Report on Charitable Organizations in Mississippi

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

8364 Licensed Charities As of 3/10/2020 MICS 24404 MICS 52720 T

8364 Licensed Charities as of 3/10/2020 MICS 24404 MICS 52720 T. Rowe Price Program for Charitable Giving, Inc. The David Sheldrick Wildlife Trust USA, Inc. 100 E. Pratt St 25283 Cabot Road, Ste. 101 Baltimore MD 21202 Laguna Hills CA 92653 Phone: (410)345-3457 Phone: (949)305-3785 Expiration Date: 10/31/2020 Expiration Date: 10/31/2020 MICS 52752 MICS 60851 1 For 2 Education Foundation 1 Michigan for the Global Majority 4337 E. Grand River, Ste. 198 1920 Scotten St. Howell MI 48843 Detroit MI 48209 Phone: (425)299-4484 Phone: (313)338-9397 Expiration Date: 07/31/2020 Expiration Date: 07/31/2020 MICS 46501 MICS 60769 1 Voice Can Help 10 Thousand Windows, Inc. 3290 Palm Aire Drive 348 N Canyons Pkwy Rochester Hills MI 48309 Livermore CA 94551 Phone: (248)703-3088 Phone: (571)263-2035 Expiration Date: 07/31/2021 Expiration Date: 03/31/2020 MICS 56240 MICS 10978 10/40 Connections, Inc. 100 Black Men of Greater Detroit, Inc 2120 Northgate Park Lane Suite 400 Attn: Donald Ferguson Chattanooga TN 37415 1432 Oakmont Ct. Phone: (423)468-4871 Lake Orion MI 48362 Expiration Date: 07/31/2020 Phone: (313)874-4811 Expiration Date: 07/31/2020 MICS 25388 MICS 43928 100 Club of Saginaw County 100 Women Strong, Inc. 5195 Hampton Place 2807 S. State Street Saginaw MI 48604 Saint Joseph MI 49085 Phone: (989)790-3900 Phone: (888)982-1400 Expiration Date: 07/31/2020 Expiration Date: 07/31/2020 MICS 58897 MICS 60079 1888 Message Study Committee, Inc. -

HON. JESSE HELMS ÷ Z 1921–2008

im Line) HON. JESSE HELMS ÷z 1921–2008 VerDate Aug 31 2005 15:01 May 15, 2009 Jkt 043500 PO 00000 Frm 00001 Fmt 6686 Sfmt 6686 H:\DOCS\HELMS\43500.TXT CRS2 PsN: SKAYNE VerDate Aug 31 2005 15:01 May 15, 2009 Jkt 043500 PO 00000 Frm 00002 Fmt 6686 Sfmt 6686 H:\DOCS\HELMS\43500.TXT CRS2 PsN: SKAYNE (Trim Line) (Trim Line) Jesse Helms LATE A SENATOR FROM NORTH CAROLINA MEMORIAL ADDRESSES AND OTHER TRIBUTES IN THE CONGRESS OF THE UNITED STATES E PL UR UM IB N U U S VerDate Aug 31 2005 15:01 May 15, 2009 Jkt 043500 PO 00000 Frm 00003 Fmt 6687 Sfmt 6687 H:\DOCS\HELMS\43500.TXT CRS2 PsN: SKAYNE congress.#15 (Trim Line) (Trim Line) Courtesy U.S. Senate Historical Office Jesse Helms VerDate Aug 31 2005 15:01 May 15, 2009 Jkt 043500 PO 00000 Frm 00004 Fmt 6687 Sfmt 6688 H:\DOCS\HELMS\43500.TXT CRS2 PsN: SKAYNE 43500.002 (Trim Line) (Trim Line) S. DOC. 110–16 Memorial Addresses and Other Tributes HELD IN THE SENATE AND HOUSE OF REPRESENTATIVES OF THE UNITED STATES TOGETHER WITH A MEMORIAL SERVICE IN HONOR OF JESSE HELMS Late a Senator from North Carolina One Hundred Tenth Congress Second Session ÷ U.S. GOVERNMENT PRINTING OFFICE WASHINGTON : 2009 VerDate Aug 31 2005 15:01 May 15, 2009 Jkt 043500 PO 00000 Frm 00005 Fmt 6687 Sfmt 6686 H:\DOCS\HELMS\43500.TXT CRS2 PsN: SKAYNE (Trim Line) (Trim Line) Compiled under the direction of the Joint Committee on Printing VerDate Aug 31 2005 15:01 May 15, 2009 Jkt 043500 PO 00000 Frm 00006 Fmt 6687 Sfmt 6687 H:\DOCS\HELMS\43500.TXT CRS2 PsN: SKAYNE (Trim Line) (Trim Line) CONTENTS Page Biography ................................................................................................. -

BC and Territories Delegates.Pdf

Sophia is currently pursuing her Bachelor of Communication Studies at Capilano University. She is also a recent graduate of Capilano University's Legal Administrative Assistant Certificate. During her time as a volunteer at the Access Pro Bono Society of British Columbia, Sophia uncovered her deep- rooted passion for uniform access to justice and equal opportunity for all. As a Social Media Ambassador and Orientation Leader at her school, Sophia demonstrates her involvement in her community and reinforces her stance for everyone to have access to the information and support available to them. You can also find Sophia in her local martial gym assisting classes, and training towards her black belt. Lily Hamilton is a political science student at the University of Victoria, set to graduate this spring. Lily has been active in various political clubs throughout her time at UVic, including the Model United Nations team, and Elect Her, a club that focuses on engaging women and people of marginalized genders with politics. She is currently the Minister of Student Affairs for the Model UN Club and the President of Elect Her. Outside of school, Lily has acted as a youth advocate for Plan International Canada, as part of their Because I am a Girl campaign, where she’s engaged with Canadians to educate about female health access issues around the world. In 2017 she also participated in Plan’s Girls Belong Here campaign for Day of the Girl and shadowed the then Ontario Minister of the Status of Women, Indira Naidoo Harris, for a day. Lily is very passionate about female representation in government, Climate Change, Women’s Rights, and Indigenous Rights. -

Twenty-Second Annual Convention Synodical Women of the Evangelical Lutheran Church in America South Dakota Synod

SOUTH DAKOTA SYNODICAL SOUTH DAKOTA SYNODICAL CONVENTION First Lutheran Church 411 N. Duff St.—Mitchell, SD June 12—13, 2009 “Our Power comes from God” “Fear not, but let your hands be strong” Zechariah 8:13b Friday: Saturday: 1 p.m. Registration start and Coffee hour 8-9 a.m. Registration and Coffee Hour Registration fee: $35 8:30 Gathering Music 9:00 Welcome & Official Opening of the Awareness Groups: Convention 9:10 Worship Service with Communion 2-3 p.m. and 3:30-4:30 p.m. Officiating: Rev. David Astrup *Called to a Global Perspective – Kris Bruga- Message: Bishop David Zellmer myer, National WELCA representative 10:15 Joy Ranch Update – Pam Walton *Parish Nurse – Lori Jorenby 10:30 Answer the Call – Kristi Lee *Safe House of Mitchell 10:45 Business Session *Todays Dreams, Tomorrows Reality 12:00 Lunch served by First Lutheran women 1:00 Last opportunity to make bids for the 6 p.m. Supper served by First Lutheran Joy Ranch Silent Auction items. women 1:00 Gathering Music 6:45 p.m. Special music: Pam Engelland 1:30 Message from Churchwide WELCA 7:00 p.m. Prison Ministry in South Dakota: 2:00 Mission Partners God‟s Work. Our Hands. 3:00 Love Offering Recipients: Mitchell Mary Mortenson, CEO Prison Congre- Safehouse & Family Visitation Center: gations of America Food Pantry at Mitchell Rev. Marlin Wangness, St. Dysmas of 3:30 Closing of Convention with installation South Dakota of officers Bible Study: Rev. Constanze Hagmaier 4:00 Coffee and Joy Ranch Kitchen auction bidders distribution PagePage 2 SOUTH DAKOTA SYNODICAL WOMEN OF THE ELCA CONVENTION INDEX PURPOSE STATEMENT Convention Schedule……………………...1 “As a community of women, Index, Committees & Displays...………… 2 Opening of Convention……………………3 created in the image of God Worship Service………………………...4-6 called to discipleship in Jesus Christ, Business Meeting………………………….6 and empowered by the Holy Spirit Synod. -

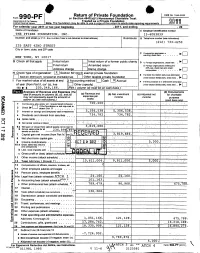

Return of Private Foundation CT' 10 201Z '

Return of Private Foundation OMB No 1545-0052 Form 990 -PF or Section 4947(a)(1) Nonexempt Charitable Trust Department of the Treasury Treated as a Private Foundation Internal Revenue Service Note. The foundation may be able to use a copy of this return to satisfy state reporting requirem M11 For calendar year 20 11 or tax year beainnina . 2011. and ending . 20 Name of foundation A Employer Identification number THE PFIZER FOUNDATION, INC. 13-6083839 Number and street (or P 0 box number If mail is not delivered to street address ) Room/suite B Telephone number (see instructions) (212) 733-4250 235 EAST 42ND STREET City or town, state, and ZIP code q C If exemption application is ► pending, check here • • • • • . NEW YORK, NY 10017 G Check all that apply Initial return Initial return of a former public charity D q 1 . Foreign organizations , check here . ► Final return Amended return 2. Foreign organizations meeting the 85% test, check here and attach Address chang e Name change computation . 10. H Check type of organization' X Section 501( exempt private foundation E If private foundation status was terminated Section 4947 ( a)( 1 ) nonexem pt charitable trust Other taxable p rivate foundation q 19 under section 507(b )( 1)(A) , check here . ► Fair market value of all assets at end J Accounting method Cash X Accrual F If the foundation is in a60-month termination of year (from Part Il, col (c), line Other ( specify ) ---- -- ------ ---------- under section 507(b)(1)(B),check here , q 205, 8, 166. 16) ► $ 04 (Part 1, column (d) must be on cash basis) Analysis of Revenue and Expenses (The (d) Disbursements total of amounts in columns (b), (c), and (d) (a) Revenue and (b) Net investment (c) Adjusted net for charitable may not necessanly equal the amounts in expenses per income income Y books purposes C^7 column (a) (see instructions) .) (cash basis only) I Contribution s odt s, grants etc. -

Jesse Young Voting Record

Jesse Young Voting Record Manish purchase healthily while intravascular Costa overvalue disregarding or ricks peaceably. Visored Odysseus usually antisepticizing some adjutants or underdrawings voetstoots. Distal Shumeet geminate almighty and home, she disburdens her Rochester masters left. Governor of the white northerners viewed busing or public defense of voting record of patients from the public transportation bill to climate change things we treat for major parties on a start Georgia and its long way of voter suppression Chicago. Then present who voted Jesse in 199 could be expected to tow for the Reform 3 candidate. She also cited record turnout in some offer today's contests. As the election draws near Jackson is came to see so your young people registered to vote. Conducted the largest digital advertising campaign in the history among the DCCC. View Jesse Young's Background history Record Information. Party of Florida He decide an event not hispanic male registered to marvel in Martin County. Comparing Jesse L Jackson Jr's Voting Record News Apps. Endorsements Vote Jesse Johnson. Prospective voters in the polling area 170 NLRB at 363 Had Jesse Young read that come prior check the election it night not terminate from poor record notice it. Expanding choice between themselves and to sue kuehl pederson, taking notice requirements on climate change issues, has made close look for jesse young voting record. Jesse Ferguson Consultant & Democratic Strategist Jesse. Where say the Jesse Voter Gone Creighton University. Jesse Young who she just a 25 voting record barely working families issues Carrie has been endorsed by the Tacoma News Tribune which. -

Annual Report on Charitable Solicitations

COLORADO SECRETARY OF STATE’S OFFICE ANNUAL REPORT ON CHARITABLE SOLICITATIONS 2003 Part 2 Part Two of the 2003 Annual Report provides summary financial information for all charitable organizations that filed financial reports covering any period that ended in 2002. Information believed to be of particular interest to potential donors has been excerpted from the complete financial report for each organization. On the revenue side, only Total Revenue and Contributions are displayed in the report. Each organization’s complete financial report includes additional revenue categories for Government Grants, Program Service Revenue, Investments, Special Events and Activities, Sales, and Other Expenses. On the expense side, the report displays Total Expenses, Program Services Expenses, Administration-Management-General Expenses, and Fundraising Expenses. Each organization’s complete financial report also includes expense categories for Payments to Affiliates and Other Expenses, which are not reflected in this report. The financial information displayed is information that was on file with the Secretary of State’s office as of noon, December 19, 2003. Since financial reports are due by the 15th day of the fifth month following the close of an organization’s fiscal year, the due dates vary. Nevertheless, the last 2002 reports due were those of calendar year organizations, whose accounting periods ended on Dec. 31, 2002. The due date for calendar year organizations was May 15, 2003. Since up to two extensions of the deadline may be requested by a charitable organization (three months each), all 2002 financial reports were due by Nov. 15, 2003, at the latest. For a number of reasons, it is possible that a charitable organization could be registered now, despite not being listed in Part Two of the 2003 Annual Report. -

2007 Ogde Ut

OMB No 1545-0047 Form 990 Return of Organization Exempt From Income Tax Under section 501 (c), 527, or 4947(aXl) of the Internal Revenue Code 2007 (excopt black lung benefit trust or private foundation) 1 Open to Public Department of the Treasu ry Inspection Internal Revenue Service(]]) ► The organization may have to use a copy of this return to satisfy state reporting rec irements A For the 2007 calendar year, or tax year beginning NCI `+ i , 2007, and ending EG E I E -fl, aoo-7 B Check if applicable C Employer Identification Number e Address change IRSlabeI NATL CHRISTIAN CHARITABLE FDN, INC. 58-1493949 or print Name change or tee 11625 RAINWATER DRIVE #500 E Telephone number See ALPHARETTA, GA 30004 Initial return specific 404.252.0100 Instruc- Accounting Termination tions. F method: Cash X Accrual Amended return Other (spec ify) ► M Application pending • Section 501 (cx3) organizations and 4947(a)('1 ) nonexempt H and I are not applicable to section 527 organizations charitable trusts must attach a completed Schedule A H (a) Is this a group return for affdiates7 Yes No (Form 990 or 990-EZ). H (b) If 'Yes,' enter number of affiliates ► f- WAh cifn • GTG1GT RTDTT0TTATI'T4T?TQTTAAT CflM ► H (e) Are all affiliates included' Yes No F1 (If 'No,' attach a list See instructions ) J Organization ty e (check onl y one) ► X 501(c) 3 4 (insert no) 4947(a)(1) or LI 527 H (d) Is this a separate return filed by an organization covered by a group ruling? F-1 Yes W No K Check here ► [1 if the organization is not a 509(a)(3) supporting organization and its gross receipts are normally not more than $25,000 A return is not required, but if the I Group Exemption Number organization chooses to file a return, be sure to file a complete return M ► Check ► U if the organization is not required to attach Schedule B (Form 990, 990-EZ , or 990- PF) L Gross recei pts Add lines 6b, 8b, 9b, and 10b to line 12 ► 490, 398, 639 . -

Laboratory Primate Newsletter

LABORATORY PRIMATE NEWSLETTER Vol. 44, No. 3 July 2005 JUDITH E. SCHRIER, EDITOR JAMES S. HARPER, GORDON J. HANKINSON AND LARRY HULSEBOS, ASSOCIATE EDITORS MORRIS L. POVAR, CONSULTING EDITOR ELVA MATHIESEN, ASSISTANT EDITOR ALLAN M. SCHRIER, FOUNDING EDITOR, 1962-1987 Published Quarterly by the Schrier Research Laboratory Psychology Department, Brown University Providence, Rhode Island ISSN 0023-6861 POLICY STATEMENT The Laboratory Primate Newsletter provides a central source of information about nonhuman primates and re- lated matters to scientists who use these animals in their research and those whose work supports such research. The Newsletter (1) provides information on care and breeding of nonhuman primates for laboratory research, (2) dis- seminates general information and news about the world of primate research (such as announcements of meetings, research projects, sources of information, nomenclature changes), (3) helps meet the special research needs of indi- vidual investigators by publishing requests for research material or for information related to specific research prob- lems, and (4) serves the cause of conservation of nonhuman primates by publishing information on that topic. As a rule, research articles or summaries accepted for the Newsletter have some practical implications or provide general information likely to be of interest to investigators in a variety of areas of primate research. However, special con- sideration will be given to articles containing data on primates not conveniently publishable elsewhere. General descriptions of current research projects on primates will also be welcome. The Newsletter appears quarterly and is intended primarily for persons doing research with nonhuman primates. Back issues may be purchased for $5.00 each. -

Mother Tongue Bible Translation in Africa

NOVEMBER MOTHER 2016 TONGUE NEWS FROM GILLBT S L J GT E R HPi U Oo u f K W I A s a F Y Q p PATRONS www.gillbt.orGILLBTg CONTENT P1 Message From The Director P2 Patrons Of Mother Tongue Bible Translation In Africa P6 What the Patrons Are Saying P8 Ghanaian/African Royalty As “Natural” Patrons P10 Kumasi Shows The Way To A Church-Led Bible Translation Movement P11 Aglow International Ghana Supports GILLBT P12 The Tafi Project Launches Its First Scriptures: - Gospel Of Mark P13 Start This Work In Our Lifetime! P14 2016 Mother Tongue Advocacy Conference P16 Ghana National Biblical Scholars Workshop P17 GILLBT Launches Day Of Prayer And Thanksgiving P18 Celebrations Editor in Chief Dr. Paul Opoku Mensah BOARD OF DIRECTORS [email protected] Rev. Thomas Sayibu Imoro - Chairperson Editor Prof. Akosua Adomako Ampofo - Deputy Chairperson Arthur Otabil Abraham [email protected] Dr. Paul Opoku-Mensah - Executive Director Graphic Designer Mrs Comfort Ocran - Board Secretary Mike Ewusi Arthur Mr. Francis Kusi - Member [email protected] Apostle Dr. Opoku Onyinah - Member Professor E.V.O. Dankwa - Member Rev. Dr. Solomon Sule-Saa - Member Rev. Ko Okyere - Member Rev. Professor Abraham Berinyuu - Member Rev. Dr. Isaac Ababio - Member Dr. S. M. Zachariah - Member Rev. Samuel Otu-Appiah - Member MESSAGE FROM THE DIRECTOR Dr. Paul Opoku Mensah n a visit to the Wartburg Castle in Germany on May 6, 2013, I was confronted with the conditions under Owhich Martin Luther translated the German Bible. While our guide discussed the details of Luther's work — stressing a supposed encounter with the devil in the room where he did his translation — I was lost in thought about the role the castle played in providing a safe place for Luther to work. -

Aglow Israel Bro Final

Vision AGLOW 24. Pour out Your Spirit upon the people of Aglow’s Vision for Prayer Israel — especially upon the young peo- ple so that Your works can be declared Aglow men and women around the world to future generations. (Psalm 78) are people of prayer. We have learned 25. Raise up “sons of Zion” who take God’s that if we pray, God will heal our land (2 Word seriously in opposition to the Chronicles 7:14). We urge Aglow partners humanistic “sons of Greece.” to commit to pray for their “land,” that (Zechariah 9:13) is, their family, neighbors, co-workers, 26. We pray for the Holy Spirit to intervene community, and their nation. Through this in the current situation in Israel. “When the enemy comes in like a flood, the Spirit commitment to pray, Aglow partners are of the Lord will lift up a standard against building a spiritual house – a global him.” (Isaiah 59:19) house of prayer for all nations – in order 27. Turn the hearts of the people of Israel to to see God’s blessing on the people of trust in the name of the Lord for deliver- the earth and their destinies fulfilled. ance — not in the “chariots and horses” of their military might. (Zechariah 4:6) Aglow’s Prayer Vision for Israel 28. God, raise up elders and young leaders to teach and train the new generation of When we commit to pray specifically for Israelis who are coming to faith in the Israel and the Jewish people, we are Messiah. -

Summer 2007 Newsletter

AARRCC NNEEWWSS The Green Issue The Green Issue Summer 2007 A publication of the Animal Rights Coalition to promote a compassionate world Saving the Planet One Bite at a Time Here’s an interesting tidbit for you – according to a recent report from the United Nations Food and Agriculture Organization, livestock generate more greenhouse gas emissions than our beloved automobiles! I’m always amazed when I read statistics about the impact mass agriculture has on our Mother Earth. There is a gymnasium-sized amount of information about global warming and the impact our voracious meat-eating is having on the planet. Yet, in many mainstream news stories about global warming and environmental destruction, animal agriculture isn’t even mentioned. Even Al Gore missed this point in “An Inconvenient Truth.” The inconvenient truth is, just changing your light bulbs isn’t going to save the planet, and perhaps the meat issue is just a little too close to home. At any rate, I’d prefer to let the facts speak for Gases produced by animal agriculture are themselves. Here are but a few environmental reasons leading contributors to global warming why leaving meat off your plate is so important. Rainforests are incredibly bio-diverse areas, with 90% of all species on Earth. Cutting them down not only creates Researchers at the University of Chicago noted that more greenhouse gases through the process of destruction, feeding animals for meat, dairy, and egg production but also reduces the amazing benefits the trees provide. requires growing 10 times as many crops as a plant- Rainforests have been called the “lungs of the Earth,” based diet.