C O N Fe Re N C E N O Te S OPEC Conference Decides to Maintain

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Algeria Upstream OG Report.Pub

ALGERIA UPSTREAM OIL & GAS REPORT Completed by: M. Smith, Sr. Commercial Officer, K. Achab, Sr. Commercial Specialist, and B. Olinger, Research Assistant Introduction Regulatory Environment Current Market Trends Technical Barriers to Trade and More Competitive Landscape Upcoming Events Best Prospects for U.S. Exporters Industry Resources Introduction Oil and gas have long been the backbone of the Algerian economy thanks to its vast oil and gas reserves, favorable geology, and new opportunities for both conventional and unconventional discovery/production. Unfortunately, the collapse in oil prices beginning in 2014 and the transition to spot market pricing for natural gas over the last three years revealed the weaknesses of this economic model. Because Algeria has not meaningfully diversified its economy since 2014, oil and gas production is even more essential than ever before to the government’s revenue base and political stability. Today’s conjoined global health and economic crises, coupled with persistent declining production levels, have therefore placed Algeria’s oil and gas industry, and the country, at a critical juncture where it requires ample foreign investment and effective technology transfer. One path to the future includes undertaking new oil and gas projects in partnership with international companies (large and small) to revitalize production. The other path, marked by inertia and institutional resistance to change, leads to oil and gas production levels in ten years that will be half of today's production levels. After two decades of autocracy, Algeria’s recent passage of a New Hydrocarbons Law seems to indicate that the country may choose the path of partnership by profoundly changing its tax and investment laws in the hydrocarbons sector to re-attract international oil companies. -

A Comparative History of Oil and Gas Markets and Prices: Is 2020 Just an Extreme Cyclical Event Or an Acceleration of the Energy Transition?

April 2020 A Comparative History of Oil and Gas Markets and Prices: is 2020 just an extreme cyclical event or an acceleration of the energy transition? Introduction Natural gas markets have gone through an unprecedented transformation. Demand growth for this relatively clean, plentiful, versatile and now relatively cheap fuel has been increasing faster than for other fossil fuels.1 Historically a `poor relation’ of oil, gas is now taking centre stage. New markets, pricing mechanisms and benchmarks are being developed, and it is only natural to be curious about the direction these developments are taking. The oil industry has had a particularly rich and well recorded history, making it potentially useful for comparison. However, oil and gas are very different fuels and compete in different markets. Their paths of evolution will very much depend on what happens in the markets for energy sources with which they compete. Their history is rich with dominant companies, government intervention and cycles of boom and bust. A common denominator of virtually all energy industries is a tendency towards natural monopoly because they have characteristics that make such monopolies common. 2 Energy projects tend to require multibillion – often tens of billions of - investments with long gestation periods, with assets that can only be used for very specific purposes and usually, for very long-time periods. Natural monopolies are generally resolved either by new entrants breaking their integrated market structures or by government regulation. Historically, both have occurred in oil and gas markets.3 As we shall show, new entrants into the oil market in the 1960s led to increased supply at lower prices, and higher royalties, resulting in the collapse of control by the major oil companies. -

FIRST QUARTER RESULTS January – March 2020

FIRST QUARTER RESULTS January – March 2020 CONTENTS: 1. Highlights 2. Backlog 3. Consolidated Income Statement 4. Consolidated Balance Sheet Appendix: Alternative Performance Metrics First Quarter Results January – March 2020 1. MAIN HIGHLIGHTS ▪ Backlog of €10.9 billion ▪ Q1 2020 Order intake of €1.9 billion ▪ Sales at €1,181 million ▪ Operating profit (EBIT) at €23.7 million, with a 2.0% EBIT margin ▪ Net profit at €8.7 million ▪ Net cash position of €419 million Backlog at the end of March stood at €10.9 billion. In Q1 2020, the main award added to the backlog was the important refining project for Sonatrach at Haoud el-Hamra, Hassi Messaoud (Algeria), with a value of $2 billion for Técnicas Reunidas. Total sales reached €1,181 million in Q1 2020, growing 29% versus Q1 2019. Sales in the last month of the quarter were slightly affected by Covid-19 disruptions. Q1 2020 EBIT was €23.7 million, that compares to the Q1 2019 EBIT of €10.6 million, with an increase of 124% year on year. Growth in operating profit was favoured by the contribution of newer projects with healthier margins and despite the slowdown of project execution due to Covid in the last month of the quarter. Net profit in Q1 2020 reached €8.7 million, a 134% higher than in the same period of last year. Net cash position at the end of March stood at €419 million. The healthy cash position reflects the maintenance of a good progress in working capital, with no cash downpayments being received in the quarter. -

The In-Salah CCS Experience

The First International Conference on the Clean Development Mechanism Riyadh, Saudi Arabia (The Intercontinental Hotel) 26-28 Shaaban, 1427, 19-21 September 2006 EU-OPEC Roundtable on Carbon Dioxide Capture & Storage.. Session 2: Prospects of CCS in OPEC Member Countries and the EU. TheThe In-SalahIn-Salah CCSCCS experienceexperience Sonatrach,Sonatrach, AlgeriaAlgeria RedouaneRedouane HADDADJIHADDADJI Sonatrach,Sonatrach, AlgeriaAlgeria 1 1 / 34 SonatrachSonatrach && ClimateClimate ChangeChange 2 2 / 34 WhoWho isis SonatrachSonatrach ?? Created in 1963 232 Million TOE produced in 2005. Processing Capacity z Liquefaction of NG : 45 Mm3/year z LPG Separation : 9.1 MT/year In Salah z Refining : 21.3 MT/year Transportation Network z 14 500 Km of oil, gas LPG and condensate pipelines 3 / 34 WhoWho isis SonatrachSonatrach ?? Sonatrach is the Algerian National Oil & Gas company z 11th largest oil company z 1st African company z 3rd largest NG exporter z 1st largest LNG exporter 4 / 34 EnvironmentalEnvironmental protectionprotection atat SonatrachSonatrach Sonatrach adopted few years ago; an ambitious Heath, Safety & Environmental (HSE) Policy. It shows a strong commitment to protect the Environment and to contribute to the sustainable development effort of the country. One of the main environmental objectives of Sonatrach is reducing atmospheric pollution including greenhouse gases 5 / 34 SonatrachSonatrach’’ss effortsefforts toto tackletackle climateclimate changechange Associated gas flaring reduction Carbon Capture & Storage projects program Voluntary projects Voluntary efforts since 1970 z First experience: In Salah gas Project GGFR member (CDM project) z Second experience: Gassi -Touil Integrated Project Flaring rates of associated gas 1995 - 2005 35% 33% 31% 30% 29% 25% 23% 20% 20% 17% 15% 13% 13% 11% 9% 10% 7% 5% 0% 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 6 / 34 InIn SalahSalah GasGas ProjectProject 7 7 / 34 InIn SalahSalah GasGas ProjectProject In Salah Gas (ISG) is a Joint Venture between : z Sonatrach (35%), z BP (33%) z Statoil (32%). -

Rising to Iran's Challenge

RISING TO IRAN’S CHALLENGE GCC Military Capability and U.S. Security Cooperation Michael Knights Policy Focus 127 | June 2013 THE WASHINGTON INSTITUTE FOR NEAR EAST POLICY RISING TO IRAN’S CHALLENGE GCC Military Capability and U.S. Security Cooperation Michael Knights Policy Focus 127 | June 2013 All rights reserved. Printed in the United States of America. No part of this publication may be reproduced or transmitted in any form or by any means, electronic or mechanical, including photocopy, recording, or any information storage and retrieval system, without permission in writing from the publisher. © 2013 by The Washington Institute for Near East Policy Published in 2013 in the United States of America by The Washington Institute for Near East Policy, 1828 L Street NW, Suite 1050, Washington, DC 20036. Cover photo: UAE, Italian, Bahraini, and U.S. armed forces sight in on a mock target while performing a Visit, Board, Search, and Seizure demonstration at the Port of Zayed area in Abu Dhabi, UAE, as part of Exercise Leading Edge 13, January 2013. Leading Edge 13 military-to-military engagements are intended to sharpen capabilities among nations in an effort to foster relationships and build regional security. (USMC photo/MSgt. Salvatore Cardella) CONTENTS The Author v Acknowledgments vii Executive Summary ix 1 | Introduction 1 2 | SWOT Analysis of the Gulf Militaries 7 3 | Key Missions for GCC Allies 23 4 | Implications for U.S. Security Cooperation 37 THE AUTHOR MICHAEL KNIGHTS is a Lafer fellow at the Washington Institute for Near East Policy, specializing in the military and security affairs of Iraq, Iran, Libya, Yemen, and the Gulf states. -

Saudi Aramco by the Numbers

making a difference Annual Review 2010 Table of contents Introduction ......................................................................... 10 Exploration ........................................................................... 18 Oil Operations ..................................................................... 22 Gas Operations .................................................................. 28 Refining & Petrochemicals .......................................... 34 Table of Research & Technology ................................................. 40 Transportation & Distribution ..................................... 48 contents Human Resources ............................................................ 54 Safety & Health ................................................................. 62 Communities ....................................................................... 68 Corporate Citizenship ...................................................... 72 Awards ................................................................................... 84 Saudi Aramco by the Numbers ................................ 88 A Saudi Aramco engineer checks pressure on a propane-transfer pump at a company gas plant. Making a difference Saudi Saudi Aramco Aramco Annual Review Annual Review 2010 2010 2 1 Saudi Saudi Aramco Aramco Annual Review The Custodian of the Two Holy Mosques HIS ROYAL HIGHNESS AMIR SULTAN Annual Review 2010 2010 2 King ‘Abd AllAH IBN ‘Abd Al-’Aziz Al SA’ud IBN ‘ABD AL-’AZIZ AL SA’UD 3 The Crown Prince, Deputy Prime Minister, -

Maritime Boundary Agreements 172 6.1 Introduction 172 6.2 Saudi-Bahrain 1958 Agreement 172 6.2.1 Historic Background 174 6.2.2 Boundary Delimitation 176

Durham E-Theses Maritime boundary delimitation of the kingdom of Saudi Arabia a study in political geography Al-Muwaled, Faraj Mobarak Jam'an How to cite: Al-Muwaled, Faraj Mobarak Jam'an (1993) Maritime boundary delimitation of the kingdom of Saudi Arabia a study in political geography, Durham theses, Durham University. Available at Durham E-Theses Online: http://etheses.dur.ac.uk/10368/ Use policy The full-text may be used and/or reproduced, and given to third parties in any format or medium, without prior permission or charge, for personal research or study, educational, or not-for-prot purposes provided that: • a full bibliographic reference is made to the original source • a link is made to the metadata record in Durham E-Theses • the full-text is not changed in any way The full-text must not be sold in any format or medium without the formal permission of the copyright holders. Please consult the full Durham E-Theses policy for further details. Academic Support Oce, Durham University, University Oce, Old Elvet, Durham DH1 3HP e-mail: [email protected] Tel: +44 0191 334 6107 http://etheses.dur.ac.uk 2 MARITIME BOUNDARY DELIMITATION OF THE KINGDOM OF SAUDI ARABIA A STUDY IN POLITICAL GEOGRAPHY Fara.i Mobarak Jam'an AI-Muwaled The copyright of this thesis rests with the author. No quotation from it should be published without his prior written consent and information derived from it should be acknowledged. Thesis submitted for the Degree of Doctor of Philosophy in Social Science in the Department of Geography, Faculty of Social Sciences, University of Durham, U.K. -

University of Bradford Ethesis

A Possible Framework for Analysing National Security. The Saudi Arabian Perspective. Item Type Thesis Authors Nasif, Mahmoud Abdullah Rights <a rel="license" href="http://creativecommons.org/licenses/ by-nc-nd/3.0/"><img alt="Creative Commons License" style="border-width:0" src="http://i.creativecommons.org/l/by- nc-nd/3.0/88x31.png" /></a><br />The University of Bradford theses are licenced under a <a rel="license" href="http:// creativecommons.org/licenses/by-nc-nd/3.0/">Creative Commons Licence</a>. Download date 27/09/2021 15:48:31 Link to Item http://hdl.handle.net/10454/7272 University of Bradford eThesis This thesis is hosted in Bradford Scholars – The University of Bradford Open Access repository. Visit the repository for full metadata or to contact the repository team © University of Bradford. This work is licenced for reuse under a Creative Commons Licence. A Possible Framework for Analysing National Security The Saudi Arabian Perspective Mahmoud Abdullah NASIF Submitted for the Degree of Doctor of Philosophy School of Social and International Studies University of Bradford 2014 i M. A. NASIF A Possible Framework for Analysing National Security The Saudi Arabian Perspective ii Abstract This study will focus on explaining the dynamics of Saudi Arabia’s national security. In explaining these dynamics, the study will consider two of Buzan’s frameworks for analysing national security. Further enhancement will be given by conceptualising specific assumptions about Saudi Arabia’s national security – these will be based on the manner in which certain features are utilised within the Saudi state. Semi- structured interviews will be utilised to examine the findings from the adapted frameworks. -

New Intelligent Completion System Enables Compartment-Level Control in Multilateral Wells

TECHNOLOGY UPDATE New Intelligent Completion System Enables Compartment-Level Control in Multilateral Wells Stephen Dyer, SPE, Schlumberger, and Brett Bouldin, SPE, Saudi Aramco Although early inflow control devices tight formations and a shortage of suit- ration and Petroleum Engineering Cen- and intelligent completions (ICs) were able surface locations drove the need to ter Advanced Research Center issued an introduced almost 20 years ago, comple- dramatically increase reservoir contact industry challenge in 2007 requesting tion technology has not kept pace with per wellhead. an extreme reservoir contact (ERC) well advancements in drilling technology. Before 2007, the company had suc- containing 50 to 100 intelligent later- Today, wells completed in multilay- cessfully drilled and completed a num- als to efficiently drain the reservoir and ered reservoirs, multilaterals with com- ber of multilateral ERD wells, achieving ultimately maximize economic recovery. partments of varying pressure, and more than 5 km (16,400 ft) of reservoir The company’s goal since then has been extended-reach drilling (ERD) with well- contact per well. These maximum reser- to increase average reservoir contact to bores as long as 12 km are becoming com- voir contact (MRC) wells were completed approximately 10 km (32,800 ft). mon. In complex, hard-to-reach reservoirs with then state-of-the-art IC technolo- and tighter formations, operators need to gy. Completions consisted of permanent Next-Generation Technologies maximize reservoir contact in every well downhole gauges (PDGs) and downhole Saudi Aramco embarked on an 8-year col- to optimize reservoir drainage and mini- flow-control valves (FCVs), which could laboration with Schlumberger to develop mize costs. -

2005 Annual Report on Form 20-F

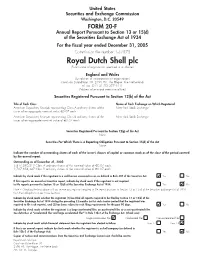

United States Securities and Exchange Commission Washington, D.C. 20549 FORM 20-F Annual Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 For the fiscal year ended December 31, 2005 Commission file number 1-32575 Royal Dutch Shell plc (Exact name of registrant as specified in its charter) England and Wales (Jurisdiction of incorporation or organisation) Carel van Bylandtlaan 30, 2596 HR, The Hague, The Netherlands tel. no: (011 31 70) 377 9111 (Address of principal executive offices) Securities Registered Pursuant to Section 12(b) of the Act Title of Each Class Name of Each Exchange on Which Registered American Depositary Receipts representing Class A ordinary shares of the New York Stock Exchange issuer of an aggregate nominal value €0.07 each American Depositary Receipts representing Class B ordinary shares of the New York Stock Exchange issuer of an aggregate nominal value of €0.07 each Securities Registered Pursuant to Section 12(g) of the Act None Securities For Which There is a Reporting Obligation Pursuant to Section 15(d) of the Act None Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report. Outstanding as of December 31, 2005: 3,817,240,213 Class A ordinary shares of the nominal value of €0.07 each. 2,707,858,347 Class B ordinary shares of the nominal value of €0.07 each. Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. -

Introduction 3/6/06 2:28 PM Page 1

01-7473-6 Introduction 3/6/06 2:28 PM Page 1 Introduction In most important oil-producing regions of the world, the oil industry has been nationalized. Ninety percent of the world’s oil reserves are entrusted to state-owned companies. The five national oil companies (NOCs) that are the focus of this book together produce one quarter of the world’s oil and hold one half of the world’s oil and gas reserves. What do we know about these oil titans? Do we understand how they operate and what drives them? Do they emphasize politics over profits? Do they have the technical and business skills to develop responsibly the immense petroleum resources entrusted to them? In spite of the dependence of importing countries’ economic fortunes on the performance of the NOCs of the Middle East and North Africa, outsiders know very little about these organizations. Their opacity has discouraged most analysis so far. However, after explaining my project, I was invited to meet with the managers of Saudi Aramco, the Kuwait Petroleum Corporation (KPC), the National Iranian Oil Company (NIOC), Sonatrach (Algeria) and the Abu Dhabi National Oil Company (ADNOC). They allowed extensive interviews to be conducted, demonstrating their interest in discussing both their past accomplishments and future challenges. These were fascinating dis- cussions, and this book will tell those companies’ stories. From the oil industry’s perspective, it is an important time to be studying NOCs. Many of them are emerging on the international scene, no longer con- fined to filling the shoes of the oil majors, which left when the host countries nationalized their oil sector. -

Frequently Asked Questions Platts Global Crude Oil Osps Latest Update: May 2021

Frequently Asked Questions Platts Global Crude Oil OSPs Latest update: May 2021 What is an Official Selling Price (OSP)? 2 What does an OSP premium (or discount) represent? 2 When are OSPs published? 2 How does Platts use OSPs? 2 www.spglobal.com/platts Frequently Asked Questions Platts Global Crude Oil OSPs: May 2021 as the spot price marker for crudes shipped to Asia and Brent Platts publishes both the monthly OSP differential once it is What is an Official Selling Price (OSP)? for crude oil shipped to Europe. Frequently, NOCs will release released and an outright price once the full pricing month has Many state-owned oil companies (NOCs) price crude oil sales to different OSPs for different refining regions. OSPs are normally passed. Using the example above, Platts will publish the August long-term customers using an official selling price (OSP) for each announced as a premium or discount to a monthly average OSP differentials for Arab Medium in July, but will not publish of their major crude streams. These OSPs are typically set by each for the relevant price markers. This differential is meant to the outright August OSP until the first working day of September, oil company on a monthly basis after an official meeting and then capture any differences in quality, supply and demand, and any once all days in August have been priced. circulated to long-term customers. OSPs are generally only sent to differences between the loading period of the crude oil being the registered lifters of the company’s crude grade, joint venture priced and the reference spot market.