Annual Reports & Financial Statements 2000

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Participating Publishers

Participating Publishers 1105 Media, Inc. AB Academic Publishers Academy of Financial Services 1454119 Ontario Ltd. DBA Teach Magazine ABC-CLIO Ebook Collection Academy of Legal Studies in Business 24 Images Abel Publication Services, Inc. Academy of Management 360 Youth LLC, DBA Alloy Education Aberdeen Journals Ltd Academy of Marketing Science 3media Group Limited Aberdeen University Research Archive Academy of Marketing Science Review 3rd Wave Communications Pty Ltd Abertay Dundee Academy of Political Science 4Ward Corp. Ability Magazine Academy of Spirituality and Professional Excellence A C P Computer Publications Abingdon Press Access Intelligence, LLC A Capella Press Ablex Publishing Corporation Accessible Archives A J Press Aboriginal Multi-Media Society of Alberta (AMMSA) Accountants Publishing Co., Ltd. A&C Black Aboriginal Nurses Association of Canada Ace Bulletin (UK) A. Kroker About...Time Magazine, Inc. ACE Trust A. Press ACA International ACM-SIGMIS A. Zimmer Ltd. Academia Colombiana de Ciencias Exactas, Fisicas y Acontecimiento A.A. Balkema Publishers Naturales Acoustic Emission Group A.I. Root Company Academia de Ciencias Luventicus Acoustical Publications, Inc. A.K. Peters Academia de las Artes y las Ciencias Acoustical Society of America A.M. Best Company, Inc. Cinematográficas de España ACTA Press A.P. Publications Ltd. Academia Nacional de la Historia Action Communications, Inc. A.S. Pratt & Sons Academia Press Active Interest Media A.S.C.R. PRESS Academic Development Institute Active Living Magazine A/S Dagbladet Politiken Academic Press Acton Institute AANA Publishing, Inc. Academic Press Ltd. Actusnews AAP Information Services Pty. Ltd. Academica Press Acumen Publishing Aarhus University Press Academy of Accounting Historians AD NieuwsMedia BV AATSEEL of the U.S. -

The Congenital and Limb-Girdle Muscular Dystrophies Sharpening the Focus, Blurring the Boundaries

NEUROLOGICAL REVIEW SECTION EDITOR: DAVID E. PLEASURE, MD The Congenital and Limb-Girdle Muscular Dystrophies Sharpening the Focus, Blurring the Boundaries Janbernd Kirschner, MD; Carsten G. Bo¨nnemann, MD uring the past decade, outstanding progress in the areas of congenital and limb- girdle muscular dystrophies has led to staggering clinical and genetic complexity. With the identification of an increasing number of genetic defects, individual enti- ties have come into sharper focus and new pathogenic mechanisms for muscular dys- Dtrophies, like defects of posttranslational O-linked glycosylation, have been discovered. At the same time, this progress blurs the traditional boundaries between the categories of congenital and limb- girdle muscular dystrophies, as well as between limb-girdle muscular dystrophies and other clini- cal entities, as mutations in genes such as fukutin-related protein, dysferlin, caveolin-3 and lamin A/C can cause a striking variety of phenotypes. We reviewed the different groups of proteins cur- rently recognized as being involved in congenital and limb-girdle muscular dystrophies, associ- ated them with the clinical phenotypes, and determined some clinical and molecular clues that are helpful in the diagnostic approach to these patients. Arch Neurol. 2004;61:189-199 Muscular dystrophies were first recog- phy. The age at onset may range from early nized as a disease entity with the detailed childhood to late adulthood.5 description of the clinical presentation of During the past decade, exciting Duchenne muscular dystrophy in 1852 and progress has been made in the field of CMD thereafter.1,2 About 50 years later, Batten3 and LGMD, emphasizing differences as published the first case reports of a con- well as commonalities between them. -

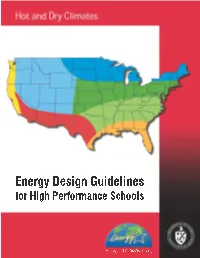

Energy Design Guidelines for High Performance Schools: Hot and Dry

Hot and Dry Climates Acknowledgements This document was The US Department of Energy would like to acknowledge the help and assistance developed by the National of the EnergySmart Schools team and the many reviewers that provided input and Renewable Energy feedback during the process of developing the report. Those include: Laboratory, with subcontractor Innovative Ren Anderson, Kate Darby, Kyra Epstein, Patty Kappaz, Bryan King, and Patricia Plympton, National Design. Technical assistance Renewable Energy Laboratory; Greg Andrews, Ken Baker, Chip Larson, Bill Mixon, and Sue Seifert, Rebuild America Products and Services; Dariush Arasteh and Doug Avery, Lawrence Berkeley National came from Padia Consulting, Laboratory; David Ashley, Ashley McGraw Architects, P.C; Michael Baechler, Kim Fowler, Eric BuildingGreen, and the Richman, and David Winiarski, Pacific Northwest National Laboratory; Robin Bailey, Texas State Sustainable Buildings Energy Office; Tony Bartorillo, TRACO; Michael Boyd, TechBrite; Bill Brenner, National Institute of Building Sciences; George Churchill, Oregon Office of Energy; Peter D'Antonio, Sarnafil, Inc.; David Industry Council. DePerro, Cutler-Hammer; John Devine and Peter Dreyfuss, US DOE — Chicago Regional Office; Mary Jo Dutra, SAFE-BIDCO; Charles Eley, Eley Associates; Mark Halverson, Building America; David Hansen, George James, and Arun Vohra, US DOE; Richard Heinisch, Lithonia Lighting Co.; Fred Hoover, Maryland Energy Administration; Dana Johnson, Environmental Support Solutions; Mark Kelley, Hickory Consortium; -

Traditional Chinese Medicine Decoction Enhances Growth

Livestock Science 128 (2010) 75–81 Contents lists available at ScienceDirect Livestock Science journal homepage: www.elsevier.com/locate/livsci Traditional Chinese medicine decoction enhances growth performance and intestinal glucose absorption in heat stressed pigs by up-regulating the expressions of SGLT1 and GLUT2 mRNA Xiaozhen Song a,b,d,1, Jianqin Xu c,2, Tian Wang a,⁎,4, Fenghua Liu d,e,3,4 a College of Animal Science and Technology, Nanjing Agricultural University, Nanjing 210095, PR China b College of Animal Science and Technology, Jiangxi Agricultural University, Nanchang 330045, PR China c College of Veterinary Medicine, China Agricultural University, Beijing 100193, PR China d College of Animal Science and Technology, Beijing University of Agriculture, Beijing 102206, PR China e Beijing Metropolis Key Laboratory of Veterinary Medicine (Traditional Chinese Medicine), Beijing University of Agriculture,Beijing 102206, PR China article info abstract Article history: This study was conducted to investigate the effects of high temperature stressor on porcine growth Received 22 April 2008 performance, small intestinal absorption and SGLT1 and GLUT2 mRNA expressions, and probe the Received in revised form 4 November 2009 regulation of traditional Chinese medicine decoction (CMD) on them. Forty-eight 2-month-old Accepted 4 November 2009 Chinese experimental pigs were screened according to weight and litter origin, and then allotted to three groups and treated as follows: normal temperature Control group (Control; 23 °C), high Keywords: temperature stressor group (HS; 26 °C for 19 h, 40 °C for 5 h); Chinese medicine decoction anti- Chinese medicine decoction stressgroup(CMD;26°Cfor19h,40°Cfor5h)(n=16 per group). -

Reed Elsevier Capital Inc

O Electronic Proof This proof may not fit on letter-sized (8.5 x 11 inch) paper. If copy is cut off, please print to larger, e.g., legal-sized (8.5 x 14 inch) paper. Accuracy of proof is guaranteed ONLY if printed to a PostScript printer using the correct PostScript driver for that printer make and model. PROSPECTUS SUPPLEMENT (To Prospectus dated April 17, 2001) Reed Elsevier Capital Inc. $550,000,000 6.125% Notes due 2006 $550,000,000 6.750% Notes due 2011 4500,000,000 5.750% Notes due 2008 Fully and Unconditionally Guaranteed Jointly and Severally by Reed International P.L.C. and Elsevier NV This is an oÅering by Reed Elsevier Capital Inc. of an aggregate of $550,000,000 6.125% notes due 2006 (the ""U.S. Dollar 6.125% Notes''), an aggregate of $550,000,000 6.750% notes due 2011 (the ""U.S. Dollar 6.750% Notes,'' and together with the U.S. Dollar 6.125% Notes, the ""U.S. Dollar Notes'') and an aggregate of 4500,000,000 5.750% notes due 2008 (the ""Euro Notes,'' and together with the U.S. Dollar Notes, the ""Notes''). The Notes will be unsecured senior obligations of Reed Elsevier Capital Inc. and will be fully and unconditionally guaranteed jointly and severally by Reed International P.L.C. and Elsevier NV (the ""Guarantees''). Interest on the U.S. Dollar 6.125% Notes and the U.S. Dollar 6.750% Notes will be payable semi-annually on February 1 and August 1 of each year, beginning on February 1, 2002. -

Documentation Organique>Telecommunications Law>Legal Express>Law in Context>Butterworths Core Texts>E-Marketplace>Legal Express>Lawcommerce

140348 20-f cover_with spine 7/3/03 12:41 pm Page 1 Reed Elsevier Reed Elsevier www.reedelsevier.com Indispensable global information Science & Medical Legal Education Business Form 20-F ANNUAL REPORT 2002 ON FORM 20-F ANNUAL REPORT 2002 ON FORM CHEMWEB>BIOMEDNET>BIOCHIMICA ET BIOPHYSICA ACTA>EVOLVE>MDL INFORMATION SYSTEMS>SCIRUS>EXCERPTA MEDICA>THE LANCET>ELSEVIER>GRAY’S ANATOMY>SCIENCEDIRECT> ACADEMIC PRESS> CHURCHILL LIVINGSTONE>L’ANNEE BIOLOGIQUE>MOSBY>WB SAUNDERS>BRAIN RESEARCH>ONCOLOGY TODAY>TETRAHEDRON LETTERS>VASCULAR SURGERY>SCIRUS >PDXMD>CELL>JOURNAL OF THE AMERICAN COLLEGE OF CARDIOLOGY> NEUROSCIENCE>THE LANGUAGE OF MEDICINE>ENCYCLOPEDIA OF THE HUMAN BRAIN>VIRTUAL CLINICAL EXCURSION>EMBASE> EI> CHEMICAL PHYSICS LETTERS>POLYMER>NEURON> JOURNAL OF CHROMATOGRAPHY A>ACTA PSYCHOLOGICA> MD CONSULT> AMERICAN JOURNAL OF CARDIOLOGY> COMPUTER NETWORKS >DEVELOPMENTAL BIOLOGY> FEBS LETTERS> HOMEOPATHY>NEUROIMAGE>PHYSICA A>SPEECH COMMUNICATION>WATER RESEARCH> ZEOLITES>MATERIALS TODAY>RISKWISE>BUTTERWORTHS TOLLEY> MATTHEW BENDER> SHEPARD’S IN PRINT> MARTINDALE HUBBELL>LEXISNEXIS AT LEXIS.COM>MALAYAN LAW JOURNAL>LEXISNEXIS AT NEXIS.COM >CONOSUR>LEXPOLONICA>NIMMER ON COPYRIGHT>DEPALMA>MBO VERLAG>COLLIER>LITEC>PEOPLEWISE>EDITIONS DU JURIS CLASSEUR> ECLIPSE>MEALEY PUBLICATIONS>LEXISNEXIS COUNTRY ANALYSIS>CHECKCITE>LEXISONE>THE ADVERTISING RED BOOKS>HALSBURY’S LAWS > > > > > > > > Reed Elsevier DICTIONARY OF CORPORATE AFFILIATIONS ORAC VERLAG FACTLANE LEGISOFT INFOLIB LE BOTTIN ADMINISTRATIF CARTER ON CONTRACT AUSTRALIAN ENCYCLOPEDIA OF FORMS -

Documents on Display

As ¢led with the Securities and Exchange Commission on 13 March 2001 SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 (Mark One) & REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) or 12(g) OF THE SECURITIES EXCHANGE ACT OF 1934 or &6 ANNUAL REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the ¢scal year ended 31 December 2000 or & TRANSITION REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to Commission ¢le number: 1-3334 REED INTERNATIONAL P.L.C. ELSEVIER NV (Exact name of Registrant as speci¢ed in its charter) (Exact name of Registrant as speci¢ed in its charter) England The Netherlands (Jurisdiction of incorporation or organisation) (Jurisdiction of incorporation or organisation) 25 Victoria Street Van de Sande Bakhuyzenstraat 4 London SW1H 0EX 1061 AG Amsterdam England The Netherlands (Address of principal executive o¤ces) (Address of principal executive o¤ces) Securities registered or to be registered pursuant to section 12(b) of the Act: Title of each class Name of exchange on which registered Reed International P.L.C.: American Depositary Shares (each representing four Reed International P.L.C. ordinary shares) New York Stock Exchange Ordinary shares of 12.5p each (the ``Reed International ordinary shares'') New York Stock Exchange* Elsevier NV: American Depositary Shares (each representing two Elsevier NV ordinary shares) New York Stock Exchange Ordinary shares of k0.06 each (the ``Elsevier ordinary shares'') New York Stock Exchange* * Listed, not for trading, but only in connection with the listing of the applicable Registrant's American Depositary Shares issued in respect thereof. -

Doctor • Kelly’S Directories • Farmers’ Weekly • Totaljobs.Com

ANNUAL REPORT 2001 ON FORM 20-F Reed Elsevier ELSEVIER SCIENCE • SCIENCEDIRECT • CHEMWEB • BIOMEDNET • MDL INFORMATION SYSTEMS • SCIRUS • EXCERPTA MEDICA • THE LANCET • GRAY’S ANATOMY • ACADEMIC PRESS • CHURCHILL LIVINGSTONE • MOSBY • WB SAUNDERS • CELL • BRAIN RESEARCH • ONCOLOGY TODAY • TETRAHEDRON LETTERS • VASCULAR SURGERY • ENCYCLOPEDIA OF GENETICS • LEXISNEXIS • BUTTERWORTHS TOLLEY • MATTHEW BENDER • SHEPARD’S • MARTINDALE HUBBELL • LEXIS.COM • NEXIS.COM • EDITIONS DU JURIS CLASSEUR • MALAYAN LAW JOURNAL • DEPALMA • CONOSUR • NIMMER ON COPYRIGHT • HALSBURY’S LAWS • MOORE’S FEDERAL PRACTICE • HARCOURT SCHOOL PUBLISHERS • LEX POLONICA • RIGBY • HEINEMANN • GINN • GREENWOOD • HOLT RINEHARTFORM AND WINSTON 20-F • STECK-VAUGHN • THE PSYCHOLOGICAL CORPORATION • WECHSLER TEST • HI.COM.AU • STANFORD ACHIEVEMENT TEST • WECHSLER INTELLIGENCE SERIES • HARCOURT EDUCATIONAL MEASUREMENT • ELECTRONIC() DESIGN NEWS • VARIETY • RESTAURANTS & INSTITUTIONS • COMPUTER WEEKLY • COMMUNITY CARE • NEW SCIENTIST • FLIGHT INTERNATIONAL • ESTATES GAZETTE • CNI.COM • RATI.COM • ELSEVIER • BELEGGERS BELANGEN • BIZZ • ZIBB.NL • TOERISTIEK • MIDEM • WORLD TRAVEL MARKET • HOTELYMPIA • BATIMAT • BOOKEXPO • STRATEGIES • MIPCOM • DOCTOR • KELLY’S DIRECTORIES • FARMERS’ WEEKLY • TOTALJOBS.COM Indispensable global information SCIENCE LEGAL EDUCATION BUSINESS & MEDICAL As ¢led with the Securities and Exchange Commission on 5 March 2002 SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 (Mark One) & REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) or 12(g) OF THE SECURITIES EXCHANGE ACT OF 1934 or &6 ANNUAL REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the ¢scal year ended 31 December 2001 or & TRANSITION REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to Commission ¢le number: 1-3334 REED INTERNATIONAL P.L.C. -

A Common Biochemical Pattern in Preneoplastic Hepatocyte Nodules Generated in Four Different Models in the Rat1

[CANCER RESEARCH 45. 564-571, February 1985] A Common Biochemical Pattern in Preneoplastic Hepatocyte Nodules Generated in Four Different Models in the Rat1 M. W. Roomi,2 R. K. Ho,3 D. S. R. Sarma, and E. Farber Departments of Pathology [M. W. R., R. K. H., D. S. R. S., E. F.] and Biochemistry [E. F.], University ol Toronto, Toronto, Ontario, Canada M5S 1A8 ABSTRACT Because of the central and presumably critical role of hepa tocyte nodules in the development of liver cancer in the rat (28), Hepatocyte nodules, structures consistently seen in every it was considered important to understand much more about model of liver carcinogenesis well before the first appearance of their biochemical properties. Initial orientation was given to the cancer, were examined with respect to some Phase I and Phase search for a possible biochemical basis for the resistance phe II components considered to be important in the metabolism of notype that allows for the genesis of nodules in the resistant carcinogens and other xenobiotics. Phase I components are hepatocyte model of liver carcinogenesis (24,26). The resistance those related to the metabolism of xenobiotics and include phenotype is expressed in this model in an obvious manner by microsomal cytochromes P-450 and mixed-function oxygenase the ability of altered hepatocytes, induced during initiation by activities. Phase II components are those related to the conju carcinogens, to proliferate to form nodules in the presence of a gation and detoxification reactions of xenobiotics and their me dose of a carcinogen that inhibits the proliferation of the majority tabolites and include glutathione S-transferases and glutathione. -

Efficacy of Venom Immunotherapy Given Every 3 Or 4 Months: A

Ann Allergy Asthma Immunol 110 (2013) 51e54 Contents lists available at SciVerse ScienceDirect Efficacy of venom immunotherapy given every 3 or 4 months: a prospective comparison with the conventional regimen y z Livio Simioni, MD *; Alberto Vianello, MD *; Patrizia Bonadonna, MD ; Guido Marcer, MD ; x { z z Maurizio Severino, MD ; Mauro Pagani, MD ; Luca Morlin, MD ; Mariangiola Crivellaro, MD ; and jj Giovanni Passalacqua, MD * Allergy and Clin. Immunology, Internal Medicine Department, “S. Maria del Prato” Feltre Hospital, Italy y Allergy Unit, Verona General Hospital, Verona, Italy z Occupational and Environmental Medicine, University of Padua, Padua, Italy x Allergy Clinic, Nuovo Ospedale San Giovanni di Dio, Florence, Italy { Allergy and Oncology Unit, Asola Hospital, Asola, Italy jj Allergy and Respiratory Diseases, DIMI, University of Genoa, Genoa, Italy ARTICLE INFO ABSTRACT Article history: Background: Standard venom immunotherapy involves the administration of the maintenance dose every 4 Received for publication April 12, 2012. to 6 weeks. This regimen may have adherence problems, especially in the long term; thus, extended Received in revised form September 2, 2012. intervals have been proposed. Accepted for publication September 18, Objective: We prospectively compared the efficacy of 3- or 4-month extended maintenance dose vs the 2012. conventional regimen. Methods: Patients receiving immunotherapy with a single venom were offered the extended maintenance dose (EMD) and were then followed up for field re-stings. Only the re-stings by the insect for which the patients received immunotherapy were considered. A comparable group of patients receiving the conven- tional maintenance dose (CMD) was used for comparison by logistic regression analysis. -

Relative Frequency of Congenital Muscular Dystrophy Subtypes: Analysis of the UK Diagnostic Service 2001–2008

Available online at www.sciencedirect.com Neuromuscular Disorders 22 (2012) 522–527 www.elsevier.com/locate/nmd Relative frequency of congenital muscular dystrophy subtypes: Analysis of the UK diagnostic service 2001–2008 E.M. Clement a, L. Feng a, R. Mein b, C.A. Sewry a, S.A. Robb a, A.Y. Manzur a, E. Mercuri a,c, C. Godfrey a, T. Cullup b, S. Abbs b, F. Muntoni a,⇑ a Dubowitz Neuromuscular Centre, Institute of Child Health and Great Ormond Street Hospital, London WC1N 1EH, United Kingdom b DNA Laboratory, GSTS Pathology, Genetics Centre, Guy’s Hospital, London, United Kingdom c Department of Child Neurology, Catholic University, Rome, Italy Received 29 November 2011; accepted 26 January 2012 Abstract The Dubowitz Neuromuscular Centre is the UK National Commissioning Group referral centre for congenital muscular dystrophy (CMD). This retrospective review reports the diagnostic outcome of 214 UK patients referred to the centre for assessment of ‘possible CMD’ between 2001 and 2008 with a view to commenting on the variety of disorders seen and the relative frequency of CMD subtypes in this patient population. A genetic diagnosis was reached in 53 of 116 patients fulfilling a strict criteria for the diagnosis of CMD. Within this group the most common diagnoses were collagen VI related disorders (19%), dystroglycanopathy (12%) and merosin deficient congenital muscular dystrophy (10%). Among the patients referred as ‘possible CMD’ that did not meet our inclusion criteria, congenital myopathies and congenital myasthenic syndromes were the most common diagnoses. In this large study on CMD the diagnostic outcomes compared favourably with other CMD population studies, indicating the importance of an integrated clinical and pathological assessment of this group of patients. -

Download History Book

Construction Specifications Canada — Fifty Years of Serving the Construction Industry Copyright © 2005 Construction Specifications Canada. All rights reserved. This book may not be duplicated in any way without the expressed written consent of Construction Specifications Canada, 120 Carlton Street, Suite 312, Toronto, ON, M5A 4K2. Tel: (416) 777-2198, Fax: (416) 777-2197, E-mail: [email protected], Web: www.csc-dcc.ca. ISBN 0-9738215-0-7 Editor and Production Manager: Lori Brooks Editorial Consultant: Katherine Coy, WORDworks Communications Writers: Randy Threndyle, Janice Walls, John Jensen, FCSC Cover design: Contact Graphics History Committee Members: Ian Bartlett, FCSC, RSW; Fred Clarke, FCSC; John Jensen, FCSC; Dinshaw Kanga, FCSC; Sandro Ubaldino, RSW; Nick Franjic, CAE; Lori Brooks, Stephanie Grant Table of Contents Dedication/Dédicace .......................................i Mission Statement/Énoncé de mission ..............................ii Acknowledgments/Remerciements................................iii Foreword/Avant-propos .....................................ix Genesis: 1954-1963 ......................................1 Governance................................................... 1 Magazine .................................................... 3 Membership .................................................. 5 Profiles ..................................................... 6 Spec Innovations................................................ 16 Technology .................................................. 24 Education ..................................................