“Vision 2030” Natural Gas Infrastructure in India

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Dakshin Gujarat Vij Company Limited (DGVCL)

GUJARAT ELECTRICITY REGULATORY COMMISSION Tariff Order Truing up for FY 2019-20, Determination of ARR and Tariff for FY 2021-22 For Dakshin Gujarat Vij Company Limited (DGVCL) Case No. 1912 of 2020 31st March, 2021 6th Floor, GIFT ONE, Road 5C, Zone 5, GIFT CITY Gandhinagar-382 355 (Gujarat), INDIA Phone: +91-79-23602000 Fax: +91-79-23602054/55 E-mail: [email protected] : Website www.gercin.org GUJARAT ELECTRICITY REGULATORY COMMISSION (GERC) GANDHINAGAR Tariff Order Truing up for FY 2019-20, Determination of ARR and Tariff for FY 2021-22 For Dakshin Gujarat Vij Company Limited (DGVCL) Case No. 1912 of 2020 31st March, 2021 Dakshin Gujarat Vij Company Limited Truing up for FY 2019-20, Determination of ARR and Tariff for FY 2021-22 CONTENTS 1. Background and Brief History......................................................................................... 2 1.1. Dakshin Gujarat Vij Company Limited (DGVCL) ..................................................... 2 1.2. Background............................................................................................................. 2 1.3. Commission’s Orders Approved under MYT Control Period for FY 2016-17 to FY 2020-21 ............................................................................................................................. 3 1.4. Background of the Present petition ......................................................................... 4 1.5. Registration of the Petition and Public Hearing Process.......................................... 5 1.6. Approach of this -

Chaipoint Outlets

Sno Store Name/Location City State Address1 Chai Point , Terminal, 1 BIAL Bangalore Karnataka Bangalore International Airport Limited , Devanahali Taluka, Bangalore-560300 Plot No. 44, Electronics 2 Infosys Bangalore Karnataka City, Hosur Road, B'lore-560100 3 Jayanagar Bangalore Karnataka No.524/2, 10th Main, 33rd Cross, Jayanagar 4th Block, Bangalore - 560 011 4 Malleshwaram Bangalore Karnataka No.64, 18th Cross, Margosa Road, Malleshwaram, Bangalore - 560 055 No.A-8, Devatha Plaza, 5 Devatha Plaza Bangalore Karnataka No.131-132, Residency Road, B'lore-560025 6 Sarjapur Bangalore Karnataka No. 38/2, Ground Floor, Kaikondrahalli village, Varthur Hobli, Bangalore East Opp to Adigas hotel, MG Road , 7 Trinity Metro Bangalore Karnataka Next to Axis Bank, Bangalore 8 DLF Cyber Hub Gurugram Delhi NCR K5, Cyber hub, Cyber City, DLF Phase 3, Gurgaon 9 Huda City Centre Gurugram Delhi NCR Huda City Centre Metro Station, Sector 29, Gurgaon, HR 122009 Near Electronics City Bommasandra village 10 Narayana Healthcare Bangalore Karnataka Bangalore Mantri commercio Kariyammana Ahgrahara , Bellendur,Bangalore-560103 11 Mantri Commercio Bangalore Karnataka Near Sakara Hospital Bangalore 12 RMZ Infinity Bangalore Karnataka Old Madras Road, Bennigana Halli, Bangalore, Karnataka 560016 S No 50, Little Plaza, Cunningham Rd, Vasanth Nagar, 13 Cunningham Road Bangalore Karnataka Bangalore, Karnataka 560002 Chai point #77 Town Building No,3 Divya shree building Yamalur post 14 77 Town Bangalore Karnataka Bangalore -37 NH Cardio center NH Health city -258/a Ground floor, Bommasandra Industrial area, 15 NH Cardio Bangalore Karnataka Bangalore, Karnataka 16 Unitech Infospace Gurugram Delhi NCR Store No 6, Unitech Infospace SEZ Sector-21, Gurgaon 17 Salarpuria Softzone Bangalore Karnataka Salarpuria Softzone ,Outer ring road ,Near sarjapur junction ,Bangalore -43 John F. -

Annual Report 2013-14 Dlf Emporio Limited

ANNUAL REPORT 201314 DLF EMPORIO LIMITED CIN: U74920HR1999PLC034168 REGD. OFFICE: SHOPPING MALL, PHASE I, DLF CITY, GURGAON HARYANA 122 002 DLF EMPORIO LIMITED (Formerly known as Regency Park Property Management Services Limited) Regd. Office: Shopping Mall, Phase-I, DLF City, Gurgaon, Haryana-122 002 (CIN - U74920HR1999PLC034168) Website: www.dlfemporio.com Tel No: 011-42102180, Fax No: 011-41501771, E-mail: [email protected] NOTICE NOTICE is hereby given that the 15th Annual General Meeting of the Members of the Company will be held on Friday, August 22, 2014 at 10.00 A.M. at Registered Office of the Company at Shopping Mall, Phase – I, DLF City, Gurgaon, Haryana – 122 002 to transact the following businesses: ORDINARY BUSINESS: 1. To receive, consider and adopt the Audited Balance Sheet as at 31st March, 2014 and the Statement of Profit and Loss for the financial year ended on that date together with the reports of Directors and Auditors thereon. 2. To declare dividend on 4,000, 9% Non-Cumulative Redeemable Preference Shares of Rs.100/- each and 100, 12% Non-Cumulative Redeemable Preference Shares of Rs.100/- each. 3. To appoint a Director in place of Ms. Dinaz Madhukar, who retires by rotation and being eligible, offers herself for re-appointment. 4. To appoint the Statutory Auditors of the Company to hold office from the conclusion of this Annual General Meeting until the conclusion of the Next Annual General Meeting and to fix their remuneration. M/s Walker, Chandiok & Co LLP, the retiring Auditors are eligible for re- appointment. SPECIAL BUSINESS: 5. -

Expression of Interest (Eoi) for Acquisition of Operational Solar Power Plants / Assets

GAIL (INDIA) LIMITED EXPRESSION OF INTEREST (EOI) FOR ACQUISITION OF OPERATIONAL SOLAR POWER PLANTS / ASSETS EOI DOCUMENT NO.: GAIL/ND/BD/SOLAR/EOI/2021 DATED 12.07.2021 EXPRESSION OF INTEREST (EOI) FOR ACQUISITION OF OPERATIONAL SOLAR POWER PLANTS / ASSETS EOI DOCUMENT NO. GAIL/ND/BD/SOLAR/EOI/2021 INVITATION FOR EXPRESSION OF INTEREST (EOI) FOR ACQUISITION OF OPERATIONAL SOLAR POWER PLANTS / ASSETS 1. INTRODUCTION GAIL (India) Limited (“GAIL”) is India’s leading Natural Gas Company with presence along entire natural gas value chain comprising of Exploration & Production, LNG imports, Gas Transmission & Marketing, Gas Processing, Petrochemicals, LPG transmission and City Gas Distribution. GAIL is listed on the National Stock Exchange of India, the Bombay Stock Exchange and the London Stock Exchange (in the form of GDRs) with the market capitalization of around Rs. 66,000 crores as on 30th June 2021. For additional information on GAIL, please visit http://www.gailonline.com 2. BRIEF ABOUT EOI 2.1. In line with its mission of providing clean energy & beyond and considering transformations taking place in the energy sector, GAIL is exploring opportunities in the renewable energy sector with a target of acquiring solar power plants / assets of around 1000 MW (AC) capacity. In this backdrop, GAIL invites EOI from Promoters / Independent Power Producers / Developers who are willing to offer 100% and / or 50% equity stake in their operational solar power plants / assets located in solar park(s), hereinafter referred to as ‘Interested Party(ies)’. 2.2. Basic details of this EOI are: EOI download EOI may be downloaded from any of the Websites as below: (i) www.gailonline.com (ii) GAIL’s Tender Website – www.gailtenders.in (iii) Govt. -

GUJARAT STATE PETRONET a I D Nominal COVID-19 Downturn; Quick Revival

s p COMPANY UPDATE a c d i M GUJARAT STATE PETRONET a i d Nominal COVID-19 downturn; quick revival n I India Equity Research| Oil, Gas and Services Gujarat State Petronet (GSPL) is a pure gas pipeline utility, which is EDELWEISS RATINGS relatively less affected by the ongoing COVID-19 downturn. In fact, it is Absolute Rating BUY poised to resume a sustainable 4-5% long-term volume CAGR. It not only Investment Characteristics Growth enjoys a healthy balance sheet, enabling it to weather the current stress, but also robust INR50bn FCF over FY21-23E will help it turn debt free. The stock has fallen ~25% since February on concerns that its largest customer MARKET DATA (R: GSPT.BO, B: GUJS IN) Reliance Industries (RIL) will sharply cut volumes following start-up of its CMP : INR 186 own petcoke gasifier. RIL continues to source 9-10mmscmd of gas despite Target Price : INR 278 full commissioning of its plant during March 2020. Besides, COVID-19- 52-week range (INR) : 264 / 146 related volume hit is also currently limited to 13%, with an ongoing quick Share in issue (mn) : 564.1 recovery. Maintain ‘BUY’ with revised DCF-based TP of INR278 (INR290 M cap (INR bn/USD mn) : 103 / 1,525 earlier) due to cut in volume demand forecast. Avg. Daily Vol. BSE/NSE (‘000) : 584.1 Corona-related volume dip nominal; quick revival underway SHARE HOLDING PATTERN (%) We expect GSPL to report a nominal 3% QoQ volume dip during Q4FY20 and a further Current Q3FY20 Q2FY20 10% dip to 32mmscmd during Q1FY21, followed by a steady revival to normal level. -

Omaxe New Chandigarh

https://www.propertywala.com/omaxe-new-chandigarh-mohali Omaxe New Chandigarh - Mullanpur, Mohali Omaxe 300 sq.yrd Residential Plot in Mullanpur New Chandigarh Omaxe New Chandigarh is residential land project located in ideal location of Mullanpur New Chandigarh. Project ID : J305763119 Builder: Omaxe Properties: Apartments / Flats, Independent Houses, Residential Plots / Lands, Commercial Plots / Lands Location: Omaxe New Chandigarh, Mullanpur, Mohali - 140901 (Chandigarh) Completion Date: Dec, 2014 Status: Started Description Omaxe New Chandigarh project, proposed over 1000 acres green land in New Chandigarh, is a modern integrated township. With New Chandigarh buzzing with development activities, the plots on offer in Omaxe New Chandigarh is sizes of 300 sq yard sizes, enabling you build a house the way you desire. Omaxe New Chandigarh has all modern facilities like schools, office-cum-shopping complex and space for recreational activities like amusement parks enthrall the township. The township is also home to one of Punjab’s tallest commercial hub, India Trade Tower. Infrastructure including educational institutions, hospitality, healthcare , beautiful landscaped gardens, kid's park, Long jogging track, underground drainage, medical facility, club with ultra-modern features to name a few add to the advantage of Omaxe New Chandigarh. Location Advantage :- Very good connectivity with Baddi, Nalagarh and Mohali. Location: 2.5 Kms From Sector 38 West , Chandigarh. Few minutes drive from Chandigarh City. Just New to Upcoming PCA Stadium at New Chandigarh . Beautiful view of mountains Shivalik Hills. Very near to PGI hosital and Punjab University / Punjab Engineering College Chandigarh. Proposed Bus Stand Mullanpur is near to Omaxe Plots/Township location. Near to Proposed Amusment Park / Film City by U.T Government. -

Press Release Gujarat Gas Limited

Press Release Gujarat Gas Limited October 07, 2019 Ratings Amount Facilities Ratings1 Rating Action (Rs. Crore) CARE AA; Positive/ CARE A1+ Long Term / Short Term 2,000.00 (Double A; Outlook: Positive/ Reaffirmed Bank Facilities A One Plus) 2,000.00 Total Bank Facilities (Rupees Two Thousand Crore Only) Details of facilities in Annexure-1 Detailed Rationale & Key Rating Drivers The ratings for the bank facilities of Gujarat Gas Ltd. (GGL) continue to derive strength from its leading position in the city gas distribution (CGD) business in India, well-established and significantly large scale of operations, established gas sourcing arrangements, moderately diversified customer segment mix, comfortable debt coverage indicators, healthy cash accruals along with strong liquidity and efficient working capital management. The ratings further continue to derive strength from its professional and experienced management and favorable industry outlook for the CGD business. GGL’s long-term rating, however, continues to remain constrained on account of its medium sized capex plans for developing CGD network in various geographical areas (GAs; including in 7 new ones) towards its growth plans, moderate leverage, susceptibility of demand for natural gas from its industrial customers based on price dynamics of competing fuels with its concomitant impact on its profitability and regulatory risk associated with CGD business. GGL’s ability to ensure sustained growth in demand from its industrial segment customers along with sustained improvement in operating profitability and its capital structure, timely execution of projects especially in the new GAs within envisaged cost and time parameters and generating envisaged returns therefrom; along with conduciveness of regulatory environment for CGD sector would be the key rating sensitivities. -

Merchants Where Online Debit Card Transactions Can Be Done Using ATM/Debit Card PIN Amazon IRCTC Makemytrip Vodafone Airtel Tata

Merchants where online Debit Card Transactions can be done using ATM/Debit Card PIN Amazon IRCTC Makemytrip Vodafone Airtel Tata Sky Bookmyshow Flipkart Snapdeal icicipruterm Odisha tax Vodafone Bharat Sanchar Nigam Air India Aircel Akbar online Cleartrip Cox and Kings Ezeego one Flipkart Idea cellular MSEDC Ltd M T N L Reliance Tata Docomo Spicejet Airlines Indigo Airlines Adler Tours And Safaris P twentyfourBySevenBooking Abercrombie n Kent India Adani Gas Ltd Aegon Religare Life Insur Apollo General Insurance Aviva Life Insurance Axis Mutual Fund Bajaj Allianz General Ins Bajaj Allianz Life Insura mobik wik Bangalore electricity sup Bharti axa general insura Bharti axa life insurance Bharti axa mutual fund Big tv realiance Croma Birla sunlife mutual fund BNP paribas mutural fund BSES rajdhani power ltd BSES yamuna power ltd Bharat matrimoni Freecharge Hathway private ltd Relinace Citrus payment services l Sistema shyam teleservice Uninor ltd Virgin mobile Chennai metro GSRTC Club mahindra holidays Jet Airways Reliance Mutual Fund India Transact Canara HSBC OBC Life Insu CIGNA TTK Health Insuranc DLF Pramerica Life Insura Edelweiss Tokio Life Insu HDFC General Insurance IDBI Federal Life Insuran IFFCO Tokio General Insur India first life insuranc ING Vysya Life Insurance Kotak Mahindra Old Mutual L and T General Insurance Max Bupa Health Insurance Max Life Insurance PNB Metlife Life Insuranc Reliance Life Insurance Royal Sundaram General In SBI Life Insurance Star Union Daiichi Life TATA AIG general insuranc Universal Sompo General I -

Annual Report 1 Start

21st Annual Report MADRAS SCHOOL OF ECONOMICS Chennai 01. Introduction ……. 01 02. Review of Major Developments ……. 02 03. Research Projects ……. 05 04. Workshops / Training Programmes …….. 08 05. Publications …….. 09 06. Invited Lectures / Seminars …….. 18 07. Cultural Events, Student Activities, Infrastructure Development …….. 20 08. Academic Activities 2012-13 …….. 24 09. Annexures ……... 56 10. Accounts 2012 – 13 ……… 74 MADRAS SCHOOL OF ECONOMICS Chennai Introduction TWENTY FIRST ANNUAL REPORT 2013-2014 1. INTRODUCTION With able guidance and leadership of our Chairman Dr. C. Rangarajan and other Board of Governors of Madras School of Economics (MSE), MSE completes its 21 years as on September 23, 2014. During these 21 years, MSE reached many mile stones and emerged as a leading centre of higher learning in Economics. It is the only center in the country offering five specialized Masters Courses in Economics namely M.Sc. General Economics, M.Sc. Financial Economics, M.Sc. Applied Quantitative Finance, M.Sc. Environmental Economics and M.Sc. Actuarial Economics. It also offers a 5 year Integrated M.Sc. Programme in Economics in collaboration with Central University of Tamil Nadu (CUTN). It has been affiliated with University of Madras and Central University of Tamil Nadu for Ph.D. programme. So far twelve Ph.Ds. and 640 M.Sc. students have been awarded. Currently six students are pursuing Ph.D. degree. The core areas of research of MSE are: Macro Econometric Modeling, Public Finance, Trade and Environment, Corporate Finance, Development, Insurance and Industrial Economics. MSE has been conducting research projects sponsored by leading national and international agencies. It has successfully completed more than 110 projects and currently undertakes more than 20 projects. -

Natural Gas in the US Economy

Natural Gas in the U.S. Economy: Opportunities for Growth Robert Pirog Specialist in Energy Economics Michael Ratner Specialist in Energy Policy November 6, 2012 Congressional Research Service 7-5700 www.crs.gov R42814 CRS Report for Congress Prepared for Members and Committees of Congress Natural Gas in the U.S. Economy: Opportunities for Growth Summary Due to the growth in natural gas production, primarily from shale gas, the United States is benefitting from some of the lowest prices for natural gas in the world and faces the question of how to best use this resource. Different segments of the U.S. economy have different perspectives on the role natural gas can play. Suppliers, which have become the victims of their own production success, are facing low prices that are forecast to remain low. Some companies that have traditionally produced only natural gas have even turned their attention to oil in order to improve their financial situation. Smaller companies are having a difficult time continuing operations and larger companies, including international companies, have bought into many shale gas assets. Prices have remained low even as consumption has increased, in part, because producers have raised production to meet the demand and because companies have improved efficiency and extraction techniques. Some companies, many with large production operations, have applied for permits to export natural gas. This has raised concerns from consumers of natural gas that domestic prices will rise. The debate regarding exports is ongoing. Industries that consume natural gas have seen input costs drop, and some have heralded low natural gas prices as the impetus for a manufacturing revolution in the United States. -

December 2016

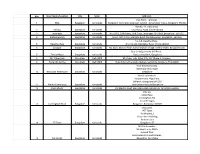

Form IV-A Short-term Inter-State Transactions of Electricity by Trading Licensees ( RTC*) Name of the Trading Licensee: NTPC VIDYUT VYAPAR NIGAM LIMITED Licence Details (No & Date) : Category-I ; No.6/Trading/CERC Dated 23rd July,2004. Month: Dec-16 Period of Power Delivery Time of Power Delivery Purchased from Sold to Trading Scheduled Purchase Price Sale Price Sr.No Start date End date Start Time Name of the Name of the Margin Remarks End Time (HH:MM) Volume (Mus) Category State Category State (Rs/Kwh) (Rs/kwh) (DD/MM/YYYY) (DD/MM/YYYY) (HH:MM) Seller Buyer (Rs/kwh) A Inter State Trading Transactions 1 01-12-2016 31-12-2016 00:00 24:00 11.842 Malco Energy IPP Tamilnadu Telangana Dist. licensee Telangana 4.603 4.633 0.030 2 01-12-2016 31-12-2016 00:00 24:00 16.927 SEL Copper IPP Tamilnadu Telangana Dist. licensee Telangana 4.603 4.633 0.030 3 01-12-2016 31-12-2016 00:00 24:00 10.915 APPCC Dist. Licencee Andhra Pradesh Govt. og Goa Dist. licensee Goa 4.420 4.490 0.070 4 01-12-2016 31-12-2016 00:00 24:00 18.600 BYPL Dist. Licencee Delhi UPCL Dist. licensee Uttarakhand 2.620 2.640 0.020 TOTAL 58.284 B Inter State Trading Transactions through Swapping or Banking Arrangement: NIL C Cross Border Transactions Sale Price 1 01-12-2016 31-12-2016 00:00 24:00 35.799 BALCO IPP Chhatisgarh NEA Distribution licensee Nepal 3.150 3.600 0.07 * 2 01-12-2016 31-12-2016 00:00 24:00 21.470 BYPL Discom Delhi NEA Distribution licensee Nepal 3.150 3.600 0.07 * Total 57.269 * Sale rate is inclusive of NVVN trading margin, transmission charges, transmission losses etc. -

The Billionaire Club TOPEARNERS

The Billionaire Club TOPEARNERS Gross salary Name Designation Company Rs cr (2007) MUKESH AMBANI CMD Reliance Industries 30.46 P R R RAJHA CMD Madras Cements 24.78 KALANITHI MARAN CMD Sun TV 23.26 KAVERY KALANITHI Joint Managing Director Sun TV 23.26 KUMAR MANGALAM BIRLA Chairman Hindalco 17.53 BRIJMOHAN LALL MUNJAL Chairman Hero Honda Motors 15.62 PAWAN KANT MUNJAL MD & CEO Hero Honda Motors 15.54 SUNIL BHARTI MITTAL CMD Bharti Airtel 14.96 K ANJI REDDY Chairman Dr Reddy's Laboratories 14.40 A C SANGHVI Managing Director Ambuja Cements 14.04 SAJJAN JINDAL VC & MD JSW Steel 13.25 TAKAO EGUCHI Whole-time Director Hero Honda Motors 12.61 PANKAJ R PATEL CMD Cadila Healthcare 12.40 NAVEEN JINDAL Ex VC & MD Jindal Steel & Power 11.63 G V PRASAD VC & CEO Dr Reddy's Laboratories 10.87 SATISH REDDY MD & COO Dr Reddy's Laboratories 10.87 ONKAR S KANWAR CMD Apollo Tyres 9.98 E SUDHIR REDDY VC & MD IVRCL Infrastructures 9.85 M A M R MUTHIAH Managing Director Chettinand Cement 8.92 RAJIV SINGH Vice Chairman DLF 7.92 Y K HAMIED CMD Cipla 7.88 MURALI K DIVI CMD Divi's Laboratories 7.88 HITAL R MESWANI Executive Director Reliance Industries 7.77 NIKHIL R MESWANI Executive Director Reliance Industries 7.77 HABIL KHORAKIWALA CMD Wockhardt 7.76 K V MANI Managing Director Kalpataru Power Transmission 7.62 ASHOK KUMAR GOEL VC & MD Essel Propack 7.60 D JAYAVARTHANAVELU CMD Lakshmi Machine Works 7.43 AMAR LULLA Joint Managing Director Cipla 7.33 M K HAMIED Joint Managing Director Cipla 7.33 P R S OBEROI Chairman & Chief Executive EIH 6.88 RAVINDER JAIN Managing