Where It Matters

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

NLJAN2013.Pdf

1 2 WHO WE ARE: ABB is a global leader in power and automation technologies. Based in Zurich, Switzerland, the company employs 145,000 people and operates in approximately 100 countries. The firm’s shares are traded on the stock exchanges of Zurich, Stockholm and New York. ABB’s business is comprised of five divisions that are in turn organized in relation to the customers and industries we serve. The company in its current form was created in 1988, but its history spans over 120 years. ABB’s success has been driven particularly by a strong focus on research and development. The company maintains seven corporate research centres around the world and has continued to invest in R&D through all market conditions. The result has been a long track record of innovation. Many of the technologies that underlie our modern society, from high-voltage DC power transmission to a revolutionary approach to ship propulsion, were developed or commercialized by ABB. Today, ABB stands as the largest supplier of industrial motors and drives, the largest provider of generators to the wind industry, and the largest supplier of power grids worldwide. HISTORY OF THE COMPANY RECRUITMENT STEPS: APTITUDE 1883 GROUP DISSCUSIONS Ludvig Fredholm establishes Elektriska Aktiebolaget in Stockholm as TECHNICAL manufacturers of electrical lighting and generators INTERVIEW HR INTERVIEW 1933 BBC obtains the patent for turbine rotors constructed from individual steel disks that are welded 3 1942 CURRENT STATUS: ASEA builds the world's first 120 MVA, 220 kV transformer in the Stockholm Elverks Värtanstation JOBS AVAILABLE=1336 1952 JOBEMPLOYERS =165K ASEA designs and installs the first 400 kV AC cable – a 70 m low TECHNOLOGIES=8000 pressure oil-filled (LPOF) cable connecting an underground power station (built to withstand an atomic bomb) to the Swedish grid. -

Application for Renewal of Honeywell Metropolis Works

Honeywell Specialty Materials Honeywell P.O. Box 430 Highway 45 North Metropolis, IL 62960 618 524-2111 618 524-6239 Fax May 27, 2005 U.S. Nuclear Regulatory Commission (UPS: 301-415-6334) Attention: Michael Raddatz Fuel Cycle Licensing Branch, Mail Stop T-8A33 Two White Flint North, 11545 Rockville Pike Rockville, MD 20852-2738 Subject: Renewal of USNRC Source Materials License Re: Docket No. 40-3392 License No. SUB-526 Dear Sirs, Please find enclosed the Honeywell International Inc. application for renewal of USNRC Source Materials License SUB-526 for Honeywell's Metropolis, Illinois Uranium Conversion Facility (Docket No. 40-3392). This application has been prepared in accordance with the requirements of 10 CFR 40. The content and format of the application and supporting materials are generally consistent with the guidance provided in USNRC Regulatory Guide 3.55, "Standard Format and Content for the Health and Safety Section of License Renewal Applications for Uranium Hexafluoride Production." We have incorporated certain variations from this guidance consistent with our April 26, 2005 discussions with the NRC staff. Enclosed are the following: * One original and 7 copies of the Metropolis Works USNRC Source Materials License Application (Regulatory Guide 3.55 Chapters 1 through 7), including USNRC Form 313 * One original and 7 copies of the revised Metropolis Works Emergency Response Plan * One original and 7 copies of the Metropolis Works Safety Demonstration Report (Regulatory Guide 3.55 Chapters 8 through 14), including related drawings and appendices * One original and 7 copies of the Metropolis Works Environmental Report * One compact disc containing the text files for each of the above in pdf format Attached to this letter, please find a summary of the significant changes to the License Application and Safety Demonstration Report. -

Juniper II Corp. Form S-1/A Filed 2021-07-22

SECURITIES AND EXCHANGE COMMISSION FORM S-1/A General form of registration statement for all companies including face-amount certificate companies [amend] Filing Date: 2021-07-22 SEC Accession No. 0001193125-21-221828 (HTML Version on secdatabase.com) FILER Juniper II Corp. Mailing Address Business Address 14 FAIRMOUNT AVENUE 14 FAIRMOUNT AVENUE CIK:1838814| IRS No.: 000000000 | State of Incorp.:DE | Fiscal Year End: 1231 CHATHAM NJ 07928 CHATHAM NJ 07928 Type: S-1/A | Act: 33 | File No.: 333-255021 | Film No.: 211107615 9735070359 SIC: 6770 Blank checks Copyright © 2021 www.secdatabase.com. All Rights Reserved. Please Consider the Environment Before Printing This Document Table of Contents As filed with the United States Securities and Exchange Commission on July 22, 2021 under the Securities Act of 1933, as amended. No. 333-255021 UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 Amendment No. 3 to FORM S-1 REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933 Juniper II Corp. (Exact name of registrant as specified in its charter) Delaware 6770 86-1434822 (State or other jurisdiction of (Primary Standard Industrial (I.R.S. Employer incorporation or organization) Classification Code Number) Identification No.) 3790 El Camino Real #818 Palo Alto, California 94306 (650) 292-9660 (Address, including zip code, and telephone number, including area code, of registrants principal executive offices) Noah Kindler Chief Financial Officer and Chief Technology Officer 3790 El Camino Real #818 Palo Alto, California 94306 (650) 292-9660 (Name, address, including zip code, and telephone number, including area code, of agent for service) Copies to: Julian Seiguer, Esq. -

Where It Matters

Aerospace • Automation and Control Solutions • Transportation Systems • Specialty Materials Honeywell International Inc. 101 Columbia Road 2005 Annual Report2005 Annual P.O. Box 2245 Morristown, NJ 07962-2245 USA Where it matters 2005 Annual Report For more information about Honeywell, visit our Internet site at: www.honeywell.com Financial Highlights Honeywell 7 People and Performance: (Dollars and Shares in Millions, Except Per Share Amounts) 2005 2004 2003 Sales · · · · · · · · · · · · · · · · · · · · · · · · · · · · · · · · $27,653 $25,601 $ 23,103 executing where it matters Net Income1 · · · · · · · · · · · · · · · · · · · · · · · · · · $ 1,655 $ 1,281 $ 1,324 Diluted Earnings Per Common Share · · · · · · · $ 1.94 $ 1.49 $ 1.54 Honeywell’s Five Initiatives – Growth, Productivity, Cash, People and the Enablers – drove our superior Cash Dividends Per Common Share · · · · · · · · $ 0.825 $ 0.75 $ 0.75 success in 2005. As part of the Growth Initiative, we recognize sites and individuals for their contributions to our customers. All of our operations and manufacturing sites are measured monthly on their ability to Book Value Per Common Share · · · · · · · · · · · $ 13.57 $ 13.24 $ 12.45 meet customer requirements for quality and on-time delivery. Our “Chairman’s Award for Everyday Heroes” Total Assets· · · · · · · · · · · · · · · · · · · · · · · · · · · $32,294 $31,062 $ 29,314 rewards one employee each week for contributions that drive company growth. “Premier Achievement” Cash Flows from Operating Activities · · · · · · · $ 2,442 $ 2,253 $ 2,199 and the “Senior Leadership Award” are our highest annual honors for individuals, recognizing outstanding Common Shares Outstanding at Year-end · · · 829 850 862 achievements in our Five Initiatives, and the “Velocity Product Development™ Award” recognizes the individual who fundamentally changes processes to improve new product introductions. -

View Annual Report

Growth at 2004 Annual Report FINANCIAL HIGHLIGHTS (Dollars and Shares in Millions, Except Per Share Amounts) 2004 2003 2002 Sales · · · · · · · · · · · · · · · · · · · · · · · · · · · · · · · · · · · · · · $25,601 $ 23,103 $ 22,274 Net Income (Loss)1 · · · · · · · · · · · · · · · · · · · · · · · · · · · $ 1,281 $ 1,324 $ (220) Diluted Earnings (Loss) Per Common Share · · · · · · · · · $ 1.49 $ 1.54 $ (0.27) Cash Dividends Per Common Share· · · · · · · · · · · · · · · $ 0.75 $ 0.75 $ 0.75 Book Value Per Common Share · · · · · · · · · · · · · · · · · · $ 13.24 $ 12.45 $ 10.45 Total Assets · · · · · · · · · · · · · · · · · · · · · · · · · · · · · · · · · $31,062 $ 29,314 $ 27,565 Cash Flows from Operating Activities· · · · · · · · · · · · · · $ 2,253 $ 2,199 $ 2,380 Common Shares Outstanding at Year-end· · · · · · · · · · · 850 862 854 Employees at Year-end · · · · · · · · · · · · · · · · · · · · · · · · · 109,000 108,000 108,000 1 In 2004, includes net repositioning, environmental, litigation, business impairment and other charges, gains on sales of non-strategic businesses and a gain related to the settlement of a patent infringement lawsuit resulting in a net after-tax charge of $315 million, or $0.36 per share. In 2003, includes the cumulative after-tax charge of $20 million, or $0.02 per share, for the adoption of SFAS No.143. In 2003, also includes net repositioning, environmental and other charges, gains on sales of non-strategic businesses and a gain related to the settlement of a patent infringement lawsuit resulting in a net after-tax -

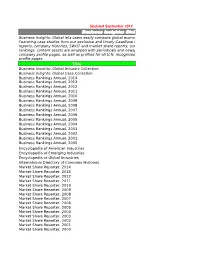

Reference Title List 2-2012

Updated September 2014 Business Insights: Global Business Insights: Global lets users easily compare global economies, companies and industries. Featuring case studies from our exclusive and timely CaseBase collection, global industry research reports, company histories, SWOT and market share reports, corporate chronologies, and business rankings, content assets are wrapped with periodicals and newspapers in hundreds of thousands of company profile pages, as well as profiles for all U.N. recognized countries and hundreds of industry profile pages. Title Business Insights: Global Industry Collection Business Insights: Global Case Collection Business Rankings Annual, 2014 Business Rankings Annual, 2013 Business Rankings Annual, 2012 Business Rankings Annual, 2011 Business Rankings Annual, 2010 Business Rankings Annual, 2009 Business Rankings Annual, 2008 Business Rankings Annual, 2007 Business Rankings Annual, 2006 Business Rankings Annual, 2005 Business Rankings Annual, 2004 Business Rankings Annual, 2003 Business Rankings Annual, 2002 Business Rankings Annual, 2001 Business Rankings Annual, 2000 Encyclopedia of American Industries Encyclopedia of Emerging Industries Encyclopedia of Global Industries International Directory of Company Histories Market Share Reporter, 2014 Market Share Reporter, 2013 Market Share Reporter, 2012 Market Share Reporter, 2011 Market Share Reporter, 2010 Market Share Reporter, 2009 Market Share Reporter, 2008 Market Share Reporter, 2007 Market Share Reporter, 2006 Market Share Reporter, 2005 Market Share Reporter, -

Riccardo Celli Partner

Riccardo Celli Partner Brussels D: +32-2-642-41-34 [email protected] Riccardo Celli is Chair of O’Melveny’s European Antitrust and Admissions Competition Practice, the Regional Head of Litigation for Europe, and managing partner of the firm’s Brussels office. Riccardo Bar Admissions joined O’Melveny in June 2004 when he founded the Brussels Solicitor, Supreme Court of England office. and Wales (1994) Italy, Avvocato (1986) Riccardo has almost 30 years of experience in counseling clients on all aspects of EU competition law with particular focus on merger control, unilateral conducts, cartel investigations, Education IP/antitrust interface and antitrust compliance. University of Rome (La Sapienza), Riccardo has worked for many of the world’s largest corporations, Law (1983) and has been involved in high-profile cases covering many global industries. For example, Riccardo led the O’Melveny-Brussels team that advised AMD in its Article 102 complaint against Intel, in which the European Commission fined Intel a record €1.06 billion for its anti-competitive practices. O’Melveny’s EU team won the 2010 “Competition Team of the Year” at The Lawyer Awards for its representation of AMD, and Riccardo was a finalist for the “Partner of the Year” award for his leadership during the case. In the area of merger control, Riccardo regularly assists clients with the legal assessment, structuring and clearance of mergers, acquisitions, joint ventures and other significant investments. Riccardo manages and coordinates multiple filings for clients, not only in Europe but worldwide, and interacts with competition authorities in multiple countries for a single transaction, including assisting clients in preparing and negotiating possible commitments with regulators. -

Honeywell Metropolis Works - Request for Extension of Exemption from Decommissioning Financial Assurance Requirements

Specialty Materials Honeywell P.O. Box 430 Highway 45 North Metropolis, IL 62960 618 524-2111 618 524-6239 Fax May 15, 2008 (UPS: 301-415-8147) U.S. Nuclear Regulatory Commission ATTN: Document Control Desk Director, Office of Nuclear Material Safety and Safeguards 11545 Rockville Pike Mail Stop T-8A33, Two White Flint N Rockville, MD 20852-2738 Docket No. 40-3392 License No. SUB-526 Subject: HONEYWELL METROPOLIS WORKS - REQUEST FOR EXTENSION OF EXEMPTION FROM DECOMMISSIONING FINANCIAL ASSURANCE REQUIREMENTS References: 1. Letter dated April 11, 2008, from M. Tillman (Honeywell International, Inc.) to NRC, requesting an extension of the exemption from financial test requirements related to the self-guarantee form of financial assurance contained in License Condition 27 in License No. SUB-526. 2. Letter dated May 11, 2007, from G. Janosko (NRC) to D. Edwards (Honeywell International, Inc.) issuing renewed License No. SUB-526 and incorporating exemption from decommissioning financial assurance requirements in License Condition 27. 3. Letter dated December 1, 2006 from J. Tus (Honeywell International, Inc.) to Director, Office of Nuclear Material Safety and Safeguards (NRC), "Request for Exemption from Decommissioning Financial Assurance Requirements." In Reference 1, Honeywell International, Inc. (Honeywell) requested an extension of the exemption previously granted by the Nuclear Regulatory Commission (NRC) in Reference 2 for the Metropolis, Illinois uranium conversion facility. In Reference 2 the NRC incorporated a one- year exemption from a portion of the financial test in 10 C.F.R. Part 30, Appendix C, for the self- guarantee form of decommissioning financial assurance in License Condition 27 in License No. -

FORM 10−K HONEYWELL INTERNATIONAL INC − Hon Filed: February 16, 2007 (Period: December 31, 2006)

FORM 10−K HONEYWELL INTERNATIONAL INC − hon Filed: February 16, 2007 (period: December 31, 2006) Annual report which provides a comprehensive overview of the company for the past year Table of Contents Part III: Proxy Statement for Annual Meeting of Shareowners to be held April 23, 2007. PART I. Item 1. Business Item 1A. Risk Factors Item 1B. Unresolved Staff Comments Item 2. Properties Item 3. Legal Proceedings Item 4. Submission of Matters to a Vote of Security Holders Part II. Item 5. Market for Registrant s Common Equity, Related Stockholder Item 6. Selected Financial Data Item 7. Management s Discussion and Analysis of Financial Condition and Item 7A. Quantitative and Qualitative Disclosures About Market Risk Item 8. Financial Statements and Supplementary Data Item 9. Changes in and Disagreements with Accountants on Accounting and Financial Disclosure Item 9A. Controls and Procedures Item 9B. Other Information Part III. Item 10. Directors and Executive Officers of the Registrant Item 11. Executive Compensation Item 12. Security Ownership of Certain Beneficial Owners and Management Item 13. Certain Relationships and Related Transactions Item 14. Principal Accounting Fees and Services Part IV. Item 15. Exhibits and Financial Statement Schedules SIGNATURES EXHIBIT INDEX EX−10.1 (Material contracts) EX−10.6 (Material contracts) EX−10.8 (Material contracts) EX−10.9 (Material contracts) EX−10.22 (DEFERRED COMPENSATION AGREEMENT) EX−10.23 (Material contracts) EX−10.24 (Material contracts) EX−10.25 (Material contracts) EX−10.26 (Material