Q3'10 Fact Sheet.Pub

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Canadas Top Media Concentration Canada 2016 Download

% MARKET Wireline SHARE Canada’s Top Media, Internet & Telecom Wireless Internet Access Companies by Market Share (2016) Cable cmcrp.org | [email protected] Broadcast TV & Pay TV 44% * y 29% Radio Newspaper & Magazine 22% Internet Advertising & Subscriptions 16.5% onom 27% Over-the-top (OTT) Subscriptions 26.8% 3% 30% 0.2% ers 32% Wireline POWER CORP Bell, Bell Alliant, NorthwestTel, DMTS, Télébec y 15% 22% 4% e media ec 15.5% Wireless 0.3% 18% 2% Bell Mobility, Virgin Mobile, Solo Mobile , tir Inukshuk (Joint-venture 50/50 with Rogers) 0.2% 3% GLOBE & MAIL 27% 12% Internet Access GROUPE Newspaper 29% Cable CAPITALE Wireline Broadcast TV & Pay TV 0.7% 11% 12% Bell Satellite, Bell Fibe, Cablevision du Nord MEDIA Wireless 12% Newspaper 4% 71.1% 4% Rogers Wireless, Fido, Chatr , 9% Internet Adverising & Subscriptions 7.7% 1% Inukshuk (Joint-venture 50/50 with Bell) Internet Access Over-the-top (OTT) Subscriptions 72% Wireline 6% Cable Over-the-top (OTT) top 5 pla Subscriptions 4% Wireless Broadcast TV & Pay TV BRO ADCAS T TV 2% Telus Mobility, ol 71.1 % of the en Koodo, Public Mobile Internet Adverising & Subscriptions Internet Access tr 13% Over-the-top (OTT) Subscriptions 23% Cable con 17% 9% Wireline PAY TV Wireless - WIND/Freedom BRO ADCAS T TV 1% Internet Access 6% TORSTAR 4.7% Cable Newspaper PAY TV 0.9% 1% Broadcast TV & Pay TV eastlink 2% 3% Internet Adverising & Subscriptions Metroland Media Group 0.8% 3% Over-the-top (OTT) Subscriptions 16% Radio 2% Wireline 10% BRO ADCAS T TV 12% Radio Internet Access Wireline 5% Cable Wireless -

Samsung Gravity™ 3

T479B PORTABLE QUAD-BAND MOBILE PHONE User Manual Please read this manual before operating your phone, and keep it for future reference. BMC_T479B_UG_EN_07202010_D4 Intellectual Property All Intellectual Property, as defined below, owned by or which is otherwise the property of Samsung or its respective suppliers relating to the SAMSUNG Phone, including but not limited to, accessories, parts, or software relating thereto (the “Phone System”), is proprietary to Samsung and protected under federal laws, provincial laws, and international treaty provisions. Intellectual Property includes, but is not limited to, inventions (patentable or unpatentable), patents, trade secrets, copyrights, software, computer programs, and related documentation and other works of authorship. You may not infringe or otherwise violate the rights secured by the Intellectual Property. Moreover, you agree that you will not (and will not attempt to) modify, prepare derivative works of, reverse engineer, decompile, disassemble, or otherwise attempt to create source code from the software. No title to or ownership in the Intellectual Property is transferred to you. All applicable rights of the Intellectual Property shall remain with SAMSUNG and its suppliers. Copyright © 2010 Samsung Electronics Canada, Inc. SAMSUNG is a registered trademark of Samsung Electronics Co., Ltd. and its related entities. Licensed by Qualcomm Incorporated under one or more of the following patents: U.S. Patent No. 4, 901, 307; 5, 056, 109; 5, 099, 204; 5, 101, 501; 5, 103, 459; 5, 107, 225; 5, 109, 390. Openwave® is a registered Trademark of Openwave, Inc. RSA® is a registered Trademark of RSA Security, Inc. Post-it® is a registered Trademark of Minnesota Mining and Manufacturing Company aka 3M CORPORATION DELAWARE. -

Moneygram | Canada Post

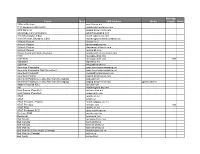

Pay for utilities, phone services, cable bills and more at your local post office with MoneyGram! Please consult the list below for all available billers. Payez vos factures de services publics, de services téléphoniques, de câblodistribution et autres factures à votre bureau de poste local avec MoneyGram! Consultez la liste ci-dessous pour tous les émetteurs de factures participants. A B C D E F G H I J K L M N O P Q R S T U V W X Y Z BILLER NAME/ PROVINCE AVAILABLE SERVICE/ NOM DE L’ÉMETTEUR DE FACTURE SERVICE DISPONIBLE 310-LOAN BC NEXT DAY/JOUR SUIVANT 407 ETR ON NEXT DAY/JOUR SUIVANT A.R.C. ACCOUNTS RECOVERY CORPORATION BC NEXT DAY/JOUR SUIVANT AAA DEBT MANAGERS BC NEXT DAY/JOUR SUIVANT ABERDEEN UTILITY SK NEXT DAY/JOUR SUIVANT ABERNETHY UTILITY SK NEXT DAY/JOUR SUIVANT ACCORD BUSINESS CREDIT ON NEXT DAY/JOUR SUIVANT ACTION COLLECTIONS & RECEIVABLES MANAGEMENT ON NEXT DAY/JOUR SUIVANT AFFINITY CREDIT SOLUTIONS AB NEXT DAY/JOUR SUIVANT AJAX, TOWN OF - TAXES ON NEXT DAY/JOUR SUIVANT ALBERTA BLUE CROSS AB NEXT DAY/JOUR SUIVANT ALBERTA MAINTENANCE ENFORCEMENT PROGRAM AB NEXT DAY/JOUR SUIVANT ALBERTA MOTOR ASSOCIATION - INSURANCE COMPANY AB NEXT DAY/JOUR SUIVANT ALGOMA POWER ON NEXT DAY/JOUR SUIVANT ALIANT ACTIMEDIA NL NEXT DAY/JOUR SUIVANT ALIANT MOBILITY - NS/NB NS NEXT DAY/JOUR SUIVANT ALIANT MOBILITY / NL NS NEXT DAY/JOUR SUIVANT ALIANT MOBILITY/PEI PE NEXT DAY/JOUR SUIVANT ALLIANCEONE ON NEXT DAY/JOUR SUIVANT ALLSTATE INSURANCE ON NEXT DAY/JOUR SUIVANT ALLY CREDIT CANADA ON NEXT DAY/JOUR SUIVANT ALLY CREDIT CANADA LIMITED (AUTO) -

Terms of Service

Terms of Service The agreement between you (“Customer” or “you”) and Lucky Mobile includes the following documents: • a summary setting out critical information about what you are signing up for (“Critical Information Summary”); • an agreement page confirming your acceptance of your agreement with us (“Our Agreement Page”); • a summary of key details about your Device, Services, promotions and related Charges (defined below) (“Mobile Service Summary”); and • the actual terms of service spelling out your, and our, obligations (including the schedule attached) (“Terms of Service” and “Schedule”) (together, the “Agreement”). You should review the entire Agreement. All of the parts are important and together create a legal contract about the Services and the Device (each as defined in Section 1) that applies to you once you have accepted it. Lucky Mobile relies upon your promise that you have reached the legal age of majority in your province or territory of residence and are authorized to enter into this Agreement. To help you to understand your rights and obligations under this Agreement, these Terms of Service are written in a question and answer format. At the end of these Terms of Service you’ll find Lucky Mobile’s contact information. Lucky Mobile is a brand operated by Bell Mobility Inc. (“Lucky Mobile”, “we” or “us”). 1. What is covered by this Agreement? This Agreement is for prepaid wireless telecommunications services provided by or through Lucky Mobile (“Lucky Mobile Services” or “Services”), including voice (exclusively for the purpose of making and receiving person-to-person voice calls and/or accessing voicemail), text, data (including data transmissions relating to the Internet of things) or other services, and account administration (for example, account changes and customer service). -

The Consumer Interest in Spectrum Auctions

THE CONSUMER INTEREST IN SPECTRUM AUCTIONS Written by Michael Janigan Researchers Eden Maher and Laman Meshadiyeva November 2012 1 The Consumer Interest in Spectrum Auctions Written by Michael Janigan Researchers Eden Maher and Laman Meshadiyeva November 2012 Prepared by the Public Interest Advocacy Centre (PIAC) With Funding from Industry Canada 2 Copyright 2012 PIAC Contents may not be commercially reproduced. Other reproduction, with acknowledgement is encouraged. The Public Interest Advocacy Centre (PIAC) Suite 1204 ONE Nicholas Street Ottawa, ON K1N 7B7 Tel: (613) 562-4002 Fax: (613) 562-0007 e-mail: [email protected] website: www.piac.ca Canadian Cataloguing and Publication Data Janigan, Michael The Consumer Interest in Spectrum Auctions ISBN 3 Acknowledgement of Support The Public Interest Advocacy Centre (PIAC) received funding from Industry Canada’s Contributions Program for Non-profit Consumer and Voluntary Organizations. The views expressed in the report are not necessarily those of Industry Canada or the Government of Canada. Le Centre Pour La Defense De L’Interet Public a reç du financement en vertu du Programme de contributions pour les organizations sans but lucratif de consommateurs et de bénévoles d”Industrie Canada. Les opinions exprimées dans ce rapport ne sont pas nécessairement celles d”Industrie Canada ou du gouvernement du Canada. We would also like to acknowledge and thank Eden Maher and Laman Meshadiyeva for their additional research and writing. 4 Table of Contents Executive Summary ...................................................................................................6 -

Politique De Protection De La Vie Privée De Lucky Mobile

Politique de protection de la vie privée de Lucky Mobile Lucky Mobile s’engage à préserver la confidentialité, l’exactitude et la sécurité de tes renseignements personnels. Nous remplissons cet engagement grâce à la formation de nos employés, aux mesures de sécurité utilisées pour protéger tes renseignements, et à nos politiques, y compris la présente Politique de protection de la vie privée. Lucky Mobile se conforme à toutes les lois et tous les règlements applicables relatifs à la protection de la vie privée. Les « renseignements personnels » sont des renseignements te concernant comme personne identifiable qui sont protégés par la loi. La présente Politique de protection de la vie privée explique : • comment et pourquoi nous recueillons, utilisons et divulguons tes renseignements personnels; • de quelle manière et à quel moment ton consentement éclairé sera demandé (ainsi que certaines exceptions); • comment tu peux accéder aux renseignements personnels te concernant que nous avons en notre possession; • avec qui communiquer si tu as des questions ou des préoccupations concernant notre protection de ta vie privée. Nous espérons que tu trouveras cette politique instructive et utile. Application de la présente Politique de protection de la vie privée : 1. À qui la présente Politique de protection de la vie privée s’applique-t-elle? À nos clients, aux utilisateurs autorisés de nos produits et services, et à nos employés. 2. S’agit-il de la seule politique de protection de la vie privée de Lucky Mobile? Même si ce document se veut le plus exhaustif possible, il ne peut pas couvrir toutes les situations où nous traitons des renseignements personnels; ainsi, il est possible que certains de nos produits ou services puissent également avoir des politiques de protection de la vie privée qui leur sont propres. -

How to Contact Someone by Text Messaging (SMS) Without Using a Mobile Phone

How to contact someone by text messaging (SMS) without using a mobile phone You can send a text message (SMS) to a cellular subscriber from your e-mail application (Outlook). Your e-mail will be converted into a text message, and your recipient will receive a text message instead of an e-mail. You simply need to send an e-mail to a special address (see table below). To send a text message to a cellular subscriber from your e-mail application, you need to know two components: • their cellular number; • the name of their cellular provider (Bell, Rogers, TELUS, etc.). The table below shows the e-mail address to use depending on the recipient’s cellular provider: Provider Recipient’s Extension to use number Bell and Solo Mobile xxx-xxx-xxxx @txt.bell.ca Chatr, Rogers and Tbaytel xxx-xxx-xxxx @pcs.rogers.com Eastlink xxx-xxx-xxxx @txt.eastlink.ca Fido xxx-xxx-xxxx @fido.ca Koodo Mobile xxx-xxx-xxxx @msg.koodomobile.com MTS xxx-xxx-xxxx @text.mtsmobility.com PC Mobile xxx-xxx-xxxx @mobiletxt.ca Public Mobile xxx-xxx-xxxx @msg.telus.com Sasktel xxx-xxx-xxxx @sms.sasktel.com TELUS xxx-xxx-xxxx @msg.telus.com Virgin Mobile xxx-xxx-xxxx @vmobile.ca WIND Mobile xxx-xxx-xxxx @txt.windmobile.ca For instance, in case of a Bell subscriber whose mobile number is 819-555-1212, you would send them a text message at [email protected] from your e-mail application. Also, if the subscriber replies to your text message and they have a data package or are connected to a wireless network, their reply will appear directly in your e-mail software! . -

Carrier Mask SMS Address Media Message

Message Carrier Mask SMS Address Media Length Notes 3 River Wireless sms.3rivers.net 7-11 Speakout (USA GSM) [email protected] ACS Wireless paging.acswireless.com Advantage Communications advantagepaging.com Airtel (Karnataka, India) [email protected] Airtel Wireless (Montana, USA) [email protected] Airtouch Pagers airtouch.net Airtouch Pagers airtouchpaging.com Airtouch Pagers alphapage.airtouch.com Airtouch Pagers myairmail.com Alaska Communications Systems [email protected] Alltel message.alltel.com Alltel PCS message.alltel.com 300 AlphaNow alphanow.net AlphNow [email protected] American Messaging page.americanmessaging.net American Messaging (SBC/Ameritech) page.americanmessaging.net Ameritech Clearpath clearpath.acswireless.com Ameritech Paging paging.acswireless.com Ameritech Paging (see also American Messaging) pageapi.com Ameritech Paging (see also American Messaging) paging.acswireless.com @mms.att.net Andhra Pradesh Airtel airtelap.com Aql [email protected] Arch Pagers (PageNet) archwireless.net Arch Pagers (PageNet) epage.arch.com AT&T mobile.att.net AT&T txt.att.net AT&T Enterprise Paging [email protected] AT&T Free2Go mmode.com 160 AT&T PCS mobile.att.net AT&T Pocketnet PCS dpcs.mobile.att.net BeeLine GSM sms.beemail.ru Beepwear beepwear.net Bell Atlantic message.bam.com Bell Canada bellmobility.ca Bell Canada txt.bellmobility.ca Bell Mobility txt.bellmobility.ca Bell Mobility & Solo Mobile (Canada) [email protected] Bell Mobility (Canada) txt.bell.ca Bell South bellsouth.cl Bell South blsdcs.net -

Canadian Mobile Wireless Services Market Report (2013 Edition)

CANADIAN MOBILE WIRELESS COMMUNICATIONS SERVICES MARKET REPORT 2013 EDITION NBI/MICHAEL SONE ASSOC...2013 CDN MOBILE WIRELESS COMMUNICATIONS SERVICES MKT REPORT CANADIAN MOBILE WIRELESS COMMUNICATIONS SERVICES MARKET REPORT, 2013 EDITION TABLE OF CONTENTS Section Page About this Report v A Note on Accuracy vi 1.0 Market Overview 1 2.0 Incumbent Service Providers 7 2.1 Bell Aliant 7 2.2 Bell Wireless 7 2.2.1 Virgin Mobile 10 2.2.2 Solo Mobile 11 2.3 MTS Allstream 12 2.4 Rogers Wireless 13 2.4.1 Fido 15 2.4.2 chat-r 16 2.5 SaskTel 16 2.6 TELUS 18 2.6.1 Koodo 20 3.0 New Entrants 22 3.1 Eastlink 22 3.2 Mobilicity 23 3.3 Public Mobile 24 3.4 Videotron 26 3.5 WIND Mobile 28 UNAUTHORIZED REPRODUCTION PROHIBITED NBI/MICHAEL SONE ASSOC...2013 CDN MOBILE WIRELESS COMMUNICATIONS SERVICES MKT REPORT CANADIAN MOBILE WIRELESS COMMUNICATIONS SERVICES MARKET REPORT, 2013 EDITION List of Exhibits Exhibit Page Exhibit 1 Subscribers/Net Activations by Service Provider (2011-2016) 33 Exhibit 2 Subscribers by Service Provider by Province (2011-2016) 34 Exhibit 3 Subscriber % Share by Service Provider by Province (2011-2016) 35 Exhibit 4 Subscriber Penetration of Canadian Population (2011-2016) 36 Exhibit 5 Subscribers by Service Type (pre- & post-paid) and Market Segment, (consumer & business) by Service Provider (2011-2016) 36 Exhibit 6 Service Revenue (voice & data), ARPU, MOU, by Service Provider (2011-2016) 37 Exhibit 7 Monthly Churn (%) and Cost of Acquisition by Service Provider (2011-2013) 38 Exhibit 8 Text and SMS Messages by Service Provider (2011-2016) -

Telesat Already Has Operating Satellites at Six of These Orbital Positions

ATTACHMENT 1 - BENEFITS OF SPECTRUM AGGREGATION INTRODUCTION AND SUMMARY In the Call for Applications to License Satellite Orbital Positions (“Call”), Notice No. DGRB-001-06 dated July 7, 2006, Industry Canada is offering 29 licences for satellite spectrum covering four frequency bands (extended Ku-band FSS, Ka-band FSS, 12 GHz BSS and 17 GHz BSS) spread over 16 orbital positions. Telesat already has operating satellites at six of these orbital positions. Telesat is applying for 10 of the 29 licences to expand its satellite fleet and to build a platform for continued growth and innovation through the next decade and beyond. Nine of the 10 licences for which Telesat is applying are for satellites at orbital locations at which Telesat already operates. Telesat’s business rationale for each application is based on detailed discussions with its customer and user groups in Canada, each of which has identified needs and growth plans of their own. Moreover, Telesat is seeking to maintain the ability to compete effectively in both Canadian and North American satellite service markets and to compete for critical investment funds in an increasingly satellite-sophisticated financial community. In this context, Telesat would like to raise a fundamental issue for consideration by Industry Canada, one that is critical to the Canadian satellite industry as a whole, and to the customers of Canadian satellite services. As discussed below, Telesat urges Industry Canada to maximize that number of frequency bands that are assigned to an operator at any given orbital location. This approach is consistent with the orbital/frequency assignment policies of the U.S. -

BCE INC. 2009 ANNUAL REPORT Bell Is a Restructured and Re-Energized Competitor Dedicated to Returning Value to Shareholders

BCE INC. 2009 ANNUAL REPORT Bell is a restructured and re-energized competitor dedicated to returning value to shareholders. Backed by a prudent capital markets strategy and a new culture of cost efficiency, the Bell team executed our service and investment focused strategy to make strong progress toward our goal in 2009. Bell’s goal: To be recognized by customers as Canada’s leading communications company. The 5 Strategic Imperatives we are executing to achieve it: 1 Improve customer service 2 Accelerate wireless 3 Leverage wireline momentum 4 Invest in broadband networks and services 5 Achieve a competitive cost structure Additional Highlights BCE Wireless Subscribers (millions) Annualized Common Dividend Per Share ($) 1.74 7.0 1.62 1.54 6.6 1.46 6.3 2007 2008 2009 Q4 2008 H1 2009 H2 2009 2010 BCE High-Speed Internet Subscribers (millions) Free Cash Flow ($ billions) Pension funding and spectrum purchases 2.9 2.4 2.8 2.7 2.0 2.0 1.7 1.5 2007 2008 2009 2007 2008 2009 BCE TV Subscribers (millions) Share Buybacks ($ billions) 2.0 1.9 1.0 1.8 ≤ 0.5 0.2 2007 2008 2009 2007 2008/2009 2010 Program Program Program The New Network Bell launched Canada’s Best Network in November, offering 93% of Canadians access to the country’s fastest and largest mobile network. Bell’s state-of- the-art HSPA/HSPA+ network covers more than a mil- lion square kilometres, offers roaming in more than 200 countries around the globe and supports the world’s most in-demand smartphones and turbo sticks. -

Terms and Conditions of Service

TERMS AND CONDITIONS OF SERVICE The agreement between you (“Member” or “you”) and Virgin Mobile Canada includes the following documents, as they may apply to you: • a summary setting out critical information about what you are signing up for (“Important Member Info”); • an agreement page confirming your acceptance of your agreement with us (“Our Agreement Page”); • a summary of key details about your Device, Services, promotions and related Charges (defined below) (“Important Member Info Recap”); • the actual terms and conditions of service spelling out your, and our, obligations (including the schedules attached) (“Terms and Conditions of Service” and “Schedules”); and • if you are a Member who makes monthly payments on your Device (“Device Payment Member”), a disclosure statement for the payment terms for your Device (“Disclosure Statement”) (together, the “Agreement”). You should review the entire Agreement. All of the parts are important and together create a legal contract about the Services and the Device that applies to you once you have accepted it. We rely upon your promise that you have reached the legal age of majority in your province or territory of residence and are authorized to enter into this Agreement. To help you to understand your rights and obligations under this Agreement, these Terms and Conditions of Service are written in a question and answer format. At the end of these Terms and Conditions of Service you’ll find our contact information. Virgin Mobile Canada is a brand operated by Bell Mobility Inc. (“Virgin Mobile”,