GAIN Report Global Agriculture Information Network

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Preventing Fraud and Deficit Through the Optimization of Health Insurance in Indonesia

Sys Rev Pharm 2020;11(7):228-231 A multifaceted review journal in the field of pharmacy Preventing Fraud and Deficit Through The Optimization of Health Insurance In Indonesia Sri Sunarti1, MT Ghozali2, Fahni Haris3,4, Ferry Fadzlul Rahman1,4*, Rofi Aulia Rahman5, Ghozali1 1 Department of Public Health, Universitas Muhammadiyah Kalimantan Timur; Indonesia 2 School of Pharmacy, Universitas Muhammadiyah Yogyakarta; Indonesia 3School of Nursing, Universitas Muhammadiyah Yogyakarta; Indonesia 4Department Healthcare Administration Asia University; Taiwan 5Department of Financial and Economic Law, Asia University; Taiwan *Corresponding Author: Ferry Fadzlul Rahman, Email: [email protected] ABSTRACT BPJS Kesehatan (Indonesian Health Insurance System) has been experiencing Keywords: BPJS Kesehatan, Fraud and Deficit, Healthcare System, a severe problem for many years that BPJS Kesehatan has been suffering a Supervisory System huge deficit. That situation is getting worse and taking a negative impact on hospitals, medical practitioners, and patients itself. The more severe problem Correspondence: felt by a patient who needs special treatment and medication. Due to the Ferry Fadzlul Rahman deficit of the BPJS Kesehatan budget, some hospitals owe some money to the 1 Department of Public Health, Universitas Muhammadiyah Kalimantan pharmaceutical company to buy some medicines. However, they cannot buy Timur; Indonesia the medication because they have no budget. This study is to explain and Email: [email protected] compare with the National Health Insurance System in Taiwan to resolve the problems within BPJS Kesehatan in Indonesia, notably on the supervisory system between 2 (two) countries. The method used in this study is the Systematic Literature Review (SLR) method with qualitative approval from secondary data in approving, reviewing, evaluating, and research supporting all available research in 2015-2020. -

Global Powers of Retailing 2019 Contents

Global Powers of Retailing 2019 Contents Top 250 quick statistics 4 Global economic outlook 5 Top 10 highlights 8 Global Powers of Retailing Top 250 11 Geographic analysis 19 Product sector analysis 23 New entrants 27 Fastest 50 30 Study methodology and data sources 35 Endnotes 39 Contacts 41 Welcome to the 22nd edition of Global Powers of Retailing. The report identifies the 250 largest retailers around the world based on publicly available data for FY2017 (fiscal years ended through June 2018), and analyzes their performance across geographies and product sectors. It also provides a global economic outlook, looks at the 50 fastest-growing retailers, and highlights new entrants to the Top 250. Top 250 quick statistics, FY2017 Minimum retail US$4.53 US$18.1 revenue required to be trillion billion among Top 250 Aggregate Average size US$3.7 retail revenue of Top 250 of Top 250 (retail revenue) billion 5-year retail Composite 5.7% revenue growth net profit margin 5.0% Composite (CAGR from Composite year-over-year retail FY2012-201 2.3% return on assets revenue growth 3.3% Top 250 retailers with foreign 23.6% 10 operations Share of Top 250 Average number aggregate retail revenue of countries where 65.6% from foreign companies have operations retail operations Source: Deloitte Touche Tohmatsu Limited. Global Powers of Retailing 2019. Analysis of financial performance and operations for fiscal years ended through June 2018 using company annual reports, Supermarket News, Forbes America’s largest private companies and other sources. 4 Global economic outlook 5 Global Powers of Retailing 2019 | Global economic outlook The global economy is currently at a turning point. -

Global Powers of Retailing Top 250, FY2015

Global Powers of Retailing 2017 | Top 250 Global Powers of Retailing Top 250, FY2015 FY2015 FY2015 Parent Parent FY2010- FY2015 FY2015 company/ company/ # 2015 Retail Retail group group Countries Retail revenue Country revenue revenue¹ net income¹ of revenue rank Company of origin (US$M) (US$M) (US$M) Dominant operational format operation CAGR² 1 Wal-Mart Stores, Inc. US 482,130 482,130 15,080 Hypermarket/Supercenter/Superstore 30 2.7% 2 Costco Wholesale Corporation US 116,199 116,199 2,409 Cash & Carry/Warehouse Club 10 8.3% 3 The Kroger Co. US 109,830 109,830 2,049 Supermarket 1 6.0% 4 Schwarz Unternehmenstreuhand KG Germany 94,448 94,448 n/a Discount Store 26 7.4% 5 Walgreens Boots Alliance, Inc. US 89,631 103,444** 4,279 Drug Store/Pharmacy 10 5.9% (formerly Walgreen Co.) 6 The Home Depot, Inc. US 88,519 88,519 7,009 Home Improvement 4 5.4% 7 Carrefour S.A. France 84,856 87,593 1,247 Hypermarket/Supercenter/Superstore 35 -3.1% 8 Aldi Einkauf GmbH & Co. oHG Germany 82,164e 82,164e n/a Discount Store 17 8.0% 9 Tesco PLC UK 81,019 82,466 535 Hypermarket/Supercenter/Superstore 10 -2.3% 10 Amazon.com, Inc. US 79,268 107,006 596 Non-Store 14 20.8% 11 Target Corporation US 73,785 73,785 3,363 Discount Department Store 1 2.3% 12 CVS Health Corporation US 72,007 153,290 5,239 Drug Store/Pharmacy 3 4.7% 13 Metro Ag Germany 68,066** 68,066** 821 Cash & Carry/Warehouse Club 31 -2.5% 14 Aeon Co., Ltd. -

Recall Retail List 030-2020

United States Food Safety Department of and Inspection Agriculture Service RETAIL CONSIGNEES FOR FSIS RECALL 030-2020 FSIS has reason to believe that the following retail location(s) received LEAN CUISINE Baked Chicken meal products that have been recalled by Nestlé Prepared Foods. This list may not include all retail locations that have received the recalled productor may include retail locations that did not actually receive the recalled product. Therefore, it is important that you use the product-specific identification information, available at https://www.fsis.usda.gov/wps/portal/fsis/topics/recalls-and-public- health-alerts/recall-case-archive/archive/2020/recall-030-2020-release, in addition to this list of retail stores, to check meat or poultry products in your possession to see if they have been recalled. Store list begins on next page United States Food Safety USDA Department of And Inspection - Agl'iculture Service Retail List for Recall Number: 030-2020 chicken meal product List Current As Of: 26-Jan-21 Nationwide, State-Wide, or Area-Wide Distribution Retailer Name Location 1 Albertsons AZ, CA, LA, NV, OR, TX, WA 2 Bashas AZ 3 Big Y CT 4 City Market CO 5 Dillons KS 6 Food Lion GA, SC, TN, VA 7 Fred Meyer OR, WA 8 Fry's Food And Drug AZ 9 Fry's Marketplace AZ 10 Gelson's Market CA 11 Giant MD, PA, VA 12 Giant Eagle Supermarket OH, PA 13 Heinen's OH 14 Hy-Vee IL, IA, KS, MN, MO, NE, SD 15 Ingles Markets GA, NC, SC, TN 16 Jay C IN 17 JewelOsco IL 18 King Soopers CO AR, GA, IL, IN, KY, MI, MS, OH, SC, TN, TX, VA, 19 Kroger WV 20 Lowes NC 21 Marianos IL 22 Meijers IL, IN, MI 23 Pavilions CA 24 Pick n Save WI 25 Piggly Wiggly WI 26 Publix FL, GA Page 1 of 85 Nationwide, State-Wide, or Area-Wide Distribution Retailer Name Location 27 Quality Food Center WA 28 Ralphs CA 29 Ralphs Fresh Fare CA 30 Randalls TX 31 Safeway AZ, CA, HI, OR, WA 32 Shaw's MA, NH 33 Smart & Final CA 34 Smith's NV, NM, UT 35 Stater Bros. -

Retail Industry

Productivity in the Service Sector: Retail Industry Recent Trends and Prospects for APO Member Countries 1 Chief Expert Toshiyuki Matsuura 2 Keio Economic Observatory, Keio University 1 We would like to thank Prof. Jonathan Haskel for helpful comments and suggestions. 2 e-Mail: [email protected] Asian Productivity Organization 0 Contributors Chief Expert Japan Prof. Toshiyuki Matsuura Assistant Professor, Keio Economic Observatory Keio University 2-15-45 Mita, Minato-ku Tokyo 108-8345 Telephone/Fax: 81-3-5427-1479 e-Mail: [email protected] National Experts India Prof. Uniyal Dwarika Prasad Dean, Chitkara Business School Chitkara University Barotiwala, Hiamchal e-Mail: [email protected] Indonesia Dr. Handito Hadi Joewono Chairman of Permanent Committee on Education, Training and Apprenticeship of Indonesia Chamber of Commerce and Industry and Chief Strategy Consultant of ARRBEY Menara Kadin Indonesia, Jl. HR. Rasuna Said X-5 Kav 2-3 Jakarta 12950 Telephone: 62-21-5274485 Fax: 62-21-53664869 e-Mail: [email protected] Republic of Korea Dr. Keun Hee Rhee Senior Researcher Korea Productivity Center 122-1 Jeokseon-dong, Jongro-ku Seoul 110-751 Telephone: 82-2-7241054 Fax: 82-2-7241050 e-Mail: [email protected] Malaysia Mr. Ramli Idris Associate Consultant Quest Consulting Group 9-5 Jalan 8/146, Bandar Tasik Selatan, Sg. Besi, 57000 Kuala Lumpur e-Mail: [email protected] Thailand Ms. Suchira Simma Decision Support System Assistant Department Manager CP. Seven Eleven Public Co., Ltd. Sibunruang 1 Bldg., 6th Floor, 283 Silom Road, Bangrak Bangkok 10500 Telephone: 66-2-6771305 Fax: 66-2-6311446 Asian Productivity Organization 1 e-Mail: [email protected] Mr. -

Perspectives on Retail and Consumer Goods

Perspectives on retail and consumer goods Number 4, Autumn 2015 Perspectives on retail and Editor McKinsey Practice consumer goods is written by Monica Toriello Publications experts and practitioners in McKinsey & Company’s Retail Contributing Editor Editor-in-Chief and Consumer Packaged Caitlin Gallagher Lucia Rahilly Goods practices, along with other McKinsey colleagues. Art Direction and Design Executive Editors Hil Albuquerque, Nicole Michael T. Borruso, Allan Gold, To send comments or request Esquerre Bill Javetski, Mark Staples copies, e-mail us: Consumer_ [email protected] Editorial Production Copyright © 2015 McKinsey & Runa Arora, Elizabeth Company. All rights reserved. Editorial Board Brown, Heather Byer, Klaus Behrenbeck, Peter Torea Frey, Heather Gross, This publication is not intended Breuer, Peter Child, Sandrine Katya Petriwsky, John C. to be used as the basis for Devillard, Dennis Martinis, Sanchez, Dana Sand, trading in the shares of any Jørgen Rugholm, Frank Sneha Vats company or for undertaking Sänger, Tobias Wachinger, any other complex or significant Anja Weissgerber Managing Editors financial transaction without Michael T. Borruso, Venetia consulting appropriate Senior Content Manager Simcock professional advisers. Tobias Wachinger Cover Illustration No part of this publication may Project and Content Keiko Morimoto be copied or redistributed Manager in any form without the prior Anja Weissgerber written consent of McKinsey & Company. Table of contents 4 12 16 28 Modern grocery and Amazon China’s president Winning in Africa’s Becoming a regional the emerging-market on ‘transformative’ consumer market powerhouse in food consumer: A complicated technologies For consumer-goods retailing courtship Doug Gurr reflects on how companies, Africa holds Croatian conglomerate In some emerging markets, China differs from Western much promise—but also Agrokor is the top grocery the response to modern markets and what role data many pitfalls. -

Dumex Thailand Thailand

DumexDumex Thailand Thailand INTRODUCTION September 12, 2003 by Gerard Geraets Managing Director, Dumex Ltd. IndexIndex Who are we ? Milestones and Highlights Market and Competition Critical Factors Growth Opportunities Critical Success Factors Recall and Recovery Outlook 2 WhoWho areare wewe ?? OrganizationOrganization ChartChart Gerard Geraets Managing Director Wanna Swuddigul Steve Donnelly Morten S. Knudsen Likhit Somboon Regional Financial Marketing Director Operations Manager HR Director Controller Wisanti Lomtakul Pisit Pittayanurak Deputy Financial Controller Sales Director Production/Technical Modern Trade Finance Marketing QA & QC/R&D HR General Trade Admin. Nutrition Supply Chain Training Trade Marketing IT Warehousing 4 GERARD GERAETS 59 years Dutch National Business Administration Nijenrode University, The Netherlands 18 years of Asian experience in Thailand, Taiwan, Singapore Extensive marketing and General Management experience with o.a. Heineken, Sara Lee and Friesland Dairy Foods Almost 7 years with Dumex as MD Dumex Ltd. Thailand 5 WANNA SWUDDIGUL 37 years Thai National Master of Business Administration, Western Illinois University, USA 9 years experience in Marketing with Consumer Products Company 2 years experience as General Manager at Fast Food business 2 years experience in Marketing with Telecommunication business 3 months with Dumex Ltd, Thailand as Marketing Director 6 STEVE DONNELLY 39 years New Zealand National Dairy Science and Technology, Massey University, New Zealand 10 years experience -

Retailers Outside the United States

Directory of Foreign Retailer Web Sites Here are links to the Web sites of more than 235 foreign retailers (with their home countries noted). These firms represent all facets of retailing. For some foreign retailers, their home language appears (rather than English). [Note: Web site URLs may change. PLEASE notify us at [email protected] if you find a broken link. Thanks!] Adeo Groupe – France Aeon Jusco – Japan Aldi Einkauf – Germany Alliance Boots – Great Britain Arcadia Group – Great Britain Arcs Co. – Japan ASDA – Great Britain Associated British Foods – Great Britain Auchan – France Axel Johnson AB – Sweden Bailian Group – China Bauhaus – Germany Beck and Call – Great Britain Beisia Group Co., Ltd. – Japan Belle International Holdings Limited – China Benetton – Italy Best Denki – Japan BGF Retail Co., Ltd. – South Korea Bic Camera Inc. – Japan Big Star – Poland BIM – Turkey Blackwell’s Bookshops – Great Britain Blue Square – Israel Body Shop – Great Britain Bompreco – Brazil Boots – Great Britain Budgens – Great Britain Buyers Edge – Australia © by Joel R. Evans, Barry Berman, and Patrali Chatterjee C&A – Netherlands Canadian Tire – Canada Carrefour – France Casino – France Castorama – France Cathay Photo – Singapore Celio – France Cencosud S.A. – Chile Central Group – Thailand Chapters Online – Canada China Resources Vanguard Co. – China Chow Tai Fook Jewellery Group Limited – Hong Kong Coles Supermarkets – Australia Colruyt Group – Belgium Comercial Mexicana – Mexico Compagnie Financiåre Richemont SA -- Switzerland Compass -

AU-Thesis-Fulltext-171148.PDF ( 4013.57 KB )

A S;fUDY OF EFFICACY OF SALES PROMOTIONS OF TOPS SUPERMARKET IN BANGKOK By PIMOLRAT KHUNVIROJPANICH I A Thesis submitted in partial fulfillment of the requirement for the degree of Master of Business Administration Examination Committee : 1. Dr. Ishwar C. Gupta (Advisor) 2. Dr. Thongdee Kijboonchoo (Member) ,{_~-..:..... 3. Dr. Sirion Chaipoopirutana (Member) "?";c"~'j 4. Dr. Jakarin Srimoon (Member) IJ ..(( 14 .. krrt?..0( 5. Assoc. Prof. Poonsak Sangsunt (MOE Representative) Examined on : 23 June 2004 Approved for Graduation on : Graduate School of Business Assumption University Bangkok, Thailand June 2004 ABSTRACT There is an intense competition in the retail business. Customers have many alternatives to select. They move away from tradition trade to modern trade such as supermarket. One of the several reasons is sales promotion tools which are used by supermarkets to attract the customers. Therefore, it is useful and interesting to study the relationship between sales promotion tools and consumers behavior response. Tops Supermarket is chosen for this study. The research problem for this study is "What is the relationship between sales promotion tools and consumer behavior". The objective of this research is to find out the relationship of four different sales promotion tools which are coupon, price discount, buy-one-get-one-free, and premium, with four different consumer behavior responses which are brand switching, brand loyalty, stockpiling, and purchase acceleration. The research instrument was administered 400 respondents, both male and female which were completed by the target population who have experienced in shopping at Tops Supermarket. After data were collected from respondents, the data were processed by SPSS program. -

Additional Case Information

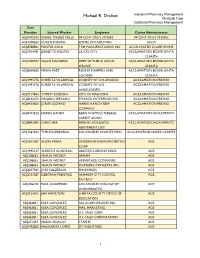

Michael R. Drobot Industrial Pharmacy Management MediLab Corp California Pharmacy Management Case Number Injured Worker Employer Claims Administrator ADJ7472102 ISMAEL TORRES VALLE 99 CENT ONLY STORES 99 CENT ONLY STORES ADJ1308567 CURTIS RIGGINS EMPIRE DISTRIBUTORS ACCA ADJ8768841 MARTIN AVILA TRM MANUFACTURING INC ACCELERATED CLAIMS IRVINE ADJ7014781 JEANETTE WILSON LA COUNTY ACCLAMATION 802108 SANTA CLARITA ADJ7200937 SUSAN NAVARRO DEPT OF PUBLIC SOCIAL ACCLAMATION 802108 SANTA SERVICE CLARITA ADJ8009655 MARIA PAEZ RUSKIN DAMPERS AND ACCLAMATION 802108 SANTA LOUVERS CLARITA ADJ1993776 ROBERTA VILLARREAL COUNTY OF LOS ANGELES ACCLAMATION FRESNO ADJ1993776 ROBERTA VILLARREAL COUNTY OF LOS ACCLAMATION FRESNO ANGELES/DPSS ADJ7117844 TOMMY ROBISON CITY OF MARICOPA ACCLAMATION FRESNO ADJ8162473 ONORIO SERRANO ESPARZA ENTERPRISES INC ACCLAMATION FRESNO ADJ8420600 JORGE LOZANO HARRIS RANCH BEEF ACCLAMATION FRESNO COMPANY ADJ8473212 DAREN HANDY KERN SCHOOLS FEDERAL ACCLAMATION SACRAMENTO CREDIT UNION ADJ8845092 CHAO HER FRESNO MOSQUITO ACCLAMATION SACRAMENTO ABATEMENT DIST ADJ1361532 THELMA JENNINGS LOS ANGELES COUNTY/DPSS ACCLAMATION SANTA CLARITA ADJ1611037 ALICIA MORA ANDERSON BARROWS METALS ACE CORP ADJ1995137 ALBERTO GUNDRAN ABLESTIK LABORATORIES ACE ADJ208633 SHAUN WIDNEY AMPAM ACE ADJ208633 SHAUN WIDNEY AMPAM RCR COMPANIES ACE ADJ208633 SHAUN WIDNEY PLUMBING CONCEPTS INC ACE ADJ2237965 JOSE CALDERON FMI EXPRESS ACE ADJ2353287 DEBORAH PRENTICE ANAHEIM CITY SCHOOL ACE DISTRICT ADJ246218 PAUL LIGAMMARI LOS ANGELES COLLEGE OF ACE CHIROPRACTIC -

Wikipedia List of Convenience Stores

List of convenience stores From Wikipedia, the free encyclopedia The following is a list of convenience stores organized by geographical location. Stores are grouped by the lowest heading that contains all locales in which the brands have significant presence. NOTE: These are not ALL the stores that exist, but a good list for potential investors to research which ones are publicly traded and can research stock charts back to 10 years on Nasdaq.com or other related websites. [edit ] Multinational • 7-Eleven • Circle K [edit ] North America Grouping is by country or united States Census Bureau regional division . [edit ] Canada • Alimentation Couche-Tard • Beckers Milk • Circle K • Couch-Tard • Max • Provi-Soir • Needs Convenience • Hasty Market , operates in Ontario, Canada • 7-Eleven • Quickie ( [1] ) [edit ] Mexico • Oxxo • 7-Eleven • Super City (store) • Extra • 7/24 • Farmacias Guadalajara [edit ] United States • 1st Stop at Phillips 66 gas stations • 7-Eleven • Acme Express gas stations/convenience stores • ampm at ARCO gas stations • Albertsons Express gas stations/convenience stores • Allsup's • AmeriStop Food Mart • A-Plus at Sunoco gas stations • A-Z Mart • Bill's Superette • BreakTime former oneer conoco]] gas stations • Cenex /NuWay • Circle K • CoGo's • Convenient Food Marts • Corner Store at Valero and Diamond Shamrock gas stations • Crunch Time • Cumberland Farms • Dari Mart , based in the Willamette Valley, Oregon Dion's Quik Marts (South Florida and the Florida Keys) • Express Mart • Exxon • Express Lane • ExtraMile at -

Factors Affecting the Level of Trust and Commitment in Tops Supermarket Supply Chain Management, Bangkok

California State University, San Bernardino CSUSB ScholarWorks Theses Digitization Project John M. Pfau Library 2008 Factors affecting the level of trust and commitment in Tops Supermarket supply chain management, Bangkok Kamolchanok Saisomboon Follow this and additional works at: https://scholarworks.lib.csusb.edu/etd-project Part of the Business Administration, Management, and Operations Commons Recommended Citation Saisomboon, Kamolchanok, "Factors affecting the level of trust and commitment in Tops Supermarket supply chain management, Bangkok" (2008). Theses Digitization Project. 3356. https://scholarworks.lib.csusb.edu/etd-project/3356 This Project is brought to you for free and open access by the John M. Pfau Library at CSUSB ScholarWorks. It has been accepted for inclusion in Theses Digitization Project by an authorized administrator of CSUSB ScholarWorks. For more information, please contact [email protected]. FACTORS AFFECTING THE LEVEL OF TRUST AND COMMITMENT IN TOPS SUPERMARKET SUPPLY CHAIN MANAGEMENT, BANGKOK A Project Presented to the Faculty of California' State University, San Bernardino In Partial Fulfillment of the Requirements for the Degree Master of Business Administration by I Kamolchanok Saisomboon June 2008 FACTORS AFFECTING THE LEVEL OF TRUST AND COMMITMENT IN TOPS SUPERMARKET SUPPLY CHAIN MANAGEMENT, BANGKOK A Project Presented to the Faculty of California State University, San Bernardino by Kamolchanok Saisomboon . June 2008 Approved by: Decision Sciences Dr. Tapie Rohm __ Dr. Walter Stewart, Jr., Department Chair, Information and Decision Sciences ABSTRACT Trust is one of the most important aspects in successful supply chain relationship. It is the aspect that encourages commitment in the relationship. A supply chain relationship which lacks of trust and commitment may affect the performance of partners which in turn results in high-cost or even lost of current suppliers or customers.