Purchasing Principles : Our Commitments All Rights Reserved

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

References to CSR Guidelines and Principles FINAL

An Analysis of Policy References made by large EU Companies to Internationally Recognised CSR Guidelines and Principles March 2013 This study was prepared by Caroline Schimanski for the European Commission (Directorate-General for Enterprise and Industry). The content of this report does not necessarily represent the official view of the European Commission. For any enquiries please contact the CSR team of the European Commission's Directorate-General for Enterprise and Industry [email protected] 1. Introduction In October 2011, the European Commission adopted a new strategy on corporate social responsibility (CSR).1 The strategy places a strong emphasis on a core set of internationally recognised CSR guidelines and principles. It highlights in particular the 10 principles of the UN Global Compact; the OECD Guidelines for Multinational Enterprises; the ISO 26000 guidance standard on social responsibility; the ILO Tri-partite Declaration of Principles Concerning Multinational Enterprises and Social Policy; and the UN Guiding Principles on Business and Human Rights. The European Commission refers to these instruments as “an evolving and recently strengthened global framework for CSR.” As part of its strategy, the European Commission invites large enterprises to make a commitment to take account of these instruments when developing their own policies on CSR, and announces an intention to monitor such commitments for enterprises with more than 1.000 employees. This paper is part of that monitoring exercise. The aim is to present statistics on the extent to which 200 randomly selected large companies (over 1.000 employees) from 10 different EU Member States make publicly available policy references to certain internationally recognised CSR guidelines and principles. -

Results of the Public Consultation 'The Urban Dimension of the EU Transport Policy'

APRIL 2013 EUROPEAN COMMISSION DG MOVE Results of the public consultation 'The urban dimension of the EU transport policy' FINAL REPORT ADDRESS COWI A/S Parallelvej 2 2800 Kongens Lyngby Denmark TEL +45 56 40 00 00 FAX +45 56 40 99 99 WWW cowi.com APRIL 2013 EUROPEAN COMMISSION DG MOVE Results of the public consultation 'The urban dimension of the EU transport policy' FINAL REPORT PROJECT NO. A032862 DOCUMENT NO. A032862_Public consultation Report VERSION 6 DATE OF ISSUE 07.05.2013 PREPARED MCMO CHECKED MMS; SHJ APPROVED MMS Final report of public consultation 5 CONTENTS Executive Summary 11 1 Introduction 13 2 Outline of the urban dimension of the EU transport policy initiative 15 3 Responses to the public consultation 17 3.1 Composition of respondents 17 3.2 Location 19 4 Results of the public consultation 21 4.1 Sustainable urban mobility in the EU 21 4.2 Access restrictions and urban pricing schemes 34 4.3 EU financial support for urban transport projects 42 4.4 Urban freight logistics 48 4.5 Other topics 51 APPENDICES Appendix A List of participants Appendix B Questionnaire Final report of public consultation 6 List of Tables Table 3-1 Composition of participants 17 Table 3-2 Respondents who chose to remain anonymous 18 Table 3-3 Sub-category of associations 19 Table 3-4 Respondents' main country of operation or residence 19 Table 4-1 Coordination between authorities and actors 22 Table 4-2 Do you think that there is a lack of coordination? 26 Table 4-3 Views on the importance of integrated urban mobility plans to foster coordination -

References to CSR Guidelines and Principles FINAL

Ref. Ares(2015)2100451 - 20/05/2015 An Analysis of Policy References made by large EU Companies to Internationally Recognised CSR Guidelines and Principles March 2013 This study was prepared by Caroline Schimanski for the European Commission (Directorate-General for Enterprise and Industry). The content of this report does not necessarily represent the official view of the European Commission. For any enquiries please contact the CSR team of the European Commission's Directorate-General for Enterprise and Industry [email protected] 1. Introduction In October 2011, the European Commission adopted a new strategy on corporate social responsibility (CSR).1 The strategy places a strong emphasis on a core set of internationally recognised CSR guidelines and principles. It highlights in particular the 10 principles of the UN Global Compact; the OECD Guidelines for Multinational Enterprises; the ISO 26000 guidance standard on social responsibility; the ILO Tri-partite Declaration of Principles Concerning Multinational Enterprises and Social Policy; and the UN Guiding Principles on Business and Human Rights. The European Commission refers to these instruments as “an evolving and recently strengthened global framework for CSR.” As part of its strategy, the European Commission invites large enterprises to make a commitment to take account of these instruments when developing their own policies on CSR, and announces an intention to monitor such commitments for enterprises with more than 1.000 employees. This paper is part of that monitoring exercise. The aim is to present statistics on the extent to which 200 randomly selected large companies (over 1.000 employees) from 10 different EU Member States make publicly available policy references to certain internationally recognised CSR guidelines and principles. -

What Role for Cars in Tomorrow's World?

What role for cars in tomorrow’s world? REPORT JUNE 2017 The Institut Montaigne is an independent think tank founded in 2000 by Claude Bébéar and directed by Laurent Bigorgne. It has no partisan ties and its highly diversified funding is from private sources only; no single contribution accounts for more than 2% of the annual budget. It brings together business leaders, senior civil servants, academics and representatives of civil society from different backgrounds and with diverse experiences. Institut Montaigne’s work focuses on four areas of research: Social cohesion (primary and secondary education, youth and older people’s employment, corporate governance, equal opportunity, social mobility, housing) Modernising public action (pension system, legal system, healthcare system) Economic competitiveness (entrepreneurship, energy & climate change, emerging states, corporate financing, intellectual property, transportation) Public finance (Tax system, social protection) Thanks to both its associated experts and its study groups, the Institut Montaigne produces practical long-term proposals on the substantial challenges that our contemporary societies are facing. It therefore helps shaping the evolutions of social consciousness. Its recommendations are based on a rigorous and critical method of analysis. These recommendations are then actively promoted to decision- making governmental officials. Throughout its publications, lectures and conferences, the Institut Montaigne aims to be a key contributor to the democratic debate. The Institut Montaigne ensures the scientific validity, accuracy and the quality of the work that it produces, yet the opinions portrayed by the authors are those of their own and not neces- sarily the Institut’s. The authorial opinions are therefore not to be attributed to the Institut nor to its governing bodies. -

Batteries and Accumulators in France

Regulations Organisation Market Collection Treatment European Outlook Data Comparison 2014 Batteries and Accumulators in France COLLECTION REPÈRES RETOUR SOMMAIRE The present synthesis report presents the market for Batteries and Accumulators in France in 2014 based on the data gathered through the ADEME’s Register of Batteries and Accumulators, which is completed by data from sector stakeholders. In 2001, the French Environmental Agency, known as ADEME, created the Observatory of batteries and accumulators (B&A) in order to keep track with the batteries and accumulators market. Following the transposition of European Directive 2006/66/EC on batteries and accumulators into French law on 22 September 2009, the National Register of Battery and Accumulator producers was created in 2010. Since January 2014, a unique website called SYDEREP (SYstème DEclaratif des filières REP) compiles all the Registers and Observatories for the WEEE*, Batteries and Accumulators, Furniture, fluorinated gases, tires and ELV* sectors (www.syderep.ademe.fr). This Register aims to record the French producers and to consolidate the B&A producers and recycling companies annual reporting: the regulation requires that all B&A producers and recycling companies report annually through the Register on the quantities of batteries and accumulators they put on the market, collect and treat. Based on analysis of the data, ADEME issues an annual report allowing both the follow-up of the batteries and accumulators market in France and communication regarding the achievement -

E-Mobility: a Green Boost for European Automotive Jobs?

E-mobility: A green boost for European automotive jobs? Results presentation JUNE 2021 Study based on long journey around the topic Shifting Gears in Auto Manufacturing Link BCG Report Study on Studies for Germany, Additional country "Shifting Gears" European level Spain and Poland studies and scenarios September 2020 Start December 2020 Start April 2021 July 2021 BCG report about the shift Study of the Automotive Dedicated country level Additional country level in Automotive job development in Europe studies in collaboration studies for other important manufacturing in collaboration with ECF with local organizations markets in consideration Detailed analysis of the Analysis of all major trends Studies considering the Idea for additional scenario necessary labor units that are driving the Auto highly different situation analysis based on behavior between ICEs and BEVs industry over next 10 years across EU countries in EU vs. China and USA 1 Copyright © by 2021 Boston Consulting Group. All rights reserved. Study based on three important pillars Interviews with Job distribution across Trends along industry various Auto experts functions & industries sectors and functions 1 Industry sectors and job families primarily affected Job categories 2 Major trends influencing job development in Auto industry 2 Major trends influencing job development in Auto industry 5 job categories based on 31 affected job families Spain & Poland preliminary 1 Industry sectors and job families primarily affected >45 expert interviews conducted to validate findings -

List of Participants Mission for Growth to China

24 June 2013 DISCLAIMER: EACI/DG ENTR CANNOT GUARANTEE THE PARTICIPATION OF THE COMPANIES LISTED BELOW IN THE MATCHMAKING MEETING TAKING PLACE ON THE OCCASION OF THE MISSION FOR GROWTH. HOWEVER, THE MAJORITY OF THE COMPANIES HAVE EXPRESSED THEIR KEEN INTEREST IN PARTICIPATING IN THE MATCHMAKING MEETINGS HOSTED BY THE EU SME CENTRE IN BEIJING. LIST OF PARTICIPANTS MISSION FOR GROWTH TO CHINA 1. ABENGOA WATER (Spain) Big Water supply; sewerage, waste management and remediation activities Carlos COSIN - CEO Abengoa Water is Abengoa´s Business Group on Water. Abengoa Water is a global water technology company that provides innovative and sustainable solutions for water needs. Abengoa Water is the leading company in RO desalination (GWI Award Desalination Company of 2012) and expanding its activities to municipal wastewater treatment and reuse and industrial water treatment. Abengoa Water believes that technology is a keygrowth driver and therefore invests in R&D to improve existing solutions and to develope new technologies that allows Abengoa Water to be more competitive. www.abengoawater.com Size: Big, Turnover: 69.133.000; 47.415.0 2. ADASA SISTEMAS (Spain) SME Manufacture of real time water quality monitoring equipment Albert MOLINA - General Director ADASA Sistemas is a large enterprise company which belongs to the Spanish COMSA EMTE Group and is an expert in the design, development, installation, operation and maintenance in the fields of automation and control, information and communication systems, mainly for hydrological control, water and air quality and meteorology applications, having total Spanish coverage and being also present in Poland, Romania, Latin America, Australia and North Africa. -

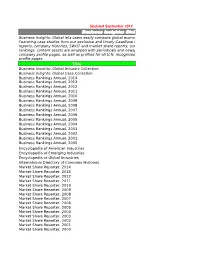

Reference Title List 2-2012

Updated September 2014 Business Insights: Global Business Insights: Global lets users easily compare global economies, companies and industries. Featuring case studies from our exclusive and timely CaseBase collection, global industry research reports, company histories, SWOT and market share reports, corporate chronologies, and business rankings, content assets are wrapped with periodicals and newspapers in hundreds of thousands of company profile pages, as well as profiles for all U.N. recognized countries and hundreds of industry profile pages. Title Business Insights: Global Industry Collection Business Insights: Global Case Collection Business Rankings Annual, 2014 Business Rankings Annual, 2013 Business Rankings Annual, 2012 Business Rankings Annual, 2011 Business Rankings Annual, 2010 Business Rankings Annual, 2009 Business Rankings Annual, 2008 Business Rankings Annual, 2007 Business Rankings Annual, 2006 Business Rankings Annual, 2005 Business Rankings Annual, 2004 Business Rankings Annual, 2003 Business Rankings Annual, 2002 Business Rankings Annual, 2001 Business Rankings Annual, 2000 Encyclopedia of American Industries Encyclopedia of Emerging Industries Encyclopedia of Global Industries International Directory of Company Histories Market Share Reporter, 2014 Market Share Reporter, 2013 Market Share Reporter, 2012 Market Share Reporter, 2011 Market Share Reporter, 2010 Market Share Reporter, 2009 Market Share Reporter, 2008 Market Share Reporter, 2007 Market Share Reporter, 2006 Market Share Reporter, 2005 Market Share Reporter, -

DISTRIBUTEURS PR L’Atlas De La Distribution PR Européenne

DISTRIBUTEURS PR zepros.fr www.zepros.fr L’Atlas de la distribution PR européenne22022001016-00016-6-2--222022001000111711777 The European IAM distribution Atlas Discover the European spare parts distribution : each country’s business model, the leaders… Plongez au cœur de la distribution européenne des pièces de rechange. Découvrez les modèles économiques de chaque pays et leurs leaders. Caroline Ridet Muriel Blancheton Rédactrice en chef édito Rédactrice en chef adjointe Chief editor Associate editor Concentré d’Europe Concentrated Europe lors que l’Europe politique à terme. Le grand mouvement hile political Europe is asking itself many questions, the enlarged se cherche, l’Europe écono- n’est donc pas terminé ! economic Europe has never been more dynamic. The Iam busi- À mique élargie n’a jamais Dans ce contexte de concentration W ness is very much caught up in this enthusiasm. Distributors été aussi dynamique. Le business et surtout d’internationalisation, are crossing borders in search of growth. Investors, mostly american, are Iam n’échappe pas à cette efferves- Zepros, leader incontesté de l’infor- joining the race to consolidate a sector still fragmented enough to present cence. Les distributeurs passent les mation professionnelle en France, interesting opportunities. frontières à la recherche de crois- a donc aussi décidé de sortir de ses In this turbulent, highly competitive market and in the face of major tech- sance et les investisseurs, américains frontières. Sa mission : dessiner le nical and structural changes, large groups are concentrating their efforts principalement, accompagnent paysage européen de la rechange to seize what they can find. They are convinced that only power will allow la course à la consolidation d’un automobile. -

Auchan S Raphael2016 Documents Boussemart 1

Le groupe Auchan – Environnement, concurrence et performances. Saint Raphaël – 10/ 2016 Présentation de Syndex 25/10/2016 40 ans d'expérience au service exclusif des représentants des salariés Depuis 1971, le cabinet Syndex assiste les représentants des salariés dans le cadre de leurs attributions économiques et sociales En 2011, Syndex est devenu le premier cabinet d’expertise comptable à choisir le statut de SCOP, intégrant ainsi pleinement le monde de l’économie sociale et solidaire Un réseau de 400 experts en France, dans les Dom–Tom et en Europe 1 600 clients Plus de 2 000 interventions par an : expertises, études – actions, formation, pour le compte des CE, CEE, Comités de groupe, CHSCT, d’organisations syndicales françaises et européennes Présentation Syndex – St Raphaël octobre 2016 3 3 Un réseau aux compétences pluridisciplinaires au service d’un dialogue social équilibré Une expertise éprouvée en stratégies d’entreprise Une évaluation des impacts sociaux des stratégies et une évaluation des marges de manœuvre Un parti pris : favoriser l’élaboration et la défense du « point de vue des salariés » Une capacité d’expertise pour faire contrepoids face aux points de vue des directions Un positionnement « d’exigence » vis-à-vis des dirigeants d’entreprise et du droit du travail Présentation Syndex – St Raphaël octobre 2016 4 4 Une compétence sectorielle affirmée…. parmi 24 secteurs d'activité Santé Hôpitaux Protection Armement Médico - Social Cliniques sociale, Emploi Défense Mutuelles Associations Construction Assurances