Citi Global REIT CEO Conference Hollywood Beach, FL March 3-5, 2013

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

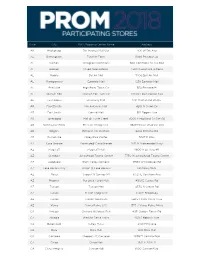

Prom 2018 Event Store List 1.17.18

State City Mall/Shopping Center Name Address AK Anchorage 5th Avenue Mall-Sur 406 W 5th Ave AL Birmingham Tutwiler Farm 5060 Pinnacle Sq AL Dothan Wiregrass Commons 900 Commons Dr Ste 900 AL Hoover Riverchase Galleria 2300 Riverchase Galleria AL Mobile Bel Air Mall 3400 Bell Air Mall AL Montgomery Eastdale Mall 1236 Eastdale Mall AL Prattville High Point Town Ctr 550 Pinnacle Pl AL Spanish Fort Spanish Fort Twn Ctr 22500 Town Center Ave AL Tuscaloosa University Mall 1701 Macfarland Blvd E AR Fayetteville Nw Arkansas Mall 4201 N Shiloh Dr AR Fort Smith Central Mall 5111 Rogers Ave AR Jonesboro Mall @ Turtle Creek 3000 E Highland Dr Ste 516 AR North Little Rock Mc Cain Shopg Cntr 3929 Mccain Blvd Ste 500 AR Rogers Pinnacle Hlls Promde 2202 Bellview Rd AR Russellville Valley Park Center 3057 E Main AZ Casa Grande Promnde@ Casa Grande 1041 N Promenade Pkwy AZ Flagstaff Flagstaff Mall 4600 N Us Hwy 89 AZ Glendale Arrowhead Towne Center 7750 W Arrowhead Towne Center AZ Goodyear Palm Valley Cornerst 13333 W Mcdowell Rd AZ Lake Havasu City Shops @ Lake Havasu 5651 Hwy 95 N AZ Mesa Superst'N Springs Ml 6525 E Southern Ave AZ Phoenix Paradise Valley Mall 4510 E Cactus Rd AZ Tucson Tucson Mall 4530 N Oracle Rd AZ Tucson El Con Shpg Cntr 3501 E Broadway AZ Tucson Tucson Spectrum 5265 S Calle Santa Cruz AZ Yuma Yuma Palms S/C 1375 S Yuma Palms Pkwy CA Antioch Orchard @Slatten Rch 4951 Slatten Ranch Rd CA Arcadia Westfld Santa Anita 400 S Baldwin Ave CA Bakersfield Valley Plaza 2501 Ming Ave CA Brea Brea Mall 400 Brea Mall CA Carlsbad Shoppes At Carlsbad -

Pirates Theaters 010308

The Pirates Who Don't Do Anything - A VeggieTales Movie - - - In Theaters January 11th Please note: This list is current as of January 3, 2008 and is subject to change. Additional theaters are being added over the next few days, so be sure to check back later for an updated list. To arrange for group ticket sales, please call 1-888-863-8564. Thanks for your support and we'll see you at the movies! Theater Address City ST Zip Code Sunridge Spectrum Cinemas 400-2555 32nd Street NE Calgary AB(CAN) T1Y 7X3 Scotiabank Theatre Chinook (formerly Paramoun 6455 Macleod Trail S.W. Calgary AB(CAN) T2H 0K4 Empire Studio 16 Country Hills 388 Country Hills Blvd., N.E. Calgary AB(CAN) T3K 5J6 North Edmonton Cinemas 14231 137th Avenue NW Edmonton AB(CAN) T5L 5E8 Clareview Clareview Town Centre Edmonton AB(CAN) T5Y 2W8 South Edmonton Common Cinemas 1525-99th Street NW Edmonton AB(CAN) T6N 1K5 Lyric 11801 100th St. Grande Prairie AB(CAN) T8V 3Y2 Galaxy Cinemas Lethbridge 501 1st. Ave. S.W. Lethbridge AB(CAN) T1J 4L9 Uptown 4922-49th Street Red Deer AB(CAN) T4N 1V3 Parkland 7 Cinemas 130 Century Crossing Spruce Grove AB(CAN) T7X 0C8 Dimond Center 9 Cinemas 800 Dimond Boulevard Anchorage AK 99515 Goldstream Stadium 16 1855 Airport Road Fairbanks AK 99701 Grand 14 820 Colonial Promenade Parkway Alabaster AL 35007 Cinemagic Indoor 1702 South Jefferson Street Athens AL 35611 Wynnsong 16-Auburn 2111 East University Drive Auburn AL 36831 Trussville Stadium 16 Colonial Promenade Shopping Center Birmingham AL 35235 Lee Branch 15 801 Doug Baker Blvd. -

Case 17-12906-CSS Doc 352 Filed 01/19/18 Page 1 of 183

Case 17-12906-CSS Doc 352 Filed 01/19/18 Page 1 of 183 UNITED STATES BANKRUPTCY COURT FOR THE DISTRICT OF DELAWARE ) In re ) Chapter 11 ) Charming Charlie Holdings Inc., et al.,) Case No 17-12906 (CSS) Debtors. ) (Jointly Administered) ) STATEMENT OF FINANCIAL AFFAIRS FOR Charming Charlie LLC Case No: 17-12909 (CSS) Case 17-12906-CSS Doc 352 Filed 01/19/18 Page 2 of 183 IN THE UNITED STATES BANKRUPTCY COURT FOR THE DISTRICT OF DELAWARE ) In re: ) Chapter 11 ) CHARMING CHARLIE HOLDINGS INC., et al.,1 ) Case No. 17-12906 (CSS) ) ) Debtors. ) (Jointly Administered) ) GLOBAL NOTES AND STATEMENT OF LIMITATIONS, METHODOLOGY, AND DISCLAIMERS REGARDING THE DEBTORS’ SCHEDULES OF ASSETS AND LIABILITIES AND STATEMENTS OF FINANCIAL AFFAIRS Charming Charlie Holdings Inc. and certain of its affiliates, as debtors and debtors in possession in the above-captioned chapter 11 cases (the “Debtors”), have filed their respective Schedules of Assets and Liabilities (the “Schedules”) and Statements of Financial Affairs (the “Statements”) in the United States Bankruptcy Court for the District of Delaware (the “Bankruptcy Court”). The Debtors, with the assistance of their legal and financial advisors, prepared the Schedules and Statements in accordance with section 521 of title 11 of the United States Code (the “Bankruptcy Code”) and rule 1007 of the Federal Rules of Bankruptcy Procedure. Robert Adamek has signed each set of the Schedules and Statements. Mr. Adamek serves as the Senior Vice President and Chief Financial Officer at Debtor Charming Charlie Holdings Inc., and he is an authorized signatory for each of the Debtors. In reviewing and signing the Schedules and Statements, Mr. -

Miller Promo Flyer

2016/2017 Gift & Craft Expo show dates & locations 2016/2017 Gift & Craft Expo show dates & locations 2016/2017 Gift & Craft Expo show dates & locations March 16-20 - Johnstown Galleria, Johnstown, Pa. March 16-20 - Johnstown Galleria, Johnstown, Pa. March 16-20 - Johnstown Galleria, Johnstown, Pa. April 6-10 - Shenango Valley Mall, Hermitage, Pa. April 6-10 - Shenango Valley Mall, Hermitage, Pa. April 6-10 - Shenango Valley Mall, Hermitage, Pa. April 13-17 - Monroeville Mall, Monroeville, Pa. April 13-17 - Monroeville Mall, Monroeville, Pa. April 13-17 - Monroeville Mall, Monroeville, Pa. April 22-24 - Washington Crown Center, Washington, Pa. April 22-24 - Washington Crown Center, Washington, Pa. April 22-24 - Washington Crown Center, Washington, Pa. April 29-May 1 - Pittsburgh Mills, Tarentum, Pa. April 29-May 1 - Pittsburgh Mills, Tarentum, Pa. April 29-May 1 - Pittsburgh Mills, Tarentum, Pa. May 6-7,- 7th annual Pamperfest - Airport Embassy Suites, May 6-7,- 7th annual Pamperfest - Airport Embassy Suites, May 6-7,- 7th annual Pamperfest - Airport Embassy Suites, Robinson, Pa. www.Pamperfest.com Robinson, Pa. www.Pamperfest.com Robinson, Pa. www.Pamperfest.com May 4-8 - Johnstown Galleria, Johnstown, Pa. May 4-8 - Johnstown Galleria, Johnstown, Pa. May 4-8 - Johnstown Galleria, Johnstown, Pa. June 1-5 - Westmoreland Mall, Greensburg, Pa. June 1-5 - Westmoreland Mall, Greensburg, Pa. June 1-5 - Westmoreland Mall, Greensburg, Pa. Aug. 13- Summer Daze Festival, Castle Shannon, Pa. Aug. 13- Summer Daze Festival, Castle Shannon, Pa. Aug. 13- Summer Daze Festival, Castle Shannon, Pa. Sept. 9-11 - Pittsburgh Mills, Tarentum, PA Sept. 9-11 - Pittsburgh Mills, Tarentum, PA Sept. -

![Uri Seiden and Associates Records (K1228); the State Historical Society of Missouri Research Center-Kansas City [After First Mention May Be Abbreviated to SHSMO-KC]](https://docslib.b-cdn.net/cover/2911/uri-seiden-and-associates-records-k1228-the-state-historical-society-of-missouri-research-center-kansas-city-after-first-mention-may-be-abbreviated-to-shsmo-kc-252911.webp)

Uri Seiden and Associates Records (K1228); the State Historical Society of Missouri Research Center-Kansas City [After First Mention May Be Abbreviated to SHSMO-KC]

THE STATE HISTORICAL SOCIETY OF MISSOURI RESEARCH CENTER-KANSAS CITY K1228 Uri Seiden and Associates Records [Jewish Community Archives] 1950-1988 38 cubic feet, 1 folder Drawings of an engineering/architecture firm in Kansas City, MO. BIOGRAPHY: PROVENANCE: This gift was received from Uri Seiden as accession KA1627 on May 12, 2008. COPYRIGHT AND RESTRICTIONS: The Donor has given and assigned to the State Historical Society of Missouri all rights of copyright which the Donor has in the Materials and in such of the Donor’s works as may be found among any collections of Materials received by the Society from others. PREFERRED CITATION: Specific item; folder number; Uri Seiden and Associates Records (K1228); The State Historical Society of Missouri Research Center-Kansas City [after first mention may be abbreviated to SHSMO-KC]. CONTACT: The State Historical Society of Missouri Research Center-Kansas City 302 Newcomb Hall, University of Missouri-Kansas City 5123 Holmes Street, Kansas City, MO 64110-2499 (816) 235-1543 [email protected] http://shs.umsystem.edu/index.shtml SHSMO-KC November 22, 2013 PRELIMINARY K1228 Uri Seiden and Associates Records Page 2 DESCRIPTION: The collection includes drawings of an engineering/architecture firm in Kansas City, Missouri. INVENTORY: BOX 001 Folder 1. Photographs-aerial-85th and Holmes area, Chestnut Hill ARCHITECTURAL DRAWINGS (see ARC database and table below) BOX AND ROLL TITLE ADDRESS STATE CITY YEAR LOCATION 103rd and Holmes 103rd and Holmes MO Kansas City K1228 Box 001x3 Roll 01 63rd and -

Property Alert!

Property Alert! Innovative Solutions for the Retail Industry For more information, Spence J. Mehl Or visit please contact: T: 212.300.5375 www.rcsrealestate.com E: [email protected] Bankruptcy Sale of Leases (Subject to Bankruptcy Court approval) # Property Address City State Sq. Ft # Property Address City State Sq. Ft 233 Colonial Mall Gadsden Gadsden AL 3,165 1138 Savannah Outlets Pooler GA 3,500 577 Parkway Place Huntsville AL 3,545 926 Ave Webb Gin Snellville GA 3,467 444 Central Mall Fort Smith AR 2,920 576 Colonial Mall Valdosta Valdosta GA 3,371 828 Turtle Creek Aeropostale Jonesboro AR 3,500 757 Lindale Mall Cedar Rapids IA 3,668 612 Superstition Springs Mesa AZ 3,310 41 River Oaks Center Calumet City IL 2,778 3383 Mariposa PS Nogales AZ 5,047 1071 Outlet Shoppes At Fremont Fremont IN 4,026 1059 Outlets at Anthem Phoenix AZ 4,733 804 Metropolis Mall Plainfield IN 3,300 788 Santa Anita Aeropostale Arcadia CA 3,335 238 Honey Creek Terre Haute IN 3,640 880 Topanga Plaza Canoga Park CA 3,907 558 Towne West Square Wichita KS 3,180 855 Capitola Aeropostale Capitola CA 3,415 334 Ashland Town Center Ashland KY 3,308 1022 The Shoppes At Chino Hill Chino Hills CA 3,859 933 Hamburg Pavilion Lexington KY 4,000 909 Puente Hills Aeropostale Industry CA 3,419 1129 The Outlet Shoppes Of the Blue Simpsonville KY 3,960 Grass 1108 South Bay Galleria Redondo CA 3,601 1109 Riverwalk New Orleans LA 6,000 Beach 1102 Promenade at Temecula Temecula CA 3,433 339 The Mall at Whitney Field Leominster MA 3,548 169 Sangertown Mall New Hartford CT 4,069 -

Silicon Valley Bank) 1\ M~Mt>Tr of SVB L'lrw~W Crwp Account Details Requested Date: From: 09/10/2015 To: 10/03/2015 Generated On: 10/15/2015

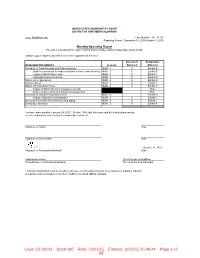

UNITED STATES BANKRUPTCY COURT DISTRICT OF NORTHERN CALIFORNIA In re: NewZoom, Inc. Case Number: 15 - 31141 Reporting Period: September 10, 2015-October 3, 2015 Monthly Operating Report File with Court and submit copy to United States Trustee within 20 days after end of month Submit copy of report to any official committee appointed in the case. Document Explanation REQUIRED DOCUMENTS Form No. Attached Attached Schedule of Cash Receipts and Disbursements MOR - 1 X Exhibit A Bank Reconciliation (or copies of debtor's bank reconciliation's) MOR - 1 X Exhibit B Copies of Bank Statements MOR - 1 X Exhibit C Cash disbursements journal MOR - 1 X Exhibit D Statement of Operations MOR - 2 X Exhibit E Balance Sheet MOR - 3 X Exhibit F Status of Postpetition Taxes MOR - 4 X Exhibit G Copies of IRS Form 6123 or payment receipt None Copies of tax returns filed during reporting period None Summary of Unpaid Postpetition Debts MOR - 4 Exhibit H Listing of aged accounts payable MOR - 4 X Exhibit I Accounts Receivable Reconciliation and Aging MOR - 5 X Exhibit J Debtor Questionnaire MOR - 5 X Exhibit K I declare under penalty of perjury (28 U.S.C. Section 1746) that this report and the attached documents are true and correct to the best of my knowledge and belief. Signature of Debtor Date Signature of Joint Debtor Date October 21, 2015 Signature of Authorized Individual* Date Andrew Hinkelman Chief Restructuring Officer Printed Name of Authorized Individual Title of Authorized Individual * Authorized individual must be an officer, director, or shareholder if debtor is a corporation; a partner if debtor is a partnership; a manager or member if debtor is a limited liability company. -

Irr Pittsburgh

INTEGRA REALTY RESOURCES IRR PITTSBURGH C O M M E R C I A L R E A L E S T A T E V A L U A T I O N & C O N S U L T I N G 21 years serving Western Pennsylvania market IRR®— INTEGRA REALTY RESOURCES— provides world-class commercial real estate valuation and counseling services to both local and national top financial institutions, developers, corporations, law firms, and government agencies. As one of the largest independent property valuation and counseling firms in the United States, we provide our diverse array of clients the highly informed opinions and trusted expert advice needed to understand the value, use and feasibility of their real estate. IRR. Local expertise. Nationally. 800+ appraisals completed annually 2 INTEGRA REALTY RESOURCES RECENT APPRAISAL ASSIGNMENTS OF NOTABLE AND VARIED ASSETS Office • U.S. Steel Tower, Pittsburgh, PA • Cherrington Corporate Center, Pittsburgh, PA • Foster Plaza Office Center, Pittsburgh, PA • William Penn Plaza, Monroeville, PA • Copperleaf Corporate Center, Wexford, PA • PNC Firstside, Pittsburgh, PA Industrial • Ardex, Aliquippa, PA • Dairy Farmers of America, Sharpsville, PA • Siemens Hunt Valley, Lower Burrell, PA • Universal Well Services, Connellsville, PA • Commonwealth I & II, Wexford, PA • Hunter Trucks, Pittsburgh, PA Multifamily • The Kenmawr Apartments, Pittsburgh, PA • Waterford at Nevillewood, Presto, PA • Cathedral Mansions, Pittsburgh, PA • Vulcan Village, California, PA • Lincoln Pointe Apartments, Bethel Park, PA • Ventana Hills Apartments, Coraopolis, PA Hospitality • Omni William -

Addressing Addiction As a Family Disease See Story on Page 4

wintervol. 23, issue 1 2012 Addressing Addiction as a Family Disease See story on page 4. FROM THE CEO TABLE OF CONTENTS Landmark addiction report reach published March 2017 is a call to action FEATURE STORY “Substance misuse is one of the critical public health problems of our time.” p.04 Addiction: A family disease Rosecrance program provides healthy techniques for healing and support That introduction from the landmark 2016 Surgeon General’s report on addiction sums up something we here at Rosecrance have known for decades. We recognized it in 1982 when LEADING THE FIELD we started treating teens for chemical dependency—as it was known back then—and again p.06 Fun glimpse at experiential therapies a decade later when we expanded and built a new treatment center for adults. p.07 Around the network Addiction is a complex brain disease with many risk factors, including genetics and age of first use. Rosecrance was founded more than 100 years ago as a children’s home to help p.08 Florian Program expands to serve families in need. Our history of working with kids is why we continue to operate the largest police and veterans residential treatment center for adolescents and young adults in the Midwest and why we specialize our programs to provide clients the best opportunity for lasting recovery. p.09 Alumni Program still going strong The Surgeon General’s report has made diagnosing and treating substance use disorders a p.09 Quitting smoking a target for young clients call to action similar to the report on the dangers of smoking released more than 50 years p. -

Voluntary Petition for Non-Individuals Filing for Bankruptcy 04/20

Case 21-31717 Document 1 Filed in TXSB on 05/26/21 Page 1 of 54 Fill in this information to identify the case: United States Bankruptcy Court for the Southern District of Texas Case number (if known): Chapter 11 Check if this is an amended filing Official Form 201 Voluntary Petition for Non-Individuals Filing for Bankruptcy 04/20 If more space is needed, attach a separate sheet to this form. On the top of any additional pages, write the debtor’s name and the case number (if known). For more information, a separate document, Instructions for Bankruptcy Forms for Non-Individuals, is available. 1. Debtor’s name Laredo Outlet Shoppes, LLC 2. All other names debtor used N/A in the last 8 years Include any assumed names, trade names, and doing business as names 3. Debtor’s federal Employer Identification Number (EIN) 81-1563566 4. Debtor’s address Principal place of business Mailing address, if different from principal place of business 2030 Hamilton Place Blvd. Number Street Number Street CBL Center, Suite 500 P.O. Box Chattanooga Tennessee 37421 City State ZIP Code City State ZIP Code Location of principal assets, if different from principal place of business Hamilton County County 1600 Water Street Number Street Laredo Texas 78040 City State ZIP Code 5. Debtor’s website (URL) www.cblproperties.com 6. Type of debtor ☒ Corporation (including Limited Liability Company (LLC) and Limited Liability Partnership (LLP)) ☐ Partnership (excluding LLP) ☐ Other. Specify: Official Form 201 Voluntary Petition for Non-Individuals Filing for Bankruptcy Page 1 WEIL:\97969900\8\32626.0004 Case 21-31717 Document 1 Filed in TXSB on 05/26/21 Page 2 of 54 Debtor Laredo Outlet Shoppes, LLC Case number (if known) 21-_____ ( ) Name A. -

State City Shopping Center Address

State City Shopping Center Address AK ANCHORAGE 5TH AVENUE MALL SUR 406 W 5TH AVE AL FULTONDALE PROMENADE FULTONDALE 3363 LOWERY PKWY AL HOOVER RIVERCHASE GALLERIA 2300 RIVERCHASE GALLERIA AL MOBILE BEL AIR MALL 3400 BELL AIR MALL AR FAYETTEVILLE NW ARKANSAS MALL 4201 N SHILOH DR AR FORT SMITH CENTRAL MALL 5111 ROGERS AVE AR JONESBORO MALL @ TURTLE CREEK 3000 E HIGHLAND DR STE 516 AR LITTLE ROCK SHACKLEFORD CROSSING 2600 S SHACKLEFORD RD AR NORTH LITTLE ROCK MC CAIN SHOPG CNTR 3929 MCCAIN BLVD STE 500 AR ROGERS PINNACLE HLLS PROMDE 2202 BELLVIEW RD AZ CHANDLER MILL CROSSING 2180 S GILBERT RD AZ FLAGSTAFF FLAGSTAFF MALL 4600 N US HWY 89 AZ GLENDALE ARROWHEAD TOWNE CTR 7750 W ARROWHEAD TOWNE CENTER AZ GOODYEAR PALM VALLEY CORNERST 13333 W MCDOWELL RD AZ LAKE HAVASU CITY SHOPS @ LAKE HAVASU 5651 HWY 95 N AZ MESA SUPERST'N SPRINGS ML 6525 E SOUTHERN AVE AZ NOGALES MARIPOSA WEST PLAZA 220 W MARIPOSA RD AZ PHOENIX AHWATUKEE FOOTHILLS 5050 E RAY RD AZ PHOENIX CHRISTOWN SPECTRUM 1727 W BETHANY HOME RD AZ PHOENIX PARADISE VALLEY MALL 4510 E CACTUS RD AZ TEMPE TEMPE MARKETPLACE 1900 E RIO SALADO PKWY STE 140 AZ TUCSON EL CON SHPG CNTR 3501 E BROADWAY AZ TUCSON TUCSON MALL 4530 N ORACLE RD AZ TUCSON TUCSON SPECTRUM 5265 S CALLE SANTA CRUZ AZ YUMA YUMA PALMS S C 1375 S YUMA PALMS PKWY CA ANTIOCH ORCHARD @SLATTEN RCH 4951 SLATTEN RANCH RD CA ARCADIA WESTFLD SANTA ANITA 400 S BALDWIN AVE CA BAKERSFIELD VALLEY PLAZA 2501 MING AVE CA BREA BREA MALL 400 BREA MALL CA CARLSBAD PLAZA CAMINO REAL 2555 EL CAMINO REAL CA CARSON SOUTHBAY PAV @CARSON 20700 AVALON -

Chapter 11 ) CHRISTOPHER & BANKS CORPORATION, Et Al

Case 21-10269-ABA Doc 125 Filed 01/27/21 Entered 01/27/21 15:45:17 Desc Main Document Page 1 of 22 TROUTMAN PEPPER HAMILTON SANDERS LLP Brett D. Goodman 875 Third Avenue New York, NY 1002 Telephone: (212) 704.6170 Fax: (212) 704.6288 Email:[email protected] -and- Douglas D. Herrmann Marcy J. McLaughlin Smith (admitted pro hac vice) Hercules Plaza, Suite 5100 1313 N. Market Street Wilmington, Delaware 19801 Telephone: (302) 777.6500 Fax: (866) 422.3027 Email: [email protected] [email protected] – and – RIEMER & BRAUNSTEIN LLP Steven E. Fox, Esq. (admitted pro hac vice) Times Square Tower Seven Times Square, Suite 2506 New York, NY 10036 Telephone: (212) 789.3100 Email: [email protected] Counsel for Agent UNITED STATES BANKRUPTCY COURT DISTRICT OF NEW JERSEY ) In re: ) Chapter 11 ) CHRISTOPHER & BANKS CORPORATION, et al., ) Case No. 21-10269 (ABA) ) ) (Jointly Administered) Debtors. 1 ) _______________________________________________________________________ 1 The Debtors in these chapter 11 cases and the last four digits of each Debtor’s federal tax identification number, as applicable, are as follows: Christopher & Banks Corporation (5422), Christopher & Banks, Inc. (1237), and Christopher & Banks Company (2506). The Debtors’ corporate headquarters is located at 2400 Xenium Lane North, Plymouth, Minnesota 55441. Case 21-10269-ABA Doc 125 Filed 01/27/21 Entered 01/27/21 15:45:17 Desc Main Document Page 2 of 22 DECLARATION OF CINDI GIGLIO IN SUPPORT OF DEBTORS’ MOTION FOR INTERIM AND FINAL ORDERS (A)(1) CONFIRMING, ON AN INTERIM BASIS, THAT THE STORE CLOSING AGREEMENT IS OPERATIVE AND EFFECTIVE AND (2) AUTHORIZING, ON A FINAL BASIS, THE DEBTORS TO ASSUME THE STORE CLOSING AGREEMENT, (B) AUTHORIZING AND APPROVING STORE CLOSING SALES FREE AND CLEAR OF ALL LIENS, CLAIMS, AND ENCUMBRANCES, (C) APPROVING DISPUTE RESOLUTION PROCEDURES, AND (D) AUTHORIZING CUSTOMARY BONUSES TO EMPLOYEES OF STORES I, Cindi Giglio, make this declaration pursuant to 28 U.S.C.