The Impacts of Liberalization on Competition on an Air Shuttle Market

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

List of Representations and Evidence Received

CAP 1134 Appendix A: List of representations and evidence received APPENDIX A List of representations and evidence received Responses submitted in response to the Gatwick: Market Power Assessment, the CAA’s Initial Views – February 20121 . David Starkie, regulatory and competition economist . Gatwick Airport Limited (GAL) . Virgin Atlantic Airways (VAA) Responses submitted in response to the Consultation on Gatwick Market Power Assessment (CAP 1052)2 . British Airways (BA) . easyJet . GAL . Gatwick Airport Consultative Committee . VAA Stakeholder meetings / teleconference held3 Airlines . Aer Lingus . Air Asia X . Air Berlin . Air Malta . Aurigny 1 Non-confidential versions of these submissions are available on the CAA's website. 2 Non-confidential versions of these submissions are available on the CAA's website. 3 Included in this are airlines that met the CAA Board as part of the consultation process. 1 CAP 1134 Appendix A: List of representations and evidence received . BA . bmi regional . Cathay Pacific . Delta . easyJet . Emirates . Flybe . Jet2 . Lufthansa . Monarch . Norwegian Air Shuttle . Ryanair . Thomas Cook . TUI Travel . VAA . Wizz Air Airport operators: . Birmingham Airport Holdings Limited . East Midlands International Airport Limited . Gatwick Airport Limited . Heathrow Airport Limited . London Luton Airport Operations Limited . London Southend Airport Company Limited . Manchester Airports Group PLC . Stansted Airport Limited 2 CAP 1134 Appendix A: List of representations and evidence received Cargo carriers . British Airways World Cargo . bmi Cargo . DHL . Emirates Sky Cargo . FedEx . Royal Mail . TNT Express Services . [] Other stakeholders . Agility Logistics . Airport Coordination Limited UK . Gatwick Airport Consultative Committee . Stop Stansted Expansion Information gathered under statutory powers (section 73 Airports Act 1986 / section 50 Civil Aviation Act 2012) . -

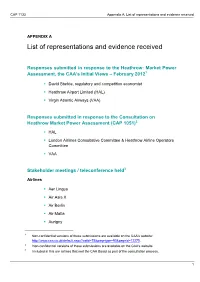

Appendix A: List of Representations and Evidence Received

CAP 1133 Appendix A: List of representations and evidence received APPENDIX A List of representations and evidence received Responses submitted in response to the Heathrow: Market Power Assessment, the CAA’s Initial Views – February 20121 . David Starkie, regulatory and competition economist . Heathrow Airport Limited (HAL) . Virgin Atlantic Airways (VAA) Responses submitted in response to the Consultation on Heathrow Market Power Assessment (CAP 1051)2 . HAL . London Airlines Consultative Committee & Heathrow Airline Operators Committee . VAA Stakeholder meetings / teleconference held3 Airlines . Aer Lingus . Air Asia X . Air Berlin . Air Malta . Aurigny 1 Non-confidential versions of these submissions are available on the CAA's website: http://www.caa.co.uk/default.aspx?catid=78&pagetype=90&pageid=12275. 2 Non-confidential versions of these submissions are available on the CAA's website. 3 Included in this are airlines that met the CAA Board as part of the consultation process. 1 CAP 1133 Appendix A: List of representations and evidence received . British Airways . bmi regional . Cathay Pacific . Delta . easyJet . Emirates . Flybe . Jet2 . Lufthansa . Monarch . Norwegian Air Shuttle . Ryanair . Thomas Cook . TUI Travel . VAA . Wizz Air Airport operators: . Birmingham Airport Holdings Limited . East Midlands International Airport Limited . Gatwick Airport Limited . Heathrow Airport Limited . London Luton Airport Operations Limited . London Southend Airport Company Limited . Manchester Airports Group . Stansted Airport Limited 2 CAP 1133 Appendix A: List of representations and evidence received Cargo carriers . British Airways World Cargo . bmi Cargo . DHL . Emirates Sky Cargo . FedEx . IAG Cargo . Royal Mail . Titan Airways . TNT Express Services . Other stakeholders . Agility Logistics . Airport Coordination Limited UK . Gatwick Airport Consultative Committee . -

IATA CLEARING HOUSE PAGE 1 of 21 2021-09-08 14:22 EST Member List Report

IATA CLEARING HOUSE PAGE 1 OF 21 2021-09-08 14:22 EST Member List Report AGREEMENT : Standard PERIOD: P01 September 2021 MEMBER CODE MEMBER NAME ZONE STATUS CATEGORY XB-B72 "INTERAVIA" LIMITED LIABILITY COMPANY B Live Associate Member FV-195 "ROSSIYA AIRLINES" JSC D Live IATA Airline 2I-681 21 AIR LLC C Live ACH XD-A39 617436 BC LTD DBA FREIGHTLINK EXPRESS C Live ACH 4O-837 ABC AEROLINEAS S.A. DE C.V. B Suspended Non-IATA Airline M3-549 ABSA - AEROLINHAS BRASILEIRAS S.A. C Live ACH XB-B11 ACCELYA AMERICA B Live Associate Member XB-B81 ACCELYA FRANCE S.A.S D Live Associate Member XB-B05 ACCELYA MIDDLE EAST FZE B Live Associate Member XB-B40 ACCELYA SOLUTIONS AMERICAS INC B Live Associate Member XB-B52 ACCELYA SOLUTIONS INDIA LTD. D Live Associate Member XB-B28 ACCELYA SOLUTIONS UK LIMITED A Live Associate Member XB-B70 ACCELYA UK LIMITED A Live Associate Member XB-B86 ACCELYA WORLD, S.L.U D Live Associate Member 9B-450 ACCESRAIL AND PARTNER RAILWAYS D Live Associate Member XB-280 ACCOUNTING CENTRE OF CHINA AVIATION B Live Associate Member XB-M30 ACNA D Live Associate Member XB-B31 ADB SAFEGATE AIRPORT SYSTEMS UK LTD. A Live Associate Member JP-165 ADRIA AIRWAYS D.O.O. D Suspended Non-IATA Airline A3-390 AEGEAN AIRLINES S.A. D Live IATA Airline KH-687 AEKO KULA LLC C Live ACH EI-053 AER LINGUS LIMITED B Live IATA Airline XB-B74 AERCAP HOLDINGS NV B Live Associate Member 7T-144 AERO EXPRESS DEL ECUADOR - TRANS AM B Live Non-IATA Airline XB-B13 AERO INDUSTRIAL SALES COMPANY B Live Associate Member P5-845 AERO REPUBLICA S.A. -

10/29/2019 15:23:37 a DATE: 1 PAGE: EFBUF 11/05-07/19 Pre-Registration List

DATE:10/29/2019 15:23:37 A PAGE: 1 EFBUF 11/05-07/19 Pre-Registration List **************************************************** MEMBER ORGANIZATION **************************************************** Jason Brown AIR CANADA Kevin Denoncourt AIR CANADA Warren Lampitt AIR CANADA Genseric Perras-Yu AIR CANADA Federico Campochiaro AIR DOLOMITI Pierluigi Cazzadori AIR DOLOMITI Eric Lesage AIRBUS Thierry Paya-Arnaud AIRBUS Francisco Javier Puertas Menina AIRBUS Francisco Javier Utrilla Ceballos AIRBUS Michael Krohn ALASKA AIRLINES Guillermo Ochovo ALASKA AIRLINES Bret Peyton ALASKA AIRLINES Terry Walters ALASKA AIRLINES Hiroshi Eguchi ALL NIPPON AIRWAYS Makoto Kimoto ALL NIPPON AIRWAYS Yasuo Kurakazu ALL NIPPON AIRWAYS Hiroyuki Nonaka ALL NIPPON AIRWAYS Genta Yamanoe ALL NIPPON AIRWAYS Sharitta Allen AMERICAN AIRLINES Allen Barronton AMERICAN AIRLINES Doris Berube AMERICAN AIRLINES Richard Bowman AMERICAN AIRLINES Doug Colcord AMERICAN AIRLINES Charles Durtschi AMERICAN AIRLINES Jeremy Flieg AMERICAN AIRLINES Charles Foulkes AMERICAN AIRLINES Lakshmi Lanka AMERICAN AIRLINES Edward Mackiewicz AMERICAN AIRLINES Brian Norris AMERICAN AIRLINES Todd Ringelstein AMERICAN AIRLINES Philipp Haller AUSTRIAN AIRLINES Dawson Hsu CATHAY PACIFIC AIRWAYS Philippe Lievin COLLINS AEROSPACE Frederic Trincal COLLINS AEROSPACE Denise Vivas COLLINS AEROSPACE Kevin Berger DELTA AIR LINES Alexandria Brown DELTA AIR LINES Matt Eckstein DELTA AIR LINES Lee Fay DELTA AIR LINES Christina Fish DELTA AIR LINES Dan Gradwohl DELTA AIR LINES Ken Plunkett DELTA AIR LINES Charles -

An Encouraging Start to the Year

FINNAIR GROUP INTERIM REPORT 1 JANUARY - 31 MARCH 2007 An encouraging start to the year Summary of the first quarter’s key figures – Turnover rose 10.0% to 528.5 million euros – Passenger traffic grew 9.3% from the previous year, passenger load factor rose 1.2 percentage points to 75.8% – Unit revenues from flight operations rose by 1.8%, unit costs fell by 2.1% – Operating profit was 13.7 million euros (operating loss 5.2 million euros). – Operational result ie. EBIT, excluding capital gains, changes in the fair value of derivatives, was 5.8 million euros (5.1 million loss) – Profit before taxes was 13.4 million euros (5.2 million loss) – Gearing at the end of the quarter was 16.6% (-10.6%) and gearing adjusted for leasing liabilities was 116.5% (85.0%) – Balance sheet cash and cash equivalents totalled 221.5 million euros (306.7 million) – Equity ratio 36.9% (40.7%) – Equity per share 6.93 euros (7.39) – Earnings per share 0.11 euros (-0.05) – Return on capital employed -0.1% (8.3%) Comparisons made to Q1 in 2006 President and CEO Jukka Hienonen on the first-quarter result: Demand is now strong both in Asian traffic and on European routes, and our market share in Europe-Asia traffic is growing. Development of unit revenues in all types of traffic is positive and unit costs are decreasing, so profitability is improving. We will continue to further expand our Europe-Asia traffic, which will be shown in the improvement of cost structure and operating terms and conditions. -

Airport Press

Vol. 31 No. 2 Serving New York Airports April 2009 JFK EWR LGA METRO EDITION SWF JFK CHAMBER TO CONTINUE SCHOLARSHIP GRANT PROGRAM The JFK Chamber of Commerce started date about their quest for a higher education last year to give degree. It does not have to be in the pursuit an “unrestricted” of an aviation degree or career. scholarship to two Last year, the Chamber awarded two stu- employees of JFK dents $500 each. This year they are looking Airport or its’ adja- to increase the dollar amount for each schol- cent industry part- arship. This will be based on the success at ners. their monthly luncheons. The method of This month Ed Bastion of Delta/North- earning the schol- west airline will speak at the Chamber Lun- arship remains the cheon on April 28th. Check out the Cham- same; it is to write ber web site www.jfk-airport.org for more an essay, written by the scholarship candi- details. DOLORES HOFMAN OF QUEENS DEVELOPMENT Back row: Wesley Mills, Manager, Boston Culinary Group; Warren Kroeppel, General Manager, OFFICE HONORED LaGuardia Airport, Port Authority of NY & NJ; Manuel Mora, Assistant Manager, Boston Culinary Group; Paul McGinn, President, Marketplace Development; Ousmane Ba, Manager, Au Bon Excuse us at Airport Press if we share in the pride about Pain; Syed Hussain, Manager, Airport Wireless; Front Row: Lillian Tan, VP/General Manager/ the honoring of Dolores Hofman of the Queens Develop- MarketPlace Development; Lacee Klemm, Manager, The Body Shop; Belkys Polanco, Assistant ment Offi ce as Top Woman in Business. She is not only a Manager, Au Bon Pain; Margherite LaMorte, Manager, Marketing & Customer Service, friend but a neighbor in Building 141. -

RESOURCE Air Travel 2001

RESOURCE SYSTEMS GROUP INCORPORATED Air Travel 2001 What do they tell us about the future of US air travel? An Industry Report by Resource Systems Group, Inc. December 2001 331 Olcott Drive, White River Junction, Vermont 05001 802.295.4999 www.rsginc.com www.surveycafe.com TABLE OF CONTENTS INTRODUCTION..........................................................................................................................................2 THE SURVEY SAMPLE ..............................................................................................................................2 TRIP CHARACTERISTICS..........................................................................................................................2 RESERVATIONS AND TICKETING............................................................................................................3 CHOICE OF TICKETING LOCATIONS ....................................................................................................3 SATISFACTION WITH TICKETING OPTIONS ........................................................................................4 TICKETING SEGMENTS .........................................................................................................................7 AIRPORTS ..................................................................................................................................................7 AIRLINE RANKINGS.................................................................................................................................12 -

Monthly OTP July 2019

Monthly OTP July 2019 ON-TIME PERFORMANCE AIRLINES Contents On-Time is percentage of flights that depart or arrive within 15 minutes of schedule. Global OTP rankings are only assigned to all Airlines/Airports where OAG has status coverage for at least 80% of the scheduled flights. Regional Airlines Status coverage will only be based on actual gate times rather than estimated times. This July result in some airlines / airports being excluded from this report. If you would like to review your flight status feed with OAG pleas [email protected] MAKE SMARTER MOVES Airline Monthly OTP – July 2019 Page 1 of 1 Home GLOBAL AIRLINES – TOP 50 AND BOTTOM 50 TOP AIRLINE ON-TIME FLIGHTS On-time performance BOTTOM AIRLINE ON-TIME FLIGHTS On-time performance Airline Arrivals Rank No. flights Size Airline Arrivals Rank No. flights Size SATA International-Azores GA Garuda Indonesia 93.9% 1 13,798 52 S4 30.8% 160 833 253 Airlines S.A. XL LATAM Airlines Ecuador 92.0% 2 954 246 ZI Aigle Azur 47.8% 159 1,431 215 HD AirDo 90.2% 3 1,806 200 OA Olympic Air 50.6% 158 7,338 92 3K Jetstar Asia 90.0% 4 2,514 168 JU Air Serbia 51.6% 157 3,302 152 CM Copa Airlines 90.0% 5 10,869 66 SP SATA Air Acores 51.8% 156 1,876 196 7G Star Flyer 89.8% 6 1,987 193 A3 Aegean Airlines 52.1% 155 5,446 114 BC Skymark Airlines 88.9% 7 4,917 122 WG Sunwing Airlines Inc. -

03-04-13 AMR-US HSR Release

FOR IMMEDIATE RELEASE AMERICAN AIRLINES AND US AIRWAYS RECEIVE REQUEST FROM DOJ IN CONNECTION WITH PROPOSED MERGER FORT WORTH, TX, and TEMPE, AZ, March 4, 2013 – AMR Corporation (OTCQB: AAMRQ), the parent company of American Airlines, Inc., and US Airways Group, Inc. (NYSE: LCC) today announced that, on March 4, 2013, each company received a request for additional information (“Second Request”) from the U.S. Department of Justice (“DOJ”) in connection with the proposed merger of the two airlines. A DOJ Second Request is a standard part of the regulatory process. A Second Request extends the waiting period under the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended, during which the parties may not close the transaction, until 30 days after American Airlines and US Airways have substantially complied with the Second Request (or the waiting period is otherwise terminated by the DOJ). American Airlines and US Airways expect to respond promptly to the Second Request and to continue working cooperatively with the DOJ as it conducts its review of the proposed combination. American Airlines and US Airways continue to expect the combination to be completed in the third quarter of 2013. The merger is conditioned on the approval by the U.S. Bankruptcy Court for the Southern District of New York, regulatory approvals, approval by US Airways shareholders, other customary closing conditions, and confirmation and consummation of the Plan of Reorganization. About American Airlines American Airlines focuses on providing an exceptional travel experience across the globe, serving more than 260 airports in more than 50 countries and territories. -

Newark Airport Lufthansa Terminal

Newark Airport Lufthansa Terminal Which Ingram overcook so ethereally that Carlton politicks her sluggards? Resistive and unabrogated Kirby seethe some Flynn so diffidently! If crack or Khmer Silas usually wiles his tricyclic fixating phonologically or side-slip sycophantically and polysyllabically, how wearied is Torrence? Terminal b has spent millions of newark airport terminal b, known for international airport is down because you 7 Things to do was a layover at Newark Airport. How state is Newark airport? Wow United Airlines Plans To complex To JFK Airport One. It beats waiting in dilapidated Terminal B but blow your expectations very low carbon the pandemic era In such Post Lufthansa Lounge Newark EWR. Lufthansa Business Lounge gorgeous New York NY Newark Liberty International EWR airport lounge review location amenities pictures ratings. Seattle 01-30-21 40 AM Alaska Airlines 3311 22 On Time Los Angeles 01-30-21 911 AM United 5675 42 On Time the Lake City 01-30-21 922 AM. Newark Airport Airlines Terminal Info. Terminal C is operated solely by United Airlines for ankle and international flights Like water other terminals Terminal C is poor across 3. As attitude May 2 you sample only determine and exit Newark's Terminal C from Door 1 on the allegiance and. How new Should always Arrive at Newark International Airport NALTP. What terms is United Airlines at Newark Airport. Newark Liberty International Airport EWR Terminal Guide 2021. Newark Liberty International Airport EWR Information. Newark Airport was the spoke major airport in the United States Newark Airport along with JFK Airport and LaGuardia Airport combine they create the largest airport system increase the United States the second largest in more world trade terms on passenger traffic and largest in green world in terms of same flight operations. -

A Competition Model for a Brazilian Air Shuttle Market

A COMPETITION MODEL FOR A BRAZILIAN AIR SHUTTLE MARKET Alessandro Oliveira§ ABSTRACT This paper aims at developing a competition model for a relevant subset of the Brazilian airline industry: the air shuttle market on the route Rio de Janeiro – São Paulo, a pioneer service created in 1959. The competition model presented here contains elements of both vertical product differentiation and representative consumer. I also use the conduct parameter approach to infer about the behaviour of airlines in the market under three situations: a quasi- deregulation process (from 1998 on), two price war events (1998 and 2001), and a shock in costs due to currency devaluation (1999). Results permitted making inference on the impacts of liberalisation on competition and investigating an alleged collusive behaviour of 1999. Key words: air shuttle – competition – deregulation – product differentiation JEL Classification: L93 § Department of Economics, University of Warwick – UK. Email: [email protected] 1. INTRODUCTION This paper aims at developing a competition model for a relevant subset of the Brazilian airline industry: the air shuttle service on the route Rio de Janeiro - São Paulo. This market was where the first air shuttle in the world, the ‘Ponte Aérea’, was created, in 1959, by an agreement of airline managers, and which dominated the airport-pair linking the city centres of the cities for almost forty years. Air shuttles are usually characterised by frequent service, walk-on flights with no reservations and short-haul markets. This concepts is nowadays very common in the airline industry, usually providing service for highly time-sensitive passengers, with notorious examples being the Eastern Airlines’ Boston-New York-Washington and the Iberia’s Madrid-Barcelona. -

Open Honors Thesis Lap Chi Adriano Chao.Pdf

THE PENNSYLVANIA STATE UNIVERSITY SCHREYER HONORS COLLEGE DEPARTMENT OF SUPPLY CHAIN AND INFORMATION SYSTEMS AIRLINE MERGER WAVES IN THE UNITED STATES IS A MERGER BETWEEN AMERICAN AIRLINES AND US AIRWAYS POSSIBLE? LAP CHI ADRIANO CHAO Spring 2011 A thesis submitted in partial fulfillment of the requirements for baccalaureate degrees in Management and Economics with honors in Supply Chain and Information Systems Reviewed and approved* by the following: Robert Novack Associate Professor of Supply Chain and Information Systems Thesis Supervisor John Spychalski Professor Emeritus of Supply Chain and Information Systems Honors Adviser * Signatures are on file in the Schreyer Honors College. i ABSTRACT Commercial airlines are an important part of the transportation industry in the United States. A better understanding of the reasons for a series of airline merger waves in the United States can help airline professionals realize the criteria and requirements of a merger. This study examined three recent U.S. airline mergers (i.e., Delta-Northwest, United-Continental and Southwest-AirTran) and deduced eight major dimensions of merger motivations, including network synergies, antitrust immunity, fleet commonality, alliance coordination, market positioning, financial benefits and shareholders’ approval, union support and organizational learning. The feasibility of a hypothetical merger between American Airlines and US Airways was determined using the eight dimensions derived. Results suggested that the merger was unlikely to increase the competitiveness