Administration

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Important News Snippets Jun 18, 2020 [email protected]

Important News Snippets Jun 18, 2020 [email protected] Following is a summary of important business news published in the leading daily newspapers of Bangladesh. For the complete news, please follow the online link given below each news. Please note that the news summary doesn’t reflect the opinion of BRAC EPL Stock Brokerage Limited. Bangladesh Bank (BB) blames banks’ misrepresentation of trade policy amid Foreign Direct Investment (FDI) fall ■ The Bangladesh Bank on Wednesday blamed authorised dealer banks for misrepresenting the country’s trade policy and putting Bangladesh’s economy at stake even after adoption of a liberal trade policy in the 1990s. A BB circular issued by its executive director Mohd Humayun Kabir on the day raised the allegation at a time when many global businesses were exploring their options to shift their manufacturing units elsewhere from China amid the mounting US- China trade war. Besides, the 56.0% fall in foreign direct investments last year could be another reason behind issuing the BB circular. The country’s FDI inflow dropped to USD 1.6 billion in 2019 from USD 3.6 billion in the previous year. ■ According to an official of the central bank said that the banks were mostly unaware of the government’s policy on foreign direct investment attraction which was why many of the banks, dealing with foreign customers, failed to provide them with the required guidelines. As a result, many potential clients got the wrong idea about the country’s liberal trade policy, prompting the central bank to come up with the circular. -

Morning Briefings Overall Market BANK

Morning Briefings Wednesday, March 16, 2016 Overall Market Stocks cheer Atiur’s resignation; Turnover crosses Tk 4 billion-mark Stocks posted marginal gain Tuesday, breaking two days losing streak with turnover crossing Tk 4.0 billion-mark on the premier bourse as optimistic investors put fresh fund on lucrative stocks. Market insiders said the resignation news of Bangladesh Bank (BB) governor might have ignited some hope and enthusiasm in the market. The BB Governor Atiur Rahman Tuesday submitted his resignation letter to Prime Minister over the heist of US$101 million from the central bank account with the New York Federal Reserve Bank by hackers last month. Meanwhile, a section of investors staged demonstration in front of the DSE building after the BB governor's resignation news. They also shouted slogans against Atiur Rahman and demanded his punishment for failure to protect the BB reserves. The market started amid rising enthusiasm, as key index of the prime bourse crossed the 4,500-mark in the mid-session. However, as the session progressed the upbeat tone slowed down amid surging volatility and DSEX finally closed marginally higher. http://print.thefinancialexpress-bd.com/2016/03/16/136628 Rakibur elected shareholder-director of DSE Rakibur Rahman, Midway Securities managing director, was on Tuesday elected shareholder-director of the Dhaka Stock Exchange for a three-year tenure defeating the lone contestant Minhaz Mannan Emon, BLI Securities managing director. According to DSE election commission declared result, of the 242 valid votes, 220 were cast. Of the cast votes, Rakibur got 131 and Emon bagged 86, while three were cancelled, the election commission for the bourse‟s director poll declared the result on Tuesday after the voting. -

ICAB Monthly News Bulletin March 2016 Issue

March 2016 ICAB NEWS BULLETIN Monthly News Briefing from the Institute of Chartered Accountants of Bangladesh Number 317 No Choice but to Implement Value Added Tax and Supplementary Duty Act NBR Chairman says at ICAB’s Members’ Conference No Choice but to 01 Implement... Duty Act ACCA Country Manager 02 Met ICAB President Felicitation to Dr 02 Jamaluddin Ahmed Training in Leadership... 03 Management ends ICAB President attended 03 NBR National Seminar Chairman of the National Board of Revenue (NBR) Nojibur Rahman addressing the members’ confer- ICAB Delegates Meet 03 ence of the Institute of Chartered Accountants of Bangladesh (ICAB) on ‘From Differential to Uniform Chittagong City Mayor Rate System in Bangladesh: Political Economy of Reforming Value Added Tax’ at the ICAB auditorium President’s Communication 04 as chief guest on Monday evening. Barrister Jahangir Hossain Member (VAT policy), NBR was also March 2016 present as special guest. ICAB Past President Dr. Jamaluddin Ahmed , ICAB President Kamrul Abedin FCA, session chairman Md. Humayun Kabir FCA, Past President-ICAB and Vice President Mahmudul Workshop on Examination 07 Techniques for CA Students Hasan Khusru FCA are also seen on the dais. Felicitation to newly 07 Appointed BB Governor hairman of the National Board of Revenue important role in NBR’s VAT reforming policy (NBR) Nojibur Rahman said that the NBR and the process of increasing revenue ICAB President attended 07 Contract Signing... DMTCL Chas now no choice but to implement the collection of the government. Value Added Tax and Supplementary Duty Act. Members’ Achievement: 07 The chief guest made the remarks while He added that global policy on finance and Congrats ! addressing the members’ conference of the trades have been undergoing reform in terms of Workshop on Job 07 Institute of Chartered Accountants of Interview Techniques capacity building to ensure sustainable development of economics. -

Revitalization of Waqf for Socio-Economic Development, Volume II

Revitalization of Waqf for Socio-Economic Development, Volume II “The benefcial impact Zakat and Waqf on achieving SDGs can be achieved by integrating them with the fnancial sector. Providing interest free loans to poor and vulnerable people from Zakat and Waqf sources will assist them to become less vulnerable and more resilient, thus allowing them to take part in produc- tive economic activities. It is imperative to expand the Zakat base, develop exist- ing Waqf properties for income generation, and enhance the effciency of these institutions to revive Zakat and Waqf for social development. The anthology of scholarly papers offers comprehensive knowledge about this important aspect of Islamic social fnance.” —Dr. Mulya Effendi Siregar, Chief Commissioner, PT Bank Syariah Mandiri, Indonesia “This edited volume on waqf results from a workshop on the ‘Revival of Waqf for Socio-Economic Development’, jointly organized by the Islamic Research and Training Institute (IRTI) of the Islamic Development Bank Group, Islami Bank Bangladesh Limited (IBBL) and the Center for Zakat Management (CZM), in Dhaka, Bangladesh during November 4th–5th 2017. The focus is on sustainable development, legal issues and management strategy. This book rep- resents a valuable addition to the literature on waqf from a contemporary per- spective. It should be essential reading for both academic researchers and those involved in waqf management professionally.” —Rodney Wilson, Emeritus Professor, Durham University, UK “The institutions of zakat and Awqaf have jointly played an important role in socio-economic development of Muslim societies and are still capable of offering a universal solution to achieve SDGs. Along with the private and public sectors, Awqaf, in particular, is capable of serving as an effective vehicle for sustainable development. -

2011-2012 03

BIDS Better research… Better policy… Better Bangladesh January 2013 Bangladesh Institute of Development Studies www.bids.org.bd Bangladesh Institute of Development Studies E-17, Agargaon, Sher-e-Bangla Nagar G.P.O. Box No. 3854, Dhaka 1207, Bangladesh Phone: 880 2 9143441-8 Fax: 880-2-8113023 Website: www.bids.org.bd E-mail: [email protected] @ Copyright BIDS, January 2013 Graphic Design Md. Fakrul Islam Printed at Dot Printing & Packaging 11, Naya Paltan, Dhaka 1000 Message from the Chairman of the Board of Trustees 5 Message from the Director General 7 One About BIDS 11 Two Research Activities 21 Three Dissemination, Advocacy and Publication 43 Four Capacity Building 49 Five Networking and Expanding Outreach 55 Six Looking Ahead: Serving the Cause of Shared and 61 Inclusive Development Annex 1: BIDS Senior Fellows 63 Annex 2: Members of BIDS Statutory Committees 64 Annex 3: Academic Profile of BIDS Professionals 66 Annex 4: BIDS Staff in 2012 73 Annex 5: Financial Statements 76 Biennial Report 2011-2012 03 It is with great pleasure that I write this message for the BIDS Biennial Report Message 2011-2012. I am happy to note that BIDS has been striving hard to achieve its from the Chairman goal of conducting policy-relevant research to help shape policy debate, of the Board of Trustees promote research excellence, and strengthen partnerships for development Air Vice Marshal (Retd.) in Bangladesh. In the process, BIDS has also been making valuable contribu- A K Khandker tions in the field of knowledge generation and in improving the quality of Honourable Minister policies through research and other activities. -

PDF Journal-01

Volume 5 Issue 2 July-December, 2016 BBTA Journal Thoughts on Banking and Finance Volume-5, Issue-2 July-December, 2016 Bangladesh Bank Training Academy Mirpur-2, Dhaka-1216 BBTA Journal Thoughts on Banking and Finance (A Journal of Bangladesh Bank Training Academy) Volume-5, Issue-2 July-December, 2016 ISSN - 2517-9918 @Bangladesh Bank Training Academy, Mirpur-2, Dhaka-1216 For all sorts of correspondence : The Executive Editor BBTA Journal "Thoughts on Banking and Finance" Research and Publications Wing Bangladesh Bank Training Academy (BBTA) Bangladesh Bank, Head Office, Mirpur-2, Dhaka-1216, Bangladesh Phone : 880-2-9028248, Fax : 880-2-8032110 E-mail : [email protected] Price : Inland BDT 200.00 Foreign US$ 3.00 BBTA Journal : Thoughts on Banking and Finance 02 Volume-5, Issue-2, July-December, 2016 Editorial Advisory Board Fazle Kabir Governor Chairman Abu Hena Mohd. Razee Hassan Deputy Governor Member Shitangshu Kumar Sur Chowdhury Deputy Governor Member S.M. Moniruzzaman Deputy Governor Member Laila Bilkis Ara Executive Director, BBTA Member-Secretary Editorial Board Shitangshu Kumar Sur Chowdhury Deputy Governor Chairman Dr. Md. Akhtaruzzaman Economic Adviser Member Laila Bilkis Ara Executive Director, BBTA Member Md. Mostafizur Rahman Sarder General Manager, BBTA Member-Secretary Executive Editor Md. Mostafizur Rahman Sarder Associate Members of Journal Management Mohammed Mahinur Alam Deputy General Manager Tania Mustafiz Joint Director Mohammad Amiruzzaman Mia Deputy Director Md. Razaul Karim Maintenance Engineer (DD) Israt Jahan Deputy Director Note : The Editorial Advisory Board, Editorial Board, Executive Editor, and Associate Members of Journal Management committee do not bear any responsibility for the views expressed in the papers by the contributors. -

01. Index.Indd

Annual Report (July 2019-June 2020) BANGLADESH BANK (The Central Bank of Bangladesh) Letter of Transmittal BANGLADESH BANK Dhaka 23 December 2020 The Senior Secretary Financial Institutions Division Ministry of Finance Government of the People’s Republic of Bangladesh Dhaka. Dear Senior Secretary, In terms of Article 40 (2) of the Bangladesh Bank Order, 1972 (P. O Number 127) I have the honour to submit to the Government of the People’s Republic of Bangladesh the Annual Report of the Bangladesh Bank for the fi nancial year 2019-2020. Audited Accounts of the Bank for the fi nancial year was forwarded earlier on 27 August 2020. Yours faithfully, (Fazle Kabir) Governor Board of Directors Mr. Fazle Kabir Chairman Mr. Md. Ashadul Islam Director Mr. Abu Hena Md. Rahmatul Muneem(i) Director Mr. Abdur Rouf Talukder Director Mr. S. M. Moniruzzaman Director Mr. Mahbub Ahmed(ii) Director Mr. A. K. M. Aftab ul Islam, FCA Director Mr. Md. Nazrul Huda(iii) Director Mr. Kazi Sayedur Rahman Secretary * As on 30 June, 2020. (i) Mr. Abu Hena Md. Rahmatul Muneem was appointed as Director of the Board in place of Mr. Md. Mosharrof Hossain Bhuiyan, NDC with effect from 09 January 2020 while Mr. Md. Mosharrof Hossain Bhuiyan, NDC has served as Director of the Board up to 08 January 2020. (ii) Mr. Mahbub Ahmed was appointed as Director of the Board with effect from 03 September 2019. (iii) Mr. Md. Nazrul Huda was appointed as Director of the Board with effect from 05 January 2020. Governor Fazle Kabir Deputy Governors S.M. -

Bangladesh PM Unveils Tk 72,750Cr Stimulus Packages

Wednesday, April 29, 2020 Bangladesh PM unveils Tk 72,750cr stimulus packages Ahammad Foyez | Updated at 12:42am on April 06, 2020 Sheikh Hasina The government on Sunday announced four fresh stimulus packages worth Tk 67,750 crore to enhance its effort to overcome the economic losses due to the coronavirus situation. Prime minister Sheikh Hasina announced the packages at a press conference at her official residence Ganabhaban 12 days after she came up with the first stimulus packages of Tk 5,000 crore for the export-oriented sectors. The overall size of the stimulus packages now stood at Tk 72,750 crore, nearly 2.52 per cent of the country’s gross domestic product, said Hasina, adding that both local and export-oriented products deserved supports amid domestic and global economic crisis caused by COVID-19 that prompted a countrywide shutdown since March 26. Of the fresh packages, Tk 30,000 crore announced for big industries and the service sector will be distributed by commercial banks as working capital loan at 9 per cent interest rate with the government providing 4.5 per cent in subsidy. Under the second package worth Tk 20,000 crore, small and medium enterprises, including cottage industries, would also get working capital loan at 9 per cent interest rate with the government giving 5 per cent subsidy. Besides, a Tk 12,750 crore package was earmarked under the Bangladesh Bank’s Export Development Fund to facilitate raw materials imports under back-to-back Letter of Credit at 2 per cent from 2.73 per cent interest rate. -

Annual Report 2016-Part 1.Pdf

LETTER OF TRANSMITTAL To: All Shareholders, Bangladesh Bank, Bangladesh Securities and Exchange Commission, Registrar of Joint Stock Companies & Firms, Dhaka Stock Exchange Limited and Chittagong Stock Exchange Limited Dear Sir(s), Re: Annual Report under reference of the year ended on December 31, 2016 We forward herewith copy(s) of Annual Report-2106 of Prime Bank Limited along with Audited Financial Statements as on the position of December 31, 2016 for your kind perusal and record please. The Annual Report-2016 includes Income Statements, Cash Flow Statements along with notes thereon on the financials of Prime Bank Limited, its Subsidiaries namely Prime Exchange Co. Pte. Limited, Singapore, PBL Exchange (UK) Limited, PBL Finance (Hong Kong) Limited, Prime Bank Investment Limited, Prime Bank Securities Limited and Prime Bank Foundation. Best regards. Yours sincerely, Mohammed Ehsan Habib Company Secretary Prime Bank Annual Report 2016 1 CONTENTS General Information Risk Management and Control Environment Statement Regarding Forward Looking Approach 5 Risk Management Framework & Vision & Mission 6 Mitigation Methodology 145 Core Values 6 Market Discipline Disclosure on Risk Based Culture 7 Capital (Basel-III) 156 Strategic Priority 8 Sustainability Analysis Corporate Profile 9 Sustainability Report 183 Awards and Recognition 12 Social Responsibility Initiatives (CSR) 185 Five Years at a Galance 14 Prime Bank Foundation 186 22 Years of Glorious Journey 16 Prime Bank Cricket Club 210 Group Corporate Structure 20 Green -

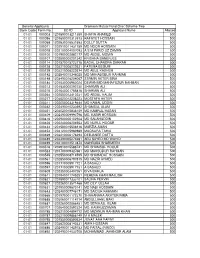

Bank Code Form No. BO ID Applicant Name Allotted 01-01 000003

General Applicants Grameen Mutual Fund One: Scheme Two Bank Code Form No. BO ID Applicant Name Allotted 01-01 000003 1201890013211389 SHAFIR AHAMED 500 01-01 000056 1201690010313913 RAFAYET HOSSAIN 500 01-01 000058 1202630016531553 DOLLY DUTTA 500 01-01 000071 1202910011431759 MD NOOR HOSSAIN 500 01-01 000078 1202100004007093 A S M FARID UZ ZAMAN 500 01-01 000100 1201900002882177 MD ABDUL MOMIN 500 01-01 000107 1202890000201342 KRISHNA BANERJEE 500 01-01 000114 1201570015723716 BADAL CHANDRA SARKAR 500 01-01 000128 1203210006222631 FATEMA BEGUM 500 01-01 000129 1203210006222674 MD ABUL KASHEM 500 01-01 000142 1202840010346025 MD MAHABOBUR RAHMAN 500 01-01 000148 1203490016204067 SSRMIN AKTER BINA 500 01-01 000184 1201530006960024 DEWAN MD MAHAFUZUR RAHMAN 500 01-01 000213 1201530000292730 SHARMIN ALI 500 01-01 000215 1201640001755818 SHARMIN ALI 500 01-01 000264 1202550013410231 MD ABDUL HALIM 500 01-01 000277 1203520012208223 MOSTAFA AKTER 500 01-01 000311 1202050003319444 MD KAMAL UDDIN 500 01-01 000342 1202490010233692 SHAMSUL ALAM 500 01-01 000351 1203020015836159 MD KAMRUL HASAN 500 01-01 000409 1202490009993796 MD. KABIR HOSSAIN 500 01-01 000416 1202900005102904 MD SALAHUDDIN 500 01-01 000426 1202240006204553 MD NURUL HOQUE 500 01-01 000434 1201580015506916 MARZIA AMAN 500 01-01 000454 1203120015980989 MAQSURA TAHIA 500 01-01 000469 1203210006176394 DEBJANEE DATTA 500 01-01 000489 1203490005274281 ABU SAYED MD WAHID 500 01-01 000499 1203180012513874 MAHBUBA SHARMEEN 500 01-01 000516 1202910015588741 MD SHAMSUL HOQUE 500 01-01 000523 -

National News International News National News

DSEX 6,336.88 14.37 Gold (Ounce) $1,289.70 Dollar 81.99 (Buy) 82.99(Sell) REPO Rate (16/10/2017) 3.44% Euro 96.73 DSE30 2,280.00 2.65 Oil (Barrel) $58.67 REPO Rate (15/10/2017) 3.46% (Buy) 101.11(Sell) Source: DSE Source: Yahoo Finance Source: One Bank Limited Source: Bangladesh Bank (W AV) National News Muhith plans Tk 4,68,000cr budget for FY19 ‘Power tariff hike won’t affect public life’ US dollar appreciates against taka Railway passengers expected to double in two years Amendment mistimed: analysts Robi registers 4% revenue growth in third quarter ‘Good governance can resolve banking crisis’ Government looking into debt records of S Alam Group Rising NPLs matter of serious concern for banking sector, experts say at ABC Chinese co gets Tk 767cr deal to convert 150MW plant to CCP Local firm to launch on-demand ride service ‘Ezzyr’ from Dec 1 International News Black Friday, Thanksgiving online sales climb to record high A ray of hope for Zimbabwe's ruined economy? National News Muhith plans Tk 4,68,000cr budget for FY19 Finance Minister AMA Muhith yesterday said the outlay of the budget for the coming 2018-2019 financial year (FY19) could be Tk 4,68,000 crore, reports BSS. “We announced Tk 4,00,266 crore budget for current fiscal. Revised budget for the current fiscal will be Tk 3,71,000 crore. We have projected Tk 4,68,000 crore for the next fiscal,” he told journalists after coordination council meeting and Budget Monitoring and Resource Committee (BMRC) meeting at the Finance Ministry in the capital. -

Morning Briefings Monday, March 21, 2016

Morning Briefings Monday, March 21, 2016 MACRO Experts want urban policy for faster poverty reduction An urban policy is required for poverty alleviation, while giving a better life to the citizens, a top urbanisation expert said Sunday. The National Urban Policy was drafted back in 2011, but it has not been endorsed by the government yet. "This is 2016, unfortunately we have not seen the approval of the policy," said Prof. Nazrul Islam, honourary chairman of Dhaka think-tank Centre for Urban Studies, said. Link: http://print.thefinancialexpress-bd.com/2016/03/21/137065 Francophonie envoys stress 'brand image' to expand trade Envoys from Francophonie countries in Dhaka Sunday said Bangladesh needs to build good brand image in French-speaking countries needed to expand foreign trade. "Bangladesh needs to build good image for foreign trade expansion, your country has to decide whether it wants to be identified as a country of cheap labour or a country of high- end goods maker," said Canadian High Commissioner to Dhaka Benoît-Pierre Laramée. Link: http://print.thefinancialexpress-bd.com/2016/03/21/137064 Help build eco-friendly infrastructure: PM Prime Minister Sheikh Hasina sought Sunday cooperation from the country's architects in building infrastructures using local resources keeping in mind the environment and land resource constraint, reports UNB. "I seek your cooperation in building infrastructures suitable for the country using the local resources," she said. Link: http://print.thefinancialexpress-bd.com/2016/03/21/137091 Experts seek public-private coordination to attain SDGs Speakers at a roundtable titled "Sustainable Development Goals (SDGs): Challenges for Bangladesh" on Sunday stressed the need for more coordination among public and private sectors as well as donors' participation to attain the SDGs.