Reject the Offer

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Broadband Workstream – Meeting Notes

South West Chilterns Community Board – Broadband Workstream – Meeting Notes Date/Time: Wednesday 10 February 2021 at 1600hrs via MS Teams 1. Present Cllr Mark Turner - Chair Cllr David Johncock Cllr Chris Whitehead Cllr Mark Harris Cllr Julia Adey Cllr Mike Appleyard Cllr Roger Wilson Cllr Alex Collingwood Sue Hynard – Office of Steve Baker MP Jacqueline Dinah-Hayward Paul Caplin Dominic John James Robinson Jackie Binning – North West Chilterns Community Board Coordinator Makyla Devlin – South West Chilterns Community Board Coordinator 2. Apologies None received 3. Notes and actions from previous meeting The last meeting was in January meeting was cancelled due to no real update. Action Date Holder Timescale Update Look at how the 19/11/2020 Sue Hynard By December Ongoing Government Meeting proposals can be achieved and funded Cllr Mark Turner 12/01/21 Makyla Devlin Straight after Completed to be linked up the meeting to Paul Caplin via email Circulate the 12/01/21 Makyla Devlin With notes from Completed letter sent to meeting Leader Martin Tett Circulate quote 12/01/21 Makyla Devlin With notes from Completed from BT meeting Openreach Organise a 12/01/21 Cllr Alex Before next Completed meeting with Collingwood meeting on 10 Swish Fibre, February Virgin Broadband and 3 Clicks for Cllr’s Collingwood, Johncock and Turner Utilise the skills 12/10/21 Sue Hynard Continual Continual of MP’s Joy Aleksandra Morrissey and Turner Steve Baker through their representatives to stress the importance of this provision in our Board Area and look at any possible further funding steams available. Establish who 12/01/21 Makyla Devlin At the end of the Completed the Cabinet meeting this Member for was looked into Broadband is for and the Cabinet Buckinghamshire Member responsible is Cllr Martin Tett. -

The Chilterns Buildings Design Guide 6 the Scale and Form of New Buildings 28 Structure and Original Features 55 the Ability to Be Repaired and Thermal Mass

CONSERVATION BOARD Chilterns Buildings Design Guide an Area of Outstanding Natural Beauty 2 3 Chilterns Buildings Design Guide Chilterns Buildings Design Guide Foreword Contents Chapter 1 Chapter 3 Chapter 5 An integral part of the outstanding Chilterns' Nevertheless, pressures for development, both in provided to reach maturity. If these decisions are landscape is its wealth of attractive villages and the AONB and the surrounding area, have poorly made the passage of time will not be kind. Introduction 4 Designing new buildings 23 Conversion of buildings 53 buildings. Many older buildings demonstrate good intensified. Increased housing allocations are The special and distinctive character The location and siting of new development 24 Conversion of farm buildings 53 design and construction practice in relation to placing strains on larger settlements around the This second edition of the Design Guide has of the Chilterns 4 The individual building 27 Openings 55 siting and orientation, the sourcing of materials, margins of the AONB, infilling threatens to destroy therefore been produced to provide updated The Chilterns Buildings Design Guide 6 The scale and form of new buildings 28 Structure and original features 55 the ability to be repaired and thermal mass. The the openness of many villages, the unsympathetic guidance and contribute to the maintenance of the The planning context 8 The 'one-off' design 29 Roofs 55 task of the Chilterns Conservation Board is to conversion of redundant buildings continues to Chilterns' landscape for future generations. Roofs 30 Inside the building 56 ensure the special qualities of the Area of erode rural character. At the same time, the Chapter 2 Chimneys 33 Context and surroundings 56 Outstanding Natural Beauty (AONB) are conserved framework for controlling development has Sir John Johnson Settlements and buildings in the Walls 33 Other buildings in the countryside 57 and enhanced. -

Species Action Plan for Green-Winged Orchid: (Orchis Morio) in Buckinghamshire

Buckinghamshire & Milton Keynes Biodiversity Action Plan Species Action Plans Species Action Plans National Species Action Plans 8.1 Biodiversity: The UK Steering Group Report (DETR, 1995) originally listed 416 priority species for which national Species Action Plans would be written. At that time 116 had already been written and 300 remained. In addition, a further 1,250 species were identified as being of ‘conservation concern’. The priority list was reviewed in 1997and in 2007. After the 2007 revision the total number of BAP priority species was set at 1149. This list is available in Biodiversity Reporting and Information Group Report on the Species and Habitat Review 2007. 8.2 The four scientific criteria that were used to select the UK BAP species in the 2007 review were; • International threat • International responsibility & moderate decline in the UK • Marked decline in the UK • Other important factors – where quantitative data on decline are inadequate but there is convincing evidence of extreme threat Local Species Action Plans for Buckinghamshire 8.3 On the publication of the Buckinghamshire & Milton Keynes BAP in 2000 it was planned that every species present in Bucks for which there is a national SAP or Conservation Statement, would eventually have a local SAP or Conservation Statement. SAPs would also be written for species which may not be considered a national priority, but which are threatened or declining within the County, such as green- winged orchid. 8.4 The following Plans were produced for species within Buckinghamshire. y Chiltern Gentian y Green-winged Orchid y Striped Lychnis Moth As Latin names were used in the original publication of the action plans for Chiltern gentian, green-winged orchid and striped lychnis moth, they have been retained in the following part of the document. -

(Public Pack)Minutes Document for South West Chilterns Community

South West Chilterns Community Board minutes Minutes of the meeting of the South West Chilterns Community Board held on Tuesday 24 November 2020 in Via MS Teams, commencing at 6.30 pm and concluding at 8.29 pm. Members present Councillor D Barnes, Councillor D Watson, Councillor J Adey, Councillor M Appleyard, Councillor S Brown, Councillor A Collingwood, Fawley Meeting, Hambleden Parish Council, Councillor M Harris, Councillor D Johncock, Lane End Parish Council, Councillor J Langley, Councillor T Lee, Little Marlow Parish Council, Marlow Town Council, Councillor N Marshall, Medmenham Parish Council and Councillor R Scott Others in attendance Sgt R Hughes, T Evans, L Sokolowksi, J Ryans, S Taylor, M Devlin and L Jeffries and S Taylor Agenda Item 1 Apologies for Absence [The apologies were not read out at the start of the meeting; however, apologies had been received from Councillor Chris Whitehead, Wooburn and Bourne End Parish Council, Councillor Roger Wilson, Councillor Ian McEnnis and Councillor Richard Scott (Ibstone Parish Council)]. 2 Welcome/Introduction The Chairman, Councillor Dominic Barnes, introduced himself and welcomed everyone to the meeting and advised that the aim of the Community Board (CB) was to work in partnership with the community to make a difference using funding to support community projects and initiatives. The action plan, included in the agenda pack, was a fluid document and the majority of the ‘business’ was carried out by the working groups. Everyone, including members of the public, was welcome to ask questions during the meeting. The Chairman stated he was looking forward to the CB membership growing as promotion continued across the area and he welcomed Mr Lloyd Jeffries, the Service Director Champion of the South West Chilterns CB. -

[ from the Editor

[ From the Editor The big news in June is always Lane End fete, this year on Saturday 14th. I know I always go on about the Zippy Dipper, but I do love it so. It’s so old-school simple, but crazy fun for the little ones. The volunteers who organise the fete really need our help this year. If you can spare an hour or two to man a stall or help set up or clear away, it would make their day a lot easier. And anyway, it’s so much fun, kids especially love to have a ’job’ and feel properly involved. Call Bob Nix on 881000 and he’ll sort you out. An initiative that could make a huge difference to the older and less able people in our parish is a community bus. A committed group of villagers have been working with Bucks CC to fund a trial of a commu- nity bus service, but it needs volunteers to keep it running. (p44) Speaking of buses, parish councillor Nigel King has been decoding our complicated bus timetables. His simplified version is on page 56. Fingers crossed for a sunny fete and have a wonderful summer. Katy (Editor) [email protected] 01494 883883 Many thanks to Mark Advertise in the Clarion Ainsworth for the cover Connect with your local image. Mark is a freelance community, reach 1700 photographer with a talent households in the area for portraiture. £55 half page per issue [email protected] £90 full page per issue Look him up on Facebook Discounts for multiple issues The Clarion — Summer 2014 page 1 Welcome to everything you need in an English country pub Gastro Pub of the Year Award Winner Recommended on TripAdvisor -

Elly's , Index to !(Elly's

INDEX TO !(ELLY'S , BUCKINGIIAl\ISIIIRE DIREOTORY. ----.---- PAGE PAGE I PAGE PAGE Abbots Aston 276 Buckland Common, see Datchet ••••..••.••....••.• 317 Great King-'s Hm, see Allkhampstead 272 Bnckland 302 Datchet Mead, see Datchet 317 Hug'henden 3i2 • Addington ••......••••.... 272 Burners Holt, see 'Vater Datchet St. Helen's, see Great King'shill, see Prest- AdstOCK .•••....••u •••••••• 272 Stratford..•......•••••.. 401 Datchet ..••••••••.••••• 317 wood...•..•••.•••...••.• 375 A~mondeshm. see Amrshm 273 Bullington End, see Han- Dean-North, see Hugh- Great Linford 350 Akeley•...••.•••..•••.•••• 272 slope ........•., .••••.. '" 335 enden ••••..••....•..•••. 342 Great l\Iarlow ......•••••• 354 Amersham 273 Burcot, see Wing- 407 Denham 318 Great ~Jissenden 363 AmershamHill,seeWycomb 419 Burcott, see Bierton 289 Denham, see Quainton 378 Great Penn's !fead, see Ankerwycke, sl'eWraysbry 415 Burnbam." 302 Denner Hill, see Prestwood 375 Wycombe 417 ArngTove, see Boarstall., .• 292 Bnrnbam Beeches·seeBurn- Dinton...•..••••.•......•• 318 Great Seabrook, see Iving- Ascott, see Wing 407 ham 302 Ditton, see Stoke Poges 389 hoe 3i5 Ash Furlong, see Olney ..•• 371 Bnrnham-East, see Burn- Doddershall, see Quainton 378 Great Wolston ........•••• 411 Ashendon•.••.•....••.••••• 275 ham.•••••..•••.••••.••••• 302 Dorney 319 Green Hig-hland, see Ashl.'ridg-e, see Chesham 308 Burston, see Aston Abbotts 276 DorneyWood,see Burnham 303 :l\Ionks Risborough ...... 365 Ashley Green 275 Bury End, see Amersham.. 271 Dorton 319 Green Valley, see Astwood 277 Askett,seeMonksRisboro' -

Hambleden, the Weir, Medmenham

point your feet on a new path Hambleden, the Weir, Medmenham Pheasants and Thames Pasture Distance: 19 km=12 miles or 16 km=10 miles easy walking Region: Chilterns Date written: 29-aug-2010 Author: Phegophilos Date revised: 6-jul-2017 Refreshments: Aston, Medmenham, Hambleden Last update: 16-feb-2019 Maps: Explorer 171 (Chiltern Hills West) & 172 (Chiltern Hills East) but the maps in this guide should be sufficient Problems, changes? We depend on your feedback: [email protected] Public rights are restricted to printing, copying or distributing this document exactly as seen here, complete and without any cutting or editing. See Principles on main webpage. River, villages, woodland, views In Brief This is a walk of great variety beginning at the Thames and then in typically wonderful Chiltern woods. It begins with an exhilarating crossing of the River Thames by a very long weir and passes through two of the most enchanting villages of the region. There are some nettles en route so long trousers are recommended. This walk is not recommended for a dog because of the sheep fields and the sensitive woodland sites. The going is easy and good walking shoes are sufficient. The walk begins next to the Flowerpot pub in the tiny hamlet of Aston (grid ref SU 785 842, postcode RG9 3DG ). You need to park your car before opening time (11am or 12 noon on Sunday). The Flowerpot is fantastically popular and you can’t use the pub’s car parks as a non-patron (unless you can buy Granny a double gin and leave her in the pub all day). -

Planning Committee Agenda and Papers

Chilterns Conservation Board Planning Committee Wednesday 6th March 2019 Members of the Planning Committee of the Chilterns Conservation Board for the Chilterns Area of Outstanding Natural Beauty are hereby summoned to a meeting of Planning Committee on 10.00 a.m. Wednesday 6th March 2019 at The Chilterns Conservation Board office, 90 Station Road, Chinnor, OX39 4HA Agenda 1. Apologies 10.00 – 10.01 2. Declarations of Interest 10.01 – 10.03 3. Minutes of Previous Meeting 10.03 – 10.06 4. Matters Arising 10.06 – 10.20 5. Public Question Time 10.20 – 10.30 6. Co-option to Planning Committee 10.30 – 10.40 7. Model Policy update 10.40 – 10.50 8. Offsetting and environmental net gain discussion 10.50 – 11.30 9. Planning Application responses and updates 11.30 – 12.15 10. Development Plans responses and updates 12.15 – 12.25 11. Any urgent business 12.25 – 12.29 12. Date of Next and Future Meetings 12.29 – 12.30 1 Chilterns Conservation Board Planning Committee Wednesday 6th March 2019 Item 3 Minutes of Previous Meeting Author: Lucy Murfett Planning Officer Lead Organisations: Chilterns Conservation Board Resources: Budget of £500 per year for minute-taker plus staff time Summary: Minutes of the previous meeting are attached (at Appendix 1) and require approval. Purpose of report: To approve the Minutes of the previous meeting. Background 1. The draft minutes from the meeting on Wednesday 21st November 2018 are attached (at Appendix 1) for approval. Recommendation 1. That the Committee approves the minutes of its meeting which took place on 21st November 2018. -

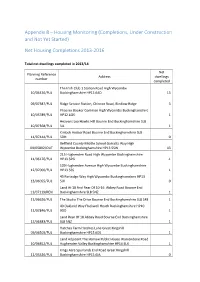

(Completions, Under Construction and Not Yet Started) Net Housing

Appendix 8 – Housing Monitoring (Completions, Under Construction and Not Yet Started) Net Housing Completions 2013-2016 Total net dwellings completed in 2013/14 Net Planning Reference Address dwellings number completed The Irish Club 1 Station Road High Wycombe 10/06436/FUL Buckinghamshire HP13 6AD 13 09/07387/FUL Ridge Service Station, Chinnor Road, Bledlow Ridge 3 Phoenix Booker Common High Wycombe Buckinghamshire 10/05789/FUL HP12 4QS 1 Heavens Lea Hawks Hill Bourne End Buckinghamshire SL8 10/07368/FUL 5JL 1 Kinloch Hedsor Road Bourne End Buckinghamshire SL8 11/07444/FUL 5DH 0 Bellfield County Middle School Garratts Way High 09/05892/OUT Wycombe Buckinghamshire HP13 5SW 43 215 Hughenden Road High Wycombe Buckinghamshire 11/06176/FUL HP13 5PG -1 109 Hughenden Avenue High Wycombe Buckinghamshire 12/07000/FUL HP13 5SS 1 43 Partridge Way High Wycombe Buckinghamshire HP13 13/06055/FUL 5JX 0 Land At 18 And Rear Of 10-16 Abbey Road Bourne End 11/07119/REN Buckinghamshire SL8 5NZ 1 11/06626/FUL The Studio The Drive Bourne End Buckinghamshire SL8 5RE 1 49 Oakland Way Flackwell Heath Buckinghamshire HP10 11/07846/FUL 9DD 1 Land Rear Of 18 Abbey Road Bourne End Buckinghamshire 12/06383/FUL SL8 5NZ 1 Hatches Farm Hatches Lane Great Kingshill 09/06509/FUL Buckinghamshire HP15 6DS 1 Land Adjacent The Harrow Public House Warrendene Road 10/06852/FUL Hughenden Valley Buckinghamshire HP14 4LX 1 Kings Acre Spurlands End Road Great Kingshill 11/05326/FUL Buckinghamshire HP15 6JA 0 Land At Rear Of Holly Acre & Mardleigh Stag Lane Great 12/06300/FUL Kingshill -

Notes of the Last Meeting PDF 487 KB

South West Chilterns Community Board minutes Minutes of the meeting of the South West Chilterns Community Board held on Tuesday 24 November 2020 in Via MS Teams, commencing at 6.30 pm and concluding at 8.29 pm. Members present Councillor D Barnes, Councillor D Watson, Councillor J Adey, Councillor M Appleyard, Councillor S Brown, Councillor A Collingwood, Fawley Meeting, Hambleden Parish Council, Councillor M Harris, Councillor D Johncock, Lane End Parish Council, Councillor J Langley, Councillor T Lee, Little Marlow Parish Council, Marlow Town Council, Councillor N Marshall, Medmenham Parish Council and Councillor R Scott Others in attendance Sgt R Hughes, T Evans, L Sokolowksi, J Ryans, S Taylor, M Devlin and L Jeffries and S Taylor Agenda Item 1 Apologies for Absence [The apologies were not read out at the start of the meeting; however, apologies had been received from Councillor Chris Whitehead, Wooburn and Bourne End Parish Council, Councillor Roger Wilson, Councillor Ian McEnnis and Councillor Richard Scott (Ibstone Parish Council)]. 2 Welcome/Introduction The Chairman, Councillor Dominic Barnes, introduced himself and welcomed everyone to the meeting and advised that the aim of the Community Board (CB) was to work in partnership with the community to make a difference using funding to support community projects and initiatives. The action plan, included in the agenda pack, was a fluid document and the majority of the ‘business’ was carried out by the working groups. Everyone, including members of the public, was welcome to ask questions during the meeting. The Chairman stated he was looking forward to the CB membership growing as promotion continued across the area and he welcomed Mr Lloyd Jeffries, the Service Director Champion of the South West Chilterns CB. -

Site Allocations and Housing Supply: Assessment of the Housing Land Availability in Wycombe District

SITE ALLOCATIONS AND HOUSING SUPPLY: ASSESSMENT OF THE HOUSING LAND AVAILABILITY IN WYCOMBE DISTRICT ON BEHALF OF “KEEP BOURNE END GREEN” PREPARED BY: SIMON CARTER NOVEMBER 2017 SITE ALLOCATIONS AND HOUSING SUPPLY ASSESSMENT CONTENTS PAGE 1. Foreword 3 2. Introduction 4 3. Methodology 7 4. Housing Supply 10 5. Office to Residential Windfall 13 6. Small Sites Windfall 19 7. Housing Policy Sites 24 8. The Adopted Development Plan 25 9. Planning Applications Pending Decision 26 10. Green Belt 27 11. Conclusion 28 APPENDICES: Appendix 1 – Delivered Housing Appendix 2 – Deliverable Housing Appendix 3 – Developable Housing Appendix 4 – Student Accommodation Appendix 5 – Windfall Sites Appendix 6 – ‘Prior Approval’ Office to residential Appendix 7 – ‘Full Planning Permission’ Office to residential Appendix 8 – Planning Applications Pending Decision Cover image: Hollands Farm and Bourne End Page 2 of 31 SITE ALLOCATIONS AND HOUSING SUPPLY ASSESSMENT 1. Foreword 1.1. I have undertaken this assessment of site allocations and housing supply upon instruction from and in the context of my involvement with Keep Bourne End Green (KBEG). The principal objectives for the assessment were defined as - • Validate the status of the housing supply in Bourne End and wider Wycombe District (including whether alternate brownfield sites are generally available), and; • Assess whether the release of Green Belt land at Hollands Farm is necessary to meet the unmet housing need. 1.2. I have a professional background founded in information technology with a long (25-year) history specialising in data services and for the past decade delivering data analytics to blue- chip companies. This gives me the necessary experience, expertise and understanding to co- ordinate the KBEG sub-group team in the core tasks required to fulfil the aims of this assessment including defining, collecting and processing data from planning records and site information embedded across a wide body of reports. -

Buckinghamshire County Council Wycombe Local Committee

Buckinghamshire County Council Wycombe Local Committee AGENDA ITEM: MINUTES OF THE MEETING OF WYCOMBE LOCAL COMMITTEE HELD ON TUESDAY 20 APRIL 2005, IN THE MAIN HALL, THE HUB, EASTON STREET, HIGH WYCOMBE COMMENCING AT 6.03 PM AND CONCLUDING AT 7.58 PM MEMBERS PRESENT Council Organisation or Society Representative Buckinghamshire County Council Mrs L Clarke (Chairman) Mr D A B Green Mr M B Oram Mrs C C Martens Wycombe District Council Mr P Morris Members in attendance Little Marlow Parish Council Mr T Juby British Motorcyclists Federation Mr I M Jennery Hambledon Parish Council Mr T Nixey Jacobs Babtie Mr S Tinnelly Hughenden Parish Council Mr D L Davis Medmenham Parish Council Mr D Clark Mrs H Reed Lane End Parish Council Ms S Wright Pedestrians Association Mr T Samson Thames Valley Police Traffic Mr D Humphries Management Cyclists Touring Club Mr N Coates West Wycombe Parish Council Mr D Callaghan Ms D Smith 1 Downley Parish Council Mr J Gowen Great and Little Hampden Parish Council Mr S Appleby Great Marlow Parish Council Mr M Blanksby Princes Risborough Town Council Mr L A Benifer Officers Buckinghamshire County Council Mr M Knight Mr I Reed Mrs K L Jones Mr S Averill Mr M Rogers Mr D Chapman Wycombe District Council Mr O Kelly Mr R Marshall Mrs C Steven 1 APOLOGIES FOR ABSENCE Apologies were received from Mr F Downes, Mrs V A Letheren, Mrs E M Lay, Mr R C Pushman, Mr P Rogerson, Mr T Fowler, Dr B Stenner and Julia Wassall Buckinghamshire County Council, Mr F V J Sweatman Marlow Town Council and Mr J Hambly Ellesborough Town Council.