Documents on Display

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

December 2011 ISSN: 0195-4857

TECHNICAL SERVICE S LAW LIBRARIAN Volume 37 No. 2 http://www.aallnet.org/sis/tssis/tsll/ December 2011 ISSN: 0195-4857 INSIDE: Management From the Officers Do We Mean It or Does OBS-SIS ..................................... 4 Mary Lippold TS-SIS ........................................ 3 It Just Sound Good? South Texas College of Law Announcements These columns will be about some of the management issues that I ponder over. Seeking Nominations for the Renee I’ll be writing about those things that confuse me, that just don’t seem to make D. Chapman Memorial Award ... 5 sense to me, while occasionally throwing in a little bit about what experts who are Joint Research Grant ................ 16 much smarter than I are saying. So while there will be questions - lots of questions, Marla Schwartz Grant .............. 22 musings, and plenty of my personal opinions, I can pretty much guarantee there will be no answers. Columns Acquisitions ............................... 6 “Team” is a big word in the library world. We like the idea of our library staff being Classification .............................. 7 a team and working as a team to meet our goals and mission. We say we value Collection Development ............ 8 “team work” and people who are “team players.” But wait-- it’s now performance Description & Entry ................. 12 review time and no one is talking much about teams. We ask people what their The Internet .............................. 14 goals are for the coming year and to list their accomplishments and successes of Management ............................... 1 the past year. So if we’re all about teamwork, why do we still evaluate and reward OCLC ....................................... 16 individual performance? Are we talking the talk, but not walking the walk? Preservation ............................. -

Evaluating the Impact of Concentration on Anti-Fungal Property of CEM Cement

Evaluating the impact of concentration on anti-fungal property of CEM cement 514 Evaluación del impacto de la concentración en las propiedades antifúngicas del cemento CEM Fatemeh Ayatollahi1, Mahdi Tabrizizadeh2, Hossein Sadeghi Tafti3, Sara Rashidian4, Ali Arab Sheibani5* 1Assistant Professor, Department of Endodontics, Dental Faculty, ShahidSadoughi University of Medical Sciences, Yazd, Iran. https://orcid.org/0000-0002-9304-0081 2Professor, Department of Endodontics, Dental Faculty, Yazd ShahidSadoughi University of Medical Sciences, Yazd, Iran. https://orcid.org/0000-0002-0413-5805 3Medical mycologist, Department of Paramedical, Yazd ShahidSadoughi University of Medical Sciences, Yazd, Iran. https://orcid.org/0000-0001-7840-7319 4Medical mycologist, Department of Medical, Yazd ShahidSadoughi University of Medical Sciences. Yazd, Iran. https://orcid.org/0000-0001-7492-1011 5Dentist, Faculty of Dentistry, DaheyeFajrBoulv, Imam Ave, Yazd, Iran. https://orcid.org/0000-0001-7271-6049 *corresponding author: Ali Arab Sheibani, Faculty of Dentistry, DaheyeFajrBoulv, Imam Ave, Yazd, Iran, Tel: 09135163050 - Fax: 035-36212222 Email: [email protected] Resumen Abstract nti-fungal property is regarded as one a propiedad antifúngica se considera una de of the appropriate proprieties of ret- las propiedades apropiadas de los materiales rograde filing materials. It has been de presentación retrógrada. Se ha encontra- found that the anti-fungal property of MTA is influenced do que la propiedad antifúngica de MTA está influenciada by its concentration. The objective of current research was por su concentración. El objetivo de la investigación actual to evaluate the impact of concentration on anti-fungal fue evaluar el impacto de la concentración en las propie- property of CEM cement .The anti-fungal properties of dades antifúngicas del cemento CEM. -

A Ten-Year Bibliometric Analysis of the Journal Review of Palaeobotany and Palynology (2003 – 2012) Saravanan G Mr

University of Nebraska - Lincoln DigitalCommons@University of Nebraska - Lincoln Library Philosophy and Practice (e-journal) Libraries at University of Nebraska-Lincoln 5-12-2014 A ten-year bibliometric analysis of the journal Review of Palaeobotany and Palynology (2003 – 2012) Saravanan G Mr. French Institute of Pondicherry, [email protected] saravanan g Mr. Ph. D. Scholar, Department of Library and Information Science, Karpagam University, Coimbatore, [email protected] Dominic J Dr. Karunya University, Coimbatore, [email protected] Follow this and additional works at: http://digitalcommons.unl.edu/libphilprac Part of the Library and Information Science Commons G, Saravanan Mr.; g, saravanan Mr.; and J, Dominic Dr., "A ten-year bibliometric analysis of the journal Review of Palaeobotany and Palynology (2003 – 2012)" (2014). Library Philosophy and Practice (e-journal). 1109. http://digitalcommons.unl.edu/libphilprac/1109 A ten-year bibliometric analysis of the journal Review of Palaeobotany and Palynology (2003 – 2012) G. Saravanan 1 and J. Dominic 2 1Librarian, French Institute of Pondicherry, # 11, Saint Louis Street, Pondicherry - 605 001, India & Ph. D. Scholar, Department of Library and Information Science, Karpagam University, Coimbatore – 641 021, Tamil Nadu, India, Email: [email protected] 2University Librarian, Karunya University, Coimbatore - 641 114, Tamil Nadu, India, Email: [email protected] ABSTRACT The present work is a bibliometric analysis of a leading journal in Palaeobotany and Palynology, ‘Review of Palaeobotany and Palynology’. The study, based on Web of Science TM as the tool reveals that 1821 authors have contributed 903 papers during the years 2003 to 2012. Our analysis includes the publications output, exponential growth rate, authorship patterns, collaborative co-efficient and prolific authors, country wise and organization- wise distribution of contributions. -

Mapping the Literature of GIS

Mapping the Literature of GIS Edith A. Scarletto This study analyzed citations in four journals, Annals of the Association of American Geographers, Cartography and Geographic Information Science, International Journal of Geographical Information Science, and Cartographic Journal, using Bradford’s Law of Scattering to identify three influence zones indicating core and peripheral titles in the study areas of GIS. Journals were ranked resulting in twenty-three core journals and 187 secondary journals. Scores for relevant indexing/abstracting services are also given to describe access points and coverage. The results can assist librarians and collection managers to support research in their institutions where GIS is both used and studied. cademic librarians have tra- to support research and to contribute ditionally fit emerging dis- additional knowledge to their discipline. ciplines into their existing Academic libraries support research by structure, and Geography collecting and providing access to journal and Map Librarians (among others) have literature in their institutions. The chal- integrated Geographic Information Sci- lenge of selecting journals is exacerbated ence (GIS) into their duties as quickly as as budgets shrink and is especially dif- faculty and students have adopted them. ficult for a multidisciplinary research The ARL (Association of Research Librar- area like GIS. ies) GIS Literacy Project began during the This article examines and creates a early 1990s to recognize the increasing list of the GIS journals in three ranked interest in GIS, and several SPEC KITS zones of influence using Bradford’s Law have been issued about its support includ- of Scattering.4 Analyzing citations in four ing Davie1 and Salem.2 Using a working source journals, Annals of the Association definition from the Encyclopedia of GIS, of American Geographers, Cartography and GIS is “knowledge acquired through Geographic Information Science, Interna- processing geographically referenced tional Journal of Geographical Information data. -

Databases Available in the National Institute of Standards and Technology Research Library

4TL INST. OF STAND & TECH R.I.C. ' '3|l¥?#^i?!SS#)l* ^'^"^ lllllilllillllll AlllOS MQSflD? PUBLICATIONS United States Department of Commerce Technology Administration Nisr National Institute of Standards and Technology NIST Special Publication 909 Databases Available in the National Institute of Standards and Technology Research Library Diane Cunningham NIST Special Publication 909 Databases Available in the National Institute of Standards and Technology Research Library Diane Cunningham Office of Information Services National Institute of Standards and Technology Gaithersburg, MD 20899-0001 December 1996 Supersedes NIST Special Publication 895 (December 1995) U.S. Department of Commerce Michael Kantor, Secretary Technology Administration Mary L. Good, Under Secretary for Technology National Institute of Standards and Technology Arati Prabhakar, Director National Institute of Standards U.S. Government Printing Office For sale by the Superintendent and Technology Washington: 1 996 of Documents Sf)ecial Publication 909 U.S. Government Printing Office Natl. Inst. Stand. Technol. Washington, DC 20402-9325 Spec. Publ. 909 Supersedes NIST Spec. Publ. 895 146 pages (Dec. 1996) CODEN: NSPUE2 FOREWORD The mission of the Office of Information Services (OIS) is "to create and implement a coordinated, cohesive NIST-wide plan of action which supports NIST's mission by identifying, collecting, organizing, and disseminating knowledge from all appropriate sources and types to as broad an audience as possible and desirable." In fulfilling this mission, the OIS NIST Research Library collects and supports information resources regardless of the form in which they appear or the source from which they emanate. Recognizing that the NIST Research Library cannot collect all knowledge, it seeks to augment its collections by identifying and providing access to a broad variety of bibliographic and full-text databases. -

BULLETIN Union Internationale De Spéléologie Volume 62-1 - June 2020

BULLETIN Union Internationale de Spéléologie Volume 62-1 - June 2020 COVID-19 ADVANCING SPELEOLOGY IN THE AGE OF COVID-19 ALSO IN THIS ISSUE • News about the International Year of Caves and Karst 2021 • UIS BULLETIN: Complete collection now available • First international cave animal of the year • UIS Prizes 2021: Call for nominations • Special issue of the INTERNATIONAL JOURNAL OF SPELEOLOGY: Call for papers • 18th ICS: Newsletter Nº 2 available and more... BULLETIN Union Internationale de Spéléologie TABLE OF CONTENTS BULLETIN Editorial: Uplifting Energy is Required .......................................................................... 3 Official publication of the UIS for publicizing the activities of the UIS and the state of the art of The President’s Column: Advancing Speleology in the age of COVID-19 ............ 4 international speleology - ©2020 International Year of Caves and Karst 2021: EDITOR IN CHIEF How to use and edit promotional material ................................................. 6 Efraín MERCADO (Puerto Rico) UIS Bulletin: Complete collection now available ...................................................... 9 GRAPHICS EDITOR Nivaldo COLZATO (Brazil) Special issue of the International Journal of Speleology: Call for papers ....... 11 DISCLAIMER UIS Prizes 2021: Call for nominations ........................................................................ 12 The views and opinions expressed in this bulletin are those of the authors and do not necessarily reflect The first international cave animal of the year -

Participating Publishers

Participating Publishers 1105 Media, Inc. AB Academic Publishers Academy of Financial Services 1454119 Ontario Ltd. DBA Teach Magazine ABC-CLIO Ebook Collection Academy of Legal Studies in Business 24 Images Abel Publication Services, Inc. Academy of Management 360 Youth LLC, DBA Alloy Education Aberdeen Journals Ltd Academy of Marketing Science 3media Group Limited Aberdeen University Research Archive Academy of Marketing Science Review 3rd Wave Communications Pty Ltd Abertay Dundee Academy of Political Science 4Ward Corp. Ability Magazine Academy of Spirituality and Professional Excellence A C P Computer Publications Abingdon Press Access Intelligence, LLC A Capella Press Ablex Publishing Corporation Accessible Archives A J Press Aboriginal Multi-Media Society of Alberta (AMMSA) Accountants Publishing Co., Ltd. A&C Black Aboriginal Nurses Association of Canada Ace Bulletin (UK) A. Kroker About...Time Magazine, Inc. ACE Trust A. Press ACA International ACM-SIGMIS A. Zimmer Ltd. Academia Colombiana de Ciencias Exactas, Fisicas y Acontecimiento A.A. Balkema Publishers Naturales Acoustic Emission Group A.I. Root Company Academia de Ciencias Luventicus Acoustical Publications, Inc. A.K. Peters Academia de las Artes y las Ciencias Acoustical Society of America A.M. Best Company, Inc. Cinematográficas de España ACTA Press A.P. Publications Ltd. Academia Nacional de la Historia Action Communications, Inc. A.S. Pratt & Sons Academia Press Active Interest Media A.S.C.R. PRESS Academic Development Institute Active Living Magazine A/S Dagbladet Politiken Academic Press Acton Institute AANA Publishing, Inc. Academic Press Ltd. Actusnews AAP Information Services Pty. Ltd. Academica Press Acumen Publishing Aarhus University Press Academy of Accounting Historians AD NieuwsMedia BV AATSEEL of the U.S. -

Specialist Bibliographic Databases

SPECIAL ARTICLE Editing, Writing & Publishing http://dx.doi.org/10.3346/jkms.2016.31.5.660 • J Korean Med Sci 2016; 31: 660-673 Specialist Bibliographic Databases Armen Yuri Gasparyan,1 Specialist bibliographic databases offer essential online tools for researchers and authors Marlen Yessirkepov,2 who work on specific subjects and perform comprehensive and systematic syntheses of Alexander A. Voronov,3 evidence. This article presents examples of the established specialist databases, which may Vladimir I. Trukhachev,4 be of interest to those engaged in multidisciplinary science communication. Access to most 5 6 Elena I. Kostyukova, Alexey N. Gerasimov, specialist databases is through subscription schemes and membership in professional 1,7 and George D. Kitas associations. Several aggregators of information and database vendors, such as EBSCOhost 1Departments of Rheumatology and Research and and ProQuest, facilitate advanced searches supported by specialist keyword thesauri. Development, Dudley Group NHS Foundation Trust Searches of items through specialist databases are complementary to those through (Teaching Trust of the University of Birmingham, multidisciplinary research platforms, such as PubMed, Web of Science, and Google UK), Russells Hall Hospital, Dudley, West Midlands, Scholar. Familiarizing with the functional characteristics of biomedical and nonbiomedical UK; 2Department of Biochemistry, Biology and Microbiology, South Kazakhstan State bibliographic search tools is mandatory for researchers, authors, editors, and publishers. Pharmaceutical Academy, Shymkent, Kazakhstan; The database users are offered updates of the indexed journal lists, abstracts, author 3Department of Marketing and Trade Deals, Kuban profiles, and links to other metadata. Editors and publishers may find particularly useful State University, Krasnodar, Russian Federation; source selection criteria and apply for coverage of their peer-reviewed journals and grey 4Department of Technological Management, Stavropol State Agrarian University, Stavropol, literature sources. -

Scopus Content Coverage Guide

Content Coverage Guide Open to accelerate science Contents 1. Introduction 4 1.1 Scopus – an overview .................................................................................................................................................. 4 1.2 Content Selection & Advisory Board (CSAB) ........................................................................................................ 6 1.3 Purpose and scope of this Content Coverage Guide (CCG) ................................................................................. 6 2. Coverage of Source Types 7 2.1 Serial Source Types ..................................................................................................................................................... 7 Journals ..................................................................................................................................................................... 7 Trade journals .......................................................................................................................................................... 7 Book series ............................................................................................................................................................... 7 Conference material ................................................................................................................................................ 8 2.2 Non-serial sources .....................................................................................................................................................10 -

Engineering Village Quick Reference Guide

Engineering Village Quick Reference Guide Version: 2.0 Last updated: 30-September 2020 Engineering Village Quick Reference Guide This user guide provides on overview of the most frequently used Engineering Village search options, to help you improve efficiency, productivity and facilitate important discoveries more easily. www.engineeringvillage.com blog.engineeringvillage.com @engvillage Quick Reference Summary Search Online Help Search for an exact phrase by using double quotation marks or brackets: "rocket propulsion laboratory" {rocket propulsion laboratory} Search within a specific field using WN "wearable technology" WN TI and video WN AB AB - abstract KY - subject/title/abstract TI - title ST - serial title (journal name) AU - author AF - author affiliation LA - language CV - controlled term (index/thesaurus term) YR - year CO - country of publication Boolean Connectors NOT - excludes terms from a document or field. AND - terms exist together within a document or field. AND narrows the number of documents retrieved. OR - each term can exist separately within a document or field. OR expands the number of documents retrieved. Connectors are evaluated in the order specified above - NOT then AND then OR. Use parentheses to search compound or nested Boolean statements ("jet propulsion" OR "rocket propulsion") AND engine* Proximity The NEAR operator searches for terms in proximity without regard to the order of the terms. It can be used with or without a proximity number to indicate the distance between words (default is 4). NEAR cannot be used with truncation, wildcards, parentheses, braces or quotation marks. solar NEAR energy (solar within 4 words of energy) wind NEAR/3 power (wind within 3 words of power) energy NEAR/0 policy (energy next to policy) Additional Tips Engineering Village searches are not case-sensitive. -

The Congenital and Limb-Girdle Muscular Dystrophies Sharpening the Focus, Blurring the Boundaries

NEUROLOGICAL REVIEW SECTION EDITOR: DAVID E. PLEASURE, MD The Congenital and Limb-Girdle Muscular Dystrophies Sharpening the Focus, Blurring the Boundaries Janbernd Kirschner, MD; Carsten G. Bo¨nnemann, MD uring the past decade, outstanding progress in the areas of congenital and limb- girdle muscular dystrophies has led to staggering clinical and genetic complexity. With the identification of an increasing number of genetic defects, individual enti- ties have come into sharper focus and new pathogenic mechanisms for muscular dys- Dtrophies, like defects of posttranslational O-linked glycosylation, have been discovered. At the same time, this progress blurs the traditional boundaries between the categories of congenital and limb- girdle muscular dystrophies, as well as between limb-girdle muscular dystrophies and other clini- cal entities, as mutations in genes such as fukutin-related protein, dysferlin, caveolin-3 and lamin A/C can cause a striking variety of phenotypes. We reviewed the different groups of proteins cur- rently recognized as being involved in congenital and limb-girdle muscular dystrophies, associ- ated them with the clinical phenotypes, and determined some clinical and molecular clues that are helpful in the diagnostic approach to these patients. Arch Neurol. 2004;61:189-199 Muscular dystrophies were first recog- phy. The age at onset may range from early nized as a disease entity with the detailed childhood to late adulthood.5 description of the clinical presentation of During the past decade, exciting Duchenne muscular dystrophy in 1852 and progress has been made in the field of CMD thereafter.1,2 About 50 years later, Batten3 and LGMD, emphasizing differences as published the first case reports of a con- well as commonalities between them. -

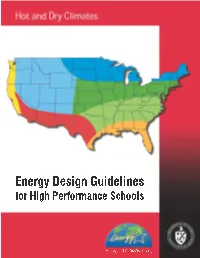

Energy Design Guidelines for High Performance Schools: Hot and Dry

Hot and Dry Climates Acknowledgements This document was The US Department of Energy would like to acknowledge the help and assistance developed by the National of the EnergySmart Schools team and the many reviewers that provided input and Renewable Energy feedback during the process of developing the report. Those include: Laboratory, with subcontractor Innovative Ren Anderson, Kate Darby, Kyra Epstein, Patty Kappaz, Bryan King, and Patricia Plympton, National Design. Technical assistance Renewable Energy Laboratory; Greg Andrews, Ken Baker, Chip Larson, Bill Mixon, and Sue Seifert, Rebuild America Products and Services; Dariush Arasteh and Doug Avery, Lawrence Berkeley National came from Padia Consulting, Laboratory; David Ashley, Ashley McGraw Architects, P.C; Michael Baechler, Kim Fowler, Eric BuildingGreen, and the Richman, and David Winiarski, Pacific Northwest National Laboratory; Robin Bailey, Texas State Sustainable Buildings Energy Office; Tony Bartorillo, TRACO; Michael Boyd, TechBrite; Bill Brenner, National Institute of Building Sciences; George Churchill, Oregon Office of Energy; Peter D'Antonio, Sarnafil, Inc.; David Industry Council. DePerro, Cutler-Hammer; John Devine and Peter Dreyfuss, US DOE — Chicago Regional Office; Mary Jo Dutra, SAFE-BIDCO; Charles Eley, Eley Associates; Mark Halverson, Building America; David Hansen, George James, and Arun Vohra, US DOE; Richard Heinisch, Lithonia Lighting Co.; Fred Hoover, Maryland Energy Administration; Dana Johnson, Environmental Support Solutions; Mark Kelley, Hickory Consortium;