Publication of the Offering Circular

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Involve Land Assembly and Land Banks

Land Assembly/Land Banks Strategy description Local governments and non-profits use land assembly or land banking to acquire individual plots of tax-foreclosed or vacant property and reassemble them into larger, more marketable parcels. While land banks generally are used in older urban communities with significant inventories of abandoned property, they also are useful for safeguarding healthy communities from deterioration, for protecting land from excessive gentrification, and for assembling land for significant government or private investment. Land banks can make property redevelopment feasible in downward economic cycles as a stimulus for reinvestment and can reserve land for targeted purposes in upward economic cycles. As compared with a community land trust, land banks generally hold land only temporarily, until sufficiently large parcels can be consolidated for redevelopment. History of the strategy Land banks were originally created over 30 years ago in response to growing numbers of vacant and abandoned properties in cities across the country. The earliest major land bank, the St. Louis Land Reutilization Authority, was created in 1971. Target population Land banks benefit the community generally, as formerly vacant or unused property, often a public health risk and an eyesore, becomes part of the community’s revitalization efforts. Affordable housing built on property acquired by land banks target low- and moderate-income renters and homebuyers. How the strategy is administered • Land banks are usually enabled by state legislation. The majority of land banks are government entities, housed in one or more city or state agency; others are separate corporations with their own board of directors. • Every land bank is designed to adapt to each specific community’s needs. -

Microplastics Pollution on Soft Shores in Hong Kong

This document is downloaded from Outstanding Academic Papers by Students (OAPS), Run Run Shaw Library, City University of Hong Kong. Title Microplastics pollution on soft shores in Hong Kong Author(s) Ng, Wing Yi (伍詠怡) Ng, W. Y. (2016). Microplastics pollution on soft shores in Hong Kong Citation (Outstanding Academic Papers by Students (OAPS), City University of Hong Kong). Issue Date 2016 URL http://dspace.cityu.edu.hk/handle/2031/85 This work is protected by copyright. Reproduction or distribution of Rights the work in any format is prohibited without written permission of the copyright owner. Access is unrestricted. CITY UNIVERSITY OF HONG KONG Department of Biology and Chemistry BSc (Hons) in Environmental Science and Management Project Report Microplastics Pollution on Soft Shores in Hong Kong By NG Wing Yi October 2016 1 _____________________________________________________________________________________________________________________________________________________ This document is downloaded from Outstanding Academic Papers by Students (OAPS), Run Run Shaw Library, City University of Hong Kong Table of content 1. Abstract ................................................................................................................................. 5 2. Introduction .......................................................................................................................... 6 2.1 Background of Microplastics Pollution.................................................................... 6 2.1.1 History of Microplastics -

Official Record of Proceedings

HONG KONG LEGISLATIVE COUNCIL — 17 May 1995 3719 OFFICIAL RECORD OF PROCEEDINGS Wednesday, 17 May 1995 The Council met at half-past Two o’clock PRESENT THE PRESIDENT THE HONOURABLE SIR JOHN SWAINE, C.B.E., LL.D., Q.C., J.P. THE CHIEF SECRETARY THE HONOURABLE MRS ANSON CHAN, C.B.E., J.P. THE FINANCIAL SECRETARY THE HONOURABLE SIR NATHANIEL WILLIAM HAMISH MACLEOD, K.B.E., J.P. THE ATTORNEY GENERAL THE HONOURABLE JEREMY FELL MATHEWS, C.M.G., J.P. THE HONOURABLE ALLEN LEE PENG-FEI, C.B.E., J.P. THE HONOURABLE MRS SELINA CHOW LIANG SHUK-YEE, O.B.E., J.P. THE HONOURABLE HUI YIN-FAT, O.B.E., J.P. THE HONOURABLE MARTIN LEE CHU-MING, Q.C., J.P. THE HONOURABLE PANG CHUN-HOI, M.B.E. THE HONOURABLE SZETO WAH THE HONOURABLE TAM YIU-CHUNG THE HONOURABLE ANDREW WONG WANG-FAT, O.B.E., J.P. THE HONOURABLE EDWARD HO SING-TIN, O.B.E., J.P. THE HONOURABLE RONALD JOSEPH ARCULLI, O.B.E., J.P. THE HONOURABLE MARTIN GILBERT BARROW, O.B.E., J.P. THE HONOURABLE MRS PEGGY LAM, O.B.E., J.P. THE HONOURABLE MRS MIRIAM LAU KIN-YEE, O.B.E., J.P. 3720 HONG KONG LEGISLATIVE COUNCIL — 17 May 1995 DR THE HONOURABLE LEONG CHE-HUNG, O.B.E., J.P. THE HONOURABLE JAMES DAVID MCGREGOR, O.B.E., I.S.O., J.P. THE HONOURABLE MRS ELSIE TU, C.B.E. THE HONOURABLE PETER WONG HONG-YUEN, O.B.E., J.P. THE HONOURABLE ALBERT CHAN WAI-YIP THE HONOURABLE VINCENT CHENG HOI-CHUEN, O.B.E., J.P. -

Ternational Cooperation Forum Hong Kong, 9-10 December 2015

th 5 EASA International Cooperation Forum Hong Kong, 9-10 December 2015 Practical information The Forum will take place at the Auditorium of Hong Kong Civil Aviation Department Headquarters (HKCAD HQ) on 9th December 2015 (09:00 to 18:00) and 10th December 2015 (09:00 to 16:00). Venue address: Auditorium (1st Floor) Civil Aviation Department Headquarters 1 Tung Fai Road, Hong Kong International Airport Lantau, Hong Kong Transportation from Tung Chung MTR Station and nearby hotels to HKCAD HQ: Taxi: Approximately HKD 40.00 / USD 5.00 Bus Route S1: - Bus fare HKD 3.50 - Location of the bus stop is just a few minutes’ walk from either the Tung Chung MTR station (Exit B) or the Regal Airport Hotel or the Hong Kong SkyCity Marriott Hotel. (Note: The Novotel Citygate Hong Kong Hotel is about 5 minutes’ walk from the Tung Chung MTR station.) The Auditorium is located in the public area of HKCAD HQ and no access pass is required. Delegates please proceed to the Registration Desk on the 1st floor, using an escalator located in the middle of the lobby, for the ICF/5 registration on 9th December 2015, before 09:00 a.m. Welcome tea and coffee will be served starting from 08:15 a.m. on the ground floor. Wi-Fi – please choose "CAD-Guest" network, and, once connected, open the browser and accept "Terms and Conditions" (no password required). Afterwards you can access the internet. Smoking is strictly prohibited in all areas in the HKCAD HQ. Delegates who wish to smoke, please approach the CAD staff for assistance. -

香港物業管理公司協會有限公司the Hong Kong Association of Property Management Companies Limited

香港物業管理公司協會有限公司 The Hong Kong Association of Property Management Companies Limited 會員轄下物業資料 Date : 2016-01-08 Members Portfolios Property Registers 會員編號 F-0060/99 公司名稱: 冠威管理有限公司 Membership No.: Company Name: Goodwill Management Limited 總樓宇面積 單位面積 (平方呎) 類別 物業名稱及地點 物業地址 類別/座數 單位數目 Unit Size GFA 樓齡 管理年數 Type Properties Properties Address Type/No. of Blocks No. of Units Min/Max Sq. Ft. Age Yrs.Managed C AIA Tower 183 Electric Road North Point HK 515645.00 17. 8 17. 8 C Dawning Views Plaza 23 Yat Ming Rd Fanling NT 96365.00 16. 7 16. 7 C Fanling Centre Shopping Arcade 33 San Wan Road Fanling NT 151513.00 25. 1 25. 1 C FWD Financial Centre 308-320 Des Voeux Rd C HK 225851.00 21. 3 21. 3 C Golden Centre 188 Des Voeux Rd Central HK 156562.00 24. 10 24. 10 C Grand Waterfront Plaza 38 San Ma Tau Street Ma Tau Kok KLN 147481.00 9. 2 8. 8 C Green Code Plaza 1 Ma Sik Road Fan Ling NT 136533.00 1. 6 0. 5 C Kolour.Tsuen Wan I 68 Chung On Street Tsuen Wan NT 394258.00 19. 4 19. 4 C Kolour.Tsuen Wan II 67-95 Market St Tsuen Wan NT 156369.00 25. 1 17. 8 C Kolour.Yuen Long 1 Kau Yuk Road Yuen Long NT 152948.00 21. 1 21. 1 C Kowloon Building 555 Nathan Rd Yau Ma Tei KLN 113384.00 28.0 16. 2 C Manhattan Plaza 23 Sai Ching St Yuen Long NT 48358.00 26. -

Sourcing Guide One-Stop Sourcing Fair with 900 Manufacturers

The 39th Jinhan Fair for Home & Gifts 21-27. 04. 2019 Poly World Trade Center Expo Guangzhou, China Sourcing Guide One-stop Sourcing Fair with 900 Manufacturers www.jinhanfair.com Facts & Figures Official Fair Name The 39th Jinhan Fair for Home & Gifts Opening Hours 21-26. 04. 2019 9:00 - 21:00 27. 04. 2019 9:00 - 16:00 Venue Poly World Trade Center Expo, Guangzhou (Opposite to Area B, Next to Area C of Canton Fair) Exhibition Area 85,000 m2 No. of Exhibitor 900 Organizer Guangzhou Poly Jinhan Exhibition Co., Ltd. Main Products Home Decorations Seasonal Decorations Outdoor & Gardening Series Decorative Furnitures Homeware & Textiles Fragrances & Personal Care Kitchen & Dining Giftware & Souvenirs Toys & Stationeries If you need any help, Please Contact us Alma Jian Tel: 13570273587 Ella Chung Tel: 13580346613 1 General Hall Plan Layout of Service Areas Home Decorations Seasonal Decorations Buyer Registration Buyer Lounge Metro Station R Location: East Gate, West Gate, B1F Location: Halls Lobby, 3, 5, 6 Location: B1F Halls Lobby, 1, 2, 3, 4, 6, Halls 3, 5, 6, Floral Gallery Information Counter Prayer Room Free Shuttle Bus Lighting Zone, Living Gallery, Floral Gallery Location: B1F, 1F, 2F, 3F Location: 2F Location: Gate E4, 1F VIP Card Registration Pacific Coffee Taxi Decorative Furnitures Giftware & Souvenirs Location: Hall 1 Location: B1F, 2F, 3F Location: North Entrance of Expo Halls Lobby, 1, 2, Living Gallery Halls 4, 5 Business Center Starbucks Coffee Booth Reservation Location: Hall 1 Location: 1F Location: Hall 1 Outdoor & Gardening -

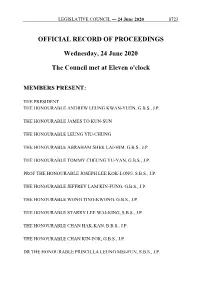

Official Record of Proceedings

LEGISLATIVE COUNCIL ― 24 June 2020 8723 OFFICIAL RECORD OF PROCEEDINGS Wednesday, 24 June 2020 The Council met at Eleven o'clock MEMBERS PRESENT: THE PRESIDENT THE HONOURABLE ANDREW LEUNG KWAN-YUEN, G.B.S., J.P. THE HONOURABLE JAMES TO KUN-SUN THE HONOURABLE LEUNG YIU-CHUNG THE HONOURABLE ABRAHAM SHEK LAI-HIM, G.B.S., J.P. THE HONOURABLE TOMMY CHEUNG YU-YAN, G.B.S., J.P. PROF THE HONOURABLE JOSEPH LEE KOK-LONG, S.B.S., J.P. THE HONOURABLE JEFFREY LAM KIN-FUNG, G.B.S., J.P. THE HONOURABLE WONG TING-KWONG, G.B.S., J.P. THE HONOURABLE STARRY LEE WAI-KING, S.B.S., J.P. THE HONOURABLE CHAN HAK-KAN, B.B.S., J.P. THE HONOURABLE CHAN KIN-POR, G.B.S., J.P. DR THE HONOURABLE PRISCILLA LEUNG MEI-FUN, S.B.S., J.P. 8724 LEGISLATIVE COUNCIL ― 24 June 2020 THE HONOURABLE WONG KWOK-KIN, S.B.S., J.P. THE HONOURABLE MRS REGINA IP LAU SUK-YEE, G.B.S., J.P. THE HONOURABLE PAUL TSE WAI-CHUN, J.P. THE HONOURABLE CLAUDIA MO THE HONOURABLE MICHAEL TIEN PUK-SUN, B.B.S., J.P. THE HONOURABLE STEVEN HO CHUN-YIN, B.B.S. THE HONOURABLE FRANKIE YICK CHI-MING, S.B.S., J.P. THE HONOURABLE WU CHI-WAI, M.H. THE HONOURABLE YIU SI-WING, B.B.S. THE HONOURABLE MA FUNG-KWOK, S.B.S., J.P. THE HONOURABLE CHARLES PETER MOK, J.P. THE HONOURABLE CHAN CHI-CHUEN THE HONOURABLE CHAN HAN-PAN, B.B.S., J.P. -

Annex Recovery Figures of Reverse Vending Machines

Annex Recovery figures of Reverse Vending Machines (RVMs) Average quantity Quantity recovered recovered Location of RVM in May on each RVM usage (in piece) (in piece) Telford Plaza, Kowloon Bay 53 200 7.6 Tin Shui Shopping Centre, Yuen 52 200 11.5 Long Choi Wan Commercial Complex, 48 600 10.7 Ngau Chi Wan V City, Tuen Mun 46 300 13.4 Kwai Chung Shopping Centre 46 300 14.3 Tak Tin Plaza, Lam Tin 44 900 9.6 Tsz Wan Shan Shopping Centre 43 800 12.7 Tin Shing Shopping Centre, Yuen 41 400 10.3 Long Kin Sang Shopping Centre, Tuen 36 900 10.8 Mun Nam Cheong Place, Sham Shui Po 36 000 13.0 Wo Che Plaza, Sha Tin 35 800 10.8 Fu Shin Shopping Centre, Tai Po 35 700 9.2 Siu Sai Wan Plaza 35 400 9.8 Lei Muk Shue Shopping Centre, 35 300 12.8 Tsuen Wan Lai On Estate, Sham Shui Po 35 000 12.9 Hin Keng Shopping Centre, Tai 34 000 9.3 Wai GREEN@EASTERN 31 100 10.9 Lok Wah Commercial Centre, 28 900 11.5 Kwun Tong Nina Mall 1, Tsuen Wan 28 600 6.8 Aeon at Panda Place, Tsuen Wan 28 100 10.6 Fanling Town Centre 26 600 9.5 GREEN@SHAM SHUI PO 24 800 15.9 Average quantity Quantity recovered recovered Location of RVM in May on each RVM usage (in piece) (in piece) YATA Supermarket at MOKO, 23 800 11.0 Mong Kok Hing Tung Shopping Centre, Sai 23 100 8.1 Wan Ho Lucky Centre, Sha Tin 22 400 6.9 Cheung Fat Plaza, Tsing Yi 22 100 14.3 GREEN@KWUN TONG 21 700 11.1 Central Market 21 600 5.8 Victoria Park, Causeway Bay 21 000 10.6 Choi Yuen Plaza, Sheung Shui 20 500 8.1 Tsuen Wan Plaza 19 900 13.3 Fu Tung Plaza, Tung Chung 19 500 8.1 V Walk, Sham Shui Po 16 800 14.9 Choi -

DOUBLE COVE Ma on Shan, Hong Kong Chairman’S Statement

DOUBLE COVE Ma On Shan, Hong Kong Chairman’s Statement Profit Attributable to Shareholders The Group’s reported profit attributable to equity shareholders for the year ended 31 December 2016 amounted to HK$21,916 million, representing an increase of HK$590 million or 3% over HK$21,326 million for the previous year. Reported earnings per share were HK$6.03 (2015: HK$5.87 as adjusted for the bonus issue in 2016). Excluding the fair value change (net of non-controlling interests and tax) of investment properties and investment properties under development, the Group’s Underlying Profit attributable to equity shareholders for the year ended 31 December 2016 was HK$14,169 million, representing an increase of HK$3,160 million or 29% over HK$11,009 million for the previous year. Underlying Earnings Per Share were HK$3.90 (2015: HK$3.03 as adjusted for the bonus issue in 2016). Dr The Honourable Lee Shau Kee, GBM Chairman and Managing Director Chairman’s Statement Dividends Hong Kong The Board recommends the payment of a final dividend of Property Sale HK$1.13 per share to shareholders whose names appear Hong Kong’s property market has become active since the on the Register of Members of the Company on Tuesday, second quarter of 2016. In response to the continuing price 13 June 2017, and such final dividend will not be subject to increases, the Government in November 2016 raised the any withholding tax in Hong Kong. Including the interim ad valorem stamp duty on residential property transactions for dividend of HK$0.42 per share already paid, the total non first-time buyers to a flat rate of 15%. -

Whole Fruit Address Store List

Whole Fruit Address Store List Shop C, G/F., Elle Bldg., 192-198 Shaukiwan Road, Shaukiwan, HK Shop 3 & 4 Yue Fung House, Yue Wan Estate, HK Shop 120 & Portion of Shop 119 Level 1, New Jade Shopping Arcade, Chai Wan, HK Shop E, G/F, Hing Cheung Building, 15-31 Shaukiwan Road, HK Shop A, G/F, Healthy Village, 180-182 Tsat Tsz Mui Rd, Podium Lvl, NP, HK G/F & C/L, Siu King Bldg., 14-16 Tsat Tsz Mui Rd, North PoiN.T., HK G/F., 98 Electric Road, North PoiN.T., HK Shop G14 on G/F., Fu Shan Mansion, Stage III, Tai Koo Shing, HK Shop No.47 + 48, Harmony Garden, 9 Siu Sai Wan Road, Chai Wan, HK Shop C,D,E & F, G/F., 8 North PoiN.T. Road, North PoiN.T., HK G/F., Shop 3, Hing Wah Shopping CeN.T.re, Hing Wah Estate, Chai Wan, HK Shop No.G5, G/F., Fok Cheong Building, Nos.1032-1044 King's Rd., HK G/F., King's Road 963A, Quarry Bay, HK Shop 6 G/F, Home World, ProvideN.T. CeN.T.re, 21-53 Wharf Rd, North PoiN.T., HK Shop 3, G/F., Youth Outreach Jockey Club Building,1-18 Hing Man Street, Shaukeiwan, HK Shop No.1 on Lower Ground Floor, Braemar Hill Shopping CeN.T.re, No.45 Braemar Hill Road, Braemar Hill, HK Shop GC04, G/F., Lei King Wan, Site C, 35 Tai Hong Street, HK Shop C & D, G/F, Yan Wo Building, 70 Java Road, North PoiN.T., HK Shop No. -

Transportation Guidance

Transportation Guidance *Nan Fung International Convention & Exhibition Center:630-638 Xingangdong Road, Haizhu District, Guangzhou, China (Beside Area C of Canton Fair) *From Guangzhou Railway Station to CAC Fair Take taxi (about 30 minutes). Take Metro Line 2 to Changgang Station and then transfer to Line 8 and get off at Xingangdong Station, Exit F. *From Guangzhou East Railway Station to CAC Fair Take taxi (about 20 minutes). Take Metro Line 3 to Kecun Station and then transfer to Line 8 and get off at Xingangdong Station, Exit F. *From Guangzhou South Railway Station to CAC Fair Take taxi (about 40 minutes). Take Metro Line 2 to Changgang Station and then transfer to Line 8 and get off at Xingangdong Station, Exit F. *From Baiyun International Airport to CAC Fair Take taxi (about 45 minutes). Take No. 5 Air Express to Haizhu Square Station, then Metro Line 2 to Changgang Station and then transfer to Line 8 and get off at Xingangdong Station, Exit F. *From Hong Kong to CAC Fair Take Guangzhou-Kowloon Through Train(about 2 hours’ trip). After arriving at Guangzhou East Railway Station, take Metro Line 3 to Kecun Station and then transfer to Line 8 and get off at Xingangdong Station, Exit F. Take Hong Kong-to-Guangzhou Coach if you depart from Hong Kong International Airport or other departure points. It only takes you about 3.5 hours. *By Taxi Please show this Chinese address to the taxi driver: *By CACFair Shuttle Bus CACFair opens free shuttle bus between Nan Fung Exhibition Center and Grand Tea Mall (The original venue of CACFair). -

The Hongkong and Shanghai Banking Corporation Branch Location

The Hongkong and Shanghai Banking Corporation Bank Branch Address 1. Causeway Bay Branch Basement 1 and Shop G08, G/F, Causeway Bay Plaza 2, 463-483 Lockhart Road, Causeway Bay, Hong Kong 2. Happy Valley Branch G/F, Sun & Moon Building, 45 Sing Woo Road, Happy Valley, Hong Kong 3. Hopewell Centre Branch Shop 2A, 2/F, Hopewell Centre, 183 Queen's Road East, Wan Chai, Hong Kong 4. Park Lane Branch Shops 1.09 - 1.10, 1/F, Style House, Park Lane Hotel, 310 Gloucester Road, Causeway Bay, Hong Kong 5. Sun Hung Kai Centre Shops 115-117 & 127-133, 1/F, Sun Hung Kai Centre, Branch 30 Harbour Road, Wan Chai, Hong Kong 6. Central Branch Basement, 29 Queen's Road Central, Central, Hong Kong 7. Exchange Square Branch Shop 102, 1/F, Exchange Square Podium, Central, Hong Kong 8. Hay Wah Building Hay Wah Building, 71-85 Hennessy Road, Wan Chai, Branch Hong Kong 9. Hong Kong Office Level 3, 1 Queen's Road Central, Central, Hong Kong 10. Chai Wan Branch Shop No. 1-11, Block B, G/F, Walton Estate, Chai Wan, Hong Kong 11. Cityplaza Branch Unit 065, Cityplaza I, Taikoo Shing, Quarry Bay, Hong Kong 12. Electric Road Branch Shop A2, Block A, Sea View Estate, Watson Road, North Point, Hong Kong 13. Island Place Branch Shop 131 - 132, Island Place, 500 King's Road, North Point, Hong Kong 14. North Point Branch G/F, Winner House, 306-316 King's Road, North Point, Hong Kong 15. Quarry Bay Branch* G/F- 1/F, 971 King's Road, Quarry Bay, Hong Kong 16.