Infratil Annual Report 2014

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Australian Airports Association National Conference Adelaide 17 13-17 Nov Program and Registration

AUSTRALIAN AIRPORTS ASSOCIATION NATIONAL CONFERENCE ADELAIDE 17 13-17 NOV PROGRAM AND REGISTRATION 550 + ATTENDEES 60 + SPEAKERS 65 + EXHIBITION BOOTHS ONCE AGAIN WE ARE Networking opportunities are a key OFFERING A STRONG part of the AAA National Conference, and this year is no different. The PROGRAM INCLUDING A Networking Program includes events GREAT MIX OF AUSTRALIAN at iconic venues such as the National AND INTERNATIONAL Wine Centre and the Adelaide Oval. PRESENTERS. Not only will delegates have ample opportunity to network with industry The program has been carefully leaders at these events but the designed to be relevant to all venues themselves will provide lasting business areas of airports. However, memories. in keeping with the successful On behalf of the AAA, our partners format of previous years, Day 2 will and our exhibitors we look forward to again feature a concurrent stream seeing you at the 2017 AAA National WELCOME FROM focussing specifically on issues Conference in Adelaide. THE NATIONAL relevant to regional airports. This CHAIRMAN year, for the first time, Regional Guy Thompson Airport Scholarships are available National Chairman to support regional aerodrome staff AAA who may not otherwise be able to attend conference. THE AUSTRALIAN AIRPORTS ASSOCIATION The AAA facilitates co-operation among all member airports and their many and varied partners in Australian aviation, whilst The Australian Airports Association (AAA) The AAA represents the interests of over contributing to an air transport system that is a non-profit organisation that was 380 members. This includes more than is safe, secure, environmentally responsible 260 airports and aerodromes Australia and efficient for the benefit of all Australians founded in 1982 in recognition of the real wide – from the local country community and visitors. -

The Climate Risk of New Zealand Equities

The Climate Risk of New Zealand Equities Hamish Kennett Ivan Diaz-Rainey Pallab Biswas Introduction/Overview ØExamine the Climate Risk exposure of New Zealand Equities, specifically NZX50 companies ØMeasuring company Transition Risk through collating firm emission data ØCompany Survey and Emission Descriptives ØPredicting Emission Disclosure ØHypothetical Carbon Liabilities 2 Measuring Transition Risk ØTransition Risk through collating firm emissions ØAimed to collate emissions for all the constituents of the NZX50. ØUnique as our dataset consists of Scope 1, Scope 2, and Scope 3 emissions, ESG scores and Emission Intensities for each firm. ØCarbon Disclosure Project (CDP) reports, Thomson Reuters Asset4, Annual reports, Sustainability reports and Certified Emissions Measurement and Reduction Scheme (CEMAR) reports. Ø86% of the market capitilisation of the NZX50. 9 ØScope 1: Classified as direct GHG emissions from sources that are owned or controlled by the company. ØScope 2: Classified as indirect emissions occurring from the generation of purchased electricity. ØScope 3: Classified as other indirect GHG emissions occurring from the activities of the company, but not from sources owned or controlled by the company. (-./01 23-./014) Ø Emission Intensity = 6789 :1;1<=1 4 Company Survey Responses Did not Email No Response to Email Responded to Email Response Company Company Company Air New Zealand Ltd. The a2 Milk Company Ltd. Arvida Group Ltd. Do not report ANZ Group Ltd. EBOS Ltd. Heartland Group Holdings Ltd. Do not report Argosy Property Ltd. Goodman Property Ltd. Metro Performance Glass Ltd. Do not report Chorus Ltd. Infratil Ltd. Pushpay Holdings Ltd. Do not report Contact Energy Ltd. Investore Property Ltd. -

FNZ Basket 14102010

14-Oct-10 smartFONZ Basket Composition Composition of a basket of securities and cash equivalent to 200,000 NZX 50 Portfolio Index Fund units effective from 14 October 2010 The new basket composition applies to applications and withdrawals. Cash Portion: $ 1,902.98 Code Security description Shares ABA Abano Healthcare Group Limited 88 AIA Auckland International Airport Limited Ordinary Shares 6,725 AIR Air New Zealand Limited (NS) Ordinary Shares 2,784 AMP AMP Limited Ordinary Shares 432 ANZ Australia and New Zealand Banking Group Limited Ord Shares 212 APN APN News & Media Limited Ordinary Shares 1,759 APT AMP NZ Office Trust Ordinary Units 8,453 ARG Argosy Property Trust Ordinary Units 4,344 CAV Cavalier Corporation Limited Ordinary Shares 482 CEN Contact Energy Limited Ordinary Shares 1,508 EBO Ebos Group Limited Ordinary Shares 537 FBU Fletcher Building Limited Ordinary Shares 1,671 FPA Fisher & Paykel Appliances Holdings Limited Ordinary Shares 6,128 FPH Fisher & Paykel Healthcare Corporation Limited Ord Shares 3,106 FRE Freightways Limited Ordinary Shares 1,625 GFF Goodman Fielder Limited Ordinary Shares 3,990 GMT Macquarie Goodman Property Trust Ordinary Units 8,004 GPG Guinness Peat Group Plc Ordinary Shares 15,588 HLG Hallenstein Glasson Holdings Limited Ordinary Shares 430 IFT Infratil Limited Ordinary Shares 6,363 KIP Kiwi Income Property Trust Ordinary Units 10,287 KMD Kathmandu Holdings Limited Ordinary Shares 690 MFT Mainfreight Limited Ordinary Shares 853 MHI Michael Hill International Limited Ordinary Shares 1,433 NPX -

Infratil Investor Day

Infratil Investor Day 4 April 2014 Infratil Investor Day Trustpower Agenda • Performance developing points of difference • Focus on retail • Update on Australia © Trustpower Limited Highlights 2014 financial year • Acquisition of EDNZ accelerates retail multi-product strategy - 224,000 electricity customers - 54,300 telco services - 13,500 gas • Re-brand and launch into new geographies - Ready for metro launch • Significant progress on Snowtown Stage 2 wind farm • Completion of Esk Hydro © Trustpower Limited Consistent performance focus EBITDAF Return on adjusted capital © Trustpower Limited … and there are challenges • Demand remains flat • Government’s MoM programme – provides greater sector choice for investors • Labour / Green policy risk … TRUSTPOWER response © Trustpower Limited Re-launching the Brand – a point of difference • Stable, trustworthy and reliable • NZ owned and operated company • NZ based call centre • Excellent customer service • Rewards loyalty via Friends Gold (55% of customers) • Community involvement “So it comes down to customer service and what they do with their profit, which is where Trustpower gets two big ticks.” © Trustpower Limited Building brand value INTEGRATION Contact Energy Genesis Energy FUNCTIONAL CARE Pulse Energy Mercury Energy Meridian Energy Power Shop POWER COMPANY © Trustpower Limited Retail success – also means doing the basics well • Profitable customers that stay with you for a long time • Upsell must add value and / or increase loyalty • Cash is king and therefore processes must be excellent -

Infratil Limited and Vodafone New Zealand Limited

PUBLIC VERSION NOTICE SEEKING CLEARANCE FOR A BUSINESS ACQUISITION UNDER SECTION 66 OF THE COMMERCE ACT 1986 17 May 2019 The Registrar Competition Branch Commerce Commission PO Box 2351 Wellington New Zealand [email protected] Pursuant to section 66(1) of the Commerce Act 1986, notice is hereby given seeking clearance of a proposed business acquisition. BF\59029236\1 | Page 1 PUBLIC VERSION Pursuant to section 66(1) of the Commerce Act 1986, notice is hereby given seeking clearance of a proposed business acquisition (the transaction) in which: (a) Infratil Limited (Infratil) and/or any of its interconnected bodies corporate will acquire shares in a special purpose vehicle (SPV), such shareholding not to exceed 50%; and (b) the SPV and/or any of its interconnected bodies corporate will acquire up to 100% of the shares in Vodafone New Zealand Limited (Vodafone). EXECUTIVE SUMMARY AND INTRODUCTION 1. This proposed transaction will result in Infratil having an up to 50% interest in Vodafone, in addition to its existing 51% interest in Trustpower Limited (Trustpower). 2. Vodafone provides telecommunications services in New Zealand. 3. Trustpower has historically been primarily a retailer of electricity and gas. In recent years, Trustpower has repositioned itself as a multi-utility retailer. It now also sells fixed broadband and voice services in bundles with its electricity and gas products, with approximately 96,000 broadband connections. Trustpower also recently entered into an arrangement with Spark to offer wireless broadband and mobile services. If Vodafone and Trustpower merged, there would therefore be some limited aggregation in fixed line broadband and voice markets and potentially (in the future) the mobile phone services market. -

2019 Autumn Newsletter

Autumn 2019 This NEWSLETTER is for Managers of Airports/Airfields in Australia and New Zealand. The industry has some • What does ADS-B mean for your airport. very innovative people, and they come up with great • Useful to have a Safety Committee. solutions for the challenges we all face in managing our own airports. In these newsletters, we’re passing on • Flying Schools… income for small towns. items of interest to other Airports. In this issue … • We are Airport Operators. ADS-B … What is it and What does it mean to you and your Airport? All aircraft will soon be required to have ADS-B to be allowed into controlled airspace. This is going to change the nature of Air Traffic Control (ATC), and much else. ADS-B can provide (in operational areas), an alert to those working on the runway to give them more time to clear their gear in an orderly way, or continue working if an expected arrival is running late. This is important in today’s Health-and-Safety conscious environment. If an H&S improvement can be done, it has to be done or you’ll be explaining why not, to the authorities after an incident. For Pilots: ADS-B is a more powerful Transponder that sends detailed position reports every second or so. ATC will know for sure exactly where they are, so can continue to allow private pilots into their airspace, and Search and Rescue will know where to look if someone must put down in an emergency. For our Aimm Movement Monitoring System: We’re adding ADS-B Ground Stations to our the Aimm recording units at airports. -

Download Our Credentials

Clare Capital Credentials About Us Clare Capital is an investment banking firm based in Wellington (NZ) specialising in mergers & acquisitions (M&A), capital raises, valuations, financial modelling, corporate finance advisory, private company benchmarking and technology insights. Clare Capital is an experienced team, with a reputation for original well-considered ideas backed by structured thinking and deep analytics. Clare Capital adds value by: ▪ Originating ideas for clients. ▪ Assisting clients by completing analysis of issues. ▪ Assisting clients to complete commercial transactions. Clare Capital The investment banking team provides advisory and transactional services across: www.clarecapital.co.nz ▪ Mergers & Acquisitions (M&A) – combining detailed financial analysis with extensive M&A experience to help our clients maximize outcomes. Level 5, 1 Woodward Street, PO Box 10269 ▪ Capital Management – advising clients on their capital raising activities. Wellington 6143, New Zealand ▪ Corporate Finance – combining fundamental corporate finance principles with real-world practical experience to provide clients with: valuations, capital structure advice, and option and incentive schemes and financial modelling. Contact: Mark Clare ▪ Strategic Advice – strategic and commercial advice to clients including: detailed strategic options analysis for clients facing key decisions and structuring and Mobile +64-21-470227 negotiating financial and commercial agreements. Email: [email protected] www.clarecapital.co.nz PAGE 1 Our Network -

Autumn 2021 Newsletter

West Auckland Airport Company Ltd 76 Green Road, Parakai 0830 Phone: (09) 420-8010 Email: [email protected] Web: www.WestAucklandAirport.co.nz Autumn 2021 Newsletter Calling retired CPLs and PPLs… Ever thought of becoming a Microlight Instructor and passing on your knowledge to a new generation of recreational flyers? And, often to the PPLs who gave up flying 25 years ago due to the kids and mortgage, and now want to take it up again. With the overseas travel restrictions, there is a big surge in recreational flying. The Airport has two Tecnams, modern microlights with better payload, range and speed than the traditional 2 seat trainers. The West Auckland fleet… Tecnams ZKECL and ZKCDL are on-line for training and hire. The DynAero ZK- WIK is used for airport business and not available for hire. It’s not too hard for experienced pilots to get a Microlight Instructor rating, which can be obtained at West Auckland Airport Parakai. We currently have three part time instructors who have as much work as they can handle… more are needed. • The Airport provides the aircraft, briefing room, booking system, fuel, and Leading Edge Engineering maintains the aircraft to ‘hire or reward’ standards. • The instructors find their own students, charge for the aircraft at whatever rate they decide, and can do as much or as little training as they wish, using our facilities but working on their own behalf independently. Instructors are also welcome to use their own aircraft for training at West Auckland Airport Parakai. For more information, talk to the Airport Manager, Simon Lockie ph 021 354 458 or Engineer, Bryn Lockie ph 021 681 900. -

Acquisition of Vodafone NZ

Acquisition of Vodafone NZ Investor Briefing Pack 14 May 2019 Disclaimer Disclaimer This presentation has been prepared by Infratil Limited (NZ company number 597366, NZX:IFT; ASX:IFT) (Company). To the maximum extent permitted by law, the Company, its affiliates and each of their respective affiliates, related bodies corporate, directors, officers, partners, employees and agents will not be liable (whether in tort (including negligence) or otherwise) to you or any other person in relation to this presentation. Information This presentation contains summary information about the Company and its activities which is current as at the date of this presentation. The information in this presentation is of a general nature and does not purport to be complete nor does it contain all the information which a prospective investor may require in evaluating a possible investment in the Company or that would be required in a product disclosure statement under the Financial Markets Conduct Act 2013 or the Australian Corporations Act 2001 (Cth). The historical information in this presentation is, or is based upon, information that has been released to NZX Limited (NZX) and ASX Limited. This presentation should be read in conjunction with the Company’s Annual Report, market releases and other periodic and continuous disclosure announcements, which are available at www.nzx.com, www.asx.com.au or infratil.com/for-investors/. United States of America This presentation is not an invitation or offer of securities for subscription, purchase or sale in any jurisdiction. In particular, this presentation does not constitute an offer to sell, or a solicitation of an offer to buy, any securities in the United States or any other jurisdiction in which such an offer would be illegal. -

Wellington's Links with the World

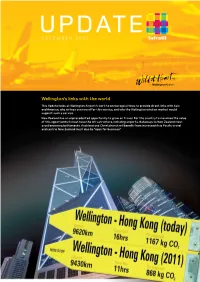

DECEMBER 2007 Wellington’s links with the world This Update looks at Wellington Airport’s work to encourage airlines to provide direct links with Asia and America, why airlines can now offer this service, and why the Wellington aviation market would support such a service. New Zealand has an unprecedented opportunity to grow air travel. For the country to maximise the value of this opportunity it must have the infrastructure, including airports. Gateways to New Zealand must avoid becoming bottlenecks. Auckland and Christchurch will benefit from increased Asia Pacific travel and central New Zealand must also be “open for business”. www.Infratil.com Air services matter Global Economic Activity (GEA) and world population within a 3.5 hour flying time PARIS CHICAGO 26% of world GEA 15% of world 32% of 25% of population HONG KONG world GEA world GEA 42% of world 7% of world population population WELLINGTON 1% of world GEA 0.4% of world population New Zealand is the furthest away place in the world. Draw a circle on a map to show 3.5 hours flying time from New Zealand and the circle captures 0.4% of the world’s population. The benefits and barriers of better connectivity are apparent from doing the same exercise centred on Hong Kong (42% of the world’s population and 32% of global economic activity), Paris (15% of the people, 26% of the economy) and Chicago (7% of the people and 25% of the world’s economy). A direct Wellington-Hong Kong air service would reduce travel time by at least three hours (six to seven if the service is via Sydney rather than Auckland). -

Recreational Pilot E-Zine Issue 99 October 2015

Recreational Pilot e-zine Issue 99 October 2015 RAANZ 2016 National Fly-in RAANZ 2016 National Fly-in Hokitika Airfield Waitangi Weekend 6-7-8 February 2016 Details and registration form attached. RAANZ AGM 2015 RAANZ 2015 AGM Raglan Saturday November 14 Details and Nomination/Remit forms will be emailed out soon. From The President Rodger Ward, RAANZ President I get a hint that winter is behind us. The days are getting longer, warmer and the calm mornings are changing into windy afternoons at times. Some aircraft that have not flown for a while are getting wheeled out and some pilots who haven't flown for a while are probably getting wheeled out as well. If you haven't flown for a while don't be afraid to get hold of an instructor to be refreshed on some of those skills that have been parked over the winter. It might be a bit late after you have done a long cross country and gotten a bit tired to find that your short strip cross wind landing technique is not what it should be! Some members of the exec recently spent a morning in Wellington with CAA discussing topical issues and areas of concern. Work is being done on: • A participation fee reduction for those aircraft that are of a special low use category. • A participation fee holiday for those aircraft that won't be used for a while. • Allowing selected IAs to do initial Permit Certification. • An Aerobatic rating. • Exchange of aircraft usage data to ensure Microlights are not unfairly tainted when accident/ incident rates are published. -

Aimm Brief Details

Aimm Brief Details: Aimm supplies a self contained recording unit to be plugged into the power and broadband at the airfield / airport, or very close by. This records the pilot radio calls, and Aimm playback operators (or the Airport’s own staff) transcribe the aircraft movements, from which reports are prepared and emailed to the client within one week of the end of each month. Known Costs. There are no hidden fees. Aimm charges a fixed monthly subscription quoted in advance and held for at least 12 months. All types of movement. Aimm records ALL types of movement (takeoffs and touch-and-go in addition to chargeable landings), so the Airport Management can show that they are considering the whole picture instead of half or less if just the chargeable landings are known. Collect or Not Collect Landing Fees. Aimm has many clients who DO collect landing fees, and many who do NOT collect individual landing fees, but still need the Risk Management and Compliance functions, and the automated reports to set the bulk yearly fees they charge to local aircraft operators. We are also Airport Operators. The Aimm team developed Aimm for their own Airport, and it was taken up by other Airfields and Airports. Clients often comment that this 'Airport centric' approach shows in the easy operation of our systems. We don't need to be persuaded to make changes as the 'Health and Safety' or Air Traffic environment evolves... we live in your world and often make the changes our clients need, at no-charge, before anyone asks.