Geri Sell Pgold Buy

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Trading Guide Philstocks Research JUSTINO B

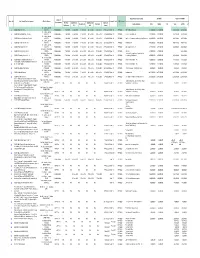

Trading Guide Philstocks Research JUSTINO B. CALAYCAY, JR Date : June 29 - July 10, 2020 VP-Head, Research & Traditional Sales +63 (2) 8588-1962 NOW JAPHET LOUIS O. TANTIANGCO Sr. Research Analyst TRADE TP: Php 2.35 +63 (2) 8588-1927 PIPER CHAUCER E. TAN Engagement Officer/Research Associate +63 (2) 8588-1928 KEY MARKET STATS CLAIRE T. ALVIAR Last Traded Price (PHP) 2.06 Research Associate Source: Philstocks Research , PSE +63 (2) 8588-1925 Entry Point (PHP) 2.00 - 2.10 Cutloss Price (PHP) 5% below entry Key Investment Highlights Ground Floor, East Tower PSE Center, Tektite Towers Aims to deploy 5G Fixed Wireless Access network in Potential Upside / Downside (%) 17.50 - 11.90 Ortigas Center, Pasig City NCR and nearby areas over 5 years. 52 wk low and High (PHP) 1.00 - 4.78 PHILIPPINES Businesses’ digitization plans offer opportunities. 20 MA Volume 8.19 M Share price is currently forming a triangle pattern. DISCLAIMER P/E Ratio (x) 438.30 The opinion, views and recommendations P/B Ratio (x) 1.76 YTD Net Foreign Transaction (as of June 26, 2020): contained in this material were prepared by YTD performance (%) -17.27% Php2.85 M the Philstocks Research Team, individually and separately, based on their specific sector assignments, contextual framework, HOME personal judgments, biases and prejudices, time horizons, methods and other factors. BUY TP: Php 9.45 The reader is enjoined to take this into account when perusing and considering the contents of the report as a basis for their stock investment or trading decisions. Furthermore, projection made and presented KEY MARKET STATS in this report may change or be updated in Last Traded Price (PHP) 7.27 between the periods of release. -

CY2020 PMR.Xlsx

a Actual Procurement Activity ABC (PhP) Contract Cost (PhP) Mode of Reso. No. Title / Item(s) for Procurement Office / End‐user Source of Funds APP Inclusion Procurement Pre‐Proc Ads/Post of Sub/Open of Notice of Pre‐bid Conf Post Qual Notice of Award Total MOOE CO Total MOOE CO Conference IAEB Bids Award Mr. Dante L. Lontok 1 CY2020 Shuttle Services AS-GSD Public Bidding 17-Oct-2019 31-Oct-2019 7-Nov-2019 20-Nov-2019 4-Dec-2019 27-Dec-2019 Fund 101 APP 2020 MG Pacific Trans Corp 13,100,000.00 13,100,000.00 12,735,282.00 12,735,282.00 Mr. Dante L. Lontok 2 CY2020 Aircon Maintenance Services AS-GSD Public Bidding 11-Oct-2019 31-Oct-2019 7-Nov-2019 20-Nov-2019 11-Dec-2019 6-Feb-2020 Fund 101 APP 2020 Rose Aire Enterprise Inc 1,973,000.00 1,973,000.00 1,637,198.40 1,637,198.40 Mr. Dante L. Lontok 3 CY2020 Electrical Maintenance Services AS-GSD Public Bidding 11-Oct-2019 31-Oct-2019 7-Nov-2019 20-Nov-2019 5-Dec-2019 6-Feb-2020 Fund 101 APP 2020 Azulerem Construction and Engineering Services 4,248,000.00 4,248,000.00 4,207,969.64 4,207,969.64 Mr. Dante L. Lontok 5 CY2020 Specialty Trade Services AS-GSD Public Bidding 11-Oct-2019 31-Oct-2019 7-Nov-2019 20-Nov-2019 10-Dec-2019 29-Jan-2020 Fund 101 APP 2020 Omniworx, Inc 4,436,000.00 4,436,000.00 4,424,831.52 4,424,831.52 Mr. -

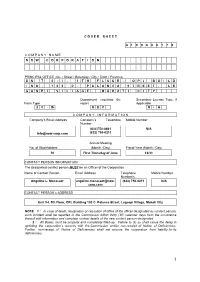

Definitive Information Statement

C O V E R S H E E T A 1 9 9 6 0 0 1 7 9 C O M P A N Y N A M E N O W C O R P O R A T I O N PRINCIPAL OFFICE (No. / Street / Barangay / City / Town / Province) U N I T 5 - I , 5 T H F L O O R , O P L B U I L D I N G , 1 0 0 C . P A L A N C A S T R E E T , L E G A S P I V I L L A G E , M A K A T I C I T Y Department requiring the Secondary License Type, If Form Type report Applicable 2 0 - IS S E C N / A C O M P A N Y I N F O R M A T I O N Company’s Email Address Company’s Telephone Mobile Number Number (632)750-0461 N/A [email protected] (632) 750-0211 Annual Meeting No. of Stockholders (Month / Day) Fiscal Year (Month / Day) 70 First Thursday of June 12/31 CONTACT PERSON INFORMATION The designated contact person MUST be an Officer of the Corporation Name of Contact Person Email Address Telephone Mobile Number Number/s Angeline L. Macasaet angeline.macasaet@now- (632) 750-0211 N/A corp.com CONTACT PERSON’s ADDRESS Unit 5-I, 5th Floor, OPL Building 100 C. Palanca Street, Legaspi Village, Makati City NOTE 1 : In case of death, resignation or cessation of office of the officer designated as contact person, such incident shall be reported to the Commission within thirty (30) calendar days from the occurrence thereof with information and complete contact details of the new contact person designated. -

NOW Corp Prospectus June 21, 2018

of of SUBJECT TO COMPLETION PRELIMINARY PROSPECTUS STRICTLY CONFIDENTIAL nary Prospectus constitute an offer to sell or the solicitation here such offer or sale is not permitted. is not oroffer sale such here notice. notice. The Offer Shares may not be sold nor may an offer to buy be NOW Corporation (A corporation duly incorporated under the laws of the Republic of the Philippines) Primary Offer of 5,000,000 Redeemable Convertible Cumulative Non-Participating Non-Voting Peso- denominated Preferred ―A‖ Shares with an Oversubscription Option of Subscriptions to 5,000,000 Preferred ―A‖ Shares, with 25,000,000 underlying Common Shares and an additional 25,000,000 Common Shares upon the exercise of the Oversubscription Option, which Common Shares shall be issued upon conversion of the Preferred ―A‖ Shares at a conversion price of ₱20.00 per share, or a conversion ratio of 5 Common Shares for every 1 Preferred ―A‖ Share, at an Initial Dividend Rate of [7.5544% to 8.3044%]1 per annum and an Offer Price of ₱100.00 per share to be listed and traded on the Main Board of the Philippine Stock Exchange, Inc. and 10,000,000 Detachable Subscription Warrants to be issued free of charge, with 10,000,000 underlying Common Shares, with an Oversubscription Option of Subscriptions to 10,000,000 Detachable Subscription Warrants and 10,000,000 underlying Common Shares to be listed and traded on the Main Board of the Philippine Stock Exchange, Inc. Unicapital, Inc. Issue Manager, Bookrunner and Underwriter The date of this Preliminary Prospectus is [June __, 2018]. -

Securities Clearing Corporation of the Philippines, a Subsidiary of the PSE

Table of Contents i About PSE 37 Connecting with Stakeholders 1 Financial Highlights 41 Advocating Good Corporate Governance 2 Message from the Chairman 42 Report of Subsidiaries 4 Message from the President 46 Sustainability Report Statement of Management’s Corporate Governance at the PSE 6 56 Responsibility for Financial Statements 22 Stock Market Highlights 57 Financial Statements 32 Operational Highlights 120 Listed Companies and Issues Accelerating Product Offerings and Corporate Information 34 Technological Developments 128 ABOUT THE COVER Converging roads heading towards one direction is the central metaphor for the PSE annual report this year. The cover uses infrastructure and dynamic motion to symbolize the advances that PSE achieved through the years in reference to innovations in products and services, improvements in regulations, upgrades in technology, and enrichment of partnerships. These undertakings have geared the Exchange for growth. PSE is guided by its core values and commitment to its stakeholders as it lives out its mission and works toward the realization of its vision. Inside back of the cover: The triangular edge of the PSE Tower’s glass canopy creates the illusion of a second tower rising. This panoramic vertical shot is suggestive of PSE’s innovations and dynamism. About PSE The Philippine Stock Exchange, Inc. (PSE) is one of the fastest growing markets in the region. Among the pioneer exchanges in Asia, it traces its origins from the country’s two former stock exchanges, the Manila Stock Exchange (MSE), which was established in 1927, and the Makati Stock Exchange (MkSE), which was established in 1963. Although both the MSE and the MkSE traded the same stocks of the same companies, the bourses were separate stock exchanges for nearly 30 years until December 23, 1992, when both exchanges were unified to become the present-day Philippine Stock Exchange. -

2020 Annual General Meeting Report GENERAL MEMBERSHIP MEETINGS

2020 Annual General Meeting Report GENERAL MEMBERSHIP MEETINGS 97TH ANNUAL GENERAL MEETING • 11.18.2020 • General Membership Meeting 2020 DATE TOPIC SPEAKER ATTENDEES Jan 15, 2020 Atty. Ira Paulo Pozon, Chief of Staff, ARTA Updates and Plans 87 1 Ballroom I, New World Anti-Red Tape Council Hotel Feb 21, 2020 2 Manila Ballroom, Honor Your Staff Day Ms. Angeline Tham, Founder, Angkas 238 Marriott Hotel Building Resilience in Times of Crisis: Mr. Peter Hayden, Capital One , Ms. April 29, 2020 3 Company Best Practices in the Battle Bettina Luz, 3M, Mr. Win Everhart, Coca 90 Via Zoom Against COVID-19” Cola Ph May 20, 2020 DOLE Updates on Philippine Labor 4 Asec. Dominque Tutay, DOLE 135 Via Zoom Market June 17, 2020 5 "Updates on US-PH Relations" Amb. Babe Romualdez 96 Via Zoom General Membership Meeting 2020 DATE TOPIC SPEAKER ATTENDEES The Fight for Philippine Sovereignty amid the July 22, 2020 Professor Renato Cruz de 74 6 Pandemic: Recent updates on the Country's Via Zoom Castro, De La Salle Maritime claim in the West Philippine Sea” “Rebuilding a More Sustainable and Resilient Aug 19, 2020 Cabinet Secretary Karlo 7 Philippines: IATF's Response to COVID-19 as we 120 Via Zoom Nograles Move Forward” “Boosting the Socioeconomic Resilience Against Sept 16, 2020 Mr. Guillermo "Bill" Luz 8 COVID-19: Updates on the Public and Private 53 Via Zoom Sector's Partnership Efforts to Economic Recovery” “Driving Resiliency and Sustainability on October 21, 2020 Sec. Arthur P. Tugade 9 Transportation: Recent Developments on the 55 Via Zoom Philippine Transportation System” TOTAL ATTENDEES FOR 2020 948 General Membership Meeting Topic: ARTA Updates and Plans Speaker: Atty. -

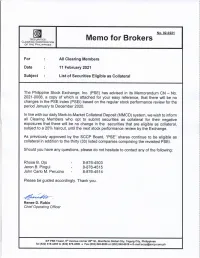

02-0221 List of Securities Eligible As Collateral

CN - No. 2021-0008 INDEX REVIEW TO : INVESTING PUBLIC AND ALL TRADING PARTICIPANTS DATE : February 8, 2021 SUBJECT : RESULTS OF THE REVIEW OF PSE INDICES The Philippine Stock Exchange is announcing the results of the regular review of the PSEi and sector indices covering trading activity for the period January to December 2020. The review of the composition of the indices was based on the revisions to the policy on managing the PSE Index Series. Attached is a list of the companies that will compose the PSEi and sector indices. All changes shall be effected on February 15, 2021, Monday. The list of index members and other index-related information can be accessed on a subscription basis through the Market Data Department at [email protected]. For your information and guidance. (Original Signed) RAMON S. MONZON President and CEO PSEi Company Stock Code 1 Ayala Corporation AC 2 Aboitiz Equity Ventures, Inc. AEV 3 Alliance Global Group, Inc. AGI 4 Ayala Land, Inc. ALI 5 Aboitiz Power Corporation AP 6 BDO Unibank, Inc. BDO 7 Bloomberry Resorts Corporation BLOOM 8 Bank of the Philippine Islands BPI 9 DMCI Holdings, Inc. DMC 10 Emperador Inc. EMP 11 First Gen Corporation FGEN 12 Globe Telecom, Inc. GLO 13 GT Capital Holdings, Inc. GTCAP 14 International Container Terminal Services, Inc. ICT 15 Jollibee Foods Corporation JFC 16 JG Summit Holdings, Inc. JGS 17 LT Group, Inc. LTG 18 Metropolitan Bank & Trust Company MBT 19 Megaworld Corporation MEG 20 Manila Electric Company MER 21 Metro Pacific Investments Corporation MPI 22 Puregold Price Club, Inc. -

C O V E R S H E E T a 1 9 9 6 0 0 1 7 9

C O V E R S H E E T A 1 9 9 6 0 0 1 7 9 C O M P A N Y N A M E N O W C O R P O R A T I O N PRINCIPAL OFFICE (No. / Street / Barangay / City / Town / Province) U N I T 5 - I , 5 T H F L O O R , O P L B U I L D I N G , 1 0 0 C . P A L A N C A S T R E E T , L E G A S P I V I L L A G E , M A K A T I C I T Y Department requiring the Secondary License Type, If Form Type report Applicable 2 0 - IS S E C N / A C O M P A N Y I N F O R M A T I O N Company’s Email Address Company’s Telephone Mobile Number Number (632)750-0461 N/A [email protected] (632) 750-0211 Annual Meeting No. of Stockholders (Month / Day) Fiscal Year (Month / Day) 70 First Thursday of June 12/31 CONTACT PERSON INFORMATION The designated contact person MUST be an Officer of the Corporation Name of Contact Person Email Address Telephone Mobile Number Number/s Angeline L. Macasaet angeline.macasaet@now- (632) 7750-0211 N/A corp.com CONTACT PERSON’s ADDRESS Unit 5-I, 5th Floor, OPL Building 100 C. Palanca Street, Legaspi Village, Makati City NOTE 1 : In case of death, resignation or cessation of office of the officer designated as contact person, such incident shall be reported to the Commission within thirty (30) calendar days from the occurrence thereof with information and complete contact details of the new contact person designated. -

Notice to File Entry, to Pay Duties and Taxes and to Claim Goods Discharged December 14, 2020

NOTICE TO FILE ENTRY, TO PAY DUTIES AND TAXES AND TO CLAIM GOODS DISCHARGED DECEMBER 14, 2020 NO Bill of Lading Discharge Date and Time Consignee Party to Notify 1 ONEYRICADA926700 14/12/2020 14:30 1224 CARGO EXPRESS CORP 1224 CARGO EXPRESS CORP JESSIE J 2 ONEYRICAEH435300 14/12/2020 15:46 1224 CARGO EXPRESS CORP 1224 CARGO EXPRESS CORP 3 ONEYRICAFG159600 14/12/2020 9:15 1224 CARGO EXPRESS CORP 1224 CARGO EXPRESS CORP 4 ONEYHFAA02640400 14/12/2020 10:43 1224 CARGO EXPRESS CORPORATION 53 JESSIE JAMES LUGTU 1224 CARGO EX 5 ONEYHFAA02643700 14/12/2020 23:26 1224 CARGO EXPRESS CORPORATION 53 JESSIE JAMES LUGTU 1224 CARGO 6 ONEYHFAA02545800 14/12/2020 20:45 1224 CARGO EXPRESS CORPORATION 53 JESSIE JAMES LUGTU 1224 CARGO EXP 7 721011266987 14/12/2020 17:31 2DOMINI8 INTERNATIONAL TRADING 2DOMINI8 INTERNATIONAL TRADING 8 713010303794 14/12/2020 21:31 2DOMINI8 INTERNATIONAL TRADING SAME AS CONSIGNEE 9 721011297653 14/12/2020 10:58 3 FOR 8 TRADING INTERNATIONAL SAME AS CONSIGNEE 10 025A684823 14/12/2020 11:39 3 FOR 8 TRADING INTERNATIONAL SAME AS CONSIGNEE 11 HEB120120032 14/12/2020 1:50 A2Z LOGISTICS INC FIRST SUMIDEN CIRCUITS INC 12 EXTMNL050904 14/12/2020 11:48 A2Z LOGISTICS INC SAME AS CONSIGNEE 13 EXTSZX2012013 14/12/2020 9:37 A2Z LOGISTICS INC SAME AS CONSIGNEE 14 WTHK20120065 14/12/2020 10:11 AAIN PHILIPPINES CORP C AND C APPAREL CO LTD 15 LEH0036710 14/12/2020 6:16 ABENSON VENTURES INC ABENSON VENTURES INC 16 ANEX2012005 14/12/2020 1:22 ACADEMY PLASTIC MODEL TOY CO INC SAME AS ABOVE 17 HKGMNL20C135 14/12/2020 11:00 ACBEL POLYTECH PHILIPPINES -

The Philippines 2020

The Philippines 2020 1 Table of Contents Doing Business in the Philippines _______________________________________ 4 Market Overview ______________________________________________________________ 4 Market Challenges ____________________________________________________________ 6 Market Opportunities __________________________________________________________ 7 Market Entry Strategy _________________________________________________________ 7 Leading Sectors for U.S. Exports and Investment __________________________ 8 Agricultural Sector ____________________________________________________________ 8 Transport Infrastructure _______________________________________________________ 9 Information Communications Technology _______________________________________ 11 Defense ____________________________________________________________________ 15 Energy _____________________________________________________________________ 17 Healthcare __________________________________________________________________ 18 Customs, Regulations and Standards ___________________________________ 19 Trade Barriers _______________________________________________________________ 19 Import Tariffs _______________________________________________________________ 23 Import Requirements and Documentation _______________________________________ 23 Labeling and Marking Requirements ____________________________________________ 24 U.S. Export Controls _________________________________________________________ 25 Temporary Entry ____________________________________________________________ -

A Beginner's Guide

Investing and Trading Effectively A Beginner's Guide >> INTRODUCTION << INVESTING AS A KEY TO FINANCIAL FREEDOM In this day and age, it is not enough to simply rely on your paycheck in earning money. You may have a constant source of income, and this might be enough to pay the bills and put food on the table, but there are better ways to keep your money. If you want to be financially free someday, then you have to learn how to invest. Investing is perhaps the best way to make your money grow. Here, what you do is you buy and sell stocks - you trade stocks - of companies you select. This makes you part-owner of that company, since stocks are ways by which businesses fund their operations, and this means that you are practically helping run the business. When your selected company earns profit, you earn money as well, and so on until you eventually store up a considerable amount of money in the long run if all goes well. In the world of buying and selling stocks, the only possibility is for your money to grow exponentially in the long run - that is, if you stick to a profitable company and master the art of trading stocks. However, investing does not come without risks. In investing, the risks are high because there are many uncertainties surrounding it. There are sudden economic downturns here and there, and stock prices are constantly fluctuating. You never know when stock values will dip or skyrocket. In some ways, 1 investing may seem like a guessing game, but a calculated one which can be won through a bit of math and some strategies. -

Philippines Infrastructure.Pdf

Market Survey /////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////// INFRASTRUCTURE IN THE PHILIPPINES Transport, Water sources, Energy, ICT & Telecom //////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////// FIT Manilla Mrs Mia Santamaria Abela Embassy of Belgium Walloon & Brussels-Capital Export Agency Multinational Bancorporation Centre 6805, Ayala Avenue 9th Floor Salcedo Village 1227 Makati City - Metro Manila – Philippines T: +63 88 43 69 82 [email protected] www.flandersinvestmentandtrade.com //////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////// 25.11.2019 Infrastructure in the Philippines pagina 2 van 18 SUMMARY 1. Introduction ......................................................................................................................................................................... 4 2. Transport infrastructure .............................................................................................................................................. 4 2.1 Road infrastructure 4 2.2 Railway 4 2.3 Mass transit systems 5 2.4 Air transport 5 2.5 Inter-island water transport 7 2.6 Water resources 7 2.7 Energy 8 2.8 ICT 9 2.9 Telecommunications 10 3. BOI approved investments in the philippines .............................................................................................