The Future of Aviation

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

JANUARY European Parliament Vote on Airport Charges (15 January)

REVIEW www.airtransportnews.aero JANUARY European Parliament vote on airport charges (15 January) he European Parliament concluded its first reading on a proposed Directive on airport charges, initially the Directive will only incentivise conflicts between airlines and airports, resulting in uncertainty over infra - adopted by the European Commission a year ago. ACI EUROPE is appreciative of the European Parlia - structure investments and potentially delaying much needed capacity development. Olivier Jankovec added: T ment’s work to improve the proposal of the European Commission, but considers that serious concerns "That the Directive is silent on the need for airports to be incentivised to invest in time for the new facilities regarding fundamental issues remain. These include risking costly and damaging over-regulation as well as com - to match demand, is puzzling. It shows that the Directive not only remains imbalanced in favour of airlines but promising the ability of European airports to finance much needed infrastructure and capacity development. also fails to reflect that the interests of the airlines and that of the travelling public are not the same." Whilst the European Commission proposed to apply the Directive to all airports with more than 1 million pas - Responding to the vote of the European Parliament on Airport Charges, IACA is extremely disappointed that an sengers per year, the European Parliament increased this figure to 5 million, leaving States still free to apply opportunity to address the unbalanced relationship between the fully deregulated airline sector and their mo - the Directive to airports below this threshold. As most European airports now operate in a highly competitive nopolistic service provider (airports) has been missed. -

Antwerp Airport

ANNUAL REPORT Luchthavenlei, z/n 2007 B- 2100 Antwerpen (Deurne) Tel.: 03-285 65 00 Fax: 03-285 65 01 ANTWERP AIRPORT 2007 Annual report ANTWERP AIRPORT 1 TABLE OF CON T EN T S PREFACEVOORWOORD 5 1 2007HOOGTEPUNTEN HIGHLIGHTS 2007 9 2 MANAGEMENTBEHEER EN BEHEERSRESULTATEN AND MANAGEMENT RESULTS 13 3 FIVEVIJF TROEVENASSETS OF VAN ANTWERP DE LUCHTHAVEN AIRPORT ANTWERPEN 15 3.1 20-MINUTE20 MINUTEN CONCEPT CONCEPT 15 3.2 FREEGRATIS PARKING PARKING AREA 15 3.3 ACCESSIBLEBEREIKBAAR BY MET CAR, AUTO, TRAIN TREIN AND EN BUS BUS 16 3.4 SITUATEDLIGGING IN AT HET FLANDERS’ ECONOMISCHE ECONOMIC HART HEART VAN VLAANDEREN 16 3.5 MODERNMODERNE PASSENGER PASSAGIERSTERMINAL TERMINAL 16 4 TRAFFICVERKEER 17 4.1 PASSENGERSPASSAGIERS 17 4.2 MOVEMENTSBEWEGINGEN 18 4.3 FREIGHTVRACHT 18 5 INVESTMENTSINVESTERINGEN 19 6 AIRPORTLUCHTHAVENBEVEILIGING SECURITY 20 6.1 SCREENINGSCREENINGAPPARATUUR DEVICES AND EN VEHICLES ROLLEND MATERIEEL 20 6.2 SECURITYVEILIGHEIDSINSPECTIES INSPECTIONS BYDOOR THE HET AVIATION DIRECTORAAT-GENERAAL DIRECTORATE-GENERAL LUCHTVAART 16 7 EMPLOYMENTWERKGELEGENHEID 22 7.1 PUBLICOPENBARE SERVICES DIENSTEN 22 7.2 AIRPORT-BASEDBEDRIJVEN GEVESTIGD BUSINESSES OP DE LUCHTHAVEN 22 8 ENVIRONMENTALMILIEUVERGUNNING LICENCE 23 9 PROMOTIONPROMOTIE 24 BALANCEBALANS SHEET 27 INCOMERESULTATENREKENING AND EXPENDITURE ACCOUNT 33 2 3 PREFA C E Growth continues with a passenger increase of 18% Following several years of falling figures, this trend was broken in 2006 with an increase of 3.6% to 147,849 passengers. The year 2007 was closed with an overall passenger number of 174,858, which means that growth continues with an increase of over 18% compared to the previous year. However, the number of flight movements declined by about 6% to 51,589. -

Thomas Cook Group Plc Annual Report & Accounts 2011

Thomas Cook Group plc Annual Report & Accounts 2011 plc Annual Thomas Cook Group Thomas Cook Group plc Annual Report & Accounts 2011 Thomas Cook Group plc Annual Report & Accounts 2011 Taking action to strengthen our business. Thomas Cook Group is one of the world’s leading leisure travel groups, with sales of £9.8bn and 23.6m customers. We operate under six geographic segments in 22 countries and are number one or two in our core markets. 2011 has been a challenging year for Thomas Cook, largely due to the disappointing performance of our UK business and the impact caused by the disruption in the MENA region, particularly on our French business. Our 2011 Annual Report is our platform to present to you the strength inherent in the scope of our business, together with the changes we have made and our plans to better position the Group for the future. Contents Directors’ Report: Business Review Financial Statements The Group’s financial and operational performance, Audited financial information for the Group and our business model, strategy and key risks key information for shareholders 01 Financial summary 73 Independent auditors’ report 02 Chairman’s statement 74 Group income statement 04 Where we operate 75 Group statement of comprehensive income 06 Joint statement from the Group Chief Executive Officer 76 Group cash flow statement and Group Chief Financial Officer 77 Group balance sheet 12 Market review 79 Group statement of changes in equity 13 Our business model 80 Notes to the financial statements 14 Our strategy 128 Company balance -

XL Leisure EMCC Case Studies

The impact of bankruptcy on restructuring in the UK tourism sector: XL Leisure EMCC case studies Click for contents Wyattville Road, Loughlinstown, Dublin 18, Ireland - Tel: (+353 1) 204 31 00 - Fax: (+353 1) 282 42 09 / 282 64 56 email: [email protected] - website: www.eurofound.europa.eu Contents Introduction 1 Company profile 2 Timeline of the company’s collapse 3 Legal context for company bankruptcy and collective redudunacies 7 Administration and redundancy process at XL Leisure 14 Measures to assist redundant XL Leisure employees 21 Lessons learnt 23 Bibliography 25 Annex 1 27 Introduction The collapse of package-holiday giant XL Leisure Group made front-page news in September 2008, with tens of thousands of British holidaymakers stranded in airports across Europe and hundreds of employees made redundant. As the company’s assets were frozen, flights grounded and holidays cancelled, the scale and nature of the meltdown quickly became apparent. Indeed, the operator’s demise was one of the earliest examples of the credit crunch affecting businesses. The size of debt amassed by XL Leisure, its previous failed restructuring, uncontrolled growth and mounting overheads meant that the company had been on the brink of insolvency for some time. The precarious financial situation into which the Group had sunk prior to collapse was only exacerbated by the economic downturn. The resulting hardships for employees and customers have raised questions over the way in which tour operators in the UK are run and how restructuring and insolvency in this industry are managed under less favourable market conditions. © European Foundation for the Improvement of Living and Working Conditions, 2009 1 Company profile 1 XL Leisure Group plc was a large travel and leisure company with offices in the UK, Ireland, France and Germany. -

A Conversation with

A MAGAZinE FOR AIRLinE EXECUTIVES 2006 Issue No. 2 2006 Issue No. 2 T a k i n g y o u r a i r l i n e t o n e w h e i g h t s the globAl AdvocAte A Conversation With . Giovanni Bisignani director general and CEO International Air Transport Association page 38 www.sabreairlinesolutions.com I NSIDE Government regulations 6 affect globalization Latin American carriers 42 grow regionally AirAsia overcomes challenges 50 to its Thai-based subsidiary making contact To suggest a topic for a possible future article, change your address or add someone to the mailing list, please send an e-mail message to the Ascend staff at [email protected]. T aking your airline to new heights For more information about products 2006 Issue No. 2 and services featured in this issue Editors in Chief of Ascend, please visit our Web site Stephani Hawkins at www.sabreairlinesolutions.com B. Scott Hunt or contact one of the following 3150 Sabre Drive Sabre Airline Solutions regional Southlake, Texas 76092 representatives: www.sabreairlinesolutions.com Sabre Airline Solutions and the Sabre Airline Solutions logo are trademarks and/or service marks of an affiliate of Sabre Holdings Corporation. ©2005 Sabre Inc. All rights reserved. Art Direction/Design Asia/Pacific Shari Manning Andrew Powell Design Contributors Vice President Erin Jackson, Michelle Kennedy, Level No. 05-05 Tim St. Clair Technopark Block 750E Contributors Chai Chee Road Shaquiq Ahmed, Walter Avila, Jack Singapore 469005 Burkholder, Vinay Dube, Kim Farrow, Phone: +65 9127 6927 Kristen Fritschel, Glen Harvell, Vicki E-mail: [email protected] Hummel, Carla Jensen, Craig Lindsey, Marcela Lizárraga, Roman Lopatko, Deborah Magee, Yusuf Mauladad, Alan Europe, Middle East and Africa McWalters, Gary Millward, Andrew Murray Smyth Powell, Srikanth Raghunathan, Jessica Vice President Schneider, Jennifer Silvia, Murray Smyth, Somerville House Kevin Stupfel, Renzo Vaccari, Jung Yu. -

World Air Transport Statistics, Media Kit Edition 2021

Since 1949 + WATSWorld Air Transport Statistics 2021 NOTICE DISCLAIMER. The information contained in this publication is subject to constant review in the light of changing government requirements and regulations. No subscriber or other reader should act on the basis of any such information without referring to applicable laws and regulations and/ or without taking appropriate professional advice. Although every effort has been made to ensure accuracy, the International Air Transport Associ- ation shall not be held responsible for any loss or damage caused by errors, omissions, misprints or misinterpretation of the contents hereof. Fur- thermore, the International Air Transport Asso- ciation expressly disclaims any and all liability to any person or entity, whether a purchaser of this publication or not, in respect of anything done or omitted, and the consequences of anything done or omitted, by any such person or entity in reliance on the contents of this publication. Opinions expressed in advertisements ap- pearing in this publication are the advertiser’s opinions and do not necessarily reflect those of IATA. The mention of specific companies or products in advertisement does not im- ply that they are endorsed or recommended by IATA in preference to others of a similar na- ture which are not mentioned or advertised. © International Air Transport Association. All Rights Reserved. No part of this publication may be reproduced, recast, reformatted or trans- mitted in any form by any means, electronic or mechanical, including photocopying, recording or any information storage and retrieval sys- tem, without the prior written permission from: Deputy Director General International Air Transport Association 33, Route de l’Aéroport 1215 Geneva 15 Airport Switzerland World Air Transport Statistics, Plus Edition 2021 ISBN 978-92-9264-350-8 © 2021 International Air Transport Association. -

Victory Against All the Odds

Victory Against All The Odds The story of how the campaign to stop a third runway at Heathrow was won “The victory was no fluke. It wasn’t a question of luck. It was the result of a clear strategy, a radical approach, daring tactics and an utter refusal by the campaigners to believe that we wouldn’t win.” Introduction This book is about a famous victory. It tells the tale of how a group of people took on the might of the aviation industry, international business and the UK Government and won. It is the story of how plans for the massive expansion of Heathrow Airport, including a third runway, were stopped. The book outlines the strategy and the tactics used. It is an inspiring story. It is a very human story. But it also contains valuable lessons for campaigners wherever they live and whatever their cause. Inevitably it is written from my perspective. It is the campaign through my eyes; told in my words. The ideal would have been for all the people involved in the campaign to have contributed to the book. That would have reflected the diversity of the campaign. But that wouldn’t have been practicable! In due course other books will be written about the campaign. Academics will analyse it. Historians will put it into perspective. More people will tell their stories. The local authorities and lawyers will have valuable insights to add. This book is essentially written from a campaigners’ perspective while events were still fresh in people’s minds. The opinions expressed, the words used, any errors that may have crept in, are all mine and should not be attributed to anybody else. -

Third Quarter Results Presentation for Analysts 25 September 2006 Content

Third quarter results Presentation for analysts 25 September 2006 Content 1 Financial Overview – Birgir Haraldsson, Director Audit 2 Aviation Services – Hafþór Hafsteinsson, CEO 3 Shipping & Logistics – Baldur Guðnason, CEO 4 Charter & Leisure – Magnus Stephensen, CEO 5 Summary – Magnús Þorsteinsson, Chairman Financial overview Birgir Haraldsson, Director Audit Financial overview • All companies started using the accounting year 1.11-31.10 at beginning of November 2005. • The comparative figures in the financial statement are for the 10 month period 1 January – 31 October 2005 • Operating revenues $ 1,400 million • Operating expenses $ 1,424 million • Loss before tax $ 83 million • Net loss $ 69 million 4 Financial overview • Total block hours flown decreased by 43% to 71,000 in Aviation Services • Number of passengers increased by 14% to 2,933 in Charter & Leisure • Total tonnes transported increased by 16% to 1,677 in Shipping & Logistics • EBITDA: $ 34 million • EBITDA / revenues: 2,5% • EBIT: $- 24 million • EBIT / revenues: -1,7% • Total assets: $ 2,129 million • Total equity: $ 523 million • Equity ratio: 25% • Current ratio: 0.98 5 1 Financial Overview 2 Income Statement & Cash flow 3 Balance Sheet 6 Income Statement for 3Q 2006 All amounts in $ ,000 2005/6 2006 2005 1.11-31.7 3Q 1.1-31.10 Net sales ............................................................................... 1.374.319 668.778 1.379.537 Other income ........................................................................ 25.335 7.653 21.954 Total operating revenue 1.399.654 676.431 1.401.491 Aviation Services .................................................................. (316.531) (94.829) (367.017) Charter & Leisure ................................................................. (744.514) (428.181) (797.999) Shipping and Logistics ......................................................... (362.605) (133.837) (189.793) Total operating expenses (1.423.650) (656.847) (1.354.809) Operating result............................................................. -

List of Airlines

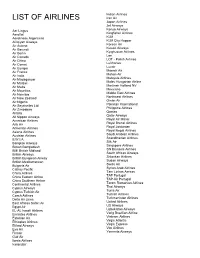

Indian Airlines LIST OF AIRLINES Iran Air Japan Airlines Jet Airways Aer Lingus Kenya Airways Aeroflot Kingfisher Airlines Aerolineas Argentinas KLM Afriqiyah Airways KLM City Hopper Air Astana Korean Air Air Barundi Kuwait Airways Air Berlin Kyrghzstan Airlines Air Canada Lan Air China LOT - Polish Airlines Air Comet Lufthansa Air Europa Luxair Air France Maersk Air Air India Mahan Air Air Madagascar Malaysia Airlines Air Malawi Malev Hungarian Airline Air Malta Martinair Holland NV Air Mauritius Mexicana Air Namibia Middle East Airlines Air New Zealand Northwest Airlines Air Nigeria Oman Air Air Seychelles Ltd. Pakistan International Air Zimbabwe Philippine Airlines Alitalia Qantas All Nippon Airways Qatar Airways American Airlines Royal Air Maroc Arik Air Royal Brunei Airlines Armenian Airlines Royal Jordanian Asiana Airlines Royal Nepal Airlines Austrian Airlines Saudi Arabian Airlines B.W.I.A. Scandinavian Airlines Bangkok Airways Silk Air Biman Bangladesh Singapore Airlines BMI British Midland SN Brussels Airlines British Airways South African Airways British European Airway Srilankan Airlines British Mediterranean Sudan Airways Bulgaria Air Swiss Air Cathay Pacific Syrian Arab Airlines China Airlines Tam Linhas Aereas China Eastern Airline TAP Portugal China Southern Airline TAP-Air Portugal Continental Airlines Tarom Romanian Airlines Cyprus Airways Thai Airways Cyprus Turkish Air Tunis Air Czech Airlines Turkish Airlines Delta Air Lines Turkmenistan Airlines East African Safari Air United Airlines Egypt Air US Airways EL-AL Israeli Airlines Uzbekistan Airways Emirates Airlines Varig Brazilian Airline Estonian Air Vietnam Airlines Ethiopian Airlines Virgin Atlantic Etihad Airways Virgin Express Eva Air Vlm Airlines Finnair Yemenia Airways Gulf Air Iberia Airlines Icelandair . -

Completed Acquisition by Air France Finance S.A.S / City Jet Ltd of VLM Airlines N.V

Completed acquisition by Air France finance S.A.S / City Jet Ltd of VLM Airlines N.V. ME/3535/08 The OFT's decision on reference under section 33(1) given on 9 May 2008. Full text of decision published 10 June 2008. PARTIES 1. Air France KLM S.A. (AFKL) is active principally in air transportation (passengers and freight) but also in ground services (for example, passenger handling). AFKL owns over 92 per cent of the economic rights in KLM Royal Dutch Airlines (KLM), a Dutch registered international carrier operating scheduled cargo and passenger services to more than 90 destinations principally from Amsterdam. AFKL is a founding member of the SkyTeam Alliance and has two international hubs at Amsterdam Schiphol and Paris CDG airports. AFKL's vehicles for this acquisition are its wholly-owned subsidiaries, Air France Finance S.A.S., and the latter's subsidiary, City Jet Ltd (City Jet), a regional European airline serving ten of its current seventeen routes from its hub at London City Airport. 2. VLM Airlines N.V. (VLM) is a Belgian-registered regional airline. VLM is active in the supply of scheduled short-haul point-to-point passenger air transport services, primarily focused on business customers. For the IATA summer 2008 season, VLM operates eight routes on a reverse-hub basis at London City Airport, with most of its aircraft and personnel based in The Netherlands and in Belgium. TRANSACTION 3. The transaction comprises the acquisition by Air France Finance S.A.S. ([…]) of the entire issued share capital of VLM together with […] Fokker 50 aircraft for €[…]. -

Marketing Communications in Tourism and Hospitality

Marketing Communications in Tourism and Hospitality This page intentionally left blank Marketing Communications in Tourism and Hospitality Concepts, Strategies and Cases Scott McCabe AMSTERDAM • BOSTON • HEIDELBERG • LONDON • OXFORD • NEW YORK PARIS • SAN DIEGO • SAN FRANCISCO • SINGAPORE • SYDNEY • TOKYO Butterworth-Heinemann is an imprint of Elsevier Butterworth-Heinemann is an imprint of Elsevier Linacre House, Jordan Hill, Oxford OX2 8DP, UK The Boulevard, Langford Lane, Kidlington, Oxford OX5 1GB, UK First edition 2009 Copyright © 2009 Elsevier Ltd. All rights reserved No part of this publication may be reproduced, stored in a retrieval system or transmitted in any form or by any means electronic, mechanical, photocopying, recording or otherwise without the prior written permission of the publisher Permissions may be sought directly from Elsevier’s Science & Technology Rights Department in Oxford, UK: phone ( ϩ 44) (0) 1865 843830; fax ( ϩ 44) (0) 1865 853333; email: [email protected]. Alternatively you can submit your request online by visiting the Elsevier web site at http://elsevier.com/locate/permissions , and selecting Obtaining permission to use Elsevier material Notice No responsibility is assumed by the publisher for any injury and/or damage to persons or property as a matter of products liability, negligence or otherwise, or from any use or operation of any methods, products, instructions or ideas contained in the material herein. British Library Cataloguing in Publication Data A catalogue record for this book is available from the British Library Library of Congress Cataloging-in-Publication Data A catalog record for this book is available from the Library of Congress ISBN: 978-0-7506-8277-0 For information on all Butterworth-Heinemann publications visit our web site at elsevierdirect.com Printed and bound in Hungary 09 10 10 9 8 7 6 5 4 3 2 1 To Lisa, Kieran and Harry. -

Network Planning 2016

NETWORK PLANNING 2016 IN ASSOCIATION WITH NETWORK PLANNING 2016 2 | FlightGlobal NETWORK PLANNING 2016 CONTENTS Airlines hit new peaks 4 Traffic gains step up in 2015 5 Top 100 airlines by traffic 6 Top 100 airports by traffic 8 Airline start-ups and failures 11 China focus 14 New Chinese intercontinental routes 17 Leading Chinese airports 18 Capacity snapshot – Asia 19 Cover picture by Don Wilson Don Wilson Don The information contained in our databases and used in this presentation has been assembled from many sources, and whilst reasonable care has been taken to ensure accuracy, the information is supplied on the understanding that no legal liability whatsoever shall attach to FlightGlobal, its offices, or employees in respect of any error or omission that may have occurred. © 2016 FlightGlobal, part of Reed Business Information Ltd Wilson Don FlightGlobal | 3 NETWORK PLANNING 2016 AIRLINES HIT NEW PEAKS Airlines and airport network planners arrive in Chengdu for “The demand for travel continues to increase, but at a slower this year’s World Routes with the industry showing distinct pace,” notes IATA director general Tony Tyler. “The fragile and signs of a split personality. uncertain economic backdrop, political shocks and a wave of terrorist attacks are all contributing to a softer demand On the one hand, for the airline sector things have seldom environment.” been better. Industry profits have been on the rise since the lows of the 2008 global financial crisis and recession. North African leisure traffic continues to struggle to recover They reached record highs in 2015 as airline consolidation from the tragic attacks to hit the region last year, while and restructuring efforts were bolstered by the sudden and Europe has been hit by a series of incidents including the welcome fall in fuel costs.