overview Eurex Future/Dividend Future Underlying ISIN Eurex Product Product ISIN product on group ID currency code ABEP Abertis Infraestructuras ES0111845014 ES02 EUR DE000A2G9TW1 S.A. AENP Aena S.A. ES0105046009 ES02 EUR DE000A2G9TY7 AI3P Amadeus IT Group S.A. ES0109067019 ES02 EUR DE000A2G9TZ4 ANAP Acciona S.A. ES0125220311 ES02 EUR DE000A2G9TX9 BAKP Bankinter S.A. ES0113679I37 ES02 EUR DE000A2G9T28 BDSP Banco de Sabadell S.A. ES0113860A34 ES02 EUR DE000A2G9UK4 CLNP Cellnex Telecom S.A. ES0105066007 ES02 EUR DE000A2G9T44 CMAP Mapfre S.A. ES0124244E34 ES02 EUR DE000A2G9UG2 COLP Inmobiliaria Colonial S.A. -

When a Dream Comes True an Illustrated History of 75 Years of Grifols When a Dream Comes True

When a Dream Comes True An Illustrated History of 75 Years of Grifols When a Dream Comes True When a Dream Comes True An Illustrated History of 75 Years of Grifols Project management: Rosa Avellà, Berta Miquel Graphic management: Natàlia Archs Text: Josep Nieto, Beatriz Martínez, Maria Ferrer Photographs: Historical Archive, Grifols, S.A. Translation: Tim Gutteridge, Kyra Sheahan Design: Marc Ancochea Proofreading: Irene Aparicio Publishing management: Ton Barnils 1st edition: January, 2015 © Grifols, S.A. Jesús i Maria, 6, 08022 Barcelona Publisher: DAU Doctor Rizal, 5, bajo, 08006 Barcelona, SPAIN ISBN: 978-84-606-6415-4 DL B 6924-2015 “To revere the past is to ennoble the present and to think of the future.” Santiago Ramón y Cajal, Nobel Laureate in Medicine, 1906 This book is dedicated to a number of different groups. Firstly, to all those employees who, over the years, have been at the forefront of the company’s activities. It is their contribution that enables Grifols to manufacture the safe, high-quality medicines and health products that are used to save human lives on a daily basis. Secondly, to those people who have expressed their solidarity with their fellow human beings by generously donating their plasma to improve the quality of life of others. Thirdly, to the millions of patients whose health and well-being are the reason why this company exists. And finally, to the health professionals with whom Grifols continues to work hand in hand to improve the quality of health care. It is a relationship that we hope to carry forward into the future. -

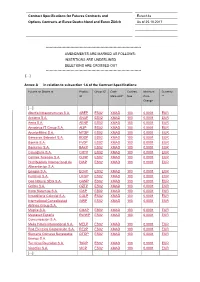

Contract Specifications for Futures Contracts and Eurex14e Options Contracts at Eurex Deutschland and Eurex Zürich As of 25.10.2017

Contract Specifications for Futures Contracts and Eurex14e Options Contracts at Eurex Deutschland and Eurex Zürich As of 25.10.2017 ************************************************************************* AMENDMENTS ARE MARKED AS FOLLOWS: INSERTIONS ARE UNDERLINED DELETIONS ARE CROSSED OUT ************************************************************************* […] Annex A in relation to subsection 1.6 of the Contract Specifications: Futures on Shares of Product Group ID* Cash Contract Minimum Currency ID Market-ID* Size Price ** Change […] Abertis Infraestructuras S.A. ABEP ES02 XMAD 100 0.0001 EUR Acciona S.A. ANAP ES02 XMAD 100 0.0001 EUR Aena S.A. AENP ES02 XMAD 100 0.0001 EUR Amadeus IT Group S.A. AI3P ES02 XMAD 100 0.0001 EUR ArcelorMittal S.A. MTSP ES02 XMAD 100 0.0001 EUR Banco de Sabadell S.A. BDSP ES02 XMAD 100 0.0001 EUR Bankia S.A. FV0P ES02 XMAD 100 0.0001 EUR Bankinter S.A. BAKP ES02 XMAD 100 0.0001 EUR CaixaBank S.A. CRTP ES02 XMAD 100 0.0001 EUR Cellnex Telecom S.A. CLNP ES02 XMAD 100 0.0001 EUR Distribuidora Internacional de DIAP ES02 XMAD 100 0.0001 EUR Alimentacion S.A. Enagas S.A. EG4P ES02 XMAD 100 0.0001 EUR Ferrovial S.A. UFGP ES02 XMAD 100 0.0001 EUR Gas Natural SDG S.A. GANP ES02 XMAD 100 0.0001 EUR Grifols S.A. OZTP ES02 XMAD 100 0.0001 EUR Indra Sistemas S.A. IDAP ES02 XMAD 100 0.0001 EUR Inmobiliaria Colonial S.A. COLP ES02 XMAD 100 0.0001 EUR International Consolidated INRP ES02 XMAD 100 0.0001 EUR Airlines Group S.A. Mapfre S.A. -

Anlage 1 History Eurex14e 2020

Contract Specifications for Futures Contracts Eurex14e and Options Contracts at Eurex Deutschland As of 26.10.2020 Page 1 ********************************************************************************** AMENDMENTS ARE MARKED AS FOLLOWS: INSERTIONS ARE UNDERLINED DELETIONS ARE CROSSED OUT ********************************************************************************** […] Annex A in relation to Subsection 1.6 of the Contract Specifications: Futures on Shares of Prod- Group Cash Contrac Minimum Curren- Mini- Minimu uct ID ID* Market- t Size Price cy** mum m Block ID* Change Block Trade Trade Size Size (Eurex (TES) EnLight and QTPIP entered Transact ions***) […] Aena S.A. AENP ES02 XMAD 100 0.0001 EUR 5 5N/A Aena S.A. AEAF ES01 XMAD 100 0.0001 EUR 10 10 […] Acciona S.A. ANAP ES02 XMAD 100 0.0001 EUR 5 5N/A […] Acerinox S.A. ACEP ES02 XMAD 100 0.0001 EUR 50 50N/A […] ACS. Actividades de Construcción y OCIP ES02 XMAD 100 0.0001 EUR 10 10N/A Servicios S.A. […] Adyen N.V. ADYF NL01 XAMS 10 0.0001 EUR 10 10 […] AHLSTROM-MUNKSJÖ AMHF FI01 XHEL 100 0.0001 EUR 50 50 OYJ […] Amadeus IT Group S.A. AI3P ES02 XMAD 100 0.0001 EUR 5 5N/A […] Banco Bilbao Vizcaya BBVP ES02 XMAD 100 0.0001 EUR 750 750N/A Argentaria S.A. (BBVA) Contract Specifications for Futures Contracts Eurex14e and Options Contracts at Eurex Deutschland As of 26.10.2020 Page 2 Futures on Shares of Prod- Group Cash Contrac Minimum Curren- Mini- Minimu uct ID ID* Market- t Size Price cy** mum m Block ID* Change Block Trade Trade Size Size (Eurex (TES) EnLight and QTPIP entered Transact ions***) […] Banco de Sabadell S.A.