News Brief 51

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

CTBUH Journal

About the Council The Council on Tall Buildings and Urban Habitat, based at the Illinois Institute of Technology in CTBUH Journal Chicago and with a China offi ce at Tongji International Journal on Tall Buildings and Urban Habitat University in Shanghai, is an international not-for-profi t organization supported by architecture, engineering, planning, development, and construction professionals. Founded in 1969, the Council’s mission is to disseminate multi- Tall buildings: design, construction, and operation | 2014 Issue IV disciplinary information on tall buildings and sustainable urban environments, to maximize the international interaction of professionals involved Case Study: One Central Park, Sydney in creating the built environment, and to make the latest knowledge available to professionals in High-Rise Housing: The Singapore Experience a useful form. The Emergence of Asian Supertalls The CTBUH disseminates its fi ndings, and facilitates business exchange, through: the Achieving Six Stars in Sydney publication of books, monographs, proceedings, and reports; the organization of world congresses, Ethical Implications of international, regional, and specialty conferences The Skyscraper Race and workshops; the maintaining of an extensive website and tall building databases of built, under Tall Buildings in Numbers: construction, and proposed buildings; the Unfi nished Projects distribution of a monthly international tall building e-newsletter; the maintaining of an Talking Tall: Ben van Berkel international resource center; the bestowing of annual awards for design and construction excellence and individual lifetime achievement; the management of special task forces/working groups; the hosting of technical forums; and the publication of the CTBUH Journal, a professional journal containing refereed papers written by researchers, scholars, and practicing professionals. -

Tall Buildings

02/12 апрель/май Рациональный консеРватизм Дубая Rational Conservatism of Dubai ПеРсПективный комПозит Prospective Composite аРхитектуРная мистеРия ngs i ld i Architectural Mysterium я» Tall bu я» Tall и Tall Buildings журнал высотных технологий 2/12 «Высотные здан международный Журнал обзор INTERNATIONAL«Высотные здания» OVERVIEW Tall buildings На обложке: проект Urban Forest, MAD Architects On the cover: Urban Forest, project by MAD Architects Учредитель ООО «Скайлайн медиа» при участии ЗАО «Горпроект» Редакционная коллегия: Сергей Лахман Надежда Буркова Юрий Софронов Петр Крюков Татьяна Печеная Святослав Доценко Елена Зайцева Александр Борисов Генеральный директор Сергей Лахман Главный редактор Содержание Татьяна Никулина Редактор Фотофакт/ Photo Session 74 Дубай Елена Домненко contents Dubai Исполнительный директор Сергей Шелешнев Среда обитания/Habitat 82 Ванкуверский «Утюг» Редактор-переводчик The «Flatiron» of Vancouver Ирина Амирэджиби Коротко/In brief 6 События и факты Редактор-корректор Город/City 90 Полицентричная модель развития городов Алла Шугайкина Events and Facts Иллюстрации Polycentric Model of Cities Development Алексей Любимкин Выставки/Exhibitions 20 Light & Building 2012. Новые рубежи Объект/Site 96 Окутанная плащом Над номером работали: Light & Building 2012. New Frontiers Марианна Маевская Enshrouded международный обзор Отдел рекламы строительство Тел./факс: (495) 545-2497 INTERNATIONAL OVERVIEW CONSTRUCTION Отдел распространения Светлана Богомолова Владимир Никонов История/History 22 Рациональный консерватизм Дубая -

Q2 2015 Report

Property Review Dubai Q2 2015 Report The market has witnessed declines in both rental rates and sales prices this quarter, as new supply increased, offering a wider choice for both tenants and buyers. This was compounded by the fact that overseas buyers interest also decreased, due to adverse economic conditions in their countries of origin and the high dollar making purchasing property in Dubai less attractive on an international scale. Q2 2015 REPORT Dubai Q2 2015 Highlights Residential • Whilst rental rates and sales prices in Dubai’s residential market saw some improvements in mid-2012, 2013, nevertheless, witnessed the fastest growth rates, which peaked in Q2 2014. • Since then, however, the market experienced a period of stabilisation, with declines observed in the last six months. As a result, apartment rental rates were 2% lower than a year ago, and villa rental rates were 5% lower, on average, during Q2 2015. • Sales prices fared similarly with villas recording an 11% drop and apartments a 7% drop since their peak in Q2 2014. • The decrease was felt throughout the market and areas with a significant amount of completed new supply were the most affected. • Furthermore, some buyers of nearly completed buildings were keen to sell at negative premiums due to the imminent completion of the building, which required final payment. • Similarly, a few buyers started advertising off-plan properties that had not yet started construction, at negative premiums, as they sought to relinquish their financial obligations. RESIDENTIAL PRICE MOVEMENT, SEP 2008 = BASE 100 GROWTH RECESSION RECOVERY & GROWTH STABILISATION 120 100 80 60 40 Index Base 100 = Sep 2008 20 0 Dec Mar Jun Sep Dec Mar Jun Sep Dec Mar Jun Sep Dec Mar Jun Sep Dec Mar Jun Sep Dec Mar Jun Sep Dec Mar Jun Sep Dec Mar Jun 2007 2008 2009 2010 2011 2012 2013 2014 2015 Q2 2015 ANNUAL RESIDENTIAL down by 7% Apartment Sales Villa Sales Apartment Remtal Villa Rental compared with Q2 2014. -

NEWS BRIEF 29 SUN DAY 26 July 2015

ASSET MANAGEMENT SALES LEASING VALUATION & ADVISORY SALES MANAGEMENT OWNER ASSOCIATION NEWS BRIEF 29 SUN DAY 26 July 2015 RESEARCH DEPARTMENT DUBAI | ABU DHABI | AL AIN | SHARJAH | JORDAN IN THE MIDDLE EAST FOR 30 YEARS © Asteco Property Management, 2015 asteco.com | astecoreports.com ASSET MANAGEMENT SALES LEASING VALUATION & ADVISORY SALES MANAGEMENT OWNER ASSOCIATION REAL ESTATE NEWS DUBAI REVERSE RELOCATION TO DUBAI MAKING SHARJAH MORE AFFORDABLE FOR TENANTS STUDIOS, 1-BED APARTMENTS IN WHICH DUBAI AREAS OFFER BETTER YIELDS? FROM MECHANIC TO OWNER OF 22 BURJ KHALIFA UNITS IN DUBAI WHICH OF DUBAI'S HIGH-END AREAS MORE AFFORDABLE TO RENT IN Q2? DOWNTOWN DUBAI TOPS CHART FOR BIGGEST OFFICE DEALS IN Q2 SIX DEALS CROSS DH195 MILLION ON DUBAI'S PALM JUMEIRAH WHICH METRO STATION BUSIEST: CITY CENTRE OR BURJ KHALIFA – DUBAI MALL? ENSHAA BEGINS HANDOVER OF 169 PALAZZO VERSACE APARTMENTS IN DUBAI LULU TO OPEN FIVE-STAR HOTEL IN DUBAI’S BUSINESS BAY WASL PLANS TO OPEN 14 HOTELS IN DUBAI BY 2020 WASL TO BEGIN WORK ON FOUR MAJOR PROJECTS WORTH DH40BN RAMADAN SLOWDOWN FOR DUBAI HOTELS AS OCCUPANCY AND ROOM RATES DECLINE ABU DHABI ARCAPITA BUYS 285 LUXURY APARTMENTS AT ABU DHABI’S SAADIYAT BEACH RESIDENCES COMPLEX NEW ALDAR PROPERTIES ACCOUNTING METHOD ALLOWS OFF-PLAN SALES TO APPEAR EARLIER IN RESULTS OFF-PLAN DEVELOPERS IN THE UAE LAUNCH MORE ‘BUY NOW, PAY LATER’ OFFERS NORTHERN EMIRATES MAJOR SHARJAH HIGHWAY CLOSED UNTIL END OF YEAR; DUBAI-BOUND TRAFFIC DIVERTED R HOTELS TO INVEST DH150M IN AJMAN AS EMIRATE AIMS TO BOOST TOURISM SHARJAH RENTS -

Presentation Template SPDR

Sectors: How to Do More for the Core Marketing Communication For Investment Professional use only. Do not reproduce or reprint without the written permission of State Street Global Advisors. All the information contained in this presentation is as of date indicated unless otherwise noted. 2388197.3.1.GBL.INST 1 Table of Contents 1. The Case for Sector Investing 2. Sector Portfolio Construction Top-Down Thematic Bottom-Up/Fundamental Technical 3. Considerations for Sector Portfolio Implementation 2388197.3.1.GBL.INST 2 The Case for Sector Investing For Institutional Use Only 2388197.3.1.GBL.INST 3 Diversification: Variable Correlations Among Sectors Correlations between sectors vary markedly, potentially providing another source of diversification to an equity portfolio Sector Rolling 90-Day Pair-wise Correlation (January 2016 – December 2018) 1.1 Average Sector Pair-wise 90-Day Correlation The shaded area indicates differences among sector pair-wise correlations 0.9 0.7 0.5 0.3 0.1 +/- 1 Stdv -0.1 Jan-16 Jul-16 Jan-17 Jul-17 Jan-18 Jul-18 Source: FactSet, as of December 31, 2018. Diversification does not ensure a profit or guarantee against loss. It is not possible to invest in an index. Sectors are represented by the corresponding S&P Select Sector Indices. 2388197.3.1.GBL.INST 4 Diversification: Variable Correlations to the Broad Market Sector correlations to the broad market are different and change over time Sector 90-Day Correlation to the S&P 500 Index ( January 2016 – December 2018) Average 1.20 Max Min 1.00 0.80 0.60 0.40 0.20 0.00 -0.20 -0.40 Utilities Telecom Real Estate Cons. -

Dubai Architecture Guide 2020

WHAT Architect WHERE Notes Zone 1: Downtown Dubai The H Hotel & This twin tower development built in 2007 houses a 40 storey office Office Tower - Sheikh Zayed Road tower and the 5 star Monarch Hotel; sitting on a large podium ***** RTKL Associates Inc. accommodating retail outlets, restaurants, a ballroom, meeting rooms شارع الشيخ زايد Monarch Office Tower and a luxury health club. Don't miss 40 Kong Rooftop on the 40th floor The Dubai World Trade Centre complex comprises the original tower (built in 1978), eight exhibition halls, the Dubai International Convention Centre and residential apartments. The 39-storey office tower stands 149 metres (489 feet) tall and a majority of the floors are let Sheikh Zayed Rd The Dubai World commercially. Renamed after the late Sheikh Rashid Bin Saeed Al مركز دبي التجاري John Harris *** Trade Centre Maktoum, the 39-story Sheikh Rashid Tower no longer stands alone as العالمي it did when it was first built. Over the years, the Dubai World Trade Centre has been extended to include Exhibition Halls, Sheikh Rashid Hall and Maktoum Hall as well as the Al Mulaqua Ballroom, Sheikh Saeed Halls, Za’abeel Halls and the Trade Centre Arena. Sun-Thu (8am-5pm) The Sama Tower (also known as Al Durrah Tower) is a residential skyscraper completed in late 2009. The design was a 330 m twisting Sheikh Zayed Road tower with more than 75 storeys for residential use, costing about US$ Sama Tower - Al million. This design was regarded as a major addition to the Dubai 140 شارع الشيخ Atkins Global *** Durrah Tower skyline, but at the same time, the height of the project was a concern زايد to the Dubai's Department of Civil Aviation. -

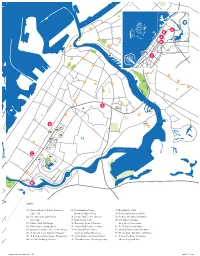

A a B C D E B

omar bin al khattab st A B E11 C D al maktoum rd E66 baniyas rd 23 222 01 24 E E11 E311 E44 RAS GHURAB ISLAND DUBAI CREEK GOLF & YACHT CLUB marrakech st KHOR FARIDAH 20th st 5th st riyadh st 26th st E11 oud metha rd A st 13th 03 st 9th 02 al khail st al sa’ada st jumeira st 04 57th st B RAMHAN ISLAND 05 2nd za’abeel rd 24 al was rd 06 E12 85th st 07 E66 08 20th st AL JUBAL ISLAND 09 10 308th rd 11 al khail st 10th st 12 AL LULU 13 ISLAND 8th st 22 E12 KHOR DUBAI 13th st 21 23 C UMM YIFENAH ISLAND ZERAA ISLAND yas leisure dr 14 01 KHOR LAFFAN 16 E10 15 al asayel st 20 19 umm amar rd 17 18 9th st al albaany st 18 dalma st al sa’ada st 03 E10 corniche rd KHOR AL BAGHAL 020 E11 al bateen st 17 141 4th st 16 burj khalifa blvd 15 13 MANGROVE al abraj st NATIONAL PARK al a’amal st SAMALIYAH ISLAND AL RAHA CREEK 20 19 E44 28th st SAS AL NAKHL D ISLAND 06 SAFA PARK 4th st 04 18th st 3rd st 21 E10 20th street 05 E66 AL HUDAYRIAT ISLAND E44 30th st 18th st 07 111 101 12 E22 30th st 08 15th st 16th st DUBAI 12th st E20 09 01. National Bank of Dubai, Dubarch + 09. Rose Rayhaan Tower, 17. Burj Khalifa, SOM 2nd st Carlos Ott Khatib & Alami Group 18. -

TOT Educators-Guide 20200122.Pdf

® ® CURRICULUM LINKS Direct and indirect connections to the BC curriculum are listed below: CORE COMPETENCIES ARTS EDUCATION Creative Thinking Arts 3–7: A variety of works of art from diverse places, Critical and Reflective Thinking Elements of Design Studio Arts 3D 10–11: Principles of design, variety of contexts, innovative and inter-cultural artists ADST Ideating MATH Prototyping Testing Math 2 Making Math 3: Construction of 3D objects Sharing Math 8 Applied Skills Math 9 ADST K–3: Designs grow out of natural curiosity, Workplace Math 10: skills can be developed through play Proportional reasoning, 3D objects ADST 4–5: Designs can be improved with prototyping and testing, skills are developed through practice, effort, and action Drafting 11 Drafting 12 Engineering 12 EDUCATOR’S GUIDE | 1 ABOUT THE EXHIBITION Towers of Tomorrow with LEGO® Bricks features On a scale of 1:200 and built with stunning 20 of the world’s most astonishing skyscrapers precision and attention to detail, the LEGO® from the United States of America, Australia, Asia, towers offer visitors a birds-eye view of these Canada and United Arab Emirates constructed extra-ordinary buildings and are just as with breathtaking architectural detail and accuracy impressive in model size. Visitors, young and by Australia’s Ryan McNaught, the only certified old, can create their own ‘tower of tomorrow’ LEGO® professional in the Southern Hemisphere. from over 200,000 loose LEGO® bricks in hands- on construction areas and add their creations to The exhibition includes some of the most iconic a steadily rising futuristic LEGO® metropolis inside and eye-popping towers from across North America the exhibition. -

Central Park Towers in Difc Introduction

WELCOME TO CENTRAL PARK TOWERS IN DIFC INTRODUCTION Dubai is home to several of the world’s most premium real estate developments showcasing world class architectural concepts and Central Park Towers is among the best. A combination of flawless aesthetics, superb engineering and insightful planning, Central Park Towers is an impressive addition to Dubai’s awe-inspiring skyline in the financial heart of the city. This prestigious mixed-use development offers a wide range of flexible office and retail spaces within an upscale contemporary urban environment complimented by over 400 luxury residential units. THE DEVELOPERS Central Park Towers is a joint venture between Dubai Asset Management and Deyaar Development. Dubai Asset Management, part of Dubai Holding, develops and manages properties, communities and destinations. Deyaar Development is a leading real estate developer and real estate services company headquartered in Dubai. Sheikh Zayed Road World Trade Financial Centre Centre Rolex Dusit Thani Tower Ritz Emirates Liberty House Financial Towers Carlton The Gate Dubai Emirates Towers Convention Central Park Gate Avenue Towers Centre Downtown Park Damac Towers Dubai Towers Index The Gate Village Tower Burj Daman Happiness Street Roda Sky Dubai Opera Al Murooj Gardens Burj Khalifa The Dubai Mall Rove Zabeel Financial Centre Road Centre Financial Hotel Nad Al Sheba Horse Course The Palace The Address Downtown Dubai Mall CONTEMPORARY URBAN LIFESTYLE DESTINATION LOCATION Ideally located in the thriving international business community at Dubai International – 5 minutes drive to Sheikh Zayed Road Financial Centre (DIFC), the property benefits from being conveniently situated – 5 minutes drive to Dubai Mall between The Gate and Downtown Dubai, both of which are within walking distance. -

Central Park Towers in Difc Introduction

WELCOME TO CENTRAL PARK TOWERS IN DIFC INTRODUCTION Dubai is home to several of the world’s most premium real estate developments showcasing world class architectural concepts and Central Park Towers is among the best. A combination of flawless aesthetics, superb engineering and insightful planning, Central Park Towers is an impressive addition to Dubai’s awe-inspiring skyline in the financial heart of the city. This prestigious mixed-use development offers a wide range of flexible office and retail spaces within an upscale contemporary urban environment complimented by over 400 luxury residential units. THE DEVELOPERS Central Park Towers is a joint venture between Dubai Asset Management and Deyaar Development. Dubai Asset Management, part of Dubai Holding, develops and manages properties, communities and destinations. Deyaar Development is a leading real estate developer and real estate services company headquartered in Dubai. Sheikh Zayed Road World Trade Financial Centre Centre Rolex Dusit Thani Tower Ritz Emirates Liberty House Financial Towers Carlton The Gate Dubai Emirates Towers Convention Central Park Gate Avenue Towers Centre Downtown Park Damac Towers Dubai Towers Index The Gate Village Tower Burj Daman Happiness Street Roda Sky Dubai Opera Al Murooj Gardens Burj Khalifa The Dubai Mall Rove Zabeel Financial Centre Road Centre Financial Hotel Nad Al Sheba Horse Course The Palace The Address Downtown Dubai Mall CONTEMPORARY URBAN LIFESTYLE DESTINATION LOCATION Ideally located in the thriving international business community at Dubai International – 5 minutes drive to Sheikh Zayed Road Financial Centre (DIFC), the property benefits from being conveniently situated – 5 minutes drive to Dubai Mall between The Gate and Downtown Dubai, both of which are within walking distance. -

WHAT Architect WHERE Notes Zone 1: Downtown Dubai This Twin Tower Development Built in 2007 Houses a 40 Storey Office the H Hote

WHAT Architect WHERE Notes Zone 1: Downtown Dubai This twin tower development built in 2007 houses a 40 storey office The H Hotel & tower and the 5 star Monarch Hotel; sitting on a large podium Office Tower - Sheikh Zayed Road ***** RTKL Associates Inc. accommodating retail outlets, restaurants, a ballroom, meeting rooms شارع الشيخ زايد Monarch Office and a luxury health club. Don't miss 40 Kong Rooftop on the 40th Tower floor The complex comprises the original tower (built in 1978), eight exhibition Sheikh Zayed Rd The Dubai World halls, the Dubai International Convention Centre and residential مركز دبي التجاري John Harris *** Trade Centre apartments. The 39-storey office tower stands 149 metres (489 feet) العالمي tall and a majority of the floors are let commercially. Sun-Thu (8-17) The building was originally proposed as a supertall building named Al Durrah Tower II. The design was a 330 m twisting tower with more than 75 storeys for residential use, costing about US$ 140 million. Sheikh Zayed Road Sama Tower - Al This design was regarded as a major addition to the Dubai skyline, but خيششا عراش Atkins Global *** Durrah Tower at the same time, the height of the project was a concern to the شدااز Dubai's Department of Civil Aviation. In response to this issue, the project was scaled back to 194 metres with 51 stories. It was built in 2010. Sheikh Zayed Road Built in 2007 as a 56-floor mixed-use tower. The tower has a total structural height of 234.1 m (768 ft), making it currently the 10th خيششا عراش Park Place Cox Group *** . -

Welcome to Central Park Towers the Developers

WELCOME TO CENTRAL PARK TOWERS THE DEVELOPERS Central Park Towers is a joint venture between Dubai Asset Management and Deyaar Development. Dubai Asset Management, part of Dubai Holding, develops and manages properties, communities and destinations. Deyaar Development is a leading real estate developer and real estate services company headquartered in Dubai. INTRODUCTION Dubai is home to several of the world’s most premium real estate developments showcasing world class architectural concepts and Central Park Towers is among the best. A combination of flawless aesthetics, superb engineering and insightful planning, Central Park Towers is an impressive addition to Dubai’s awe-inspiring skyline in the financial heart of the city. This prestigious mixed-use development offers a wide range of flexible office and retail spaces within an upscale contemporary urban environment complimented by over 400 luxury residential units. Sheikh Zayed Road World Trade Financial Centre Centre Rolex Dusit Thani Tower Ritz Emirates Liberty House Financial Towers Carlton The Gate Dubai Emirates Towers Convention Central Park Gate Avenue Towers Damac Towers Centre Downtown Park Dubai Towers Index Tower The Gate Village Burj Daman Happiness Street Roda Sky Gardens Dubai Opera Al Murooj Burj Khalifa The Dubai Mall Rove Zabeel Financial Centre Road Centre Financial Hotel Nad Al Sheba Horse Course The Palace The Address Downtown Dubai Mall CONTEMPORARY URBAN LIFESTYLE DESTINATION Ideally located in the thriving international business community at Dubai International Financial Centre (DIFC), the property benefits from being conveniently situated between The Gate and Downtown Dubai, both of which are within walking distance. LOCATION Central Park Towers sits on the southern corner of DIFC making the accessibility to and from major roadways easy and efficient.