Houston Chronicle | Sunday, April 17,2016 |Houstonchronicle.Com and Chron.Com Section N Xx

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

City of Houston Invitation to Bid

CITY OF HOUSTON INVITATION TO BID Issued: March 27, 2020 BID OPENING Sealed bids (labelled with the company name, address and bid number), in duplicate will be received by the City Secretary of the City of Houston, in the City Hall Annex, Public Level, 900 Bagby Street, Houston, Texas 77002, until 10:30 a.m., Thursday, April 30, 2020. Once the award is made, a bid tabulation for this procurement may be posted and made publicly available on the Strategic Procurement Division’s website. All bids will be opened and publicly read in the City Council Chamber, City Hall Annex, Public Level, 900 Bagby Street at 11:00 AM on that date for the purchase of: ELECTRICAL MAINTENANCE, REPAIR, AUTOMATION SUPPORT AND TECHNICAL SERVICES FOR HOUSTON PUBLIC WORKS BID INVITATION NO.: S89-L29375 NIGP CODE: 910-82 MWBE GOAL 11% BUYER Questions regarding this solicitation document should be addressed to SueEllen Arredondo at 832.393.9131, or e-mail to [email protected]. ELECTRONIC BIDDING In order to submit a bid for the items associated with this procurement, vendor must fill in the pricing information on the “PLACE BID” page. PRE-BID CONFERENCE The City of Houston’s Strategic Procurement Division has decided to suspend ALL onsite Pre-Bid Conferences until further notice. Therefore, there will be a teleconference for this Pre-Bid at 10:00 a.m. on Wednesday, April 8, 2020. The dial in number is 425-436-6336, access code 136424. It is the bidder’s responsibility to ensure that they have secured and thoroughly reviewed all aspects of the bidding documents prior to the Pre-Bid teleconference. -

Winter-Spring 1994

28 C i t e 3 I 1 9 9 4 The mall before the roof was added in 1966. Gulf gain, view from loop 610 oaQtfga^ The BRUCE C. W E B B C i t e 3 1 : 1 9 9 4 29 Gulf gale in ihe lot e 1950s. HI-; PROJK.T of relocating vintage center - Houston's first regional America's urban life into shopping center, located at Houston's entirely new, free-floating sub- first freeway interchange - was designed urban forms, begun after and built before the ubiquitous mall for TWorld War II, was accomplished in such mula had been fully developed and codi- short order and is now so pervasive that it fied. Gulfgate defies expectation by being is difficult to see it as a process at all. lopsidedly organized: its two anchor stores, Sakowitz (emptied out when the Particularly in a city such as Houston, 1 whose character was established along the Sakowitz chain folded in the early eight- lines of a suburban model, growth has ies) and Joske's (now Dillard's) were become synonymous with sprawl, and the located side by side at one end of the Gulfgate: view from the southeast showing entrance to underground servke tunnel an right. automobile orientation is so deeply woven center, whereas the usual plan forms the into the spatial fabric that even coherent mall into a dumbbell, with the two high- remnants of the city past, when they are volume "magnet" stores at either end of preserved at all, are splintered and frag- an inside street. -

Agenda - Council Meeting - Wednesday - September 8, 2004 - 9:00 A

AGENDA - COUNCIL MEETING - WEDNESDAY - SEPTEMBER 8, 2004 - 9:00 A. M. COUNCIL CHAMBER - SECOND FLOOR - CITY HALL 901 BAGBY - HOUSTON, TEXAS with notes of action taken MOTIONS 2004-0971 to 2004-0989 2004-0970-1 ORDINANCES – 2004-0927 to 2004-0953 RESOLUTION – 2004-0017 DESCRIPTIONS OR CAPTIONS OF AGENDA ITEMS WILL BE READ BY THE CITY SECRETARY PRIOR TO COMMENCEMENT PRAYER AND PLEDGE OF ALLEGIANCE - Council Member Alvarado 9:00 A. M. - ROLL CALL ADOPT MINUTES OF PREVIOUS MEETING 9:30 A. M. - PUBLIC SPEAKERS - Pursuant to City Council Rule 8, City Council will hear from members of the public; the names and subject matters of persons who had requested to speak at the time of posting of this Agenda are attached; the names and subject matters of persons who subsequently request to speak may be obtained in the City Secretary’s Office MAYOR’S REPORTS CONSENT AGENDA NUMBERS 1 through 39 MISCELLANEOUS - NUMBERS 1 through 6 Council Member Holm presented the following written motion to amend proposed 2005 Capital Improvement Plan: “Amendment #1: FY 2005-2009 Capital Improvement Plan Deletion of D-0118 Houston Museum of African American Culture, unless alternative funding sources can be identified that create no impact on the general fund.” Council Members Galloway, Goldberg, Sekula-Gibbs, Wiseman, Lawrence, Khan and Alvarado Council Member Goldberg presented the following written motion to amend proposed 2005 Capital Improvement Plan: “Amendment to Agenda Item 1 Description of Project: Appropriate $2 million dollars for construction of the “Asia House” in FY 07.” Council Member Goldberg tagged Motion 2004-0981 – Suspend rules to hear from Firefighters in the audience Motion 2004-0982 – Suspend rules to remain in session to complete the Agenda AGENDA - SEPTEMBER 8, 2004 - PAGE 2 MISCELLANEOUS - continued 1. -

Houston LGBT History

•.••EEKEND PASS HOST HOTELS includes: c ••11 hotel. directly for re.ervatians FRIDFI".:I "MILITFlR".:IBFlLL" mention white party For epeclal rates ~ #OTheBritish Invasion'" UJ"::IN~HFlM HOT~ Boy George a,.Wayne G Poa'side [7 EiO]- 322 -EiO 00 e- i:lavid Knapp wyndham Ballroom n.wl.., .dd_d SFITlJRUFI".:I 'u..-«TE ~ 2CJI:3CJ" HILTON HOTEL LJ..J victor calderone [7 Ei0 ]-320- EiaEi a at The palm springe convention center MFlR![iJUIS HOTEL SUNDFI".:I "SUNSET T-DFINCE" [a 00]- 223 -:L 0 so 00..1phil EI with Live performance by AMBER LFI MFiNCHFI VILLFIS The Marquis park ill new and larqer location [aaa]- 52Ei- 2Ei2 •..• Weekend Pass S2DD.DD COMFOR! T INN [7 EiO ]-77 a-3Ei 99 PLFlTINUM lI.IEEKEND PFiSS MARRIOTT COUR T'::IARLl inc. prlarlt" U.I.P. entrillnc:. [7 EiO]- 322 - Ei:LOO to all main events.,.. e.- THURSii:JAII::I "WELCOME PFiRTII::::I" :3 Llays of unForgettable Pool Parties O..J Roland Be.mars with live Llj'S spinning at the FRILlAII::::I FOREPLAY "AFTER HOURS" UJyndham Hotel and Hilton Hotel LJ..JNeil Lewis FDA FIlA TRAVEL CALL SFiTURLlA'::::I "CLIMAX S" AFTER HOURS TMG[aaa]-993-0 •..••..0• 0 •..•Mark Anthony To order tickets By Phone please call SUNLlFlI::::I "CLOSING PARTY" i:J •..• Manny Lehman with i:J...J Sue poalside BOXOFFICEnKS 800 494 8497 I V.I •••••LDUNBII& at !II Main events Drder tickets on our website and InFormation Limited quantity available ••.$ 3 7 5 .CJCJ www.jeFFreysanker.coRl Dr ElEIEI 777 ElEIElEi spon.orad b.., •.•!...t. OUT ~B~~~I BACARDI ~ !-_~§_~ ~. -

Daily Court Review All Rights Reserved Become the First State in the Nation to Adopt Plan Approved by the Hawaii Legislature

AILY OURT EVIEW D CPublic Notices. Business Leads. R Thursday, May 7, 2015 Vol. 126 No. 5 Founded 1889 Houston, Texas $1.25 www.dailycourtreview.com IN THE NEWS Daily Oil train derailment prompts evacuation in ND town Ten tanker cars on the BNSF said. no immediate word on the cause of the wreck Review “The engine and cars that aren’t burning or on the source of the oil the train was car- Railway train caught fire have been decoupled and moved to safety,” rying. A statement from BNSF did not cite she said. the source, and officials did not immediately Citations – Civil Suits Firefighters from four area communities return calls from The Associated Press. By Blake Nicholson & Matt Brown responded to the fire, and regional hazardous Since 2006, the U.S. and Canada have CITATION BY The Associated Press materials teams from Grand Forks and Devils seen at least 24 oil train accidents involving a PUBLICATION Lake were sent to the scene, Fong said. A team fire, derailment or significant amount of fuel No. 2013-38352 of 10 investigators from the Federal Railroad spilled, according to federal accident records Plaintiff: n oil train derailed and caught fire Administration was expected to arrive on the reviewed by the AP. The derailment Wednes- Samantha Alvarez early Wednesday in a rural area of scene by mid-day Wednesday, said spokesman day was the fifth this year and comes less than Vs. Acentral North Dakota, prompting the Kevin Thompson. a week after the Department of Transportation Defendant: evacuation of a nearby town where about three The Environmental Protection Agency was announced a rule to toughen construction Jesus Chavez Vargas dozen people live. -

Recycling Dates Heavy Trash

Westbury Crier VOLUME 64, ISSUE 5 M A Y 2 0 1 9 Glass Curbside Recycling Is BACK! Keep Westbury Beautiful Good News Westbury! Glass Recycling is NOW ACCEPTED again in your green recycle bin for bi-weekly recycle collection. Yay! Two years ago the City of Houston Part 2 @ Hager Park stopped accepting glass in our green recycling bins. The change means that Saturday, May 4, 9AM-Noon Westbury residents can now conveniently once again place their clean glass items Bring the family out and help keep Westbury (clear, green, or brown glass) into their green recycle bins instead of driving Beautiful at Hager Park (next to Anderson elsewhere to recycle glass. Elementary) on Saturday, May 4, from 9AM The City of Houston is able to collect glass for recycle again due to a new contract to 12PM. We will be collecting trash, trim- with recycling contractor, Fomento de Construcciones y Contratas, Inc. (FCC), which ming trees, and mulching plants at Hager built a new recycling facility in northeast Houston. This new facility accepts recycling Park. See page 9 for more information. for the entire city, including Westbury. In 2018, Houston City Council selected FCC Meet at Hager Park between 8AM and 9AM after considering several proposals from competing recycling companies. The FCC to sign up. Bring the kids out to help and agreement saves taxpayers millions in recycling costs and expands the type of meet great neighbors! materials the City's Solid Waste Department can collect curbside. The FCC facility opened in March and has a 145,000 ton per year capacity, which is more than double the current needs of the City. -

BUYING OR SELLING AHOME? Visit Remax.Com

FUELFIX The wheeling and dealing in the oil patchgot off to afast startthis year. Page D26 BUSINESS HoustonChronicle @HoustonChron Houston Chronicle | Sunday, May4,2014 |HoustonChronicle.com and Chron.com Section D HOME PRICE SURVEY Foradetailedlook at how local subdivisions stack up,searchthe database and explorethe interactive maps at Chron.com/homepricedata.Alist of prices by subdivision starts on Page D9. The high hurdle forbuyersislow,low inventory SellersinmanydesirableHoustonneighborhoods Shaunessy have the advantageinablistering housing market Bostic and her fiance, By Nancy Sarnoff stacked flagstone fireplace friends and acquaintances Jordan in the living room and the on the PTOand hitsend. Riddick, One morning lasT earthy stone-covered wall Thesubject line: “Not list- started month, Melissa Levin in the redone kitchen, ed yet!! OldBraeswood lookingat droppedoffhertwoyoung Levin, aformer NewYork house for sale.” houses about children at school, drove publicist, described the Levin waseager for amonth ago. back home and satdown 1950s ranchas“modern- someone to buyher house, Theysay they at her computer to create a ized and remodeled for but shewasn’t ready to don’twant flier advertising her house luxury,”witha“swanky listitpublicly because she to be forced in OldBraeswood, an es- Sinatra-worthyMartini wasconcerned it would into making tablished neighborhood Happy Hour design.” sell before sheand her ahasty near the Texas Medical Sheattached her per- familyoffour were ready decision. Center with large homes sonallydesigned creation to move.They recently on oversized lots. to an email, typed in ad- bought ahouse in Bellaire Next to photos of the dresses of neighbors, Many continuesonD4 Gary Fountain NEIGHBORHOODS Cody Duty/HoustonChronicle The Lam family—Meadow,Herman, Autumn and Carrie —walkstoOak Forest Elementary School. -

Bomd-Nl-2014-March-Web

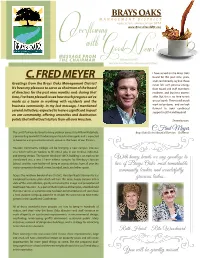

BRAYS OAKS MANAGEMENT DISTRICT neWSLetter - SPring editiON 2014 WWW.BraYSOAKSMD.Org MESSAGE FROM THE CHAIRMAN @BRAYSOAKSMD FACEBOOK.COM/BRAYSOAKSMANAGEMENTDISTRICT I have served on the Brays Oaks C. FRED MEYER board for the past nine years, and I can honestly say that I have Greetings from the Brays Oaks Management District! never felt such positive energy It’s been my pleasure to serve as chairman of the board from board and staff members, of directors for the past nine months and, during that residents, and business owners time, I’ve been pleased to see how much progress we’ve alike. But, this is no time to rest made as a team in working with residents and the on our laurels. There is still much business community. In my last message, I mentioned work to be done, and we look forward to your continued several initiatives expected to have a significant impact support in 2014 and beyond! on our community, offering amenities and destination points that will attract visitors from all over Houston. Sincerely yours, C.Fred Meyer The Levitt Pavilion, destined to bring outdoor concerts to Willow Waterhole, Brays Oaks District Board of Directors - Chairman is proceeding toward its fundraising and construction goals and is expected to become a major entertainment venue in the heart of our District. Houston Community College will be bringing a new campus into our area which will train workers to fill critical jobs in our medical, industrial, and energy sectors. The former Westland YMCA building is on track to be transformed into a new 15-acre athletic complex for Westbury Christian With heavy hearts we say goodbye to School, and this new facility will bring in young athletes from all over the two of Brays Oaks’ most remarkable city to compete in football, soccer, baseball, track, and other sports. -

TDLR COS Salons & Schools

TDLR COS Salons & Schools Based on TDLR - All Licenses LICENSE TYPE LICENSE NUMBER Cosmetology Beauty Salon 612598 Cosmetology Beauty Salon 613595 Cosmetology Beauty Salon 631623 Cosmetology Beauty Salon 633646 Cosmetology Beauty Salon 658360 Cosmetology Beauty Salon 658548 Cosmetology Beauty Salon 659055 Cosmetology Beauty Salon 662768 Cosmetology Beauty Salon 663302 Cosmetology Beauty Salon 666413 Cosmetology Beauty Salon 677126 Cosmetology Beauty Salon 680709 Cosmetology Beauty Salon 682894 Cosmetology Beauty Salon 688679 Cosmetology Beauty Salon 691704 Cosmetology Beauty Salon 693385 Cosmetology Beauty Salon 693813 Cosmetology Beauty Salon 694674 Cosmetology Beauty Salon 695065 Page 1 of 1673 09/28/2021 TDLR COS Salons & Schools Based on TDLR - All Licenses BUSINESS NAME LITTLE HAIR SHOP MARIA'S BEAUTY SALON SNIPPERS DIANE'S HAIR DESIGN ROBIN'S HAIR ATITUDES BEAUTY SALON BARBIE'S HAIR DESIGN LATIN CUTS SALON MATOS TOUCH OF GLORY HAIR DIMENSIONS ETC FAMILY CUTS CUTTIN UP STUDIO 105 TANGLES SALON 34 JASMINE'S PRO-CLIPS LUCY'S Page 2 of 1673 09/28/2021 TDLR COS Salons & Schools Based on TDLR - All Licenses LICENSE EXPIRATION DATE (MMDDCCYY) 01/31/2021 10/22/2021 06/20/2022 12/12/2022 04/17/2020 12/19/2022 05/12/2020 03/31/2022 05/14/2020 05/29/2023 04/30/2020 08/13/2023 08/26/2022 08/03/2023 03/30/2020 03/31/2022 04/30/2022 06/30/2022 09/25/2022 Page 3 of 1673 09/28/2021 TDLR COS Salons & Schools Based on TDLR - All Licenses MAILING ADDRESS LINE1 PO BOX 177 PO BOX 1314 276 LESLIEWOOD 120 MAIN ST 1335 E HIGHWAY 285 13122 VETERANS MEMORIAL -

![Cristo Rey Funeral Home 2]5 N. Sampson](https://docslib.b-cdn.net/cover/4466/cristo-rey-funeral-home-2-5-n-sampson-3484466.webp)

Cristo Rey Funeral Home 2]5 N. Sampson

-- ,.".....- -.•.--~ •.. Immediately Following Texas' Largest Pool Party, Join Your Hosts At... ,GI',.. V~JYIn' _1Aftb)~1 Na 11$1. ~Q. $.ep*' "itIftbI. ..•••••••••••••••• WIM'..... ·18 <> I" 'hn"e 1 art d Ro'n Juf f eI' .",.~ ItnQ"ll J"IlMIl 'I !I :. 'f1:11tt4rtlnez d'O Arn(t 1d ,.A\ *111. C!(:~ 'OarRI$11 "ure .avid Stevens .. JOfU!llt :Righter Hery (Ant u SUnda\l, f\./\a\l21 IIll1v 1d Setlw&rt z Ada. (Olllun· ',. " Ray West d(u, Er ieIU4:on No Cover [f r ell ~hjIIU,Q1 'e;; k;..H*n".l:en cash Bar 1\I:perlt at" Ken • • 2401 San Jacinto. Houston • 713~ Monday Nights > .. "~ 99~Frozen Margaritas iner And Author Mi<::flael Kasten Thursday Nights $3.00 - Mason Jar 36 CURRENT EVENTS Long Island Tea 55 ON OUR COVER Photographer James Franklin Brings Us Houston Hottie Jack George 61 BACKSTAGE 64 THAT WEEK IN TEXAS Inside The Pages Of lWT Magazine Twenty-Five Years Ago 72 TEXAS TEA See The People Who Crossed The Path Of Our Infamous CRUISE CAMERA And Where You Can Do The Same In The Week To Come 82 THEATER Reviewer Gary Laird And His Interesting Evening With Some Fat Men In Skirts 84 ON FILM Reviewer Steven Undsey Shows UsThe Beefcake And Highlights Houston's Gay And Lesbian Film Festival 88 CLASSIFIEDS 96 THE GUIDE A City By City Usting Of Clubs, Organizations And Our Adverlisers And Supporters All Across The Lone Star State No Cover & Tons of Free Parking Distributed weekly, free of Charge, in Abilene, Amarillo, Arlington, Austin, Beaumont, Brownsville, Bryan, College i()sJde the Shepherd Plaza Station, Corpus Christi. -

Becoming the Ranch House City

relatively short period of time. Houston grew at a phenom- Houston: Becoming enal rate during the decades immediately after World War II. Its population soared from 384,514 in 1940 to 1,595,138 in 1980.1 A booming economy fueled the growth, which city the Ranch House City leaders guided through an aggressive annexation policy. By Stephen James As late as the 1940s, Houston was a compact city of seventy-five square miles. Its boundaries extended no ouston is a vast city that spreads to the horizon in all farther than Kirby Drive on the west, Brays Bayou on the Hdirections. Gleaming commercial districts punctu- southwest, and Sims Bayou on the southeast. The Heights, ate its sprawl, but the landscape is a blanket of residential Rice Institute, and the new Texas Medical Center were neighborhoods. They define its architectural character. on the edge of town. Today, this area defines the urban They tell us how and when the city grew. core, a central business district ringed by the city’s earliest Every urban area reflects the architectural styles that pre- suburbs. A 1947 land use map (below) shows that most vailed during the years of its greatest growth. The industrial residential areas—highlighted in shades of gray accord- cities of the Northeast and Midwest, which boomed in the ing to density—developed on a grid pattern with small nineteenth century, are known for their many neighbor- compact lots.2 An informal survey of these areas today hoods of narrow row houses wrapped in picturesque brown- shows that architectural types varied according to income. -

THIS WEEK in TEXAS March 10-16, 1995 HIGHLIGHT the Austin Festival of Dance

THIS WEEK IN TEXAS March 10-16, 1995 HIGHLIGHT The Austin Festival of Dance THEATRE Jeffrey in Austin, The Night Larry Kramer Kissed Me and Scenes from My Love Life in Houston SONG & DANCE Vocal Ensemble Chanticleer Ends Texas Tour in Dallas plus CURRENT EVENTS LETTERS - TEXAS NEWS BACKSTAGE-SPORTS STARSCOPE - TEXAS TEA FRESH BEATS THE ROUND·UP SALOON " '~ IS presents tI "~Ak~~ ~.w;l ~"O+ st TUESDAY,.,,,.MARCH 14 '10:30 PM FEATURING ADULT CENTERFOLD AND COVER MODEL DAVID BURRILL SINGING THEIR HITS 'yS Repres~lIting "WHO'S NORMAL" • "LET THE WALLS FALL DOWN" SA • OLBA • TGRA "OUT TO DANCE" • "IS IT LOVE" AND MORE the Leather Knights • Cheer Dallas. ARC All Proceeds ToAIDS Resource Center / I)OILCANHARRY'S t4eptaee t6 k... ~ ~ ~ tI4! 3912 Cedar Springs • Dallas, Texas 75219 • 214-522-9611 211 West 4th Street • Austin, Texas • (512) 320·8823 From Broadway to the Village Station (Q)~ [E ~ U((jj[H]1r U~ [H][EAV[E[N Starring the National Touring Company of "HELLa DOLLY" The Hi-NRG Dance benefit event. Proceeds benefit Dallas' AIDS Resource Center and Broadway Cares (Equity Fights AIDS) WEDNESDAY, MARCH 22 VILLAGE STATION 3911 Ceda r Spri ngs, Dalias (214) 380 -3808 lOAM' SATURDAY, MARCH 18 AIDS FUNDING A5S0ClAnON CHIU COOKOFF VILLAGESTAnON PAnO VOLUME 21, NUMBER 1 MARCH 10 - MARCH 16, 1995 14 THEATRE Jeffrey In Austin Reviewed by Bruce Williams TheNight Larry Kramer KissedMe In Houston Reviewed by Susan McDonald Scenes from My Love Life In Houston Reviewed by Brent Shackley 29 SONG at DANCE A Cappella Ensemble Chanticleer EndsTexas Tour In Dallas