Annual Report to Our Strengthening Technology Leadership Global Business Shareholders Our Solutions Through Innovation Integration 2 4 8 12

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Report and Accounts 2008 About Your Company

F&C Global Smaller Companies PLC Report and Accounts 2008 About Your Company Objective Why an investment trust? F&C Global Smaller Companies PLC (“the Company”) As an investment trust, the Company offers a invests in smaller companies worldwide in order to number of advantages over other kinds of savings. secure a high total return. For example it has: • The freedom to borrow money to invest for What we do our shareholders. We invest around the globe in markets, sectors • The ability to enhance net asset value per share by and companies that we believe will achieve the buying back our own shares. Company’s objective. • Low charges to investors, typically well below We help to reduce the risk of stock market those for comparable OEICs or unit trusts. investment by spreading your investment over a • No capital gains tax is charged on transactions wide range of stocks. within the portfolio. The low-cost savings plans available through F&C • Management of the portfolio is not complicated by Management Limited allow us to offer investment regular redemptions and subscriptions. opportunities to as many people as possible. Why choose to invest in the Company? We believe that investing in global smaller companies offers the opportunity to benefit from the superior potential of fast-growing businesses – the chance to participate in economic growth from the ground floor. We offer particular strengths that flow from: • Spread: We invest in over 200 companies covering markets around the world. • Global reach: Investing in smaller companies worldwide, we have the scope to take advantage of opportunities wherever they are. -

Vertiv Holdings Co

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D. C. 20549 FORM 10-K ☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2020 or ☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from __to__ Commission File No. 001-38518 Vertiv Holdings Co (Exact name of registrant as specified in it charter) Delaware 81-2376902 (State or other jurisdiction of (I.R.S Employer incorporation or organization) Identification No.) 1050 Dearborn Dr, Columbus, Ohio 43085 (Address of principal executive offices including zip code) 614-888-0246 (Registrant's telephone number, including area code) Securities registered pursuant to Section 12(b) of the Act: None. Title of each class Trading Symbol(s) Name of each exchange on which registered Class A common stock, $0.0001 par value per VRT New York Stock Exchange share Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒ Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(D) of the Exchange Act from their obligations under those Sections. Yes ☐ No ☒ Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. -

UNIFIED LIST of UNITED STATES COMPANIES with Investments Or Loans in SOUTH AFRICA and NAMIBIA

UNIFIED LIST of UNITED STATES COMPANIES with Investments or Loans in SOUTH AFRICA and NAMIBIA Compiled from Existing Source Lists by PACIFIC NORTHWEST RESEARCH CENTER June 1985 Project Managers: ROGER WALKE Pacific Northwest Research Center RICHARD KNIGHT The Africa Fund (associated with the American Committee on Africa) 198 Broadway e New York, NY 10038 Published in cooperation with the United Nations Centre Against Apartheid UNIFIED LIST TABLE OF CONTENTS INTRODUCTION .................................................... 1 RANKING OF U.S. COMPANIES IN SOUTH AFRICA AND NAMIBIA .......... 3 Ranked by Number of Employees Ranked by Direct Investment (Assets) Ranked by Outstanding Loans/Underwritings Participated In Ranked by Total of Loans/Underwritings Participated In KEY TO THE UNIFIED LIST ........................................ 8 NOTES AND ABBREVIATIONS ....................................... 10 UNIFIED LIST ................................................... 11 APPENDIX ....................................................... 93 Parent Companies No Longer in South Africa or Namibia Parent Companies that MAY No Longer Be in South Africa or Namibia Accounting Firms Claiming No Ownership in South African Firm NUMBERED SOURCES ............................................... 94 GENERAL SOURCES ................................................ 95 Please read the sections KEY TO THE UNIFIED LIST and NOTES AND ABBREVIATIONS before using the Unified List. Special thanks for assistance on this project to Katherine Black, James Campbell, Mark Cheatham, Christina Cowger, Debra George(PNWRC), Steve Johnson (PNWRC), Maureen King, Carol Pritchett, and Stephanie Weber (PNWRC). o 1985 The Africa Fund and Pacific Northwest Research Center, Inc. INTRODUCTION This unified list on U.S. corporate involvement in South Africa and Namibia has been compiled to meet the needs of the divestment movement. Accurate information about U.S. corporate economic involvement is essential to divestment action. Over the past few years, a number of lists of U.S. -

The Smart Difference

2012 annual report The SmarT Difference WorldReginfo - 643bad5a-9309-4186-aa2d-99315dede06c Financial Highlights 1 To Our Shareholders 4 The Emerson Difference 8 Financial Review 18 Financial Statements 31 Notes to Consolidated Financial Statements 36 Report of Independent Registered Public Accounting Firm 55 Eleven-Year Summary 56 Board of Directors & Management 58 Stockholders Information 60 WorldReginfo - 643bad5a-9309-4186-aa2d-99315dede06c Compound annual growth $3.39 of dividend since 1956 Earnings 11% pEr sharE* Consecutive years of 56 dividend increases Dividends per share for 2012 $1.60 dividEnds $1.60 pEr sharE 1956 – 2012 *2012 earnings per share of $3.39 excludes the $0.72 goodwill impairment charge. 2002 earnings per share is before the $1.12 per share cumulative effect of a change in accounting principle. One-Year PerfOrmance five-Year PerfOrmance Years ended September 30 percent Years ended September 30 five-year Dollars in millions, except per share amounts 2011 2012 change Dollars in millions, except per share amounts 2007 2012 cagr Sales $24,222 $24,412 1 % Sales $21,013 $24,412 3 % Net earnings $ 2,480 $ 1,968 (21)% Net earnings $ 2,136 $ 1,968 (2)% Net earnings per share $ 3.27 $ 2.67 (18)% Net earnings per share $ 2.66 $ 2.67 – % Net earnings per share Net earnings per share excluding goodwill impairment* $ 3.30 $ 3.39 3 % excluding goodwill impairment* $ 2.66 $ 3.39 5 % Dividends per share $ 1.38 $ 1.60 16 % Dividends per share $ 1.05 $ 1.60 9 % Operating cash flow $ 3,233 $ 3,053 (6)% Operating cash flow $ 3,016 $ 3,053 – % Return on total capital 19.6% 15.8% Return on total capital 20.1% 15.8% Return on equity 24.6% 19.0% Return on equity 25.2% 19.0% *Earnings per share excludes goodwill impairment charges of $0.03 and $0.72 in 2011 and 2012, respectively. -

Case No COMP/M.5886 - EMERSON ELECTRIC/ CHLORIDE GROUP

EN Case No COMP/M.5886 - EMERSON ELECTRIC/ CHLORIDE GROUP Only the English text is available and authentic. REGULATION (EC) No 139/2004 MERGER PROCEDURE Article 6(1)(b) NON-OPPOSITION Date: 24/08/2010 In electronic form on the EUR-Lex website under document number 32010M5886 Office for Publications of the European Union L-2985 Luxembourg EUROPEAN COMMISSION Brussels, 24.8.2010 SG-Greffe(2010) D/12896 C(2010) 5944 In the published version of this decision, some information has been omitted pursuant to Article 17(2) of Council Regulation (EC) No 139/2004 PUBLIC VERSION concerning non-disclosure of business secrets and other confidential information. The omissions are shown thus […]. Where possible the information omitted has been replaced by ranges of figures or a MERGER PROCEDURE general description. ARTICLE 6(1)(b) DECISION To the notifying party: Dear Sir/Madam, Subject: Case No COMP/M.5886 – EMERSON ELECTRIC/ CHLORIDE GROUP Notification of 19.07.2010 pursuant to Article 4 of Council Regulation No 139/20041 1. On 19 July 2010, the European Commission received a notification of a proposed concentration pursuant to Article 4 of Council Regulation No 139/2004 ("the Merger Regulation") by which Emerson Electric Company ("Emerson", USA) acquires within the meaning of Article 3(1)(b) of the Merger Regulation sole control of the whole of Chloride Group plc ("Chloride", UK) by way of a public bid. 2. After examination of the notification, the Commission has concluded that the notified operation falls within the scope of the Merger Regulation and does not raise serious doubts as to its compatibility with the internal market and the EEA Agreement. -

UNIFIED LIST of UNITED STATES COMPANIES Doing Business in SOUTH AFRICA and NAMIBIA

UNIFIED LIST of UNITED STATES COMPANIES Doing Business in SOUTH AFRICA and NAMIBIA by Richard Knight The Africa Fund and Roger Walke Pacific Northwest Research Center Second Edition 1988 (associated with the American Committee on Africa) 198 Broadway e New York, NY 10038 CONTENTS Introduction ................................................... i U.S. Companies with Ownership in South Africa and Namibia Ranked by Number of Employees ............................. v Ranked by Sales .......................................... vi Ranked by Assets ........................................ vii Key to the Unified List ..................................... viii The Unified List ............................................... I Numbered Sources .............................................. 81 Special thanks to Andrew Weiss, who put in many hours of work helping to collect the information necessary to publish this list. copyright 1988 The Africa Fund INTRODUCTION This unified list on U.S. corporate involvement in South Africa and Namibia has been compiled to meet the needs of the divestment movement. As the campaign to isolate South Africa has grown, so has the need for accurate information about U.S. corporate economic involvement in the apartheid economy. Over the past few years, a number of lists of U.S. corporations with investments in South Africa or Namibia have been compiled. This work has been done by research organizations, business reference services, U.S. government agencies and activist groups. The Unified List is a compilation of existing sources to create a master list of American firms with investments, loans or licensing/franchising agreements in South Africa and Namibia. Those sources include the U.S. government, the Investor Responsibility Research Center (IRRC), the U.N. Centre on Transnational Corporations, and Corporate Data Exchange. Further information comes from The Africa Fund's extensive correspondence with several hundred companies profiled in this list. -

Uninterruptible Power Supplies & Other Power Protection Systems

Uninterruptible Power Supplies & Other Power Protection Systems with forecasts to 2005 and 2010 New study finds: • The US market for uninterruptible power supplies (UPS) and other power protection systems is projected to increase 7.2 percent per annum (including inflation) through 2005 to $9.2 billion • The industrial and health care sectors are already considered mature markets for power protection system products, although the latter will benefit from some base broadening as demand for electronic medical systems rises with an aging population • Leading suppliers include American Power Conversion, Caterpillar, Cooper Industries, Cummins Engine, Danaher, Invensys, Liebert (subsidiary of Emerson Electric), MGE UPS Systems, Pillar (subsidiary of TESSAG of Germany), Toshiba, Tripp Lite, Tyco International and Wiremold (subsidiary of Legrand of France) Freedonia Industry Study #1438 Study Publication Date: June 2001 Price: $3,700 Uninterruptible Power Pages: 197 Supplies (UPS) & Other Power Protection Systems Uniterruptible Power Supplies (UPS) & Other Power Protection Systems, a new study from The Freedonia Group, provides you with an in-depth analysis of major trends in the industry and the outlook for product seg- ments and major markets -- critical information to help you with strategic planning. This brochure gives you an indication of the scope, depth and value of Freedonia's new study, Uninterruptible Power Supplies (UPS) & Other Power Protection Systems. Ordering information is included on the back page of the brochure. Brochure Table of Contents Study Highlights ............................................................................... 2 Table of Contents and List of Tables and Charts ............................. 4 Sample Pages and Sample Tables from: Market Environment & Technology ............................ 6 Power Protection Systems ........................................... 7 Applications ................................................................. 8 Industry Structure ....................................................... -

Information Productivity™ Rankings by Country

Strassmann, Inc. Global Information PRoductivity™ Rankings © Copyright 1996, All Rights Reserved Companies Total Revenues Weighted Country in Database (US$000) Average IP™ ARGENTINA 3 881,675 -0.751 AUSTRALIA 20 25,393,032 -0.119 AUSTRIA 11 12,234,878 -0.042 BELGIUM 23 17,921,628 -0.128 BRAZIL 33 60,641,605 -0.346 CANADA 311 265,364,969 -0.367 CHILE 15 8,009,723 0.017 COLOMBIA 6 1,662,989 -0.219 DENMARK 78 45,369,476 -0.159 FINLAND 57 58,337,766 0.078 FRANCE 124 511,606,973 -0.145 GERMANY 123 650,231,734 -0.036 GREECE 1 9 2,977,286 -0.606 HONG KONG 6 6,149,926 -2.658 INDIA 1 168,241 0.251 IRELAND 48 20,526,573 0.077 ITALY 161 346,779,093 -0.214 JAPAN 1,767 5,233,053,608 -0.170 KOREA (SOUTH) 41 113,933,255 -0.120 LUXEMBOURG 3 6,507,677 -0.060 MALAYSIA 2 1,158,941 0.679 MEXICO 30 28,921,380 -0.619 NETHERLANDS 78 321,808,668 0.066 NEW ZEALAND 6 5,704,196 1.097 NORWAY 65 28,838,430 0.042 PAKISTAN 2 44,402 0.302 PHILIPPINES 1 128,325 -0.325 PORTUGAL 3 301,723 1.671 SINGAPORE 1 1,388,783 -0.188 SOUTH AFRICA 9 18,655,473 0.032 SPAIN 4 3,031,222 -1.152 SWEDEN 24 75,540,278 0.117 SWITZERLAND 108 244,267,380 -0.689 TAIWAN 1 2,472,902 -0.651 THAILAND 14 2,924,239 0.292 UNITED KINGDOM 1,178 1,032,147,384 -0.032 UNITED STATES 2,959 4,839,398,019 0.077 7,335 13,994,483,852 IP Ranking within Country Overall Rank 1994 1994 IP Rank Company Name Within Country Revenues ($000) IP™ ARGENTINA 3770 ASTRA COMPANIA ARGENTINA DE PE 1 304,211 -0.127 5711 GAROVAGLIO Y ZORRAQUIN S.A. -

AI Disclosure Final

The voting records available within this document represent decisions made by Aviva Investors (Aviva Investors Global Services Limited in the UK and Aviva Investors Ireland Limited in Ireland) on behalf of clients who have given Aviva Investors full discretion to make voting decisions. To search for a specific company, hold down the Ctrl and F keys on your keyboard, type in all or some of the Company name required and then click "Find Next". Note that meeting dates are updated 3 months in arrears (i.e a meeting held on 1 Dec 2008 will be displayed on this page on 1 Mar 2009) in descending date order. Mtg Date / Type Company / Resolutions Vote Cast Country 29/12/09 EGM Tenon Group plc UK 1 Approve Change of Company Name to RSM Tenon Group plc; Waive Provision which Sets a Maximum For Amount of Shares that May Be Allotted by the Company (Placing and Acquisition); Issue Equity with 30/12/09 AGM Lagan Capital PLC UK 1 Accept Financial Statements and Statutory Reports Abstain 2 Re-elect Stephen Casey as Director For 3 Reappoint Grant Thornton UK LLP as Auditors and Authorise Board to Fix Their Remuneration For 4 Authorise Issue of Equity or Equity-Linked Securities with Pre-emptive Rights up to Aggregate Nomina Abstain 5 Authorise Issue of Equity or Equity-Linked Securities without Pre-emptive Rights up to Aggregate Abstain 30/12/09 EGM Redstone plc UK 1 Approve Waiver on Tender-Bid Requirement For 2 Subdivide and Convert Each Issued Ordinary Share of Ten Pence Each Into One Ordinary Share of 0.1 For 3 Adopt New Articles of Association For 4 Authorise Issue of Equity or Equity-Linked Securities with Pre-emptive Rights up to 1,306,156,208 For 5 Authorise Issue of Equity or Equity-Linked Securities without Pre-emptive Rights up to Aggregate For 6 Approve Redstone Management Incentive Plan Abstain 7 Amend Redstone Approved and Unapproved 2008 Incentive Option Scheme and Authorise the Abstain 24/12/09 Bondholder Chelsea Building Society UK Meeting of the Holders of the Outstanding GBP 100,000,000 6.25 Per Cent. -

Economic and Social Council GENERAI

UNITED NATIONS Distr. Economic and Social Council GENERAI, E/C.10/1993/13/Add.l 30 March 1993 ORIGINAL: ENGLISH COMMISSION ON TRANSNATIONAL CORPORATIONS Nineteenth session 5-15 April 1993 Item 7 of the provisional agenda* ACTIVITIES OF THE TRANSNATIONAL CORPORATIONS AND MANAGEMENT DIVISION AND ITS JOIN* UNITS List of transnational corporations with interests in South Africa Report of the Secretary-General SUMMARY The present report lists transnational corporations that have disposed of their equity interests in South Africa and those with equity interests of more than 20 per cent. Included among the latter are transnational corporations in the process of disposing of their equity interests in South Africa, transnational corporations that have reduoed their equity interests in South Africa and transnational corporations that have increased their equity interests in South Africa. The 1992 report of transnational corporations included the responses of the Secretary-General on the list of transnational corporations with interests in South Africa (E/C.10/1992/7) to a questionnaire on their social responsibility programmes in South Africa. This year the South African trade union movement was asked for its views on the social responsibility programmes that transnational corporations have in place and on the action that they think those corporations should take in that area. In response to a questionnaire, the Congress of South African Trade Unions (COSATU) submitted its Code of Conduct for Multinational Companies Investing in South Africa and the Platform of Guiding Principles for Foreign Investors, formulated in conjunction with the African National Congress. The Code of Conduct and the Platform of Guiding Principles are contained respectively in annex I and annex II to this report. -

Mergers, Acquisitions, Name Changes

164 AIR CONDITIONING, HEATING & REFRIGERATION NEWS Mergers, Acquisitions, Name Changes Looking for a manufacturing company that doesn’t seem to be listed in this 2017 Directory Issue? If you can’t find it in the Manufacturers Alphabetic Listings, then one of several things may have happened. The company could have dropped out of the hvacr industry — ceased to operate altogether, or just stopped making hvacr products; or the company may have changed owners and it is now a part of another corpo- rate identity. In either case, this listing may help. Following are the names of hundreds of manufacturers and their brand names that were found in previous editions of the Directory Issue. Many of these companies continue to exist, but are now known under dif- ferent names. To find the new identity, just look up the old name in this alphabetic listing. If no informa- tion is available, we simply provide the last year the company was listed in the Directory Issue. This listing represents our best efforts at tracking the manufacturer-members of the hvacr community. If we have erred or provided incomplete information, we apologize and hope that you will set us straight. Contact The News Editorial Department at P.O. Box 2600, Troy, Mich. 48007. Watsco would acquire ACR’s outstanding common stock A in a cash tender offer. AAF International, Louisville, Ky. Adams Manufacturing Co., Cleveland In 2006, Daikin obtained AAF as part of its acquisition Acquired assets and rights to G1 and G2 power gas of the OYL Group. In 2016, AAF acquired Flanders burners from R.W. -

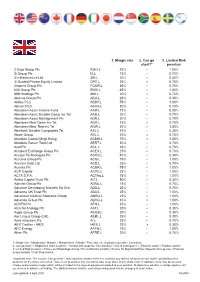

1. Margin Rate 2. Can Go Short?

1. Margin rate 2. Can go 3. Limited Risk short?* premium 2 Ergo Group Plc RGO.L 25% P 1.00% 3i Group Plc III.L 15% P 0.70% 3i Infrastructure Ltd 3IN.L 20% P 0.30% 3i Quoted Private Equity Limited QPE.L 25% O 0.70% 4imprint Group Plc FOUR.L 25% P 0.70% 600 Group Plc SIXH.L 45% P 1.00% 888 Holdings Plc 888.L 20% P 0.70% Abacus Group Plc ABU.L 25% P 0.30% Abbey PLC ABBY.L 75% P 1.00% Abcam PLC ABCA.L 30% P 0.70% Aberdeen Asian Income Fund AAIF.L 15% P 0.30% Aberdeen Asian Smaller Comp Inv Tst AAS.L 25% P 0.70% Aberdeen Asset Management Plc ADN.L 20% P 0.70% Aberdeen New Dawn Inv Tst ABD.L 15% P 0.70% Aberdeen New Thai Inv Tst ANW.L 30% P 1.00% Aberforth Smaller Companies Tst ASL.L 15% P 0.30% Ablon Group ABL.L 25% O 0.70% Absolute Capital Mngt Hldng ACMH.L 75% O 1.00% Absolute Return Trust Ltd ABRT.L 50% P 0.70% Acal Plc ACL.L 35% P 0.70% Accident Exchange Group Plc ACEX.L 25% P 0.70% Accsys Technologies Plc ACCS.L 40% P 0.30% Accuma Group Plc ACG.L 75% P 1.00% Acencia Debt Ltd ACD.L 25% P 0.70% Acertec Plc ACER.L 75% P 1.00% ACP Capital ACPC.L 25% P 1.00% ACTA S.P.A. ACTAq.L 75% P 1.00% Active Capital Trust Plc AIT.L 50% P 0.30% Admiral Group Plc ADML.L 15% P 0.70% Advance Developing Markets Tst Ord ADD.L 25% P 0.70% Advance UK Trust Plc ADU.L 25% P 1.00% Advanced Medical Solutions Group AMSU.L 25% P 1.00% Adventis Group Plc ADVG.L 45% O 1.00% ADVFN Plc AFN.L 35% P 1.00% AEA Technology Plc AAT.L 20% P 0.30% Aegis Group Plc AEGS.L 20% P 0.30% Aer Lingus Group (UK) AERL.L 25% P 0.30% Aero Inventory Plc AI.L 25% P 0.70% AEX Tracker - IAEX