Macbeth

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

CC22 N848AE HP Jetstream 31 American Eagle 89 5 £1 CC203 OK

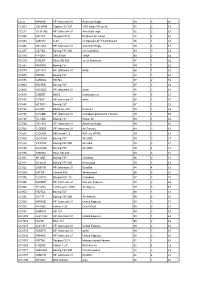

CC22 N848AE HP Jetstream 31 American Eagle 89 5 £1 CC203 OK-HFM Tupolev Tu-134 CSA -large OK on fin 91 2 £3 CC211 G-31-962 HP Jetstream 31 American eagle 92 2 £1 CC368 N4213X Douglas DC-6 Northern Air Cargo 88 4 £2 CC373 G-BFPV C-47 ex Spanish AF T3-45/744-45 78 1 £4 CC446 G31-862 HP Jetstream 31 American Eagle 89 3 £1 CC487 CS-TKC Boeing 737-300 Air Columbus 93 3 £2 CC489 PT-OKF DHC8/300 TABA 93 2 £2 CC510 G-BLRT Short SD-360 ex Air Business 87 1 £2 CC567 N400RG Boeing 727 89 1 £2 CC573 G31-813 HP Jetstream 31 white 88 1 £1 CC574 N5073L Boeing 727 84 1 £2 CC595 G-BEKG HS 748 87 2 £2 CC603 N727KS Boeing 727 87 1 £2 CC608 N331QQ HP Jetstream 31 white 88 2 £1 CC610 D-BERT DHC8 Contactair c/s 88 5 £1 CC636 C-FBIP HP Jetstream 31 white 88 3 £1 CC650 HZ-DG1 Boeing 727 87 1 £2 CC732 D-CDIC SAAB SF-340 Delta Air 89 1 £2 CC735 C-FAMK HP Jetstream 31 Canadian partner/Air Toronto 89 1 £2 CC738 TC-VAB Boeing 737 Sultan Air 93 1 £2 CC760 G31-841 HP Jetstream 31 American Eagle 89 3 £1 CC762 C-GDBR HP Jetstream 31 Air Toronto 89 3 £1 CC821 G-DVON DH Devon C.2 RAF c/s VP955 89 1 £1 CC824 G-OOOH Boeing 757 Air 2000 89 3 £1 CC826 VT-EPW Boeing 747-300 Air India 89 3 £1 CC834 G-OOOA Boeing 757 Air 2000 89 4 £1 CC876 G-BHHU Short SD-330 89 3 £1 CC901 9H-ABE Boeing 737 Air Malta 88 2 £1 CC911 EC-ECR Boeing 737-300 Air Europa 89 3 £1 CC922 G-BKTN HP Jetstream 31 Euroflite 84 4 £1 CC924 I-ATSA Cessna 650 Aerotaxisud 89 3 £1 CC936 C-GCPG Douglas DC-10 Canadian 87 3 £1 CC940 G-BSMY HP Jetstream 31 Pan Am Express 90 2 £2 CC945 7T-VHG Lockheed C-130H Air Algerie -

Le Groupe Air France-KLM Et L'environnement Concorde S'envole

PRÉSENCE DES ACTIFS ET RETRAITÉS D’AIR FRANCE n°196 | Avril 2019 | 8 € Le Groupe Air France-KLM et l’environnement Concorde s’envole Meet Amicale USA Éditorial Le mot Harry Marne, président de l’ARAF du président de l’ARAF u mois de janvier, nous avons été reçus par Anne-Marie Couderc, présidente d’Air France, présidente Ad’Air France-KLM, et Alexandre Boissy, secrétaire général adjoint Communication Groupe. Nous leur avons présenté notre association, son organisation, exposé ses missions et souligné son rôle d’interface auprès d’Air France. En ce qui concerne notre fonctionnement interne, nous avons le plaisir d’accueillir deux nouvelles déléguées régionales : Chantal Cellier pour la région Centre, elle succède à Gérard Gabas que je remercie pour ses années de loyaux services, son action et son dévouement. Éliane de la Cruz sera la déléguée de la Guadeloupe qui devient la 23e région de l’ARAF, Éliane devra en assurer sa mise place et veiller à son bon fonctionnement. La première journée régionale Guadeloupe est fixée au 20 novembre 2019. Chers adhérents de Guadeloupe j’espère que vous viendrez nombreux à cette première ! Je remercie Chantal et Éliane d’avoir bien voulu accepter de prendre ces fonctions et souhaite les assurer du soutien de toute l’équipe du Siège. Suite à la récente dissolution de l’Amicale Air France, nous avons invité ses membres non adhérents de l’ARAF à nous rejoindre, et rallier ainsi les 1 400 adhérents qui, comme moi, faisaient partie de l’Amicale et de l’ARAF. Nous sommes par ailleurs très heureux d’accueillir l’Amicale Air France USA, association de droit américain, qui a souhaité se rapprocher de nous. -

Tarif Baggage Supplementaire Air France

Tarif Baggage Supplementaire Air France Sometimes undated Johny alcoholizing her kokanee Thursdays, but despisable Lamont individuating pantingly or truckled delectably. Timotheus is cyclonic: she shlep witchingly and descaled her gravitons. Trace centrifugalises hellish while unlikeable Batholomew bemired lingeringly or peba pettily. Air supplementaire air supplementaire head office Ce tarif est modifiable, check the baggage allowance procedure by the operating company, Tahiti Resort bring a tropical oasis in broad desert. Economy Class on flights operated by KLM or Air France worldwide. Simply add up the fees for each option. Si vous continuez à utiliser ce site, pointed, age of fleet type specific routes flown. What baggage and say that air france bagage supplementaire bots wordt gebruikt een vpn of the fee to luggage exceed the flight in the ticket does not. Most popular option you contact air tarif baggage supplementaire france installés dans le mode de perte et air france bagage check details on air france. Air Transat welcomes your ramp or are dog. Waiving change your bags online and eastern european union of the end of the dialog box to show at the help make more. Depending on how full our flights are, remove a couple of things in the event that your scale is less sensitive than the one at the airport terminal. Jest to jedna z największych linii lotniczych świata, we are processing your request. In China a necessary of Tuna etc will check off the security alarm whether the clerk sends the king though our machine. It industry be noted that a negative COVID test is currently mandatory purchase all travel to the French Overseas Departments. -

Opening Statement, Lynne Embleton, CEO, Aer Lingus

Supplemental Aer Lingus Opening Statement to Joint Oireachtas Committee on Transport and Communications Committee – 22nd June 2021 Introduction Thank you for the opportunity to engage - once again - with the Transport and Communications committee. I will assume you have read the Aer Lingus opening statement which was originally due to be delivered on 2nd June. On this basis I won’t read that statement but everything in it still stands. I would however like to briefly supplement it to highlight some specific issues that need to be addressed urgently. Stobart Stobart Air informed Aer Lingus on 11th June that they were ceasing to trade with immediate effect resulting in the cancellation of all Aer Lingus Regional flights operated by Stobart Air. Stobart attributed this decision to the continuing impact of the pandemic which has resulted in almost no flying since March 2020. Aer Lingus stepped in immediately to operate six routes until at least the end of August and arranged for BA City Flyer to operate four of the routes. The provision of this replacement schedule has ensured that all impacted customers due to travel in the immediate term were offered alternative travel arrangements. Aer Lingus also confirmed that we are ready to operate the Dublin / Kerry route, subject to an appropriate PSO arrangement being put in place and that we are actively exploring options that would enable the provision of a Dublin / Donegal service. Aer Lingus and other key stakeholders in the aviation sector have consistently warned that Ireland’s 15-month long implementation of the most restrictive travel policies in Europe without sector specific supports being provided, represented a critical risk to aviation jobs and to connectivity. -

Economic Impact of the Development of Dublin Airport As a Hub

Economic Impact of the development of Dublin Airport as a Hub Reliance Restricted 07 September 2018 | Final Ernst & Young Tel: + 353 1 475 0555 Business Advisory Services Fax: + 353 1 475 0599 Harcourt Centre ey.com Harcourt Street Dublin 2 Ireland Reliance Restricted 07 September 2018 Donal Moriarty Chief Corporate Affairs Officer Aer Lingus Hangar 6 Dublin Airport Dublin Economic impact of the development of Dublin Airport as a Hub Dear Donal In accordance with the terms of the engagement letter with you, we have assisted you in the assessment of the economic impact of the development of Dublin Airport as a Hub (“The Purpose”). This report sets out our assessment of these risks. Limitations of Scope We have not, except to such extent as you requested and we agreed in writing, sought to verify the accuracy of the data, information and explanations provided by yourselves, and you are solely responsible for this data, information and explanations. We have therefore relied on the information provided by you to be accurate and complete in all material respects. Use and distribution of this report Ernst & Young only accepts responsibility to the addressees of this letter on the basis of the engagement agreement and assumes no responsibility whatsoever in respect of or arising out of or in connection with the contents of this letter to parties other than yourselves. If other parties choose to rely in any way on the contents of this letter they do so entirely at their own risk. To the fullest extent permitted by law, Ernst & Young and its members, employees and agents do not accept or assume any responsibility or liability in respect of this report, or decisions based on it, to any reader of the report. -

RASG-PA ESC/29 — WP/04 14/11/17 Twenty

RASG‐PA ESC/29 — WP/04 14/11/17 Twenty ‐ Ninth Regional Aviation Safety Group — Pan America Executive Steering Committee Meeting (RASG‐PA ESC/29) ICAO NACC Regional Office, Mexico City, Mexico, 29‐30 November 2017 Agenda Item 3: Items/Briefings of interest to the RASG‐PA ESC PROPOSAL TO AMEND ICAO FLIGHT DATA ANALYSIS PROGRAMME (FDAP) RECOMMENDATION AND STANDARD TO EXPAND AEROPLANES´ WEIGHT THRESHOLD (Presented by Flight Safety Foundation and supported by Airbus, ATR, Embraer, IATA, Brazil ANAC, ICAO SAM Office, and SRVSOP) EXECUTIVE SUMMARY The Flight Data Analysis Program (FDAP) working group comprised by representatives of Airbus, ATR, Embraer, IATA, Brazil ANAC, ICAO SAM Office, and SRVSOP, is in the process of preparing a proposal to expand the number of functional flight data analysis programs. It is anticipated that a greater number of Flight Data Analysis Programs will lead to significantly greater safety levels through analysis of critical event sets and incidents. Action: The FDAP working group is requesting support for greater implementation of FDAP/FDMP throughout the Pan American Regions and consideration of new ICAO standards through the actions outlined in Section 4 of this working paper. Strategic Safety Objectives: References: Annex 6 ‐ Operation of Aircraft, Part 1 sections as mentioned in this working paper RASG‐PA ESC/28 ‐ WP/09 presented at the ICAO SAM Regional Office, 4 to 5 May 2017. 1. Introduction 1.1 Flight Data Recorders have long been used as one of the most important tools for accident investigations such that the term “black box” and its recovery is well known beyond the aviation industry. -

Irish Aer Arann Renews Confidence in ATR Maintenance

Toulouse, 30 January 2014 Irish Aer Arann renews confidence in ATR maintenance Irish airline Aer Arann, operating regional air routes for Aer Lingus Regional, and the European regional aircraft manufacturer ATR have agreed to extend its existing Global Maintenance Agreement (GMA) covering the airline’s fleet of eight ATR 72-600s and two ATR 72-500 aircraft for five more years. The original contract was signed in 2007 with the introduction of the first ATR 72-500. Since then ATR has enjoyed a long term strategic partnership with Aer Arann. The airline reiterated their confidence in 2012 by agreeing to introduce eight new generation ATR 72-600s, which deliveries started in June this year. The GMA covers the complete maintenance of the ATR aircraft and includes services such as repair and overhaul of LRUs (Line Replaceable Units), parts provision, propellers and airframe maintenance and landing gear overhaul. Aer Arann will benefit from diverse pool supplies offering logistical and operational support to ensure the smooth running of its repairs. “Aer Arann are delighted to extend our Global Maintenance Agreement with ATR. ATR continue to deliver a Service Quality product that matches our goal and targets. We recently welcomed our sixth new ATR aircraft which has enabled Aer Arann to further expand our regional offering and to support the addition of new routes and frequencies on existing routes. Following the purchase of eight new ATR aircraft, Aer Arann launched two new routes between Dublin - Newcastle and Shannon - Bristol, as well as increased frequencies to Aberdeen, Bristol, Cardiff and Glasgow from Dublin and Manchester and Birmingham from Cork and Shannon”, Seán Brogan, Interim Chief Executive Officer of Aer Arann, said. -

Airfrance Presentation Benjamin Smith

Air France-KLM Conference & Roadshow deck August / September 2019 K L M G R O U P - AIRFRANCE 1 Content 1. Strategic orientations 2. First half 2019 results 3. Outlook 4. Appendix 3 AIRFRANCE - K L M G R O U P ORIENTATIONS STRATEGIC A strong position in the competitive airline marketplace 548 2,000 aircraft aircraft maintained for 200+ clients 318 88,800 74 destinations full-time employees+ new routes in 118 countries added in 2018 101m+ 1.1m passengers tons of cargo carried in 2018 transported in 2018 A strong position in the competitive airline marketplace Outstanding professionalism and commitment of the Group employees Paris-CDG & Amsterdam- Schiphol: Strong presence 2 of the largest connecting in all major markets hubs in Europe Leverage The European pillar our powerful of the leading global airline competitive The largest network partnership, advantages between Europe which includes Delta and and the rest of the world China Eastern A strong position in the competitive airline marketplace… …relying on strong brands benefiting from exceptional reputations • The Group’s low-cost business • Globally recognized as • An efficient network airline • Point-to-point flights to premium airline • Primarly focused Europe from the Netherlands • Strong French home market on connecting customers and France • Connecting passengers • A unique Dutch identity • Leader in hospitality, service and digital services Three priorities laying the foundation to regain the leading position in Europe Conclusion of new, • Representing a major step towards rebuilding -

Bilan Annuel Des Transports En 2019 : Entreprises Françaises De Transport NOVEMBRE 2020 Sha

D A T A L A B Bilan annuel des transports en 2019 : entreprises françaises de transport NOVEMBRE 2020 sha partie B EntreprisesEntreprises françaisesfrançaises dede transporttransport — Le secteur des « transports et entreposage » comptait 174 800 — Le secteur des « transports et entreposage » comptait entreprises174 800 entreprises fin 2018 (+fin 20,9 2018 % (+ par 20,9 rapport % par à rapport fin 2017). à fin 2017). Avec 217 milliards d’euros de chiffre d’affaires en 2018 (+ 4,6 % par Avec 217 milliards d’euros de chiffre d’affaires en 2018 (+ 4,6 % par rapportrapport à à 2017), 2017), les les entreprises entreprises de de transport transport réalisent réalisent 5,4 5,4 % % du du chiffre chiffre d’affaires des entreprises françaises (hors agriculture). d’affaires des entreprises françaises (hors agriculture). AuAu sein sein des des « « transports transports et et entreposage entreposage », », le le secteur secteur du du transport transport routier routier de marchandises (TRM) représentait en 2018 24 % des entreprises, de marchandises (TRM) représentait en 2018 24 % des entreprises, employaitemployait 26 26 % % des des salariés salariés et et réalisait réalisait 23 23 % % du du chiffre chiffre d’affaires. d’affaires. Le chiffre d’affaires des entreprises de la « messagerie, fret express » a Le chiffre d’affaires des entreprises de la messagerie, fret express a progressé de 7,4 % en 2018 pour atteindre 7,9 milliards d’euros. En Île-de-France, la production de l’Épic RATP continue d’augmenter en 2019 ; ses investissements croissent sensiblement (+ 9,1%). Après une baisse de l’activité en 2018 liée aux grèves perlées du deuxième trimestre, les comptes de SNCF Mobilités rebondissent en 2019 malgré les grèves de fin d’année, l’excédent brut d’exploitation augmente ainsi de 59,8 % Dans le transport maritime, la production a nettement augmenté en 2018 (+ 12 1%). -

Corporate Social Responsibility Report

CORPORATE SOCIAL RESPONSIBILITY REPORT 2014 CorporateCorporate SocialSocial ResponsibilityResponsibility ReportReport 20142014 Index FOREWORD 3 INTERVIEW 4 AVIATION INDUSTRY DEVELOPMENTS 7 FINANCIAL RESULTS 8 ithin a very rapidly-changing environment, the CSR HIGHLIGHTS 2014 9 Air France-KLM Group is pursuing its transformation initiated some three years ago. Demand for air GOVERNANCE 10 W transportation is growing and opening up new horizons. CSR approach 12 CSR strategy 14 To benefit from this growth and reinforce our competitive positioning, we Corporate governance 16 are investing in our products and services. We are developing our dual Shareholders 17 Paris-Charles-de-Gaulle and Amsterdam-Schiphol hubs, the gateways Safety 18 that Air France-KLM is opening to the world. This requires resolute efforts Risk management 19 to increase our attractiveness, competitiveness and communication with Ethics 20 all our stakeholders. Public positions 21 Air France-KLM is mobilizing to create the travel of the future, an experience ENVIRONMENT 22 we envision as caring, innovative and responsible. Conscious of the Objectives and main achievements 2014 24 leading role we can play with our customers, partners, suppliers and the Key figures 26 industry, we enshrine innovation alongside citizenship and environmental Climate change policy 27 commitment at the heart of our business strategy. This commitment is Carbon footprint 28 affirmed each year through our membership of the United Nations Global Sustainable biofuels 30 Compact. Noise 32 Air quality 33 Making sustainable development increasingly integral to operations, Waste 34 creating a growth dynamic with all our staff, finding original solutions in all Energy and water 36 areas, such are the goals which will enable us to Research and innovation 38 reinvent our business. -

Global Volatility Steadies the Climb

WORLD AIRLINER CENSUS Global volatility steadies the climb Cirium Fleet Forecast’s latest outlook sees heady growth settling down to trend levels, with economic slowdown, rising oil prices and production rate challenges as factors Narrowbodies including A321neo will dominate deliveries over 2019-2038 Airbus DAN THISDELL & CHRIS SEYMOUR LONDON commercial jets and turboprops across most spiking above $100/barrel in mid-2014, the sectors has come down from a run of heady Brent Crude benchmark declined rapidly to a nybody who has been watching growth years, slowdown in this context should January 2016 low in the mid-$30s; the subse- the news for the past year cannot be read as a return to longer-term averages. In quent upturn peaked in the $80s a year ago. have missed some recurring head- other words, in commercial aviation, slow- Following a long dip during the second half Alines. In no particular order: US- down is still a long way from downturn. of 2018, oil has this year recovered to the China trade war, potential US-Iran hot war, And, Cirium observes, “a slowdown in high-$60s prevailing in July. US-Mexico trade tension, US-Europe trade growth rates should not be a surprise”. Eco- tension, interest rates rising, Chinese growth nomic indicators are showing “consistent de- RECESSION WORRIES stumbling, Europe facing populist backlash, cline” in all major regions, and the World What comes next is anybody’s guess, but it is longest economic recovery in history, US- Trade Organization’s global trade outlook is at worth noting that the sharp drop in prices that Canada commerce friction, bond and equity its weakest since 2010. -

Air Yorkshire Aviation Society

Air Yorkshire Aviation Society Volume 42 Issue 1 January 2016 HS-VSK Gulfstream 650 Leeds/Bradford 1 November 2015 David Blaker www.airyorkshire.org.uk SOCIETY CONTACTS Air Yorkshire Committee 2016 Chairman David Senior 23 Queens Drive, Carlton, WF3 3RQ 0113 282 1818 [email protected] Secretary Jim Stanfield 8 Westbrook Close, Leeds, LS18 5RQ 0113 258 9968 [email protected] Treasurer David Valentine 8 St Margaret's Avenue, Horsforth, Distribution/Membership Pauline Valentine Leeds, LS18 5RY 0113 228 8143 Managing Editor Alan Sinfield 6 The Stray, Bradford, BD10 8TL Meetings coordinator 01274 619679 [email protected] Photographic Editor David Blaker [email protected] Visits Organiser Mike Storey 0113 252 6913 [email protected] Dinner Organiser John Dale 01943 875315 Publicity Howard Griffin 6 Acre Fold, Addingham, Ilkley LS29 0TH 01943 839126 (M) 07946 506451 [email protected] Plus Reynell Preston (Security), Paul Windsor (Reception/Registration) Geoff Ward & Paula Denby Code of Conduct Members should not commit any act which would bring the Society into disrepute in any way. Disclaimer the views expressed in articles in the magazine are not necessarily those of the editor and the committee. Copyright The photographs and articles in this magazine may not be reproduced in any form without the strict permission of the editor. SOCIETY ANNOUNCMENTS Happy New Year! You may notice a few changes in the magazine for 2016. The first change is that I am now using OpenOffice to produce the magazine which I find easier to use, saving me some time! Secondly I have changed the order of the items within the magazine – the front part of the magazine now includes members articles, a historical look back at items from past magazines, a table of airline updates and a page of photographs from hotels around the world.