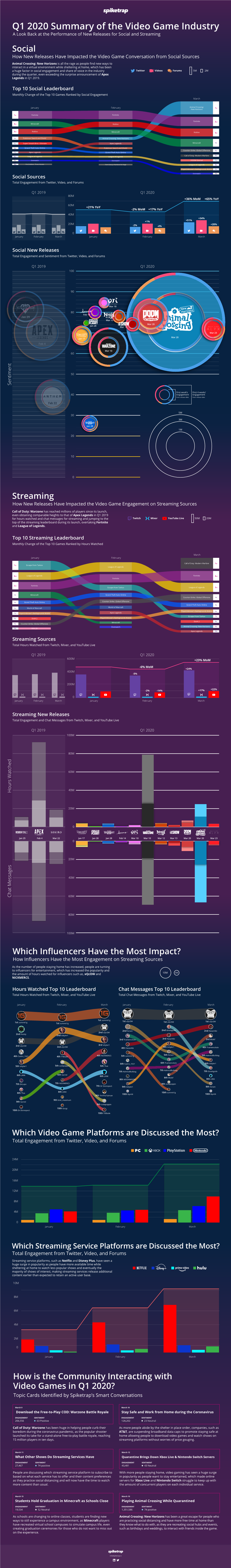

Which Video Game Platforms Are Discussed the Most? Total Engagement from Twitter, Video, and Forums

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Esports Marketer's Training Mode

ESPORTS MARKETER’S TRAINING MODE Understand the landscape Know the big names Find a place for your brand INTRODUCTION The esports scene is a marketer’s dream. Esports is a young industry, giving brands tons of opportunities to carve out a TABLE OF CONTENTS unique position. Esports fans are a tech-savvy demographic: young cord-cutters with lots of disposable income and high brand loyalty. Esports’ skyrocketing popularity means that an investment today can turn seri- 03 28 ous dividends by next month, much less next year. Landscapes Definitions Games Demographics Those strengths, however, are balanced by risk. Esports is a young industry, making it hard to navigate. Esports fans are a tech-savvy demographic: keyed in to the “tricks” brands use to sway them. 09 32 Streamers Conclusion Esports’ skyrocketing popularity is unstable, and a new Fortnite could be right Streamers around the corner. Channels Marketing Opportunities These complications make esports marketing look like a high-risk, high-reward proposition. But it doesn’t have to be. CHARGE is here to help you understand and navigate this young industry. Which games are the safest bets? Should you focus on live 18 Competitions events or streaming? What is casting, even? Competitions Teams Keep reading. Sponsors Marketing Opportunities 2 LANDSCAPE LANDSCAPE: GAMES To begin to understand esports, the tra- game Fortnite and first-person shooter Those gains are impressive, but all signs ditional sports industry is a great place game Call of Duty view themselves very point to the fact that esports will enjoy even to start. The sports industry covers a differently. -

Optimizing the Video Game Live Stream APPROVED

Paycheck.exe: Optimizing the Video Game Live Stream by Alexander Holmes A Thesis Submitted to the Faculty of the WORCESTER POLYTECHNIC INSTITUTE in partial fulfillment of the requirements for the Degree of Master of Science in Interactive Media and Game Development April 24, 2019 APPROVED: Dean O'Donnell, Thesis Advisor Jennifer deWinter, Committee Brian Moriarty, Committee 2 1.0 Abstract Multiple resources currently exist that provide tips, tricks, and hints on gaining greater success, or increasing one’s chances for success, in the field of live video streaming. However, these resources often lack depth, detail, large sample size, or significant research on the topic. The purpose of this thesis is twofold: to aggregate and optimize the very best methods for live content creators to employ as they begin a streaming career, and how best to implement these methodologies for maximum success in the current streaming market. Through analysis of a set of semi-structured interviews, popular literature, and existing, ancillary research, repeating patterns will be identified to be used as the basis for a structured plan that achieves the stated objectives. Further research will serve to reinforce as well as optimize the common methodologies identified within the interview corpus. 3 2.0 Table of Contents 1.0 Abstract 2 2.0 Table of Contents 3 3.0 Introduction 5 3.1 History of the Medium 5 3.2 Current Platforms 12 3.3 Preliminary Platform Analysis 14 3.4 Conclusion 15 3.5 Thesis Statement 15 3.6 Implications of & Further Research 16 4.0 Literature -

The Rise of Esports Investments a Deep Dive with Deloitte Corporate Finance LLC and the Esports Observer

The rise of esports investments A deep dive with Deloitte Corporate Finance LLC and The Esports Observer April 2019 The rise of esports investments | Contents Contents Image - TEO Page 06 Page 22 Page 28 04 Executive summary This publication contains general information only and Deloitte Corporate Finance LLC and The Esports Observer are not, by means of this publication, rendering accounting, business, financial, investment, legal, tax, or other professional advice 06 or services. This publication is not a substitute for such professional advice or services, nor should it be used as a Leveling up: the rise of basis for any decision or action that may affect your business. esports investment Before making any decision or taking any action that may affect your business, you should consult a qualified Esports investment has made professional advisor. significant strides in recent years as traditional investors join Deloitte Corporate Finance LLC and The Esports Observer venture capital in exploring many shall not be responsible for any loss sustained by any person who relies on this publication. of the diverse investment opportunities across the industry’s Copyright © 2019 Deloitte Development LLC. All rights diverse ecosystem. reserved. 01 The rise of esports investment | Contents Contents Page 32 Page 34 Page 38 25 29 34 The value of an esports Why Modern Times Group The rising power (and risk) of investment: an investor view made two of esports' best influencers in esports investments to-date Many investors will find the strong By recognizing -

ESPORTS PLAYBOOK for BRANDS 2019 INTRODUCTION “Where Can We Help?”

ESPORTS PLAYBOOK FOR BRANDS 2019 INTRODUCTION “Where can we help?” It’s a question I ask nearly every potential client I talk to in my role. But this particular time, I was asking our Nielsen Esports Advisory Board, a group of industry experts including the likes of game publishers, event operators, broadcasters and media companies, traditional sports organizations, and brands, who have been invaluable to Nielsen’s successful entry into the Nicole Pike esports space. Managing Director Nielsen Esports The resounding answer: figure out how to explain the esports ecosystem to brands in a way only Nielsen can. So here we are. Since we launched our initial report in our Nielsen Esports Playbook series, esports has grown and evolved in so many ways. One in five fans globally just began following esports within the past year. This growth brings rapid change that is hard to keep track of, even if you’re working in the industry every day. For many brands, this is a daunting task – and ultimately, THE INDUSTRY’S a barrier to their esports investment. HEAVY RELIANCE ON And yet, there is proven value to unlock through esports. Esports fans around the world include some of the hardest-to-reach consumers for brands through SPONSORSHIP OFFERS traditional media – they’re young, digital natives who are also cutting cords and blocking ads at rapid rates. Esports allows brands to reach these fans WAYS FOR BRANDS while they’re engaging with their number one entertainment passion point: TO BOTH CREATE video games. AWARENESS AMONG We’ve created the Nielsen Esports Playbook for Brands - not to explain to brands why they should invest in esports, but ensure brands have the FANS AND BUILD information they need to make an informed decision about whether esports RELATIONSHIPS AND is right for them. -

Twitch Players with the Highest Follower Growth Over the Past 30 Days

The Twitch League Data & Sources Top 30 Twitch Players Average Total Hours Total Hours Total Videos Earnings Per Ranking Twitch Name Twitch Profile URL Streamed Watched Age Uploaded Total Views Followers Type of Video Video Twitch Income 1 SHROUD https://www.twitch.tv/shroud 7,505 212M 25 1,239 365M 7.07M Apex Legends $26,887 $33,312,993 2 AURONPLAY https://www.twitch.tv/auronplay 379 14.2M 31 52 15.6M 2.32M Minecraft $287,164 $14,932,528 3 LIRIK https://www.twitch.tv/lirik 6,950 171M 29 3,655 340M 2.60M Lost Ember $3,637 $13,293,235 4 RUBIUS https://www.twitch.tv/rubius 1,206 32.2M 30 91 49.5M 3.98M Just Chatting $134,979 $12,283,089 5 FORTNITE https://www.twitch.tv/fortnite 553 33.7M N/A 181 78.9M 2.81M Fortnite $61,973 $11,217,113 6 LOLTYLER1 https://www.twitch.tv/loltyler1 5,417 110M 25 714 159M 3.24M League of Legends $8,089 $5,775,546 7 ALANZOKA https://www.twitch.tv/alanzoka 4,901 69.5M 29 1,241 98.5M 2.73M Special Events $4,543 $5,637,863 8 GOTAGA https://www.twitch.tv/gotaga 6,914 78.0M 26 4,064 104M 2.20M Fortnite $1,253 $5,092,192 9 POKIMANE https://www.twitch.tv/pokimane/ 3,347 33M 23 734 107M 4.55M Valorant $6,593 $4,839,262 10 CASTRO_1021 https://www.twitch.tv/castro_1021 5,144 68.4M 28 1,738 84.8M 2.27M FIFA 20 $2,434 $4,230,292 11 NICKMERCS https://www.twitch.tv/nickmercs 7,525 104M 29 2,138 96.8M 3.39M Fortnite $1,801 $3,850,538 12 RIOT GAMES https://www.twitch.tv/riotgames 4,963 265M N/A 2,256 1,221M 4.42M League of Legends $1,442 $3,253,152 13 SODAPOPPIN https://www.twitch.tv/sodapoppin 6,567 148M 26 1,007 312M 2.71M -

Technology, Media and Telecom Esports in N

Technology, Media and Telecom North American Equity Research 17 July 2019 Industry Update Canaccord Genuity LLC (US) Michael Graham, CFA | Analyst - Esports in N. America: entering the major leagues 212.849.3924 [email protected] Esports proof points are everywhere. The 2018 League of Legends world championship final match featured two teams of five gamers each battling it out on screen to destroy Maria Ripps, CFA | Analyst - 212.849.3923 each other's Nexus. According to game publisher Riot Games, the event drew 99.6 [email protected] million unique viewers across various streaming platforms like Twitch (most estimates Alexander Frankiewicz | Associate - for actual viewership are higher). ESPN2 now regularly broadcasts Overwatch League 212.389.8070 matches alongside major golf tournaments. Leading Fortnite gamer Tyler "Ninja" [email protected] Belvins reports earning ~$1M per month solely from revenue shares with Twitch and Canaccord Genuity Corp. (Canada) YouTube (not counting sponsorship deals with Samsung, RedBull, & Uber). Netflix CEO Robert Young, MBA | Analyst - 1.416.869.7341 Reed Hastings commented earlier this year that his company loses more viewers to [email protected] Fortnite than to HBO. Esports viewership consists primarily of a hard-to-reach millennial audience, and the numbers are growing quickly. In this report (a continuation of our Christian Sgro, CFA | Associate - 1.416.869.7364 February Esports Investment Landscape Report), we revisit key themes, estimate the [email protected] size and outlook for various segments of the esports market, and alert investors to key operators on the landscape. Esports market projections - we project total N. American Esports platform viewership will grow from 112.3M this year to 223.6M by 2023. -

Esports: a Content Analysis of Alcohol, Energy Drinks, Junk Food, and Gambling Category Sponsorship

Sponsorship Activation in Esports: A Content Analysis of Alcohol, Energy Drinks, Junk Food, and Gambling Category Sponsorship A/PROF SARAH KELLY & RUBY GERRISH SEPTEMBER 2019 SPONSORSHIP ACTIVATION IN ESPORTS 1 THE CORRECT CITATION FOR THIS PUBLICATION IS: Kelly, S. & Gerrish, R. (2019). Sponsorship Activation in Esports: A Content Analysis of Alcohol, Energy Drinks, Junk Food, and Gambling Category Sponsorship. Foundation for Alcohol Research and Education: Canberra The Foundation for Alcohol Research and Education (FARE) is an independent, not-for- profit organisation working to stop the harm caused by alcohol. Alcohol harm in Australia is significant. Nearly 6,000 lives are lost every year and more than 144,000 people are hospitalised making alcohol one of our nation’s greatest preventative health challenges. As a leading advocate of evidence-based research, FARE contributes to policies and programs that support the public good, while holding the alcohol industry to account. FARE works with leading researchers, communities, governments, health professionals and frontline service providers to bring about change and reduce alcohol harm. The University of Queensland (UQ) is one of Australia’s premier learning and research institutions. It has produced over 200,000 graduates since opening in 1911. Graduates have gone on to become leaders in all areas of society and industry. UQ is one of the three Australian members of the global Universitas 21, an international network of leading, research-intensive universities that work cooperatively to create large- scale global opportunities. UQ is a founding member of the national Group of Eight (Go8), a coalition of leading Australian research intensive universities that work together to improve outcomes for all. -

Coyote Droppings

COYOTE DROPPINGS T H E N E W S L E T T E R O F C H A N D L E R E A R L Y C O L L E G E OCT. 2020, VOLUME 4, ISSUE 1 O T H E R G R E A T R E A D S I N S I D E : ALEXANDRIA OCASIO-CORTEZ: A STREAMER? - 3 COVID AND YOUR PETS - 4 THERE'S MORE TO THE SEASON THAN JUST HALLOWEEN - 5 SENIORITIS AND COVID? - 6 Photo by Savannah McIntyre COVID AND 2020: A MATCH XBOX VS PLAYSTATION: THE DEBATE CONTINUES - 7 MADE IN OUR NIGHTMARES WILL THE REAL JOE PLEASE STAND UP? - BY SAVANNAH MCINTYRE 8 In December of 2019, the world would change ELECTION 2020 YUCK! - 10 forever. SARS-CoV-2, better known as COVID-19, would strike Wuhan, China, and then eventually AND MORE! make its way around the globe. Experts believe the virus originated from animal origins -a bat, to be exact. It then made its way to humans through “wet markets”. These markets sell live mammals for human consumption, which makes it a perfect condition for the spread of disease. As of October 26, worldwide, the amount of COVID cases is at almost 44 million. Fortunately, 29 million of these have recovered. Sadly, almost 1.16 people have died due to COVID. In Arizona alone, the number of cases has risen to 238,964, with 5875 deaths. The CDC suggests that if you have had close contact (15 minutes or more of being within 6 feet) of someone who has been confirmed with COVID- 19, or if you have shown any symptoms of the virus, to get tested. -

Video Game Streaming Trends Report

VIDEO GAME STREAMING TRENDS REPORT Q3 - 2020 WEEKLY STREAMING HOURS WATCHED ■ Weekly game streaming hours INCREASE 73% YOY watched have dramatically JAN 2019 - OCT 2020 | TWITCH, YOUTUBE GAMING, MIXER, AND FACEBOOK GAMING increased year over year 800M ■ Esports streaming hours had a large increase at the start of the 2020 2019 COVID-19 pandemic, but has maintained the momentum since 600M the return of traditional sports ■ The average weekly hours watched this year eclipsed ½ billion, a 73% increase from last year’s average 400M (291M) ■ Q4 is positioned to close off a record breaking year in streaming 200M with major esports events and fall video game release slate JAN MAR MAY JUL SEP NOV REPORT BY // STREAM HATCHET 2 HOURS WATCHED TOP WESTERN STREAMING PLATFORMS ■ The top game streaming platforms reached a total of 7.4B hours Q4 2019 - Q3 2020 | TWITCH, YOUTUBE GAMING, AND FACEBOOK GAMING watched this quarter 6B ■ YouTube Gaming experienced 5.1B the strongest growth with an 4.7B increase of more than 150 million hours in Q3 4B ■ Facebook Gaming is on track to 3.2B even bigger market shares after eclipsing 1B quarterly hours 2.7B watched 2B ■ In spite of securing partnerships 1.5B 1.7B with major influencers like Ninja 1.1B 1.02B and Shroud, Twitch decreased its 1.0B 0.97B quarterly hours watched by about 0.5B 0.6B 375M million 0 Q4 ‘19 Q1 ‘20 Q2 ‘20 Q3 ‘20 REPORT BY // STREAM HATCHET 3 TOP 10 GAMES IN STREAMING ■ League of Legends was the most watched game of Q3 with a Q3 2020 HOURS WATCHED | ON TWITCH, YOUTUBE GAMING, AND FACEBOOK GAMING -

Video Game Streaming Trends Report

VIDEO GAME STREAMING TRENDS REPORT Q3 - 2020 WEEKLY STREAMING HOURS WATCHED ■ Weekly game streaming hours INCREASE 73% YOY watched have dramatically JAN 2019 - OCT 2020 | TWITCH, YOUTUBE GAMING, MIXER, AND FACEBOOK GAMING increased year over year 800M ■ Esports streaming hours had a large increase at the start of the 2020 2019 COVID-19 pandemic, but has maintained the momentum since 600M the return of traditional sports ■ The average weekly hours watched this year eclipsed ½ billion, a 73% increase from last year’s average 400M (291M) ■ Q4 is positioned to close off a record breaking year in streaming 200M with major esports events and fall video game release slate JAN MAR MAY JUL SEP NOV REPORT BY // STREAM HATCHET 2 HOURS WATCHED TOP WESTERN STREAMING PLATFORMS ■ The top game streaming platforms reached a total of 7.4B hours Q4 2019 - Q3 2020 | TWITCH, YOUTUBE GAMING, AND FACEBOOK GAMING watched this quarter 6B ■ YouTube Gaming experienced 5.1B the strongest growth with an 4.7B increase of more than 150 million hours in Q3 4B ■ Facebook Gaming is on track to 3.2B even bigger market shares after eclipsing 1B quarterly hours 2.7B watched 2B ■ In spite of securing partnerships 1.5B 1.7B with major influencers like Ninja 1.1B 1.02B and Shroud, Twitch decreased its 1.0B 0.97B quarterly hours watched by about 0.5B 0.6B 375M million 0 Q4 ‘19 Q1 ‘20 Q2 ‘20 Q3 ‘20 REPORT BY // STREAM HATCHET 3 TOP 10 GAMES IN STREAMING ■ League of Legends was the most watched game of Q3 with a Q3 2020 HOURS WATCHED | ON TWITCH, YOUTUBE GAMING, AND FACEBOOK GAMING -

Portfolio 2020 the Center of Esports Entertainment

PORTFOLIO 2020 THE CENTER OF ESPORTS ENTERTAINMENT Recognized by Fast Company in 2019 as one of the “World’s Most Innovative Companies”, Allied Esports is a global esports entertainment company positioned at the center of the $1.1 Billion esports industry. While our network of dedicated esports properties and trucks put us on the international map, our expertise at creating unique live experiences and entertainment content continues to turn the heads of fans, partners and investors. • Owner and operator of one of the world’s most recognized esports venue and production facility – HyperX Esports Arena Las Vegas • A global property network designed to create scalable proprietary and third-party events and content • Collaborate with game publishers, content creators, brands, media platforms and event organizers to create bespoke content through live experiences and broadcasts 2 THE ALLIED ESPORTS PORTFOLIO PROGRAMMING & CONTENT SNAPSHOT ALLIED ORIGINALS Ninja Vegas ‘18, Playtime with KittyPlays, Simon Cup, Odyssey, Allied Esports R6 Minor, Vie.gg CS:GO Legend Series COMMUNITY PROGRAMMING Friday Frags, Saturday Speedway, Wednesday Whiffs, Combustion Series ESPORTS CHANNEL PROGRAMMING TV Azteca, Azteca Esports, eLiga MX, Nation vs. Nation, Gears of War, LOL Liga Latinoamerica THIRD PARTY PRODUCTIONS Riot, Nintendo, Capcom, NHL, NBA2K, Twitch, Mountain Dew, NASCAR 3 EVENTS & CONTENT PORTFOLIO I. ORIGINALS III. CHANNEL PROGRAMING IV. 3RD PARTY EVENTS & CONTENT • Ninja Vegas ‘18 • AZE Circuit – Community tournament NA EU • Ninja #comesayhi programming -

Video Game Streaming Trends Q3 2020

VIDEO GAME STREAMING TRENDS REPORT Q3 - 2020 We provide Business Intelligence products OUR tailored to the needs of the organizations around SERVICES esports and the livestream scene. Stream Hatchet provides live streaming data analytics from the leading video game streaming sites to power data-driven solutions leading to innovation and growth web reports api through the aggregation of readily accessible data. Analytic Custom reports for esports Our API enables you to Stream Hatchet offers live streaming data analytics dashboards of the events, brand impact, build your esports solution solutions to game publishers, marketing and influencer live streaming games, sponsorship events using Stream Hatchet agencies, esports organizations, and brands to help them platforms and audience engagement infrastructure and data leverage their products or services across the gaming and esports industry through data-driven decisions. Methodology Stream Hatchet analyzes 6 million broadcasting channels daily across 20 unique platforms around the world, transforming around 2.5 Terabytes of data into 50,000 pieces of actionable analytics and business intelligence tool sets. WEEKLY STREAMING HOURS WATCHED ■ Weekly game streaming hours INCREASE 73% YOY watched have dramatically JAN 2019 - OCT 2020 | TWITCH, YOUTUBE GAMING, MIXER, AND FACEBOOK GAMING increased year over year 800M ■ Esports streaming hours had a large increase at the start of the 2020 2019 COVID-19 pandemic, but has maintained the momentum since 600M the return of traditional sports ■ The average