Mainstreet Investment Advisors, Llc

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The Power of Small State of Main Is Published As a Membership Benefi T of Main Street America, a Program of the National Main Street Center

A PUBLICATION OF MAIN STREET AMERICA WINTER 2018 The Power of Small State of Main is published as a membership benefi t of Main Street America, a program of the National Main Street Center. For information on how to join Main Street America, please visit mainstreet.org/main-street/join/. National Main Street Center, Inc. Patrice Frey President and CEO Board of Directors: Editorial Staff: Social Media: Ed McMahon, Chair Rachel Bowdon TWITTER: @NatlMainStreet Darryl Young, Vice Chair Editor in Chief Senior Manager of Content David J. Brown Development FACEBOOK: Kevin Daniels @NationalMainStreetCenter Emily Wallrath Schmidt Samuel B. Dixon Editor Joe Grills Associate Manager of INSTAGRAM: @NatlMainStreet Irvin M. Henderson Communications Laura Krizov Hannah White Contact: Mary Thompson Editor Tel.: 312.610.5611 Director of Outreach and Engagement Email: [email protected] Design: Website: mainstreet.org The Nimble Bee Main Street America has been helping revitalize older and historic commercial districts for more than 35 years. Today it is a network of more than 1,600 neighborhoods and communi- ties, rural and urban, who share both a commitment to place and to building stronger communities through preservation-based economic development. Main Street Ameri- ca is a program of the nonprofi t National Main Street Center, a subsidiary of the National Trust for Historic Preservation. © 2018 National Main Street Center, All Rights Reserved WINTER Table of contents 2018 3 President’s Note By Patrice Frey 5 Editor’s Note By Rachel Bowdon -

Detroit Media Guide Contents

DETROIT MEDIA GUIDE CONTENTS EXPERIENCE THE D 1 Welcome ..................................................................... 2 Detroit Basics ............................................................. 3 New Developments in The D ................................. 4 Destination Detroit ................................................... 9 Made in The D ...........................................................11 Fast Facts ................................................................... 12 Famous Detroiters .................................................. 14 EXPLORE DETROIT 15 The Detroit Experience...........................................17 Dearborn/Wayne ....................................................20 Downtown Detroit ..................................................22 Greater Novi .............................................................26 Macomb ....................................................................28 Oakland .....................................................................30 Itineraries .................................................................. 32 Annual Events ..........................................................34 STAYING WITH US 35 Accommodations (by District) ............................. 35 NAVIGATING THE D 39 Metro Detroit Map ..................................................40 Driving Distances ....................................................42 District Maps ............................................................43 Transportation .........................................................48 -

Mainstreet Advisors Financial Market Update

MainStreet Advisors MainStreet Advisors January 7, 2011 Financial Market Update [page 1] Economic Update Employment data released this week by the U.S. Labor Department reflected an unexpected decrease in the unemployment rate, which fell Economic Indicators, Quarterly Change from 9.8% to 9.4% in December, its lowest measure in 19 months. The 12.0% drop is not a purely positive sign, however, as a large portion of the decrease can be attributed to a third consecutive contraction in the labor 10.0% force as job-seekers continue to exit the market in the face of stagnating job prospects. Languid wage inflation and a payroll increase that failed 8.0% to meet consensus estimates contributed to the disappointing report. 6.0% Jobless claims data provided some positive news on the labor front, coming in under analyst estimates. The Challenger Job-Cut Report was 4.0% another bright spot, exhibiting the lowest amount of announced layoffs in over 10 years. 2.0% 0.0% Federal Reserve Chairman Ben Bernanke testified before the Senate Budget Committee on Friday, communicating an optimistic economic -2.0% outlook in his first address since revealing the details of the government’s Q4 09 Q1 10 Q2 10 Q3 10 second round of quantitative easing. Bernanke noted that there exists “increased evidence that a self-sustaining recovery in consumer and Real GDP Core CPI* Unemployment Rate business spending may be taking hold,” adding that it is likely the Source: Bureau of Economic Analysis, Bureau of Labor Statistics recovery will strengthen in 2011. In regard to concerns that were raised *Core CPI excludes energy and food prices from the calculation of the Consumer Price Index about the inflationary ramifications of the previously implemented bond- buying program, Bernanke ensured that the Fed is committed to keeping Jan. -

Detroit Media Guide Contents

DETROIT MEDIA GUIDE CONTENTS EXPERIENCE THE D 1 Welcome ..................................................................... 2 Detroit Basics ............................................................. 3 New Developments in The D ................................. 4 Destination Detroit ................................................... 9 Made in The D ...........................................................11 Fast Facts ................................................................... 12 Famous Detroiters .................................................. 14 EXPLORE DETROIT 15 The Detroit Experience...........................................17 Dearborn/Wayne ....................................................20 Downtown Detroit ..................................................22 Greater Novi .............................................................26 Macomb ....................................................................28 Oakland .....................................................................30 Itineraries .................................................................. 32 Annual Events ..........................................................34 STAYING WITH US 35 Accommodations (by District) ............................. 35 NAVIGATING THE D 39 Metro Detroit Map ..................................................40 Driving Distances ....................................................42 District Maps ............................................................43 Transportation .........................................................48 -

Main Street America™ Coordinating Programs Organized at the State

Main Street America™ Coordinating Programs Organized at the state, county, and city level, coordinating programs partner with the National Main Street Center to provide support and training to Main Street America communities across the country. Main Street Alabama Mary M. Helmer, CMSM P.O. Box 483 Birmingham, Alabama 35201 Phone: 205.910.8819 Email: [email protected] Main Street Arkansas Greg Phillips, Director 323 Center Street, Suite 1500 Little Rock, Arkansas 72201 Phone: 501.324.9887 Fax: 501.324.9192 Email: [email protected] Website: www.mainstreetarkansas.org California Main Street Alliance, administered by the National Main Street Center Amanda Elliott, Senior Program Officer and Director of California Programs 53 W. Jackson Blvd, Suite 350 Chicago, IL 60604 Phone: 312.610.5613 Fax: 202.588.6050 Email: [email protected] Website: www.californiamainstreet.org Colorado Main Street Program, Colorado Department of Local Affairs Gayle Langley, Main Street Coordinator 1313 Sherman Street, Room 521 Denver, Colorado 80203 Phone: 303.864.7728 Fax: 303.864.7759 Email: [email protected] Website: https://www.colorado.gov/pacific/dola/main-street-story Connecticut Main Street Center Patrick McMahon, President & CEO c/o Eversource PO Box 270 Hartford, CT 06141 Phone: 860.280.2023 Fax: 860.280.2202 Email: [email protected] Website: www.ctmainstreet.org Downtown Delaware, Delaware Economic Development Office Patty Cannon, Director of Special Projects 820 N. French St. 10th Floor Dover, -

Metro Detroit Relocation Guide 2021

P nt hot me o Co elop urte Dev sy of mic Macomb County Econo Visit us online at www.MetroDetroitArea.com Follow the DAILY PLUG for the Metro Detroit Area at www.facebook.com/dailyplugMetroDetroit DETROIT • WAYNE • OAKLAND • MACOMB GENESEE • LIVINGSTON • WASHTENAW Community Profiles.....................…4 Colleges & Universities..............68 What’s City of Detroit...........................6-8 Attractions.................................70 Wayne County.......................11-21 Parks……………………………….78 Inside Oakland County....................22-49 Basics........................................82 Macomb County....................50-61 Business Connections.................88 Livingston County................62-63 International Information...........91 O Genesee County....................64-65 Sports & Recreation....................96 u r Washtenaw County...............66-67 Health Care................................99 Sp ec ia l P art ner s LIKE IT FOLLOW IT www.facebook.com/dailyplugMetroDetroit Metro Detroit Relocation Guide™ PUBLISHER RESEARCH / EDITOR Lawrence A. Ribits Lynn Ribits Published Annually by Keaton Publications Group, LLC 8959 Sturgeon Bay Dr. • Harbor Springs, MI 49740 • (231) 537-3330 www.keatonpublications.com • e-mail: [email protected] The Metro Detroit Relocation Guide© is also published as Relocate 2 Metro Detroit™ by Keaton Publications Group, llc. Every effort has been made to ensure the accuracy of the information contained herein, however, it cannot be guaranteed. Copyright © 2005 – 2021 by Keaton Publications Group, llc. No part of this publication or the web-based Metro Detroit Relocation Guide© or Relocate 2 Metro Detroit™ may be reproduced or duplicated in any form without the expressed written permission of the publisher. COMMUNITY PROFILES Detroit • Wayne • Oakland • Macomb • Livingston • Genesee Welcome to Metro Detroit The Metro Detroit/Southeast Michigan area is made up of over 130 communities that provide a rich and diverse quality of life for its inhabitants. -

MICHIGAN MAIN STREET Director Manual

MICHIGAN MAIN STREET Director Manual TABLE OF CONTENTS GETTING TO KNOW THE MICHIGAN MAIN STREET CENTER MMS Staff Contact List…………………………………………………………………………………....………………………………………4 National Main Street Center……………………………………………………………………………………………………………………5 MMS Communities & Contact List…..…………………………………………………………………………………………….6,7,8,9 MMS Program Agreement………………………………………………………………………………………………………………………9 HOW CAN WE HELP? Services list………………………………………………………………………………………………………………………………………9, 10 MAIN STREET DIRECTOR TRAINING New Executive Director Training……………………………………………………………………………………………………………10 Quarterly Training……………………………………………………………………………………………………………………………10,11 MAIN STREET AMERICA NATIONAL ACCREDITATION National Accreditation and Year-End Assessment………………………………………………………………………..11,12,13 GETTING UPDATES FROM THE MICHIGAN MAIN STREET CENTER Monthly MMS Director Call…………………………………………………………………………………………………………….…….14 Michigan Main Street Listserv………………………………………………………………………………………………………….14, 15 THE MAIN STREET MODEL The Main Street Approach………………………………………………………………………………………………………….16, 17, 18 Organizational Structure………………………………………………………………………………………………………………….19, 20 Board of Directors…………………………………………………………………………………………………………………………..20 - 28 Committees………………………………………………………………………………………………………………………………..….28 - 38 ALIGNMENT WITH REDEVELOPMENT READY COMMUNITIES RRC Program Information………………………………………………………………………………………………..…..38, 39, 40, 41 YOUR ROLE IN MAIN STREET Things to Know………………………………………………………………………………………………………………………………………41 DDA, PSD, BID/BIZ Legislation…………………………………………………………………………………………………..……..41, -

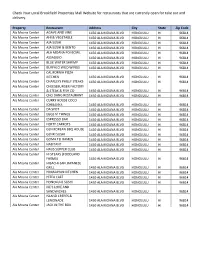

Check Your Local Brookfield Properties Mall Website for Restaurants That Are Currently Open for Take out and Delivery

Check Your Local Brookfield Properties Mall Website for restaurants that are currently open for take out and delivery. Property Restaurant Address City State Zip Code Ala Moana Center AGAVE AND VINE 1450 ALA MOANA BLVD HONOLULU HI 96814 Ala Moana Center AHI & VEGETABLE 1450 ALA MOANA BLVD HONOLULU HI 96814 Ala Moana Center AJA SUSHI 1450 ALA MOANA BLVD HONOLULU HI 96814 Ala Moana Center AJA SUSHI & BENTO 1450 ALA MOANA BLVD HONOLULU HI 96814 Ala Moana Center ALA MOANA POI BOWL 1450 ALA MOANA BLVD HONOLULU HI 96814 Ala Moana Center ASSAGGIO 1450 ALA MOANA BLVD HONOLULU HI 96814 Ala Moana Center BLUE WATER SHRIMP 1450 ALA MOANA BLVD HONOLULU HI 96814 Ala Moana Center BUFFALO WILD WINGS 1450 ALA MOANA BLVD HONOLULU HI 96814 Ala Moana Center CALIFORNIA PIZZA KITCHEN 1450 ALA MOANA BLVD HONOLULU HI 96814 Ala Moana Center CHARLEYS PHILLY STEAKS 1450 ALA MOANA BLVD HONOLULU HI 96814 Ala Moana Center CHEESEBURGER FACTORY & STEAK & FISH CO 1450 ALA MOANA BLVD HONOLULU HI 96814 Ala Moana Center CHO DANG RESTAURANT 1450 ALA MOANA BLVD HONOLULU HI 96814 Ala Moana Center CURRY HOUSE COCO ICHIBANYA 1450 ALA MOANA BLVD HONOLULU HI 96814 Ala Moana Center DA SPOT 1450 ALA MOANA BLVD HONOLULU HI 96814 Ala Moana Center EGGS N' THINGS 1450 ALA MOANA BLVD HONOLULU HI 96814 Ala Moana Center ESPRESSO BAR 1450 ALA MOANA BLVD HONOLULU HI 96814 Ala Moana Center FORTY CARROTS 1450 ALA MOANA BLVD HONOLULU HI 96814 Ala Moana Center GEN KOREAN BBQ HOUSE 1450 ALA MOANA BLVD HONOLULU HI 96814 Ala Moana Center GENKI SUSHI 1450 ALA MOANA BLVD HONOLULU HI 96814 Ala Moana -

Strategic Audit of Kohl's Corporation Abigail Jarratt University of Nebraska - Lincoln

University of Nebraska - Lincoln DigitalCommons@University of Nebraska - Lincoln Honors Theses, University of Nebraska-Lincoln Honors Program Spring 2019 Strategic Audit of Kohl's Corporation Abigail Jarratt University of Nebraska - Lincoln Follow this and additional works at: https://digitalcommons.unl.edu/honorstheses Part of the Strategic Management Policy Commons Jarratt, Abigail, "Strategic Audit of Kohl's Corporation" (2019). Honors Theses, University of Nebraska-Lincoln. 147. https://digitalcommons.unl.edu/honorstheses/147 This Thesis is brought to you for free and open access by the Honors Program at DigitalCommons@University of Nebraska - Lincoln. It has been accepted for inclusion in Honors Theses, University of Nebraska-Lincoln by an authorized administrator of DigitalCommons@University of Nebraska - Lincoln. STRATEGIC AUDIT OF KOHL’S CORPORATION An Undergraduate Honors Thesis Submitted in Partial Fulfillment of University Honors Program Requirements The University of Nebraska-Lincoln by Abigail Jarratt, BS Computer Science College of Arts and Sciences April 2019 Faculty Mentor: Samuel Nelson, Ph.D., College of Business Abstract Since its founding in Brookfield, Wisconsin Kohl’s Corporation has managed to adapt and consistently satisfy customer needs. By focusing on customer experience Kohl’s has become a le leader within the department store industry capturing $19.1 billion in total sales. However, with recent shifts in the retail and department store industry, it is time to take a step back and analyze its strategy given the current state of the economy. As such, this report will investigate the current state of Kohl’s Corporation and provide future recommendations. Companies within the department store industry must continue grow and adapt to customer needs and desires in order to succeed in today’s market. -

Participating Restaurants (Continued) Home

The following restaurant list is broken down into five regions around the state which are North, West, Central, Southeast and Bay-Thumb (in that order). The restaurant locations are alphabetized by city in each region. Click your region below for these locations. A menu on the side of each page can be clicked to move through the different regions. North North Please click your region Bay-Thumb to find a restaurant! Central West Southeast participating restaurants (continued) Home North Michigan (cities Alden – East Jordan) Torch Lake Beer Company 9149 Helena Rd. Alden Black Sheep Pub 113 S 2nd Ave. Alpena Pompeyos Mexican Grill 11120 S. State Ave. Alpena Court Yard Ristorante 2024 US-23 Alpena JJ's Steak & Pizza House 411 N 2nd Ave. Alpena North Nowicki's Sausage Shoppe 1224 N 2nd Ave. Alpena Michigan th Player’s Pub & Grub 113 S. 9 Ave. Alpena West H&H Bakery & Restaurant 604 E. Huron Rd. Au Gres Central Grille 44 12951 Pleasanton Hwy. Bear Lake Toonie’s Fish & Steak House 216 N. Bridge St. Bellaire Southeast A. Papano's Pizza 7803 Crystal Dr. Beulah Bay-Thumb The Mountain Bar And Grill 5495 N. US Hwy. 23 Black River BC Pizza 1191 M-75 Boyne City Cafe Sante 1 Water St. Boyne City Stiggs Brewing Company 112 S. Park St. Boyne City 13th Street Market & Restaurant 3075 W. 13th St. Cadillac Coyote Crossing Resort Restaurant 8593 S. 13 Rd. Cadillac Blue Heron Cafe 304 N. Mitchell St. Cadillac Hermann's European Cafe 214 N. Mitchell St. Cadillac Pizza Plus 302 N. -

Expanding the Corktown- Mexicantown Greenlink: Connecting Southwest Neighbors

Expanding the Corktown- Mexicantown Greenlink: Connecting Southwest Neighbors Healthy Environments Partnership Brightmoor Community Center Detroit Department of Health and Wellness Promotion Detroit Hispanic Development Corporation Friends of Parkside Henry Ford Health System Rebuilding Communities Inc. University of Michigan School of Public Health and Taubman College of Architecture and Urban Planning November1 2007 Report prepared by Donna Erickson Consulting, Inc. www.westernopenlands.com May 2007 With funding through the Healthy Environments Partnership 2 TABLE OF CONTENTS Page List of Figures and Tables……………………………………………………………………5 Acknowledgements……………………………………………………………………………7 I. INTRODUCTION AND BACKGROUND………………………………………….9 II. HISTORY OF SOUTHWEST DETROIT NEIGHBORHOODS…………………11 III. HISTORY AND RECENT DEVELOPMENT OF SELECTED SOUTHWEST DETROIT NEIGHBORHOODS……………………………………………………19 Corktown………………………………………………………………………………19 North Corktown/Briggs ..……………………………………………………………...21 Hubbard Richard—including Hubbard Farms, Mexicantown and Bagley Housing….22 IV. CORKTOWN-MEXICANTOWN GREENLINK…………………………………25 V. NEIGHBORHOOD ANALYSES …………………………………………………..9 Demographic Factors………………………………………………………………….29 Community Assets…………………………………………………………………….33 Educational Resources………………………………………………………...33 Social and Health Service Organizations ……………………………………..33 Shopping/Commercial Areas………………………………………………….34 Arts and Cultural Destinations………………………………………………...35 Churches……………………………………………………………………....36 Organized Labor Institutions………………………………………………….36 -

Employers Who Match Employee Contributions

Employers Who Air Products & Chemicals, Inc. Alco Standard Corp. Match Employee Alliance Capital Mgmt Corp Contributions AllianceBernstein AllianceOne, Inc The businesses, corporations and organizations below have matching gift programs that will Alliant Energy double, and in some cases triple, your contribution to a qualified nonprofit organization. Alliant Techsystems Inc. If your employer is listed, contact your human Allianz Life Ins resources department for additional information about their matching gift program. Allied Signal Inc If your employer is not listed here, they may still Allstate Giving Campaign have a program. Be sure to check with your employer to see if they have a matching gift Altria Group Inc program. Please note that some programs have additional restrictions, and the United Way may American Express Foundation not meet all guidelines for some programs. American International Companies (AIG) 3M Ameriprise Philanthropic Program -A- Abbot Laboratories Fund Ameritech Corporation Abbott Northwestern Center for Amgen, Inc Outpatient Surgery Analysts International Corp, ABN AMRO Bank Minneapolis ACE INA Foundation Antioch Companies/Webway Acrometal Companies Inc (A-TEK) Aon Foundation Acxiom Corporation Archdiocese of Saint Paul and Minneapolis ADC Telecommunications Archer-Daniels-Midland Co. (ADM) Adeptec Inc Archie D. and Bertha H. Walker Adobe Systems Incorporated Foundation Advantis ARCO Foundation ADP Foundation Arthur J. Gallagher Foundation AES Corporation Aspect Global Systems Inc Aetna Life & Casualty Assurant Inc AGIA Inc Astra Merck, Inc. Agribank FCB ATC Agriliance AT&T Foundation Atek, Inc Borden ATK Sporting Equipment Boston Scientific Corporation Avaya BP Amoco Aventis Pharmaceuticals BP Foundation Inc Avon Products Inc. Braun Intertec AXA Foundation Bremer Bank (Brainerd) Bromelkamp Company -B- BAE Systems Brunswick Bakers Square Restaurants BTD Manufacturing, Inc.