Economic Review

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Campus Comment, February 1931 Bridgewater State Normal School

Bridgewater State University Virtual Commons - Bridgewater State University The ommeC nt Campus Journals and Publications 1931 Campus Comment, February 1931 Bridgewater State Normal School Volume 4 Number 5 Recommended Citation Bridgewater State Normal School. (1931). Campus Comment, February 1931. 4(5). Retrieved from: http://vc.bridgew.edu/comment/19 This item is available as part of Virtual Commons, the open-access institutional repository of Bridgewater State University, Bridgewater, Massachusetts. CAMPUS COMMENT PUBLISHED BY BRIDGEWATER NORMAL SCHOOL No.5 FEBRUARY, 1931 Vol. IV When the Indian Makes Music Glee Club Assisted by Noted Artists The Ideal Teacher The Glee Club was most fortunate in having as visiting artists for In America, teaching is considered one Taken from the Mentor, Sept. 1928. their annual concert Mr. Tillotson and lVIr. Yves Chardon. of the greatest human employments; al 11r. Tillotson received his earliest education in Denver. Colorado, though, sad to say, its importance is. not Digest by Pamela Chase, C-4. later came to Boston, and studied with Homer Humphrey at the New always fully understood. The touch of England Conservatory, and Piano with Heinrich Gebhard." In 1922, he the teacher is formative, molding, and 'Music to the American Indian is much came under the influence of Dr. LeRoy B. B. Campbell at vVarren, Penn influential in the growth of her pupils, more than a recreation or diversion. sylvania and then spent the summers of 1924 and 1925 in London with intellectually. Both important and trivial events in the Tobias Matthay. Teaching considered as a trade in which life of an Indian are recorded in song. -

Records of the Immigration and Naturalization Service, 1891-1957, Record Group 85 New Orleans, Louisiana Crew Lists of Vessels Arriving at New Orleans, LA, 1910-1945

Records of the Immigration and Naturalization Service, 1891-1957, Record Group 85 New Orleans, Louisiana Crew Lists of Vessels Arriving at New Orleans, LA, 1910-1945. T939. 311 rolls. (~A complete list of rolls has been added.) Roll Volumes Dates 1 1-3 January-June, 1910 2 4-5 July-October, 1910 3 6-7 November, 1910-February, 1911 4 8-9 March-June, 1911 5 10-11 July-October, 1911 6 12-13 November, 1911-February, 1912 7 14-15 March-June, 1912 8 16-17 July-October, 1912 9 18-19 November, 1912-February, 1913 10 20-21 March-June, 1913 11 22-23 July-October, 1913 12 24-25 November, 1913-February, 1914 13 26 March-April, 1914 14 27 May-June, 1914 15 28-29 July-October, 1914 16 30-31 November, 1914-February, 1915 17 32 March-April, 1915 18 33 May-June, 1915 19 34-35 July-October, 1915 20 36-37 November, 1915-February, 1916 21 38-39 March-June, 1916 22 40-41 July-October, 1916 23 42-43 November, 1916-February, 1917 24 44 March-April, 1917 25 45 May-June, 1917 26 46 July-August, 1917 27 47 September-October, 1917 28 48 November-December, 1917 29 49-50 Jan. 1-Mar. 15, 1918 30 51-53 Mar. 16-Apr. 30, 1918 31 56-59 June 1-Aug. 15, 1918 32 60-64 Aug. 16-0ct. 31, 1918 33 65-69 Nov. 1', 1918-Jan. 15, 1919 34 70-73 Jan. 16-Mar. 31, 1919 35 74-77 April-May, 1919 36 78-79 June-July, 1919 37 80-81 August-September, 1919 38 82-83 October-November, 1919 39 84-85 December, 1919-January, 1920 40 86-87 February-March, 1920 41 88-89 April-May, 1920 42 90 June, 1920 43 91 July, 1920 44 92 August, 1920 45 93 September, 1920 46 94 October, 1920 47 95-96 November, 1920 48 97-98 December, 1920 49 99-100 Jan. -

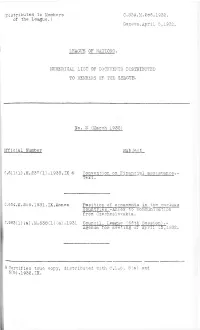

Of the League.) C.339.M.206.1932. Geneva,April 5,1932. LEAGUE of MATIONS. NUMERICAL LIST of DOCUMENTS DISTRIBUTED to MEMBERS OF

(Distributed, to Members C.339.M.206.1932. of the League.) Geneva,April 5,1932. LEAGUE OF MATIONS. NUMERICAL LIST OF DOCUMENTS DISTRIBUTED TO MEMBERS OF THE LEAGUE < No. 3 (March 1932) Official Number Sub .ject C,611(1).M,237 (1).1930.IX © Convention on Financial assistance.- Text. C.654.M.266.1931.IX,Annex Position of armaments in the various countries.-Annex to communication from Czechoslovakia. C.983(1)(a),M.538(1)(a) .1931 Council, League (66th Session).- Agenda for meeting of April 12,1932. @ Certified, true copy, distributed with C.L.5, 5(a) and 5(b).1932.IX. ,53 (a .M,35(a) .1932.XI Conyention for limiting manufacture an ci regulating distribution of narcotic drugs.- Text. ;9(b).M.3ü(b) .1932.XI @ Protocol of signature of the Convention for limiting manufacture and regulating distribution of narcotic drugs.- Text. -3.M.38.1932. II. A. Taxation of foreign and national enter prises in certain countries.-General survey. §35,M.47 .1932.VIII .Addendum Publicity of civil aviation.-Addendum to study concerning the present situation and collection of provisions in force. ■216.M.112.1932. IX,Erra turn Position of armaments in the various countries.- Erratum to communication from Turkey. .£21.M. 116,1932. IX Communication from the Greek Government SO.M.167.1932.VII Report of Sub-Committee of Economic Experts to Commission of Enquiry for European Unjon.- Observations of Danzig and letter from Polish Government. |>37(l) .M,174(1) .1932.VII Communication from China(February 29,193 »238.M, 175 .1932 .VII Communication from Japan (March 1 ,1932). -

Pacific Review February 1931 Pacific Alumni Association

University of the Pacific Scholarly Commons Pacific Review University of the Pacific ubP lications 2-1-1931 Pacific Review February 1931 Pacific Alumni Association Follow this and additional works at: https://scholarlycommons.pacific.edu/pacific-review Part of the Higher Education Commons Recommended Citation Pacific Alumni Association, "Pacific Review February 1931" (1931). Pacific Review. 52. https://scholarlycommons.pacific.edu/pacific-review/52 This Newsletter is brought to you for free and open access by the University of the Pacific ubP lications at Scholarly Commons. It has been accepted for inclusion in Pacific Review by an authorized administrator of Scholarly Commons. For more information, please contact [email protected]. •ACIFIC REVIEW VOL. V COLLEGE OF THE PACIFIC, STOCKTON, CALIFORNIA, FEBRUARY, 1931 No. 3 Alumni Clubs Are Organized In Sixth Summer Session Will Open San Francisco, Los Angeles, Fresno June 22, Announces Dean Werner Pacific Alumni Clubs have been organized in San Francisco, Los Angeles, Pacific's sixth annual Summer Session will begin June 22 for a period of and Fresno, and officers were elected at meetings held in December during six weeks, according to Dr. G. A. Werner, Dean of the session. Courses will the California Teachers' Institutes. Alumni of the Monterey Bay Region, be offered in the departments of art, biologic sciences, chemistry, economics, where a group was organized last year, met in Santa Cruz. Meetings of these education, English, geology, history and political science, ancient and modern groups will be held periodically to enable alumni to renew old acquaintances, languages', music, religious education, speech, mathematics, engineering, law, meet other former Pacific students who are residing in their communities, and and physical education. -

Special Libraries, February 1930 Special Libraries Association

San Jose State University SJSU ScholarWorks Special Libraries, 1930 Special Libraries, 1930s 2-1-1930 Special Libraries, February 1930 Special Libraries Association Follow this and additional works at: http://scholarworks.sjsu.edu/sla_sl_1930 Part of the Cataloging and Metadata Commons, Collection Development and Management Commons, Information Literacy Commons, and the Scholarly Communication Commons Recommended Citation Special Libraries Association, "Special Libraries, February 1930" (1930). Special Libraries, 1930. Book 2. http://scholarworks.sjsu.edu/sla_sl_1930/2 This Book is brought to you for free and open access by the Special Libraries, 1930s at SJSU ScholarWorks. It has been accepted for inclusion in Special Libraries, 1930 by an authorized administrator of SJSU ScholarWorks. For more information, please contact [email protected]. Vol. 21 February, 1930 No. 2 Business Builders Business Book Reviews THE PACIFIC COAST Librarians' Mecca in June S* L* A. San Francisco, Calif, JUNE 18, 19, 20, 21 A* L* A* Los Angeles, Calif. JUNE 23.28 Entmd u msmnd clu matter at the Pod Ofice, Pmvldence, R. I. under the Act of March 8, 117B. Aemptma for mltllne mt .peeid mta of postago pmvldcd for in don 1105, Act of October 8, 1B11. authorLed October 22, 1921. Rata: 15.00 a year. Fomlgn $6.60; sinela mpla W olltr Contents ' ARTICLES Business Builders. By Margaret Reynolds .............. 39 Digest of Business Book Reviews. By the Staff of the Newark Business Branch Library .................... 46 Commendation.. ...... 59 National Character of 5.L.A.................... 55 Fellowship Grants. ... 59 Sqn Francisco Conven- Japanese Classification 52 ti....................... 53 Milwaukee Municipal Trayslators' Associa- Library .................. 59 tion ............................. 59 DEPARTMENTS Associations ............... -

Vital Statistics, 1930-1939 (PDF)

IAPIOAYE Vital Statistics 1930-1939 Translations by Etta Perkins 107 IAPIOAYE VITAL STATISTICS 1930-1939 Most names translated by Etta Perkins Those names marked with # Translated by Pat Spears and friends • Volume 59-January 1930 #1 Baptism pg 3 MITCHELL, CURTIS WILLIAM son of Mr. & Mrs. Albert Mitchell bap 11-10-1929 - Parmelee, SD [v 59 # 1 p 3] FRAZIER, RAMONA MILDRED dau of Mr. & Mrs. Earlwin Frazier bap 11-10-1929 - Parmelee, SD [v 59 # 1 p 3] EAGLEHAWK, BARBARA PANSY dau of Mr. & Mrs. Raymon (Louisa) Eaglehawk bap 12-29-1929 - Cannupsapa (Norris, SD) [v 59 # 1 p 3] EPSEN, LEONA dau of Mrs Elsie Isabel Epsen, born 10-12-1920, bap 1-1-1930 - Ohnihde (Pilgraim) [v 59 # 1 p 3] EPSEN, DONALD son of Mrs Elsie Isabel Epsen born 5-8-1922, bap 1-1-1930 - Ohnihde (Pilgrim) [v 59 # 1 p 3] EPSEN, MARVIN son of Mrs Elsie Isabel Epsen born 10-18-1923 bap 1-1-1930 - Ohnihde (Pilgrim) [v 59 # 1 p 3] EPSEN, ALVIN son of Mrs Elsie Isabel Epsen born 10-19-1926 bap 1-1-1930- Ohnihde (Pilgrim) [v 59 # 1 p 3] EPSEN, BETTY JEAN dau of Mrs. Elsie Isabel Epsen born 1-24-1928 bap 1-1-1930 - Ohnihde (Pilgrim) [v 59 # 1 p 3] ONESKUNK, ARTHUR bap 12-16-1920 - Frazier Memorial, Chase, SD [v 59 # 1 p 3] Baptism pg 3 KITTO, BERLIN MYRTLE dau of Mr.& Mrs. David (Nancy) Kitto born 10-21-1929 (?), bap 10-20-1929 - Cankuwaste (Good Road - Stanford, SD) [v 59 # 1 p 3] LONGWARRIER, GERMAINE ETHEL dau of Mr. -

Scrapbook Inventory

E COLLECTION, H. L. MENCKEN COLLECTION, ENOCH PRATT FREE LIBRARY Scrapbooks of Clipping Service Start and End Dates for Each Volume Volume 1 [sealed, must be consulted on microfilm] Volume 2 [sealed, must be consulted on microfilm] Volume 3 August 1919-November 1920 Volume 4 December 1920-November 1921 Volume 5 December 1921-June-1922 Volume 6 May 1922-January 1923 Volume 7 January 1923-August 1923 Volume 8 August 1923-February 1924 Volume 9 March 1924-November 1924 Volume 10 November 1924-April 1925 Volume 11 April 1925-September 1925 Volume 12 September 1925-December 1925 Volume 13 December 1925-February 1926 Volume 14 February 1926-September 1926 Volume 15 1926 various dates Volume 16 July 1926-October 1926 Volume 17 October 1926-December 1926 Volume 18 December 1926-February 1927 Volume 19 February 1927-March 1927 Volume 20 April 1927-June 1927 Volume 21 June 1927-August 1927 Volume 22 September 1927-October 1927 Volume 23 October 1927-November 1927 Volume 24 November 1927-February 1928 Volume 25 February 1928-April 1928 Volume 26 May 1928-July 1928 Volume 27 July 1928-December 1928 Volume 28 January 1929-April 1929 Volume 29 May 1929-November 1929 Volume 30 November 1929-February 1930 Volume 31 March 1930-April 1930 Volume 32 May 1930-August 1930 Volume 33 August 1930-August 1930. Volume 34 August 1930-August 1930 Volume 35 August 1930-August 1930 Volume 36 August 1930-August 1930 Volume 37 August 1930-September 1930 Volume 38 August 1930-September 1930 Volume 39 August 1930-September 1930 Volume 40 September 1930-October 1930 Volume -

The London Gazette, 21 February, 1930. 1147

THE LONDON GAZETTE, 21 FEBRUARY, 1930. 1147 INDIAN MEDICAL SERVICE. No person will be admitted to Examination from whom the Secretary of the Civil- Service Maj. A. N. Palit, F.R.C.S.E., to be Lt.-Col., 29th July 1929. Commission has not received on or before the 10th April, 1930, an application, in the can- The promotion of the undermentioned didate's own handwriting, on the prescribed officers to the rank of Maj. is antedated as form, which may be obtained from the Secre- follows: — tary at once. Maj. T. S. Shastry, M.B., to 1st Feb. 1926. Maj. Eanjit Sen, M.B., to 7th Aug. 1928. Civil Service Commission, The undermentioned officers relinquish February 21, 1930. their temp, commns.: — The Civil Service Commissioners hereby give Capt. B. N. Khan, 8th Nov. 1929. notice that, at the request of the Lords Com- Lt. P. Nath, 16th Dec. 1929. missioners of His Majesty's Treasury, the following situation has been added to the ARMY IN INDIA RESERVE OF Schedule appended to the Order in Council of OFFICERS. the 22nd July, 1920, namely: — Lt. to be Capt. Unestablished Assistant to the Economic W. Marsh-Collis, 21st Dec. 1929. Advisory Council. 2nd Lts. to be Lts. A. C. T. Blease, llth Oct. 1929. J. O. Wadhams, 29th Nov. 1929. MINISTRY OF HEALTH. A. C. Corner, 30th Nov. 1929. LOCAL GOVERNMENT ACT, 1929. The undermentioned appts. are made : — Notice is hereby given under the Rules Pub- To be Capt. lication Act, 1893, that it is proposed by the John William Hope, 5th Oct. -

United States Department of Agriculture

S. R. A.-B. A. 1. 274 I ss ued March, 1930 United States Department of Agriculture SERVICE AND REGULATORY ANNOUNCEMENT BUREAU OF ANIMAL INDUSTRY FEBRUARY, 1930 [This publication is issued monthly for the dissemination of information, instructions, rulings, etc., c oncerning the work of the Bureau of Animal Industry. Free distribution is limited to persons in the services of the bureau, establishment at which the Federal meat inspection is conducted, public officers whose duties make it desirable for them to have such information, and journals especially concerned. Others desiring copies may obtain them from the Superintendent of Docunents Government Printing Office, Washington, D. C., at 5 cents each, or 25 cents a year. A supply will be sent to each official in charge of a station or branch of the bureau service, who should promptly distribute copies to members of his force. A file should be kept at each station for reference.] CONTENTS Page Changes in directory------------------------------- ---------------------------------- 9 Notices regarding meat inspection. --- - --------------.------------------------------ 10 Animal casings of foreign origin -------------------------------- ---------------------- 10 Shipments of meats requiring special supervision---.----------------------------------- 10 Paper in contact with fresh meat shipped in slack barrels --------- ------------------------ 10 Use of barium carbonate, red squill, and sodium fluoride ---------------------------------- 10 Animals slaughtered under Federal meat inspection -

1930 Annual Report

ANNUAL REPORT OF THE FEDERAL TRADE COMMISSION FOR THE FISCAL YEAR ENDED JUNE 30 1930 UNITED STATES GOVERNMENT PRINTING OFFICE WASHINGTON: 1930 For sale by the Superintendent of Documents, Washington, D. C. - - - - - - - - Price 25 cents FEDERAL TRADE COMMISSION GARLAND S. FERGUSON, Jr., Chairman. CHARLES W. HUNT. WILLIAM E HUMPHREY. CHARLES H. MARCH EDGAR A. MCCULLOCH. OTIS B. JOHNSON, Secretary. FEDERAL TRADE COMMISSIONER--1915-1930 Name State from which appointed Period of service Joseph E Davies Wisconsin Mar. 16, 1915-Mar. 18, 1918. William J. Harris Georgia Mar. 16, 1915-May 31, 1918. Edward N. Hurley Illinois Mar.16, 1915-Jan. 31, 1917. Will H. Parry Washington Mar.16, 1915-Apr. 21, 1917. George Rublee New Hampshire Mar.16, 1915-May 14, 1916. William B. Colver Minnesota Mar.16, 1917-Sept. 25, 1920. John Franklin Fort New Jersey Mar.16, 1917-Nov. 30, 1919. Victor Murdock Kansas Sept. 4, 1917-Jan. 31, 1924. Huston Thompson Colorado Jan.17, 1919-Sept. 25, 1926. Nelson B. Gaskill New Jersey Feb. 1, 1920-Feb. 24, 1925. John Garland Pollard Virginia Mar. 6, 1925-Sept. 25,1921. John F. Nugent Idaho Jan.15, 1921-Sept. 25, 1927 Vernon W. Van Fleet Indiana June 26, 1922-July 31, 1926. C. W. Hunt Iowa June 16, 1924. William E Humphrey Washington Feb.25, 1925. Abram F. Myers Iowa Aug. 2, 1926-Jan. 15, 1929. Edgar A. MCCULLOCH Arkansas Feb.11, 1927. G. S. Ferguson, Jr North Carolina Nov.14, 1927. Charles H. March Minnesota Feb. 1, 1929. II CONTENTS PART 1. INTRODUCTION Page The fire of August 30, 1930 4 The year’s activities 6 Public utilities investigation 11 Background and procedure 15 PART II. -

The Foreign Service Journal, February 1930

BANKING AND INVESTMENT SERVICE THROUGHOUT THE WORLD The National City Bank of New York and Affiliated Institutions THE NATIONAL CITY BANK OF NEW YORK CAPITAL, SURPLUS AND UNDIVIDED PROFITS $239,650,233.27 (AS OF DECEMBER 31, 1929) HEAD OFFICE THIRTY-SEVEN BRANCHES IN 55 WALL STREET, NEW YORK GREATER NEW YORK Foreign Branches in ARGENTINA . BELGIUM . BRAZIL . CHILE . CHINA . COLOMBIA . CUBA DOMINICAN REPUBLIC . ENGLAND . INDIA . ITALY . JAPAN . MEXICO . PERU . PORTO RICO REPUBLIC OF PANAMA . STRAITS SETTLEMENTS . URUGUAY . VENEZUELA. THE NATIONAL CITY BANK OF NEW YORK (FRANCE) S. A. Paris 41 BOULEVARD HAUSSMANN 44 AVENUE DES CHAMPS ELYSEES Nice: 6 JARDIN du Roi ALBERT 1 er INTERNATIONAL BANKING CORPORATION (OWNED BY THE NATIONAL CITY BANK OF NEW YORK) Head Office: 55 WALL STREET, NEW YORK Foreign and Domestic Branches in UNITED STATES . PHILIPPINE ISLANDS . SPAIN . ENGLAND anil Representatives in The National City Bank Chinese Branches BANQUE NATIONALE DE LA REPUBLIQUE D’HAITI (AFFILIATED WITH THE NATIONAL CITY BANK OF NEW YORK) Head Office: PORT AU-PRINCE, HAITI CITY BANK FARMERS TRUST COMPANY (AFFILIATED WITH THE NATIONAL CITY' BANK OF NEW YORK) Head Office: 22 WILLIAM STREET, NEW YORK Temporary Headquarters: 43 EXCHANGE PLACE '•y*' THE NATIONAL CITY COMPANY (AFFILIATED WITH THE NATIONAL CITY BANK OF NEW YORK) HEAD OFFICE OFFICES IN 50 LEADING 55 WALL STREET, NEW YORK AMERICAN CITIES Foreign Offices: LONDON . AMSTERDAM . GENEVA . TOKIO . SHANGHAI Canadian Offices: MONTREAL . TORONTO The National City Company, through its offices and affiliations in the United States and abroad, offers a world-wide investment service to those interested in Dollar Securities. LONDON OFFICE: 34 BISHOPSGATE, E.C. -

1930 Congressional Record

1930 CONGRESSIONAL RECORD-HOUSE ~069 court has held with that contention, but that is the contention HOUSE OF REPRESENTATIVES that has been made before some of the courts. The Supreme Court of the United States did not pass on the FRIDAY, Feb1'1.14ry ~1, 1930 question at all as presented by Mr. Hughes in the district court The House met at 12 o'clock noon and w~J,s called to order by pf appeals, and the district court of appeals, in deciding the the Speaker pro tempore, Mr. TIL-soN. case, waived that matter aside and placed its decision on the The Chaplain, Rev. James Shera Montgomery, D. D., offered basis of public interest. So far as I know it has not been passed the following prayer : on, except that the Federal courts in Illinois have declared c.gainst it. The matter is coming to the Supreme Court by Our Father, little by little show us the beauty of Thy truth. reference from one of the Federal courts in Illinois on a Lighten our eyes and help us to read Thy presence in our glad constitutional question of confiscation of property rights in ness and in our sorrow. 0 bless us with the patient, cheerful, the air, and that question will probably be passed on by the and healing ways of Thy Holy Spirit. 0 Lord, take the mys Supreme Court within the coming year. teries of our hearts, the spiritual forces that breathe them, the Mr. WHEELER. Mr. President, I am not going to press the hidden desires that impel them, and drop into them the pure point that Mr.