Retail Industry

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

GAIN Report Global Agriculture Information Network

Foreign Agricultural Service GAIN Report Global Agriculture Information Network Required Report - public distribution Date: 11/19/2001 GAIN Report #ID1031 Indonesia Retail Food Sector Report 2001 Approved by: Dennis Voboril U.S. ATO Jakarta Prepared by: Kussusilowati & Fahwani Y.R. Report Highlights: The modern retail food business in Indonesia continues to grow rapidly despite the ongoing economic crisis and political uncertainty. Since the onset of the current crisis in 1997, there has been a 41% increase in the number of supermarkets and a 66% increase in minimarkets. Best market prospects for U.S. suppliers include fresh fruit, canned food, frozen french fries, potato chips, sauces & seasonings, salad dressing, snack food, beans, and pastas. Niche markets exist for frozen pizzas, frozen meat & poultry, delicatessen items, breakfast cereals, non-alcoholic beverages, tomato paste, cream cheese, confectionary, and biscuits. Includes PSD changes: No Includes Trade Matrix: No Unscheduled Report Jakarta ATO [ID2], ID GAIN Report #ID1031 Page 1 of 13 RETAIL FOOD SECTOR REPORT: INDONESIA SECTION I. MARKET SUMMARY Retail System The traditional sector still dominates the retail food business in Indonesia, but the data shown below indicates a growing trend towards the supermarket and other modern retail outlets. In 2001, an A.C. Nielsen study indicates that there were 1,903,602 retail food outlets in Indonesia. Of these outlets, 814 were supermarkets (up 41 percent since Retail Outlet Share of Market 1997), 3,051 were mini-markets (up 99 percent) 59,055 were large provision shops (no change), Warung 599,489 were small provision shops (up 66 (65.2%) Traditional Small percent), and 1,241,193 were warung provision Traditional Large shops (up 18 percent).1 Other (Supermkt & Minimkt) (0.2%) (3.1%) It is currently estimated by trade sources that 25 percent of retail food sales in Jakarta take place in supermarkets and other modern retail outlets. -

OCTOBER 3, 2019 LIVESTOCKWEEKLY.COM $35 PER YEAR Pounds and 37,000 Head the Previous Week

Sheep Markets Mostly Steady Some Higher ® Sheep markets managed to arrest the recent downward spiral as most reported steady to higher prices. Livestock Weekly Estimated domestic produc- tion of lamb and mutton for the week ending September 28 totaled 2.37 million pounds on a slaughter count of 37,000 head as compared to 2.4 million VOL. 71 - NO. 39 SAN ANGELO, TEXAS THURSDAY, OCTOBER 3, 2019 LIVESTOCKWEEKLY.COM $35 PER YEAR pounds and 37,000 head the previous week. Imported lamb and mutton for the week ending September 21, totaled 1105 metric tons or about 2.4 million pounds, which is equal to the domestic production for the same period. At San Angelo medium and large 1-2 feeder lambs weigh- ing 43-48 pounds $200-210, 50-59 pounds $186-202, 63-81 pounds $160-190. Choice 1-2 wooled slaughter lambs 66- 78 pounds $158-164, 85-94 pounds $129-140, 100-123 pounds $120-134. Choice and prime 1-2 hair lambs 48 pounds $216, 53-55 pounds $200-214, 65-69 pounds $180- 194, few averaging 75 pounds $184, 87-96 pounds $122-158, 100-113 pounds $116-128. At New Holland, Penn., NEAR LOVING, Texas, this scene is atypical for much choice and prime 2-3 wooled of the central plains as a hot, dry summer lingers on into lambs weighing 93-99 pounds $200-210, 100-112 pounds what should be fall. Change is coming, a weather system Range Sales brought flooding to eastern New Mexico and parts of the $195-205, choice 1-2 lambs 48-55 pounds $180-190, 62- Texas Panhandle this week. -

Vietnam Retail Food

Required Report: Required - Public Distribution Date: June 25, 2021 Report Number: VM2021-0054 Report Name: Retail Foods Country: Vietnam Post: Hanoi Report Category: Retail Foods Prepared By: Kiet Vo Approved By: Benjamin Petlock Report Highlights: Vietnam’s total retail sales were estimated at approximately $172 billion, up 6.8 percent over 2019, with food and beverage accounting for approximately 30 percent. Effective control of COVID-19 has allowed the retail sector to overcome short-term challenges and constraints while strong economic growth, increasing foreign investment, benefits from free trade agreements, a growing middle class with higher disposable incomes, and rapid urbanization continue to drive long-term sustainable growth. Vietnam’s modern retail food channels have seen expansions, exits, and mergers and acquisitions in 2020 and 2021. While e-commerce and food delivery services continue to enjoy sustainable growth, sales in traditional retail food channels have declined due to changes in consumer shopping habits as a result of COVID-19. THIS REPORT CONTAINS ASSESSMENTS OF COMMODITY AND TRADE ISSUES MADE BY USDA STAFF AND NOT NECESSARILY STATEMENTS OF OFFICIAL U.S. GOVERNMENT POLICY Market Fact Sheet: Vietnam Quick Facts CY 2020 Executive Summary Imports of Consumer-Oriented Products Vietnam remained one of the fastest growing economies in Imports from the world: $13.1 billion Asia in 2020, with gross domestic product (GDP) growth at Imports from the United States: $928 million 2.9 percent despite the negative effects of COVID-19. GDP Top-10 Growth Products in Vietnam growth for 2021 is projected at 6.6 percent (World Bank). Pork and pork products Condiment and sauces Fresh vegetable Spices According to the Trade Data Monitor (TDM), global exports Tree nuts Meat products NESOI of consumer-oriented products serving Vietnam’s retail food Dairy products Processed vegetables channels were down 11 percent year on year, from $14.8 Fresh fruit Prepared foods billion in 2019 to $13.1 billion in 2020. -

Recall Retail List 030-2020

United States Food Safety Department of and Inspection Agriculture Service RETAIL CONSIGNEES FOR FSIS RECALL 030-2020 FSIS has reason to believe that the following retail location(s) received LEAN CUISINE Baked Chicken meal products that have been recalled by Nestlé Prepared Foods. This list may not include all retail locations that have received the recalled productor may include retail locations that did not actually receive the recalled product. Therefore, it is important that you use the product-specific identification information, available at https://www.fsis.usda.gov/wps/portal/fsis/topics/recalls-and-public- health-alerts/recall-case-archive/archive/2020/recall-030-2020-release, in addition to this list of retail stores, to check meat or poultry products in your possession to see if they have been recalled. Store list begins on next page United States Food Safety USDA Department of And Inspection - Agl'iculture Service Retail List for Recall Number: 030-2020 chicken meal product List Current As Of: 26-Jan-21 Nationwide, State-Wide, or Area-Wide Distribution Retailer Name Location 1 Albertsons AZ, CA, LA, NV, OR, TX, WA 2 Bashas AZ 3 Big Y CT 4 City Market CO 5 Dillons KS 6 Food Lion GA, SC, TN, VA 7 Fred Meyer OR, WA 8 Fry's Food And Drug AZ 9 Fry's Marketplace AZ 10 Gelson's Market CA 11 Giant MD, PA, VA 12 Giant Eagle Supermarket OH, PA 13 Heinen's OH 14 Hy-Vee IL, IA, KS, MN, MO, NE, SD 15 Ingles Markets GA, NC, SC, TN 16 Jay C IN 17 JewelOsco IL 18 King Soopers CO AR, GA, IL, IN, KY, MI, MS, OH, SC, TN, TX, VA, 19 Kroger WV 20 Lowes NC 21 Marianos IL 22 Meijers IL, IN, MI 23 Pavilions CA 24 Pick n Save WI 25 Piggly Wiggly WI 26 Publix FL, GA Page 1 of 85 Nationwide, State-Wide, or Area-Wide Distribution Retailer Name Location 27 Quality Food Center WA 28 Ralphs CA 29 Ralphs Fresh Fare CA 30 Randalls TX 31 Safeway AZ, CA, HI, OR, WA 32 Shaw's MA, NH 33 Smart & Final CA 34 Smith's NV, NM, UT 35 Stater Bros. -

Retail (Overweight)

July 6, 2012 2H12 Outlook Report Industry Report Retail (Overweight) Daewoo Securities Co., Ltd. Mina Kim +822-768-4163 [email protected] Jieun Lee +822-768-3265 [email protected] Sunny days ahead In 2H12, we anticipate domestic consumption to pick up, driven by improving consumer sentiment and the structural growth of new retail channels, along with low base effect. Domestic consumption stagnated during 1H12, affected by factors such as declining disposable income, dampened consumer sentiment (amid an economic slump), and high base effect. In particular, spending restraint (due to wide economic uncertainties), greater household debt burdens (resulting from jeonse surges), and declining asset values drove down consumption and sentiment. For the department store segment, we expect a considerable recovery in 2H. We forecast department store sales growth to pick up starting in 3Q12 (after showing deterioration since 3Q11). With consumers becoming increasingly price-conscious, SPA (specialty-store retailers of private label (PL) apparel) brands and low-end cosmetics are likely to stay strong in 2H (regardless of economic conditions). We attribute this to their successful efforts to provide quality products at reasonable prices and effective marketing. Given their strong competitiveness, we expect these types of companies to display hyper growth going forward. We believe that new retail channels (e.g., convenience stores, category killers) still have ample room for growth. The convenience store segment is likely to expand in light of the increase in single households, consumers seeking convenience in shopping, and the reinforcement of product merchandising. Category killers (e.g., electronic appliance segment) are also likely to show structural growth on the back of product diversification and consumersÊ increasing awareness of product values. -

Dumex Thailand Thailand

DumexDumex Thailand Thailand INTRODUCTION September 12, 2003 by Gerard Geraets Managing Director, Dumex Ltd. IndexIndex Who are we ? Milestones and Highlights Market and Competition Critical Factors Growth Opportunities Critical Success Factors Recall and Recovery Outlook 2 WhoWho areare wewe ?? OrganizationOrganization ChartChart Gerard Geraets Managing Director Wanna Swuddigul Steve Donnelly Morten S. Knudsen Likhit Somboon Regional Financial Marketing Director Operations Manager HR Director Controller Wisanti Lomtakul Pisit Pittayanurak Deputy Financial Controller Sales Director Production/Technical Modern Trade Finance Marketing QA & QC/R&D HR General Trade Admin. Nutrition Supply Chain Training Trade Marketing IT Warehousing 4 GERARD GERAETS 59 years Dutch National Business Administration Nijenrode University, The Netherlands 18 years of Asian experience in Thailand, Taiwan, Singapore Extensive marketing and General Management experience with o.a. Heineken, Sara Lee and Friesland Dairy Foods Almost 7 years with Dumex as MD Dumex Ltd. Thailand 5 WANNA SWUDDIGUL 37 years Thai National Master of Business Administration, Western Illinois University, USA 9 years experience in Marketing with Consumer Products Company 2 years experience as General Manager at Fast Food business 2 years experience in Marketing with Telecommunication business 3 months with Dumex Ltd, Thailand as Marketing Director 6 STEVE DONNELLY 39 years New Zealand National Dairy Science and Technology, Massey University, New Zealand 10 years experience -

AU-Thesis-Fulltext-171148.PDF ( 4013.57 KB )

A S;fUDY OF EFFICACY OF SALES PROMOTIONS OF TOPS SUPERMARKET IN BANGKOK By PIMOLRAT KHUNVIROJPANICH I A Thesis submitted in partial fulfillment of the requirement for the degree of Master of Business Administration Examination Committee : 1. Dr. Ishwar C. Gupta (Advisor) 2. Dr. Thongdee Kijboonchoo (Member) ,{_~-..:..... 3. Dr. Sirion Chaipoopirutana (Member) "?";c"~'j 4. Dr. Jakarin Srimoon (Member) IJ ..(( 14 .. krrt?..0( 5. Assoc. Prof. Poonsak Sangsunt (MOE Representative) Examined on : 23 June 2004 Approved for Graduation on : Graduate School of Business Assumption University Bangkok, Thailand June 2004 ABSTRACT There is an intense competition in the retail business. Customers have many alternatives to select. They move away from tradition trade to modern trade such as supermarket. One of the several reasons is sales promotion tools which are used by supermarkets to attract the customers. Therefore, it is useful and interesting to study the relationship between sales promotion tools and consumers behavior response. Tops Supermarket is chosen for this study. The research problem for this study is "What is the relationship between sales promotion tools and consumer behavior". The objective of this research is to find out the relationship of four different sales promotion tools which are coupon, price discount, buy-one-get-one-free, and premium, with four different consumer behavior responses which are brand switching, brand loyalty, stockpiling, and purchase acceleration. The research instrument was administered 400 respondents, both male and female which were completed by the target population who have experienced in shopping at Tops Supermarket. After data were collected from respondents, the data were processed by SPSS program. -

Additional Case Information

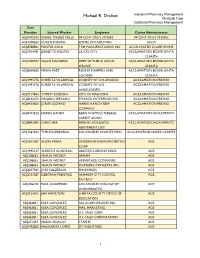

Michael R. Drobot Industrial Pharmacy Management MediLab Corp California Pharmacy Management Case Number Injured Worker Employer Claims Administrator ADJ7472102 ISMAEL TORRES VALLE 99 CENT ONLY STORES 99 CENT ONLY STORES ADJ1308567 CURTIS RIGGINS EMPIRE DISTRIBUTORS ACCA ADJ8768841 MARTIN AVILA TRM MANUFACTURING INC ACCELERATED CLAIMS IRVINE ADJ7014781 JEANETTE WILSON LA COUNTY ACCLAMATION 802108 SANTA CLARITA ADJ7200937 SUSAN NAVARRO DEPT OF PUBLIC SOCIAL ACCLAMATION 802108 SANTA SERVICE CLARITA ADJ8009655 MARIA PAEZ RUSKIN DAMPERS AND ACCLAMATION 802108 SANTA LOUVERS CLARITA ADJ1993776 ROBERTA VILLARREAL COUNTY OF LOS ANGELES ACCLAMATION FRESNO ADJ1993776 ROBERTA VILLARREAL COUNTY OF LOS ACCLAMATION FRESNO ANGELES/DPSS ADJ7117844 TOMMY ROBISON CITY OF MARICOPA ACCLAMATION FRESNO ADJ8162473 ONORIO SERRANO ESPARZA ENTERPRISES INC ACCLAMATION FRESNO ADJ8420600 JORGE LOZANO HARRIS RANCH BEEF ACCLAMATION FRESNO COMPANY ADJ8473212 DAREN HANDY KERN SCHOOLS FEDERAL ACCLAMATION SACRAMENTO CREDIT UNION ADJ8845092 CHAO HER FRESNO MOSQUITO ACCLAMATION SACRAMENTO ABATEMENT DIST ADJ1361532 THELMA JENNINGS LOS ANGELES COUNTY/DPSS ACCLAMATION SANTA CLARITA ADJ1611037 ALICIA MORA ANDERSON BARROWS METALS ACE CORP ADJ1995137 ALBERTO GUNDRAN ABLESTIK LABORATORIES ACE ADJ208633 SHAUN WIDNEY AMPAM ACE ADJ208633 SHAUN WIDNEY AMPAM RCR COMPANIES ACE ADJ208633 SHAUN WIDNEY PLUMBING CONCEPTS INC ACE ADJ2237965 JOSE CALDERON FMI EXPRESS ACE ADJ2353287 DEBORAH PRENTICE ANAHEIM CITY SCHOOL ACE DISTRICT ADJ246218 PAUL LIGAMMARI LOS ANGELES COLLEGE OF ACE CHIROPRACTIC -

Something About Convenience Stores CIRCLE K

Something about convenience stores CIRCLE K 1 THỊ TRƯỜNG CỬA HÀNG 02 04 TIỆN LỢI CIRCLEK Global Company Info Vietnam Competition What shapes the trends Marketing Campaign of market? TRENDS MARKETING 01 03 CAMPAIGN 2 01. Market Thị trường CVS Global Thị trường CVS Việt Nam *CVS: Convenience Store 3 OVERVIEW - Doanh số bán lẻ toàn cầu thông qua kênh cửa hàng tiện lợi đạt 3.256 tỷ USD trong năm 2017, tăng 6,7% vào năm 2016 và dự kiến sẽ đăng ký CAGR 8,5% trong giai đoạn dự báo 2017-2022 để đạt 4,902 tỷ USD vào năm 2022. - Phân loại: ○ Kiosks ○ Mini Convenience Store ○ Limited Selection Convenience Store ○ Traditional Convenience Store ○ Expanded Convenience Store ○ Hyper Convenience Store 4 Kiosks PRODUCT (global) - Xăng dầu là sản phẩm được bán nhiều nhất tại các cửa hàng tiện lợi và do đó nó chiếm thị phần lớn nhất với 53,2% trong năm 2017 trong tổng số sản phẩm được bán trong cửa hàng tiện lợi (xét trên thị trường global). - Phân khúc thuốc lá là thị trường cơ hội nhất cùng với đồ uống tăng trưởng với tỷ lệ 1,3% nhờ vào sự sẵn có so với nhu cầu của các sản phẩm này. Hyper Convenience Store 5 In vietnam Big picture Doanh thu thị trường cửa hàng tiện lợi Dự đoán tốc độ phát triển của thị trường bán tại Việt Nam lẻ tiện lợi Châu Á. Việt Nam được kỳ vọng sẽ dẫn đầu thị trường Source với CAGR cao nhất. Source 6 In vietnam So sánh retail vs cvs Thị trường bán lẻ và CVS đều có tốc độ tăng trưởng cao. -

Factors Affecting the Level of Trust and Commitment in Tops Supermarket Supply Chain Management, Bangkok

California State University, San Bernardino CSUSB ScholarWorks Theses Digitization Project John M. Pfau Library 2008 Factors affecting the level of trust and commitment in Tops Supermarket supply chain management, Bangkok Kamolchanok Saisomboon Follow this and additional works at: https://scholarworks.lib.csusb.edu/etd-project Part of the Business Administration, Management, and Operations Commons Recommended Citation Saisomboon, Kamolchanok, "Factors affecting the level of trust and commitment in Tops Supermarket supply chain management, Bangkok" (2008). Theses Digitization Project. 3356. https://scholarworks.lib.csusb.edu/etd-project/3356 This Project is brought to you for free and open access by the John M. Pfau Library at CSUSB ScholarWorks. It has been accepted for inclusion in Theses Digitization Project by an authorized administrator of CSUSB ScholarWorks. For more information, please contact [email protected]. FACTORS AFFECTING THE LEVEL OF TRUST AND COMMITMENT IN TOPS SUPERMARKET SUPPLY CHAIN MANAGEMENT, BANGKOK A Project Presented to the Faculty of California' State University, San Bernardino In Partial Fulfillment of the Requirements for the Degree Master of Business Administration by I Kamolchanok Saisomboon June 2008 FACTORS AFFECTING THE LEVEL OF TRUST AND COMMITMENT IN TOPS SUPERMARKET SUPPLY CHAIN MANAGEMENT, BANGKOK A Project Presented to the Faculty of California State University, San Bernardino by Kamolchanok Saisomboon . June 2008 Approved by: Decision Sciences Dr. Tapie Rohm __ Dr. Walter Stewart, Jr., Department Chair, Information and Decision Sciences ABSTRACT Trust is one of the most important aspects in successful supply chain relationship. It is the aspect that encourages commitment in the relationship. A supply chain relationship which lacks of trust and commitment may affect the performance of partners which in turn results in high-cost or even lost of current suppliers or customers. -

'Seyahat Etmek Hayal Gücümüzü Gerçeklerle Dengeler Ve Bazı

‘Seyahat etmek hayal gücümüzü gerçeklerle dengeler ve bazı şeylerin nasıl göründüğünü düşünmek yerine onları görmemizi sağlar.’ S. Johnson SEUL GEZİ REHBERİ; Ülkemizden hayli uzakta olması ve haliyle uçak biletlerinin de pek uygun olmaması nedeniyle Türk vatandaşları tarafından çok fazla ziyaret edilmeyen veya edilemeyen Seul, aslında harcanan parayı her kuruşuna kadar hak eden bir şehir. Arkadaşım Hakan’la birlikte yaptığımız bireysel Uzak Doğu turunda zaman problemimiz nedeniyle Seul’da sadece 4 gün geçirebildiğimiz için tadı damağımızda kaldı diyebilirim. Biz Güney Kore’de sadece Seul’u gezdik ama bana göre Güney Kore böyle bir tura dahil edilmemeli, ülkenin görülmesi gereken her şehrini gezmek için geniş bir zaman ayırmalı. 2002 yılında düzenlenen Dünya Kupası sayesinde hafızalarımızda uzun süre yer edinen Güney Kore, turnuvanın son maçında karşı karşıya gelmemiz ve mağlup etmemize rağmen dostluğumuza zerre kadar zarar gelmeyen bir ülke. Hem nasıl gelsin ki? Kore Savaşı’nda omuz omuza mücadele etmiş iki milletin insanları birbirine karşı nasıl kötü hisler besleyebilir? Güney Korelilerin bize karşı duydukları sempatinin sebebi, şüphesiz savaş döneminde kader ortaklığı yapmamız ama bizim insanlarımızın Güney Kore’ye karşı bu denli ilgi duymasının sebeplerinden bence en önemlisi Güney Kore dizileri. Hatta kendi adıma konuşursam; Efsane Prens dizisinde Güney Kore saraylarını ve etnik kıyafetleri gördükçe Seul’a gitme istediğim daha da artıyordu. Güney Koreliler oldukça kibar insanlar, sadece bize karşı değil, dünyanın hangi ülkesinden olursa olsun ülkelerine gelen herkese iyi davranıyor, asla nezaketten ve saygıdan ödün vermiyorlar. Sohbet ederken, alışveriş yaparken veya toplu taşıma araçlarına binerken Güney Korelilerin hem birbirlerine hem de yabancılara karşı olan nazik tutumu oldukça net gözlemlenebiliyor. Yaklaşık 5000 yıllık tarihi geçmişe sahip Güney Kore’nin başkenti olan Seul’un nüfusu yaklaşık 12 milyon ve dünyanın en kalabalık 13. -

Korea - Republic Of

THIS REPORT CONTAINS ASSESSMENTS OF COMMODITY AND TRADE ISSUES MADE BY USDA STAFF AND NOT NECESSARILY STATEMENTS OF OFFICIAL U.S. GOVERNMENT POLICY. Voluntary - Public Date: 6/13/2019 GAIN Report Number: KS1918 Korea - Republic of Post: Seoul ATO Retail Foods Report Categories: Retail Foods Approved By: Peter Olson, Acting ATO Director Prepared By: Sangyong Oh, Marketing Specialist Report Highlights: Strong consumer demand for value, quality, convenience, and diversity generates increased demand for imported agricultural products in the Korean retail industry. The United States remains the leading supplier of consumer-oriented agricultural products to the Korean retail industry. Korea’s imports of these products from the United States amounted to a record $5.1 billion in 2018. Market Fact Sheet: South Korea Executive Summary Quick Facts CY 2018 South Korea is the 11th largest economy in the world with a national GDP of $1.6 trillion and a per capita GNI of $31,355 in 2018. It is about the size of the state of Imports of Ag. Products from the World Indiana and has a population of 51.8 million. Over 90 percent of Koreans live in - Basic Products US $5.2 billion urban areas. Korean consumers maintain strong demand for healthy diet, diversified - Intermediate Products US $8.0 billion choices, and new tastes. While domestic production meets 45% of Korean food and - Consumer-Oriented Products US $14.5 billion agricultural needs, the country relies heavily on imports to fulfill total demand. Korea - Forest Products US $3.5 billion is the fifth largest export market for American agriculture. The United States was the - Seafood Products US $5.8 billion leading supplier of imported agricultural products to Korea by accounting for $9.4 - Total US $37.1 billion billion or 25.3% of Korea's agricultural imports of $37.1 billion in 2018.