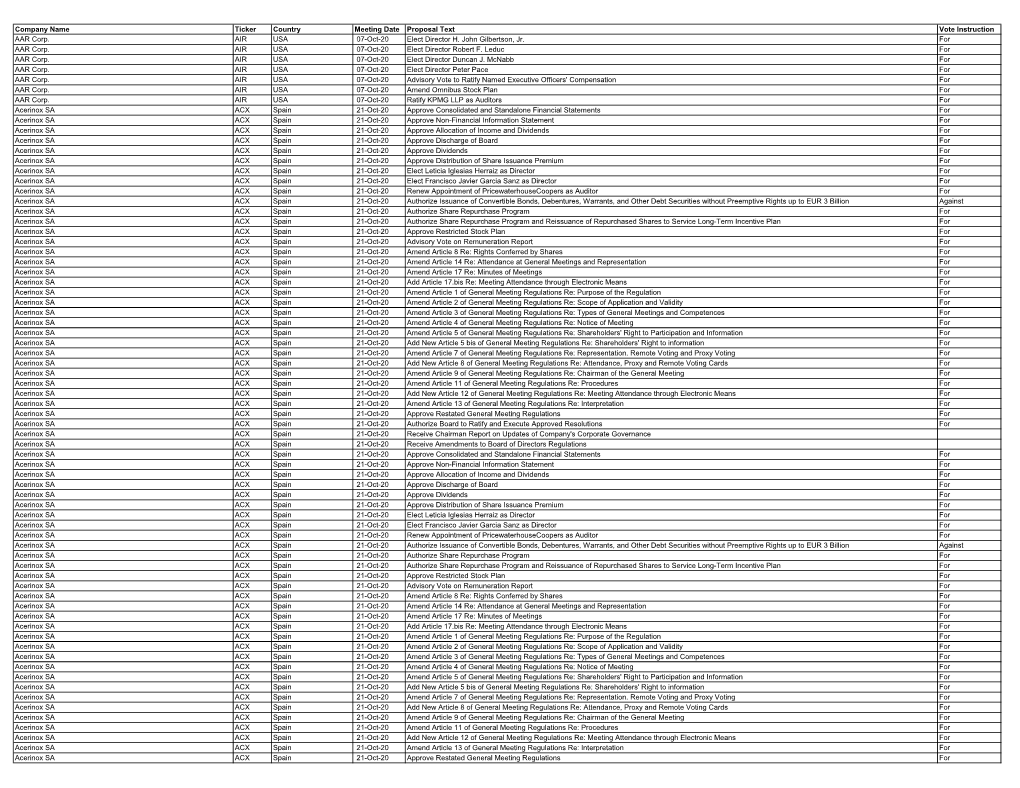

Proxy Vote Record

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Inbound E-Directory 2016

INBOUND E-DIRECTORY 2016 What is the Tourism Export Council of New Zealand? The Tourism Export Council of New Zealand is a trade association that has represented the interests of inbound tourism since 1971. Their inbound members package holidays for international visitors whether they be part of a group tour, independent traveller, conference/incentives, education or cruise visitors. What do we do & who do we represent? The Tourism Export Council’s focus is to build long term business relationships with distribution networks in New Zealand and offshore. The relationship with product suppliers in New Zealand and offshore wholesalers is integral to the country’s continued growth as a visitor destination. Member categories include: . Inbound member - inbound tour operators (ITO’s) . Allied member - attraction, activity, accommodation, transport and tourism service suppliers Examples of the allied membership include: . Attraction – Milford Sound, SkyTower, Te Papa Museum . Activities – Jetboating, Whalewatch, Maori Culture show . Accommodation – hotels, luxury lodges, backpackers . Transport – airlines, bus & coaches, sea transport, shuttles . Tourism services – Regional Tourism Organisations (RTO’s) digital & marketing companies, education & tourism agencies eg. DOC, Service IQ, Qualmark, AA Tourism, BTM Marketing, ReserveGroup Why is tourism considered an export industry? Tourism, like agriculture is one of New Zealand’s biggest income earners. Both are export industries because they bring in foreign dollars to New Zealand. With agriculture, you grow an apple, send it offshore and a foreigner eats it. A clear pathway of a New Zealand product consumed or purchased by someone overseas. Tourism works slightly differently: The product is still developed in NZ (just like the apple) It is sold offshore (like the apple) It is purchased by a foreigner (again like the apple) BUT it is experienced in NZ and therein lies the difference. -

Bank Leumi Le-Israel B.M. 2019 Periodic Report

Bank Leumi Le-Israel B.M. 2019 Periodic Report Regulation No. 9, 9(c) Financial Statements and Independent Auditors’ Opinion 1, 7 and 25A The Corporation’s Details, including Registered Address 10C Use of the Proceeds of Securities 11 List of Investments in Subsidiaries and Associates as of the Balance Sheet Date 12 Changes in Investments in Subsidiaries and Associates in the Report Period 13 Income of Subsidiaries and Associates and the Corporation’s Income therefrom as of the Balance Sheet Date 14 List of Groups of Balances of Loans Granted as of the Balance Sheet Date, if the Granting of Loans was One of the Corporation’s Main Lines Of Business 20 Listed for Trade on the Stock Exchange or Cessation of Trade 21 Compensation of Interested Parties and Senior Officers 21A Control of the Corporation 22 Transactions with Controlling Shareholders 24 Holdings of Interested Parties and Senior Officers 24A Registered Share Capital, Issued Share Capital and Convertible Securities 24B The Corporation’s Shareholder Register 26 The Corporation's Directors 26A The Corporation’s Senior Officers 26B The Corporation’s Authorized Signatories 27 The Corporation’s Independent Auditors 28 Change in Memorandum or Articles of Association 29 Recommendations and Resolutions of the Board of Directors and General Meeting 29A The Company’s Resolutions 5 Signatures 2019 Periodic Report Company: Bank Leumi Le-Israel B.M. Company no. at Registrar 520018078 of Companies: Registered address: Beit Leumi, 34 Yehuda Halevi St., Tel Aviv 6513616 (Regulation 25A) Email: [email protected] (Regulation 25A) Tel. 1: +972-76-885-8111 Tel. -

Thl Interim Report 2012

Interim Report Tourism Holdings Limited 2012 Chairman’s Report Keith Smith Tourism Holdings Limited (thl) has achieved a significant Summary of Results turnaround in performance in the half-year to December The NPAT for the first half at $4.2m is well above the prior 2011, with a strong increase in profit, resumption in dividend corresponding period due to the Rugby World Cup effect in New payments and positive indicators for continued growth. Zealand and the first high-season profit from the Road Bear business in the USA. Net Profit After Tax (NPAT) for the first half was well above the Revenue for the period increased by $23m or 27%. Revenue December 2010 half-year result, due to the Rugby World Cup effect excluding fleet sales increased by $16m to $83m. Road Bear in New Zealand and the first high-season profit from the Road Bear represented $11m of the increase. business in the USA, acquired in December 2010. The Road Bear business has continued to perform above The Board is encouraged by the performance of the business in an expectations, with an EBIT of NZD$6.1m. This included the USA operating environment that continues to be difficult. high season period. The winter low season (January – June 2012) forecast is a loss of up to $1.0m at the EBIT level. As announced by our CEO Grant Webster, the new manufacturing Net Debt for the half was $102m compared to $91m for the prior joint venture RV Manufacturing Group LP (RVMG LP) provides an corresponding period. The debt increase for the half of $11m outstanding and rare opportunity to create a step change in reducing including increased fleet in Road Bear and the purchase of the costs, improving efficiency and provides a platform for strong profit Motek Hamilton building for $7.3m growth in that business. -

Retirement Strategy Fund 2060 Description Plan 3S DCP & JRA

Retirement Strategy Fund 2060 June 30, 2020 Note: Numbers may not always add up due to rounding. % Invested For Each Plan Description Plan 3s DCP & JRA ACTIVIA PROPERTIES INC REIT 0.0137% 0.0137% AEON REIT INVESTMENT CORP REIT 0.0195% 0.0195% ALEXANDER + BALDWIN INC REIT 0.0118% 0.0118% ALEXANDRIA REAL ESTATE EQUIT REIT USD.01 0.0585% 0.0585% ALLIANCEBERNSTEIN GOVT STIF SSC FUND 64BA AGIS 587 0.0329% 0.0329% ALLIED PROPERTIES REAL ESTAT REIT 0.0219% 0.0219% AMERICAN CAMPUS COMMUNITIES REIT USD.01 0.0277% 0.0277% AMERICAN HOMES 4 RENT A REIT USD.01 0.0396% 0.0396% AMERICOLD REALTY TRUST REIT USD.01 0.0427% 0.0427% ARMADA HOFFLER PROPERTIES IN REIT USD.01 0.0124% 0.0124% AROUNDTOWN SA COMMON STOCK EUR.01 0.0248% 0.0248% ASSURA PLC REIT GBP.1 0.0319% 0.0319% AUSTRALIAN DOLLAR 0.0061% 0.0061% AZRIELI GROUP LTD COMMON STOCK ILS.1 0.0101% 0.0101% BLUEROCK RESIDENTIAL GROWTH REIT USD.01 0.0102% 0.0102% BOSTON PROPERTIES INC REIT USD.01 0.0580% 0.0580% BRAZILIAN REAL 0.0000% 0.0000% BRIXMOR PROPERTY GROUP INC REIT USD.01 0.0418% 0.0418% CA IMMOBILIEN ANLAGEN AG COMMON STOCK 0.0191% 0.0191% CAMDEN PROPERTY TRUST REIT USD.01 0.0394% 0.0394% CANADIAN DOLLAR 0.0005% 0.0005% CAPITALAND COMMERCIAL TRUST REIT 0.0228% 0.0228% CIFI HOLDINGS GROUP CO LTD COMMON STOCK HKD.1 0.0105% 0.0105% CITY DEVELOPMENTS LTD COMMON STOCK 0.0129% 0.0129% CK ASSET HOLDINGS LTD COMMON STOCK HKD1.0 0.0378% 0.0378% COMFORIA RESIDENTIAL REIT IN REIT 0.0328% 0.0328% COUSINS PROPERTIES INC REIT USD1.0 0.0403% 0.0403% CUBESMART REIT USD.01 0.0359% 0.0359% DAIWA OFFICE INVESTMENT -

NSCC Important Notice

OTC# 206 Date: October 23, 2008 To: ALL PARTICIPANTS - OTC COMPARISON SYSTEM CASHIER, MANAGER REORGANIZATION Attention: OPERATIONS PARTNER/OFFICER, MANAGER P&S DEPT. CASHIER, MANAGER REORGANIZATION, GLOSSARY DEPT UPDATES TO THE LIST OF OTC CLEARED SECURITIES From: Underwriting Subject: OTC THIS NSCC OTC IMPORTANT NOTICE IS NOW AVAILABLE ON THE NSCC WEB SITE. THE WEB SITE WWW.DTCC.COM IS PASSWORD PROTECTED AND IS OPEN TO ALL FULL-SETTLING MEMBERS OR OTHER NSCC PARTICIPANTS. FIRMS THAT WANT ACCESS TO THE NOTICES OF CHANGES TO THE LIST OF OTC CLEARED SECURITIES SHOULD CALL THEIR NSCC ACCOUNT MANAGER AT 800-422- 0582 TO OBTAIN THE APPROPRIATE INFORMATION FOR ACCESS. UPDATE CUSIP # SYMBOL NAME DATE ADD G6481L101 NWCYF NEW CITY ENERGY LTD, ST HELIER 10/23/2008 ORDINARY SHARES (JERSEY) ADD N70967117 KNLJF KONINKLIJKE DELFTSCH 10/23/2008 AARDEWERK-FABRIEK DE PORCELEYNE FLES OR ADD *** Y2560F107 FSRCF FIRST RESOURCES LTD ORDINARY 10/23/2008 SHARES (SINGAPORE) ADD 00289R102 ABGOY ABENGOA SA UNSPONSORED ADR 10/23/2008 (SPAIN) ADD 004326104 ACXIY ACCIONA SA UNSPONSORED ADR 10/23/2008 (SPAIN) ADD 00444E103 ANIOY ACERINOX SA UNSPONSORED ADR 10/23/2008 (SPAIN) ADD 019146109 AECJY ALLIED ELECTRONICS CORP LTD 10/23/2008 UNSPONSORED ADR (SOUTH AFRICA) ADD 04313V204 AKPN ARTHUR KAPLAN COSMETICS, INC. 10/23/2008 COMMON STOCK ADD 05355Q102 AVEPY AVENG LTD UNSPONSORED ADR 10/23/2008 (SOUTH AFRICA) ADD 058779109 BLHEY BALOISE HOLDING AG UNSPONSORED 10/23/2008 Non-Confidential DTCC is now offering enhanced access to all important notices via a new, Web-based subscription service. The new notification system leverages RSS Newsfeeds, providing significant benefits including real-time updates and customizable delivery. -

Spain's Multinationals: the Dynamic Part of an Ailing Economy (WP)

Spain’s Multinationals: the Dynamic Part of an Ailing Economy (WP) William Chislett Area: International Economy and Trade / Europe Working Paper 17/2011 15/9/2011 Elcano Royal Institute Madrid – Spain http://www.realinstitutoelcano.org/wps/portal/rielcano_eng 1 Spain’s Multinationals: the Dynamic Part of an Ailing Economy (WP) William Chislett * Contents (1) Summary (2) Background (3) Current Situation (4) Telecommunications: Telefónica (5) Energy: Repsol YPF and Gas Natural Fenosa (6) Banks: Santander and BBVA (7) Electricity: Iberdrola and Gamesa (8) Construction and Infrastructure: Ferrovial, Acciona, ACS, FCC, Sacyr Vallehermoso and OHL (9) Other Multinationals: Abengoa, Acerinox, CAF, Ebro Puleva, Iberostar, Indra, La Seda, Mapfre, Mondragon Cooperative Corporation, NH Hoteles, Prisa, Prosegur and Sol Meliá (10) Family‐owned Multinationals: Antolín‐Irausa, Inditex, Pronovias, Roca and Talgo (11) Brands (12) The Paradox of Exports (13) Conclusion Appendix (a) Foreign Direct Investment Outflows by Selected Country, 1990‐2010 (US$ billion) Appendix (b) Outward Stock as a percentage of GDP by Selected Country, 1990‐2010 Appendix (c) Net Foreign Direct Investment Inflows of Spain and the United States in Latin America and the Caribbean (US$ million), 2005‐10 Selective bibliography (1) Summary Spain’s outward direct investment continues to rise. At the end of 2010, it stood at US$660.1 billion, higher than Italy’s and Germany’s in GDP terms. More than 20 companies have attained leading positions in their respective fields in the global market. Meanwhile, exports have become the engine of economic growth. While the US, the UK, Germany, France and Italy have lost global market share to varying degrees over the last decade, mainly to China and other emerging countries, Spain’s share of world merchandise exports has remained virtually unchanged. -

Company Date Type Resid Proposal Vote Rescode CARR's GROUP

Company Date Type ResId Proposal Vote ResCode CARR'S GROUP PLC 07/01/2020 AGM 1 Receive the Annual Report Abstain 201 CARR'S GROUP PLC 07/01/2020 AGM 2 Approve the Dividend For 401 CARR'S GROUP PLC 07/01/2020 AGM 3 Elect Peter Page Oppose 301 CARR'S GROUP PLC 07/01/2020 AGM 4 Re-elect Tim Davies For 301 CARR'S GROUP PLC 07/01/2020 AGM 5 Re-elect Neil Austin For 301 CARR'S GROUP PLC 07/01/2020 AGM 6 Re-elect Alistair Wannop Oppose 301 CARR'S GROUP PLC 07/01/2020 AGM 7 Re-elect John Worby Oppose 301 CARR'S GROUP PLC 07/01/2020 AGM 8 Re-elect Ian Wood Oppose 301 CARR'S GROUP PLC 07/01/2020 AGM 9 Appoint the Auditors For 501 CARR'S GROUP PLC 07/01/2020 AGM 10 Allow the Board to Determine the Auditor's Remuneration For 503 CARR'S GROUP PLC 07/01/2020 AGM 11 Approve the Remuneration Report Oppose 202 CARR'S GROUP PLC 07/01/2020 AGM 12 Issue Shares with Pre-emption Rights For 601 CARR'S GROUP PLC 07/01/2020 AGM 13 Issue Shares for Cash For 602 CARR'S GROUP PLC 07/01/2020 AGM 14 Authorise Share Repurchase Oppose 607 CARR'S GROUP PLC 07/01/2020 AGM 15 Meeting Notification-related Proposal For 1511 DIPLOMA PLC 15/01/2020 AGM 1 Receive the Annual Report Oppose 201 DIPLOMA PLC 15/01/2020 AGM 2 Approve the Dividend For 401 DIPLOMA PLC 15/01/2020 AGM 3 Re-elect John Nicholas Oppose 301 DIPLOMA PLC 15/01/2020 AGM 4 Elect Johnny Thomson For 301 DIPLOMA PLC 15/01/2020 AGM 5 Re-elect Nigel Lingwood For 301 DIPLOMA PLC 15/01/2020 AGM 6 Re-elect Charles Packshaw For 301 DIPLOMA PLC 15/01/2020 AGM 7 Re-elect Andy Smith For 301 DIPLOMA PLC 15/01/2020 AGM 8 -

Annual Financial Results | 2012

Annual Financial Results | 2012 Directors’ Statement The directors of Air New Zealand Limited are pleased to present to shareholders the Annual Report* and financial statements for Air New Zealand and its controlled entities (together the “Group”) for the year to 30 June 2012. The directors are responsible for presenting financial statements in accordance with New Zealand law and generally accepted accounting practice, which give a true and fair view of the financial position of the Group as at 30 June 2012 and the results of the Group’s operations and cash flows for the year ended on that date. The directors consider the financial statements of the Group have been prepared using accounting policies which have been consistently applied and supported by reasonable judgements and estimates and that all relevant financial reporting and accounting standards have been followed. The directors believe that proper accounting records have been kept which enable with reasonable accuracy, the determination of the financial position of the Group and facilitate compliance of the financial statements with the Financial Reporting Act 1993. The directors consider that they have taken adequate steps to safeguard the assets of the Group, and to prevent and detect fraud and other irregularities. Internal control procedures are also considered to be sufficient to provide a reasonable assurance as to the integrity and reliability of the financial statements. This Annual Report is signed on behalf of the Board by: John Palmer Roger France CHAIRMAN DIRECTOR -

Fiscal Quarter-End Holdings (Pdf)

Quarterly Schedules of Portfolio Holdings International & Global Funds July 31, 2020 Retirement Institutional Administrative Investor Class Class Class Class Harbor Diversified International All Cap Fund HNIDX HAIDX HRIDX HIIDX Harbor Emerging Markets Equity Fund HNEMX HAEMX HREMX HIEEX Harbor Focused International Fund HNFRX HNFSX HNFDX HNFIX Harbor Global Leaders Fund HNGIX HGGAX HRGAX HGGIX Harbor International Fund HNINX HAINX HRINX HIINX Harbor International Growth Fund HNGFX HAIGX HRIGX HIIGX Harbor International Small Cap Fund HNISX HAISX HRISX HIISX Harbor Overseas Fund HAORX HAOSX HAOAX HAONX Table of Contents Portfolios of Investments HARBOR DIVERSIFIED INTERNATIONAL ALL CAP FUND. ..... 1 HARBOR EMERGING MARKETS EQUITY FUND . .......... 8 HARBOR FOCUSED INTERNATIONAL FUND. ................................. 11 HARBOR GLOBAL LEADERS FUND. ................. 13 HARBOR INTERNATIONAL FUND . 15 HARBOR INTERNATIONAL GROWTH FUND . ........................ 21 HARBOR INTERNATIONAL SMALL CAP FUND. ................. 24 HARBOR OVERSEAS FUND . ............................................ 26 Notes to Portfolios of Investments ..................................... 31 Harbor Diversified International All Cap Fund PORTFOLIO OF INVESTMENTS—July 31, 2020 (Unaudited) Value, Cost, and Principal Amounts in Thousands COMMON STOCKS—96.4% COMMON STOCKS—Continued Shares Value Shares Value AEROSPACE & DEFENSE—0.7% BANKS—Continued 28,553 Airbus SE (France)* .............................. $ 2,090 236,142 Svenska Handelsbanken AB (Sweden) ............... $ -

Annual Report Year Ended 30 June 2019

Annual Report Year Ended 30 June 2019 GENERAL Year in Review 4 Creating Value 6 Performance 8 Diversity Snapshot 12 Chair’s Review 14 Chief Executive Officer’s Review 15 Delivering Our Group Strategy 16 About SkyCity 24 Auckland 27 Hamilton 31 Adelaide 32 Queenstown 34 International Business 35 Our Risk Profile and Management 36 Our Board 40 Our Senior Leadership Team 44 SUSTAINABILITY Our Sustainability 48 Our Sustainability Pillars Our Customers 52 Our People 58 Our Communities 72 Our Suppliers 78 Our Environment 84 Independent Limited Assurance Statement 91 CORPORATE GOVERNANCE STATEMENT AND OTHER DISCLOSURES Corporate Governance Statement 92 Director and Employee Remuneration 104 Shareholder and Bondholder Information 118 Directors’ Disclosures 121 Company Disclosures 123 This annual report is dated 14 August 2019 and is signed on behalf of the Board of directors of SkyCity Entertainment Group Limited (SkyCity or the company and, together with its subsidiaries, the Group) by: FINANCIAL STATEMENTS Independent Auditor’s Report 127 Income Statement 134 Statement of Comprehensive Income 135 Rob Campbell Bruce Carter Balance Sheet 136 Chair Deputy Chair Statement of Changes in Equity 137 An electronic copy of this annual report is available in the Investor Centre section of the company’s Statement of Cash Flows 138 website at www.skycityentertainmentgroup.com Notes to the Financial Statements 139 Reconciliation of Normalised Results to Reported Results 174 GRI CONTENT INDEX 178 ABOUT THIS ANNUAL REPORT GLOSSARY 182 Unless otherwise stated, all dollar amounts in this annual report are expressed in New Zealand dollars. DIRECTORY 183 Where appropriate, information is also provided in relation to activities that have occurred after 30 June 2019, but prior to publication of this annual report. -

A Description and Analysis of the Implementation of the Concentration Law and Its Economic

A Description and Analysis of the Implementation of the Concentration Law and Its Economic Impact on the Israeli Economy Written by: Noam Botosh, Economist | Approved by: Ami Tzadik, Head of the Budgetary Control Department Date: February 25rd 2020 Economic Review www.knesset.gov.il/mmm Knesset Research and Information Center 1 | A Description and Analysis of the Implementation of the Concentration Law and Its Economic Impact on the Israeli Economy Summary This review was written at the request of MK Ofer Shelah, and it addresses the implementation of the Law for Promotion of Competition and Reduction of Concentration, 5774-2013 (herein, "the Concentration Law" or "the Law") and provides a preliminary analysis of the Law's impact on the Israeli economy. A Bank of Israel study from 2009 about business groups showed that, compared to other developed countries, the level of concentration in Israel is high, as reflected in the number of existing business groups, and that these groups possess high levels of financial leverage. The study suggested that this structure of business groups may constitute a risk to Israel's financial stability due to the groups' size and complexity. In October 2010, the Committee on Increasing Competitiveness in the Economy was established in order to examine general market competitiveness in Israel—mainly due to the existence of large business groups— and to recommend possible policy tools to promote market competitiveness. According to the committee's interim report, which was published in October 2011, the ownership structure of public companies in Israel is centralized, and the committee identified a phenomenon of large business groups controlling a large share of real and financial assets. -

25 February 2015 MEDIA | NZX RELEASE TOURISM HOLDINGS LIMITED (Thl) FINANCIAL RESULTS for SIX MONTHS

Tourism Holdings Limited Tel: +64 9 336 4299 The Beach House Fax: +64 9 309 9269 Level 1, 83 Beach Road www.thlonline.com Auckland City PO Box 4293, Shortland Street Auckland 1140, New Zealand 25 February 2015 MEDIA | NZX RELEASE TOURISM HOLDINGS LIMITED (thl) FINANCIAL RESULTS FOR SIX MONTHS ENDED 31 DECEMBER 2014 GROWTH ACHIEVED, $17M FULL YEAR FORECAST HIGHLIGHTS: Operating Profit Before Financing Costs and Tax (EBIT) of $10.6M up $3.4M or 48% on the prior corresponding period (pcp) Net Profit After Tax of $5.6M versus $2.5M for pcp Interim dividend of 7 cents per share (cps) declared versus 5 cents for pcp Net Debt decreased to $85M down $12M on the pcp FY15 year end NPAT forecast confirmed at greater than $17M Strategic financial goals set at the Annual Meeting are well on track thl today announced a half year profit in line with updated expectations released to the market in December. Chairman Mr Rob Campbell said: “We continue to deliver on the expectations we have provided shareholders. Further earnings improvements will be achieved in the current operations. We are now addressing appropriate smart growth opportunities. We are already the global leader in self drive RV tourist experiences and there are further opportunities to increase the scope and value of this industry segment globally. thl will remain very focused on growing earnings and flexible capital utilisation.” The business also confirmed it anticipates at least $17M Net Profit After Tax for the FY15 financial year. Chief Executive Officer Mr Grant Webster said: “We are operating in a positive tourism environment and have addressed the core operating issues within the business.