The Economic Fog

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

UK Equity Income Fund

MI Chelverton UK Equity Income Fund Investment Objective and Policy The objective of the Fund is to provide a progressive income stream and achieve long-term capital growth by investing primarily in a portfolio of fully listed and AIM traded UK equities. The Fund Monthly Fact Sheet will invest in UK companies which aim to provide a high initial dividend, progressive dividend 31 October 2017 payments and long term capital appreciation. Launch Date 4th December 2006 Monthly Manager Commentary Fund Size £563.0m The recent interest rate increase was widely anticipated and benefited our portfolio in the latter part Historic Yield (%)* 3.95 of the month as sterling strengthened whilst the rise in the oil price was a mild headwind. We have often referred to the short term effects of ‘investor sentiment’ on both share prices and the relative Share Price (as at 31.10.17) performance of small and mid caps compared to their larger counterparts. In a nutshell, when Shares Income Accumulation sentiment is positive investors tend to be happier to own stocks within our universe. One significant B Shares 131.96p 242.08p macro input into investors’ appetite for our companies is the domestic and global political backdrop and arguably, at the moment, the ability to ‘price’ political risk here at home, in the US, and now in Germany is as difficult as it has ever been. It appears that investors have little option but to look through the ‘top down’ political ‘noise’ and concentrate more on the actual companies themselves. With strong balance sheets and cash flows, gently improving trading and growing dividends, this should be good news for the type of company we invest in. -

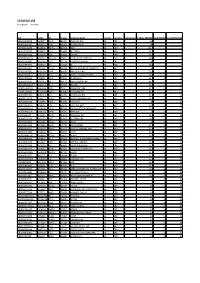

Description Iresscode Exchange Current Margin New Margin 3I

Description IRESSCode Exchange Current Margin New Margin 3I INFRASTRUCTURE PLC 3IN LSE 20 20 888 HOLDINGS PLC 888 LSE 20 20 ASSOCIATED BRITISH ABF LSE 10 10 ADMIRAL GROUP PLC ADM LSE 10 10 AGGREKO PLC AGK LSE 20 20 ASHTEAD GROUP PLC AHT LSE 10 10 ANTOFAGASTA PLC ANTO LSE 15 10 ASOS PLC ASC LSE 20 20 ASHMORE GROUP PLC ASHM LSE 20 20 ABERFORTH SMALLER COM ASL LSE 20 20 AVEVA GROUP PLC AVV LSE 20 20 AVIVA PLC AV LSE 10 10 ASTRAZENECA PLC AZN LSE 10 10 BABCOCK INTERNATIONAL BAB LSE 20 20 BARR PLC BAG LSE 25 20 BARCLAYS PLC BARC LSE 10 10 BRITISH AMERICAN TOBA BATS LSE 10 10 BAE SYSTEMS PLC BA LSE 10 10 BALFOUR BEATTY PLC BBY LSE 20 20 BARRATT DEVELOPMENTS BDEV LSE 10 10 BARING EMERGING EUROP BEE LSE 50 100 BEAZLEY PLC BEZ LSE 20 20 BH GLOBAL LIMITED BHGG LSE 30 100 BOWLEVEN PLC BLVN LSE 60 50 BANKERS INVESTMENT BNKR LSE 20 20 BUNZL PLC BNZL LSE 10 10 BODYCOTE PLC BOY LSE 20 20 BP PLC BP LSE 10 10 BURBERRY GROUP PLC BRBY LSE 10 10 BLACKROCK WORLD MININ BRWM LSE 20 65 BT GROUP PLC BT-A LSE 10 10 BRITVIC PLC BVIC LSE 20 20 BOVIS HOMES GROUP PLC BVS LSE 20 20 BROWN GROUP PLC BWNG LSE 25 20 BELLWAY PLC BWY LSE 20 20 BIG YELLOW GROUP PLC BYG LSE 20 20 CENTRAL ASIA METALS PLC CAML LSE 40 30 CLOSE BROTHERS GROUP CBG LSE 20 20 CARNIVAL PLC CCL LSE 10 10 CENTAMIN PLC CEY LSE 20 20 CHARIOT OIL & GAS LTD CHAR LSE 100 100 CHEMRING GROUP PLC CHG LSE 25 20 CONYGAR INVESTMENT CIC LSE 50 40 CALEDONIA INVESTMENTS CLDN LSE 25 20 CARILLION PLC CLLN LSE 100 100 COMMUNISIS PLC CMS LSE 50 100 CENTRICA PLC CNA LSE 10 10 CAIRN ENERGY PLC CNE LSE 30 30 COBHAM PLC -

Parker Review

Ethnic Diversity Enriching Business Leadership An update report from The Parker Review Sir John Parker The Parker Review Committee 5 February 2020 Principal Sponsor Members of the Steering Committee Chair: Sir John Parker GBE, FREng Co-Chair: David Tyler Contents Members: Dr Doyin Atewologun Sanjay Bhandari Helen Mahy CBE Foreword by Sir John Parker 2 Sir Kenneth Olisa OBE Foreword by the Secretary of State 6 Trevor Phillips OBE Message from EY 8 Tom Shropshire Vision and Mission Statement 10 Yvonne Thompson CBE Professor Susan Vinnicombe CBE Current Profile of FTSE 350 Boards 14 Matthew Percival FRC/Cranfield Research on Ethnic Diversity Reporting 36 Arun Batra OBE Parker Review Recommendations 58 Bilal Raja Kirstie Wright Company Success Stories 62 Closing Word from Sir Jon Thompson 65 Observers Biographies 66 Sanu de Lima, Itiola Durojaiye, Katie Leinweber Appendix — The Directors’ Resource Toolkit 72 Department for Business, Energy & Industrial Strategy Thanks to our contributors during the year and to this report Oliver Cover Alex Diggins Neil Golborne Orla Pettigrew Sonam Patel Zaheer Ahmad MBE Rachel Sadka Simon Feeke Key advisors and contributors to this report: Simon Manterfield Dr Manjari Prashar Dr Fatima Tresh Latika Shah ® At the heart of our success lies the performance 2. Recognising the changes and growing talent of our many great companies, many of them listed pool of ethnically diverse candidates in our in the FTSE 100 and FTSE 250. There is no doubt home and overseas markets which will influence that one reason we have been able to punch recruitment patterns for years to come above our weight as a medium-sized country is the talent and inventiveness of our business leaders Whilst we have made great strides in bringing and our skilled people. -

High Impact Sector Companies Analysed in the CDP Europe Report – 2019 Disclosure Year

High impact sector companies analysed in the CDP Europe Report – 2019 disclosure year The materials, energy and transport sectors, along with agriculture, comprise CDP’s high impact sectors. However due to lack of reporting data, the Agriculture sector was not included in the high- impact company analysis. Organization name Country Sector EVN AG Austria Electric utilities Mayr-Melnhof Karton Aktiengesellschaft Austria Paper & forestry OMV AG Austria Oil & gas Österreichische Post AG Austria Transport services VERBUND AG Austria Electric utilities Voestalpine AG Austria Steel Food, beverage & Anheuser Busch InBev Belgium tobacco Bekaert NV Belgium Metals & mining bpost Belgium Transport services Elia System Operator Belgium Electric utilities Fluxys Belgium Belgium Oil & gas Nyrstar NV Belgium Metals & mining Ontex Group NV Belgium Paper & forestry Solvay S.A. Belgium Chemicals CEZ Czechia Electric utilities A.P. Moller - Maersk Denmark Transport services Food, beverage & Carlsberg Breweries A/S Denmark tobacco Food, beverage & Chr. Hansen Holding A/S Denmark tobacco Dampskibsselskabet NORDEN A/S Denmark Transport services DFDS A/S Denmark Transport Services DSV A/S Denmark Transport services Novozymes A/S Denmark Chemicals Ørsted Denmark Electric utilities Finnair Finland Transport services Fortum Oyj Finland Electric utilities Huhtamäki Oyj Finland Paper & forestry Kemira Corporation Finland Chemicals Metsä Board Finland Paper & forestry Neste Oyj Finland Oil & gas Outokumpu Oyj Finland Steel Stora Enso Oyj Finland Paper & forestry UPM-Kymmene -

FTSE Russell Publications

2 FTSE Russell Publications 19 August 2021 FTSE 250 Indicative Index Weight Data as at Closing on 30 June 2021 Index weight Index weight Index weight Constituent Country Constituent Country Constituent Country (%) (%) (%) 3i Infrastructure 0.43 UNITED Bytes Technology Group 0.23 UNITED Edinburgh Investment Trust 0.25 UNITED KINGDOM KINGDOM KINGDOM 4imprint Group 0.18 UNITED C&C Group 0.23 UNITED Edinburgh Worldwide Inv Tst 0.35 UNITED KINGDOM KINGDOM KINGDOM 888 Holdings 0.25 UNITED Cairn Energy 0.17 UNITED Electrocomponents 1.18 UNITED KINGDOM KINGDOM KINGDOM Aberforth Smaller Companies Tst 0.33 UNITED Caledonia Investments 0.25 UNITED Elementis 0.21 UNITED KINGDOM KINGDOM KINGDOM Aggreko 0.51 UNITED Capita 0.15 UNITED Energean 0.21 UNITED KINGDOM KINGDOM KINGDOM Airtel Africa 0.19 UNITED Capital & Counties Properties 0.29 UNITED Essentra 0.23 UNITED KINGDOM KINGDOM KINGDOM AJ Bell 0.31 UNITED Carnival 0.54 UNITED Euromoney Institutional Investor 0.26 UNITED KINGDOM KINGDOM KINGDOM Alliance Trust 0.77 UNITED Centamin 0.27 UNITED European Opportunities Trust 0.19 UNITED KINGDOM KINGDOM KINGDOM Allianz Technology Trust 0.31 UNITED Centrica 0.74 UNITED F&C Investment Trust 1.1 UNITED KINGDOM KINGDOM KINGDOM AO World 0.18 UNITED Chemring Group 0.2 UNITED FDM Group Holdings 0.21 UNITED KINGDOM KINGDOM KINGDOM Apax Global Alpha 0.17 UNITED Chrysalis Investments 0.33 UNITED Ferrexpo 0.3 UNITED KINGDOM KINGDOM KINGDOM Ascential 0.4 UNITED Cineworld Group 0.19 UNITED Fidelity China Special Situations 0.35 UNITED KINGDOM KINGDOM KINGDOM Ashmore -

Annual Report 2020

HILTON FOOD GROUP PLC The leading specialist international food packing business ANNUAL REPORT AND FINANCIAL STATEMENTS 2020 HILTON FOOD GROUP PLC ANNUAL REPORT AND FINANCIAL STATEMENTS 2020 FINANCIAL HIGHLIGHTS REVENUE (£M) ADJUSTED OPERATING PROFIT (£M) NET BANK CASH/(DEBT)** (£M) £2,774.0m £67.0m £(122.2)m ‘16 1,234.5 ‘16 34.3 ‘16 34.6 ‘17 1,357.2 ‘17 38.3 ‘17 27.6 ‘18 1,649.6 ‘18 48.7 ‘18 (25.0) ‘19 1,814.7 ‘19 54.7 ‘19 (86.8) ‘20 2,774.0 ‘20 67.0 ‘20 (122.2) STRATEGIC HIGHLIGHTS OPERATING HIGHLIGHTS – Turnover up 50.0%* with strong growth in Australia – Strong response to Covid-19 ensuring continuous supply arising from: to our retailer partners, keeping our factories open – Joint venture transition period concluded with purchase and our colleagues safe of assets relating to the joint venture – Volume growth of 23.8%* within which Australia grew – A full year of the state-of-the art facility in 107.9%* and Europe grew 8.5%* Brisbane, Queensland – Adjusted operating profit £67.0m up 20.0%* and basic – New facility opened in Belgium for Ahold Delhaize with earnings per share 55.4p up 18.0%* volume ramp up under way – Strong operating cash generation of £91.7m up 30.5% – New Zealand facility scheduled to open in Q3 this year supporting a robust balance sheet – Committed to setting science-based target through the – Significant £95.5m investment in facilities to support Science Based Targets initiative and signed the Business future growth Ambition for 1.5°C pledge to net-zero by 2050 – Continued growth in protein diversification into plant-based, seafood and convenience foods * On a 52 week constant currency basis ** Excluding lease liabilities Adjusted results represent the IFRS results before deduction of acquisition intangibles amortisation and exceptional items and also IFRS 16 lease adjustments as detailed in the Alternative performance measures note 31. -

FTSE Factsheet

FTSE COMPANY REPORT Share price analysis relative to sector and index performance Dekel Agri-Vision DKL Food Producers — GBP 0.045 at close 21 April 2021 Absolute Relative to FTSE UK All-Share Sector Relative to FTSE UK All-Share Index PERFORMANCE 21-Apr-2015 1D WTD MTD YTD Absolute - - - - Rel.Sector - - - - Rel.Market - - - - VALUATION Data unavailable Trailing PE -ve EV/EBITDA -ve PB 2.2 PCF -ve Div Yield 0.0 Price/Sales 1.4 Net Debt/Equity 1.4 Div Payout 0.0 ROE -ve DESCRIPTION Data unavailable The Company is engaged in developing and cultivating palm oil plantations in Cote d'Ivoire for the purpose of producing and marketing Crude Palm Oil (CPO). Past performance is no guarantee of future results. Please see the final page for important legal disclosures. 1 of 4 FTSE COMPANY REPORT: Dekel Agri-Vision 21 April 2021 Valuation Metrics Price to Earnings (PE) EV to EBITDA Price to Book (PB) 31-Mar-2021 31-Mar-2021 31-Mar-2021 100 ‖ ‖ ‖ ‖ 60 25 ‖ 50 80 +1SD 20 40 60 15 30 40 Avg 10 20 +1SD +1SD 20 5 10 Avg Avg -1SD 0 ‖ ‖ ‖ ‖ 0 ‖ ‖ 0 Apr-2016 Apr-2017 Apr-2018 Apr-2019 Apr-2020 Apr-2016 Apr-2017 Apr-2018 Apr-2019 Apr-2020 Apr-2016 Apr-2017 Apr-2018 Apr-2019 Apr-2020 Associated British Foods 42.0 Greencore Group 18.2 Hilton Food Group 4.7 Hilton Food Group 26.5 Cranswick 13.2 Devro 3.3 Food Producers 26.3 Hilton Food Group 12.1 Greencore Group 3.2 Cranswick 23.0 Associated British Foods 11.7 Cranswick 3.1 Tate & Lyle Bakkavor Group 20.1 Food Producers 10.4 2.6 Dekel Agri-Vision 2.2 Anglo-Eastern Plantations 19.2 Anglo-Eastern Plantations -

Fidelity® Variable Insurance Products: Overseas Portfolio

Quarterly Holdings Report for Fidelity® Variable Insurance Products: Overseas Portfolio September 30, 2020 VIPOVRS-QTLY-1120 1.808774.116 Schedule of Investments September 30, 2020 (Unaudited) Showing Percentage of Net Assets Common Stocks – 99.4% Shares Value Shares Value Australia – 0.0% France – 9.8% National Storage (REIT) unit 1 $ 1 ALTEN (a) 88,970 $ 8,449,343 Amundi SA (b) 104,310 7,362,355 Austria – 0.3% Capgemini SA 116,920 15,044,843 Erste Group Bank AG 196,500 4,118,157 Dassault Systemes SA 55,500 10,395,088 Mayr‑Melnhof Karton AG 1,900 330,138 Edenred SA 245,353 11,046,302 Kering SA 21,108 14,047,007 TOTAL AUSTRIA 4,448,295 Legrand SA 142,900 11,423,089 LVMH Moet Hennessy Louis Vuitton SE 56,433 26,405,042 Bailiwick of Jersey – 1.3% Pernod Ricard SA 80,000 12,770,325 Experian PLC 320,000 12,023,801 Sanofi SA 223,515 22,398,850 Glencore Xstrata PLC 392,700 814,136 SR Teleperformance SA 58,360 18,036,614 Sanne Group PLC 991,298 8,403,827 Total SA 50,642 1,739,176 TOTAL BAILIWICK OF JERSEY 21,241,764 TOTAL FRANCE 159,118,034 Belgium – 0.7% Germany – 7.2% KBC Groep NV 208,968 10,483,744 adidas AG 51,764 16,756,703 UCB SA 7,200 818,839 Allianz SE 75,900 14,560,373 Bayer AG 136,853 8,442,973 TOTAL BELGIUM 11,302,583 Bertrandt AG 18,195 689,047 Delivery Hero AG (a) (b) 6,800 782,277 Bermuda – 2.0% Deutsche Borse AG 79,200 13,910,134 Credicorp Ltd. -

Form F-4 Registration Statement and Amendment No

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 SCHEDULE 14A Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934 Filed by the Registrant ⌧ Filed by a Party other than the Registrant Check the appropriate box: Preliminary Proxy Statement Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) ⌧ Definitive Proxy Statement Definitive Additional Materials Soliciting Material Pursuant to §240.14a-12 COCA-COLA ENTERPRISES, INC. (Name of Registrant as Specified In Its Charter) (Name of Person(s) Filing Proxy Statement, if other than the Registrant) Payment of Filing Fee (Check the appropriate box): ⌧ No fee required. Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. (1) Title of each class of securities to which the transaction applies: (2) Aggregate number of securities to which the transaction applies: (3) Per unit price or other underlying value of the transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): (4) Proposed maximum aggregate value of the transaction: (5) Total fee paid: Fee paid previously with preliminary materials. Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. (1) Amount Previously Paid: (2) Form, Schedule or Registration Statement No: (3) Filing Party: (4) Date Filed: LETTER TO CCE SHAREHOLDERS To the shareholders of Coca-Cola Enterprises, Inc.: You are cordially invited to attend a special meeting of the shareholders of Coca-Cola Enterprises, Inc. -

STOXX UK 180 Selection List

STOXX UK 180 Last Updated: 20210301 ISIN Sedol RIC Int.Key Company Name Country Currency Component FF Mcap (BEUR) Rank (FINAL)Rank (PREVIOUS) GB00B10RZP78 B10RZP7 ULVR.L 091321 UNILEVER PLC GB GBP Y 113 1 1 GB0009895292 0989529 AZN.L 098952 ASTRAZENECA GB GBP Y 105 2 2 GB0005405286 0540528 HSBA.L 040054 HSBC GB GBP Y 101.6 3 3 GB0007188757 0718875 RIO.L 071887 RIO TINTO GB GBP Y 76.5 4 7 GB0002374006 0237400 DGE.L 039600 DIAGEO GB GBP Y 75.8 5 4 GB00B03MLX29 B09CBL4 RDSa.AS B09CBL ROYAL DUTCH SHELL A GB EUR Y 69.3 6 8 GB0009252882 0925288 GSK.L 037178 GLAXOSMITHKLINE GB GBP Y 69 7 5 GB0007980591 0798059 BP.L 013849 BP GB GBP Y 68.3 8 9 GB0002875804 0287580 BATS.L 028758 BRITISH AMERICAN TOBACCO GB GBP Y 62 9 6 GB00BH0P3Z91 BH0P3Z9 BHPB.L 005666 BHP GROUP PLC. GB GBP Y 55.2 10 11 GB00B24CGK77 B24CGK7 RB.L 072769 RECKITT BENCKISER GRP GB GBP Y 50.9 11 10 GB0007099541 0709954 PRU.L 070995 PRUDENTIAL GB GBP Y 42.3 12 14 GB00B1XZS820 B1XZS82 AAL.L 490151 ANGLO AMERICAN GB GBP Y 40.5 13 15 GB00B2B0DG97 B2B0DG9 REL.L 073087 RELX PLC GB GBP Y 38.6 14 12 GB00BH4HKS39 BH4HKS3 VOD.L 071921 VODAFONE GRP GB GBP Y 37.7 15 13 JE00B4T3BW64 B4T3BW6 GLEN.L GB10B3 GLENCORE PLC GB GBP Y 36.5 16 18 GB00BDR05C01 BDR05C0 NG.L 024282 NATIONAL GRID GB GBP Y 32.7 17 16 GB0008706128 0870612 LLOY.L 087061 LLOYDS BANKING GRP GB GBP Y 31.8 18 22 GB0031348658 3134865 BARC.L 007820 BARCLAYS GB GBP Y 30 19 23 GB00BD6K4575 BD6K457 CPG.L 053315 COMPASS GRP GB GBP Y 29.9 20 21 GB00B0SWJX34 B0SWJX3 LSEG.L 095298 LONDON STOCK EXCHANGE GB GBP Y 25.2 21 17 GB00B19NLV48 B19NLV4 -

Premium Listed Companies Are Subject to the UK's Super-Equivalent Rules Which Are Higher Than the EU Minimum "Standard Listing" Requirements

List of Premium Equity Comercial Companies - 29th April 2020 Definition: Premium listed companies are subject to the UK's super-equivalent rules which are higher than the EU minimum "standard listing" requirements. Company Name Country of Inc. Description of Listed Security Listing Category Market Status Trading Venue Home Member State ISIN(S) 4IMPRINT GROUP PLC United Kingdom Ordinary Shares of 38 6/13p each; fully paid Premium Equity Commercial Companies RM LSE United Kingdom GB0006640972 888 Holdings Plc Gibraltar Ordinary Shares of 0.5p each; fully paid Premium Equity Commercial Companies RM LSE United Kingdom GI000A0F6407 AA plc United Kingdom Ordinary Shares of 0.1p each; fully paid Premium Equity Commercial Companies RM LSE United Kingdom GB00BMSKPJ95 Admiral Group PLC United Kingdom Ordinary Shares of 0.1p each; fully paid Premium Equity Commercial Companies RM LSE United Kingdom GB00B02J6398 AGGREKO PLC United Kingdom Ordinary Shares of 4 329/395p each; fully paid Premium Equity Commercial Companies RM LSE United Kingdom GB00BK1PTB77 AIB Group Plc Ireland Ordinary Shares of EUR0.625 each; fully paid Premium Equity Commercial Companies RM LSE Ireland IE00BF0L3536 Air Partner PLC United Kingdom Ordinary Shares of 1p each; fully paid Premium Equity Commercial Companies RM LSE United Kingdom GB00BD736828 Airtel Africa plc United Kingdom Ordinary Shares of USD0.50 each; fully paid Premium Equity Commercial Companies RM LSE United Kingdom GB00BKDRYJ47 AJ Bell plc United Kingdom Ordinary Shares of GBP0.000125 each; fully paid Premium -

FTSE Russell Publications

FTSE Russell Publications 19 November 2018 FTSE 250 Indicative Index Weight Data as at Closing on 28 September 2018 Index weight Index weight Index weight Constituent Country Constituent Country Constituent Country (%) (%) (%) 3i Infrastructure 0.34 UNITED Capital & Counties Properties 0.51 UNITED Esure Group 0.21 UNITED KINGDOM KINGDOM KINGDOM 888 Holdings 0.13 UNITED Card Factory 0.16 UNITED Euromoney Institutional Investor 0.19 UNITED KINGDOM KINGDOM KINGDOM AA 0.15 UNITED Centamin 0.3 UNITED F&C Commercial Property Trust 0.19 UNITED KINGDOM KINGDOM KINGDOM Aberforth Smaller Companies Tst 0.32 UNITED Charter Court Financial Services Group 0.12 UNITED F&C Global Smaller Companies 0.22 UNITED KINGDOM KINGDOM KINGDOM Aggreko 0.54 UNITED Cineworld Group 0.82 UNITED FDM Group Holdings 0.21 UNITED KINGDOM KINGDOM KINGDOM Alliance Trust 0.68 UNITED City of London Investment Trust 0.39 UNITED Ferrexpo 0.15 UNITED KINGDOM KINGDOM KINGDOM Amigo Holdings 0.09 UNITED Clarkson 0.17 UNITED Fidelity China Special Situations 0.21 UNITED KINGDOM KINGDOM KINGDOM Ascential 0.43 UNITED Close Brothers Group 0.62 UNITED Fidelity European Values 0.25 UNITED KINGDOM KINGDOM KINGDOM Ashmore Group 0.36 UNITED CLS Holdings 0.09 UNITED Fidelity Special Values 0.13 UNITED KINGDOM KINGDOM KINGDOM Assura 0.33 UNITED Coats Group 0.3 UNITED Finsbury Growth & Income Trust 0.36 UNITED KINGDOM KINGDOM KINGDOM Auto Trader Group 1.07 UNITED Cobham 0.72 UNITED FirstGroup 0.29 UNITED KINGDOM KINGDOM KINGDOM Avast 0.18 UNITED Computacenter 0.23 UNITED Fisher (James) & Sons