Annual Report and Accounts 2020 Sustaining Resilience

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Full Portfolio Holdings

Hartford Multifactor International Fund Full Portfolio Holdings* as of August 31, 2021 % of Security Coupon Maturity Shares/Par Market Value Net Assets Merck KGaA 0.000 152 36,115 0.982 Kuehne + Nagel International AG 0.000 96 35,085 0.954 Novo Nordisk A/S 0.000 333 33,337 0.906 Koninklijke Ahold Delhaize N.V. 0.000 938 31,646 0.860 Investor AB 0.000 1,268 30,329 0.824 Roche Holding AG 0.000 74 29,715 0.808 WM Morrison Supermarkets plc 0.000 6,781 26,972 0.733 Wesfarmers Ltd. 0.000 577 25,201 0.685 Bouygues S.A. 0.000 595 24,915 0.677 Swisscom AG 0.000 42 24,651 0.670 Loblaw Cos., Ltd. 0.000 347 24,448 0.665 Mineral Resources Ltd. 0.000 596 23,709 0.644 Royal Bank of Canada 0.000 228 23,421 0.637 Bridgestone Corp. 0.000 500 23,017 0.626 BlueScope Steel Ltd. 0.000 1,255 22,944 0.624 Yangzijiang Shipbuilding Holdings Ltd. 0.000 18,600 22,650 0.616 BCE, Inc. 0.000 427 22,270 0.605 Fortescue Metals Group Ltd. 0.000 1,440 21,953 0.597 NN Group N.V. 0.000 411 21,320 0.579 Electricite de France S.A. 0.000 1,560 21,157 0.575 Royal Mail plc 0.000 3,051 20,780 0.565 Sonic Healthcare Ltd. 0.000 643 20,357 0.553 Rio Tinto plc 0.000 271 20,050 0.545 Coloplast A/S 0.000 113 19,578 0.532 Admiral Group plc 0.000 394 19,576 0.532 Swiss Life Holding AG 0.000 37 19,285 0.524 Dexus 0.000 2,432 18,926 0.514 Kesko Oyj 0.000 457 18,910 0.514 Woolworths Group Ltd. -

Frederic Ozanam, a Life in Letters

OTHER BOOKS BY JOSEPH I. DIRVIN, C.M. St. Catherine Laboure of the Miraculous Medal Farrar, Straus & Cudahy, New York, 1958; reissue Tan Books and Publishers, Rockland, Illinois 1984. Woman Clothed With the Sun (Collaboration), Hanover House, New York, 1960. Mrs. Seton, Foundress of the American Sisters of Charity Farrar, Straus & Cudahy, New York, 1962, 1975. Louise de Marillac Farrar, Straus & Giroux, New York, Spring, 1970. Frederic Ozanam A LIFE IN LETTERS ' " , ~~ , ,-·~-- . ,, ~~~ Frederic Ozanam 1813-1853 ~ Frederic Ozanam A LIFE IN LETTERS Translated and edited by JOSEPH I. DIRVIN, C.M. SOCIETY OF ST. VINCENT DE PAUL COUNCIL OF THE UNITED STATES © 1986 by Society of St. Vincent de Paul, Council of the United States, 4140 Lindell, St. Louis, Missouri 63108 All rights reserved. No part of this book may be reproduced, in any form or by any means, without permission in writing from the publisher. Printed in the United States of America Library of Congress Cataloging-in-Publication Data Ozanam, A.-F. (Antoine Frederic), 1813-1853. Frederic Ozanam, a life in letters. Includes index. 1. Ozanam, A.-F. (Antoine Frederic), 1813-1853- Correspondence. 2. Catholics-France-Correspondence. 3. Society of St. Vincent de Paul. I. Dirvin, Joseph I. II. Title. BX4705.08A4 1986 282'.092'4 [B] 86-26127 10 9 8 7 6 5 4 3 2 1 FOREWORD The Council of the United States has taken on the responsibility of publishing an annotated English translation of selected correspondence of our Frederic Ozanam. This praiseworthy effort is made possible by the unselfish labor of Father Joseph I. Dir, vin, C.M., who has translated the letters from the original French. -

2019-20 Annual Report

PRINCETON UNIVERSITY DEPARTMENT AND PROGRAM OF EAST ASIAN STUDIES Annual Report 2019-2020 1 COVER: The wooden doors to 202 Jones. Photo taken by Martin Kern. 2 Annual Report 2019-20 Contents Director’s Letter 4 Department and Program News 6 Language Programs 8 Undergraduates 11 Graduate Students 14 Faculty 18 Events 24 Summer Programs 26 Affiliated Programs 29 Libraries & Museum 34 3 Director’s Letter, 2019-20 In normal years, the Director’s Letter is a retrospective of the year in East Asian Studies—but where to begin? Annual disasters and upheavals are standard topics in traditional East Asian chronicles. By June of 2020 (a gengzi 庚子 year), we had already lived through more than our share: the coronavirus pandemic, severe economic downturn, government inaction and prevarication, Princeton’s shift to online teaching, dislocation of undergraduate and graduate life, shuttering of libraries and labs, disruption to travel, study, and research for students, staff, and faculty, the brutal murder of George Floyd, and the international renaissance of the Black Lives Matter movement. invigorate campus intellectual life, completing book This spring semester, the usual hum of summer manuscripts, or starting new projects. The heaviest burden, programming and plans for next academic year grew no doubt, fell on our language instructors. The faculty quiet, and many EAS projects were cancelled, postponed, in Chinese, Japanese, and Korean innovated non-stop to shifted online, or put on hold. As this Annual Report goes insure that, in the era of Zoom, students would remain fully to press, plans for undergraduate residence on campus engaged in all four language skills of speaking, listening, and the format for classes in fall of 2020 are still being reading, and writing. -

Parker Review

Ethnic Diversity Enriching Business Leadership An update report from The Parker Review Sir John Parker The Parker Review Committee 5 February 2020 Principal Sponsor Members of the Steering Committee Chair: Sir John Parker GBE, FREng Co-Chair: David Tyler Contents Members: Dr Doyin Atewologun Sanjay Bhandari Helen Mahy CBE Foreword by Sir John Parker 2 Sir Kenneth Olisa OBE Foreword by the Secretary of State 6 Trevor Phillips OBE Message from EY 8 Tom Shropshire Vision and Mission Statement 10 Yvonne Thompson CBE Professor Susan Vinnicombe CBE Current Profile of FTSE 350 Boards 14 Matthew Percival FRC/Cranfield Research on Ethnic Diversity Reporting 36 Arun Batra OBE Parker Review Recommendations 58 Bilal Raja Kirstie Wright Company Success Stories 62 Closing Word from Sir Jon Thompson 65 Observers Biographies 66 Sanu de Lima, Itiola Durojaiye, Katie Leinweber Appendix — The Directors’ Resource Toolkit 72 Department for Business, Energy & Industrial Strategy Thanks to our contributors during the year and to this report Oliver Cover Alex Diggins Neil Golborne Orla Pettigrew Sonam Patel Zaheer Ahmad MBE Rachel Sadka Simon Feeke Key advisors and contributors to this report: Simon Manterfield Dr Manjari Prashar Dr Fatima Tresh Latika Shah ® At the heart of our success lies the performance 2. Recognising the changes and growing talent of our many great companies, many of them listed pool of ethnically diverse candidates in our in the FTSE 100 and FTSE 250. There is no doubt home and overseas markets which will influence that one reason we have been able to punch recruitment patterns for years to come above our weight as a medium-sized country is the talent and inventiveness of our business leaders Whilst we have made great strides in bringing and our skilled people. -

CBI South East Regional Council Directory of Members

CBI South East Regional Council Directory of members South East Delivering prosperity through private-sector growth Getting Britain building Creating a global role for Britain in a new Europe Encouraging high-growth export champions Delivering for consumers and communities CBI South East Regional Council: Directory of members 3 Chairman’s message Having been an active member of the CBI SE These are all great foundations but to make real council for a number of years I am delighted to progress a great deal more building work needs to begin my two year term as the CBI South East be done. To achieve this we have set out our Regional Chairman, taking over the reins from workplan – our own growth agenda – for 2013, Debbie McGrath who I must congratulate and under the banner ‘Delivering prosperity through thank for doing such a fine job. private sector growth.’ The four central pillars will In addition to being an informal networking seek to: Get Britain Building; Create a global role opportunity and an unrivalled forum in which to for the UK; To encourage high-growth export share views on the current state of business and champions; and Deliver for consumers and trade, the Council above all, plays a vital role in communities. ensuring that the CBI’s national campaigns reflect These though will not be in isolation to the many the views of businesses in the region. I am looking other issues affecting business, so members will forward to working with so many experienced continue to contribute to discussions on, for business leaders and council members from a example, aviation, energy, business reputation diverse range of business and educational and of course the economic and business case establishments that singles out the South East relevant to the European referendum debate that and Thames Valley as unique and highly will gain momentum over the next two years. -

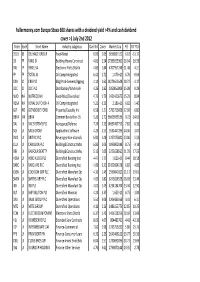

Fullermoney.Com Europe Stoxx 600 Shares with a Dividend Yield >4

Fullermoney.com Europe Stoxx 600 shares with a dividend yield >4% and cash dividend cover >1 July 2nd 2012 Ticker Exch Short Name industry subgroup Dvd Yld Cover Market Cap P/E TR YTD DELB BB DELHAIZE GROUP Food-Retail 6.09 2.65 3696837120 6.10 -31.17 DG FP VINCI SA Building-Heavy Construct 4.81 1.54 27399055360 10.64 10.33 RXL FP REXEL SA Electronic Parts Distrib 4.83 1.84 4707957248 11.48 4.21 FP FP TOTAL SA Oil Comp-Integrated 6.42 2.72 1.07E+11 6.76 -9.63 CRH ID CRH PLC Bldg Prod-Cement/Aggreg 4.14 1.62 14079643648 18.72 -1.17 DCC ID DCC PLC Distribution/Wholesale 4.26 1.82 1950855808 15.08 0.29 NUO NA NUTRECO NV Food-Misc/Diversified 4.73 1.79 2431420672 15.29 8.04 RDSA NA ROYAL DUTCH SH-A Oil Comp-Integrated 5.21 3.23 2.18E+11 6.82 -5.40 GJF NO GJENSIDIGE FORSI Property/Casualty Ins 6.58 1.21 5795755008 12.60 6.80 BBVA SM BBVA Commer Banks Non-US 5.26 1.71 36606939136 9.72 -14.65 BA/ LN BAE SYSTEMS PLC Aerospace/Defense 7.24 2.13 14692467712 7.82 6.36 SGE LN SAGE GROUP Applications Software 4.23 2.57 5531447296 14.36 -1.07 BVIC LN BRITVIC PLC Beverages-Non-alcoholic 6.03 1.48 1257075840 13.06 5.33 CLLN LN CARILLION PLC Building&Construct-Misc 6.80 2.09 1890802048 8.75 -3.14 BBY LN BALFOUR BEATTY Building&Construct-Misc 5.15 2.05 3222658560 11.29 17.55 HSBA LN HSBC HLDGS PLC Diversified Banking Inst 4.47 1.77 1.62E+11 9.44 18.58 BARC LN BARCLAYS PLC Diversified Banking Inst 4.09 3.10 32422064128 6.82 -4.85 CKSN LN COOKSON GRP PLC Diversified Manufact Op 4.10 1.49 2590840320 11.17 19.61 SMIN LN SMITHS GRP PLC Diversified Manufact -

High Performance Stallions Standing Abroad

High Performance Stallions Standing Abroad High Performance Stallions Standing Abroad An extract from the Irish Sport Horse Studbook Stallion Book The Irish Sport Horse Studbook is maintained by Horse Sport Ireland and the Northern Ireland Horse Board Horse Sport Ireland First Floor, Beech House, Millennium Park, Osberstown, Naas, Co. Kildare, Ireland Telephone: 045 850800. Int: +353 45 850800 Fax: 045 850850. Int: +353 45 850850 Email: [email protected] Website: www.horsesportireland.ie Northern Ireland Horse Board Office Suite, Meadows Equestrian Centre Embankment Road, Lurgan Co. Armagh, BT66 6NE, Northern Ireland Telephone: 028 38 343355 Fax: 028 38 325332 Email: [email protected] Website: www.nihorseboard.org Copyright © Horse Sport Ireland 2015 HIGH PERFORMANCE STALLIONS STANDING ABROAD INDEX OF APPROVED STALLIONS BY BREED HIGH PERFORMANCE RECOGNISED FOREIGN BREED STALLIONS & STALLIONS STALLIONS STANDING ABROAD & ACANTUS GK....................................4 APPROVED THROUGH AI ACTION BREAKER.............................4 BALLOON [GBR] .............................10 KROONGRAAF............................... 62 AIR JORDAN Z.................................. 5 CANABIS Z......................................18 LAGON DE L'ABBAYE..................... 63 ALLIGATOR FONTAINE..................... 6 CANTURO.......................................19 LANDJUWEEL ST. HUBERT ............ 64 AMARETTO DARCO ......................... 7 CASALL LA SILLA.............................22 LARINO.......................................... 66 -

Missouri Voting and Elections 597

CHAPTER 7 MISSOURI ELECTIONS Vice President Harry S Truman preparing to take oath of offi ce. Harry S Truman Library and Museum 596 OFFICIAL MANUAL When do Missourians vote? In addition to certain special and emergency dates, there are fi ve offi cial election dates in Mis- Missouri Voting souri: State law requires that all public elections be held on the general election day, the primary and Elections election day, the general municipal election day, the fi rst Tuesday after the fi rst Monday in Novem- Who registers to vote in Missouri? ber, or on another day expressly provided by city or county charter. In nonprimary years, an elec- Citizens living in Missouri must register in tion may be held on the fi rst Tuesday after the fi rst order to vote. Any U.S. citizen 17 years and 6 months of age or older, if a Missouri resident, Monday in August. (RSMo 115.123.1) may register to vote in any election held on or The general election day is the fi rst Tuesday after his/her 18th birthday, except: after the fi rst Monday in November in even-num- • A person who is adjudged incapacitated. bered years. The primary election day is the fi rst Tuesday after the fi rst Monday in August in even- • A person who is confi ned under sentence numbered years. (RSMo 115.121.1 and .2) of imprisonment. Elections for cities, towns, villages, school • A person who is on probation or parole boards and special district offi cers are held the after conviction of a felony until fi nally dis- fi rst Tuesday after fi rst Monday in April each charged. -

Babcock International Group PLC Half Year Results for the Period Ended 30 September 2020

Babcock International Group PLC half year results for the period ended 30 September 2020 25 November 2020 Resilient revenue but operating profit reflects disposals, the impact of civil nuclear insourcing, COVID-19 and weakness in civil aviation Financial results 30 September 30 September 2020 2019 Order book £17.2bn £16.9bn Revenue £2,109.6m £2,194.8m Underlying revenue1 £2,243.7m £2,457.8m Operating profit £76.2m £168.7m Underlying operating profit2 £143.1m £250.6m Basic earnings per share 10.5p 25.6p Underlying basic earnings per share3 15.7p 32.5p Cash generated from operations £149.3m £150.5m Underlying free cash flow (post pension payments)4 £58.4m £6.8m Net debt incl. lease obligations £1,519m £1,754.2m Net debt excl. lease obligations5 £871.3m £1,138.0m Net debt/EBITDA6 2.0x 1.9x See notes on page 2. David Lockwood, Chief Executive Officer, said: “I have been enormously impressed by the way in which our people have adapted to the COVID-19 pandemic and continued to prioritise meeting the needs of our customers. Nevertheless, while demand for our critical services has remained resilient overall, the additional costs incurred and inefficiencies created have impacted our profitability. Our operating profit performance in the first half reflects this COVID-19 impact as well as disposals, the impact of government insourcing of Magnox and Dounreay, and weak trading in civil aviation. “In my first three months at Babcock I have spent time seeing many parts of the business. Our strengths are clear. We have many high-quality businesses, with a deep understanding of our customers, operating in markets where demand for our expertise is strong. -

Investment Checklist

ukvalueinvestor.com UKValueInvestor High quality value investing for income & growth May 2012 Back in recession again Contents Although we’ve managed to avoid it for quite some time, the UK is back in recession. I don’t Market Overview think this is much of a surprise to most people; the UK economy has gone pretty much With the FTSE 100 at 5,700 the nowhere since the credit crunch started back in 2007/8. market is once again back in the ‘cheap’ range, with 7-year total As always though, it isn’t the end of the world just yet. The US is starting to show signs of returns expected to be around recovery and in the past most recessions ended when the US pulled us out. With any luck, 10% per annum. the same process will apply this time round. Model Portfolio Obviously most people would much prefer that we got back to growth sooner rather than Annual results are in from JD later, but from an investing point of view it shouldn’t matter too much one way or the other. Sports One of the basic assumptions of sound investing is that the future will always hold unpleasant Buy Alert surprises and that prudent and rational investors should be prepared for them at all times. A leading home shopping retailer This means sticking to the basics of being diversified, picking high quality companies, buying will be joining the portfolio. them when they are attractively valued and selling them when they’re not. FTSE 350 Sorted by Rating Find the top rated stocks in next New name, new rating system to no time. -

Restoring Strength, Building Value

Restoring Strength, Building Value QinetiQ Group plc Annual Report and Accounts 2011 Group overview Revenue by business The Group operates three divisions: US Services, 29% UK Services and Global Products; to ensure efficient 35% leverage of expertise, technology, customer relationships and business development skills. Our services businesses which account for more 36% than 70% of total sales, are focused on providing 2011 2010 expertise and knowledge in national markets. Our £m £m products business provides the platform to bring US Services 588.2 628.0 valuable intellectual property into the commercial UK Services 611.6 693.9 markets on a global basis. Global Products 502.8 303.5 Total 1,702.6 1,625.4 Division Revenue Employees US Services £588.2m 4,500 (2010: £628.0m) (2010: 5,369) Underlying operating profit* £44.3m (2010: £52.6m) Division Revenue Employees UK Services £611.6m 5,045 (2010: £693.9m) (2010: 5,707) Underlying operating profit* £48.7m (2010: £59.1m) Division Revenue Employees Global £502.8m 1,663 Products (2010: £303.5m) (2010: 2,002) Underlying operating profit* £52.4m (2010: £8.6m) * Definitions of underlying measures of performance are in the glossary on page 107. Underlying operang profit* by business Revenue by major customer type Revenue by geography 7% 17% 36% 31% 52% 37% 56% 31% 33% 2011 2010 2011 2010 2011 2010 £m £m £m £m £m £m US Services 44.3 52.6 US Government 894.3 754.1 North America 949.2 825.3 UK Services 48.7 59.1 UK Government 526.5 614.5 United Kingdom 623.7 720.0 Global Products 52.4 8.6 Other 281.8 -

Fiscal Quarter-End Holdings (Pdf)

Quarterly Schedules of Portfolio Holdings International & Global Funds July 31, 2020 Retirement Institutional Administrative Investor Class Class Class Class Harbor Diversified International All Cap Fund HNIDX HAIDX HRIDX HIIDX Harbor Emerging Markets Equity Fund HNEMX HAEMX HREMX HIEEX Harbor Focused International Fund HNFRX HNFSX HNFDX HNFIX Harbor Global Leaders Fund HNGIX HGGAX HRGAX HGGIX Harbor International Fund HNINX HAINX HRINX HIINX Harbor International Growth Fund HNGFX HAIGX HRIGX HIIGX Harbor International Small Cap Fund HNISX HAISX HRISX HIISX Harbor Overseas Fund HAORX HAOSX HAOAX HAONX Table of Contents Portfolios of Investments HARBOR DIVERSIFIED INTERNATIONAL ALL CAP FUND. ..... 1 HARBOR EMERGING MARKETS EQUITY FUND . .......... 8 HARBOR FOCUSED INTERNATIONAL FUND. ................................. 11 HARBOR GLOBAL LEADERS FUND. ................. 13 HARBOR INTERNATIONAL FUND . 15 HARBOR INTERNATIONAL GROWTH FUND . ........................ 21 HARBOR INTERNATIONAL SMALL CAP FUND. ................. 24 HARBOR OVERSEAS FUND . ............................................ 26 Notes to Portfolios of Investments ..................................... 31 Harbor Diversified International All Cap Fund PORTFOLIO OF INVESTMENTS—July 31, 2020 (Unaudited) Value, Cost, and Principal Amounts in Thousands COMMON STOCKS—96.4% COMMON STOCKS—Continued Shares Value Shares Value AEROSPACE & DEFENSE—0.7% BANKS—Continued 28,553 Airbus SE (France)* .............................. $ 2,090 236,142 Svenska Handelsbanken AB (Sweden) ............... $