Nota Integrativa

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Stagione 1991-1992

Stagione 1991-1992 Almanacco delle Amichevoli e delle Coppe minori 60' di testa Reuter sfiora l'autogol, al 63' il portierone Sede: via Filippo Turati, 3 – Milano bianconero si supera volando all'incrocio dei pali per Centro sportivo: Milanello – Carnago deviare un siluro su punizione di Van Basten. Dopo il Presidente: Silvio Berlusconi gol dell'1-2, ci sono un tiro di Simone deviato in tuffo e Vice-presidente: Paolo Berlusconi un clamoroso palo al 90' di Cornacchini, con un tiro a Amministratori delegati: Giancarlo effetto. Se non basta tutto questo (e infatti non basta) Foscale, Adriano Galliani per legittimare una vittoria, conviene fare subito un gi- Resp. organizzativo: Paolo Taveggia ro a Lourdes. Prima di rivedere lo stesso film.” (L. Sera- Segretario: Rina Barbara Ercoli fini – Forza Milan!, settembre 1991) Team manager: Silvano Ramaccioni Allenatore: Fabio Capello Allenatore in 2a: Italo Galbiati Direttore sportivo: Ariedo Braida Responsabile settore sanitario: Rodolfo Tavana Medico sociale: Giovanni Battista Monti Preparatore atletico: Vincenzo Pincolini Massaggiatori: Pier Angelo Pagani, Giancarlo Bertassi Capitano: Franco Baresi Campo di gioco: Stadio San Siro “Giuseppe Meazza” Sponsor: Mediolanum Assicurazioni Primo giorno di raduno: 20 luglio a Milanello (sino al 1° agosto) Palmares: Campione d'Italia (12° titolo) Trofeo “Villa de Madrid” Trofeo “Città di Zurigo” Trofeo di Capodanno “Amaro Lucano” Coppa Italo-Canadese Columbus Cup Tournament Coppe minori 1991: I TROFEO LUIGI BERLUSCONI Milano (San Siro), 23 agosto 1991 Juventus-Milan 2-1 (1-1) Milan: Rossi; Tassotti, Maldini; Evani (71’ Fuser), Co- stacurta, Baresi; Donadoni (82’ Gambaro), Rijkaard, Van Basten, Gullit (78’ Simone), Serena (46’ Cornacchini). All.: Capello. -

SERGIO TACCONE RACCONTI ROSSONERI Antologia Casciavit

SERGIO TACCONE RACCONTI ROSSONERI Antologia Casciavit Venti puntate tratte dalla rubrica “L’angolo della Storia” del MilanBlogClub Prefazione di Mirko Morini http://milanblogclub.splinder.com/ 2 "I nostri colori saranno rosso, perché noi saremo dei diavoli, e nero, come il terrore che dovremo incutere agli avversari". Herbert Kilpin (Fondatore e primo capitano del Milan) 3 4 Racconti Rossoneri Antologia Casciavit 5 6 Indice Prefazione – di Mirko Morini “Butirro” ................................................. Introduzione: Storie per Milanisti Veri ......................................................... 1. L’avvocato del diavolo che castigò i nerazzurri 2. Elogio del Piscinin, milanista per eccellenza 3. Maradona ai piedi del Diavolo 4. Maggio 1979, la Stella finalmente 5. La bellissima, inutile prodezza di Dustin 6. Il poker che annientò il Barca di Cruijff 7. Elegia del Golden Boy 8. La classe del Cigno Olandese 9. La resa di Puskas 10. In ricordo di Beppe Viola 11. Mark, ascensore per il paradiso 12. Due rossoneri nel gorgo della guerra 13. Gol di Capra, digiuno finito, bauscia zittito 14. Quando Milan-Juve valeva una Champions 15. “Brillantina”, il giocattore 16. La favola triste di Germano 17. Van Hege, primo bomber della storia rossonera 18. Il “coast to coast” di George 19. Ricordo del Paron 20. Lo strano esonero di Guttmann Qualcuno era (ed è) milanista… Fonti fotografiche 7 8 PREFAZIONE Preservare il ricordo delle grandi storie di Mirko Morini “Butirro” Qualsiasi raggruppamento di persone può chiamarsi comunità se condivide un insieme di valori. Il trasferimento di questi valori fondanti della convivenza avviene con l’emulazione diretta od indiretta di campioni. A questo serve il preservare il ricordo delle grandi storie. -

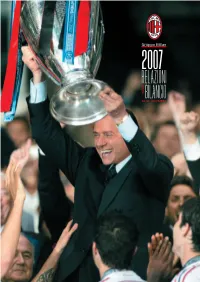

Bilancio 2007

A-cop_BIL MILAN 2008.qxd:A-cop_BIL MILAN 2008.qxd 12-05-2008 13:36 Pagina 1 RELAZIONI E BILANCIO AL 31 DICEMBRE 2007 GRUPPO MILAN Gruppo Milan 2007 RELAZIONI eBILANCIO AL 31 DICEMBRE A.C. Milan spa Milano - via Turati,3 2007 RELAZIONI E BILANCIO AL 31 DICEMBRE LA MISSION “...diventare la squadra più prestigiosa del mondo attraverso una serie di vittorie nei tornei più importanti!” (luglio, 1987) Domani sogneremo altri traguardi, inventeremo altre sfide. Cercheremo altre vittorie che valgano a realizzare ciò che di buono, di forte, di vero c’è in noi, in tutti noi che abbiamo avuto questa ventura di intrecciare la nostra vita a un sogno che si chiama Milan. Avviso di convocazione pag. 9 Cariche sociali pag. 11 Organigramma pag. 13 RELAZIONE DEL CONSIGLIO DI AMMINISTRAZIONE pag. 16 SOMMARIO BILANCIO BILANCIO CONSOLIDATO AL 31 DICEMBRE 2007 CONSOLIDATO Stato Patrimoniale pag. 24 2007 Conto Economico pag. 26 NOTA INTEGRATIVA Informazioni generali pag. 30 Struttura e contenuto del bilancio pag. 30 Area e tecniche di consolidamento pag. 31 Criteri di valutazione e principi contabili pag. 32 Altre informazioni pag. 41 Commento alle principali voci dell’attivo pag. 42 Commento alle principali voci del passivo pag. 52 Conti d’ordine pag. 61 Altre informazioni pag. 61 Commento alle principali voci del conto economico pag. 65 ALLEGATI Prospetto delle variazioni delle immobilizzazioni immateriali pag. 84 Prospetto delle variazioni delle immobilizzazioni materiali pag. 85 Prospetto delle variazioni delle immobilizzazioni finanziarie pag. 86 Prospetto delle variazioni nei conti di patrimonio netto pag. 87 Rendiconto finanziario pag. 88 Prospetto settoriale pag. -

AC Milan - Sevilla FC CARTELLA STAMPA Louis II, Principato Di Monaco Venerdì 31 Agosto 2007 - 20.45CET

AC Milan - Sevilla FC CARTELLA STAMPA Louis II, Principato di Monaco Venerdì 31 Agosto 2007 - 20.45CET Contenuto 1 - Storia della partita 7 - Finali 2006/07 2 - Dati sulla partita 8 - Notizie nazionali 3 - Rosa squadra 9 - Dati sulla competizione 4 - Tecnico 10 - Dati sulle squadre 5 - Direttori di gara 11 - Legenda 6 - Guida Storia della partita L'intera famiglia del calcio europeo è in lutto per la tragica scomparsa del centrocampista del Sevilla FC Antonio Puerta. La partita tra AC Milan e Siviglia valida per la Supercoppa UEFA rappresenterà un tributo speciale per il 22enne che una delle tante voci chiamate a descrivere il tragico evento ha descritto come "un giocatore magnifico e una persona speciale". • L’attesa sfida in programma a Montecarlo fra AC Milan e Sevilla FC, valida per la Supercoppa UEFA 2007, sarà la prima fra queste due squadre a livello di competizioni UEFA. • Il Milan detiene il record di trofei conquistati con quattro successi, l’ultimo dei quali nel 2003 da campione d’Europa, ed è anche l’unico club ad aver conquistato due titoli consecutivi nel 1989 e 1990. I rossoneri se la vedranno contro un Siviglia che punta a eguagliare l’impresa avendo già conquistato il trofeo lo scorso anno con un netto 3-0 ai danni dell'FC Barcelona. • Il Milan partecipa alla 32esima edizione della Supercoppa UEFA, competizione ufficiale UEFA dal 1973, nella veste di campione d’Europa grazie alla vittoria per 2-1 contro il Liverpool FC nella finale di UEFA Champions League giocata ad Atene il 23 maggio. Il Siviglia è invece detentore della Coppa UEFA avendo superato a Glasgow 3-1 ai calci di rigore l’RCD Espanyol, dopo il 2-2 dei tempi regolamentari e supplementari. -

Catalogo Completo Su ASTE BOLAFFI Full Catalogue on RACCOMANDAZIONI ANTI COVID-19

ASTE BOLAFFI SPORT MEMORABILIA Internet live, 9 dicembre 2020 ASTE BOLAFFI S.p.A. Presidente e A.D. ESPERTI | SPECIALISTS Chairman and C.E.O. Giulio Filippo Bolaffi Francobolli Orologi Stamps Watches Consiglieri [email protected] [email protected] Directors Matteo Armandi Enrico Aurili consulente | consultant Nicola Bolaffi Giovanna Morando Fabrizio Prete Alberto Ponti Arti del Novecento 20th Century Art Business Development [email protected] Monete, banconote e medaglie Cristiano Collari Coins, banknotes and medals Cristiano Collari [email protected] [email protected] Caterina Fossati consulente | consultant Operations Gabriele Tonello Laura Cerruti assistente | assistant Tommaso Marchiaro Carlo Barzan Design [email protected] Alberto Pettinaroli Design [email protected] Manifesti Alberto Serra consulente | consultant Posters Torino [email protected] Arredi, dipinti e oggetti d’arte Via Cavour 17 Francesca Benfante Furniture, paintings and works of art 10123, Torino Armando Giuffrida consulente | consultant [email protected] Tel. +39 011-0199101 Cristiano Collari Fax +39 011-5620456 Libri rari e autografi Umberta Boetti Villanis Rare books and autographs [email protected] Laura Cerruti assistente | assistant [email protected] Cristiano Collari Auto e moto classiche Annette Pozzo Classic motor vehicles [email protected] Vini e distillati Ezio Chiantello Wines and spirits Stefano Angelino consulente | consultant [email protected] Massimo Delbò consulente | consultant Grafica | Graphic -

Stagione 2000-2001

Stagione 2000-2001 Almanacco delle Amichevoli e delle Coppe minori dente: il giovane talento Comandini si sposta sulla fa- Sede: via Filippo Turati, 3 – Milano scia destra; Bierhoff, al debutto stagionale, si piazza al Centro sportivo: Milanello – Carnago centro e Sheva opera sulla sinistra. I tre attaccanti Presidente: Silvio Berlusconi rossoneri non si incrociano quasi mai, con Comandini Vice-presidenti: Franco Baresi, Paolo che finisce per stringere troppo al centro. Schiaccian- Berlusconi, Adriano Galliani, Gianni dosi su Bierhoff. Nardi Nonostante la lucida regia di Brncic (un giocatore da Amministratore deleg.: Adriano Galliani seguire con attenzione) e le arrembanti incursioni di Direttore generale: Ariedo Braida Gattuso, il Milan nel primo tempo non riesce ad andare Team manager: Umberto Gandini a segno. E gli unici brividi sono frutto di conclusioni da Segretario: Mary Gazzotti fuori area di Sheva e Comandini. Esecuzioni spettaco- Capo ufficio stampa: Paolo Tarozzi lari ma fuori da qualsiasi schema. Direttore della comunicazione: Vittorio Mentana Rispetto alle precedenti esibizioni appare più solida, Direttore sportivo: Silvano Ramaccioni invece, la difesa che chiude la gara senza subire gol. Allenatore: Alberto Zaccheroni fino al 14 marzo 2001, Finalmente. Piace, ad esempio, Roque Junior, schierato poi Mauro Tassotti a sorpresa da Zaccheroni. Il brasiliano non sbaglia un Allenatore in 2a: Stefano Agresti fino al 14 marzo 2001 anticipo dimostrando, anche, grande disinvoltura quan- Direttore tecnico: Cesare Maldini dal 14-3-2001 do avanza con il pallone tra i piedi. Il Seregno non è Allenatore dei portieri: Maurizio Guido, poi Luigi certo l'avversario ideale per testare in maniera seria il Romano reparto, ma l'unico attimo di sbandamento è figlio di Responsabile sett. -

Stagione 1992-1993 Almanacco Delle Amichevoli E Delle Coppe Minori

Stagione 1992-1993 Almanacco delle Amichevoli e delle Coppe minori Sede: via Filippo Turati, 3 – Milano Centro sportivo: Milanello – Carnago Presidente: Silvio Berlusconi Vice-presidente: Paolo Berlusconi Amministratori delegati: Giancarlo Foscale, Adriano Galliani Resp. organizzativo: Paolo Taveggia Segretario: Rina Barbara Ercoli Capo Ufficio Stampa: Paolo Tarozzi Team manager: Silvano Ramaccioni Allenatore: Fabio Capello Allenatore in 2a: Italo Galbiati Allenatore dei portieri: Roberto Negrisolo Direttore sportivo: Ariedo Braida Responsabile settore sanitario: Rodolfo Tavana Medico sociale: Giovanni Battista Monti Preparatore atletico: Vincenzo Pincolini Massaggiatori: Pier Angelo Pagani, Giancarlo Bertassi Capitano: Franco Baresi Campo di gioco: Stadio San Siro “Giuseppe Meazza” Sponsor: Motta Primo giorno di raduno: 20 luglio a Milanello (sino al 12 agosto) Palmares: Campione d'Italia (13° titolo) Supercoppa Italiana Torneo “Nereo Rocco” Coppa del Mediterraneo Trofeo “Ciudad de La Coruña” Trofeo “Luigi Berlusconi” Trofeo dell'Isola Trofeo Bontà Motta Nashua Challenge Cup Coppe minori 1992: I TORNEO NEREO ROCCO (torneo in un solo giorno con partite da 45 minuti) Il Milan 1992-93 (da Guerin Sportivo) Padova (Appiani), 1° agosto 1992 Milan-HASK Gradanski Zagabria 2-1 centravanti, pur in ritardo di preparazione, delizia con Milan: Rossi; Tassotti, Maldini; Donadoni, Costacurta, un paio di numeri la platea – colpi di tacco e finte di Baresi; Lentini, Rijkaard, Papin, Van Basten, Evani (30’ corpo in velocità -, è sicuramente il “bomber” -

Stagione 1999-2000 Almanacco Delle Amichevoli E Delle Coppe Minori

Stagione 1999-2000 Almanacco delle Amichevoli e delle Coppe minori Sede: via Filippo Turati, 3 – Milano Centro sportivo: Milanello – Carnago Presidente: Silvio Berlusconi Vice-presidenti: Franco Baresi, Paolo Berlusconi, Adriano Galliani, Gianni Nardi Amministr. delegato: Adriano Galliani Direttore generale: Ariedo Braida Team manager: Umberto Gandini Segretario: Mary Gazzotti Capo Ufficio Stampa: Paolo Tarozzi Vice Capo Uff. Stampa e Respons. Progetti Editoriali: Vittorio Mentana Direttore sportivo: Silvano Ramaccioni Allenatore: Alberto Zaccheroni Allenatore in 2a: Stefano Agresti Allenatore dei portieri: Maurizio Guido Responsabile sett. sanitario: Jean Pierre Meersseman Medico sociale: Rodolfo Tavana Preparatori atletici: Paolo Baffoni, William Tillson, Milanello, 29 luglio 1999. Il nuovo acquisto Andriy Shevchenko, Daniele Tognaccini l'allenatore Alberto Zaccheroni e il capitano Cesare Maldini presentano la maglia del Centenario milanista (foto Ap) Massaggiatori: Giancarlo Bertassi, Roberto Boerci, Giorgio Puricelli, Tomislav Vrbnjak Milan: Abbiati; N’Gotty, Costacurta, Maldini; Ba, Alber- Capitano: Paolo Maldini tini, Gattuso, Orlandini; Shevchenko, Bierhoff, Weah. Campo di gioco: Stadio San Siro “Giuseppe Meazza” All.: Zaccheroni. Sponsor: Opel Reti: 20’ Weah, 32’ Shevchenko su rigore. Primo giorno di raduno: 20 luglio a Milanello (sino al ▸ Il Milan parte con una coppa 28 luglio) “Parigi - Il Milan comincia la nuova stagione con una Palmares: Trofeo Opel Masters coppa. Fa suo il Triangolare Opel, giocato ieri sera al Parco dei Principi di Parigi, contro Bayern Monaco e Coppe minori Paris St. Germain, tre squadre unite dallo stesso spon- 1999: TROFEO OPEL MASTERS sor. (torneo in un solo giorno con partite da 45 minuti) Il Milan ha vinto la prima partita con il Bayern (2-0) e Parigi (Francia), 2 agosto 1999 ha perso quella con il Paris St. -

Stagione 1994-1995 Almanacco Delle Amichevoli E Delle Coppe Minori Ne (14’ Boban), Stroppa

Stagione 1994-1995 Almanacco delle Amichevoli e delle Coppe minori ne (14’ Boban), Stroppa. All.: Capello. Sede: via Filippo Turati, 3 – Milano ▸ Vittoria rossonera nel mini-torneo Centro sportivo: Milanello – Carnago “Cesena – Il Milan conquista il primo trofeo stagionale: Presidente: Silvio Berlusconi il Memorial Ghezzi, nel triangolare di Cesena. Come Vice-presidente: Paolo Berlusconi l'estate scorsa. Ma, non batte il Parma. Lo scontro che Amministr. delegato: Adriano Galliani profuma già di scudetto si conclude 0-0, dopo 45' Resp. organizzativo: Paolo Taveggia minuti tirati, combattuti e nervosi, con l'espulsione del Segretario: Rina Barbara Ercoli milanista Panucci dopo 10' per una scorrettezza rilevata Direttore organizzativo: Umberto Gandini dall'arbitro ai danni di Susic. Capo Ufficio Stampa: Paolo Tarozzi Il Milan, che veniva da due sconfitte consecutive nelle Team manager: Silvano Ramaccioni precedenti amichevoli estive (a Lucca e Reggio Emilia) Allenatore: Fabio Capello senza aver segnato neppure una rete, dimostra molti Assistente tecnico: Franco Balestra miglioramenti, in particolare in Lentini che ha segnato Allenatore in 2a: Italo Galbiati al Cesena la prima rete rossonera della serata ed è Allenatore dei portieri: Roberto Negrisolo parso in completo recupero psico-fisico un anno dopo il Direttore sportivo: Ariedo Braida grave incidente automobilistico. Anche Gullit va sempre Responsabile settore sanitario: Rodolfo Tavana meglio; scambi in velocità col rientrante Simone e Medico sociale: Giovanni Battista Monti affondi perentori che hanno creato molto panico nelle Preparatore atletico: Vincenzo Pincolini difese avversarie. Massaggiatori: Franco Pagani, Giancarlo Bertassi Meno appariscente il Parma che può schierare solo tre Capitano: Franco Baresi titolari sicuri: Di Chiara, Branca e il nuovo arrivato Fer- Campo di gioco: Stadio San Siro “Giuseppe Meazza” nando Couto. -

Stagione 2011-2012 Almanacco Delle Amichevoli E Delle Coppe Minori Binho)

Stagione 2011-2012 Almanacco delle Amichevoli e delle Coppe minori binho). All.: Allegri. Sede: via Filippo Turati, 3 – Milano Bayern Monaco (4-2-3-1): Neuer; Rafinha (61' J. Boa- Centro sportivo: Milanello – Carnago teng), Van Buyten, Badstuber, Lahm; Tymoshchuk (64' Presidente: Silvio Berlusconi Gustavo), Schweinsyelger; Robben (63' Alaba), Kroos, Vice-pres. Vicario e Amm. Delegato: Muller; Gomez. All.: Heynckes. Adriano Galliani Arbitro: Sippel (Germania). Vice-presidenti: Paolo Berlusconi, Reti: 4' Ibrahimovic, 35' Kroos. Gianni Nardi (sino al 4-10-2011) Sequenza rigori: Alaba (B) gol, Robinho (M) gol, Gomez Direttore sportivo: Ariedo Braida (B) gol, Oddo (M) gol, Muller (B) gol, Thiago Silva (M) Team manager: Vittorio Mentana gol, Kroos (B) gol, Paloschi (M) fuori, Scweinsteiger (B) Segreteria tecnica: Mary Buscaglia, Virna Bonfanti, gol. Cristina Moschetta Note: il Milan col lutto al braccio per la scomparsa in Responsabile comunicazione: Giuseppe Sapienza mattinata del magazziniere Giovanni Carbonoli. Allenatore: Massimiliano Allgeri ▸ Il Milan contiene un Bayern già in palla Allenatore in 2a: Mauro Tassotti “Bayern Monaco - Per una eventuale sfida ai campioni Allenatori dei portieri: Valerio Fiori, Marco Landucci d'Europa bisognerà aspettare. Il Milan perde ai rigori Collaboratore tecnico: Andrea Maldera contro i padroni di casa del Bayern e domani si dovrà Responsabile sanitario: Rodolfo Tavana accontentare della finale per il terzo posto della Audi Medici sociali: Stefano Mazzoni, Armando Gozzini Cup, contro l'Internacional di -

Relazione E Bilancio Al 31 Dicembre 2012

RELAZIONE E BILANCIO AL 31 DICEMBRE 2012 RELAZIONE E BILANCIO AL 31 DICEMBRE 2012 La MISSION “Diventare la squadra più prestigiosa del mondo attraverso una serie di vittorie nei tornei più importanti!” - Luglio 1987 - Domani sogneremo altri traguardi, inventeremo altre sfide. Cercheremo altre vittorie che valgono a realizzare ciò che di buono, di forte, di vero c’è in noi, in tutti noi che abbiamo avuto questa ventura di intrecciare la nostra vita a un sogno che si chiama Milan. Silvio Berlusconi Sommario bilancio consolidato 11 Avviso di convocazione 17 Bilancio consolidato al 31 dicembre 2012 18 Relazione sulla gestione 24 Stato Patrimoniale 26 Conto Economico 28 Nota Integrativa 28 Informazioni generali 28 Struttura e contenuto del bilancio 29 Area di consolidamento 29 Tecniche di consolidamento 29 Criteri di valutazione e principi contabili 33 Altre informazioni 34 Commento alle principali voci dell’attivo 42 Commento alle principali voci del passivo 47 Conti d’ordine e altre informazioni 48 Commento alle principali voci del conto economico 63 Allegati 64 Prospetto delle variazioni delle immobilizzazioni immateriali 65 Prospetto delle variazioni delle immobilizzazioni materiali 66 Prospetto delle variazioni delle partecipazioni 67 Prospetto delle variazioni del patrimonio netto 68 Rendiconto finanziario 69 Prospetto settoriale 71 Prospetto di raccordo tra il patrimonio netto e il risultato di esercizio di A.C. Milan S.p.A. con quello consolidato 72 Operazioni con parti correlate 73 Elenco delle partecipazioni in imprese controllate, -

Stagione 2007-2008 Almanacco Delle Amichevoli E Delle Coppe Minori Bakkal, Aissati (85’ De Jong), Lazovic (67’ Jonathan)

Stagione 2007-2008 Almanacco delle Amichevoli e delle Coppe minori Bakkal, Aissati (85’ De Jong), Lazovic (67’ Jonathan). Sede: via Filippo Turati, 3 – Milano All.: Koeman. Centro sportivo: Milanello – Carnago Arbitro: Ivanov (Russia). Presidente: Silvio Berlusconi Sequenza dei rigori: Simons (P) parato, Kakà (M) gol, Vice-presidente vic. e amministratore De Jong (P) gol, Serginho (M) gol, Addo (P) gol, Pirlo delegato: Adriano Galliani (M) gol, Zonneveld (P) gol, Gourcuff (M) parato, Salcido Vice-presidenti: Paolo Berlusconi, (P) gol, Seedorf (M) traversa. Gianni Nardi Note: spettatori 35.000 circa. Ammonito Afellay. Recu- Direttore generale: Ariedo Braida peri 1' e 0'. Dirett. Operaz. area tecnica: Leonardo Nascimeto de A. ▸ Il Milan in attesa delude e si arrende ai rigori Direttore organizzativo: Umberto Gandini “Mosca - Al di là degli aggiustamenti stilistici (righe Segreteria tecnica: Mary Buscaglia, Cristina Moschetta rosse più sottili, maggiore presenza del nero), la maglia Direttore della comunicazione: Vittorio Mentana non è cambiata. Kakà ieri ha infatti indossato quella del Team manager: Silvano Ramaccioni Milan che ha perduto ai calci di rigore (3-4) la squallida Allenatore: Carlo Ancelotti sfida con gli olandesi del Psv e non quella del Real Allenatori in 2a: Mauro Tassotti, Alessandro Costacurta Madrid, che pure ha giocato subito dopo i rossoneri Allenatori dei portieri: William Vecchi (responsabile), rimontando i padroni di casa della Lokomotiv Mosca (da Beniamino Abate 0-2 nel primo tempo a 5-2) nella prima tornata di incon-