Chapter 2: Annex

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

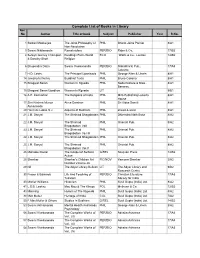

Complete List of Books in Library Acc No Author Title of Book Subject Publisher Year R.No

Complete List of Books in Library Acc No Author Title of book Subject Publisher Year R.No. 1 Satkari Mookerjee The Jaina Philosophy of PHIL Bharat Jaina Parisat 8/A1 Non-Absolutism 3 Swami Nikilananda Ramakrishna PER/BIO Rider & Co. 17/B2 4 Selwyn Gurney Champion Readings From World ECO `Watts & Co., London 14/B2 & Dorothy Short Religion 6 Bhupendra Datta Swami Vivekananda PER/BIO Nababharat Pub., 17/A3 Calcutta 7 H.D. Lewis The Principal Upanisads PHIL George Allen & Unwin 8/A1 14 Jawaherlal Nehru Buddhist Texts PHIL Bruno Cassirer 8/A1 15 Bhagwat Saran Women In Rgveda PHIL Nada Kishore & Bros., 8/A1 Benares. 15 Bhagwat Saran Upadhya Women in Rgveda LIT 9/B1 16 A.P. Karmarkar The Religions of India PHIL Mira Publishing Lonavla 8/A1 House 17 Shri Krishna Menon Atma-Darshan PHIL Sri Vidya Samiti 8/A1 Atmananda 20 Henri de Lubac S.J. Aspects of Budhism PHIL sheed & ward 8/A1 21 J.M. Sanyal The Shrimad Bhagabatam PHIL Dhirendra Nath Bose 8/A2 22 J.M. Sanyal The Shrimad PHIL Oriental Pub. 8/A2 Bhagabatam VolI 23 J.M. Sanyal The Shrimad PHIL Oriental Pub. 8/A2 Bhagabatam Vo.l III 24 J.M. Sanyal The Shrimad Bhagabatam PHIL Oriental Pub. 8/A2 25 J.M. Sanyal The Shrimad PHIL Oriental Pub. 8/A2 Bhagabatam Vol.V 26 Mahadev Desai The Gospel of Selfless G/REL Navijvan Press 14/B2 Action 28 Shankar Shankar's Children Art FIC/NOV Yamuna Shankar 2/A2 Number Volume 28 29 Nil The Adyar Library Bulletin LIT The Adyar Library and 9/B2 Research Centre 30 Fraser & Edwards Life And Teaching of PER/BIO Christian Literature 17/A3 Tukaram Society for India 40 Monier Williams Hinduism PHIL Susil Gupta (India) Ltd. -

U.S. and Affiliates, Bermuda and Bahamas

U.S. and Affiliates, Bermuda and Bahamas 65533 District 1 A PAULINE ABADILLA DORIE ARCHETA ELNA AVELINO #### BOBBY BAKER KRISTA BOEHM THOMAS CARLSON #### ARTHUR DILAY ASHLEY HOULIHAN KIM KAVANAGH #### THERESA KUSTA ELENA MAGUAD MARILYN MC LEAN #### DAVID NEUBAUER VICKY SANCHEZ MARIA SCIACKITANO #### RICHARD ZAMLYNSKI #### 65535 District 1 CN CAROLYN GOSHEN BRIAN SCHWARZ PATRICIA TAYLOR #### 65536 District 1 CS KIMBERLY HAMMOND MARK SMITH #### 65537 District 1 D KENNETH BRAMER KARLA BURN TOM HART #### BETSY JOHNSON C. SKOOG #### 65539 District 1 F DAVID GAYTON RACHEL PERKOWITZ LIZZET STONE #### RAYMOND SZULL JOYCE VOLL MICHAEL WITKOWSKI #### 65540 District 1 G GARY EVANS #### 65541 District 1 H BRENDA BIERI JO ANNE NELSON JERRY PEABODY #### GLENN POTTER JERRY PRINE #### Monday, July 02, 2018 Page 1 of 210 Silver Centennial Awards U.S. and Affiliates, Bermuda and Bahamas 65542 District 1 J SHAWN BLOBAUM SEAN BRIODY GREG CLEVENGER #### MITCHELL COHEN TONI HOARLE KEVIN KELLY #### DONALD MC COWAN JAMES WORDEN #### 65545 District 2 T1 MELISSA MARTINEZ MIKE RUNNING SHAWN WILHELM #### RE DONN WOODS #### 65546 District 2 T2 ROBERT CLARK RANDAL PEBSWORTH TOM VERMILLION #### 65547 District 2 T3 JOHN FEIGHERY TARA SANCHEZ #### 65548 District 2 E1 BRYAN ALLEN KENNETH BAKER JAMES BLAYLOCK #### STACY CULLINS SONYA EDWARDS JANNA LEDBETTER #### JOE EDD LEDBETTER KYLE MASTERS LYNDLE REEVES #### JAMES SENKEL CAROLYN STROUD HUGH STROUD #### DIANA THEALL CYNTHIA WATSON #### 65549 District 2 E2 JERRY BULLARD JIMMIE BYROM RALPH CANO #### CHRISANNE CARRINGTON SUE CLAYTON RODNEY CLAYTON #### GARY GARCIA THOMAS HAYFORD TINA JACOBSEN #### JOHN JEFFRIES JOANNA KIMBRELL ELOY LEAL #### JEREMY LONGORIA COURTNEY MCLAUGHLIN LAURIS MEISSNER #### DARCIE MONTGOMERY KINLEY MURRAY CYNTHIA NAPPS #### SIXTO RODRIGUEZ STEVE SEWELL WILLIAM SEYBOLD #### DORA VASQUEZ YOLANDA VELOZ CLIFFORD WILLIAMSON #### LINDA WOODHAM #### Monday, July 02, 2018 Page 2 of 210 Silver Centennial Awards U.S. -

Driving the Change from Computers to Computerisation

Driving the Change from Computers to Computerisation Excerpts from the book Icons of Indian IT By by Anand Parthasarathy & S Sadagopan 2018 / 148 pages / Hardcover / Rs. 1995 ISBN: 978-8183284851 / Wisdom Tree Prof Mahabala never saw himself as just an academic, so while he helped to set up the first mainframe computers in India’s leading engineering institutions, he also assisted in opening them up for research and industrial use. At the Indian Institutes of Technology (IIT) at Kanpur and Madras (now Chennai) and at the Computer Society of India (CSI), he kick- started the computer revolution and ensured it permeated every facet of societal change in India. Fresh from Canada, where he had obtained his doctorate in Electrical Engineering, Mahabala together with V Rajaraman and HK Kesavan, played a pioneering role in shaping IIT Kanpur into a crucible of Computer Science. When Mahabala finished his doctorate in electrical engineering in 1964 at the University of Saskatchewan, Canada, he took a few days off to visit the IBM plant in Don Mills, Ontario. ‘I saw an IBM 1620 being tested prior to shipping. It carried a placard “CAWNPORE”. I was told that it was being sent to IIT Kanpur, and was, in fact, the first computer to be installed in an educational institution in India,’ he recounts. By one of those happy coincidences, Mahabala ended up in the same institution. He got a telegram from IIT Kanpur— ‘Come and join as an assistant professor’. He later found out this was the work of Prof HK Kesavan of the electrical engineering department, with whom he had interacted briefly on a previous short visit. -

CIN Company Name

CIN L85195TG1984PLC004507 Company Name DR.REDDY'S LABORATORIES LTD Date Of AGM(DD-MON-YYYY) 31-JUL-2015 Sum of unpaid and unclaimed dividend 7304520 Sum of interest on unpaid and unclaimed dividend 0 Sum of matured deposit 0 Sum of interest on matured deposit 0 Sum of matured debentures 0 Sum of interest on matured debentures 0 Sum of application money due for refund 0 Sum of interest on application money due for refund 0 First Name Middle Name Last Name Father/Husb Father/Husba Father/Husband Address Country State District PINCode Folio Number of Investment Type Amount Proposed Date of and First nd Middle Last Name Securities Due(in Rs.) transfer to IEPF Name Name (DD-MON-YYYY) NEETA NARENDRA SHAH NA NA NA CHANDRIKA APT.,SHINGADAINDIA TALAV,W.NO.4016,,NASIKMAHARASHTRA NASIK 1201750200019180Amount for unclaimed and unpaid 150.00dividend30-AUG-2020 ARUN KUMAR RADHAKRISHAN A-40,(60.MEATER),POCKET-00,,SECTOR-2,ROHINI,DELHIINDIA Delhi Delhi A00001 Amount for unclaimed and unpaid 180.00dividend30-AUG-2020 AVINASH BALWANT DEV BALWANT 1 JASMIN APARTMENTS,NEWINDIA PANDIT MAHARASHTRACOLONY GANGAPUR ROAD,NASIK,NASIKNASIK A00403 Amount for unclaimed and unpaid dividend60.00 30-AUG-2020 A RAVI KUMAR A KAMESWAR RAO DR. REDDY'S LABORATORIESINDIA LTD.,C/O WEST PRADEEP BENGAL ENTERPRISE,3RDKOLKATA FLOOR, 5, KUSTIA ROAD, TILJALA,KOLKATA - 39 A01423 Amount for unclaimed and unpaid 300.00dividend30-AUG-2020 BHAVANJI M SHAH MANAKCHAND SHAH C/O RAJESH TIMEBERINDIA TRADERS,171, TRPLICANETAMIL NADU HIGH ROAD,IEE HOUSE,CHENNAICHENNAI B00206 Amount for unclaimed -

53Rd AIIMS ANNUAL REPORT 2008–2009

53rd AIIMS ANNUAL REPORT 2008–2009 All India Institute of Medical Sciences New Delhi 110029 Edited jointly by: Dr Sunil Chumber, Additional Professor, Department of Surgical Disciplines and Sub-Dean (Academic) Dr Tanuj Dada, Associate Professor, Dr R.P. Centre for Ophthalmic Sciences Dr Venkata Karthikeyan C, Assistant Professor, Department of Otorhinolaryngology (ENT) Dr S.K. Maulik, Professor, Department of Pharmacology Dr Raj D. Mehra, Professor, Department of Anatomy Dr Kameshwar Prasad, Professor, Department of Neurology Dr S. Rastogi, Professor, Department of Orthopaedics Dr Sushma Sagar, Assistant Professor, JPNA Trauma Centre Dr Peush Sahni, Professor, Department of Gastrointestinal Surgery Dr Pratap Sharan, Professor, Department of Psychiatry Dr D.N. Sharma, Assistant Professor, Dr BRA, Institute Rotary Cancer Hospital Dr Subrata Sinha, Professor and Head, Department of Biochemistry Dr Sanjay Kumar Sood, Assistant Professor, Department of Physiology Dr Sachin Talwar, Assistant Professor, Department of C.T.V.S. February 2010 Printed at Saurabh Printers Pvt. Ltd., A-16, Sector-IV, NOIDA (U.P.) All India Institute of Medical Sciences The All India Institute of Medical Sciences (AIIMS) was established in 1956 as an institution of national importance by an Act of Parliament with the objects to develop patterns of teaching in undergraduate and postgraduate medical education in all its branches so as to demonstrate a high standard of medical education to all medical colleges and other allied institutions in India; to bring together in one place educational facilities of the highest order for the training of personnel in all important branches of health activity and to attain self-sufficiency in postgraduate medical education. -

Annual Report 2014–15 © 2015 National Council of Applied Economic Research

National Council of Applied Economic Research Annual Report Annual Report 2014–15 2014–15 National Council of Applied Economic Research Annual Report 2014–15 © 2015 National Council of Applied Economic Research August 2015 Published by Dr Anil K. Sharma Secretary & Head Operations and Senior Fellow National Council of Applied Economic Research Parisila Bhawan, 11 Indraprastha Estate New Delhi 110 002 Telephone: +91-11-2337-9861 to 3 Fax: +91-11-2337-0164 Email: [email protected] www.ncaer.org Compiled by Jagbir Singh Punia Coordinator, Publications Unit ii | NCAER Annual Report 2014-15 NCAER | Quality . Relevance . Impact The National Council of Applied Economic Research, or NCAER as it is more commonly known, is India’s oldest and largest independent, non-profit, economic policy research institute. It is also one of a handful of think tanks globally that combine rigorous analysis and policy outreach with deep data collection capabilities, especially for household surveys. NCAER’s work falls into four thematic NCAER’s roots lie in Prime Minister areas: Nehru’s early vision of a newly- independent India needing independent • Growth, macroeconomics, trade, institutions as sounding boards for international finance, and economic the government and the private sector. policy; Remarkably for its time, NCAER was • The investment climate, industry, started in 1956 as a public-private domestic finance, infrastructure, labour, partnership, both catering to and funded and urban; by government and industry. NCAER’s • Agriculture, natural resource first Governing Body included the entire management, and the environment; and Cabinet of economics ministers and • Poverty, human development, equity, the leading lights of the private sector, gender, and consumer behaviour. -

An Indian Summer: Corruption, Class, and the Lokpal Protests

Article Journal of Consumer Culture 2015, Vol. 15(2) 221–247 ! The Author(s) 2013 An Indian summer: Reprints and permissions: sagepub.co.uk/journalsPermissions.nav Corruption, class, and DOI: 10.1177/1469540513498614 the Lokpal protests joc.sagepub.com Aalok Khandekar Department of Technology and Society Studies, Faculty of Arts and Social Sciences, Maastricht University, The Netherlands Deepa S Reddy Anthropology and Cross-Cultural Studies, University of Houston-Clear Lake, USA and Human Factors International Abstract In the summer of 2011, in the wake of some of India’s worst corruption scandals, a civil society group calling itself India Against Corruption was mobilizing unprecedented nation- wide support for the passage of a strong Jan Lokpal (Citizen’s Ombudsman) Bill by the Indian Parliament. The movement was, on its face, unusual: its figurehead, the 75-year- old Gandhian, Anna Hazare, was apparently rallying urban, middle-class professionals and youth in great numbers—a group otherwise notorious for its political apathy. The scale of the protests, of the scandals spurring them, and the intensity of media attention generated nothing short of a spectacle: the sense, if not the reality, of a united India Against Corruption. Against this background, we ask: what shared imagination of cor- ruption and political dysfunction, and what political ends are projected in the Lokpal protests? What are the class practices gathered under the ‘‘middle-class’’ rubric, and how do these characterize the unusual politics of summer 2011? Wholly permeated by routine habits of consumption, we argue that the Lokpal protests are fundamentally structured by the impulse to remake social relations in the image of products and ‘‘India’’ itself into a trusted brand. -

India Policy Forum July 12–13, 2016

Programme, Authors, Chairs, Discussant and IPF Panel Members India Policy Forum July 12–13, 2016 NCAER | National Council of Applied Economic Research 11 IP Estate, New Delhi 110002 Tel: +91-11-23379861–63, www.ncaer.org NCAER | Quality . Relevance . Impact NCAER is celebrating its 60th Anniversary in 2016-17 Tuesday, July 12, 2016 Seminar Hall, 1st Floor, India International Centre, New Wing, New Delhi 8:30 am Registration, coffee and light breakfast 9:00–9:30 am Introduction and welcome Shekhar Shah, NCAER Keynote Remarks Amitabh Kant, CEO, NITI Aayog 9:30–11:00 am The Indian Household Savings Landscape [Paper] [Presentation] Cristian Badarinza, National University of Singapore Vimal Balasubramaniam & Tarun Ramadorai, Saïd Business School, Oxford & NCAER Chair Barry Bosworth, Brookings Institution Discussants Rajnish Mehra, University of Luxembourg, NCAER & NBER [Presentation] Nirvikar Singh, University of California, Santa Cruz & NCAER [Presentation] 11:00–11:30 am Tea 11:30 am–1:00 pm Measuring India’s GDP growth: Unpacking the Analytics & Data Issues behind a Controversy that Refuses to Go Away [Paper] [Presentation] R Nagaraj, Indira Gandhi Institute of Development Research T N Srinivasan, Yale University Chair Indira Rajaraman, Member, 13th Finance Commission Discussants Pronab Sen, Former Chairman, National Statistical Commission & Chief Statistician, Govt. of India; India Growth Centre B N Goldar, Institute of Economic Growth [Presentation] 1:00–2:00 pm Lunch 2:00–3:30 pm Early Childhood Development in India: Assessment & Policy -

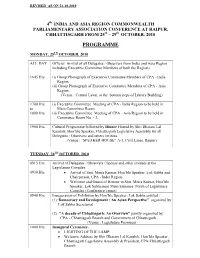

Chhattisgarh Legislative Assembly for All Delegates / Observers and Others Invitees

REVISED AS ON 24-10-2010 4th INDIA AND ASIA REGION COMMONWEALTH PARLIAMENTARY ASSOCIATION CONFERENCE AT RAIPUR, CHHATTISGARH FROM 25th – 29th OCTOBER, 2010 PROGRAMME MONDAY, 25TH OCTOBER, 2010 ALL DAY Official Arrival of all Delegates / Observers from India and Asia Region including Executive Committee Members of both the Regions. 1645 Hrs. (i) Group Photograph of Executive Committee Members of CPA - India Region. (ii) Group Photograph of Executive Committee Members of CPA - Asia Region. (Venue : Central Lawn, at the bottom steps of Library Building) 1700 Hrs. (i) Executive Committee Meeting of CPA - India Region to be held in to Main Committee Room. 1800 Hrs. (ii) Executive Committee Meeting of CPA - Asia Region to be held in Committee Room No. - 2. 1900 Hrs. Cultural Programme followed by Dinner Hosted by Shri Dharam Lal Kaushik, Hon’ble Speaker, Chhattisgarh Legislative Assembly for all Delegates / Observers and others invitees. (Venue : “SPEAKER HOUSE” A-1, Civil Lines, Raipur) TUESDAY, 26TH OCTOBER, 2010 0915 Hrs. Arrival of Delegates / Observers / Spouse and other invitees at the Legislature Complex. 0930 Hrs. • Arrival of Smt. Meira Kumar, Hon’ble Speaker, Lok Sabha and Chairperson, CPA - India Region. • Welcome and Guard of Honour to Smt. Meira Kumar, Hon’ble Speaker, Lok Sabha near Main Entrance Porch of Legislature Complex (Conference venue) 0940 Hrs. Inauguration of Exhibition by Hon’ble Speaker, Lok Sabha entitled : (1)“Democracy and Development : An Asian Perspective” organized by Lok Sabha Secretariat. (2) "A decade of Chhattisgarh: An Overview" jointly organized by CPA - Chhattisgarh Branch and Government of Chhattisgarh. (Venue : Legislature Premises) 1000 Hrs. Inaugural Ceremony- • LIGHTING OF THE LAMP. -

Binoy Viswam New Delhi - 110 001 Member of Parliament

116, North Avenue Binoy Viswam New Delhi - 110 001 Member of Parliament (Rajya Sabha) CALL FOR APPLICATION INTERNSHIP OPPORTUNITY UNDER MEMBER OF PARLIAMENT The office of Rajya Sabha MP Binoy Viswam is offering two internship positions to work in the office of the MP for a minimum period of 2 Parliament sessions starting with the Monsoon Session of 2021. About the MP: Com. Binoy Viswam represents the state of Kerala in the Rajya Sabha and is the Secretary of the National Council, Communist Party of India. He is a member of the Standing Committees on Science and Technology, Environment, Forests and Climate Change in the Parliament. With over 40 years of political experience, Com. Binoy Viswam has previously served as the Minister for Forests and Housing in the Kerala Government (2006-2011) and was a 2 time MLA 2001-2011 in the Kerala Legislative Assembly(2001- 2011). He is actively engaged in issues relating to social justice, human rights, education, health, workers’ rights, environment, gender equality, science and technology, amongst others. About the Internship: The internship provides a unique exposure to the contours of public policy and law making through the lens of a parliamentarian. The primary role of the intern would be to provide extensive research support to the MP for his various works and would also include drafting parliamentary questions for the MP, preparing speeches for zero hour debates, raising matters of public importance, drafting private members' bills etc. In addition, the internship also provides the opportunity to engage with leading experts in various fields on important public policy and developmental issues. -

Statistical Report General Election, 1998 The

STATISTICAL REPORT ON GENERAL ELECTION, 1998 TO THE LEGISLATIVE ASSEMBLY OF MADHYA PRADESH ELECTION COMMISSION OF INDIA NEW DELHI Election Commission of India – State Elections, 1998 Legislative Assembly of Madhya Pradesh STATISCAL REPORT ( National and State Abstracts & Detailed Results) CONTENTS SUBJECT Page No. Part – I 1. List of Participating Political Parties 1 - 2 2. Other Abbreviations And Description 3 3. Highlights 4 4. List of Successful Candidates 5 - 12 5. Performance of Political Parties 13 - 14 6. Candidate Data Summary 15 7. Electors Data Summary 16 8. Women Candidates 17 - 25 9. Constituency Data Summary 26 - 345 10. Detailed Results 346 - 413 Election Commission of India-State Elections, 1998 to the Legislative Assembly of MADHYA PRADESH LIST OF PARTICIPATING POLITICAL PARTIES PARTYTYPE ABBREVIATION PARTY NATIONAL PARTIES 1 . BJP Bharatiya Janata Party 2 . BSP Bahujan Samaj Party 3 . CPI Communist Party of India 4 . CPM Communist Party of India (Marxist) 5 . INC Indian National Congress 6 . JD Janata Dal (Not to be used in General Elections, 1999) 7 . SAP Samata Party STATE PARTIES 8 . ICS Indian Congress (Socialist) 9 . INLD Indian National Lok Dal 10 . JP Janata Party 11 . LS Lok Shakti 12 . RJD Rashtriya Janata Dal 13 . RPI Republican Party of India 14 . SHS Shivsena 15 . SJP(R) Samajwadi Janata Party (Rashtriya) 16 . SP Samajwadi Party REGISTERED(Unrecognised ) PARTIES 17 . ABHM Akhil Bharat Hindu Mahasabha 18 . ABJS Akhil Bharatiya Jan Sangh 19 . ABLTC Akhil Bhartiya Lok Tantrik Congress 20 . ABMSD Akhil Bartiya Manav Seva Dal 21 . AD Apna Dal 22 . AJBP Ajeya Bharat Party 23 . BKD(J) Bahujan Kranti Dal (Jai) 24 . -

The Lockdown to Contain the Coronavirus Outbreak Has Disrupted Supply Chains

JOURNALISM OF COURAGE SINCE 1932 The lockdown to contain the coronavirus outbreak has disrupted supply chains. One crucial chain is delivery of information and insight — news and analysis that is fair and accurate and reliably reported from across a nation in quarantine. A voice you can trust amid the clanging of alarm bells. Vajiram & Ravi and The Indian Express are proud to deliver the electronic version of this morning’s edition of The Indian Express to your Inbox. You may follow The Indian Express’s news and analysis through the day on indianexpress.com eye THE SUNDAY EXPRESSMAGAZINE Find Me on a NEWDELHI,LATECITY Hill in Imphal AUGUST30,2020 ‘Battlefield diggers’ look for 18PAGES,`6.00 remains of soldierswho died (`8PATNA&RAIPUR,`12SRINAGAR) in Manipur hills in WWII DAILY FROM: AHMEDABAD, CHANDIGARH,DELHI,JAIPUR, KOLKATA, LUCKNOW, MUMBAI, NAGPUR, PUNE, VADODARA WWW.INDIANEXPRESS.COM PAGES 15, 16, 17 Reliance Retail adds UNLOCK 4.0: CENTRE’S GUIDELINES Future Group firms MetrotostartSept7,no to its shopping cart statelockdownsoutside D Sale of Big Bazaar, E Whythis Easyday part of iskeyto PLAIN E containmentzones ● RILplans Rs 24,713-cr deal EX THE DEAL strengthens Studentscan visitschools, colleges; PRANAVMUKUL& RIL’sposition in the coun- WHAT’SALLOWED GEORGEMATHEW try’s retail ecosystem by gatherings of up to 100fromSept21 ■ MetrofromSept7 NEWDELHI,MUMBAI, enabling it to control ■ Congregations of up AUGUST29 nearly athirdoforganised The Centrehas also allowedop- to 100peoplefromSept retail revenues, and also DEEPTIMANTIWARY eration