Retail Study

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Sedgemoor Town Centres and Retail Study

Sedgemoor District Council SEDGEMOOR TOWN CENTRES AND RETAIL STUDY Volume 2: Market Share and Spending Pattern Tables June 2009 Sedgemoor Town Centres and Retail Study Spreadsheet 1 - Study Zones by Ward Ward 07 Mid-yr Pop Est Survey Zone Berrow 2,410 1 Burnham North 6,400 1 Burnham South 6,526 1 Brent North 2,270 2 Highbridge 6,306 2 Knoll 2,412 2 Axbridge 2,171 3 Axe Vale 2,250 3 Cheddar and Shipham 6,776 3 Wedmore and Mark 4,738 3 Huntspill and Pawlett 3,781 4 Puriton 2,063 4 Sandford 3,317 4 West Poldens 2,510 4 Woolavington 2,203 4 Bridgwater Eastover 4,330 5 Bridgwater Hamp 6,968 5 Bridgwater Sydenham 6,614 5 Bridgwater Victoria 5,903 5 Bridgwater Bower 6,287 6 East Poldens 2,234 6 King's Isle 4,489 6 Bridgwater Quantock 6,161 7 Cannington and Quantocks 7,231 7 North Petherton 5,817 7 Sedgemoor Town Centres and Retail Study Spreadsheet 2 - Population Projections 2009-2026 All Zones Zone 1 Zone 2 Zone 3 Zone 4 Zone 5 Zone 6 Zone 7 Total Population 2007 15,336 10,988 15,935 13,874 23,815 13,010 19,209 112,167 Population 2009 15,560 11,110 16,000 13,946 24,571 13,237 19,922 114,344 Population 2011 15,783 11,232 16,066 14,018 25,315 13,463 20,623 116,500 Population 2016 15,827 11,256 16,099 14,053 26,309 15,109 23,148 121,800 Population 2021 16,359 11,526 16,269 14,180 28,290 16,846 23,629 127,100 Population 2026 16,852 11,776 16,427 14,299 30,691 17,635 24,320 132,000 Change in population 2009 - 2011 Numeric change 223 122 65 72 744 225 700 2,156 Percentage change 1.4% 1.1% 0.4% 0.5% 3.0% 1.7% 3.5% 1.9% Change in population 2011 - 2016 -

Economy Technical Note

ECONOMY TECHNICAL NOTE November 2011 SESplan ECONOMY TECHNICAL NOTE (V8) CONTENTS 1. INTRODUCTION ......................................................................................................................1 2. NATIONAL PLANNING POLICY .............................................................................................2 Scottish Planning Policy (SPP).................................................................................................2 National Planning Framework 2 (NPF2)...................................................................................2 3. ECONOMIC CHALLENGES ....................................................................................................6 4. KEY (GLOBAL) SECTORS, MARKET ANALYSIS AND EXPECTED DEMAND...................7 Property Market Consultancy for Scottish Enterprise .............................................................17 Edinburgh City Region Benchmarks 2011..............................................................................23 5. EMPLOYMENT LAND SUPPLY ............................................................................................25 Key Employment Locations ....................................................................................................26 Land Use Implications ............................................................................................................32 6. TRAVEL TO WORK AREAS AND ACCESSIBILITY ............................................................32 SESplan Accessibility Analysis.................................................Error! -

The Sustainability of European Food Supply Chains

The sustainability of European food supply chains A report by Ethical Corporation March 2006 1 Executive summary......................................................................................... 3 Section 1........................................................................................................ 13 Food Value Chains........................................................................................ 13 The ‘Value Chain’ ........................................................................................ 14 The first link in the demand chain ................................................................................ 17 ‘Value chain governance’ … ........................................................................................ 17 How to turn a supply chain into a demand chain.......................................................... 21 ‘Credence claims’ ......................................................................................... 23 Traceability ................................................................................................... 27 Standards: the codification of retailer demand. ............................................ 34 Contracts ....................................................................................................... 45 Vertical Coordination ................................................................................... 59 ‘Forward Integration’.................................................................................... 67 Buyer Power................................................................................................. -

Plymouth Shopping Survey (2005)

Shopping Survey 2005 Plymouth City Council www.plymouth.gov.uk/ldf Shopping Survey 2005 Contents Part 1 Summary of Use Classes in Prime/Core Frontages Part 2 Listing of Use Classes by Centre Centre Centre Name Page Centre Centre Name Page Centre Centre Name Page No. No. No. No. No. No. City Centre 1 City Centre 4 District Centres 2 Crownhill 26 5 Plympton Ridgeway 36 8 St.Budeaux 45 3 Estover 28 6 Plymstock Broadway 41 9 Transit Way 47 4 Mutley Plain 29 7 Roborough 44 Local Centres 10 Albert Road 48 28 Ham Green 66 46 Segrave Road 79 11 Barbican 51 29 Henders Corner 67 47 Southway 80 12 Beaumont Road 54 30 Higher Compton 67 48 Station Road (Devonport) 81 13 Chaddlewood 55 31 Honicknowle Green 68 49 Stoke Village 82 14 Clittaford Road 55 32 Hooe 68 50 Stone Barton 84 15 Colebrook 56 33 Hyde Park Road 69 51 Tamerton Foliot 85 16 Congreve Gardens 56 34 Keyham(Fleet St/Victory St 71 52 Underwood 85 17 Cumberland Street 57 35 King Street 71 53 Union Street 86 18 Dale Road 58 36 Leigham (Thurlestone Walk) 72 54 Upland Drive 86 19 Delamere Road 58 37 Lipson Vale 72 55 Victoria Road 87 20 Ebrington Street 59 38 Marlborough Street 73 56 West Hoe 88 21 Efford 61 39 Milehouse 75 57 West Park 88 22 Eggbuckland 61 40 North Prospect 75 58 Whitleigh Green 90 23 Elburton 62 41 Oreston 76 59 Wolseley Road 90 24 Embankment Road 63 42 Pennycomequick 76 Out of Centre Stores (Listing) 92 25 Ernesettle 64 43 Peverell Corner 77 26 George Street 65 44 Peverell Park Road 77 27 Glenholt 66 45 Salisbury Road 78 Part 1. -

Chapter Five Structure of the Grocery Trade

Chapter Five Structure of the Grocery Trade 5.1 Introduction As with previous reviews of the operation of the Groceries Order undertaken by the Restrictive Practices Commission, we have found it extremely difficult to obtain sufficiently up to date data to enable us to express the structure of the grocery trade in Ireland in reliable statistical form. The grocery trade does not publish detailed turnover or net profit figures which make it difficult to establish precise market share for individual operators. This was recognised by the Joint Oireachtas Committee on Enterprise & Small Business in the March 2005 Report on the Grocery Sector when they called for greater transparency and recommended that firms in the sector be required to publish turnover and net profit figures. Figures on store numbers are available, as indeed are trends in such numbers over the years but they can, in our opinion be misleading, as individual grocery stores vary considerably in size and presumably in turnover thus not telling us a great deal about the statistical size of the market. In this Chapter, we have relied for the purposes of examining the structure of the market on the market share figures provided by the Joint Oireachtas Committee in their March 2005 Report as we believe these to be an accurate indication of current standings. 5.2 Comparison with UK A large number of submissions received as part of the consultation process have drawn comparisons between Ireland and the UK. Musgraves and many others have referred to the fact that in the UK, four multiples control “more than 80%” of the retail food market.” We have undertaken an analysis of the standings in the respective markets, although we have compared the Irish market with available figures for Great Britain rather than for the UK. -

Gloucester Road.Xlsx

Businesses on the Gloucester Road (Snapshot in June 2014) (see footnotes for key) No. Pln. Lic. Ch. Category Name Previously/Notes Cromwell Road 1 A1 N Electronics Maplin Electronics Moved from no.288(?) 3 ^^ History: Originally Bristol Tramway Garage, rebuilt as Morgan's Department Store (1930s) then Colmers (1963), Homeplan Furnishers (1970s). Cash Converters Pawnbrokers (moved to nos. 322-324) and a pine furniture factory shop. 5 A4 Y Public House Prince of Wales 7 A1 Jeweller Bamba Beads 9 A1 N Computer ComputerRight Opened Aug 2011 - Rooted Records – Newsagent/Tobacconist C W Ford 11 A1 Grocer Harvest Essential Trading Cooperative 13a A1 Grocer Oriental Market 13 A3 Fd Restaurant (Indian) Sheesh Mahal 15 A5 Takeaway Benny's KFC - very old photo (Flickr) Tobacconist J Stacey 17 A1 Off Off Licence No. 1 Grocer Polish Market - Records Disk'n'Tape 19 A1 Head Shop Red Eye opened Jun 2014 - Oct 2013-Early 2014 Hobo lighting (came and went in a flash) - 21 ^^ Active Employment (Moved early 2012?) 23 A1 N Pharmacy Vantage/Sood 25 ^^ 27 A3 BYO Restaurant (Korean/Japanese) Dain Korea Opened Sept 2013 - Zulu (Closed July 2013) - J5 – Lynn's 29 A1 N Takeaway (Sandwiches) Subway Select TV 31 A1 TV/Hi-Fi Paul Roberts 33 ^^ 35 A3 Y Bar/Café The Urban Standard Opened Feb 2014. Amusement Arcade Time Out Planning application => A3 Restaurant/Café Granted Sep 2012 Licence application April 2013. Premises Licence application Jun 2013 37 A1 Hairdresser Aka Premises swap with ZZZone photographic studio in Zetalnd Road Apr 2013 - Design Snap2 39 A5 Fd -

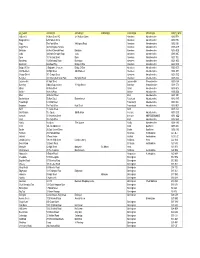

Ou Name Address1 Address2 Address3 Address4

OU_NAME ADDRESS1 ADDRESS2 ADDRESS3 ADDRESS4 ADDRESS5 POST_CODE Holburn St Holburn Street PO 281 Holburn Street Aberdeen Aberdeenshire AB10 7FN Bridge Of Dee 625 Holburn Street Aberdeen Aberdeenshire AB10 7JN Nigg The Post Office Wellington Road Aberdeen Aberdeenshire AB12 3JB Argyll Place 3a Beechgrove Terrace Aberdeen Aberdeenshire AB15 5DR Bieldside 45 North Deeside Road Bieldside Aberdeen Aberdeenshire AB15 9DB Cults 324 North Deeside Road Cults Aberdeen Aberdeenshire AB15 9SE Dyce 119 Victoria Street Dyce Aberdeen Aberdeenshire AB21 7BJ Bankhead 132 Bankhead Road Bucksburn Aberdeen Aberdeenshire AB21 9EB Braehead Braehead Way Bridge Of Don Aberdeen Aberdeenshire AB22 8RR Bridge Of Don 2 Balgownie Crescent Bridge Of Don Aberdeen Aberdeenshire AB23 8ER Old Aberdeen 39 High Street Old Aberdeen Aberdeen Aberdeenshire AB24 3EH George Street 371 George Street Aberdeen Aberdeenshire AB25 1EQ Berryden Unit 5 Berryden Retail Park Berryden Road Aberdeen Aberdeenshire AB25 3XZ Laurencekirk 41 High Street Laurencekirk Kincardineshire AB30 1AA Banchory Alldays Supermarket 37 High Street Banchory Kincardineshire AB31 5TJ Alford 48 Main Street Alford Aberdeenshire AB33 8PX Ballater Netherly Place Ballater Aberdeenshire AB35 5QE Ellon 34 Market Street Ellon Aberdeenshire AB41 9JD Buchanhaven Skelton Street Buchanhaven Peterhead Aberdeenshire AB42 1HR Fraserburgh 6-12 Mid Street Fraserburgh Aberdeenshire AB43 9AJ Broadsea The Post Office High Street Fraserburgh Aberdeenshire AB43 9EX Banff 11 Castle Street Banff AB45 1DH Old Meldrum The Square Old