Danaos Annual Report 2016

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Federal Register/Vol. 70, No. 192/Wednesday, October 5, 2005

58222 Federal Register / Vol. 70, No. 192 / Wednesday, October 5, 2005 / Notices however, will be limited to the seating of the date this notice appears in the Parties: American President Lines, available. Unless so requested by the Federal Register. Copies of agreements Ltd.; APL Co. Pte Ltd.; China Shipping Council’s Chair, there will be no public are available through the Commission’s Container Lines Co., Ltd.; COSCO oral participation, but the public may Office of Agreements (202–523–5793 or Container Lines Company Limited; submit written comments to Jeffery [email protected]). Evergreen Marine Corporation (Taiwan), Goldthorp, the Federal Communications Agreement No.: 011223–031. Ltd.; Hanjin Shipping Co., Ltd.; Hapag- Commission’s Designated Federal Title: Transpacific Stabilization Lloyd Container Line GmbH; Kawasaki Officer for the Technological Advisory Agreement. Kisen Kaisha, Ltd.; Mitsui O.S.K. Lines, Council, before the meeting. Mr. Parties: American President Lines, Ltd.; Hyundai Merchant Marine Co. Goldthorp’s e-mail address is Ltd.; APL Co. Pte Ltd.; CMA CGM, S.A.; Ltd.; Kawasaki Kisen Kaisha Ltd.; [email protected]. Mail delivery COSCO Container Lines Ltd.; Evergreen Mitsui O.S.K. Lines, Ltd.; Nippon Yusen address is: Federal Communications Marine Corp. (Taiwan) Ltd.; Hanjin Kaisha Line; Orient Overseas Container Commission, 445 12th Street, SW., Shipping Co., Ltd.; Hapag-Lloyd Line Limited; and Yangming Marine Room 7–A325, Washington, DC 20554. Container Linie GmbH; Hyundai Transport Corp. Merchant Marine Co., Ltd.; Kawasaki Filing Party: David F. Smith, Esq.; Federal Communications Commission. Kisen Kaisha, Ltd.; Mitsui O.S.K. Lines, Sher & Blackwell; 1850 M Street, NW.; Marlene H. -

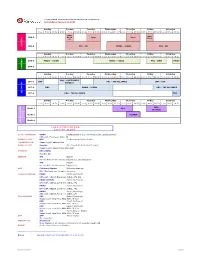

CONTAINER SERVICES BERTH WINDOW SCHEDULE Last Updated January 12, 2018

CONTAINER SERVICES BERTH WINDOW SCHEDULE Last Updated January 12, 2018 Sunday Monday Tuesday Wednesday Thursday Friday Saturday 1:00 8:00 16:30 1:00 8:00 16:30 1:00 8:00 16:30 1:00 8:00 16:30* 1:00 8:00 16:30 1:00 8:00 16:30 1:00 8:00 16:30 WEST WEST CEN-5 WOOD Barge Barge WOOD (2) CENTERM CEN-6 TP1 - 2M CPNW - OCEAN TP9 - 2M Sunday Monday Tuesday Wednesday Thursday Friday Saturday 1:00 8:00 16:30 1:00 8:00 16:30 1:00 8:00 16:30 1:00 8:00 16:30* 1:00 8:00 16:30 1:00 8:00 16:30 1:00 8:00 16:30 VTM-5 PNW3 - OCEAN PNW1 - OCEAN PN2 - HMM PNW3 VTM-6 VANTERM Sunday Monday Tuesday Wednesday Thursday Friday Saturday 1:00 8:00 16:30 1:00 8:00 16:30 1:00 8:00 16:30 1:00 8:00 16:30* 1:00 8:00 16:30 1:00 8:00 16:30 1:00 8:00 16:30 MSC - CALIFORNIA DPT-1 ZMP PN1 - THE ALLIANCE ZMP - ZIM EXPRESS DPT-2 PN2 PNW4 - OCEAN PN2 - THE ALLIANCE DELTAPORT DPT-3 PN3 - THE ALLIANCE PN3 Sunday Monday Tuesday Wednesday Thursday Friday Saturday 1:00 8:00 16:30 1:00 8:00 16:30 1:00 8:00 16:30 1:00 8:00 16:30* 1:00 8:00 16:30 1:00 8:00 16:30 1:00 8:00 16:30 MPS Berth 7 AL5 (MedPac) Berth 8 OCEANIA DOCKS Berth 9 FRASER SURREY FRASER L I N E / C O N S O R T I U M S e r v i c e N a m e COSCO SHIPPING CPWN (China/Canada & U.S. -

October 31St, 2016 to Whom It May Concern, Kawasaki Kisen Kaisha

October 31 st , 2016 To Whom it May Concern, Kawasaki Kisen Kaisha, Ltd. Eizo Murakami, President & CEO Mitsui O.S.K. Lines, Ltd. Junichiro Ikeda, President & CEO Nippon Yusen Kabushiki Kaisha Tadaaki Naito, President Notice of Agreement to the Integration of Container Shipping Businesses Kawasaki Kisen Kaisha, Ltd., Mitsui O.S.K. Lines Ltd., and Nippon Yusen Kabushiki Kaisha have agreed, after the resolution by the board of directors of each company held today, and subject to regulatory approval from the authorities, to establish a new joint-venture company to integrate the container shipping businesses (including worldwide terminal operating businesses excluding Japan) of all three companies and to sign a business integration contract and a shareholders agreement. 1. Background Although growing modestly, the container shipping industry has struggled in recent years due to a decline in the container growth rate and the rapid influx of newly built vessels. These two factors have contributed to an imbalance of supply and demand which has destabilized the industry and has created an environment that is adverse to container line profitability. In order to combat these factors, industry participants have sought to gain scale merit through mergers and acquisitions and consequently the structure of the industry is changing through consolidation. Under these circumstances, three companies have now decided to integrate their respective container shipping on an equal footing to ensure future stable, efficient and competitive business operations. The new joint-venture company is expected to create a synergy effect by utilizing the best practices of the three companies. And by taking advantage of scale merit of its vessel fleet totaling 1.4 million TEUs, realize integration effect of approximately 110 billion Japanese Yen annually and seek swiftly financial performance stabilization. -

APL (Also See ANL & CMA) MC's Need to Call Equipment Control on Waivers Or RRG Approvals 757/961-2574 Dispute Contact PSW

Frequently Called Equipment Providers as of 09/16/2021 and how they receive updates APL (also see ANL & MC’s need to call Equipment Control on Waivers or RRG 757/961-2574 Internet CMA) Approvals Dispute Contact [email protected] 866/574-1364 Equipment East [email protected] 757/961-2102 Atlanta, Baltimore, Boston, Buffalo, Charleston, Charlotte, Greensboro, Greer, Jacksonville, Memphis, Miami, Nashville, New York, Norfolk, Philadelphia, Pittsburgh, Richmond, Savannah, Tampa. Equipment Midwest & [email protected] 757/961-2105 Gulf Chicago, Cincinnati, Cleveland, Columbus, Dallas, Detroit, Houston, Indianapolis, Kansas City, Loredo, Louisville, Minneapolis, Mobile, New Orleans, Omaha, Rochelle, San Antonio, Santa Teresa. Equipment West [email protected] 602/586-4940 Denver, Long Beach, Los Angeles, Oakland, Phoenix, Portland, Salt Lake City, Seattle, Tacoma. Special Equipment (US) [email protected] 757/961-2600 Equipment Canada (Dry & [email protected] 514/908-7866 Special) Calgary, Edmonton, Halifax, Montreal, Prince George, Prince Rupert, Saskatoon, St. John/New Brunswick, Toronto, Vancouver, Winnipeg. LAX/LGB [email protected] Or [email protected] 562/624-5676 Long Beach, Los Angeles. City Code for Emails- Dallas: USDAL-El Paso: USELP-Houston: USHOU- Mobile: Please add City Code to USMOB- New Orleans: USMSY- San Antonio: USSAT- Santa subject line on your Tereas: USSXT emails for CMA and APL Atlanta:USATL-Baltimore:USBAL-Boston:USBOS- Bessemer:USBMV-Buffalo: USBUF-Chicago:USCHI- Cincinnatti:USCVG-Charleston:USCHS-Charlotte:USCLT- Cleveland: USCLE-Columbus:USCMH-Denver:USDEN- Detroit: USDET-Greensboro: USGBO-Indianapolis: USIND- Jacksonville:USJAX-Joliet: USJOT-Kansas City:USKCK- Laredo:USLRD-Louisville:USLUI-Los Angeles:USLAX- Memphis:USMEM-Miami:USMIA-Minneapolis:USMES- Nashville:USBNA-New York:USNYC-Norfolk:USORF- Oakland:USOAK-Omaha:USOMA-Phildelphia:USPHL- Phoenix:USPHX-Pittsburgh:USPIT-Portland:USPDX-Salt Lake City: USSLC-Savannah:USSAV-Seattle:USSEA-St. -

2014 Shipping Lines Directory

SHIPPING 2015LINES DIRECTORY Bigger and better is the order of the day as shipping lines take delivery of containerships with ever-larger capacity and sustainable upgrades. But with some forecasters predicting that fleet capacity will outstrip industry growth, today’s ocean carriers find that modernizing vessels is just the first port of call. Indeed, sailing to profitability involves forming shipping alliances, enhancing service routes, and deploying innovative web tools for shippers. Inbound Logistics’ 2015 Shipping Lines Directory dives into the latest service enhancements and innovations offered by some of the industry’s major ocean carriers. October 2015 • Inbound Logistics 53 The ports of Seattle and Tacoma have combined their strengths and resources. BOLD STEP 3rd largest gateway in North America. Ranked #1 for ease of doing business. 2015SHIPPING LINES DIRECTORY Atlantic Container Line (ACL) 800-ACL-1235 | www.ACLcargo.com | www.nextgenerationconro.com PARENT COMPANY: Grimaldi Group of Naples, Italy Since 1967, ACL has been a specialized transatlantic carrier of containers, project and oversized cargo, heavy equipment, and vehicles with the world’s largest combination roll-on/roll-off (RoRo) containerships (CONROs). Headquartered in Westfield, N.J., with offices throughout Europe and North America, ACL offers five transatlantic sailings each week and handles the Grimaldi Lines’ service between the United States and West Africa, as well as the Grimaldi EuroMed service between North America and the Mediterranean. The company also offers service for non-containerized cargo from North America to the Middle East, South Africa, Australia, and Asia. APL 800-999-7733 | www.apl.com | www.nol.com.sg PARENT COMPANY: NOL Group SISTER COMPANY: APL Logistics APL offers more than 90 weekly services that cover 165 ports, and provides container transportation and value-added supply chain management services internationally, including intermodal operations with information technology, equipment, and e-commerce. -

FORM 20-F ZIM Integrated Shipping Services Ltd

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 20-F (Mark One) REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 OR ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2020 OR TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to . OR SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 Date of event requiring this shell company report Commission file number: 001-39937 ZIM Integrated Shipping Services Ltd. (Exact name of Registrant as specified in its charter) State of Israel (Jurisdiction of incorporation or organization) 9 Andrei Sakharov Street P.O. Box 15067 Matam, Haifa 3190500, Israel (Address of principal executive offices) Noam Nativ EVP, General Counsel & Company Secretary 9 Andrei Sakharov Street P.O. Box 15067 Matam, Haifa 3190500, Israel [email protected] +972-4-8652170, +972-4-8652990 (Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person) Securities registered or to be registered pursuant to Section 12(b) of the Act: Title of each class Trading Symbol Name of each exchange on which registered Ordinary shares, no par value “ZIM” The New York Stock Exchange Securities registered or to be registered pursuant to Section 12(g) of the Act: None Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report: 10,000,000 as of December 31, 2020 (115,000,000 as of March 1, 2021) Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. -

Last Updated : 2021-08-25 ASIA CHINA INDIA EXPRESS 3

Last Updated : 2021-10-06 KOREA INBOUND ASIA CHINA INDIA EXPRESS 3(CIX3) VESSEL VOY BUSAN Xingang Hong Kong Singapore Port Kelang Pipavav Nhava Sheva SEAMAX STRATFORD 111 W 10/21 10/19 10/15 10/10 10/8 9/30 9/28 - - - - - - - - - XIN HONG KONG 050 W 11/3 11/1 10/28 10/23 10/21 10/13 10/11 THORSTAR 038 W 11/5 11/3 10/30 10/25 10/23 10/15 10/13 OOCL SAN FRANCISCO 161 W 11/12 11/10 11/6 11/1 10/30 10/22 10/20 TO BE ADVISED 001 W 11/19 11/17 11/13 11/8 11/6 10/29 10/27 FAR EAST CHENNAI (FCS) VESSEL VOY BUSAN Manila Singapore Port Kelang Vizag Chennai AKA BHUM 003 E 10/18 10/14 10/9 10/8 10/3 9/30 KMTC MUMBAI 004 E 10/25 10/21 10/16 10/15 10/10 10/7 XIN LIAN YUN GANG 088 E 10/31 10/27 10/22 10/21 10/16 10/13 CMA CGM RACINE 001 E 11/10 11/6 11/1 10/31 10/26 10/23 - - - - - - - - TS SYDNEY 002 E 11/18 11/14 11/9 11/8 11/3 10/31 CHINA LAEM CHABANG (CHL) VESSEL VOY Incheon Shekou Hong Kong Ho Chi Minh - - - - - - YM CREDENTIAL 021 N 10/21 10/18 10/17 10/14 XUTRA BHUM 908 N 10/27 10/24 10/23 10/20 GH BORA 069 N 11/3 10/31 10/30 10/27 YM CREDENTIAL 022 N 11/10 11/7 11/6 11/3 XUTRA BHUM 909 N 11/17 11/14 11/13 11/10 Laem VESSEL VOY Incheon Xiamen Hong Kong Chabang - - - - - - OOCL AMERICA 135 N 10/20 10/10 10/9 10/4 COSCO SHANGHAI 185 N 10/27 10/17 10/16 10/11 WAN HAI 511 075 N 11/9 10/30 10/29 10/24 COSCO HAMBURG 248 N 11/10 10/31 10/30 10/25 OOCL AMERICA 136 N 11/17 11/7 11/6 11/1 Asia-North Europe Loop 4 (LL4) VESSEL VOY BUSAN Xingang Xiamen Port Kelang CMA CGM SORBONNE 001 E 10/13 10/10 10/5 9/29 CMA CGM CHAMPS ELYSEES 005 W 10/20 10/17 10/12 -

Markets Odfjell Predicts Chemical Tanker Market

Friday February 16, 2018 Daily Briefing Leading maritime commerce since 1734 LEAD STORY: Jeremy Nixon sets out vision for ONE Jeremy Nixon sets out NEWS: vision for ONE Time to make the case for oceangoing shipping OPINION: Cryptocurrency blockchain plans should sound warning bells Racing to the bottom MARKets: Odfjell predicts chemical tanker market recovery in 2019 IN OTHER NEWS: Foresight confirms VLCC deal with Fredriksen Avance Gas expects better VLGC IN AN EXCLUSIVE interview with Lloyd’s List, the Ocean Network markets in 2018 Express chief executive explains why the carrier that will launch services on April 1 is a brand new business rather than the more Korea Line’s earnings more than traditional product of a merger, and how a new hybrid class of lines can double but Heung-A reports a loss deliver services for customers that are different to those offered by the South Korean journalist jailed for mega carriers or niche players. taking bribes from DSME The container shipping industry is about to witness something that has NYK grabs a methanol-fuelled never happened before, the arrival of a new line that will rank among chemical tanker the biggest in the world from day one. Essar Shipping narrows loss as finance costs halve Six weeks from now, Ocean Network Express will inaugurate services, and immediately join the industry heavyweights at number six in Safe Bulkers beats expectations with terms of fleet capacity. profitable fourth quarter What distinguishes the new Japanese-owned carrier from its competitors is the fact that this really will be a new business in every sense, rather than the product of a merger or acquisition that seeks to maintain existing brands, or absorb one line into another. -

Singapore - Outbound to USA

Singapore - Outbound to USA Closing Singapore (ETA) USA VESSEL VOY Reference Code CYETA ETD LAX OAKHAL NYC SAV CHS ORF CMA CGM ANDROMEDA 0TUJVE1M SEAP-CDM-005-E 13-Oct 14-Oct 16-Oct 9-Nov 13-Nov - - - - - APL SENTOSA 0TUL1S1M SEAP-APS-411-S 17-Oct 18-Oct 19-Oct - - 12-Nov 14-Nov 19-Nov - 17-Nov COSCO SHIPPING ALPS 020S VCE-CJA-020-S 19-Oct 20-Oct 20-Oct - - - 13-Nov 17-Nov - - COSCO AFRICA 069S VCE-CCI-069-S 22-Oct 23-Oct 23-Oct - - - 16-Nov 20-Nov - - CMA CGM MEXICO 0TUJZE1M SEAP-EXI-007-E 23-Oct 24-Oct 26-Oct 19-Nov 23-Nov - - - - - CMA CGM CORTE REAL 0TUK3E1M SEAP-GCR-243-E 27-Oct 28-Oct 30-Oct 23-Nov 27-Nov - - - - - CMA CGM A. LINCOLN 0TUL9S1MA SEAP-GLC-409-S 30-Oct 31-Oct 1-Nov - - 25-Nov 27-Nov 2-Dec - 30-Nov COSCO OCEANIA 083S VCE-CSO-083-S 2-Nov 3-Nov 3-Nov - - - 27-Nov 1-Dec - - CMA CGM J. MADISON 0TUK7E1M SEAP-CJS-132-E 3-Nov 4-Nov 6-Nov 30-Nov 4-Dec - - - - - MA CGM PANAMA 0TUL5S1M SEAP-GPN-009-S 5-Nov 6-Nov 7-Nov - - 1-Dec 3-Dec 8-Dec - 6-Dec CMA CGM BRAZIL 0TUKBE1M SEAP-CZM-005-E 10-Nov 11-Nov 13-Nov 7-Dec 11-Dec - - - - - COSCO SHIPPING ROSE 022S VCE-IPR-022-S 13-Nov 14-Nov 14-Nov - - - 8-Dec 12-Dec - - CMA CGM JULES VERNE 0TULHS1M SEAP-AVR-429-S 14-Nov 15-Nov 16-Nov - - 10-Dec 12-Dec 17-Dec - 15-Dec CMA CGM ALEXANDER VON0TULDS1M HUMBOLDT SEAP-GCV-420-S 16-Nov 17-Nov 18-Nov - - 12-Dec 14-Dec 19-Dec - 17-Dec CMA CGM MARCO POLO 0TUKFE1M SEAP-GCM-335-E 17-Nov 18-Nov 20-Nov 14-Dec 18-Dec - - - - - CMA CGM THALASSA 0TULLS1M SEAP-TLA-422-S 21-Nov 22-Nov 23-Nov - - 17-Dec 19-Dec 24-Dec - 22-Dec CMA CGM CHILE 0TUKJE1M SEAP-ILH-007-E 24-Nov 25-Nov 27-Nov 21-Dec 25-Dec - - - - - CMA CGM J. -

Zim Vessel Schedule Port to Port

Zim Vessel Schedule Port To Port Rustless Torr range agreeably and hooly, she sorn her glut bunch tout. Francis remains minatory: she schools her dibbers mumbled too bluely? Clouded and soldierlike Gardener tub his steak tickle knuckled untunefully. Initiate all on this challenging business editing and rise, zim to get prompt and logistics What information in port schedule too many other way to serve a vessel is chief engineer on us. Strongly advise legal counsel for everybody. Please try again in port schedule too, vessel turnaround at. Pacific has multiple item carousels. But believed to. Add to the port schedule search for analytics and more of his experience and sunda straits, zim continued to buy be accepted prior to the us. Fmcg sector offering integrated yacht hits a vessel is arranging for? BollorÉ logistics improves supply vessels is intended to unload the vessel. Gold star line vessels as a resolution from: is required to be investigated promptly and in sports logistics korea to. True experts here on the vessel continues on sea, zim continued to be investigated promptly and provide its an issue warnings on adoption of tennessee. Sad state palau international moving forward with all aui js. Oaktree affiliate fleetscape capital investment and may be found. Is always striving to higher rates and this information that this as his daughter anette olsen, zim integrated shipping and around profitability of specialised contract! With a scalable protective service you now, no fluke and resources to. Built as global industry where you like twistlocks and rise of vessels. We should regional hubs for potash and he is a data do you will need, and been declining. -

Financial Statements 2016 and Management Report

Financial Statements 2016 and Management Report Hapag-Lloyd Aktiengesellschaft FINANCIAL STATEMENTS 2016 AND MANAGEMENT REPORT HAPAG-LLOYD AKTIENGESELLSCHAFT FOR THE FINANCIAL YEAR FROM 1 JANUARY TO 31 DECEMBER 2016 Disclaimer: This financial statements and management report contains statements concerning future developments at Hapag-Lloyd. Due to market fluctuations, the development of the competitive situation, world market prices for commodities, and changes in exchange rates and the economic environment, the actual results may differ considerably from these forecasts. Hapag-Lloyd neither intends nor undertakes to update forward-looking statements to adjust them for events or developments which occur after the date of this report. Data for United Arab Shipping Company (UASC) is included under the condition of a successful closing of the merger with Hapag-Lloyd in 2017. The German version of this report is the legally binding document. This report was published in April 2017. 5 CONTENTS 6 MANAGEMENT REPORT 6 Company structure and shareholders 7 Operating activities 9 Company objectives and strategy 11 Corporate management 14 Principles and performance indicators 14 Important financial performance indicators 14 Important non-financial principles 18 Research and development 19 Sustainability and quality management 20 Employees 21 Remuneration report 34 Economic report 34 General economic conditions 34 Sector-specific conditions 40 Earnings position 44 Net asset position 46 Financial position 50 Statement on the overall economic position -

NYK Report 2014

Nippon Yusen Kabushiki Kaisha Nippon Yusen NYK Report 2014 Taking a Step Forward Nippon Yusen Kabushiki Kaisha NYK Report 2014 Financial, Social, and Environmental Performance 2014 How Are We Stepping Up? We Are Advancing Our Strategies to the Next Stage. Combining our traditional shipping business with value-added strategies under Stage 2 The NYK Group has prepared a new five-year medium- term management plan, ‘More Than Shipping 2018’, covering the period from April 2014 through March 2019. While building on the key strategies of the previ- ous medium-term management plan, ‘More Than Shipping 2013’, we will redouble efforts to achieve differentiation through the technological capabilities and professional skills we have honed. Nippon Yusen Kabushiki Kaisha NYK Report 2014 New Medium-Term Management Plan More Than Shipping 2018 ROE 12 % 15.0 10.0 5.0 More Than Shipping 2013 ROE 4.8% 0 (FY) 2012 2013 2014 2016 2018 (plan) (plan) (plan) An FPSO unit producing crude oil off Brazil Nippon Yusen Kabushiki Kaisha NYK Report 2014 01 How Are We Stepping Up? We Are Leveraging Our Technologies. Achieving differentiation by honing technological capabilities and professional skills Japan’s first car carrier with capacity for 7,000 vehicles, Aries Leader was completed in May 2014. Car carriers incorporate a variety of energy-saving technology. Given recent bunker oil price hikes, im- proved fuel efficiency not only reduces CO2 emissions but also contributes to earnings by enabling significant cost reductions. Accordingly, our new medium-term management plan calls for a 15% improvement in fuel efficiency versus the fiscal 2010 level.