Cellcom Israel Ltd. Announces Agreement to Purchase Golan Telecom

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Goodwill Impairment Test of the Cellular Segment June 30Th, 2019

Bezeq The Israel Telecommunication Corporation Limited Goodwill Impairment Test of the Cellular Segment June 30th, 2019 August 2019 14 Kreminitzky St., Tel Aviv 6789912 I Tel.: 03-5617801 I Fax: 077-3181607 Introduction and Limit of Liability • We were retained by Bezeq The Israel Telecommunication Corp. Ltd. (hereunder “Bezeq” and/or “Bezeq Group” and/or the ”Client”) to prepare a goodwill impairment test report (the “Report”) of the cellular business unit (hereunder: “Pelephone” and/or the “Cellular Segment”) as of June 30th, 2019. • The Report intended solely for the use of the Client and is . This Report may not be reproduced, in whole or in part, and the findings of this Report may not be used by a third party for any purpose, without our expressed written consent. Notwithstanding any of the above, this Report may be included in the Client’s financial statements of as of June. 30, 2017. • For the purpose of preparing this Report, we relied upon financial and other information including prospective financial information obtained from the Company and/or the Client and/or anyone on their behalf (the “Information”). We assumed that the Information is credible and therefore did not perform an independent audit of the information. In addition, nothing suggesting that the Information may be unreasonable has come to our attention. The Information has not been examined in an independent manner, and therefore this Report does not constitute a verification of the Information’s correctness, completeness and accuracy. If the case that the Information is not complete nor accurate or credible, the results of this valuation might change. -

Cellcom Israel Ltd. Announces Agreement to Purchase Golan Telecom

November 5, 2015 Cellcom Israel Ltd. Announces Agreement To Purchase Golan Telecom NETANYA, Israel, Nov. 5, 2015 /PRNewswire/ -- Cellcom Israel Ltd. (NYSE: CEL) (TASE: CEL) (hereinafter: the "Company") announced today that the Company entered an agreement (the "Agreement" with Golan Telecom Ltd., or Golan, and its shareholders for the purchase of 100% of the shares of Golan, an Israeli cellular operator, for the sum of NIS 1.17 billion ("Purchase Price"). Golan is one of the four other Mobile Network Operators ("MNO") operating in Israel in addition to Cellcom Israel. It launched operations in 2012 with a strong brand recognized for low-cost services, and primarily provides cellular services to approximately 900,000 customers (as of November 2015), with a comparatively low churn. Golan is expected to end 2015 with total revenues exceeding NIS 500 million1. The Purchase Price represents an Enterprise Value, or EV2 of NIS 1 billion for Golan and EV/Adjusted EBITDA multiple of approximately 5.0, based on Golan's forecasted Adjusted EBITDA for 2015 (NIS 204 million)3. Ami Erel, the Company's Chairman of the Board, said: "In the last few years, Cellcom Group has repeatedly proven its ability to increase its service offerings, going from a cellular only operator to a full service communications group, with cellular, fixed line, internet and TV offerings, and succeeding despite the fierce competition. The acquisition of Golan Telecom will allow us to add a low-cost brand to our portfolio, and I'm confident that Cellcom's management will be able to successfully combine Golan's operations as the Company's low cost brand. -

Cellcom Israel Announces Developments Re Legal Actions Against Golan Telecom

CELLCOM ISRAEL ANNOUNCES DEVELOPMENTS RE LEGAL ACTIONS AGAINST GOLAN TELECOM Netanya, Israel – July 21, 2016 – Cellcom Israel Ltd. (NYSE: CEL) (TASE: CEL) (hereinafter: the "Company") announced today that following the Company's previously reported legal actions against Golan Telecom in relation to Golan Telecom's hosting agreement with Hot Mobile Ltd., another Israeli cellular operator, the district court granted an interim injunction against the consummation of the Golan Telecom – Hot Mobile agreement, as requested by the Company. For additional details see the Company's most recent annual report for the year ended December 31, 2015 on Form 20-F, filed on March 21, 2016, under "Item 3 Key Information - D. Risk Factors– Risks Related to our Business –We face intense competition in all aspects of our business" and "- Risks Related to the Proposed Acquisition of Golan Telecom Ltd." and under "Item 4. Information on the Company - B. Business Overview - General - Agreement for the Purchase of Golan", and under "-Competition – Cellular" and " - Government Regulation – Additional MNOs", and the Company's current reports on Form 6-K date March 28, 2016, April 12, 2016, May 16, 2016, June 13, 2016 and July 12, 2016. About Cellcom Israel Cellcom Israel Ltd., established in 1994, is the largest Israeli cellular provider; Cellcom Israel provides its approximately 2.813 million cellular subscribers (as at March 31, 2016) with a broad range of value added services including cellular telephony, roaming services for tourists in Israel and for its subscribers abroad and additional services in the areas of music, video, mobile office etc., based on Cellcom Israel's technologically advanced infrastructure. -

Cellcom Israel Ltd. Announces Preliminary Review of Possibility to Purchase Golan Telecom

CELLCOM ISRAEL LTD. ANNOUNCES PRELIMINARY REVIEW OF POSSIBILITY TO PURCHASE GOLAN TELECOM Netanya, Israel –August 27, 2015 – Cellcom Israel Ltd. (NYSE: CEL) (TASE: CEL) (hereinafter: the "Company") announced today that although the company is not required to report this information, the Company's controlling shareholder will report this information under its Israeli reporting obligations and therefore the Company is publishing this press release regarding its intention to review the possible purchase of holdings in, or assets of, Golan Telecom Ltd., or Golan Telecom, an Israeli mobile network operator and competitor of the Company, following an invitation by Bank Rothschild, representing Golan Telecom's shareholders. There is no assurance that the Company will make an offer to purchase Golan Telecom nor as to the execution of such a sale. Finally, the Company can provide no assurances as to the impact of this sale, and any potential sale of holdings in, or assets of, Golan, on the parties' agreements or the competitive environment in the market. For additional details regarding the Company's agreements with Golan Telecom Ltd. and the competitive environment in which we operate see the Company's most recent annual report for the year ended December 31, 2014 on Form 20-F, filed on March 16, 2015, under "Item 3. Key Information – D. Risk Factors – Risks Related to our Business –"We face intense competition in all aspects of our business" and "Item 4. Information on the Company – B. Business Overview – Network and Technology - Network and Cell Sites Sharing Agreements", "Competition – Cellular" and "Government Regulation – Network Sharing" and "- Additional MNOs" and the Company's current report regarding the Company's results of operations in the second quarter of 2015, on form 6-K, dated May 14, 2015 under "Other Developments During the First Quarter of 2015 and Subsequent to the End of the Reporting Period – Network Sharing Agreements". -

Mobile Network Codes (MNC) for the International Identification Plan for Public Networks and Subscriptions (According to Recommendation ITU-T E.212 (09/2016))

Annex to ITU Operational Bulletin No. 1111 – 1.XI.2016 INTERNATIONAL TELECOMMUNICATION UNION TSB TELECOMMUNICATION STANDARDIZATION BUREAU OF ITU __________________________________________________________________ Mobile Network Codes (MNC) for the international identification plan for public networks and subscriptions (According to Recommendation ITU-T E.212 (09/2016)) (POSITION ON 1 NOVEMBER 2016) __________________________________________________________________ Geneva, 2016 Mobile Network Codes (MNC) for the international identification plan for public networks and subscriptions Note from TSB 1. A centralized List of Mobile Network Codes (MNC) for the international identification plan for public networks and subscriptions has been created within TSB. 2. This List of Mobile Network Codes (MNC) is published as an annex to ITU Operational Bulletin No. 1111 of 1.XI.2016. Administrations are requested to verify the information in this List and to inform ITU on any modifications that they wish to make. The notification form can be found on the ITU website at www.itu.int/itu-t/inr/forms/mnc.html . 3. This List will be updated by numbered series of amendments published in the ITU Operational Bulletin. Furthermore, the information contained in this Annex is also available on the ITU website at www.itu.int/itu-t/bulletin/annex.html . 4. Please address any comments or suggestions concerning this List to the Director of TSB: International Telecommunication Union (ITU) Director of TSB Tel: +41 22 730 5211 Fax: +41 22 730 5853 E-mail: [email protected] 5. The designations employed and the presentation of material in this List do not imply the expression of any opinion whatsoever on the part of ITU concerning the legal status of any country or geographical area, or of its authorities. -

Cellular ARPU 65.0 72.1 (9.9%)

Israel Cellcom Company Presentation | 2015 1 FORWARD LOOKING STATEMENTS The following information contains, or may be deemed to contain forward-looking statements (as defined in the U.S. Private Securities Litigation Reform Act of 1995 and the Israeli Securities Law, 1968). In some cases, you can identify these statements by forward-looking words such as “may,” “might,” “will,” “should,” “expect,” “plan,” “anticipate,” “believe,” “estimate,” “predict,” “potential” or “continue,” the negative of these terms and other comparable terminology. These forward-looking statements, which are subject to risks, uncertainties and assumptions about us, may include projections of our future financial results, our anticipated growth strategies and anticipated trends in our business. These statements are only predictions based on our current expectations and projections about future events. There are important factors that could cause our actual results, level of activity, performance or achievements to differ materially from the results, level of activity, performance or achievements expressed or implied by the forward-looking statements. Factors that could cause such differences include, but are not limited to: changes to the terms of our license, new legislation or decisions by the regulator affecting our operations, the outcome of legal proceedings to which we are a party, particularly class action lawsuits, our ability to maintain or obtain permits to construct and operate cell sites, and other risks and uncertainties detailed from time to time in our filings with the U.S. Securities and Exchange Commission, including under the caption “Risk Factors” in our Annual Report for the year ended December 31, 2014. Although we believe the expectations reflected in the forward-looking statements contained herein are reasonable, we cannot guarantee future results, level of activity, performance or achievements. -

The Telecommunication Sector in the Palestinian Territories

THE WORLD BANK GROUP Public Disclosure Authorized The Telecommunication Sector in the Palestinian Territories: A Missed Opportunity for Economic Development Note for the Palestinian Ministry of Telecommunications and Information Technology Public Disclosure Authorized Carlo Maria Rossotto, Anat Lewin, Xavier Decoster 2/1/2016 Public Disclosure Authorized TA-P150798-TAS-BB Public Disclosure Authorized The Telecommunication Sector in the Palestinian Territories: A Missed Opportunity for Economic Development 2016 Standard Disclaimer This volume is a product of the staff of the International Bank for Reconstruction and Development / The World Bank. The findings, interpretations, and conclusions expressed in this paper do not necessarily reflect the views of the Executive Directors of The World Bank or the governments they represent. The World Bank does not guarantee the accuracy of the data included in this work. The boundaries, colors, denominations, and other information shown on any map in this work do not imply any judgment on the part of The World Bank concerning the legal status of any territory or the endorsement or acceptance of such boundaries. Copyright Statement The material in this publication is copyrighted. Copying and/or transmitting portions or all of this work without permission may be a violation of applicable law. The International Bank for Reconstruction and Development / The World Bank encourages dissemination of its work and will normally grant permission to reproduce portions of the work promptly. For permission to photocopy or reprint any part of this work, please send a request with complete information to the Copyright Clearance Center, Inc., 222 Rosewood Drive, Danvers, MA 01923, USA, telephone 978‐750‐8400, fax 978‐ 750‐4470, http://www.copyright.com/. -

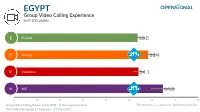

64.8 54.1 58.4 53.8 Group Video Calling Experience

EGYPT Group Video Calling Experience in 0-100 points E Etisalat 53.8 O Orange 58.4 V Vodafone 54.1 W WE 64.8 0 10 20 30 40 50 60 70 80 ⌶ Group Video Calling Report | May 2021 | © Opensignal Limited The brackets represent conFidence intervals Data collection period 12 February – 13 May 2021 ISRAEL Group Video Calling Experience in 0-100 points C Cellcom 62.8 G Golan Telecom 55.0 H Hot Mobile 54.7 P Partner 61.4 P Pelephone 64.7 0 10 20 30 40 50 60 70 80 ⌶ Group Video Calling Report | May 2021 | © Opensignal Limited The brackets represent conFidence intervals Data collection period 12 February – 13 May 2021 LIBYA Group Video Calling Experience in 0-100 points A Al-Madar 34.6 L Libyana 21.7 0 10 20 30 40 50 ⌶ Group Video Calling Report | May 2021 | © Opensignal Limited The brackets represent conFidence intervals Data collection period 12 February – 13 May 2021 MOROCCO Group Video Calling Experience in 0-100 points I Maroc Telecom 69.9 I inwi 54.1 O Orange 53.1 0 10 20 30 40 50 60 70 80 ⌶ Group Video Calling Report | May 2021 | © Opensignal Limited The brackets represent conFidence intervals Data collection period 12 February – 13 May 2021 QATAR Group Video Calling Experience in 0-100 points O Ooredoo 81.1 V Vodafone 69.1 0 10 20 30 40 50 60 70 80 90 100 ⌶ Group Video Calling Report | May 2021 | © Opensignal Limited The brackets represent conFidence intervals Data collection period 12 February – 13 May 2021 SAUDI ARABIA Group Video Calling Experience in 0-100 points M Mobily 63.4 S STC 68.6 Z Zain 58.6 0 10 20 30 40 50 60 70 80 ⌶ Group Video -

Israel Technology, Public Sphere and Journalism

MEDIA INFLUENCE MATRIX: ISRAEL TECHNOLOGY, PUBLIC SPHERE AND JOURNALISM Author: Roni Dorot Editor: Marius Dragomir 2021 | MARCH PUBLISHED BY CEU CENTER FOR MEDIA, DATA AND SOCIETY About CMDS About the authors The Center for Media, Data and Society Roni Dorot is a researcher for the Center for Media, (CMDS) is a research center for the study Data and Society. She received her PhD in Social and of media, communication, and Political Sciences from the European University information policy and its impact on Institute, Florence, and holds a MA in Public Policy society and practice. Founded in 2004 as from Tel-Aviv University. She was a postdoctoral the Center for Media and Communication fellow at the Center of Conflict, Negotiation and Studies, CMDS is part of Central Recovery, at the School of Public Policy, CEU. Her European University’s Democracy dissertation, “Dead End: Israeli Militarism and the Institute and serves as a focal point for an Dynamics of State Retribution”, examines the history international network of acclaimed of political revenge and the genealogy of retaliation scholars, research institutions and discourses in the Jewish press within the context of the activists. Palestinian-Israeli conflict. Her previous research analyzed the governmental outcomes of Israeli municipalities from a comparative perspective. She is a CMDS ADVISORY BOARD recipient of the Sapir Price for municipal studies (in Israel), the Istituto Italiano di Cultura scholarship and Clara-Luz Álvarez the EUI excellence fellowship. She currently writes for Floriana Fossato Haaretz newspaper her blog ‘Documania’ where she Ellen Hume critically analyses documentaries from a cultural and Monroe Price sociological perspective. -

PARTNER COMMUNICATIONS COMPANY LTD. (Exact Name of Registrant As Specified in Its Charter)

SECURITIES AND EXCHANGE COMMISSION WASHINGTON, D.C. 20549 ANNUAL REPORT FILED PURSUANT TO SECTION 12, 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 As filed with the Securities and Exchange Commission on March 27, 2019 UNITED STATES SECURITIES AND EXCHANGE COMMISSION WASHINGTON, D.C. 20549 FORM 20-F ☐ REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 OR ☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2018 OR ☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from ___________ to ___________ OR ☐ SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 Date of event requiring this shell company report ___________ Commission file number 1-14968 PARTNER COMMUNICATIONS COMPANY LTD. (Exact Name of Registrant as Specified in its Charter) ISRAEL (Jurisdiction of Incorporation or Organization) 8 AMAL STREET AFEQ INDUSTRIAL PARK ROSH-HA’AYIN 48103 ISRAEL (Address of Principal Executive Offices) Hadar Vismunski-Weinberg [email protected] (Name, Telephone, E-mail and/or facsimile Number and Address of Company Contact Person) Securities registered pursuant to Section 12(b) of the Act: Title of each class Name of each exchange on which registered American Depositary Shares, each representing The NASDAQ Global Select Market one ordinary share, nominal value NIS 0.01 per share Ordinary Shares, nominal value NIS 0.01 per share* The NASDAQ Global Select Market * Not for trading, but only in connection with the registration of American Depositary Shares representing such ordinary shares, pursuant to the requirements of the Securities and Exchange Commission. -

Mobile Network Codes (MNC) for the International Identification Plan for Public Networks and Subscriptions (According to Recommendation ITU-T E.212 (09/2016))

Annex to ITU Operational Bulletin No. 1162 – 15.XII.2018 INTERNATIONAL TELECOMMUNICATION UNION TSB TELECOMMUNICATION STANDARDIZATION BUREAU OF ITU __________________________________________________________________ Mobile Network Codes (MNC) for the international identification plan for public networks and subscriptions (According to Recommendation ITU-T E.212 (09/2016)) (POSITION ON 15 DECEMBER 2018) __________________________________________________________________ Geneva, 2018 Mobile Network Codes (MNC) for the international identification plan for public networks and subscriptions Note from TSB 1. A centralized List of Mobile Network Codes (MNC) for the international identification plan for public networks and subscriptions has been created within TSB. 2. This List of Mobile Network Codes (MNC) is published as an annex to ITU Operational Bulletin No. 1162 of 15.XII.2018. Administrations are requested to verify the information in this List and to inform ITU on any modifications that they wish to make. The notification form can be found on the ITU website at http://www.itu.int/en/ITU-T/inr/forms/Pages/mnc.aspx . 3. This List will be updated by numbered series of amendments published in the ITU Operational Bulletin. Furthermore, the information contained in this Annex is also available on the ITU website. 4. Please address any comments or suggestions concerning this List to the Director of TSB: International Telecommunication Union (ITU) Director of TSB Tel: +41 22 730 5211 Fax: +41 22 730 5853 E-mail: [email protected] 5. The designations employed and the presentation of material in this List do not imply the expression of any opinion whatsoever on the part of ITU concerning the legal status of any country or geographical area, or of its authorities. -

Signal Strength: Occupied the Telecommunications Sector and the Israeli Occupation

Flash Report SIGNAL STRENGTH: OCCUPIED THE TELECOMMUNICATIONS SECTOR AND THE ISRAELI OCCUPATION July 2018 Introduction 2 Separate and Unequal: The Occupied Structure of Palestinian Telecommunications 2 Codifying Dependency: Telecommunications under the Oslo Framework 3 De-Development by Military Violence 4 Telecommunications as a Site of Surveillance and Control 5 A Captive Market for Israeli Cellular Providers 6 Mobile Telephony and the Settlement Enterprise 8 Corporate Complicity 10 Altice 10 Cellcom Israel 12 Bezeq – The Israel Telecommunication Corp. 13 Partner Communications 14 Annex I: Pension Funds Invested in Altice 15 Annex II: Pension Funds Invested in Bezeq 16 Introduction Separate and Unequal: The Occupied Structure of Palestinian Communications technology is often associated Telecommunications with a high degree of mobility and relative free- dom from territorial constraints. However, under Israeli-occupied Palestinian infrastructure is char- Israel’s prolonged occupation of Palestinian and acterized by forced integration into Israeli systems Syrian land, the sphere of telecommunications alongside dependency on and segregation from has become a privatized site of control and a cor- said systems. porate instrument of territorial expansion. Previous research by Who Profits detailed the As this flash report demonstrates, all major Israeli ways in which these elements converge in the telecommunications providers are commercially electricity sector to create a subservient Pales- involved in the Israeli occupation. These compa- tinian electric network that is the site of chronic nies build infrastructure and maintain property structural violence.1 In the case of electricity, in- and equipment in illegal Israeli settlements, often tegration into the Israeli national grid was top- on privately owned Palestinian land.