View Annual Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Magirus Interschutz Innovation 2015

MAGIRUS INTERSCHUTZ INNOVATION 2015 1 MAGIRUS PHILOSOPHY 1 LIFE MAKES THE DIFFERENCE. Firefi ghters are following their calling. Our mission is to develop and build the best fi re-fi ghting equipment in the world. Every day fi re-fi ghters and disaster responders all over the world We are absolutely convinced that the best fi re-fi ghting equipment do their best to save lives, defy the forces of nature and save is built by fi re-fi ghters themselves. They know exactly how their people in diffi cult situations. This requires them to constantly comrades think, what they need in an emergency, what makes overcome their own limitations and become the real heroes of their job easier and how to make sure they are as safe as possible. our time. These people not only have a career, they’re living out a calling. Our mission is to give them ideal support for facing This is the reason why many of our staff are themselves in all their challenges and provide them with the best equipment fi re- fi ghting and disaster response teams and stay in close possible. contact with their customers, who are at the same time their comrades. This lets us continuously create trend-setting innova- “There are no second That’s why we do everything we can to produces the most tions adopted for use by fi re brigades all around the world. innovative and reliable turntable ladders, fi re-fi ghting vehicles, rescue vehicles, logistics vehicles, special vehicles, airport fi re-fi ghting vehicles and components. -

Shipbreaking # 43 – April 2016

Shipbreaking Bulletin of information and analysis on ship demolition # 43, from January 1 to 31 March 31, 2016 April 29, 2016 Content Novorossiysk, the model harbour 1 Overview : 1st quarter 2016 11 Bulk carrier 46 Ports : the Top 5 2 Factory ship / fishing ship 13 Cement carrier 76 Ships aground and cargoes adrift 2 Reefer 14 Car carrier 77 In the spotlight 5 Offshore 15 Ro Ro 80 Yellow card and red card for grey ships 6 General cargo 19 Ferry 80 From Champagne to the blowtorch 8 Container ship 30 The END : Italy is breaking 82 Tsarev the squatter 9 Tanker 42 up migrant carriers The disgrace of German ship-owners 9 Chemical tanker 45 Sources 85 Dynamite in Indonesia 10 Gas tanker 45 Novorossiysk (Black Sea, Russia), the model harbour 1 Novorossiysk : detentionstorm in the Black Sea The port of Novorossiysk plays in the Black Sea and the Mediterranean a major role of watchdog. The Russian port has a long tradition in the control of merchant vessels. Within the framework of international agreements on maritime transport safety, inspectors note aboard deficiencies relating to maritime security, protection of the environment and living conditions of crews and do not hesitate to retain substandard ships as much as necessary. Of the 265 ships to be broken up between January 1st and March 31 2016, 14 were detained in Novorossiysk, sometimes repeatedly, and therefore reported as hazardous vessels to all states bordering the Black Sea and the Mediterranean. At least 4 freighters, the Amina H, the Majed and Randy, the Venedikt Andreev and the Med Glory had the migrant carriers profile. -

The Life-Cycle of the Barcelona Automobile-Industry Cluster, 1889-20151

The Life-Cycle of the Barcelona Automobile-Industry Cluster, 1889-20151 • JORDI CATALAN Universitat de Barcelona The life cycle of a cluster: some hypotheses Authors such as G. M. P. Swann and E. Bergman have defended the hy- pothesis that clusters have a life cycle.2 During their early history, clusters ben- efit from positive feedback such as strong local suppliers and customers, a pool of specialized labor, shared infrastructures and information externali- ties. However, as clusters mature, they face growing competition in input mar- kets such as real estate and labor, congestion in the use of infrastructures, and some sclerosis in innovation. These advantages and disadvantages combine to create the long-term cycle. In the automobile industry, this interpretation can explain the rise and decline of clusters such as Detroit in the United States or the West Midlands in Britain.3 The objective of this paper is to analyze the life cycle of the Barcelona au- tomobile- industry cluster from its origins at the end of the nineteenth centu- ry to today. The Barcelona district remained at the top of the Iberian auto- mobile clusters for a century. In 2000, when Spain had reached sixth position 1. Earlier versions of this paper were presented at the International Conference of Au- tomotive History (Philadelphia 2012), the 16th World Economic History Congress (Stellen- bosch 2012), and the 3rd Economic History Congress of Latin America (Bariloche 2012). I would like to thank the participants in the former meetings for their comments and sugges- tions. This research benefitted from the financial support of the Spanish Ministry of Econo- my (MINECO) and the European Regional Development Fund (ERDF) through the projects HAR2012-33298 (Cycles and industrial development in the economic history of Spain) and HAR2015-64769-P (Industrial crisis and productive recovery in the Spanish history). -

Annual Report 2005

Annual report 2005 Società per Azioni Capital stock - € 163,251,460 fully paid-in Registered office in Turin - Corso Matteotti, 26 – Turin Company Register No. 00470400011 TABLE OF CONTENTS DIRECTORS’ REPORT ON OPERATIONS 1 Board of Directors, General Manager, Board of Statutory Auditors and Independent Auditors 2 Chairman’s letter 4 IFI Group profile 10 Major events in 2005 10 IFI Group - Review of the condensed consolidated results 14 IFI Group - Review of the results of the consolidated financial statements 15 IFI S.p.A. - Review of the results of the statutory financial statements 18 Transition to International Financial Reporting Standards (IFRS) by IFI S.p.A. 21 Related party disclosures 23 Stock option plans 23 Other information 24 Equity investments held by directors, statutory auditors and general manager 25 Significant events subsequent to the end of the year 25 Business outlook 26 Review of the operating performance of the holdings IFIL and Exor Group 32 Motion for the approval of the financial statements and the appropriation of net income for the year IFI S.p.A. - STATUTORY FINANCIAL STATEMENTS AT DECEMBER 31, 2005 34 Balance sheet 36 Income statement 37 Notes to the financial statements 53 Annexes IFI GROUP - CONSOLIDATED FINANCIAL STATEMENTS AT DECEMBER 31, 2005 66 Consolidated balance sheet 67 Consolidated income statement 68 Statement of changes in consolidated equity 69 Consolidated statement of cash flows 70 Notes to the consolidated financial statements 131 Appendix – Transition to International Financial Reporting Standards (IFRS) 142 REPORTS OF THE BOARD OF STATUTORY AUDITORS 146 REPORTS OF THE INDEPENDENT AUDITORS 149 LIST OF IFI GROUP COMPANIES AND SIGNIFICANT INVESTMENTS AT DECEMBER 31, 2005 This is an English translation of the Italian original document “Relazioni e Bilanci 2005” approved by the IFI Board of Directors on March 31, 2006, which has been prepared solely for the convenience of the reader. -

Bombas De Agua•Water Pumps•Wasserpumpen•Pompes a Eau

BOMBAS DE AGUA•WATER PUMPS•WASSERPUMPEN•POMPES A EAU Truck 2007 Truck 2007 INDUSTRIAS DOLZ, S.A. C/Vall de Uxó nº 1 · 12004 · Castellón · SPAIN T.: +34 964 34 00 38 · F: +34 964 24 13 01 e-mail: [email protected] · www.idolz.com DOLZ ARGENTINA, S.A. Av. Marcelo T. de Alvear 3894 Ciudadela Bs/As · Argentina · C/P: 1702 Telefax: 5411-4488-3397/2849 e-mail: [email protected] · www.idolz.com tecnologíaBOMBAS DE AGUA • WATER PUMPS Con más de 70 años de liderazgo en la investigación, desarrollo y fabricación de bombas de agua, Industrias Dolz ha creado una nueva generación de productos con los que consigue situarse en la vanguardia internacional del mercado. La calidad certificada de todas las referencias, partiendo de diseños y componentes originales y fruto de una constante y exigente labor de I+D, nos permite ofrecer la gama de bombas de agua más amplia del mercado. Por este motivo, las bombas DOLZ están plenamente adaptadas a todas las exigencias de la industria de la automoción y continúan nuestra filosofía, cuyo objetivo parte del firme compromiso que avala toda nuestra trayectoria: satisfacer las necesidades de nuestros clientes. In its more than 70 years at the head of research, development and manufacturing of water pumps, Dolz has created a new generation of products which have placed it in prime position in the market. The certified quality of all our models, from original designs and components to the highest and most exacting R&D, have enabled us to supply the fullest range of pumps.Dolz pumps are fully adapted to the demands of the motor industry and continue our basic philosophy which is: to satisfy the needs of our customers. -

The Magazine Of

No.58 - WINTER 2012 THE MAGAZINE OF LLeylandeyland TTorqueorque 558.indd8.indd 1 22/12/12/12/12 118:59:098:59:09 Hon. PRESIDENT To be appointed Hon. VICE PRESIDENT Neil D. Steele, 18 Kingfi sher Crescent, also CHAIRMAN Cheadle, Staffordshire, ST10 1RZ VICE-CHAIRMAN David E.Berry, 40 Bodiam Drive, SALES & WEBSITE CO-ORDINATOR Toothill, Swindon, Wilts, SN5 8BE Mike A. Sutcliffe, MBE, FCA, ‘Valley Forge’ SECRETARY and 213 Castle Hill Road, Totternhoe, MAGAZINES EDITOR Dunstable, Beds. LU6 2DA TREASURER Gary Dwyer, 8 St Mary’s Close, West St. EVENT CO-ORDINATOR Sompting, Lancing, W. Sussex, BN15 0AF BCVM LIAISON, FLEET BOOKS, Ron Phillips, 16 Victoria Avenue, PRESERVED LEYLAND RECORDS ‘Grappenhall, Warrington, WA4 2PD John Howie, 37 Balcombe Gardens, MEMBERSHIP SECRETARY Horley, Surrey, RH6 9BY ASSISTANT MEMBERSHIP SEC’Y David J. Moores, 10 Lady Gate, (NEW MEMBERS) Diseworth, Derby, DE74 2QF CHASSIS RECORDS, Don Hilton, 79 Waterdell, Leighton TECHNICAL & SPARES Buzzard, Beds. LU7 3PL COMMITTEE MEMBER John Bennett, 174 Leicester Road, ASSISTING WITH PUBLICATIONS Loughborough, Leics. LE11 2AH WEBMASTER Gerry Tormey, Contact via David Berry MEMBERSHIP Subscription levels are £27 per annum (Family £31), £33 for EEC members, £38 (in Sterling) for membership outside the EEC. Anyone joining after 1st April and before 31st July will have their membership carried over to the next 31st July, ie up to 16 months. This is good value for money and new members are welcomed. Application forms are available from the Membership Secretary or via the Website www.leylandsociety.co.uk LLeylandeyland TTorqueorque 558.indd8.indd 2 22/12/12/12/12 118:59:108:59:10 Issue No. -

Ivecobus Range Handbook.Pdf

CREALIS URBANWAY CROSSWAY EVADYS 02 A FULL RANGE OF VEHICLES FOR ALL THE NEEDS OF A MOVING WORLD A whole new world of innovation, performance and safety. Where technological excellence always travels with a true care for people and the environment. In two words, IVECO BUS. CONTENTS OUR HISTORY 4 OUR VALUES 8 SUSTAINABILITY 10 TECHNOLOGY 11 MAGELYS DAILY TOTAL COST OF OWNERSHIP 12 HIGH VALUE 13 PLANTS 14 CREALIS 16 URBANWAY 20 CROSSWAY 28 EVADYS 44 MAGELYS 50 DAILY 56 IVECO BUS CHASSIS 68 IVECO BUS ALWAYS BY YOUR SIDE 70 03 OUR HISTORY ISOBLOC. Presented in 1938 at Salon de Paris, it was the fi rst modern European coach, featuring a self-supporting structure and rear engine. Pictured below the 1947 model. 04 PEOPLE AND VEHICLES THAT TRANSPORTED THE WORLD INTO A NEW ERA GIOVANNI AGNELLI JOSEPH BESSET CONRAD DIETRICH MAGIRUS JOSEF SODOMKA 1866 - 1945 1890 - 1959 1824 - 1895 1865 - 1939 Founder, Fiat Founder, Société Anonyme Founder, Magirus Kommanditist Founder, Sodomka des établissements Besset then Magirus Deutz then Karosa Isobloc, Chausson, Berliet, Saviem, Fiat Veicoli Industriali and Magirus Deutz trademarks and logos are the property of their respective owners. 05 OVER A CENTURY OF EXPERIENCE AND EXPERTISE IVECO BUS is deeply rooted into the history of public transport vehicles, dating back to when the traction motor replaced horse-drawn power. We are proud to carry on the tradition of leadership and the pioneering spirit of famous companies and brands that have shaped the way buses and coaches have to be designed and built: Fiat, OM, Orlandi in Italy, Berliet, Renault, Chausson, Saviem in France, Karosa in the Czech Republic, Magirus-Deutz in Germany and Pegaso in Spain, to name just a few. -

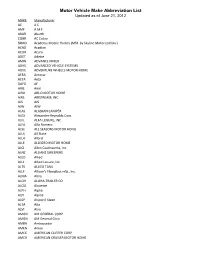

Motor Vehicle Make Abbreviation List Updated As of June 21, 2012 MAKE Manufacturer AC a C AMF a M F ABAR Abarth COBR AC Cobra SKMD Academy Mobile Homes (Mfd

Motor Vehicle Make Abbreviation List Updated as of June 21, 2012 MAKE Manufacturer AC A C AMF A M F ABAR Abarth COBR AC Cobra SKMD Academy Mobile Homes (Mfd. by Skyline Motorized Div.) ACAD Acadian ACUR Acura ADET Adette AMIN ADVANCE MIXER ADVS ADVANCED VEHICLE SYSTEMS ADVE ADVENTURE WHEELS MOTOR HOME AERA Aerocar AETA Aeta DAFD AF ARIE Airel AIRO AIR-O MOTOR HOME AIRS AIRSTREAM, INC AJS AJS AJW AJW ALAS ALASKAN CAMPER ALEX Alexander-Reynolds Corp. ALFL ALFA LEISURE, INC ALFA Alfa Romero ALSE ALL SEASONS MOTOR HOME ALLS All State ALLA Allard ALLE ALLEGRO MOTOR HOME ALCI Allen Coachworks, Inc. ALNZ ALLIANZ SWEEPERS ALED Allied ALLL Allied Leisure, Inc. ALTK ALLIED TANK ALLF Allison's Fiberglass mfg., Inc. ALMA Alma ALOH ALOHA-TRAILER CO ALOU Alouette ALPH Alpha ALPI Alpine ALSP Alsport/ Steen ALTA Alta ALVI Alvis AMGN AM GENERAL CORP AMGN AM General Corp. AMBA Ambassador AMEN Amen AMCC AMERICAN CLIPPER CORP AMCR AMERICAN CRUISER MOTOR HOME Motor Vehicle Make Abbreviation List Updated as of June 21, 2012 AEAG American Eagle AMEL AMERICAN ECONOMOBILE HILIF AMEV AMERICAN ELECTRIC VEHICLE LAFR AMERICAN LA FRANCE AMI American Microcar, Inc. AMER American Motors AMER AMERICAN MOTORS GENERAL BUS AMER AMERICAN MOTORS JEEP AMPT AMERICAN TRANSPORTATION AMRR AMERITRANS BY TMC GROUP, INC AMME Ammex AMPH Amphicar AMPT Amphicat AMTC AMTRAN CORP FANF ANC MOTOR HOME TRUCK ANGL Angel API API APOL APOLLO HOMES APRI APRILIA NEWM AR CORP. ARCA Arctic Cat ARGO Argonaut State Limousine ARGS ARGOSY TRAVEL TRAILER AGYL Argyle ARIT Arista ARIS ARISTOCRAT MOTOR HOME ARMR ARMOR MOBILE SYSTEMS, INC ARMS Armstrong Siddeley ARNO Arnolt-Bristol ARRO ARROW ARTI Artie ASA ASA ARSC Ascort ASHL Ashley ASPS Aspes ASVE Assembled Vehicle ASTO Aston Martin ASUN Asuna CAT CATERPILLAR TRACTOR CO ATK ATK America, Inc. -

Fahrzeugstatistik

Fahrzeugstatistik Bestand 30. Juni 2015 Herausgeber und Vertrieb Amt für Statistik Äulestrasse 51 9490 Vaduz Liechtenstein T +423 236 68 76 F +423 236 69 36 www.as.llv.li Auskunft Christian Brunhart T +423 236 68 82 Brigitte Schwarz T +423 236 68 94 [email protected] Bearbeitung Brigitte Schwarz Gestaltung Karin Knöller Thema 6 Verkehr Erscheinungsweise Jährlich Copyright Wiedergabe unter Angabe des Herausgebers gestattet. © Amt für Statistik Fahrzeugstatistik - Bestand 30. Juni 2015 Inhaltsübersicht Tabellenverzeichnis 4 A Einführung in die Ergebnisse 1 Vorwort 7 2 Hauptergebnisse 8 3 Analyse des Fahrzeugbestands 9 3.1 Fahrzeuge insgesamt 9 3.2 Personenwagen (FAZG 1) 10 3.3 Personentransportfahrzeuge (FAZG 2) 13 3.4 Sachentransportfahrzeuge (FAZG 3) 13 3.5 Landwirtschaftliche Fahrzeuge (FAZG 4) 14 3.6 Gewerbliche Fahrzeuge (FAZG 5) 14 3.7 Motorräder (FAZG 6) 14 3.8 Anhänger (FAZG 7) 15 3.9 Nutzlastkapazität der Sachentransportfahrzeuge und Anhänger 15 4 Ländervergleich 16 B Tabellenteil 1 Fahrzeugbestand 17 2 Bestand nach Fahrzeuggruppen 19 2.1 Personenwagen 19 2.2 Personentransportfahrzeuge 41 2.3 Sachentransportfahrzeuge 51 2.4 Landwirtschaftliche Fahrzeug 59 2.5 Gewerbliche Fahrzeug 65 2.6 Motorräder 83 2.7 Anhänger 89 3 Zeitreihen 103 C Methodik und Qualität 1 Methodik 129 2 Qualität 132 D Glossar 1 Abkürzungen und Zeichenerklärungen 134 2 Begriffserklärungen 135 3 Klassifikationen 137 Statistik Liechtenstein 3 Fahrzeugstatistik - Bestand 30. Juni 2015 Tabellenverzeichnis 1 Fahrzeugbestand Fahrzeugbestand nach Fahrzeugarten seit 2012 -

Del Prado World Fire Engines + Special Fire Engines Sorted by Italian, Then German, Then Japanese Numbering

Die-Cast Fire Models Del Prado World Fire Engines + Special Fire Engines Sorted by Italian, then German, then Japanese Numbering it de jp fr es uk us nl Country Scale Description / Notes Era Type Picture 1939 Bedford Hose 1 1 1 1 1 1 1 UK 43 Vintage 1 Tender Based on Matchbox Collectibles mold? 2002 Iveco Euro Fire 72 Actual?: 2002 Iveco / Lohr-Magirus 2 20 27 24 20 18 Italy Modern Pumper 2 61.5 RLF 1000 actual RLF = Rüstlöschfahrzeug? 87 Morita MAF-125A 3 4 2 11 23 Japan Modern Airport 3 90.5 No moving parts actual 1912 Christie Front Drive Steamer 4 3 3 3 5 2 2 USA 43 Actual: 1912 Christie Antique Steamer 4 Based on Road Champs mold? it de jp fr es uk us nl Country Scale Description / Notes Era Type Picture 1939 Leyland FK7 5 7 5 15 7 8 UK 43 Vintage Pumper 5 Based on Matchbox Collectibles mold? 2002 Morita FFA-001 Pumper / 6 15 4 18 14 8 7 Japan 50 Modern 6 Ambulance FFA = Firefighting Ambulance 1907 Seagrave AC53 7 5 6 13 4 USA 43 Antique Pumper 7 Based on Matchbox Collectibles mold? 1924 Ahrens Fox 8 6 7 14 6 12 1 12 USA 43 Antique Pumper 8 Based on larger Franklin Mint version? 1985 Morita MLEX5-30 Actual: 1985 Nissan / Morita MLEX5- 9 22 8 38 15 Japan 64 30 Modern Ladder 9 Ladder raises, rotates, and extends. Basket is removable it de jp fr es uk us nl Country Scale Description / Notes Era Type Picture 1996 Morita Robot Robo Fighter 330 10 33 9 35 32 15 Japan 43 Modern Robot 10 Turret rotates. -

Afghanistan: Post-Taliban Governance, Security, and U.S. Policy

Afghanistan: Post-Taliban Governance, Security, and U.S. Policy Kenneth Katzman Specialist in Middle Eastern Affairs August 17, 2012 Congressional Research Service 7-5700 www.crs.gov RL30588 CRS Report for Congress Prepared for Members and Committees of Congress Afghanistan: Post-Taliban Governance, Security, and U.S. Policy Summary The Obama Administration and several of its partner countries are seeking to reduce U.S. military involvement in Afghanistan while continuing to build Afghan governing and security capacity to defend the country by the end of 2014. To secure longer term U.S. gains, on May 1, 2012, during a visit to Afghanistan, President Obama signed a Strategic Partnership Agreement that will likely keep some (perhaps 15,000—20,000) U.S. troops in Afghanistan after 2014 as advisors and trainers. Until then, the United States and its partners will continue to transfer overall security responsibility to Afghan security forces, with Afghan forces to assume the lead nationwide by mid-2013. As lead responsibility shifts, the number of U.S. forces in Afghanistan, which peaked at about 99,000 in June 2011, will be reduced to 68,000 by the end of September 2012. President Obama has said that “reductions will continue at a steady pace” from then until the completion of the transition to Afghan lead at the end of 2014. In keeping with the Strategic Partnership Agreement, on July 7, 2012 (one day in advance of a major donors’ conference on Afghanistan in Tokyo) the United States named Afghanistan a “Major Non-NATO Ally,” further assuring Afghanistan of longterm U.S. -

ESPTEND21.Pdf

número 24 febrero 2021 www.cadenadesuministro.es l s 3 Editorial : Recuperar el tono, la mejor vacuna Ricardo Ochoa de Aspuru, director de Cadena de Suministro a i o Hay que sobreponerse al golpe 4 r d rar el tono, Un primer análisis del impacto de la pandemia en el sector Recupe i 6 Opinión: De la digitalización a la hiperautomatización o t n Roberto Martínez, director Desarrollo de Negocio Gartner Supply Chain España i la mejor vacuna e 8 E-commerce, un motor contra la pandemia La logística en 2020 d t ada volverá a ser como era antes de marzo de 12 La logística ante un cambio radical E n 2020. Hace un año, un virus letal se colaba Tendencias logísticas para 2021 entre nosotros para, como dicen algunos, recor - o Opinión: Mirando al futuro a través del e-commerce y la automatización 16 darnos la insignificancia del ser humano ante la Cristian Oller, vicepresidente y director general de Prologis en Españan C embestida de la naturaleza. 18 El sector inmologístico sale reforzado de un convulso 2020 Impulsado por el crecimiento del e-commerce N El golpe, también por inesperado, ha sido de tal magni - 21 VGP: objetivo cero emisiones en 2025 tud que en los últimos meses se han puesto en cuestión La sostenibilidad como elemento estratégico en inmologística muchos de los que hasta ahora eran dogmas inamovibles. Número 24- febrero 2021 22 El papel de los desarrollos logísticos en segunda y tercera corona Depósito Legal: M-8324-2018 Amplia oferta de Cushman & Wakefield Meses después, la pandemia sigue alterando lo que El sector inmologístico ante un año clave para la inversión EDITA 24 hasta antes de marzo era la actividad diaria logística y de Tendencias del sector inmologístico en 2021 Cadesum Digital, SL transporte.