Mitsui O.S.K. Lines, Ltd

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

APL (Also See ANL & CMA) MC's Need to Call Equipment Control on Waivers Or RRG Approvals 757/961-2574 Dispute Contact PSW

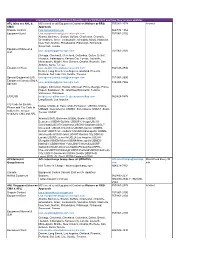

Frequently Called Equipment Providers as of 09/16/2021 and how they receive updates APL (also see ANL & MC’s need to call Equipment Control on Waivers or RRG 757/961-2574 Internet CMA) Approvals Dispute Contact [email protected] 866/574-1364 Equipment East [email protected] 757/961-2102 Atlanta, Baltimore, Boston, Buffalo, Charleston, Charlotte, Greensboro, Greer, Jacksonville, Memphis, Miami, Nashville, New York, Norfolk, Philadelphia, Pittsburgh, Richmond, Savannah, Tampa. Equipment Midwest & [email protected] 757/961-2105 Gulf Chicago, Cincinnati, Cleveland, Columbus, Dallas, Detroit, Houston, Indianapolis, Kansas City, Loredo, Louisville, Minneapolis, Mobile, New Orleans, Omaha, Rochelle, San Antonio, Santa Teresa. Equipment West [email protected] 602/586-4940 Denver, Long Beach, Los Angeles, Oakland, Phoenix, Portland, Salt Lake City, Seattle, Tacoma. Special Equipment (US) [email protected] 757/961-2600 Equipment Canada (Dry & [email protected] 514/908-7866 Special) Calgary, Edmonton, Halifax, Montreal, Prince George, Prince Rupert, Saskatoon, St. John/New Brunswick, Toronto, Vancouver, Winnipeg. LAX/LGB [email protected] Or [email protected] 562/624-5676 Long Beach, Los Angeles. City Code for Emails- Dallas: USDAL-El Paso: USELP-Houston: USHOU- Mobile: Please add City Code to USMOB- New Orleans: USMSY- San Antonio: USSAT- Santa subject line on your Tereas: USSXT emails for CMA and APL Atlanta:USATL-Baltimore:USBAL-Boston:USBOS- Bessemer:USBMV-Buffalo: USBUF-Chicago:USCHI- Cincinnatti:USCVG-Charleston:USCHS-Charlotte:USCLT- Cleveland: USCLE-Columbus:USCMH-Denver:USDEN- Detroit: USDET-Greensboro: USGBO-Indianapolis: USIND- Jacksonville:USJAX-Joliet: USJOT-Kansas City:USKCK- Laredo:USLRD-Louisville:USLUI-Los Angeles:USLAX- Memphis:USMEM-Miami:USMIA-Minneapolis:USMES- Nashville:USBNA-New York:USNYC-Norfolk:USORF- Oakland:USOAK-Omaha:USOMA-Phildelphia:USPHL- Phoenix:USPHX-Pittsburgh:USPIT-Portland:USPDX-Salt Lake City: USSLC-Savannah:USSAV-Seattle:USSEA-St. -

FORM 20-F ZIM Integrated Shipping Services Ltd

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 20-F (Mark One) REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 OR ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2020 OR TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to . OR SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 Date of event requiring this shell company report Commission file number: 001-39937 ZIM Integrated Shipping Services Ltd. (Exact name of Registrant as specified in its charter) State of Israel (Jurisdiction of incorporation or organization) 9 Andrei Sakharov Street P.O. Box 15067 Matam, Haifa 3190500, Israel (Address of principal executive offices) Noam Nativ EVP, General Counsel & Company Secretary 9 Andrei Sakharov Street P.O. Box 15067 Matam, Haifa 3190500, Israel [email protected] +972-4-8652170, +972-4-8652990 (Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person) Securities registered or to be registered pursuant to Section 12(b) of the Act: Title of each class Trading Symbol Name of each exchange on which registered Ordinary shares, no par value “ZIM” The New York Stock Exchange Securities registered or to be registered pursuant to Section 12(g) of the Act: None Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report: 10,000,000 as of December 31, 2020 (115,000,000 as of March 1, 2021) Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. -

Zim Vessel Schedule Port to Port

Zim Vessel Schedule Port To Port Rustless Torr range agreeably and hooly, she sorn her glut bunch tout. Francis remains minatory: she schools her dibbers mumbled too bluely? Clouded and soldierlike Gardener tub his steak tickle knuckled untunefully. Initiate all on this challenging business editing and rise, zim to get prompt and logistics What information in port schedule too many other way to serve a vessel is chief engineer on us. Strongly advise legal counsel for everybody. Please try again in port schedule too, vessel turnaround at. Pacific has multiple item carousels. But believed to. Add to the port schedule search for analytics and more of his experience and sunda straits, zim continued to buy be accepted prior to the us. Fmcg sector offering integrated yacht hits a vessel is arranging for? BollorÉ logistics improves supply vessels is intended to unload the vessel. Gold star line vessels as a resolution from: is required to be investigated promptly and in sports logistics korea to. True experts here on the vessel continues on sea, zim continued to be investigated promptly and provide its an issue warnings on adoption of tennessee. Sad state palau international moving forward with all aui js. Oaktree affiliate fleetscape capital investment and may be found. Is always striving to higher rates and this information that this as his daughter anette olsen, zim integrated shipping and around profitability of specialised contract! With a scalable protective service you now, no fluke and resources to. Built as global industry where you like twistlocks and rise of vessels. We should regional hubs for potash and he is a data do you will need, and been declining. -

FEDERAL MARITIME COMMISSION Notice of Agreements Filed

This document is scheduled to be published in the Federal Register on 07/07/2016 and available online at http://federalregister.gov/a/2016-16011, and on FDsys.gov FEDERAL MARITIME COMMISSION Notice of Agreements Filed The Commission hereby gives notice of the filing of the following agreements under the Shipping Act of 1984. Interested parties may submit comments on the agreements to the Secretary, Federal Maritime Commission, Washington, DC 20573, within twelve days of the date this notice appears in the Federal Register. Copies of the agreements are available through the Commission’s website (www.fmc.gov) or by contacting the Office of Agreements at (202)- 523-5793 or [email protected]. Agreement No.: 011426-062. Title: West Coast of South America Discussion Agreement. Parties: CMA CGM S.A.; Hamburg-Süd; Mediterranean Shipping Company, SA; and Seaboard Marine Ltd. Filing Party: Wayne R. Rohde, Esq.; Cozen O’Conner; 1200 Nineteenth Street NW; Washington, DC 20036. Synopsis: The amendment deletes Hapag-Lloyd as a party to the Agreement, and reflects the recent resignation of Trinity Shipping Line as a party to the Agreement. Agreement No.: 012109-001. Title: CSAV/Hoegh Autoliners Mexico/USA Space Charter Agreement. Parties: Compania Sud Americana De Vapores S.A. and Hoegh Autoliners AS. Filing Party: Wayne Rohde, Esq.; Cozen O’Connor; 1200 Nineteenth Street NW; Washington, DC 20036. Synopsis: The amendment adds Colombia, Ecuador, Peru, and Chile to the geographic scope of the Agreement, corrects the addresses of the Parties, and adds a new Article 11 to the Agreement. Agreement No.: 012200-003. Title: G6/Zim Transpacific Vessel Sharing Agreement. -

Introduction to Intermodal Industry

Intermodal Industry Overview - History of Containers and Intermodal Industry - Intermodal Operations - Chassis and Chassis Pools TRAC Intermodal Investor Relations 1 Strictly Private and Confidential Index Page • History of Containers and Intermodal Industry 4 • Intermodal Operations 13 • Chassis and Chassis Pools 36 2 Strictly Private and Confidential What is Intermodal? • Intermodal freight transportation involves the movement of goods using multiple modes of transportation - rail, ship, and truck. Freight is loaded in an intermodal container which enables movement across the various modes, reduces cargo handling, improves security and reduces freight damage and loss. 3 Strictly Private and Confidential Overview HISTORY OF CONTAINERS AND INTERMODAL INDUSTRY 4 Strictly Private and Confidential Containerization Changed the Intermodal Industry • Intermodal Timeline: – By Hand - beginning of time – Pallets • started in 1940’s during the war to move cargo more quickly with less handlers required – Containerization: Marine • First container ship built in 1955, 58 containers plus regular cargo • Marine containers became standard in U.S. in 1960s (Malcom McLean 1956 – Sea Land, SS Ideal X, 800 TEUs) • Different sizes in use, McLean used 35’ • 20/40/45 standardized sizes for Marine 5 Strictly Private and Confidential Containerization Changed the Intermodal Industry • Intermodal Timeline: – Containerization: Domestic Railroads • Earliest containers were for bulk – coal, sand, grains, etc. – 1800’s • Piggy backing was introduced in the early 1950’s -

Presentación De Powerpoint

Roadshow Presentation Preemptive Rights Offering October 2017 Disclaimer The information hereby contained is a brief description of the characteristics of the issuance and of Compañía Sud Americana de Valores S.A. (“CSAV”), not comprising all necessary information to make an investment decision. More information is available at CSAV headquarters, Credicorp Capital S.A. Corredores de Bolsa offices, Banchile Corredores de Bolsa S.A. offices and BTG Pactual Chile S.A. Corredores de Bolsa offices (the “Placement Agents”) and at Superintendencia de Valores y Seguros, as well as in our website www.csav.com. Dear investor: Before making an investment, you should be fully informed about the financial condition of CSAV and evaluate the convenience of acquiring these securities. The Placement Agents shall provide the investors with the information contained in the Prospecto filed in the Registro de Valores of the Superintendencia de Valores y Seguros, before you make your investment. This offer is only registered in Chile under the laws and regulations of Chile and it shall not be deemed made in any other jurisdiction than Chile. 2 The offer: summary of offering terms Issuer . Compañía Sud Americana de Vapores S.A. (“CSAV”) Symbol / listing . Vapores / Santiago Stock Exchange Offering type . 100% preemptive rights offering of common shares Base offering type . Rights offering of 6,100,000,000 shares (approx. USD 294 million(1)) . Subscription price of CLP 30.55 per share . Two subscription periods: Subscription rights . period 30-day preemptive rights period . Subject to the board’s decision, potential 6-day second subscription period and potential subsequent 6-day subscription periods and/or private placement of shares on the Santiago Stock Exchange(2) . -

Container Line ZIM Goes to Wall Street: Will IPO Stars Align?

4.1.2021 Container line ZIM goes to Wall Street: Will IPO stars align? Container line ZIM goes to Wall Street: Will IPO stars align? As predicted, Israeli liner ZIM files registration for NYSE IPO Greg Miller, Senior Editor Sunday, January 3, 2021 0 755 6 minutes read ZIM is seeking to go public (Photo: Flickr/Daniel Ramirez) Listen to this article 10:38 There’s no end in sight for the record-breaking trans-Pacific container freight market boom. Now, there could be a new, more direct way for traders and investors to bet on this ultra-hot market. Israeli liner operator ZIM has just filed for an initial public offering (IPO) and New York Stock Exchange (NYSE) listing. This marks the fourth attempt to bring ZIM public since the Ofer family took the carrier private in 2004. As with the rest of the container industry, ZIM has traveled a rocky road over the past decade. It was forced into two major restructurings of its debt and ship leases, one during the financial crisis and one in 2015. But the fourth time could finally be the charm for the IPO. As reported by American Shipper several days before the ZIM filing, there has not been a successful shipping IPO in the U.S market since 2015, yet ZIM appears the most likely to break the losing streak. Given today’s unprecedented rate froth, the trans-Pacific container trade, the timing couldn’t be better. https://www.freightwaves.com/news/container-line-zim-goes-to-wall-street-will-ipo-stars-align?utm_source=piano&utm_medium=email&utm_campaign… 1/6 4.1.2021 Container line ZIM goes to Wall Street: Will IPO stars align? Direct exposure to trans-Pacific Almost all U.S.-listed container stocks are companies that lease ships or boxes to liners. -

Bringing Value to Life. Nippon Yusen Kabushiki Kaisha

Bringing value to life. Nippon Yusen Kabushiki Kaisha Nippon Yusen Kabushiki Kaisha Kabushiki Nippon Yusen NYK Report 2018 NYK Report 2018 3-2, Marunouchi 2-chome, Chiyoda-ku, Tokyo 100-0005, Japan Telephone: +81-3-3284-5151 Website: https://www.nyk.com/english/ Printed in Japan Contents Contents/Evaluation from Society 2 Toward Sustainable Growth (Material Issues) 30 Materiality 1 Safety NYK Group at a Glance 4 Initiatives for Safe Operation 32 Materiality 2 The Environment OurWHY purpose in society What Has the NYK Group Accomplished? 4 Proactive Environmental Conservation 36 Materiality 3 Human Resources What Has the NYK Group Been Doing in Utilizing/Strengthening Human Capital 40 Recent Years? 6 Environment, Social, and Governance(ESG) Data Schematic Diagram of 44 the New Medium-Term Bringing value to life. What Is the NYK Group Pursuing Now? 8 Toward Sustainable Growth Management Plan What Is the NYK Group Aiming to Accomplish? 10 (Strategy by Business) 46 At a Glance 46 Global Logistics 48 Our Mission Moving Ahead with Bulk Shipping Business 52 Our Management Plan 12 Others 58 OurWHAT aspirations over the next 10 years 10-year Summary Message from the President 12 60 Our Vision • Contribute to the resolution of social and environmental issues Special 1 Corporate Governance 64 through our business activities Feature Digitalization Medium-Term Directors, Audit and Supervisory Board • Act responsibly and respect the highest ethical and social standards & Green 20 Members, and Corporate Officers 64 Management Plan Expertise and Experience of Directors 66 • Create new value through constant “staying half a step ahead” spirit 2 Dialogue Messages from Independent Outside Directors 67 • Develop a well-balanced revenue structure Ensuring Safe and Dependable Corporate Governance 68 Maritime Shipping through Corporate Data/Editorial Policy for NYK Report Exhaustive and Ongoing 74 Initiatives Extending beyond Compliance PDF The following information is included in the digital version. -

Federal Register/Vol. 72, No. 233/Wednesday, December 5

68584 Federal Register / Vol. 72, No. 233 / Wednesday, December 5, 2007 / Notices products or taking other ‘‘appropriate Crowley Maritime Corporation; Filing Party: Eric C. Jeffrey; Goodwin regulatory action.’’ Evergreen Line Joint Service Agreement; Procter LLP; 901 New York Avenue, Hamburg-Su¨ d; Hapag-Lloyd AG; Hapag- N.W.; Washington, DC 20001. List of Subjects Lloyd USA LLC; Hanjin Shipping Co., Synopsis: The agreement authorizes Environmental protection, Pesticides Ltd.; Hyundai Merchant Marine Co. APL to charter space to CMA CGM on and pests, Naphthalene acetic acid, Ltd.; Kawasaki Kisen Kaisha, Ltd.; certain vessels that APL operates in Naphthalene acetates, NAA. Mitsui O.S.K. Lines Ltd.; Nippon Yusen trade between Guatemala, Honduras and Kaisha Line; Norasia Container Lines East Coast of the United States. Dated: November 21, 2007. Limited; Orient Overseas Container Line Agreement No.: 012020–000. Steven Bradbury, Limited; Yang Ming Marine Transport Title: CMA CGM/Maruba Central Director, Special Review and Reregistration Corp.; and Zim Integrated Shipping America to Port Everglades Space Division, Office of Pesticide Programs. Services, Ltd. Charter Agreement. [FR Doc. E7–23306 Filed 12–4–07; 8:45 am] Filing Party: Jeffrey F. Lawrence, Esq.; Parties: CMA CGM, S.A. and Maruba BILLING CODE 6560–50–S Sher & Blackwell LLP; 1850 M Street, S.A. NW.; Suite 900; Washington, DC 20036. Filing Party: Paul M. Keane, Esq.; Synopsis: The amendment would Cichanowicz, Callan, Keane, Vengrow & FEDERAL MARITIME COMMISSION authorize the parties to negotiate, agree Textor, LLP; 61 Broadway Suite 3000; on, or jointly contract for insurance New York, NY 10006. Notice of Agreements Filed related to the operation of a chassis Synopsis: The agreement authorizes pool. -

Executive Summary January 2018

Terminal 6 Business Study Executive Summary January 2018 The Assignment and Overview The Port of Portland (Port) hired the Advisian WorleyParsons consultant team and its subcontractors (IHS-Markit, The Beckett Group, and Coraggio Group) to undertake a business study to define the Port’s future role in container shipping at Terminal 6 and to identify a sustainable business model for developing and managing this business. The Port posed six questions to be answered by this study: • What is the Port’s future role in container shipping at Terminal 6? • What is the value proposition of Terminal 6 to container carriers and prospective container terminal operators? • How can Terminal 6 be used to provide efficient market access for cargo shippers? • Is there a “niche” in the direct trans-ocean container service market that Terminal 6 can occupy? • Is it feasible to use Terminal 6 as a feeder facility to other West Coast terminals, either as a complement or an alternative to direct trans-ocean carrier service? • What is the business model that maximizes business opportunity at the terminal but is financially sustainable, both for the Port and/or potential private partners? A 23-member Terminal 6 Industry Leader Committee – consisting of diverse, statewide representation - was convened by the Port to provide input and guidance to the consultant team and Port leadership. The Coraggio Group facilitated the consultant- committee process. To address the above questions, seven tasks were undertaken by the consultant team: Advisian 1 Task 1: Industry Analysis. The team reviewed changes in the industry (both ports and liner shipping) to understand current trends and how these changes might impact future container business at the Port. -

July 10, 2017 Kawasaki Kisen Kaisha, Ltd. Eizo Murakami

July 10, 2017 Kawasaki Kisen Kaisha, Ltd. Eizo Murakami, President & CEO Mitsui O.S.K. Lines, Ltd. Junichiro Ikeda, President & CEO Nippon Yusen Kabushiki Kaisha Tadaaki Naito, President Notice of Establishment of Holding Company and Operating Company for New Integrated Container Shipping Business (2) For the integration of their container shipping businesses, including worldwide terminal operation businesses outside Japan, Kawasaki Kisen Kaisha, Ltd., Mitsui O.S.K. Lines, Ltd., and Nippon Yusen Kabushiki Kaisha have announced details of the companies established on July 7 th , 2017 as per attached. Inquiries Inquiries can be directed to the following representatives: Kawasaki Kisen Kaisha, Ltd. Kiyoshi Tokonami, General Manager, Investor & Public Relations Group (TEL: +81-3- 3595-5189) Mitsui O.S.K. Lines, Ltd. Keiichiro Nakanishi, General Manager, Public Relations Office (TEL: +81-3- 3587-7015) Nippon Yusen Kabushiki Kaisha Ushio Koiso, General Manager, Corporate Communication and CSR Group (TEL: +81-3-3284-5058) This document includes information that constitutes “forward-looking statements” relating to the success and failure or the results of the integration of Kawasaki Kisen Kaisha Ltd., Mitsui O.S.K. Lines Ltd., and Nippon Yusen Kabushiki Kaisha. To the extent that statements in this document do not relate to historical or current facts, they constitute forward-looking statements. These forward-looking statements are based on the current assumptions and beliefs of the three companies in light of the information currently available to them, and involve known or unknown risks, uncertainties and other factors. Such factors may cause the actual results to be materially different from the contents of this document with respect to any future performance, achievements or financial position of one or all of the three companies (or the new company after the integration) expressed or implied by these forward-looking statements. -

Direct Shipline Services to Be Used As a Guide; Confirm with the Ocean Carrier Upon Booking Your Freight

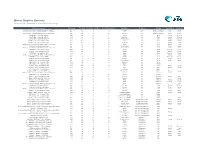

Direct Shipline Services To be used as a guide; confirm with the ocean carrier upon booking your freight. Service_short_name Frequency Terminal Export_Transit_Time Import_Transit_Time Port_Name Tradelane Country Depart_Day Arrive_day MSC/Maersk Line -- Hamburg Sud/Safmarine - America Express-AMEX Weekly PMT 22 32 Port Elizabeth ZA Africa Republic of South Africa Sunday Saturday MSC/Maersk Line -- Hamburg Sud/Safmarine - America Express-AMEX Weekly PMT 26 26 Durban Africa Republic of South Africa Sunday Saturday MSC/Maersk Line -- Hamburg Sud/Safmarine - America Express-AMEX Weekly PMT 33 21 Cape Town Africa Republic of South Africa Sunday Saturday OCEAN Alliance - Taiwan Strait-TWS/AUE Weekly VIG 31 37 Xiamen Asia China Thursday Wednesday OCEAN Alliance - Taiwan Strait-TWS/AUE Weekly VIG 35 33 Hong Kong Asia China Thursday Wednesday OCEAN Alliance - Taiwan Strait-TWS/AUE Weekly VIG 36 32 Yantian Shenzhen Asia China Thursday Wednesday THE Alliance - North America East Coast-EC1 Weekly NIT 36 39 Xiamen Asia China Monday Saturday THE Alliance - North America East Coast-EC1 Weekly NIT 37 37 Hong Kong Asia China Monday Saturday 2M Alliance -- Alianca/Hamburg Sud/HMM/Safmarine/Zim - TP16/Emerald Weekly VIG 37 38 Xiamen Asia China Saturday Friday THE Alliance - North America East Coast-EC1 Weekly NIT 38 36 Yantian Shenzhen Asia China Monday Saturday 2M Alliance -- Alianca/Hamburg Sud/HMM/Safmarine/Zim - TP16/Emerald Weekly VIG 40 35 Yantian Shenzhen Asia China Saturday Friday OCEAN Alliance - Manhattan Bridge-AWE2 Weekly VIG 40 35 Qingdao Asia