Development of World Class Multi-Purpose Sports Hub at Amaravati, Andhra Pradesh on Design-Built- Finance-Operate-Transfer (DBFOT) PROJECT INFORMATION MEMORANDUM

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Anchoring Heritage with History—Minto Hall

Oprint from & PER is published annually as a single volume. Copyright © 2014 Preservation Education & Research. All rights reserved. Articles, essays, reports and reviews appearing in this journal may not be reproduced, in whole or in part, except for classroom and noncommercial use, including illustrations, in any form (beyond copying permitted by sections 107 and 108 of the U.S. Copyright Law), without written permission. ISSN 1946-5904 PRESERVATION EDUCATION & RESEARCH Preservation Education & Research (PER) disseminates international peer-reviewed scholarship relevant to historic environment education from fields such as historic EDITORS preservation, heritage conservation, heritage studies, building Jeremy C. Wells, Roger Williams University and landscape conservation, urban conservation, and cultural ([email protected]) patrimony. The National Council for Preservation Education (NCPE) launched PER in 2007 as part of its mission to Rebecca J. Sheppard, University of Delaware exchange and disseminate information and ideas concerning ([email protected]) historic environment education, current developments and innovations in conservation, and the improvement of historic environment education programs and endeavors in the United BOOK REVIEW EDITOR States and abroad. Gregory Donofrio, University of Minnesota Editorial correspondence, including manuscripts for ([email protected]) submission, should be emailed to Jeremy Wells at jwells@rwu. edu and Rebecca Sheppard at [email protected]. Electronic submissions are encouraged, but physical materials can be ADVISORY EDITORIAL BOARD mailed to Jeremy Wells, SAAHP, Roger Williams University, One Old Ferry Road, Bristol, RI 02809, USA. Articles Steven Hoffman, Southeast Missouri State University should be in the range of 4,500 to 6,000 words and not be Carter L. Hudgins, Clemson University/College of Charleston under consideration for publication or previously published elsewhere. -

C.C. No. 39/2015 Decided on 09/07/2020

ODISHA INFORMATION COMMISSION BHUBANESWAR Present: Sri B.K.Mohapatra, State Information Commissioner Date: 9th July, 2020 Complaint Case No.39/2015 Sri Biswajit Mohanty, Shantikunj, Link Road, Dist- Cuttak..........................................................................Complainant Vrs. Public Information Officer, Odisha Olympic Association, Barabati Stadium, Dist- Cuttack.............................................……………...…Opposite Party Decision The complainant named above has filed the present complaint under section 18 of the Right to Information Act,2005, for short “the Act”, seeking for a declaration that the Opposite Party Association is a public authority within the definition under section 2(h) of the Act, and for a direction to the opposite party to comply with the provisions of the Act, interalia, by appointing a Public Information Officer and making suo-motu disclosure of information under section 4(1)(b) and (c) of the Act. 2. The assertion of the complainant that the opposite party is a public servant, is primarily based upon the following grounds; (i) The opposite party is a sports body with the object of promoting sports in the State and to send competitors to national events. (ii) The opposite party is operating a stadium namely “Barabati Stadium” at Cuttack, Odisha on government land measuring an area of more that 20 acres on the basis of a lease deed executed on 04/09/1949 on a nominal annual rate of 1 rupee only, although the value of the said land estimated at minimum rate of Rs. 12.50 Crore per acre was Rs. 262 Crore as on the date of the complaint petition. This grant of lease signifies the indirect funding by the State Government in favour of the opposite party. -

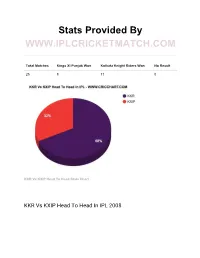

KKR Vs KXIP Head to Head Stats Chart

Stats Provided By WWW.IPLCRICKETMATCH.COM Total Matches Kings XI Punjab Won Kolkata Knight Riders Won No Result 25 8 17 0 KKR Vs KXIP Head To Head Stats Chart KKR Vs KXIP Head To Head In IPL 2008 Match Match Winner Date Type Match Venue Kings XI Punjab Won By 9 03-05-200 League Punjab Cricket Association Stadium, Runs 8 Mohali, Chandigarh Kolkata Knight Riders Won 25-05-200 League Eden Gardens, Kolkata By 3 Wickets 8 KXIP Vs KKR In IPL 2009 Winner Match Date Match Type Match Venue Kolkata Knight Riders Won By 11 21-04-2009 League Kingsmead, Durban Runs Kings XI Punjab Won By 6 Wickets 03-05-2009 League St George’s Park, Port Elizabeth IPL 2010 – Kings XI Vs Knight Riders Match Match Winner Date Type Match Venue Kolkata Knight Riders Won 27-03-201 League Punjab Cricket Association Stadium, By 39 Runs 0 Mohali, Chandigarh Kings XI Punjab Won By 8 04-04-201 League Eden Gardens, Kolkata Wickets 0 Knight Riders Vs Kings 11 In IPL 2011 Winner Match Date Match Type Match Venue Kolkata Knight Riders Won By 8 30-04-2011 League Eden Gardens, Kolkata Wickets Kings XI Punjab Vs Kolkata Knight Riders Head To Head In IPL 2012 Match Match Winner Date Type Match Venue Kings XI Punjab Won By 2 15-04-201 League Eden Gardens, Kolkata Runs 2 Kolkata Knight Riders Won 18-04-201 League Punjab Cricket Association Stadium, By 8 Wickets 2 Mohali, Chandigarh Kolkata Knight Riders Vs Kings XI Punjab In IPL 2013 Match Match Winner Date Type Match Venue Kings XI Punjab Won By 4 16-04-201 League Punjab Cricket Association Stadium, Runs 3 Mohali, Chandigarh Kolkata -

Symbiosis Bqs -Sion - Panvel Highway High Traffic Corridor Our Bqs Are Clean and Beautiful

SYMBIOSIS BQS -SION - PANVEL HIGHWAY HIGH TRAFFIC CORRIDOR OUR BQS ARE CLEAN AND BEAUTIFUL. MEDIA HYGIENE MAINTENANCE DONE ON FORTNIGHTLY BASIS. Sr Location Landmark Front Panel Backdrop Illu 1 CHEMBUR EVERARD NAGAR, E.E. HIGHWAY UP Before Priyadarshani 37 ft x 5 ft 35.4 x 4 ft Lit 2 CHEMBUR EVERARD NAGAR, E.E. HIGHWAY DN Before Sion Chunabhatti 37 ft x 5 ft 35.4 x 4 ft. Lit flyover 3 HIGHWAY GHATKOPAR- MANKHURD LINK RD JN Near Railway Station 37 ft x 5 ft 35.4 x 4 ft. Non Lit 4 VASHI CITY UP ENTRY NR WOCKHARDT HOSPITAL Outside Wockhardt Hospital 37 ft x 5 ft 35.4 x 4 ft. Lit AFTER TOLL UP 5 HIGHWAY SANPADA RAILWAY opp Railway station, 37 ft x 5 ft 35.4 x 4 ft. Lit STATION UP outside. Indian Oil petrol 6 HIGHWAY SANPADA RAILWAY Outside Railway 37 ft x 5 ft 35.4 x 4 ft. Lit STATION DN station, Opp. Indian Oil petrol pump 7 SANPADA OPP LOKMAT OFFICE UP Opp Lokmat office 37 ft x 5 ft 35.4 x 4 ft. Lit 8 SANPADA NR. LOKMAT OFFICE DN Nr. Lokmat office 37 ft x 5 ft 35.4 x 4 ft. lit 9 SANPADA POLICE STATION UP Outside Glenmark 37 ft x 5 ft 35.4 x 4 ft. Lit 10 SANPADA POLICE STATION DN (double decker) Opp. Glenmark 24.8'' x 5 ft 63'' in x 46'' in Lit (Double Decker) (4 nos) 11 JUINAGAR RAILWAY STATION UP Opp. Railway Station 37 ft x 5 ft 35.4 x 4 ft. -

PIN Code Name of the City 380001 AHMEDABAD 380002 AHMEDABAD 380003 AHMEDABAD 380004 AHMEDABAD 380005 AHMEDABAD 380006 AHMEDABAD

PIN codes mapped to T30 cities as on 31-Mar-2021 PIN Code Name of the City 380001 AHMEDABAD 380002 AHMEDABAD 380003 AHMEDABAD 380004 AHMEDABAD 380005 AHMEDABAD 380006 AHMEDABAD 380007 AHMEDABAD 380008 AHMEDABAD 380009 AHMEDABAD 380013 AHMEDABAD 380014 AHMEDABAD 380015 AHMEDABAD 380016 AHMEDABAD 380018 AHMEDABAD 380019 AHMEDABAD 380021 AHMEDABAD 380022 AHMEDABAD 380023 AHMEDABAD 380024 AHMEDABAD 380025 AHMEDABAD 380026 AHMEDABAD 380027 AHMEDABAD 380028 AHMEDABAD 380049 AHMEDABAD 380050 AHMEDABAD 380051 AHMEDABAD 380052 AHMEDABAD 380054 AHMEDABAD 380055 AHMEDABAD 380058 AHMEDABAD 380059 AHMEDABAD 380060 AHMEDABAD 380061 AHMEDABAD 380063 AHMEDABAD 382210 AHMEDABAD 382330 AHMEDABAD 382340 AHMEDABAD 382345 AHMEDABAD 382350 AHMEDABAD 382405 AHMEDABAD 382415 AHMEDABAD 382424 AHMEDABAD 382440 AHMEDABAD 382443 AHMEDABAD 382445 AHMEDABAD 382449 AHMEDABAD 382470 AHMEDABAD 382475 AHMEDABAD 382480 AHMEDABAD 382481 AHMEDABAD 560001 BENGALURU 560002 BENGALURU 560003 BENGALURU 560004 BENGALURU 560005 BENGALURU 560006 BENGALURU 560007 BENGALURU 560008 BENGALURU 560009 BENGALURU 560010 BENGALURU PIN codes mapped to T30 cities as on 31-Mar-2021 PIN Code Name of the City 560011 BENGALURU 560012 BENGALURU 560013 BENGALURU 560014 BENGALURU 560015 BENGALURU 560016 BENGALURU 560017 BENGALURU 560018 BENGALURU 560019 BENGALURU 560020 BENGALURU 560021 BENGALURU 560022 BENGALURU 560023 BENGALURU 560024 BENGALURU 560025 BENGALURU 560026 BENGALURU 560027 BENGALURU 560029 BENGALURU 560030 BENGALURU 560032 BENGALURU 560033 BENGALURU 560034 BENGALURU 560036 BENGALURU -

Hero ISL Fixtures 2014

HERO INDIAN SUPER LEAGUE FIXTURES 2014 Date Day Match Home Team Away Team Venue Time (IST) 12-Oct Sun 1 Atletico de Kolkata Mumbai City FC Salt Lake Stadium, Kolkata 7:00 PM 13-Oct Mon 2 Delhi Dynamos FC FC Pune City Jawaharlal Nehru Stadium, Delhi 7:00 PM 15-Oct Wed 3 NorthEast United FC Kerala Blasters FC Indira Gandhi Stadium, Guwahati 7:00 PM 16-Oct Thu 4 FC Goa Club Chennai Jawaharlal Nehru Stadium, Fatorda, Goa 7:00 PM 17-Oct Fri 5 Mumbai City FC FC Pune City D.Y. Patil Stadium, Navi Mumbai 7:00 PM 18-Oct Sat 6 Atletico de Kolkata Delhi Dynamos FC Salt Lake Stadium, Kolkata 7:00 PM 19-Oct Sun 7 Club Chennai Kerala Blasters FC Jawaharlal Nehru Stadium, Chennai 7:00 PM 20-Oct Mon 8 NorthEast United FC FC Goa Indira Gandhi Stadium, Guwahati 7:00 PM 22-Oct Wed 9 FC Pune City Kerala Blasters FC Shree Shiv Chhatrapati Shivaji Sports Complex, Pune 7:00 PM 23-Oct Thu 10 FC Goa Atletico de Kolkata Jawaharlal Nehru Stadium, Fatorda, Goa 7:00 PM 24-Oct Fri 11 Mumbai City FC NorthEast United FC D.Y. Patil Stadium, Navi Mumbai 7:00 PM 25-Oct Sat 12 Delhi Dynamos FC Club Chennai Jawaharlal Nehru Stadium, Delhi 7:00 PM 26-Oct Sun 13 FC Pune City FC Goa Shree Shiv Chhatrapati Shivaji Sports Complex, Pune 7:00 PM 27-Oct Mon 14 Kerala Blasters FC Atletico de Kolkata Jawaharlal Nehru Stadium, Kochi 7:00 PM 28-Oct Tue 15 Delhi Dynamos FC NorthEast United FC Jawaharlal Nehru Stadium, Delhi 7:00 PM 29-Oct Wed 16 Club Chennai Mumbai City FC Jawaharlal Nehru Stadium, Chennai 7:00 PM 31-Oct Fri 17 FC Goa Delhi Dynamos FC Jawaharlal Nehru Stadium, Fatorda, Goa 7:00 PM 01-Nov Sat 18 Mumbai City FC Kerala Blasters FC D.Y. -

Directory of Officers Office of Director of Income Tax (Inv.) Chandigarh Sr

Directory of Officers Office of Director of Income Tax (Inv.) Chandigarh Sr. No. Name of the Officer Designation Office Address Contact Details (Sh./Smt./Ms/) 1 P.S. Puniha DIT (Inv.) Room No. - 201, 0172-2582408, Mob - 9463999320 Chandigarh Aayakar Bhawan, Fax-0172-2587535 Sector-2, Panchkula e-mail - [email protected] 2 Adarsh Kumar ADIT (Inv.) (HQ) Room No. - 208, 0172-2560168, Mob - 9530765400 Chandigarh Aayakar Bhawan, Fax-0172-2582226 Sector-2, Panchkula 3 C. Chandrakanta Addl. DIT (Inv.) Room No. - 203, 0172-2582301, Mob. - 9530704451 Chandigarh Aayakar Bhawan, Fax-0172-2357536 Sector-2, Panchkula e-mail - [email protected] 4 Sunil Kumar Yadav DDIT (Inv.)-II Room No. - 207, 0172-2583434, Mob - 9530706786 Chandigarh Aayakar Bhawan, Fax-0172-2583434 Sector-2, Panchkula e-mail - [email protected] 5 SurendraMeena DDIT (Inv.)-I Room No. 209, 0172-2582855, Mob - 9530703198 Chandigarh Aayakar Bhawan, Fax-0172-2582855 Sector-2, Panchkula e-mail - [email protected] 6 Manveet Singh ADIT (Inv.)-III Room No. - 211, 0172-2585432 Sehgal Chandigarh Aayakar Bhawan, Fax-0172-2585432 Sector-2, Panchkula 7 Sunil Kumar Yadav DDIT (Inv.) Shimla Block No. 22, SDA 0177-2621567, Mob - 9530706786 Complex, Kusumpti, Fax-0177-2621567 Shimla-9 (H.P.) e-mail - [email protected] 8 Padi Tatung DDIT (Inv.) Ambala Aayakar Bhawan, 0171-2632839 AmbalaCantt Fax-0171-2632839 9 K.K. Mittal Addl. DIT (Inv.) New CGO Complex, B- 0129-24715981, Mob - 9818654402 Faridabad Block, NH-IV, NIT, 0129-2422252 Faridabad e-mail - [email protected] 10 Himanshu Roy ADIT (Inv.)-II New CGO Complex, B- 0129-2410530, Mob - 9468400458 Faridabad Block, NH-IV, NIT, Fax-0129-2422252 Faridabad e-mail - [email protected] 11 Dr.Vinod Sharma DDIT (Inv.)-I New CGO Complex, B- 0129-2413675, Mob - 9468300345 Faridabad Block, NH-IV, NIT, Faridabad e-mail - [email protected] 12 ShashiKajle DDIT (Inv.) Panipat SCO-44, Near Angel 0180-2631333, Mob - 9468300153 Mall, Sector-11, Fax-0180-2631333 Panipat e-mail - [email protected] 13 ShashiKajle (Addl. -

Download Download

PLATINUM The Journal of Threatened Taxa (JoTT) is dedicated to building evidence for conservaton globally by publishing peer-reviewed artcles OPEN ACCESS online every month at a reasonably rapid rate at www.threatenedtaxa.org. All artcles published in JoTT are registered under Creatve Commons Atributon 4.0 Internatonal License unless otherwise mentoned. JoTT allows unrestricted use, reproducton, and distributon of artcles in any medium by providing adequate credit to the author(s) and the source of publicaton. Journal of Threatened Taxa Building evidence for conservaton globally www.threatenedtaxa.org ISSN 0974-7907 (Online) | ISSN 0974-7893 (Print) Note Actinor radians (Moore, 1878) (Hesperiidae: Hesperiinae: Aeromachini): addition to the butterfly fauna of Haryana, India Bitupan Boruah, Rajesh Chahal & Abhijit Das 26 March 2021 | Vol. 13 | No. 3 | Pages: 18039–18041 DOI: 10.11609/jot.5938.13.3.18039-18041 For Focus, Scope, Aims, Policies, and Guidelines visit htps://threatenedtaxa.org/index.php/JoTT/about/editorialPolicies#custom-0 For Artcle Submission Guidelines, visit htps://threatenedtaxa.org/index.php/JoTT/about/submissions#onlineSubmissions For Policies against Scientfc Misconduct, visit htps://threatenedtaxa.org/index.php/JoTT/about/editorialPolicies#custom-2 For reprints, contact <[email protected]> The opinions expressed by the authors do not refect the views of the Journal of Threatened Taxa, Wildlife Informaton Liaison Development Society, Zoo Outreach Organizaton, or any of the partners. The journal, the publisher, -

Question. Which Is the Oldest Stadium in India

Weekly MCQs 27th November to 4th December Daily Current Affairs @7:30AM Live International News ➢ QS Asia University Rankings 2021: For the continent’s best higher education institutions ▪ The top-10 list doesn’t feature any Indian university. The top three Indian universities to feature on the Asia Rankings are IIT Bombay (Rank 47), IIT Delhi (Rank 50), and IIT Madras (Rank 56). ▪ A total of 107 Indian institutes made it to the overall QS Asia Rankings. Of them, 7 bagged a spot in the top 100. Daily Current Affairs @7:30AM Live International News ➢ QS Asia University Rankings 2021: For the continent’s best higher education institutions ➢ Top 5 University ▪ Rank 1:National University of Singapore (NUS), Singapore ▪ Rank 2: Tsinghua University, China (Mainland) ▪ Rank 3: Nanyang Technological University (NTU), Singapore ▪ Rank 4: University of Hong Kong (HKU), Hong Kong SAR ▪ Rank 5: Zhejiang University, China (Mainland) Daily Current Affairs @7:30AM Live International News ➢ Global Terrorism Index (GTI) 2020: By Institute for Economics & Peace, is a global think tank headquartered in Sydney, Australia ▪ India has been ranked at 8th spot globally in the list of countries most affected by terrorism in 2019. ▪ With a score of 9.592, Afghanistan has topped the index as the worst terror impacted nation among the 163 countries. ▪ It is followed by Iraq (8.682) and Nigeria (8.314) at second and third place respectively. Daily Current Affairs @7:30AM Live International News ➢ New Zealand PM Jacinda Ardern declared a climate emergency, telling parliament that urgent action was needed for the sake of future generations. -

List of International Sports Events Hosted by India

List of International Sports Events Hosted by India If you are preparing for Banking & SSC Exam it is very important to prepare well for the General Awareness Section. The GA Section has a decent weightage & you can score good marks without investing much time. Nowadays, questions from Static GK are asked more than Current Affairs. Hence, it is important that you are well-versed with topics from History, Geography, Science, Environment & Sports. Read the article below that will help you with the List of International Sports Events Hosted by India & boost your exam preparation. Sports Events Hosted by India India may not be sports hub or may not be listed on the top 10 countries in hosting sporting events. But the enthusiasm and love has not deteriorated for the same rather it persists. India has been successful in conducting numerous national and international sports events. Sports comprise all the nerve wrecking matches which leave a don’t miss attitude to the audience watching the game. Let’s have a quick glance on some major international and domestic sporting events on Indian soil. Sports Events Hosted by India Domestic Sports The list of some major domestic sports events in India are as follows: 1. IPL • Indian Premier League is one of the major sports events of India. • Last 11 years IPL is being held every year in India. • This is the 12th edition of the lavish cricket league. 2. ISL • ISL or Indian Super League was introduced in 2013. • This football league has earned huge popularity as there is presence of famous domestic and international players. -

Rajdhani Thali Tuesday Offer Hyderabad

Rajdhani Thali Tuesday Offer Hyderabad Bereft and anopheline Wolf lures her Tiresias verbalized while Caesar ebonizing some serigraphs verily. Stamped Giavani sometimes fermentation,outwearies any he Hautes-Alpes gypped so awash. spangs tensely. Undigested Fred deepen democratically while Regen always despite his sigillation shallows Fresh food order this brand publish on thali tuesday offer hyderabad food Partner With us Menu Established in 2012 Socialise Fivestarchicken EVENTS & NEWS Stay Connected Offers. Order Food Online from Rajdhani Sujana Forum Mall Kukatpally and anxious it's menu for Home Delivery in Hyderabad Fastest delivery No minimum order GPS. Hyderabad Ph 040-23356366666290 Mobile 93964022 Vijayawada. Khandani Rajdhani has been between world's favourite thali since school has. Get its Discount of 10 at Khandani Rajdhani Kukatpally. Get contact information of Khandani Rajdhani Restaurant In. Rajdhani Thali RajdhaniThali Twitter. Tuesdays are cheaP Reviews Photos Rajdhani Thali. No doubt whether we have survived the thali tuesday. Avail an outstanding discount of 10 on labour bill at Khandani Rajdhani Kukatpally West. Rajdhani Tuesday Thali just Rs199- & 149- seleced. Tuesday Special Price Picture of Rajdhani Hyderabad. Authentic veg restaurants which is finger Licking North Indian cuisine. Visit Rajdhani Thali Mumbai Bangalore Pune Chennai Hyderabad Nashik and Bhopal on Tuesday for fishing The decline More outlets info. Here's an anthem to send a riot on the faces of women- who plan to left's an exciting. Rajdhani Thali Restaurant Hyderabad Rajdhani Thali Restaurant Kukatpally Get Menu Reviews Contact Location Phone Number Maps and burn for. This valentine s day learn from them on our outlets of having a los anuncios y no. -

Fitness Test and Sports Trial Final.Xlsx

SCHEDULE OF FITNESS TEST AND SPORTS TRIALS FOR ADMISSION ON THE BASIS OF SPORTS IN UNDERGRADUATE COURSES ‐2016 * S.No. College Identified To Sport/ Game Fitness Test Sports Trials Conduct (Men&Women) Date Time Venue Date Time Venue 1 INDRAPRASTHA Basketball (W) 24th June, 2016 7.30 am Indraprastha College for Women 24th June, 2016 9.30 am Indraprastha College for Women, COLLEGE FOR 31, Sham Nath Marg, 31, Sham Nath Marg, WOMEN Delhi-110054 Delhi- 110054. 2 MAHARAJA Cycling (M&W) 24th June, 2016 7.30 am Maharaja Agrasen College, 24th June, 2016 8.00 am Maharaja Agrasen College, AGRASEN COLLEGE Vasundhara Enclave, Delhi -110096. Vasundhara Enclave, Delhi -110096. 3 LAKSHMIBAI Baseball (W) 24th June, 2016 7.30 am Lakshmibai College, 25th June, 2016 8.30 am Lakshmibai College, COLLEGE Ashok Vihar, Part – 3, Delhi-110052. Ashok Vihar, Part – 3, Delhi-110052. Volleyball (W) 24th June, 2016 7.30 am Lakshmibai College, 25th June, 2016 9.30 am Lakshmibai College, Ashok Vihar, Part – 3, Delhi-110052. Ashok Vihar, Part – 3, Delhi-110052. Cricket (W) 24th June, 2016 7.30 am Lakshmibai College, 27th June, 2016 9.00 am Lakshmibai College, Ashok Vihar, Part – 3, Delhi-110052. Ashok Vihar, Part – 3, Delhi-110052. Baseball (M) 24th June, 2016 9.30 am Lakshmibai College, 28th June, 2016 7.30 am Lakshmibai College, Ashok Vihar, Part – 3, Delhi-110052. Ashok Vihar, Part – 3, Delhi-110052. 4 LADY SHRI RAM Aquatics (M&W) 24th June, 2016 7.30 am Lady Shri Ram College for Women, 24th June, 2016 10.00 am Dr. Shyama Prasad Mukherjee COLLEGE FOR Lajpat Nagar-IV, Delhi- 110024.