FOI Response – University Residences Please Could the Following

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

THE BRISTOL MEDICAL SCHOOL the Bristol Medical School Is the Fifty-Eighth Pamphlet to Be Published by the Bristol Branch of the Historical Association

BRISTOL BRANCH OF THE HISTORICAL ASSOCIATION THE THE UNIVERSITY, BRISTOL BRISTOL MEDICAL Price 90p 1984 SCHOOL ISBN O 901388 40 8 C. BRUCE PERRY � \ Pb BRISTOL BRANCH OF THE HISTORICAL ASSOCIATION LOCAL HISTORY PAMPHLETS AVON C1U\iTY LIBfi:i'\iW Hon. General Editor: PATRICK McGRATH - DEC1984 ---�------4 Ct-1:•,i,i> Assistant General Editor: PETER HARRIS No ....,,_\M_.� 3_ I�- 0 . THE BRISTOL MEDICAL SCHOOL The Bristol Medical School is the fifty-eighth pamphlet to be published by the Bristol Branch of the Historical Association. The author, Professor C. Bruce Perry, is Emeritus Professor of Medi May I firstof all express my thanks to the University of Bristol for cine in the University of Bristol. He has made a number of studies inviting me to give this lecture in honour of an enthusiastic of Bristol medical history, including The Bristol Royal Infirmary historian of Bristol, Frederick Creech Jones. A photograph of him 1904-1974, which was published in 1981, and he has contributed taken about 1920 on the _base of the Whitchurch Cross illustrates an earlier pamphlet to this series - The Voluntary Medical his interest in antiquities (see p. 2). His working life was spent Institutions of Bristol. with the Bristol Waterworks Company whose history he wrote on This pamphlet is basically the Frederick Creech Jones Memorial the occasion of their centenary in 1946. In the same year he Lecture which Professor Perry delivered in the University of published his book The Glory that was Bristol in which he recorded Bristol in 1983. It has unfortunately not been possible to re many historical Bristol buildings and deplored the loss of s� many produce here all the numerous illustrations which Professor Perry of them not only by enemy action but also by urban 'develop used on that occasion. -

The University of Bristol Historic Gardens 2Nd Edition Marion Mako

The University Bristol of Historic Gardens Marion Mako Marion UK £5 Marion Mako is a freelance historic garden and landscape historian. She has a Masters Degree in Garden History designed by greenhatdesign.co.uk ISBN 978-0-9561001-5-3 from the University of Bristol where she occasionally lectures. She researches public and private gardens, leads bespoke garden tours and offers illustrated talks. 2nd Edition The University of Bristol She has collaborated with Professor Tim Mowl on two 2nd Edition books in The Historic Gardens of England series: Cheshire Historic Gardens 9 780956 100153 and Somerset. Marion lives in Bristol. Marion Mako The University of Bristol Historic Gardens 2nd Edition Marion Mako Acknowledgements The history of these gardens is based on both primary and secondary research and I would like to acknowledge my gratitude to the authors of those texts who made their work available to me. In addition, many members of staff and students, both past and present, have shared their memories, knowledge and enthusiasm. In particular, I would like to thank Professor Timothy Mowl and Alan Stealey for their support throughout the project, and also the wardens of the University’s halls of residence, Dr. Martin Crossley-Evans, Professor Julian Rivers, Professor Gregor McLennan and Dr. Tom Richardson. For assistance with archival sources: Dr. Brian Pollard, Annie Burnside, Janice Butt, Debbie Hutchins, Alex Kolombus, Dr. Clare Hickman, Noni Bemrose, Rynholdt George, Will Costin, Anne de Verteuil, Douglas Gillis, Susan Darling, Stephanie Barnes, Cheryl Slater, Dr. Laura Mayer, Andy King, Judy Preston, Nicolette Smith and Peter Barnes. Staff at the following libraries and collections, have been most helpful: Bristol Reference Library, Bristol Record Office, The British Library, The British Museum, Bristol Museum and Art Gallery and especially Michael Richardson and the staff of Special Collections at the University of Bristol Arts and Social Sciences Library. -

Heroic Chancellor: Winston Churchill and the University of Bristol 1929–65

Heroic Chancellor: Winston Churchill and the University of Bristol 1929–65 David Cannadine Heroic Chancellor: Winston Churchill and the University of Bristol 1929–65 To the Chancellors and Vice-Chancellors of the University of Bristol past, present and future Heroic Chancellor: Winston Churchill and the University of Bristol 1929–65 David Cannadine LONDON INSTITUTE OF HISTORICAL RESEARCH Published by UNIVERSITY OF LONDON SCHOOL OF ADVANCED STUDY INSTITUTE OF HISTORICAL RESEARCH Senate House, Malet Street, London WC1E 7HU © David Cannadine 2016 All rights reserved This text was first published by the University of Bristol in 2015. First published in print by the Institute of Historical Research in 2016. This PDF edition published in 2017. This book is published under a Creative Commons Attribution- NonCommercial-NoDerivatives 4.0 International (CC BY- NCND 4.0) license. More information regarding CC licenses is available at https://creativecommons.org/licenses/ Available to download free at http://www.humanities-digital-library.org ISBN 978 1 909646 18 6 (paperback edition) ISBN 978 1 909646 64 3 (PDF edition) I never had the advantage of a university education. Winston Churchill, speech on accepting an honorary degree at the University of Copenhagen, 10 October 1950 The privilege of a university education is a great one; the more widely it is extended the better for any country. Winston Churchill, Foundation Day Speech, University of London, 18 November 1948 I always enjoy coming to Bristol and performing my part in this ceremony, so dignified and so solemn, and yet so inspiring and reverent. Winston Churchill, Chancellor’s address, University of Bristol, 26 November 1954 Contents Preface ix List of abbreviations xi List of illustrations xiii Introduction 1 1. -

UNIVERSITY of LONDON, SCHOOL of ADVANCED STUDY Senate

Downloaded from the Humanities Digital Library http://www.humanities-digital-library.org Open Access books made available by the School of Advanced Study, University of London ***** Publication details: Heroic Chancellor: Winston Churchill and the University of Bristol 1929–65 David Cannadine http://humanities-digital-library.org/index.php/hdl/catalog/book/heroicchancellor DOI: 10.14296/517.9781909646643 ***** This edition published 2017 by UNIVERSITY OF LONDON SCHOOL OF ADVANCED STUDY INSTITUTE OF HISTORICAL RESEARCH Senate House, Malet St, Bloomsbury, London WC1E 7HU, United Kingdom ISBN 978 1 909646 64 3 (PDF edition) This work is published under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License. More information regarding CC licenses is available at https://creativecommons.org/licenses UNIVERSITY OF LONDON, SCHOOL OF ADVANCED STUDY Senate House, Malet Street, London, WC1E 7HU Enquiries: [email protected] Heroic Chancellor: Winston Churchill and the University of Bristol 1929–65 David Cannadine Heroic Chancellor: Winston Churchill and the University of Bristol 1929–65 To the Chancellors and Vice-Chancellors of the University of Bristol past, present and future Heroic Chancellor: Winston Churchill and the University of Bristol 1929–65 David Cannadine LONDON INSTITUTE OF HISTORICAL RESEARCH Published by UNIVERSITY OF LONDON SCHOOL OF ADVANCED STUDY INSTITUTE OF HISTORICAL RESEARCH Senate House, Malet Street, London WC1E 7HU © David Cannadine 2016 All rights reserved This text was first published by the University of Bristol in 2015. First published in print by the Institute of Historical Research in 2016. This PDF edition published in 2017. This book is published under a Creative Commons Attribution- NonCommercial-NoDerivatives 4.0 International (CC BY- NCND 4.0) license. -

Tyndall's Memories 1958

Sixty years of Academic Life in Bristol A. M. Tyndall [The following talk was given to the Forum of the Senior Common Room of the University of Bristol on 10 March 1958 by the late A. M. Tyndall, who was at that time Professor Emeritus of Physics, having joined the staff in 1903, been Professor of Physics from 1919 to 1948, and acting Vice-Chancellor 1945—46. The text appeared, in slightly shortened form, in 'University and Community', edited by McQueen and Taylor, 1976: a collection of essays produced to mark the centenary of the founding of University College, Bristol. The Editors were then extremely grateful to Dr Anne Cole for providing a transcript of a tape-recording of the talk; and so are we.] I thought this was going to be a conversation piece to a small group of intimate friends! As I look at the audience, I realise that I joined the Staff of University College, Bristol at a time when few of the men and, of course, none of the women were born! 1 was a student before that and in fact it will be sixty years next October since I first entered the doors of University College with the intention of studying for a degree of the University of London in a scientific subject. I was one of about 220 students in the University College at that time, of whom 60 were in what was really an affiliated institution called the Day Training College for Women Teachers. The income of the College was then a little under £5,000 a year. -

Battery Bin Location

Battery tube location list: Updated October 2020 Bin Site Name Address Postcode Waste type Bin Type Bin(s) Location Quantity Alfred Marshall Building 12 Priory Rd BS8 1TU Batteries 10L tube 1 Photocopier room in Alfred Marshall Building 12 Woodland Rd Clifton, Bristol 1-5 Whiteladies 1-5 Whiteladies Road BS8 2RP Batteries 7L tube 1 Main entrance, by recycling bins Road, Clifton, Bristol 1-9 Old Park Hill lead acid Clifton Batteries (lead 1-9 Old Park Hill BS2 8BB battery pallet 1 In Waste compound in Chemistry car park. Bristol acid) box 1-9 Old Park Hill Clifton Batteries Mixed battery 1-9 Old Park Hill BS2 8BB 1 In Waste compound in Chemistry car park. Bristol (mixed) pallet box 1-9 Old Park Hill Clifton 1×Atrium outside sustainability 1-9 Old Park Hill BS2 8BB Batteries 20L tube 2 Bristol 1× outside main stores 31 Great George Clifton, Bristol BS1 5QD Batteries 10L tube 2 Level's 1, 2 and 3 in the kitchens, by the recycling bins Street 35 Berkeley Square 35 Berkeley Square BS8 1JA Batteries 10L tube 1 Main foyer Bristol 3-5 Woodland Road 3 Woodland Road, 7L tube Room G88 BS8 1TB Batteries 2 Clifton, Bristol 10L tube Estate Assistance Lodge (17 Woodland Road access via 3-5 link corridor) School of Policy Studies 8 Priory Rd BS8 1TU Batteries 10L tube 1 Staff common room 8 Priory Rd Clifton, Bristol Augustine's Courtyard Orchard Lane, Bristol BS1 5DS Batteries 10L tube 1 Reception Badock Hall, Stoke Park Road, Badock Hall BS9 1JQ Batteries 10L tube 1 Estate Assistance Lodge Stoke Bishop, Bristol Department of Archaeology Baptist College -

Manor Hall Residents' Handbook

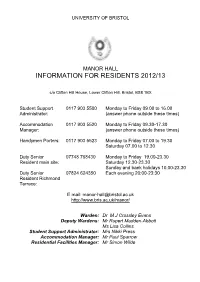

UNIVERSITY OF BRISTOL MANOR HALL INFORMATION FOR RESIDENTS 2012/13 c/o Clifton Hill House, Lower Clifton Hill, Bristol, BS8 1BX Student Support 0117 903 5500 Monday to Friday 09.00 to 16.00 Administrator: (answer phone outside these times) Accommodation 0117 903 5520 Monday to Friday 09.30-17.30 Manager: (answer phone outside these times) Handymen Porters: 0117 903 5523 Monday to Friday 07.00 to 19.30 Saturday 07.00 to 12.30 Duty Senior 07748 768430 Monday to Friday 19.00-23.30 Resident main site: Saturday 12.30-23.30 Sunday and bank holidays 10.00-23.30 Duty Senior 07824 624350 Each evening 20:00-23:30 Resident Richmond Terrace: E mail: [email protected] http://www.bris.ac.uk/manor/ Warden: Dr M J Crossley Evans Deputy Wardens: Mr Rupert Madden-Abbott Ms Lisa Collins Student Support Administrator: Mrs Nikki Press Accommodation Manager: Mr Paul Sparrow Residential Facilities Manager: Mr Simon Wilde CONTENTS WARDEN’S WELCOME............................................. 5 INTRODUCTION .................................................. 6 Your Accommodation Contract ................................... 6 Arriving at Manor Hall.......................................... 7 Hall Location and Site Plan...................................... 7 What To Bring With You ........................................ 7 What Not To Bring With You..................................... 8 Accommodation Inventory ...................................... 8 GENERAL INFORMATION ABOUT MANOR HALL ......................... 9 Absence .................................................. -

Student Accommodation Topic Paper

Bristol Central Area Plan Publication Version (February 2014) Student Accommodation Topic Paper Student Accommodation – Issues and policy approach 1. Introduction 1.1. Bristol is host to two major higher education institutions, the University of Bristol (UoB), located within the city centre, and the University of the West of England (UWE), located to the north of the city and within the adjoining authority of South Gloucestershire. Each plays a significant role in the city’s economy, helping to maintain Bristol as a strong centre for research and innovation, supporting the city’s knowledge and technology industries and contributing to local business through student spend. Both Universities also make a significant contribution to the city’s social and cultural life. Their sizeable student communities add much to Bristol’s reputation as a vibrant and diverse city. Their strong academic standing and international connections also strengthen Bristol’s status as an important European centre. 1.2. Bristol’s future success is linked to the continued growth and development of these institutions, supported through a positive planning policy approach. With this come challenges; in particular, the management of rising student numbers and the adequate supply of good quality accommodation in appropriate locations. In recent years demand for student accommodation has placed pressure on the local housing stock often resulting in perceived or actual harmful impacts on communities accommodating students, especially in areas close to the UoB. With aspirations for increased growth the council has a clear and robust policy strategy that addresses such issues whilst also supporting the development plans of these important institutions. -

18Open Day 2018

Open day 2018 Programme Friday 15 June 18Saturday 16 June OPEN DAY 2018 OPEN DAY 2018 2 WELCOME WELCOME 3 Welcome Welcome Welcome to the University of Bristol. We Enjoy a taste of About your open day 4 have designed our open days so that they Bristol with street Exhibition 6 provide an enjoyable and comprehensive insight into student life at the University. I food and a place to Accommodation 8 encourage you to take advantage of the relax among the University campus map 10 full range of activities available. Our open greenery of Royal Information talks 12 days offer unique access to our beautiful Fort Gardens at Subject activities 13 campuses at Langford and Clifton, so please Veterinary subject explore and take opportunities to speak the centre of the activities 22 to staff about our innovative teaching and Clifton campus. Langford campus map 23 cutting-edge facilities at the subject displays and tours. The exhibition in the Richmond Building is an ideal opportunity to talk in person with our student services teams, who support every aspect of student life here. Finally, do take time to visit Royal Fort Gardens and experience a little of what our lively and independent city can offer. Professor Hugh Brady Vice-Chancellor and President Talk to teams from accommodation, admissions, funding and more at the open day exhibition. bristol.ac.uk/opendays bristol.ac.uk/opendays OPEN DAY 2018 OPEN DAY 2018 4 ABOUT YOUR OPEN DAY ABOUT YOUR OPEN DAY 5 About your open day Open days are special events, designed to help you explore subjects and student life at Bristol and experience a little of the unique atmosphere on campus. -

The Churchillian Autumn 2019

The Churchillian The Newsletter of the Churchill Hall Association Autumn 2019 Churchill Hall Association News Updates Would you like to help the Churchill Hall Association Committee? Churchill Hall Association (CHA) comprises all who have lived (and mostly loved their time) at Churchill Hall. The CHA Committee organises activities designed to support the Hall and to encourage engagement among all members of the CHA community The CHA Committee is looking for assistance and to diversify its membership. We would particularly welcome relatively recent Churchillians to help us to better represent the ideas of the entirety of the CHA community. Churchillians based in and around Bristol would also be very valuable. If you would like to join the CHA Committee, or discuss other volunteering opportunities, please contact us at [email protected] Alumni Reunion Weekend 2020 The 2020 Alumni Reunion Weekend will take place from Friday 17 – Sunday 19 July, and will include the annual CHA dinner on the Saturday evening (together with a wide variety of other events). More details will follow early next year, and be available on the website https://www.churchillhallassociation.co.uk/ or via newsletters and mailings from the University. At the CHA dinner, we will be welcoming a contingent from the Badock Hall Association, and a star Churchillian speaker – so don’t wait until you receive further information; make a diary note now (and then book as soon as you are able, once the details are known and a booking form is circulated) Visit to Chartwell (Kent) Following a successful day's visit to Chartwell- the long-time private home of Sir Winston Churchill- in 2014, we have been asked whether we would like another privately organised tour and lecture. -

All Approved Premises

All Approved Premises Local Authority Name District Name and Telephone Number Name Address Telephone BARKING AND DAGENHAM BARKING AND DAGENHAM 0208 227 3666 EASTBURY MANOR HOUSE EASTBURY SQUARE, BARKING, 1G11 9SN 0208 227 3666 THE CITY PAVILION COLLIER ROW ROAD, COLLIER ROW, ROMFORD, RM5 2BH 020 8924 4000 WOODLANDS WOODLAND HOUSE, RAINHAM ROAD NORTH, DAGENHAM 0208 270 4744 ESSEX, RM10 7ER BARNET BARNET 020 8346 7812 AVENUE HOUSE 17 EAST END ROAD, FINCHLEY, N3 3QP 020 8346 7812 CAVENDISH BANQUETING SUITE THE HYDE, EDGWARE ROAD, COLINDALE, NW9 5AE 0208 205 5012 CLAYTON CROWN HOTEL 142-152 CRICKLEWOOD BROADWAY, CRICKLEWOOD 020 8452 4175 LONDON, NW2 3ED FINCHLEY GOLF CLUB NETHER COURT, FRITH LANE, MILL HILL, NW7 1PU 020 8346 5086 HENDON HALL HOTEL ASHLEY LANE, HENDON, NW4 1HF 0208 203 3341 HENDON TOWN HALL THE BURROUGHS, HENDON, NW4 4BG 020 83592000 PALM HOTEL 64-76 HENDON WAY, LONDON, NW2 2NL 020 8455 5220 THE ADAM AND EVE THE RIDGEWAY, MILL HILL, LONDON, NW7 1RL 020 8959 1553 THE HAVEN BISTRO AND BAR 1363 HIGH ROAD, WHETSTONE, N20 9LN 020 8445 7419 THE MILL HILL COUNTRY CLUB BURTONHOLE LANE, NW7 1AS 02085889651 THE QUADRANGLE MIDDLESEX UNIVERSITY, HENDON CAMPUS, HENDON 020 8359 2000 NW4 4BT BARNSLEY BARNSLEY 01226 309955 ARDSLEY HOUSE HOTEL DONCASTER ROAD, ARDSLEY, BARNSLEY, S71 5EH 01226 309955 BARNSLEY FOOTBALL CLUB GROVE STREET, BARNSLEY, S71 1ET 01226 211 555 BOCCELLI`S 81 GRANGE LANE, BARNSLEY, S71 5QF 01226 891297 BURNTWOOD COURT HOTEL COMMON ROAD, BRIERLEY, BARNSLEY, S72 9ET 01226 711123 CANNON HALL MUSEUM BARKHOUSE LANE, CAWTHORNE, -

Bristol Big Give Wrap up Report 2014

Bristol Big Give Wrap Up Report 2014 September 2014 – August 2015 2 Contents Overview............................................................................................................................................... 5 Donations Results ............................................................................................................................... 6 British Heart Foundation – City .................................................................................................. 6 British Heart Foundation – UWE ............................................................................................... 6 British Heart Foundation - Unite................................................................................................ 6 University of Bristol Halls of Residence .................................................................................... 7 Evaluation by Key Partners .............................................................................................................. 8 British Heart Foundation .............................................................................................................. 8 The Community ............................................................................................................................ 8 Unite ............................................................................................................................................... 9 University of Bristol ......................................................................................................................