Statement of Media Content Policy Methodology for 2020 SMCP

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

PSB Report Definitions

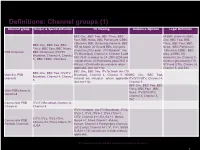

Definitions: Channel groups (1) Channel group Output & Spend definition TV Viewing Audience Opinion Legal Definition BBC One, BBC Two, BBC Three, BBC All BBC channels (BBC Four, BBC News, BBC Parliament, CBBC, One, BBC Two, BBC CBeebies, BBC streaming channels, BBC Three, BBC Four, BBC BBC One, BBC Two, BBC HD (to March 2013) and BBC Olympics News , BBC Parliament Three, BBC Four, BBC News, channels (2012 only). ITV Network* (inc ,CBeebies, CBBC, BBC PSB Channels BBC Parliament, ITV/ITV ITV Breakfast), Channel 4, Channel 5 and Alba, all BBC HD Breakfast, Channel 4, Channel S4C (S4C is added to C4 2008-2009 and channels), the Channel 3 5,, BBC CBBC, CBeebies excluded from 2010 onwards post-DSO in services (provided by ITV, Wales). HD variants are included where STV and UTV), Channel 4, applicable (but not +1s). Channel 5, and S4C. BBC One, BBC Two, ITV Network (inc ITV BBC One, BBC Two, ITV/ITV Main five PSB Breakfast), Channel 4, Channel 5. HD BBC One, BBC Two, Breakfast, Channel 4, Channel channels variants are included where applicable ITV/STV/UTV, Channel 4, 5 (but not +1s). Channel 5 BBC One, BBC Two, BBC Three, BBC Four , BBC Main PSB channels News, ITV/STV/UTV, combined Channel 4, Channel 5, S4C Commercial PSB ITV/ITV Breakfast, Channel 4, Channels Channel 5 ITV+1 Network (inc ITV Breakfast) , ITV2, ITV2+1, ITV3, ITV3+1, ITV4, ITV4+1, CITV, Channel 4+1, E4, E4 +1, More4, CITV, ITV2, ITV3, ITV4, Commercial PSB More4 +1, Film4, Film4+1, 4Music, 4Seven, E4, Film4, More4, 5*, Portfolio Channels 4seven, Channel 4 Paralympics channels 5USA (2012 only), Channel 5+1, 5*, 5*+1, 5USA, 5USA+1. -

Why Freesat Chose Mapp As Their Technology Partner

CASE STUDY Why Freesat Chose Mapp as Their Technology Partner Freesat is a subscription-free satellite TV service offering “no subscriptions, just great telly.” Even though they partnered with Mapp only a couple of months ago, they are already fully integrated with the platform and their marketing campaigns are up and running. Freesat is a company with big ambitions for their marketing – and Mapp is helping them realize those ambitions. , Freesat s challenges 1 SPREAD AWARENESS 2 BECOME DATA-DRIVEN 3 FIND A REAL PARTNER Freesat’s primary objective Freesat had been capturing Freesat wasn’t just in search is increasing awareness customer data for some time, of a new email tool, they for their TV service and but it hadn’t really been used were looking for a vendor informing people that there as effectively as possible. They who could partner with them is a smarter choice when wanted to be more data-driven to reach their marketing it comes to watching great and personalize the customer goals. A hands-off account TV. Freesat operates in a journey in a way that they management team didn’t fit highly competitive market weren’t able to do with their their current needs, and, therefore, need to previous marketing tools. With a so the challenge was finding make people aware of the data-driven approach, they have a partner that could help differences between their more control over the journey – them evolve, as well as service and the competitor’s and are able to expand to new a platform that could offerings – and, ultimately, channels – and turn a visitor evolve with them. -

Channel 4 - a Change of Ownership?

By John Woodhouse 15 September 2021 Channel 4 - a change of ownership? Summary 1 Background 2 Further reading commonslibrary.parliament.uk Number 9280 Channel 4 - a change of ownership? Contributing Authors Maria Lalic Image Credits Channel 4 building by Tom Morris. Licensed by CC BY-SA 3.0 Disclaimer The Commons Library does not intend the information in our research publications and briefings to address the specific circumstances of any particular individual. We have published it to support the work of MPs. You should not rely upon it as legal or professional advice, or as a substitute for it. We do not accept any liability whatsoever for any errors, omissions or misstatements contained herein. You should consult a suitably qualified professional if you require specific advice or information. Read our briefing ‘Legal help: where to go and how to pay’ for further information about sources of legal advice and help. This information is provided subject to the conditions of the Open Parliament Licence. Feedback Every effort is made to ensure that the information contained in these publicly available briefings is correct at the time of publication. Readers should be aware however that briefings are not necessarily updated to reflect subsequent changes. If you have any comments on our briefings please email [email protected]. Please note that authors are not always able to engage in discussions with members of the public who express opinions about the content of our research, although we will carefully consider and correct any factual errors. You can read our feedback and complaints policy and our editorial policy at commonslibrary.parliament.uk. -

Sky's Response to Ofcom's Strategic Review Of

SKY’S RESPONSE TO OFCOM’S STRATEGIC REVIEW OF SATELLITE AND SPACE SCIENCE USE OF SPECTRUM: CALL FOR INPUT 1.1 Sky welcomes the opportunity to comment on Ofcom’s call for input on its strategic review of satellite and space science use of spectrum (“the call for input”). 1.2 Sky is a heavy spectrum user, with activities ranging across many frequency bands. We use spectrum to deliver our services (via satellite, DTT, Wi-Fi and mobile), to create our content (using wireless microphones and cameras and programme links) and to connect our customers (through in-home and public Wi-Fi). 1.3 Our varied use of spectrum makes us well placed to appreciate the tensions between competing applications which make use of scarce spectrum, and the challenges that policymakers may face when considering spectrum allocation in the medium- to long-term. 1.4 Sky strongly supports moves that ensures more efficient use of spectrum, through (for example) the use of newer more advanced and efficient technologies, the application of market forces wherever practical and innovative approaches to allocation and access such as spectrum sharing. This approach is consistent with Ofcom’s general duties as set out in statute, including securing the optimal use of the spectrum and encouraging investment and innovation. 1.5 Sections 2 and 3 of this response provide brief and high level comments on the call for input. In section 4, we provide specific answers to questions that are relevant to Sky. 2. The motivation for Ofcom’s review is unclear 2.1 Ofcom states that the reason for issuing the call for input is “to understand potential demand and supply trends, as well as trends in technology that might mitigate additional demand”1. -

ITV Plc Final Results 2007

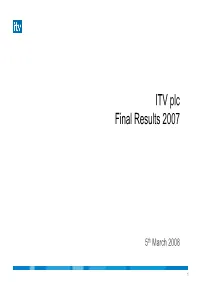

ITV plc Final Results 2007 5th March 2008 1 Introduction Michael Grade Executive Chairman 2 Agenda Introduction Financial and operating review Current trading and strategy update 3 Overview 2007 financial results Total revenue £2,082m (2006: £2,181m) Operating EBITA £311m (2006: £375m) Impacted by legacy issues and digital investment 2007 operational and strategic progress ITV viewing increased year-on-year for first time in over a decade ITV NAR stabilised at £1,489m (2006: £1,494m) Strengthened management team appointed Strategic plan and targets announced 2008 current trading ITV outperforming market in revenues and ratings Î Turnaround plan on track 4 Board and management changes Executive Chairman term extended to four years and end of 2010 John Cresswell becomes dedicated COO, with new FD to be appointed Dawn Airey and Rupert Howell join plc Board Peter Fincham to join as ITV Director of Television 5 Financial and operating review John Cresswell Chief Operating Officer 6 Final Results 12 months to 31st Dec - £m 2007 2006 Change Published Published % Revenue 2,082 2,181 (5) Operating EBITA 311 375 (17) Amortisation Normal (56) (56) CSA Impairment (28) (20) Exceptional items inc gains on sales (9) 4 Associates, JVs and investment income 3 11 Profit before interest and tax 221 314 (30) Interest (33) (26) 27 Profit before tax 188 288 (35) 7 Final Results 12 months to 31st Dec - £m 2007 2006 Change Published Published % Profit before tax 188 288 (35) Tax (50) (66) (24) Profit after tax 138 222 (38) Minority interests (1) -

AT2400 Alltouch® Remote Control How Do I Program the Mode Keys? What If None of the Codes Work? the Same Time, Regardless of the Current Mode

FCC Compliance Setting Up Your Remote (continued) User’s Guide Can I Change My Volume Control? Can I Change My Channel Control? This device complies with Part 15 of the FCC Rules. You can program your Volume and Mute keys to By default, the channel keys on your remote (CH+, Operation is subject to the following two conditions: function in one of two ways: CH-, digits 0-9, and Last) let you change channels (1) This device may not cause harmful interference, • To control the volume on a single device all on the set-top, the TV, or a VCR, depending on the and (2) this device must accept any interference the time current mode. You can disable or enable channel received, including interference that may cause control for the TV or VCR mode. Also, if you have ® • To control the volume on each device, AT2400 AllTouch undesired operation. reassigned your AUX key to control a second TV depending on the mode key that you press or VCR, you can disable or enable channel control Note Remote Control Note: The default setting is to control volume for that device as well. See Reassigning Mode This equipment has been tested and found to comply through your TV all the time. Keys, earlier in this section, for more information. with the limits for a class B digital device, pursuant Follow these steps to change the way your Volume If you disable the channel control for a TV or VCR, to Part 15 of the FCC Rules. These limits are and Mute keys function. -

BBC Trust’S Review of BBC Services for Younger Audiences

Channel 4 submission to the BBC Trust’s review of BBC services for younger audiences 1. Channel 4 welcomes the opportunity to provide its views to the BBC Trust’s review of BBC services for younger audiences. Channel 4 is a publicly-owned, commercially-funded public service broadcaster. Its core public service channel, Channel 4, is a free-to-air service funded predominantly by advertising. Unlike the other commercially-funded public service broadcasters, Channel 4 is not shareholder owned: commercial revenue is only a means to delivering Channel 4’s public purpose end and any surplus revenues are reinvested in the delivery of its public service remit. 2. In recent years, Channel 4 has broadened its portfolio to offer a range of digital services, including the free-to-air, commercially-funded digital television channels Channel 4+1, E4, E4+1, Film4, More4 and 4Music. Channel 4 also offers a video on demand service, 4oD, and it is expanding its range of services at channel4.com. In addition, Channel 4 offers a range of online education projects for 14 to 19 year olds and has launched an innovation pilot fund, 4iP, which seeks to stimulate whole new digital media services across a range of areas, including video games, the arts, democracy and sport. 3. These innovations have allowed Channel 4 to stay in touch with audiences— especially younger viewers—who are rapidly migrating to digital media. Ever since its launch in 1982, Channel 4’s brand has resonated particularly strongly with teenagers and younger adults, and the organisation speaks with an authenticity of voice which is not easily replicated by other public institutions. -

FREEVIEW DTT Multiplexes (UK Inc NI) Incorporating Planned Local TV and Temporary HD Muxes

As at 07 December 2020 FREEVIEW DTT Multiplexes (UK inc NI) incorporating planned Local TV and Temporary HD muxes 3PSB: Available from all transmitters (*primary and relay) 3 COM: From *80 primary transmitters only Temp HD - 25 Transmiters BBC A (PSB1) BBC A (PSB1) continued BBC B (PSB3) HD SDN (COM4) ARQIVA A (COM5) ARQIVA B (COM6) ARQIVA C (COM7) HD ARQIVA D (COM8) HD LCN LCN LCN LCN LCN LCN LCN 1 BBC ONE 65 TBN UK 12 QUEST 11 Sky Arts 22 Ideal World 64 Free Sports BBC RADIO: 1 BBC ONE NI Cambridge, Lincolnshire, 74 Shopping Quarter 13 E4 (Wales only) 17 Really 23 Dave ja vu 70 Quest Red+1 722 Merseyside, Oxford, 1 BBC ONE Scot Solent, Somerset, Surrey, 101 BBC 1 Scot HD 16 QVC 19 Dave 26 Yesterday 83 NOW XMAS Tyne Tees, WM 1 BBC ONE Wales 101 BBC 1 Wales HD 20 Drama 30 4Music 33 Sony Movies 86 More4+1 2 BBC TWO 101 BBC ONE HD 21 5 USA 35 Pick 36 QVC Beauty 88 TogetherTV+1 (00:00-21:00) 2 BBC TWO NI BBC RADIO: 101 BBC ONE NI HD 27 ITVBe 39 Quest Red 37 QVC Style 93 PBS America+1 726 BBC Solent Dorset 2 BBC TWO Wales BBC Stoke 102 BBC 2 Wales HD 28 ITV2 +1 42 Food Network 38 DMAX 96 Forces TV 7 BBC ALBA (Scot only) 102 BBC TWO HD 31 5 STAR 44 Gems TV 40 CBS Justice 106 BBC FOUR HD 9 BBC FOUR 102 BBC TWO NI HD 32 Paramount Network 46 Film4+1 43 HGTV 107 BBC NEWS HD Sony Movies Action 9 BBC SCOTLAND (Scot only) BBC RADIO: 103 ITV HD 41 47 Challenge 67 CBS Drama 111 QVC HD (exc Wales) 734 Essex, Northampton, CLOSED 24 BBC FOUR (Scot only) Sheffield, 103 ITV Wales HD 45 Channel 5+1 48 4Seven 71 Jewellery Maker 112 QVC Beauty HD 201 CBBC -

TP Vision Confirms Arrival of Freeview Play on Philips Android Tvs

News Release TP Vision confirms arrival of Freeview Play on Philips Android TVs TP Vision has confirmed the imminent arrival of Freeview Play to the company’s Philips Android TVs. Freeview Play is the UK’s fastest growing TV platform, launched in 2015, the platform now has over 7 million users. Freeview Play gives viewers access to live and on demand TV in one easy to use interface. The platform provides 85 live channels (including 15 in HD), as well as 20,000 hours of on-demand content from BBC iPlayer, ITV Hub, All 4, My 5, UKTV Play, CBS Catchup Channels UK and Horror Bites. TP Vision has been one of the strongest and most successful partners for Android TV having first introduced the platform back in 2014 and having committed nearly 50% of the company’s range of Philips sets to Android TV ever since – including the premium OLED and OLED+ ranges, frequently awarded the status of the Best TV available by the media, consumers and the trade. Philips Android TVs manufactured from now on will include firmware that enables Freeview Play by default. 2019 model year Philips Android TVs which are in-store or are already in use in consumer homes will receive an over-the-air software update which will prompt users to enable Freeview Play on the TV via easy onscreen instructions. In the case of any further questions, consumers can easily contact Philips’ Consumer Care info-line for help. Commenting on the inclusion of Freeview Play to Philips Android TVs, Martijn Smelt CMO for Europe at TP Vision said: ‘The addition of Freeview Play is the final piece that allows us to confidently say Philips Android TV sets offer the best overall package on the UK market. -

Diamond Technical Account and Methodology

Diamond Technical Account and Methodology What is Diamond? Diamond is designed to answer two questions: - Does the workforce on UK productions, both on and off-screen, reflect the diversity of the UK population? - Are audiences seeing themselves reflected on-screen. With the support of production companies, Diamond collects diversity data directly from cast and crew working on TV programmes (actual data), as well as information about how those on-screen might be perceived by viewing audiences (perceived data). Diamond data collection Scope Diamond is collecting data from: UK original productions commissioned by BBC, ITV, Channel 4, C5/ViacomCBS and Sky. All genres (although we do not currently report on film, sport and news) A large number of on and off-screen TV production roles (see Appendix 2) Programmes broadcast across the following channels BBC One, BBC Two, BBC Scotland, CBBC, CBEEBIES, CITV, GMTV1, GMTV2, ITV Encore, ITV1, ITV2, ITV3, ITV4, ITVBe, 4seven, Channel4, E4, Film Four, More 4, 5 Star, Channel5, Challenge TV, Paramount Network, Pick TV, Real Lives, Sky Arts, Sky Atlantic, Sky One, Sky Two, Sky Witness1 Data about 6 diversity characteristics: gender, gender identity, age, ethnicity, disability and sexual orientation. Diamond is not collecting data about: Programmes which have not been commissioned by the five Diamond broadcasters People working across broadcasting more generally, outside of production (our data are not overall workforce statistics). People who are not making a significant contribution to a programme (for example part of a crowd scene) More information about what is and isn’t collected can be found in the guidance notes issued to producers. -

Crossing the Line Between News and the Business of News: Exploring Journalists' Use of Twitter Jukes, Stephen

www.ssoar.info Crossing the line between news and the business of news: exploring journalists' use of Twitter Jukes, Stephen Veröffentlichungsversion / Published Version Zeitschriftenartikel / journal article Empfohlene Zitierung / Suggested Citation: Jukes, S. (2019). Crossing the line between news and the business of news: exploring journalists' use of Twitter. Media and Communication, 7(1), 248-258. https://doi.org/10.17645/mac.v7i1.1772 Nutzungsbedingungen: Terms of use: Dieser Text wird unter einer CC BY Lizenz (Namensnennung) zur This document is made available under a CC BY Licence Verfügung gestellt. Nähere Auskünfte zu den CC-Lizenzen finden (Attribution). For more Information see: Sie hier: https://creativecommons.org/licenses/by/4.0 https://creativecommons.org/licenses/by/4.0/deed.de Media and Communication (ISSN: 2183–2439) 2019, Volume 7, Issue 1, Pages 248–258 DOI: 10.17645/mac.v7i1.1772 Article Crossing the Line between News and the Business of News: Exploring Journalists’ Use of Twitter Stephen Jukes Faculty of Media and Communication, Bournemouth University, Poole, BH12 5BB, UK; E-Mail: [email protected] Submitted: 7 September 2018 | Accepted: 4 January 2018 | Published: 21 March 2019 Abstract Anglo-American journalism has typically drawn a firm dividing line between those who report the news and those who run the business of news. This boundary, often referred to in the West as a ‘Chinese Wall’, is designed to uphold the inde- pendence of journalists from commercial interests or the whims of news proprietors. But does this separation still exist in today’s age of social media and at a time when news revenues are under unprecedented pressure? This article focuses on Twitter, now a widely used tool in the newsroom, analysing the Twitter output of 10 UK political correspondents during the busy party conference season. -

BBC Worldwide and ITV SVOD Service Britbox to Launch in Canada Early 2018

BBC Worldwide and ITV SVOD Service BritBox to Launch in Canada Early 2018 Service Will Feature Canadian Premieres of Compelling New Dramas Including Idris Elba’s ‘Five by Five,’ Jeff Pope's ‘The Moorside,’ and Jimmy McGovern's 'Reg,' SVOD Drama & Comedy Premieres ‘Maigret,’ ‘Broken,’ ‘Rev,’ ‘Mum,’ and ‘Inside No. 9,’ as Well as Season Premieres of Drama Favorites ‘Cold Feet’ and ‘Silent Witness’ Special ‘Now’ Category of Service to Offer Current Affairs Series ‘The Papers’ and ‘PMQ,’ along with Panel Show ‘QI,’ and Top UK Soaps ‘Casualty,’ ‘Emmerdale,’ and ‘Holby City’ as Soon as 24 Hours After UK Broadcast New York/London – Tuesday, December 12, 2017 – BritBox, the subscription video-on- demand (SVOD) streaming service from BBC Worldwide, the commercial arm of the BBC, and ITV, the UK’s biggest commercial broadcaster, will launch in Canada in early 2018. The service initially launched in the U.S. in March of this year. This unique streaming service will celebrate the very best of British TV, and offer the most comprehensive collection of British content in the market today. For decades, BBC and ITV have produced iconic British television series, and now Canadians will be able to access these programs in a single, curated service allowing fans to find the classic shows they love and discover new hit series. The BritBox proposition will feature: • An array of drama premieres never-before-seen in Canada, including Five by Five, produced by and starring Golden Globe® winner and Oscar® nominee Idris Elba (Luther), and the critically acclaimed series The Moorside, starring Gemma Whelan (Game of Thrones) and Siobhan Finneran (Downton Abby), and Reg, Jimmy McGovern's International Emmy® nominated and RTS winning drama starring Tim Roth (Twin Peaks) and Anna Maxwell Martin (Philomena).