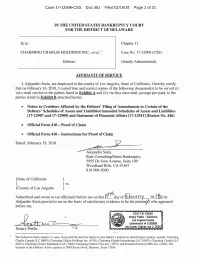

Case 17-12906-CSS Doc 352 Filed 01/19/18 Page 1 of 183

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

GENEVA COMMONS SWC Randall Road & Bricher Road | Geneva, IL

GENEVA COMMONS SWC Randall Road & Bricher Road | Geneva, IL ANCHORS ▪ Geneva Commons is the premier lifestyle center serving the west suburban FEATURES Chicago metropolitan area. With co-tenants including Dick’s Sporting Goods, Barnes & Noble, Forever 21, H&M, Pottery Barn, Sephora, California Pizza Kitchen, Houlihan’s and Bar Louie, Geneva Commons provides the ultimate shopping and dining experience ▪ The Geneva Commons trade area serves over 54,000 households with a population of nearly 159,000 and average household income of $114,575 within a 15 minute drive time ▪ Dynamic new gathering green featuring digital screens for movies on the lawn, pergola and outdoor seating, fireplace and life-size chessboard ▪ Premier retail and restaurant opportunities are available from 876 up to 10,000+ square feet CONTACT MARGET GRAHAM MARIA ROSSOBILLO APRIL SMITH T: 630.954.7307 T: 630.954.7385 T: 630.954.7451 One Parkview Plaza, 9th Floor F: 630.954.7306 F: 630.954.7306 F: 630.954.7306 Oakbrook Terrace, IL 60181 [email protected] [email protected] [email protected] www.midamericagrp.com The information contained herein has either been given to us by the owner of the property or obtained from sources that we deem reliable. We have no reason to doubt its accuracy but we do not guarantee it. S31 GENEVA/BATAVIA, IL RANDALL RD.GENEVA & FABYAN PKWY. COMMONS SWC Randall Road & Bricher Road | Geneva, IL 48,600 T Y S K E P I R I ILLINOIS N T A A S R BY P 38 N I A A F T D S R M W N E I L L A I V M E N W VACANT A K 24,700 T S E E -

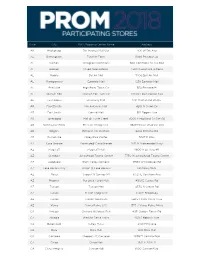

Prom 2018 Event Store List 1.17.18

State City Mall/Shopping Center Name Address AK Anchorage 5th Avenue Mall-Sur 406 W 5th Ave AL Birmingham Tutwiler Farm 5060 Pinnacle Sq AL Dothan Wiregrass Commons 900 Commons Dr Ste 900 AL Hoover Riverchase Galleria 2300 Riverchase Galleria AL Mobile Bel Air Mall 3400 Bell Air Mall AL Montgomery Eastdale Mall 1236 Eastdale Mall AL Prattville High Point Town Ctr 550 Pinnacle Pl AL Spanish Fort Spanish Fort Twn Ctr 22500 Town Center Ave AL Tuscaloosa University Mall 1701 Macfarland Blvd E AR Fayetteville Nw Arkansas Mall 4201 N Shiloh Dr AR Fort Smith Central Mall 5111 Rogers Ave AR Jonesboro Mall @ Turtle Creek 3000 E Highland Dr Ste 516 AR North Little Rock Mc Cain Shopg Cntr 3929 Mccain Blvd Ste 500 AR Rogers Pinnacle Hlls Promde 2202 Bellview Rd AR Russellville Valley Park Center 3057 E Main AZ Casa Grande Promnde@ Casa Grande 1041 N Promenade Pkwy AZ Flagstaff Flagstaff Mall 4600 N Us Hwy 89 AZ Glendale Arrowhead Towne Center 7750 W Arrowhead Towne Center AZ Goodyear Palm Valley Cornerst 13333 W Mcdowell Rd AZ Lake Havasu City Shops @ Lake Havasu 5651 Hwy 95 N AZ Mesa Superst'N Springs Ml 6525 E Southern Ave AZ Phoenix Paradise Valley Mall 4510 E Cactus Rd AZ Tucson Tucson Mall 4530 N Oracle Rd AZ Tucson El Con Shpg Cntr 3501 E Broadway AZ Tucson Tucson Spectrum 5265 S Calle Santa Cruz AZ Yuma Yuma Palms S/C 1375 S Yuma Palms Pkwy CA Antioch Orchard @Slatten Rch 4951 Slatten Ranch Rd CA Arcadia Westfld Santa Anita 400 S Baldwin Ave CA Bakersfield Valley Plaza 2501 Ming Ave CA Brea Brea Mall 400 Brea Mall CA Carlsbad Shoppes At Carlsbad -

Addressing Addiction As a Family Disease See Story on Page 4

wintervol. 23, issue 1 2012 Addressing Addiction as a Family Disease See story on page 4. FROM THE CEO TABLE OF CONTENTS Landmark addiction report reach published March 2017 is a call to action FEATURE STORY “Substance misuse is one of the critical public health problems of our time.” p.04 Addiction: A family disease Rosecrance program provides healthy techniques for healing and support That introduction from the landmark 2016 Surgeon General’s report on addiction sums up something we here at Rosecrance have known for decades. We recognized it in 1982 when LEADING THE FIELD we started treating teens for chemical dependency—as it was known back then—and again p.06 Fun glimpse at experiential therapies a decade later when we expanded and built a new treatment center for adults. p.07 Around the network Addiction is a complex brain disease with many risk factors, including genetics and age of first use. Rosecrance was founded more than 100 years ago as a children’s home to help p.08 Florian Program expands to serve families in need. Our history of working with kids is why we continue to operate the largest police and veterans residential treatment center for adolescents and young adults in the Midwest and why we specialize our programs to provide clients the best opportunity for lasting recovery. p.09 Alumni Program still going strong The Surgeon General’s report has made diagnosing and treating substance use disorders a p.09 Quitting smoking a target for young clients call to action similar to the report on the dangers of smoking released more than 50 years p. -

Voluntary Petition for Non-Individuals Filing for Bankruptcy 04/20

Case 21-31717 Document 1 Filed in TXSB on 05/26/21 Page 1 of 54 Fill in this information to identify the case: United States Bankruptcy Court for the Southern District of Texas Case number (if known): Chapter 11 Check if this is an amended filing Official Form 201 Voluntary Petition for Non-Individuals Filing for Bankruptcy 04/20 If more space is needed, attach a separate sheet to this form. On the top of any additional pages, write the debtor’s name and the case number (if known). For more information, a separate document, Instructions for Bankruptcy Forms for Non-Individuals, is available. 1. Debtor’s name Laredo Outlet Shoppes, LLC 2. All other names debtor used N/A in the last 8 years Include any assumed names, trade names, and doing business as names 3. Debtor’s federal Employer Identification Number (EIN) 81-1563566 4. Debtor’s address Principal place of business Mailing address, if different from principal place of business 2030 Hamilton Place Blvd. Number Street Number Street CBL Center, Suite 500 P.O. Box Chattanooga Tennessee 37421 City State ZIP Code City State ZIP Code Location of principal assets, if different from principal place of business Hamilton County County 1600 Water Street Number Street Laredo Texas 78040 City State ZIP Code 5. Debtor’s website (URL) www.cblproperties.com 6. Type of debtor ☒ Corporation (including Limited Liability Company (LLC) and Limited Liability Partnership (LLP)) ☐ Partnership (excluding LLP) ☐ Other. Specify: Official Form 201 Voluntary Petition for Non-Individuals Filing for Bankruptcy Page 1 WEIL:\97969900\8\32626.0004 Case 21-31717 Document 1 Filed in TXSB on 05/26/21 Page 2 of 54 Debtor Laredo Outlet Shoppes, LLC Case number (if known) 21-_____ ( ) Name A. -

Michael Kors® Make Your Move at Sunglass Hut®

Michael Kors® Make Your Move at Sunglass Hut® Official Rules NO PURCHASE OR PAYMENT OF ANY KIND IS NECESSARY TO ENTER OR WIN. A PURCHASE OR PAYMENT WILL NOT INCREASE YOUR CHANCES OF WINNING. VOID WHERE PROHIBITED BY LAW OR REGULATION and outside the fifty United States (and the District of ColuMbia). Subject to all federal, state, and local laws, regulations, and ordinances. This Gift ProMotion (“Gift Promotion”) is open only to residents of the fifty (50) United States and the District of ColuMbia ("U.S.") who are at least eighteen (18) years old at the tiMe of entry (each who enters, an “Entrant”). 1. GIFT PROMOTION TIMING: Michael Kors® Make Your Move at Sunglass Hut® Gift Promotion (the “Gift ProMotion”) begins on Friday, March 22, 2019 at 12:01 a.m. Eastern Time (“ET”) and ends at 11:59:59 p.m. ET on Wednesday, April 3, 2019 (the “Gift Period”). Participation in the Gift Promotion does not constitute entry into any other promotion, contest or game. By participating in the Gift Promotion, each Entrant unconditionally accepts and agrees to comply with and abide by these Official Rules and the decisions of Luxottica of America Inc., 4000 Luxottica Place, Mason, OH 45040 d/b/a Sunglass Hut (the “Sponsor”) and WYNG, 360 Park Avenue S., 20th Floor, NY, NY 10010 (the “AdMinistrator”), whose decisions shall be final and legally binding in all respects. 2. ELIGIBILITY: Employees, officers, and directors of Sponsor, Administrator, and each of their respective directors, officers, shareholders, and employees, affiliates, subsidiaries, distributors, -

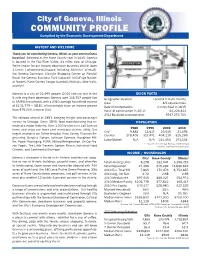

COMMUNITY PROFILE Compiled by the Economic Development Department

City of Geneva, Illinois COMMUNITY PROFILE Compiled by the Economic Development Department HISTORY AND WELCOME Thank you for considering Geneva, Illinois as your next business location! Selected as the Kane County seat in 1835, Geneva is located in the Fox River Valley, 43 miles west of Chicago. We’re known for our historic downtown business district (over 1.1 mil s.f. of commercial space, including .66 mil s.f. of retail), the Geneva Commons Lifestyle Shopping Center on Randall Road, the Geneva Business Park (adjacent to DuPage Nation- al Airport), Kane County Cougar baseball, festivals, bike trails, and fun! Geneva is a city of 21,495 people (2010 census) but in the QUICK FACTS 5 mile ring from downtown Geneva over 116,757 people live Geographic location: Located in Kane County in 39,951 households with a 2010 average household income Area: 8.5 square miles of $105,779 — 58.8% of households have an income greater Date of incorporation: County Seat in 1835 than $75,000. (source: Esri) Value of construction in 2012: $4,223,324 2012 Equalized assessed value: $937,275,763 The railroad arrived in 1853, bringing freight and passenger service to Chicago. Since 1840, food manufacturing has re- POPULatiON mained a major industry. Over 1,000 businesses call Geneva 1980 1990 2000 2010 home and enjoy our lower cost municipal electric utility. Our City1 9,881 12,617 19,515 21,495 largest employers are Delnor Hospital, Kane County, Peacock En- County2 278,405 317,471 404,119 515,269 gineering, Burgess Norton, Johnson Controls, Houghton Mif- Labor Market3 N/A N/A 212,454 271,334 flin, Power Packaging, FONA, Millard Refrigeration, On-Cor Fro- 1, 2 Source: U.S. -

CBL & Associates Properties 2012 Annual Report

COVER PROPERTIES : Left to Right/Top to Bottom MALL DEL NORTE, LAREDO, TX CROSS CREEK MALL, FAYETTEVILLE, NC BURNSVILLE CENTER, BURNSVILLE, MN OAK PARK MALL, KANSAS CITY, KS CBL & Associates Properties, Inc. 2012 Annual When investors, business partners, retailers Report CBL & ASSOCIATES PROPERTIES, INC. and shoppers think of CBL they think of the leading owner of market-dominant malls in CORPORATE OFFICE BOSTON REGIONAL OFFICE DALLAS REGIONAL OFFICE ST. LOUIS REGIONAL OFFICE the U.S. In 2012, CBL once again demon- CBL CENTER WATERMILL CENTER ATRIUM AT OFFICE CENTER 1200 CHESTERFIELD MALL THINK SUITE 500 SUITE 395 SUITE 750 CHESTERFIELD, MO 63017-4841 strated why it is thought of among the best 2030 HAMILTON PLACE BLVD. 800 SOUTH STREET 1320 GREENWAY DRIVE (636) 536-0581 THINK 2012 Annual Report CHATTANOOGA, TN 37421-6000 WALTHAM, MA 02453-1457 IRVING, TX 75038-2503 CBLCBL & &Associates Associates Properties Properties, 2012 Inc. Annual Report companies in the shopping center industry. (423) 855-0001 (781) 398-7100 (214) 596-1195 CBLPROPERTIES.COM HAMILTON PLACE, CHATTANOOGA, TN: Our strategy of owning the The 2012 CBL & Associates Properties, Inc. Annual Report saved the following resources by printing on paper containing dominant mall in SFI-00616 10% postconsumer recycled content. its market helps attract in-demand new retailers. At trees waste water energy solid waste greenhouse gases waterborne waste Hamilton Place 5 1,930 3,217,760 214 420 13 Mall, Chattanooga fully grown gallons million BTUs pounds pounds pounds shoppers enjoy the market’s only Forever 21. COVER PROPERTIES : Left to Right/Top to Bottom MALL DEL NORTE, LAREDO, TX CROSS CREEK MALL, FAYETTEVILLE, NC BURNSVILLE CENTER, BURNSVILLE, MN OAK PARK MALL, KANSAS CITY, KS CBL & Associates Properties, Inc. -

Case 17-12906-CSS Doc 451 Filed 02/19/18 Page 1 of 21

Case 17-12906-CSS Doc 451 Filed 02/19/18 Page 1 of 21 Case 17-12906-CSS Doc 451 Filed 02/19/18 Page 2 of 21 Case 17-12906-CSS Doc 451 Filed 02/19/18 Page 3 of 21 Charming Charlie Holdings Inc. - Service List to e-mail Recipients Served 2/16/2018 BALLARD SPAHR LLP BALLARD SPAHR LLP BALLARD SPAHR LLP DAVID L. POLLACK DUSTIN P. BRANCH LAUREL D. ROGLEN [email protected] [email protected] [email protected] BALLARD SPAHR LLP BALLARD SPAHR LLP BENESCH, FRIEDLANDER, COPLAN & ARONOFF LLP LESLIE HEILMAN MATTHEW SUMMERS JENNIFER HOOVER [email protected] [email protected] [email protected] BENESCH, FRIEDLANDER, COPLAN & ARONOFF LLP BEWLEY, LASSLEBEN & MILLER, LLP BLANK ROME LLP KEVIN CAPUZZI ERNIE PARK JOSEF MINTZ [email protected] [email protected] [email protected] BURR & FORMAN LLP BURR & FORMAN LLP BURR & FORMAN LLP J. CORY FALGOWSKI JOE JOSEPH REGAN LOPER [email protected] [email protected] [email protected] CLARK HILL PLC CLARK HILL PLC CONNOLLY GALLAGHER LLP DAVID M. BLAU KAREN M. GRIVNER KAREN BIFFERATO [email protected] [email protected] [email protected] CONNOLLY GALLAGHER LLP COOLEY LLP COOLEY LLP KELLY CONLAN CATHY HERSHCOPF EVAN LAZEROWITZ [email protected] [email protected] [email protected] COOLEY LLP COOLEY LLP DUANE MORRIS LLP MICHAEL KLEIN SETH VAN AALTEN JARRET HITCHINGS [email protected] [email protected] [email protected] FROST BROWN TODD LLC FROST BROWN TODD LLC GGP LIMITED PARTNERSHIP, AS AGENT A.J. WEBB RONALD E. GOLD KRISTEN N. PATE [email protected] [email protected] [email protected] HINCKLEY ALLEN JOHNSON DELUCA KURISKY & GOULD P.C. -

Citi Global REIT CEO Conference Hollywood Beach, FL March 3-5, 2013

Citi Global REIT CEO Conference Hollywood Beach, FL March 3-5, 2013 1 Safe Harbor Statement The information included herein contains "forward-looking statements" within the meaning of the Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934. All statements, other than statements of historical facts, included or incorporated by reference in this presentation that address ongoing or projected activities, events or trends that the Company expects, believes or anticipates will or may occur in the future, including such matters as future capital expenditures, prospective development projects, distributions and acquisitions (including the amount and nature thereof), expansion and other trends of the real estate industry, business strategies, expansion and growth of the Company's operations and other such matters are forward-looking statements. Such statements are based on assumptions and expectations which may not be realized and are inherently subject to risks and uncertainties, many of which cannot be predicted with accuracy and some of which might not even be anticipated. Prospective investors are cautioned that any such statements are not guarantees of future performance and that future events and actual events, financial and otherwise, may differ materially from the events and results discussed in forward-looking statements. The reader is directed to the Company's various filings with the Securities and Exchange Commission, including without limitation the Company's Annual Report on Form 10K and the "Management's Discussion and Analysis of Financial Condition and Results of Operations" incorporated therein, for a discussion of such risks and uncertainties. -

Cherryvale Mall-Leasing Sheet-2019.Indd

MALL CHERRYVALE Rockford, IL CBL PROPERTIES HIGHLIGHTS NUMBER OF STORES 130 TRADE AREA 640,142 (2018 est.) SIZE 849,253 square feet CENTER EMPLOYMENT 2,500 (est.) FEATURED STORES Macy’s, JCPenney, Barnes & Noble, H&M, Victoria’s Secret, White House/Black Market, LOFT, Pandora, Chico’s, Bath & 1973 Body Works, Soma, and Francesca’s YEAR OPENED WEBSITE ShopCherryvaleMall.com CORPORATE OFFICE: FOR LEASING: CBL Center, Suite 500 MALL OFFICE: CBL PROPERTIES Allen Rock 7200 Harrison Ave., Suite 5 cblproperties.com 2030 Hamilton Place Boulevard p. 734.462.1100 ext. 5522 c. 423.802.9324 Rockford, IL 61112 NYSE: CBL Chattanooga, TN 37421-6000 [email protected] 815.332.2451 423.855.0001 DEMOGRAPHICS TRADE AREA FACTS PRIMARY SECONDARY TOTAL • Adjacent to CherryVale Mall is an upscale lifestyle center, The District POPULATION TRENDS TRADE AREA TRADE AREA TRADE AREA at CherryVale. 2018 Estimate 342,252 296,890 640,142 • Rockford is the largest city in Illinois outside of the Chicago 2023 Projection 335,889 298,751 634,640 metropolitan area, and is conveniently located just 65 miles 2010 Census 356,541 305,959 662,500 northwest of Chicago’s O’Hare Airport. 2018 Daytime Population Estimate 199,177 139,548 338,725 • The aerospace industry has a very large presence in the Rockford area with over 100 companies making products which contribute to the aerospace industry, and two Tier 1 aerospace suppliers. AVERAGE HOUSEHOLD INCOME 2018 Estimate $77,153 $72,628 $75,061 • There are 50% more engineers per capita in the Rockford area than 2023 Projection $95,643 $87,474 $91,848 the US average. -

Bank of America (Ground Lease | Chicago MSA) 802 Commons Drive Geneva, Illinois 60134 TABLE of CONTENTS

NET LEASE INVESTMENT OFFERING Bank of America (Ground Lease | Chicago MSA) 802 Commons Drive Geneva, Illinois 60134 TABLE OF CONTENTS I. Executive Summary II. Location Overview III. Market & Tenant Overview Executive Summary Site Plan Tenant Profile Investment Highlights Aerial Location Overview Property Overview Map Demographics Photos NET LEASE INVESTMENT OFFERING DISCLAIMER STATEMENT DISCLAIMER The information contained in the following Offering Memorandum is proprietary and strictly confidential. It STATEMENT: is intended to be reviewed only by the party receiving it from The Boulder Group and should not be made available to any other person or entity without the written consent of The Boulder Group. This Offering Memorandum has been prepared to provide summary, unverified information to prospective purchasers, and to establish only a preliminary level of interest in the subject property. The information contained herein is not a substitute for a thorough due diligence investigation. The Boulder Group has not made any investigation, and makes no warranty or representation. The information contained in this Offering Memorandum has been obtained from sources we believe to be reliable; however, The Boulder Group has not verified, and will not verify, any of the information contained herein, nor has The Boulder Group conducted any investigation regarding these matters and makes no warranty or representation whatsoever regarding the accuracy or completeness of the information provided. All potential buyers must take appropriate measures to verify all of the information set forth herein. NET LEASE INVESTMENT OFFERING EXECUTIVE SUMMARY EXECUTIVE The Boulder Group is pleased to exclusively market for sale a single tenant Bank of America ground lease located SUMMARY: within the Chicago MSA, in Geneva, Illinois. -

Retail Market Study and Recruitment Project Date: 12/11/2014

TO: JOSEPH CAVALLARO, VILLAGE MANAGER FROM: CATHLEEN TYMOSZENKO, COMMUNITY DEVELOPMENT DIRECTOR SUBJECT: RETAIL MARKET STUDY AND RECRUITMENT PROJECT DATE: 12/11/2014 INTRODUCTION To assist with our efforts to identify and recruit national and regional potential retailers and restaurants, the Village Board approved the commencement of a two phase Retail Market Study and Recruitment Project and authorized a contract with Barry Bain of GRS Group in January 2014. Phase 1 consists of a Retail Market Study to map and identify national and regional retailers who are not presently operating in this market. Phase 2 consists of a Recruitment Project to work to bring identified operators to West Dundee. BACKGROUND The Retail Market Study was initiated in January 2014 and concluded at ICSC Dealmakers in October 2014. A phase 1 report was completed in May 2014 and is attached. The information garnered during phase 1 informed the efforts put forward in phase 2, the recruitment phase of the project. Phase 2 recruitment efforts work involved direct contact with potential users and efforts were initiated at ReCon ICSC in Las Vegas on May 18-20 th . Barry Bain was already attending this conference and worked to generate interest in West Dundee existing retail spaces and developable areas at no additional cost to the Village. To gear up for the event and initial contact, a number of different tools were created including a general marketing brochures, targeted lists of available existing retail spaces and available properties for development, a marketing brochure to highlight the Spring Hill Market Area existing retailers and demographic information, a few different potential site plans for the redevelopment of Gateway East as designed with staff and consultant input by Rick Gilmore, architect.