COMMITTEE of PUBLIC ACCOUNTS Briefing for Posts & Hosts Visit To

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Download the Red Book

The For this agenda-setting collection, the leading civil society umbrella groups ACEVO and CAF worked with Lisa Nandy MP to showcase some of Red Book Labour’s key thinkers about the party’s future relationship with charities The and social enterprises. The accompanying ‘Blue Book’ and ‘Yellow Book’ feature similar essays from the Conservative and Liberal Democrat Parties. ‘This collection of essays shows the depth and vibrancy of thinking across the Labour movement on this important issue and makes a vital the Voluntary of Sector Red Book contribution to the debate in the run-up to the next election.’ Rt Hon Ed Miliband MP, Leader of the Labour Party of the ‘I hope this collection will be a provocation to further dialogue with Labour and with all the major political parties. It demonstrates a willingness to listen … that our sector should be grateful for.’ Voluntary Sector Sir Stephen Bubb, Chief Executive, ACEVO ‘The contributions in this collection show that the Labour Party possesses exciting ideas and innovations designed to strengthen Britain’s charities, Civil Society and the Labour Party and many of the concepts explored will be of interest to whichever party (or parties) are successful at the next election.’ after the 2015 election Dr John Low CBE, Chief Executive, Charities Aid Foundation With a foreword by the Rt Hon Ed Miliband MP £20 ISBN 978-1-900685-70-2 9 781900 685702 acevo-red-book-cover-centred-spine-text.indd All Pages 05/09/2014 15:40:12 The Red Book of the Voluntary Sector Civil Society and the Labour Party after -

The Privatisation of Qinetiq

House of Commons Committee of Public Accounts The privatisation of QinetiQ Twenty–fourth Report of Session 2007–08 Report, together with formal minutes, oral and written evidence Ordered by The House of Commons to be printed 12 May 2008 HC 151 Published on 10 June 2008 by authority of the House of Commons London: The Stationery Office Limited £0.00 The Committee of Public Accounts The Committee of Public Accounts is appointed by the House of Commons to examine “the accounts showing the appropriation of the sums granted by Parliament to meet the public expenditure, and of such other accounts laid before Parliament as the committee may think fit” (Standing Order No 148). Current membership Mr Edward Leigh MP (Conservative, Gainsborough) (Chairman) Mr Richard Bacon MP (Conservative, South Norfolk) Angela Browning MP (Conservative, Tiverton and Honiton) Mr Paul Burstow MP (Liberal Democrat, Sutton and Cheam) Rt Hon David Curry MP (Conservative, Skipton and Ripon) Mr Ian Davidson MP (Labour, Glasgow South West) Mr Philip Dunne MP (Conservative, Ludlow) Angela Eagle MP (Labour, Wallasey) Nigel Griffiths MP (Labour, Edinburgh South) Rt Hon Keith Hill MP (Labour, Streatham) Mr Austin Mitchell MP (Labour, Great Grimsby) Dr John Pugh MP (Liberal Democrat, Southport) Geraldine Smith MP (Labour, Morecombe and Lunesdale) Rt Hon Don Touhig MP (Labour, Islwyn) Rt Hon Alan Williams MP (Labour, Swansea West) Phil Wilson MP (Labour, Sedgefield) The following were also Members of the Committee during the period of the enquiry: Annette Brooke MP (Liberal Democrat, Mid Dorset and Poole North) and Mr John Healey MP (Labour, Wentworth). Powers Powers of the Committee of Public Accounts are set out in House of Commons Standing Orders, principally in SO No 148. -

Parliamentary Debates House of Commons Official Report General Committees

PARLIAMENTARY DEBATES HOUSE OF COMMONS OFFICIAL REPORT GENERAL COMMITTEES Public Bill Committee INTELLECTUAL PROPERTY BILL [LORDS] Second Sitting Tuesday 28 January 2014 (Afternoon) CONTENTS CLAUSES 21 to 24 agreed to. Adjourned till Thursday 30 January at half-past Eleven o’clock. PUBLISHED BY AUTHORITY OF THE HOUSE OF COMMONS LONDON – THE STATIONERY OFFICE LIMITED £5·00 PBC (Bill 102) 2013 - 2014 Members who wish to have copies of the Official Report of Proceedings in General Committees sent to them are requested to give notice to that effect at the Vote Office. No proofs can be supplied. Corrigenda slips may be published with Bound Volume editions. Corrigenda that Members suggest should be clearly marked in a copy of the report—not telephoned—and must be received in the Editor’s Room, House of Commons, not later than Saturday 1 February 2014 STRICT ADHERENCE TO THIS ARRANGEMENT WILL GREATLY FACILITATE THE PROMPT PUBLICATION OF THE BOUND VOLUMES OF PROCEEDINGS IN GENERAL COMMITTEES © Parliamentary Copyright House of Commons 2014 This publication may be reproduced under the terms of the Open Parliament licence, which is published at www.parliament.uk/site-information/copyright/. 41 Public Bill Committee28 JANUARY 2014 Intellectual Property Bill [Lords] 42 The Committee consisted of the following Members: Chairs: MR DAI HAVARD,†MR ANDREW TURNER † Birtwistle, Gordon (Burnley) (LD) Pawsey, Mark (Rugby) (Con) Bradshaw, Mr Ben (Exeter) (Lab) † Sutcliffe, Mr Gerry (Bradford South) (Lab) † Doughty, Stephen (Cardiff South and Penarth) (Lab/ -

ECON Thesaurus on Brexit

STUDY Requested by the ECON Committee ECON Thesaurus on Brexit Fourth edition Policy Department for Economic, Scientific and Quality of Life Policies Authors: Stephanie Honnefelder, Doris Kolassa, Sophia Gernert, Roberto Silvestri Directorate General for Internal Policies of the Union July 2017 EN DIRECTORATE GENERAL FOR INTERNAL POLICIES POLICY DEPARTMENT A: ECONOMIC AND SCIENTIFIC POLICY ECON Thesaurus on Brexit Fourth edition Abstract This thesaurus is a collection of ECON related articles, papers and studies on the possible withdrawal of the UK from the EU. Recent literature from various sources is categorised, chronologically listed – while keeping the content of previous editions - and briefly summarised. To facilitate the use of this tool and to allow an easy access, certain documents may appear in more than one category. The thesaurus is non-exhaustive and may be updated. This document was provided by Policy Department A at the request of the ECON Committee. IP/A/ECON/2017-15 July 2017 PE 607.326 EN This document was requested by the European Parliament's Committee on Economic and Monetary Affairs. AUTHORS Stephanie HONNEFELDER Doris KOLASSA Sophia GERNERT, trainee Roberto SILVESTRI, trainee RESPONSIBLE ADMINISTRATOR Stephanie HONNEFELDER Policy Department A: Economic and Scientific Policy European Parliament B-1047 Brussels E-mail: [email protected] LINGUISTIC VERSIONS Original: EN ABOUT THE EDITOR Policy departments provide in-house and external expertise to support EP committees and other parliamentary bodies -

Daily Report Tuesday, 13 January 2015 CONTENTS

Daily Report Tuesday, 13 January 2015 This report shows written answers and statements provided on 13 January 2015 and the information is correct at the time of publication (06:30 P.M., 13 January 2015). For the latest information on written questions and answers, ministerial corrections, and written statements, please visit: http://www.parliament.uk/writtenanswers/ CONTENTS ANSWERS 5 DEFENCE 17 BUSINESS, INNOVATION AND Bahrain 17 SKILLS 5 Christmas Cards 17 Construction: Industry 5 Defence Assistance Fund 17 Higher Education: Admissions 5 Defence Audit Committee 18 Postal Services: Harrow 6 Defence Infrastructure Work Programme 6 Organisation 18 CABINET OFFICE 7 Defence Support Group 18 Civil Servants: Recruitment 7 HMS Vengeance 19 Jobseekers Allowance: East of Investment Approvals Board 19 England 7 Service Complaints COMMUNITIES AND LOCAL Commissioner 20 GOVERNMENT 7 Tanks 21 Affordable Housing 7 DEPUTY PRIME MINISTER 21 Community Relations 8 Economic Growth: North of Council Tax 10 England 21 Disadvantaged 11 Electoral Register 22 Fire Prevention 11 EDUCATION 22 Housing: Construction 11 Academies 22 Mobile Homes 13 History: Curriculum 22 Private Rented Housing 14 Pre-school Education 23 Private Rented Housing: Greater Students: Surveys 26 London 14 Teachers: South West 27 Public Expenditure 15 Teachers: Training 31 Public Sector: Land 16 ENERGY AND CLIMATE CHANGE 31 Travellers 16 Energy: Meters 31 2 Tuesday, 13 January 2015 Daily Report Fracking 31 Ambulance Services: East Green Climate Fund 32 Midlands 54 International Climate Fund -

Antisemitic Anti-Zionism: the Root of Labour's Crisis. a Submission To

Antisemitic anti-Zionism: the root of Labour’s crisis A submission to the Labour Party inquiry into antisemitism and other forms of racism Professor Alan Johnson June 2016 Antisemitic anti-Zionism: the root of Labour’s Palestine, pro-Israel, pro-peace crisis 4.4 A final word Professor Alan Johnson is Senior Research Fellow at the Britain Israel Communications and Introduction Research Centre (BICOM), founder and editor of Fathom: for a deeper understanding of Israel Everything depends on the Labour Party and the region, and a registered Labour Party understanding what it is dealing with: almost supporter (Unite). never old-fashioned Jew hatred, almost always modern antisemitic anti-Zionism – a programme to abolish Israel, a movement to boycott Israel CONTENTS and discourse to demonise Israel. To combat it, the party needs to understand the historical roots, Introduction ideological tributaries, contemporary modes and forms of expressions of antisemitic anti-Zionism. Part 1: Ideological Tributaries 1.1 Rethinking our values: assimilationism, * universalism, the Jews and the Left 1.2 Ideological Tributary: Communism and ‘anti- Antisemitism is the most protean of hatreds and Cosmopolitanism’ it has shape-shifted again (Gidley 2011). Labour 1.3 Ideological Tributary: The New Left and ‘anti- does not have a neo-Nazi problem. It does, Zionism’ however, have a problem with a modern anti- 1.4 Ideological Tributary: Islam, Islamism and Zionism of a particularly excessive, obsessive, and antisemitism demonising kind, which has co-mingled with an older set of classical antisemitic tropes, images Part 2: Modes and assumptions to create antisemitic anti- 2.1 The Programme to abolish Israel Zionism (Wistrich 1984, 1991, 2004, 2009, 2012; 2.2 The Discourse to demonise Israel Johnson 2015a, 2016). -

Helen Goodman MP

Tradition and Change: Four People A Response to the Politics of Paradox By Helen Goodman MP June 2011 Contents Foreword The Reeve’s Tale The Miner’s Tale Looking Back The Mother’s Tale The Priest’s Tale Looking Forward Foreword The Politics of Paradox (POP) is a collection of essays written by proponents of Blue Labour with responses based on a series of seminars. Blue Labour’s thesis is that having lost the election, we need a thorough re-examination of our ideas and a return to concepts and practices prevalent at the founding of the party. Maurice Glasman – the lead editor - has been involved in the ground breaking London Citizen’s movement for the living wage. His central argument is that we need to return to the community based practices of the late 19th century Labour movement and that if we do we shall effect change in people’s lives building solidarity and reciprocity which has a real meaning and value to them, far greater than the abstract philosophical principles of equality and justice. This approach strikes a real note of relevance, because many people feel their lives are insecure and that social ties and obligations have been undermined by globalisation. Sometimes the state institutions set up to tackle problems descend into bossiness and bureaucracy, leaving people feeling frustrated and powerless. I want to begin my response with two stories about communities in my constituency. The first impression might be that these are very traditional and would benefit from the Blue Labour approach. But if we look more deeply, it becomes clear that while voluntarism and co-operation have a part to play – the forces and structures in the modern world require far more than this for them to flourish. -

Reading the Signs Why Anwyn Chose to Learn British Sign Language Aged 14

11 30 46 Mum Lisa Radio aid Deaf role on daughter’s myth busting models in the moderate world of work deafness Spring 2017 Issue 44 New articles inside! I feel strongly that BSL is important for Anwyn’s confidence and identity. Reading the signs Why Anwyn chose to learn British Sign Language aged 14 Towards a world without barriers www.ndcs.org.uk School for Deaf Children 5-16 years Hamilton Lodge offers a full curriculum to deaf children aged 5-16 years in our school. We take a “child-centred communication” approach at Hamilton Lodge and we support the development of both English and British Sign Language. We focus our curriculum development on courses and accreditations that match the needs of individual pupils. We offer a range of GCSE, Entry Level, Functional Skills, Pathways, Unit Award courses and Signature sign language qualifications. We have a well-established Work Experience Programme and Duke of Edinburgh Award Scheme, both of which focus on individuals being able to build their independence skills, confidence and self-esteem. Further Education for Deaf New Specialist Provision for Deaf Young People 16 -19 years Children with Complex Needs Hamilton Lodge College provides the right stepping stone into In 2016, Hamilton Lodge opened this provision to ensure an independent and successful adult life. Based in the heart of that deaf pupils with more complex needs could access our a vibrant city, our college students are supported to make the education. most of the city’s facilities. With support some pupils are able to transition to our core We provide FE places in partnership with City College Brighton provision but some require a different curriculum and care & Hove, Plumpton College, and St John’s College. -

Beat the Credit Crunch with Alvin’S Stardust

learthe ni ng rep » Winter 2010 Viva the revolution! Festival promotes informal learning Welcome to No 10 … Apprentices meet their own minister Teaching the teachers Unions help combat bad behaviour Quick Reads exclusive Beat the credit crunch with Alvin’s stardust www.unionlearn.org.uk » Comment A celebration of 49 apprenticeships Last month unionlearn was at 10 Downing Street to celebrate apprenticeships. A packed event saw apprentices from a range of backgrounds and from a range of unions mixing with guests and ministers. The enjoyable and inspiring evening showed off the benefits of apprenticeships and brought together some exceptional young people. Three of the apprentices (Adam Matthews from the PFA and Cardiff City FC; Leanne Talent from UNISON and Merseytravel; Richard Sagar from Unite and Eden Electrics) addressed the audience and impressed everyone there. A big thank to them for their professionalism and eloquence when speaking on the day. 10 14 A thank you too to ministers Kevin Brennan, Pat McFadden and Iain Wright for joining us, as well as Children’s Secretary Ed Balls and 16 Business Secretary Lord Mandelson. A strong commitment to support and expand apprentices was given by Gordon Brown, which was warmly welcomed by all those there. In this issue of The Learning Rep , you will find a full report of the Downing Street event with some great photographs of the apprentices. 18 28 We’ve decided to make this issue an apprentices special and it includes interviews with Richard, Leanne and Adam who spoke at the Downing Contents: Street event as well as an interview with Kevin 3 24 Brennan, the apprentices minister. -

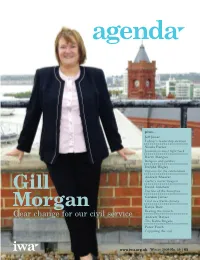

Gill Morgan, Is Dealing with Whitehall Arrogance

plus… Jeff Jones Labour’s leadership election Nicola Porter Journalism must fight back Barry Morgan Religion and politics Dafydd Wigley Options for the referendum Andrew Shearer Garlic’s secret weapon Gill David Culshaw Decline of the honeybee Gordon James Coal in a warm climate Morgan Katija Dew Beating the crunch Gear change for our civil service Andrew Davies The Kafka Brigade Peter Finch Capturing the soul www.iwa.org.uk Winter 2009 No. 39 | £5 clickonwales ! Coming soon, our new website www. iwa.or g.u k, containing much more up-to-date news and information and with a freshly designed new look. Featuring clickonwales – the IWA’s new online service providing news and analysis about current affairs as it affects our small country. Expert contributors from across the political spectrum will be commissioned daily to provide insights into the unfolding drama of the new 21 st Century Wales – whether it be Labour’s leadership election, constitutional change, the climate change debate, arguments about education, or the ongoing problems, successes and shortcomings of the Welsh economy. There will be more scope, too, for interactive debate, and a special section for IWA members. Plus: Information about the IWA’s branches, events, and publications. This will be the must see and must use Welsh website. clickonwales and see where it takes you. clickonwales and see how far you go. The Institute of Welsh Affairs gratefully acknowledges core funding from the Joseph Rowntree Charitable Trust , the Esmée Fairbairn Foundation and the Waterloo Foundation . The following organisations are corporate members: Private Sector • Principality Building Society • The Electoral Commission Certified Accountants • Abaca Ltd • Royal Hotel Cardiff • Embassy of Ireland • Autism Cymru • Beaufort Research • Royal Mail Group Wales • Fforwm • Cartrefi Cymunedol / • Biffa Waste Services Ltd • RWE NPower Renewables • The Forestry Commission Community Housing Cymru • British Gas • S. -

Wednesday 8 February 2017 COMMITTEE of the WHOLE HOUSE PROCEEDINGS

1 SUPPLEMENT TO THE VOTES AND PROCEEDINGS Wednesday 8 February 2017 COMMITTEE OF THE WHOLE HOUSE PROCEEDINGS EUROPEAN UNION (NOTICE OF WITHDRAWAL) BILL [THIRD DAY] GLOSSARY This document shows the fate of each clause, schedule, amendment and new clause. The following terms are used: Agreed to: agreed without a vote. Agreed to on division: agreed following a vote. Negatived: rejected without a vote. Negatived on division: rejected following a vote. Not called: debated in a group of amendments, but not put to a decision. Not moved: not debated or put to a decision. Question proposed: debate underway but not concluded. Withdrawn after debate: moved and debated but then withdrawn, so not put to a decision. Not selected: not chosen for debate by the Chair. NEW CLAUSES AND NEW SCHEDULES RELATING TO THE PRIORITIES IN NEGOTIATIONS FOR THE UNITED KINGDOM’S WITHDRAWAL FROM THE EUROPEAN UNION; CLAUSES 1 AND 2; REMAINING NEW CLAUSES; REMAINING NEW SCHEDULES; REMAINING PROCEEDINGS IN COMMITTEE NEW CLAUSES AND NEW SCHEDULES RELATING TO THE PRIORITIES IN NEGOTIATIONS FOR THE UNITED KINGDOM’S WITHDRAWAL FROM THE EUROPEAN UNION Jeremy Corbyn Mr Nicholas Brown Keir Starmer Paul Blomfield Jenny Chapman 2 Committee of the whole House Proceedings: 8 February 2017 European Union (Notice of Withdrawal) Bill, continued Matthew Pennycook Mr Graham Allen Ian Murray Ann Clwyd Valerie Vaz Heidi Alexander Stephen Timms Mike Gapes Liz Kendall Mr Ben Bradshaw Mrs Madeleine Moon Angela Smith Stephen Doughty Owen Smith Sarah Champion Mr Clive Betts Helen Goodman Seema -

Z675928x Margaret Hodge Mp 06/10/2011 Z9080283 Lorely

Z675928X MARGARET HODGE MP 06/10/2011 Z9080283 LORELY BURT MP 08/10/2011 Z5702798 PAUL FARRELLY MP 09/10/2011 Z5651644 NORMAN LAMB 09/10/2011 Z236177X ROBERT HALFON MP 11/10/2011 Z2326282 MARCUS JONES MP 11/10/2011 Z2409343 CHARLOTTE LESLIE 12/10/2011 Z2415104 CATHERINE MCKINNELL 14/10/2011 Z2416602 STEPHEN MOSLEY 18/10/2011 Z5957328 JOAN RUDDOCK MP 18/10/2011 Z2375838 ROBIN WALKER MP 19/10/2011 Z1907445 ANNE MCINTOSH MP 20/10/2011 Z2408027 IAN LAVERY MP 21/10/2011 Z1951398 ROGER WILLIAMS 21/10/2011 Z7209413 ALISTAIR CARMICHAEL 24/10/2011 Z2423448 NIGEL MILLS MP 24/10/2011 Z2423360 BEN GUMMER MP 25/10/2011 Z2423633 MIKE WEATHERLEY MP 25/10/2011 Z5092044 GERAINT DAVIES MP 26/10/2011 Z2425526 KARL TURNER MP 27/10/2011 Z242877X DAVID MORRIS MP 28/10/2011 Z2414680 JAMES MORRIS MP 28/10/2011 Z2428399 PHILLIP LEE MP 31/10/2011 Z2429528 IAN MEARNS MP 31/10/2011 Z2329673 DR EILIDH WHITEFORD MP 31/10/2011 Z9252691 MADELEINE MOON MP 01/11/2011 Z2431014 GAVIN WILLIAMSON MP 01/11/2011 Z2414601 DAVID MOWAT MP 02/11/2011 Z2384782 CHRISTOPHER LESLIE MP 04/11/2011 Z7322798 ANDREW SLAUGHTER 05/11/2011 Z9265248 IAN AUSTIN MP 08/11/2011 Z2424608 AMBER RUDD MP 09/11/2011 Z241465X SIMON KIRBY MP 10/11/2011 Z2422243 PAUL MAYNARD MP 10/11/2011 Z2261940 TESSA MUNT MP 10/11/2011 Z5928278 VERNON RODNEY COAKER MP 11/11/2011 Z5402015 STEPHEN TIMMS MP 11/11/2011 Z1889879 BRIAN BINLEY MP 12/11/2011 Z5564713 ANDY BURNHAM MP 12/11/2011 Z4665783 EDWARD GARNIER QC MP 12/11/2011 Z907501X DANIEL KAWCZYNSKI MP 12/11/2011 Z728149X JOHN ROBERTSON MP 12/11/2011 Z5611939 CHRIS