Annual Report 2019

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

TIN CAS Number

Common Name: TIN CAS Number: 7440-31-5 RTK Substance number: 1858 DOT Number: None Date: January 1986 Revision: April 2001 ------------------------------------------------------------------------- ------------------------------------------------------------------------- HAZARD SUMMARY WORKPLACE EXPOSURE LIMITS * Tin can affect you when breathed in. OSHA: The legal airborne permissible exposure limit * Contact can irritate the skin and eyes. (PEL) is 2 mg/m3 averaged over an 8-hour * Breathing Tin can irritate the nose, throat and lungs workshift. causing coughing, wheezing and/or shortness of breath. * Tin can cause nausea, vomiting, diarrhea and abdominal NIOSH: The recommended airborne exposure limit is pain, headache, fatigue and tremors. 2 mg/m3 averaged over a 10-hour workshift. * Tin can cause "spots" to appear on chest x-ray with normal lung function (stannosis). ACGIH: The recommended airborne exposure limit is 3 * Tin may damage the liver and kidneys. 2 mg/m averaged over an 8-hour workshift. * High exposure can affect the nervous system. WAYS OF REDUCING EXPOSURE IDENTIFICATION * Where possible, enclose operations and use local exhaust Tin is a soft, white, silvery metal or a grey-green powder. It ventilation at the site of chemical release. If local exhaust is found in alloys, Babbitt and similar metal types, and is used ventilation or enclosure is not used, respirators should be as a protective coating and in glass bottle and can worn. manufacturing. * Wear protective work clothing. * Wash thoroughly immediately after exposure to Tin. REASON FOR CITATION * Post hazard and warning information in the work area. In * Tin is on the Hazardous Substance List because it is addition, as part of an ongoing education and training regulated by OSHA and cited by ACGIH and NIOSH. -

Healthcare Reform in Russia: Problems and William Tompson Prospects

OECD Economics Department Working Papers No. 538 Healthcare Reform in Russia: Problems and William Tompson Prospects https://dx.doi.org/10.1787/327014317703 Unclassified ECO/WKP(2006)66 Organisation de Coopération et de Développement Economiques Organisation for Economic Co-operation and Development 15-Jan-2007 ___________________________________________________________________________________________ _____________ English text only ECONOMICS DEPARTMENT Unclassified ECO/WKP(2006)66 HEALTHCARE REFORM IN RUSSIA: PROBLEMS AND PROSPECTS ECONOMICS DEPARTMENT WORKING PAPERS No. 538 By William Tompson All Economics Department Working Papers are available through OECD's website at www.oecd.org/eco/working_papers text only English JT03220416 Document complet disponible sur OLIS dans son format d'origine Complete document available on OLIS in its original format ECO/WKP(2006)66 ABSTRACT/RÉSUMÉ Healthcare Reform in Russia: Problems and Prospects This paper examines the prospects for reform of Russia’s healthcare system. It begins by exploring a number of fundamental imbalances that characterise the current half-reformed system of healthcare provision before going on to assess the government’s plans for going ahead with healthcare reform over the medium term. The challenges it faces include strengthening primary care provision and reducing the current over-reliance on tertiary care; restructuring the incentives facing healthcare providers; and completing the reform of the system of mandatory medical insurance. This paper relates to the OECD Economic Survey of the Russian Federation 2006 (www.oecd.org/eco/surveys/russia). JEL classification: I11, I12, I18 Keywords: Russia; healthcare; health insurance; competition; primary care; hospitalisation; pharmaceuticals; single payer; ***************** La reforme du système de santé en Russie: problèmes et perspectives La présente étude analyse les perspectives de réforme du système de santé en Russie. -

Five Keys to Safer Food Manual

FIVE KEYS TO SAFER FOOD MANUAL DEPARTMENT OF FOOD SAFETY, ZOONOSES AND FOODBORNE DISEASES FIVE KEYS TO SAFER FOOD MANUAL DEPARTMENT OF FOOD SAFETY, ZOONOSES AND FOODBORNE DISEASES INTRODUCTION Food safety is a significant public health issue nsafe food has been a human health problem since history was first recorded, and many food safety Uproblems encountered today are not new. Although governments all over the world are doing their best to improve the safety of the food supply, the occurrence of foodborne disease remains a significant health issue in both developed and developing countries. It has been estimated that each year 1.8 million people die as a result of diarrhoeal diseases and most of these cases can be attributed to contaminated food or water. Proper food preparation can prevent most foodborne diseases. More than 200 known diseases are transmitted through food.1 The World Health Organization (WHO) has long been aware of the need to educate food handlers about their responsibilities for food safety. In the early 1990s, WHO developed the Ten Golden Rules for Safe Food Preparation, which were widely translated and reproduced. However, it became obvious that something simpler and more generally applicable was needed. After nearly a year of consultation with food safety expertsandriskcommunicators, WHOintroducedtheFive KeystoSaferFoodposterin2001.TheFive Keys toSaferFoodposterincorporatesallthemessagesoftheTen Golden Rules for Safe Food Preparation under simpler headings that are more easily remembered and also provides more details on the reasoning behind the suggested measures. The Five Keys to Safer Food Poster The core messages of the Five Keys to Safer Food are: (1) keep clean; (2) separate raw and cooked; (3) cook thoroughly; (4) keep food at safe temperatures; and (5) use safe water and raw materials. -

Guide to Developing the Safety Risk Management Component of a Public Transportation Agency Safety Plan

Guide to Developing the Safety Risk Management Component of a Public Transportation Agency Safety Plan Overview The Public Transportation Agency Safety Plan (PTASP) regulation (49 C.F.R. Part 673) requires certain operators of public transportation systems that are recipients or subrecipients of FTA grant funds to develop Agency Safety Plans (ASP) including the processes and procedures necessary for implementing Safety Management Systems (SMS). Safety Risk Management (SRM) is one of the four SMS components. Each eligible transit operator must have an approved ASP meeting the regulation requirements by July 20, 2020. Safety Risk Management The SRM process requires understanding the differences between hazards, events, and potential consequences. SRM is an essential process within a transit The Sample SRM Definitions Checklist can support agencies agency’s SMS for identifying hazards and analyzing, as- with understanding and distinguishing between these sessing, and mitigating safety risk. Key terms, as de- terms when considering safety concerns and to help ad- fined in Part 673, include: dress Part 673 requirements while developing the SRM • Event–any accident, incident, or occurrence. section of their ASP. • Hazard–any real or potential condition that can cause injury, illness, or death; damage to or loss of the facilities, equipment, rolling stock, or infra- structure of a public transportation system; or damage to the environment. • Risk–composite of predicted severity and likeli- hood of the potential effect of a hazard. • Risk Mitigation–method(s) to eliminate or re- duce the effects of hazards. Sample SRM Definitions Checklist The following is not defined in Part 673. However, transit Part 673 requires transit agencies to develop and imple- agencies may choose to derive a definition from other text ment an SRM process for all elements of its public provided in Part 673, such as: transportation system. -

What Exactly Is Patient Safety?

What Exactly Is Patient Safety? Linda Emanuel, MD, PhD; Don Berwick, MD, MPP; James Conway, MS; John Combes, MD; Martin Hatlie, JD; Lucian Leape, MD; James Reason, PhD; Paul Schyve, MD; Charles Vincent, MPhil, PhD; Merrilyn Walton, PhD Abstract We articulate an intellectual history and a definition, description, and model of patient safety. We define patient safety as a discipline in the health care professions that applies safety science methods toward the goal of achieving a trustworthy system of health care delivery. We also define patient safety as an attribute of health care systems that minimizes the incidence and impact of adverse events and maximizes recovery from such events. Our description includes: why the field of patient safety exists (the high prevalence of avoidable adverse events); its nature; its essential focus of action (the microsystem); how patient safety works (e.g., high- reliability design, use of safety sciences, methods for causing change, including cultural change); and who its practitioners are (i.e., all health care workers, patients, and advocates). Our simple and overarching model identifies four domains of patient safety (recipients of care, providers, therapeutics, and methods) and the elements that fall within the domains. Eleven of these elements are described in this paper. Introduction A defining realization of the 1990s was that, despite all the known power of modern medicine to cure and ameliorate illness, hospitals were not safe places for healing. Instead, they were places fraught with risk of patient harm. One important response to this realization has been the growth of interest in patient safety. It is increasingly clear that patient safety has become a discipline, complete with an integrated body of knowledge and expertise, and that it has the potential to revolutionize health care, perhaps as radically as molecular biology once dramatically increased the therapeutic power in medicine. -

Safety and Health Injury Prevention Sheets (SHIPS)

Occupational Safety and Health Administration S AFETY and H EALTH I NJURY P REVENTION S HEETS Working with the Shipyard Industry Occupational Safety and Health Shipbuilding,Ship Repair Administration and Ship Breaking Introduction : Working with the ShipyardShipyard IndustrIndustryy Shipyards operating in the United States often do not have the benefit of full-time, on-board safety and health specialists. Although help is available from workers’ compensation loss control consultants, or state consultation services, their consultants are not always familiar with the unique aspects and hazards of shipyard operations. To meet this need and help prevent injuries, the shipyard community and OSHA have jointly developed Safety and Health Injury Prevention Sheets (SHIPS). Representatives of large and small shipyards around the country assisted OSHA in identifying the most frequent hazards and injuries in shipbuilding and ship repair work. Designed for both employers and workers, SHIPS presents information on hazard awareness and controls in a user-friendly format. Pictures from actual shipyards depict hazards and recommended solutions. The time-tested solutions presented are those the shipyard community has found to be most effective in reducing or eliminating shipyard injuries. The goal of SHIPS is to reduce or eliminate unsafe work practices by increasing employer and worker awareness of safety and health hazards. The first SHIPS presented is Hot Work-Welding, Cutting and Brazing. Some of the material may need to be adapted to different size shipyards and different local conditions. We hope that you will find the information helpful in setting up a plan to make your shipyard a safer and more healthful place to work. -

Housing-Related Health and Safety Hazard Assessment

4 Housing-Related Health and Safety Hazard Assessment Resident Interviews Purpose Past Experience Interviewer Staffing Interviewer Training Interview Documentation Quality Control/Quality Assurance Managing Confidential Data and Resident Concerns for Privacy Interview Tools Interview Data Security Visual Assessment Purpose—Identify Housing Defects and Causes Limitations of Visual Assessment and Training Needed Scope Sequencing Areas Healthy Home Rating System Specific Housing Conditions to Assess Visually Prioritizing Visual Assessment Results Environmental Sampling and Measurements Environmental Sampling Methods— General Considerations Energy Audits page 65 page 66 Housing-Related Health and Safety Hazard Assessment 4 ousing conditions should support the health and well-being of its residents; Hthey should not cause injuries or illness. This simple principle lies at the heart of healthy housing initiatives and recognizes interactions Key Messages between housing and disease, injury, and •• There are three primary ways of identifying overall well being. Identifying unhealthy housing housing health and safety problems: conditions is a prerequisite to correcting them resident interviews, visual assessments, and before they negatively impact health. environmental sampling. Visual assessments are the foundation of the assessment This chapter provides an overview of inspection process, while environmental sampling is and assessment methods, highlights specific usually limited because of cost constraints. tools, and lays the foundation for effective and efficient interventions addressed in •• Interviews with residents should be Chapter 5. Home-based health hazards can conducted by skilled individuals. The be assessed by: (1) collecting information interview can help to inform the visual on occupants’ health and housing concerns assessment and environmental sampling, as during resident interviews; (2) performing a well as provide an education opportunity. -

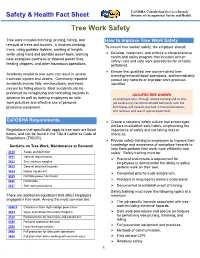

Tree Work Safety Fact Sheet

Cal/OSHA Consultation Services Branch Safety & Health Fact Sheet Division of Occupational Safety and Health Tree Work Safety Tree work includes trimming, pruning, felling, and How to Improve Tree Work Safety removal of trees and bushes. It involves climbing To ensure tree worker safety, the employer should: trees, using portable ladders, working at heights while using hand and portable power tools, working • Develop, implement, and enforce a comprehensive health and safety program that includes written near energized overhead or downed power lines, safety rules and safe work procedures for all tasks feeding chippers, and other hazardous operations. performed. • Ensure that qualified tree workers direct tree Accidents related to tree work can result in severe trimming/removal/repair operations, and immediately traumatic injuries and deaths. Commonly reported correct any hazards or improper work practices accidents include falls, electrocutions, and those identified. caused by falling objects. Most accidents can be prevented by recognizing and controlling hazards in QUALIFIED TREE WORKER advance as well as training employees on safe An employee who, through related training and on-the- work practices and effective use of personal job experience, has demonstrated familiarity with the techniques and hazards involved in tree maintenance, protective equipment. and removal, and use of special equipment. Cal/OSHA Requirements • Create a company safety culture that encourages workers to establish safe habits, emphasizing the Regulations that specifically apply to tree work are listed importance of safety and not taking risks or below, and can be found in the Title 8 California Code of shortcuts. Regulations (T8CCR) • Provide safety training to employees to improve their Sections on Tree Work, Maintenance or Removal knowledge and awareness of workplace hazards to help them perform their work more efficiently and 3420 Scope and definition safely. -

Guidance for the Selection and Use of PPE in the Healthcare Setting

Guidance for the Selection and Use of Personal Protective Equipment (PPE) in Healthcare Settings 1 PPE Use in Healthcare Settings: Program Goal Improve personnel safety in the healthcare environment through appropriate use of PPE. PPE Use in Healthcare Settings The goal of this program is to improve personnel safety in the healthcare environment through appropriate use of PPE. 2 PPE Use in Healthcare Settings: Program Objectives • Provide information on the selection and use of PPE in healthcare settings • Practice how to safely don and remove PPE PPE Use in Healthcare Settings The objectives of this program are to provide information on the selection and use of PPE in healthcare settings and to allow time for participants to practice the correct way to don and remove PPE. 3 Personal Protective Equipment Definition “specialized clothing or equipment worn by an employee for protection against infectious materials” (OSHA) PPE Use in Healthcare Settings Personal protective equipment, or PPE, as defined by the Occupational Safety and Health Administration, or OSHA, is “specialized clothing or equipment, worn by an employee for protection against infectious materials.” 4 Regulations and Recommendations for PPE • OSHA issues workplace health and safety regulations. Regarding PPE, employers must: – Provide appropriate PPE for employees – Ensure that PPE is disposed or reusable PPE is cleaned, laundered, repaired and stored after use • OSHA also specifies circumstances for which PPE is indicated • CDC recommends when, what and how to use PPE PPE Use in Healthcare Settings OSHA issues regulations for workplace health and safety. These regulations require use of PPE in healthcare settings to protect healthcare personnel from exposure to bloodborne pathogens and Mycobacterium tuberculosis. -

Guidelines for Employers to Reduce Motor Vehicle Crashes

Guidelines for Employers to Reduce Motor Vehicle Crashes This document represents a joint effort by NETS, NHTSA and OSHA to reduce motor vehicle-related deaths and injuries in the nation’s workforce. This [white paper] was funded under [Purchase Order Number B-9-4-2- 3576] for the U.S. Department of Labor, Occupational Safety and Health Administration. The views expressed herein do not necessarily represent the official position or policy of the U.S. Department of Labor. This document is not a standard or regulation, and it creates no new legal obligations. Likewise, it cannot and does not diminish any obligations established by Federal or state statute, rule, or standard. The document is advisory in nature, informational in content, and is intended to assist employers in providing a safe and healthful workplace. The Occupational Safety and Health Act requires employers to comply with hazard-specific safety and health standards. In addition, pursuant to Section 5(a)(1), the General Duty Clause of the Act, employers must provide their employees with a workplace free from recognized hazards likely to cause death or serious physical harm. Employers can be cited for violating the General Duty Clause if there is a recognized hazard and they do not take reason- able steps to prevent or abate the hazard. Every 12 minutes someone dies in a motor vehicle crash, every 10 seconds an injury occurs and every 5 seconds a crash occurs. Many of these incidents occur during the workday or during the commute to and from work. Employers bear the cost for injuries that occur both on and off the job. -

Food Safety and Good Hygienic Practices Handbook for Gambian

FOOD SAFETY AN D GO O D H YGIEN IC PRACTICES H AN DBO O K FO R GAMBIAN YO UTH ENTREPRENEURS October 2017 Banjul, and Geneva Under the supervision of Khemraj Ramful, Senior Adviser, Export Quality Management, this guide on food safety has been prepared by Hema Menon, Trade Training Officer, at the International Trade Centre, in partnership with The Food Safety and Quality Authority of The Gambia (FSQA) and as part of “ The Gambia: Youth Empowerment Project” (YEP), financed by the European Union. For more information on this guide, contact: For more information on YEP, contact: Mr. Khemraj Ramful Ms. Fatou Jallow Senior Adviser, Export Quality Management YEP Project Coordinator and Trade Facilitation and Policy for Business Senior Technical Adviser, Email: [email protected] Email: [email protected] Telephone: +41 22 730 04 87 Tel. +220 3616993; +220 9662895 International Trade Centre International Trade Centre 54-56 Rue de Montbrillant Sait Matty Road, Bakau 1202 Geneva, Switzerland The Gambia I: www.intracen.org/eqm F: www.facebook.com/groups/yepgambia/ T: twitter.com/ITCstandards I: www.yep.gm T: twitter.com/yepgambia Copyright images Shutterstock, FAO, ITC. The designations employed and the presentation of material in this document do not imply the expression of any opinion whatsoever on the part of the International Trade Centre concerning the legal status of any country, territory, city or area or of its authorities, or concerning the delimitation of its frontiers or boundaries. Mention of firm names does not imply endorsement. This document has not formally been edited by the International Trade Centre. -

Produce Safety Rule Draft Guidance: Chapter 3: Health and Hygiene (Subpart D)

AT A GLANCE: KEY POINTS IN THE PRODUCE SAFETY RULE DRAFT GUIDANCE AT A GLANCE: KEY POINTS IN THE PRODUCE SAFETY RULE DRAFT GUIDANCE CHAPTER 3: HEALTH AND HYGIENE (SUBPART D) What is the goal of this chapter? The goal is to help farm personnel understand how they can use hygienic practices to prevent the contamination of produce and food contact surfaces. References to “you” in this document (as well as in the Produce Safety Rule and draft guidance) mean the owner, operator, or agent in charge of a covered farm that is subject to some or all of the requirements of the rule. In addition, unless otherwise specified, we’re only talking about produce covered by the rule. Why are hygienic practices important? Unhygienic practices by farm personnel have contributed to some outbreaks of foodborne illness. A person can carry and transmit pathogens (disease-causing microorganisms) on their skin and in their gastrointestinal and respiratory tracts, and unhygienic practices when handling produce or food contact surfaces could potentially contaminate produce. There is also the potential for produce contamination if a worker comes in contact with contaminated surfaces, such as unclean surfaces, the floor, trash, or animals, and then handles produce. People can spread communicable diseases even if they don’t show symptoms. Who does this most affect? Farm personnel who work in any operations that could result in the contamination of produce and those who supervise such activities. This chapter also outlines precautions for farm visitors. What kind of health conditions is FDA concerned about? An applicable health condition typically is a communicable illness (can be passed on from one person to another) that presents a public health risk in the context of normal work duties.