Deloitte Global Powers of Luxury Goods 2018

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Annual Report 2002

ANNUAL REPORT 2002 Founded nearly a century ago by the chemist Eugène Schueller, L’Oréal has consistently applied its policy of investing in research, ensuring that its products meet the highest possible standards of quality, safety and innovation. Today, the group contributes to the beauty of women and men all over the world, providing everyday solutions that enhance their sense of well-being. CONTENTS 01 Board of Directors 02 Chairman’s message 06 Management Committee 08 Financial highlights L’Oréal over ten years 12 Brands 14 Research and Development 18 Production and Technology 20 Human Resources 22 Sustainable Development 24 COSMETICS 26 Professional Products 32 Consumer Products 40 Luxury Products 48 Active Cosmetics 52 DERMATOLOGY AND NUTRICOSMETICS 54 PHARMACEUTICALS The L’Oréal Annual Report comprises three separate 56 CORPORATE GOVERNANCE documents: 1 a general brochure; 2 the consolidated financial statements 58 Stock exchange and shareholders available on Thursday 3rd April 2003; 3 the Management Report of the Board of Directors, the L’Oréal parent company financial statements plus additional information for the Reference Document as required by law, available two weeks prior to the Annual General Meeting convened for Thursday 22nd May 2003. L’Oréal Annual Report 2002 BOARD OF DIRECTORS BOARD OF DIRECTORS Lindsay Owen-Jones CBE Chairman and Chief Executive Officer Jean-Pierre Meyers Rainer E. Gut Vice-Chairman Xavier Fontanet Liliane Bettencourt Director since 29th May 2002 Françoise Bettencourt Meyers Marc Ladreit de Lacharrière Peter Brabeck–Letmathe Olivier Lecerf Franck Riboud Francisco Castañer Basco Director since 29th May 2002 François Dalle Edouard de Royère Jean-Louis Dumas Michel Somnolet Director since 29th May 2002 Director up to 31st December 2002 Auditors The presentation of the directors is on page 57. -

Press Release

Press release Zurich/Geneva, 17 April 2019 Global Powers of Luxury Goods: Swiss luxury companies are taking the digital path to accelerate growth • The sales of the world’s Top 100 luxury goods companies grew by 11% and generated aggregated revenues of USD 247 billion in fiscal year 2017 • Richemont, Swatch Group and Rolex remain in the top league of Deloitte’s Global Powers of Luxury Goods ranking • All Swiss companies in the Top 100 returned to growth in FY2017, but with only 8% increase, they lagged behind the whole market for the third time in a row • Luxury goods companies are making significant investments in digital marketing and the use of social media to engage their customers Despite the recent slowdown of economic growth in major markets including China, the Eurozone and the US, the luxury goods market looks positive. In FY2017, the world’s Top 100 luxury goods companies generated aggregated revenues of USD 247 billion, representing composite sales growth of 10.8%, according to Deloitte’s 2019 edition of Global Powers of Luxury Goods. For comparison, in FY2016 sales were USD 217 billion and annual sales growth was as low as 1.0%. Three-fourth of the companies (76%) reported growth in their luxury sales in FY2017, with nearly half of these recording double-digit year-on-year growth. Switzerland and Hong Kong prevail in the luxury watches sector Looking at product sectors, clothing and footwear dominated again in FY2017, with a total of 38 companies. The multiple luxury goods sector represented the largest sales share (30.8%), narrowly followed by jewellery and watches (29.6%). -

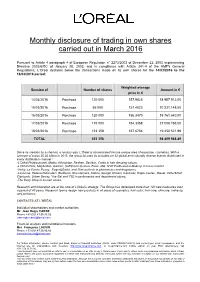

Monthly Disclosure of Trading in Own Shares Carried out in March 2016

Monthly disclosure of trading in own shares carried out in March 2016 Pursuant to Article 4 paragraph 4 of European Regulation n° 2273/2003 of December 22, 2003 implementing Directive 2003/6/EC of January 28, 2003, and in compliance with Article 241-4 of the AMF's General Regulations, L’Oreal declares below the transactions made on its own shares for the 14/03/2016 to the 18/03/2016 period: Weighted average Session of Number of shares Amount in € price in € 14/03/2016 Purchase 120 000 157,9826 18 957 912,00 15/03/2016 Purchase 65 000 157,4023 10 231 149,50 16/03/2016 Purchase 120 000 156,3470 18 761 640,00 17/03/2016 Purchase 175 000 154,3358 27 008 765,00 18/03/2016 Purchase 123 358 157,6754 19 450 521,99 TOTAL 603 358 94 409 988.49 Since its creation by a chemist, a century ago, L’Oréal is concentrated on one unique area of expertise, cosmetics. With a turnover of euros 25.26 billion in 2015, the group focuses its activities on 32 global and culturally diverse brands distributed in every distribution channel : -L’Oréal Professionnel, Matrix, Kérastase, Redken, Decléor, Carita in hair dressing salons. -L’Oréal Paris, Maybelline, Garnier, SoftSheen·Carson, Essie, MG, NYX Professional Makeup in mass market. -Vichy, La Roche Posay, Roger&Gallet, and Skinceuticals in pharmacies and drugstores. -Lancôme, Helena Rubinstein, Biotherm, Shu Uemura, Kiehl’s, Giorgio Armani, Cacharel, Ralph Lauren, Diesel, Viktor&Rolf, Clarisonic, Urban Decay, Yue-Sai and YSL in perfumeries and department stores, -The Body Shop in its own stores. -

Chief Executive Agendas

the insider’s beauty bible A FAIRCHILD PUBLICATION Leaders Outline Plans for Changing Times Shiseido’s Shinzo Maeda Victoria’s Secret’s Christine Beauchamp N.V. Perricone’s Shashi Batra Jurlique’s Eli Halliwell Frédéric Fekkai’s Melisse Shaban PLUS Fall Fragrances CHIEF Edible Beauty Second Life EXECUTIVE AGENDAS L’Oréal’s Jean-Paul Agon Plots a New Course for Growth Contents DEPARTMENTS 16 People, Places & Lipsticks Inside-out beauty, the lighting guru and an unsual take on the manicure. 20 What’s In Store Beach-ready essentials, artistic cosmetics and relief for stressed-out strands. 26 A Closer Look: Fragrance The comeback of classic flowers, not to mention the return of more celebrity scents. 52 The It List: Beauty Still Life Photographers When these artists get behind the camera, the results are more than just a pretty picture. They’re money-making masterpieces. 58 Last Call: Second (Life) Coming In our tech-savvy times, more beauty brands are embracing the undeniable tug of marketing products in a virtual world. FEATURES 30 Agon In Command L’Oréal’s ceo sets the stage for a new era at the French beauty company. And the analysts weigh in. 38 Beauty CEO Pop Quiz What’s on William Lauder’s reading list? And how does Maureen Chiquet keep her cool? Beauty’s top brass reveal all. 40 Young & Royally Talented Say hello to four emerging beauty bosses who are taking the industry into new territory. Shiseido’s Heidi Manheimer and Carsten Fischer flank ceo Shinzo Maeda, whose sweeping changes will soon be felt 44 Quiet Giant beyond Japan’s borders. -

Central Park the Upper East Side

Hunter College High School The Jewish Museum Pascalou Sarabeth’s DINING & HOTELS Nightingale-Bamford School jacqueline kennedy onassis reservoir Yura on Madison The Dalton School RETAIL & SPECIALTY SHOPS Convent of the Sacred Heart First Program The Spence School Cooper-Hewitt, Smithsonian Design Museum SCHOOLS MUSEUMS & INSTITUTIONS National Academy Museum National Academy School of Fine Art SALONS Solomon R. Guggenheim Museum Saint David’s School ART GALLERIES The Dalton School museum mile 86th Neue Gallerie Morgenthal Frederics Theory Park Avenue Christian Church Day School the great lawn Lululemon Athletica Ramaz James Perse School Regis High School Grazie madison ave The Metropolitan Museum of Art Warren Tricomi Salon . fifth ave Marymount School delacourt theater Tambaran Gallery William Greenberg Desserts . American Museum of Natural History Loyola School & Hayden Planetarium turtle pond Crawford Doyle Booksellers belvedere castle Aesop PS 6 E.A.T. Adam Williams Fine Art New York Rudolf Steiner School Barbour . park ave Historical Society l’Occitane Skarstedt Gallery 79th Acquavella Gallery Gallery Mourlot Serafina All Souls School Almine Rech Gallery Lilly Pulitzer La Maison du Chocolat Alain Mikli Saint James Clothing Boutique Lady M Cake Boutique Sant Ambroeus Missoni central park The Mark Hotel Castelli Gallery Vera Wang Bride Allen Stevenson Gagosian Gallery Bemelmans Bar School the lake Vince The Carlyle Hotel Juice Press Cafe Boulud & Bar Pleiades loeb boathouse The Surrey Hotel Safani Gallery John Freida Salon Lenox Hill Hospital Christian Louboutin Carolina Herrera Diptyque Kilian strawberry fields French Consulate Apple The Met Breuer The Hewitt School David Webb bethesda fountain . Caravaggio Nancy Wiener Gallery Marché Madison Maison du Vin . -

Color Theory and Cosmetics Emma E

Central Washington University ScholarWorks@CWU Undergraduate Honors Theses Student Scholarship and Creative Works Spring 2016 Color Theory and Cosmetics Emma E. Mahr Central Washington University, [email protected] Follow this and additional works at: http://digitalcommons.cwu.edu/undergrad_hontheses Part of the Photography Commons Recommended Citation Mahr, Emma E., "Color Theory and Cosmetics" (2016). Undergraduate Honors Theses. Paper 6. This Thesis is brought to you for free and open access by the Student Scholarship and Creative Works at ScholarWorks@CWU. It has been accepted for inclusion in Undergraduate Honors Theses by an authorized administrator of ScholarWorks@CWU. Color Theory and Cosmetics Emma Mahr Senior Thesis Submitted in Partial Fulfillment of the Requirements for Graduation Arts & Humanities Honors Program William O. Douglas Honors College Central Washington University May 2016 Accepted by: ___________________________________________________________ __________ Andrea Eklund, Associate Professor, Family & Consumer Sciences Dept. Date _________________________________________________________ __________ Katherine Boswell, Lecturer, English Department Date 2 Table of Contents Abstract 3 Introduction 4 Background 5 A Brief History of Modern Cosmetics 5 Terms Defined 8 Methods 9 Models 9 Consultations 10 Products 11 Sanitation 13 Process 13 Look One 14 Look Two 14 Look Three 15 Individualized Looks 16 Analysis 17 Look One 17 Look Two 18 Look Three 19 Individualized Looks 20 Reflection 21 References 23 Appendix Consent Forms 25 Face Templates 28 Photographs 35 3 Abstract In this research project, I attempted to discover what difference does color make on the perception of the face. I examined the effects of cosmetics on the appearance of the face using color theory. Three models were used for this project. -

New Twenty~4 Models Is Accompanied by a Digital Communication Campaign Addressing Modern Women Sure of Their Taste, with an Affinity for Beauty and Fine Design

Press release Patek Philippe, Geneva October 2020 A new face for the Twenty~4, the Patek Philippe ladies’ watch born to accompany every moment of the modern woman’s life The manufacture is stepping up the allure of its Twenty~4 collection exclusively for women with a fresh interpretation of the original “manchette” or cuff-style quartz model in steel of 1999. It is launching two new versions adorned with white-gold applied Arabic numerals and white-gold applied trapeze-shaped hour markers. Designed as stylish companions to every facet of an active lifestyle, these Twenty~4 references 4910/1200A- 001 with a blue sunburst dial and 4910/1200A-010 with a gray sunburst dial stand out more than ever as paragons of timeless feminine elegance. Since 1839, timepieces for women have always featured prominently in Patek Philippe’s collections – whether as the pocket watches or pendant watches of the nineteenth century or the wristwatches that first emerged in the early twentieth century. Several milestones in the manufacture’s history also relate to watches destined for women, such as the first true wristwatch made in Switzerland, created for a Hungarian countess in 1868, and the Geneva company’s very first striking wristwatch, a five-minute repeater housed in a small platinum case with an integrated chain bracelet in 1916. A modern classic In 1999, Patek Philippe strengthened its privileged links with feminine watch lovers by launching its first collection dedicated exclusively to women. The aim was to meet the demands of the independent active woman who sought a timepiece with an assertive personality able to adapt to her modern lifestyle. -

L'oréal Returns to Growth

Clichy, 22 October 2020 at 6.00 p.m. SALES AT 30 SEPTEMBER 2020 L’ORÉAL RETURNS TO GROWTH Sales: 20.11 billion euros 1 o -7,4% like-for-like o -6,9% at constant exchange rates o -8,6% based on reported figures Growth in the third quarter: +1.6% like-for-like 1 Exceptional growth of the Active Cosmetics Division: +15.2% like-for-like 1 Power and growth in e-commerce 2: 23.7% of sales, +61.6% 1 Strong growth in mainland China: +20.8% like-for-like 1 Commenting on the figures, Mr Jean-Paul Agon, Chairman and Chief Executive Officer of L'Oréal, said: “In the context of the ongoing epidemic crisis, L’Oréal’s absolute priority continues to be to protect the health of all its employees worldwide. The Group was able to return to growth as soon as this third quarter thanks to the determination and the relevance of the strategic choices taken in all Divisions and geographic Zones. After a first half marked by a crisis of supply, linked to the closure of points of sale around the world, L’Oréal put everything in place, as early as June, to stimulate demand for its brands and products and to re-engage all its business drivers. All of the launches initially planned went ahead, business drivers and media investments were strengthened, and “Back to Beauty” plans were deployed with our distribution partners everywhere, in brick-and-mortar and e-commerce, to stimulate the return to consumption. This return to growth is evidence of consumers’ robust appetite for beauty products and our innovations. -

2020 ANNUAL REPORT Passionate About Creativity

2020 ANNUAL REPORT Passionate about creativity Passionate about creativity THE LVMH SPIRIT Louis Vuitton and Moët Hennessy merged in 1987, creating the LVMH Group. From the outset, Bernard Arnault gave the Group a clear vision: to become the world leader in luxury, with a philosophy summed up in its motto, “Passionate about creativity”. Today, the LVMH Group comprises 75 exceptional Maisons, each of which creates products that embody unique craftsmanship, carefully preserved heritage and resolute modernity. Through their creations, the Maisons are the ambassadors of a refined, contemporary art de vivre. LVMH nurtures a family spirit underpinned by an unwavering long-term corporate vision. The Group’s vocation is to ensure the development of each of its Maisons while respecting their identity and their autonomy, by providing all the resources they need to design, produce and distribute their creations through carefully selected channels. Our Group and Maisons put heart and soul into everything they do. Our core identity is based on the fundamental values that run through our entire Group and are shared by all of us. These values drive our Maisons’ performance and ensure their longevity, while keeping them attuned to the spirit of the times and connected to society. Since its inception, the Group has made sustainable development one of its strategic priorities. Today, this policy provides a powerful response to the issues of corporate ethical responsibility in general, as well as the role a group like LVMH should play within French society and internationally. Our philosophy: Passionate about creativity THE VALUES OF A DEEPLY COMMITTED GROUP Being creative and innovative Creativity and innovation are part of LVMH’s DNA; throughout the years, they have been the keys to our Maisons’ success and the basis of their solid reputations. -

LVMH Files Countersuit Against Tiffany the Conditions to Close the Acquisition Are Not Met

LVMH files countersuit against Tiffany The conditions to close the acquisition are not met September 29th, 2020 LVMH filed yesterday its countersuit against Tiffany in Delaware Chancery Court. LVMH continues to have full confidence in its position that the conditions necessary to close the acquisition of Tiffany have not been met and that the spurious arguments put forward by Tiffany are completely unfounded. LVMH’s filing details the Company’s position on these matters and, among other things, outlines: • A Material Adverse Effect has occurred. The notable absence of a pandemic carveout in the definition of a Material Adverse Effect in the Tiffany Merger Agreement is clear. It was common before COVID-19 for transactions to contain a pandemic carveout. In the course of the negotiation, Tiffany sought and received carveouts for highly specific events, such as “cyberattacks”, the “Yellow Vest” movement and the “Hong-Kong Protests”. Yet Tiffany did not obtain a carveout for public health crises or pandemics. In contrast, hundreds of other merger agreements executed in the decade preceding the Merger Agreement contained express pandemic or epidemic carveouts. The pandemic, whose effects are devastating and lasting on Tiffany, has irrefutably caused a Material Adverse Effect. This clause alone would be enough to prevent the closing, but there are other arguments included below that reinforce LVMH’s position. • Tiffany breached its covenants to operate in the Ordinary Course of Business and to preserve its business organizations substantially intact. Tiffany’s mismanagement of its business constitutes a blatant breach of its obligation to operate in the ordinary course. For instance, Tiffany paid the highest possible dividends while the company was burning cash and reporting losses. -

LVMH 2017 Annual Report

2017 ANNUAL REPORT Passionate about creativity Passionate about creativity W H O W E A R E A creative universe of men and women passionate about their profession and driven by the desire to innovate and achieve. A globally unrivalled group of powerfully evocative brands and great names that are synonymous with the history of luxury. A natural alliance between art and craftsmanship, dominated by creativity, virtuosity and quality. A remarkable economic success story with more than 145,000 employees worldwide and global leadership in the manufacture and distribution of luxury goods. A global vision dedicated to serving the needs of every customer. The successful marriage of cultures grounded in tradition and elegance with the most advanced product presentation, industrial organization and management techniques. A singular mix of talent, daring and thoroughness in the quest for excellence. A unique enterprise that stands out in its sector. Our philosophy: passionate about creativity LVMH VALUES INNOVATION AND CREATIVITY Because our future success will come from the desire that our new products elicit while respecting the roots of our Maisons. EXCELLENCE OF PRODUCTS AND SERVICE Because we embody what is most noble and quality-endowed in the artisan world. ENTREPRENEURSHIP Because this is the key to our ability to react and our motivation to manage our businesses as startups. 2 • 3 Selecting leather at Berluti. THE LVMH GROUP 06 Chairman’s message 12 Responsible initiatives in 2017 16 Interview with the Group Managing Director 18 Governance and Organization 20 Our Maisons and business groups 22 Performance and responsibility 24 Key fi gures and strategy 26 Talent 32 Environment 38 Responsible partnerships 40 Corporate sponsorship BUSINESS GROUP INSIGHTS 46 Wines & Spirits 56 Fashion & Leather Goods 66 Perfumes & Cosmetics 76 Watches & Jewelry 86 Selective Retailing 96 LVMH STORIES PERFORMANCE MEASURES 130 Stock market performance measures 132 Financial performance measures 134 Non-fi nancial performance measures 4 • 5 LVMH 2017 . -

LVMH COP 2017 Global Compact B

United Nations Global Compact Communication On Progress 2017 About main facts and best practices for the year 2016-17 201 6-17 see more particularly informations linked to the pictogram : The other informations (policies, processes,…) are always available and pursued by LVMH. - 2 / 121 - Summary Statement from the CEO 3 Implementing the Ten Principles into Strategies & Operations : Criterion 1 : The COP describes mainstreaming into corporate functions and business units 6 Criterion 2 : The COP describes value chain implementation 10 Robust Human Rights Management Policies & Procedures : Criterion 3 : The COP describes robust commitments, strategies or policies in the area of human rights 30 Criterion 4 : The COP describes effective management systems to integrate the human rights principles 33 Criterion 5 : The COP describes effective monitoring and evaluation mechanisms of human rights 42 integration Robust Labour Management Policies & Procedures : Criterion 6 : The COP describes robust commitments, strategies or policies in the area of labour 44 Criterion 7 : The COP describes effective management systems to integrate the labour principles 46 Criterion 8 : The COP describes effective monitoring and evaluation mechanisms of labour principles 54 integration Robust Environmental Management Policies & Procedures : Criterion 9 : The COP describes robust commitments, strategies or policies in the area of environmental 59 stewardship Criterion 10 : The COP describes effective management systems to integrate the environmental 71 principles