WMS INDUSTRIES INC. (Exact Name of Registrant As Specified in Its Charter)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

WMS Industries 2010 Annual Report

The gAME has cHANGED… 2 0 1 0 a nn ual report // WMS I N d u S t r I e S I N c . LEADS the Way During the last decade, WMS has become the recognized leader in gaming innovation: • WMS is well-known for creating exciting products with new and unique gaming experiences and leading the way forward based on a clear vision, transcendent innovation and disciplined focus on consistently executing strategic priorities. The gaming industry has evolved and is now on the threshold of exhilarating changes in technologies, new products, new markets and expanded global growth opportunities: • WMS is well positioned to deliver on this future because of its vision and team of passionate, dedicated and diverse people with their proven ability for creativity, innovation and high-performance. 3 the game has changed To Our Stockholders: In fiscal 2010, we demonstrated once again that with the right corporate culture, the right products, the right focus on operational improvement and the right team…we can grow our revenues, margins and earnings, even during difficult times. It was a year that included both significant accomplishments and great challenges. In EPS IncrEased terms of financial performance, we achieved 8% growth in total revenues, proving yet again the value of our 18 % on 8 % innovation-driven vision and the talented and passionate people throughout our organization who bring to life RevEnuE Grow th unique and innovative products that expand the range of differentiated and exciting gaming experiences. And just as importantly, through our focused efforts on continuous improvement, we leveraged our revenue growth and better execution to an improved operating margin and, as a result, our diluted earnings per share grew by 18% to a record $1.88. -

View Annual Report

TRANSFORMATION THROUGH COMBINATION 2013 Annual Report Interactive Our Interactive Group, primarily through our Williams Interactive subsidiary, markets and distributes gaming entertainment products and services for real-money and social gaming across desktop and mobile devices. We provide our player-favorite casino slot games to real-money online casino operators through integration with our centrally located servers. We also integrate our Play4Fun Network™™ B2B operator- branded social casino pplatformlatform into tterrestrialerrestrial cascasinoino operatorsoperators’’ wewebsites.bsites. AddiAdditionally,tionally, we ooperateperate Jackpot Partyy® andand GoldGold FishFish® socialsocial casinoscasinos acrossacross a wide range ofof devices. Lottery Since creating the world’srld’s first secure instant lottery game inn 1973, our Lottery Group designs, pprintsrints and sells a comprehensive suite of creativcreativee instant games along wiwithth vavalue-addinglue-adding services to help our lotteryttery customers grow their revenues, includingncluding marketinmarketingg support, specialty games,mes, mercmerchandisinghandising and promotion packages,es, iinventorynventory management and fulfillmentlment services, and player loyalty programs.s. We also pproviderovide lottery systems, includinging eequipment,quipment, software, data communicationsnications services GamingGaming and support. Additionally,ally, we pproviderovide OurOur GamingGaming GroupGroup develops,devel software, hardware andnd related services mmanufactures,anufactures, markets -

Thf SO~Twarf Toolworks®Catalog SOFTWARE for FUN & INFORMATION

THf SO~TWARf TOOlWORKS®CATAlOG SOFTWARE FOR FUN & INFORMATION ORDER TOLL FREE 1•800•234•3088 moni tors each lesson and builds a seri es of personalized exercises just fo r yo u. And by THE MIRACLE PAGE 2 borrowi ng the fun of vid eo ga mes, it Expand yo ur repertoire ! IT'S AMIRAClf ! makes kids (even grown-up kids) want to The JI!/ irac/e So11g PAGE 4 NINT!NDO THE MIRACLE PIANO TEACHING SYSTEM learn . It doesn't matter whether you 're 6 Coflectioll: Vo/11111e I ~ or 96 - The Mirttcle brings th e joy of music adds 40 popular ENT!RTA INMENT PAGE/ to everyo ne. ,.-~.--. titles to your The Miracle PiC1110 PRODUCTI VITY PAGE 10 Tet1dti11gSyste111, in cluding: "La Bamba," by Ri chi e Valens; INFORMATION PAGElJ "Sara," by Stevie Nicks; and "Thi s Masquerade," by Leon Russell. Volume II VA LU EP ACKS PAGE 16 adds 40 MORE titles, including: "Eleanor Rigby," by John Lennon and Paul McCartney; "Faith," by George M ichael; Learn at your own pace, and at "The Girl Is M in e," by Michael Jackson; your own level. THESE SYMBOLS INDICATE and "People Get Ready," by C urtis FORMAT AVAILABILITY: As a stand-alone instrument, The M irt1de Mayfield. Each song includes two levels of play - and learn - at yo ur own rivals the music industry's most sophis playin g difficulty and is full y arra nged pace, at your own level, NIN TEN DO ti cated MIDI consoles, with over 128 with complete accompaniments for a truly ENTERTAINMENT SYST!M whenever yo u want. -

Ant CARTOLINA 12Luglio 150X

Bologna, Sotto dal 4 luglio al 1° settembre le stelle Piazza Maggiore e BarcArena del Cinema ore 21.30 molte coscienze, trasformando il film in terreno di scontro. La stroncatura Domenica 12 luglio 2020 più celebre, dell’influentissima Pauline Kael, bollava senza mezzi termini Dirty Harry come apologia del fascismo. [...] Serata promossa da L’infuocato dibattito ideologico attorno al film si comprende meglio se in- serito nel clima dell’epoca, segnato da rivolte studentesche, cultura hippy sulla cresta dell’onda, guerra in Vietnam vicina allo sfascio: Ispettore Cal- Polizieschi urbani laghan emerge come oggetto scomodo, in cui si afferma il desiderio di un punto fermo virile e forcaiolo in mezzo alle incertezze sociali. Al tempo ISPETTORE CALLAGHAN: stesso, la figura di Callaghan si staglia come angelo della vendetta fuori IL CASO SCORPIO È TUO dalla storia, attraversato da pulsioni di morte eterne e universali. Il detecti- ve di Eastwood, insomma, sembra trarre forza dal convergere di un alone (Dirty Harry, USA/1971) mitizzante e di un tratteggio realistico preciso, in un’oscillazione che con- tribuisce ad arricchire la complessa riflessione sulla violenza che altri film, Regia: Don Siegel. Soggetto: Harry Julian Fink, Rita M. Fink. Sceneggiatura: nello stesso 1971, stanno intraprendendo: Il braccio violento della legge di Harry Julian Fink, Rita M. Fink, Dean Riesner. Fotografia: Bruce Surtees. William Friedkin, Cane di paglia e Arancia meccanica. Ispettore Callaghan, Montaggio: Carl Pingitore. Scenografia: Dale Hennesy. Musica: Lalo in particolare, insiste sulla dimensione urbana del fenomeno. Schifrin. Interpreti: Clint Eastwood (Harry Callahan), Harry Guardino Ferme restando le posizioni etiche dei vari commentatori, quasi tutti si (Bressler), Andy Robinson (Scorpio), Reni Santoni (Chico Sanchez), John sono trovati d’accordo sulla potenza visiva e narrativa del film, tra gli esiti Vernon (il sindaco), John Larch (il capo della polizia), John Mitchum più alti di un regista che ha sempre fatto dell’efficacia una virtù stilistica. -

PINBALL NVRAM GAME LIST This List Was Created to Make It Easier for Customers to Figure out What Type of NVRAM They Need for Each Machine

PINBALL NVRAM GAME LIST This list was created to make it easier for customers to figure out what type of NVRAM they need for each machine. Please consult the product pages at www.pinitech.com for each type of NVRAM for further information on difficulty of installation, any jumper changes necessary on your board(s), a diagram showing location of the RAM being replaced & more. *NOTE: This list is meant as quick reference only. On Williams WPC and Sega/Stern Whitestar games you should check the RAM currently in your machine since either a 6264 or 62256 may have been used from the factory. On Williams System 11 games you should check that the chip at U25 is 24-pin (6116). See additional diagrams & notes at http://www.pinitech.com/products/cat_memory.php for assistance in locating the RAM on your board(s). PLUG-AND-PLAY (NO SOLDERING) Games below already have an IC socket installed on the boards from the factory and are as easy as removing the old RAM and installing the NVRAM (then resetting scores/settings per the manual). • BALLY 6803 → 6116 NVRAM • SEGA/STERN WHITESTAR → 6264 OR 62256 NVRAM (check IC at U212, see website) • DATA EAST → 6264 NVRAM (except Laser War) • CLASSIC BALLY → 5101 NVRAM • CLASSIC STERN → 5101 NVRAM (later Stern MPU-200 games use MPU-200 NVRAM) • ZACCARIA GENERATION 1 → 5101 NVRAM **NOT** PLUG-AND-PLAY (SOLDERING REQUIRED) The games below did not have an IC socket installed on the boards. This means the existing RAM needs to be removed from the board & an IC socket installed. -

24-35 Top 50 0705

MAY contents volume 56/number 9 COVERSTORY With digital technologies occupying increasing space in our minds and lives, it’s no surprise that many of this year’s award winners took honors for innovations in the areas of marketing and merchandising, or that a number aligned themselves with another big trend that is making waves as technology makes more things possible: mass one-to-one customization. We say kudos to all of Apparel’s innovators, who continue to move the industry forward in interesting and unexpected ways. BY JORDAN K. SPEER, JESSICA BINNS AND DEENA M. AMATO-MCCOY Cover photography courtesy of Kokatat, Photo credit Jordy Searle INNOVATOR . .PAGE INNOVATOR . .PAGE Acustom Apparel . .17 Kokatat . .42 Aerosoles . .10 Koos Manufacturing . .21 Ascena Retail Group . .38 L. L. Bean . .22 Betabrand . .18 Lands' End Business Outfitters . .12 Brooks Brothers . .24 Macy's . .26 Buffalo Exchange . .34 Mitchells . .33 bumbrella . .37 Mizuno Running . .19 Canada Goose . .36 Mountain Equipment Co-op . .29 Chico's . .13 Performance Scrubs . .32 Dragon Crowd . .9 Rebecca Minkoff . .9 Everything But Water . .26 RG Barry . .41 Francesca's . .41 Stantt . .36 Garmatex . .17 SustainU . .33 Harry Rosen . .23 Timberland . .14 Hatley . .43 Topson Downs . .44 in the pink . .11 Twice as Nice Uniforms . .28 JustFab . .30 Under Armour . .21 Kathmandu . .20 Vestagen Technical Textiles . .15 TOP INNOVATOR SPONSORS BY JORDAN K. SPEER, JESSICA BINNS AND DEENA M. AMATO-MCCOY With digital technologies occupying increasing space in our minds and lives, it’s no surprise that many of this year’s award winners took honors for innovations in the areas of marketing and merchandising, or that a number aligned themselves with another big trend that is making waves as technology makes more things possible: mass one-to-one customization. -

The Peer Review Process-The Good Bad and Ugly

The Hospital Medical Staff Peer Review Process: The Good, The Bad, and The Ugly Presented by: www.TheHealthLawFirm.com © Copyright 2017. George F. Indest III. All rights reserved. SUBTITLE: “Practical Matters the Physician Must Know When Confronted by a Medical Staff Peer Review/ Clinical Privileges/Fair Hearing Proceeding” Originally presented by George F. Indest III at an annual meeting of the American College of Surgeons Presented by: www.TheHealthLawFirm.com © Copyright 2017. George F. Indest III. All rights reserved. George F. Indest III, J.D., M.P.A., LL.M. Board Certified by the Florida Bar in the Legal Specialty of Health Law Website: www.TheHealthLawFirm.com Main Office: 1101 Douglas Avenue Altamonte Springs, Florida 32714 Phone: (407) 331-6620 Fax: (407) 331-3030 Website: www.TheHealthLawFirm.com “In the next fifteen minutes we have to create enough confusion to get out of here alive.” -Smith [Clint Eastwood] in “Where Eagles Dare” “If you want to play the game, you’d better know the rules….” -Inspector Harry Callahan [Clint Eastwood] in “The Dead Pool” TERMINOLOGY “Peer Review Hearing” a/k/a – Privileges Hearing – Fair Hearing – Medical Review Hearing – Credentials Hearing – Medical Staff Hearing – Disciplinary Hearing – Credentials Committee Hearing – Ad Hoc Committee Hearing The “Private Practice Physician” We are Discussing 1. Not a Hospital employee. 2. Does not have a direct contract with the Hospital. 3. Not a member of a group with an exclusive contract. 4. Does have clinical privileges at the Hospital. Two components of a physician’s medical staff relationship in a Hospital (often used interchangeably & incorrectly): 1. -

Film Locations in San Francisco

Film Locations in San Francisco Title Release Year Locations A Jitney Elopement 1915 20th and Folsom Streets A Jitney Elopement 1915 Golden Gate Park Greed 1924 Cliff House (1090 Point Lobos Avenue) Greed 1924 Bush and Sutter Streets Greed 1924 Hayes Street at Laguna The Jazz Singer 1927 Coffee Dan's (O'Farrell Street at Powell) Barbary Coast 1935 After the Thin Man 1936 Coit Tower San Francisco 1936 The Barbary Coast San Francisco 1936 City Hall Page 1 of 588 10/02/2021 Film Locations in San Francisco Fun Facts Production Company The Essanay Film Manufacturing Company During San Francisco's Gold Rush era, the The Essanay Film Manufacturing Company Park was part of an area designated as the "Great Sand Waste". In 1887, the Cliff House was severely Metro-Goldwyn-Mayer (MGM) damaged when the schooner Parallel, abandoned and loaded with dynamite, ran aground on the rocks below. Metro-Goldwyn-Mayer (MGM) Metro-Goldwyn-Mayer (MGM) Warner Bros. Pictures The Samuel Goldwyn Company The Tower was funded by a gift bequeathed Metro-Goldwyn Mayer by Lillie Hitchcock Coit, a socialite who reportedly liked to chase fires. Though the tower resembles a firehose nozzle, it was not designed this way. The Barbary Coast was a red-light district Metro-Goldwyn Mayer that was largely destroyed in the 1906 earthquake. Though some of the establishments were rebuilt after the earthquake, an anti-vice campaign put the establishments out of business. The dome of SF's City Hall is almost a foot Metro-Goldwyn Mayer Page 2 of 588 10/02/2021 Film Locations in San Francisco Distributor Director Writer General Film Company Charles Chaplin Charles Chaplin General Film Company Charles Chaplin Charles Chaplin Metro-Goldwyn-Mayer (MGM) Eric von Stroheim Eric von Stroheim Metro-Goldwyn-Mayer (MGM) Eric von Stroheim Eric von Stroheim Metro-Goldwyn-Mayer (MGM) Eric von Stroheim Eric von Stroheim Warner Bros. -

Finding Aid to James Loflin's Bally-Midway-Williams Collection, 1980-1997

Brian Sutton-Smith Library and Archives of Play James Loflin’s Bally-Midway-Williams Collection Finding Aid to James Loflin’s Bally-Midway-Williams Collection, 1980-1997 Summary Information Title: James Loflin’s Bally-Midway-Williams collection Creator: James Loflin (primary) ID: 115.94 Date: 1980-1997 (inclusive); 1996-1997 (bulk) Extent: 4 linear feet Language: The materials in this collection are in English. Abstract: James Loflin’s Bally-Midway-Williams collection is a compilation of original copies of documents from a collector who retains the records of Bally-Midway-Williams. The bulk of the materials are dated between 1996 and 1997, though some are undated. Repository: Brian Sutton-Smith Library and Archives of Play at The Strong One Manhattan Square Rochester, New York 14607 585.263.2700 [email protected] Administrative Information Conditions Governing Use: This collection is open for research use by staff of The Strong and by users of its library and archives. Though the donor has not transferred intellectual property rights (including, but not limited to any copyright, trademark, and associated rights therein) to The Strong, he has given permission for The Strong to make copies in all media for museum, educational, and research purposes. Custodial History: James Loflin’s Bally-Midway-Williams collection was donated to The Strong in January 2015 as a gift from James Loflin. The papers were accessioned by The Strong under Object ID 115.94. Preferred citation for publication: James Loflin’s Bally-Midway-Williams collection, Brian Sutton-Smith Library and Archives of Play at The Strong Processed by: Julia Novakovic, June 2016 Controlled Access Terms Personal Names Gomez, George Kordek, Steve Loflin, James Ritchie, Steve Corporate Names Bally Midway Mfg. -

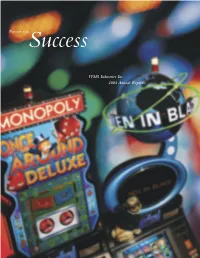

WMS Industries 2004 Annual Report

POISED FOR Success WMS Industries Inc. 2004 Annual Report WMS Industries Inc. (NYSE: WMS) IS EXCLUSIVELY FOCUSED ON THE GAMING INDUSTRY THROUGH THE CREATION, DESIGN, MANUFACTURE AND MARKETING OF HIGH-EARNING VIDEO AND MECHANICAL REEL SPINNING SLOT MACHINES AND VIDEO LOTTERY TERMINALS. WMS’ MISSION IS TO CREATE THE MOST ENTERTAINING GAMING PRODUCTS IN THE WORLD AND SERVICE ITS CUSTOMERS WITH AN UNCOMPROMISING PASSION FOR QUALITY. ALL OF OUR EMPLOYEES EMBRACE OUR CORE VALUES OF INNOVATION, TENACITY, PASSION, QUALITY AND INTEGRITY AND ARE GUIDED BY THE FUNDAMENTAL PRINCIPLE OF TEAMWORK. This report contains forward-looking statements concerning our future business performance, strategy, outlook, plans, liquidity, pending regulatory matters and outcomes of contingencies including legal proceedings, among others. Forward-looking statements may be typically identified by such words as “may,” “will,” “should,” “expect,” “anticipate,” “seek,” “believe,” “estimate,” and “intend,” among others. These forward-looking statements are subject to risks and uncertainties that could cause our actual results to differ materially from the expectations expressed in the forward-looking statements. Although we believe that the expectations reflected in our forward-looking statements are reasonable, any or all of our forward-looking statements may prove to be incorrect. Consequently, no forward-looking statements may be guaranteed. Factors that could cause our actual results to differ from expectations include the risks set forth under “Item 1. Business” and -

SUPERSTOCK INVESTOR This Page Intentionally Left Blank

Y L F M A E T Team-Fly® FM 7/9/01 8:43 AM Page i THE SUPERSTOCK INVESTOR This page intentionally left blank. FM 7/9/01 8:43 AM Page iii THE SUPERSTOCK INVESTOR Profiting from Wall Street’s Best Undervalued Companies Charles M. LaLoggia Cherrie A. Mahon McGraw-Hill New York Chicago San Francisco Lisbon London Madrid Mexico City Milan New Delhi San Juan Seoul Singapore Sydney Toronto McGraw-Hill abc Copyright © 2001 by the McGraw-Hill Companies Inc. All rights reserved. Manufactured in the United States of America. Except as permitted under the United States Copyright Act of 1976, no part of this publication may be reproduced or distributed in any form or by any means, or stored in a database or retrieval system, without the prior written permission of the publisher. 0-07-138116-3 The material in this eBook also appears in the print version of this title: 0-07-136083-2 All trademarks are trademarks of their respective owners. Rather than put a trademark symbol after every occurrence of a trademarked name, we use names in an editorial fashion only, and to the benefit of the trademark owner, with no intention of infringement of the trademark. Where such designations appear in this book, they have been printed with initial caps. McGraw-Hill eBooks are available at special quantity discounts to use as premiums and sales pro- motions, or for use in corporate training programs. For more information, please contact George Hoare, Special Sales, at [email protected] or (212) 904-4069. -

WMS Industries Inc. ”

we LISTEN 2 0 0 9 ANNUAL REPORT W M S I N D U S TR I E S I NC. WMS “SUCCeeDS and continues to achieve profitable GROWTH because we carefully LISTEN to our EMPLOYees & CUSTOmeRS. WMS Industries Inc. ” LIS·TEN (verb) 1. TO PAY ATTENTION 2. TO HEAR WITH THOUGHTFUL CONSIDERATION: TO HEED 3. TO BE ALERT TO CATCH AN EXPECTED SOUND WMS is known worldwide for our groundbreaking gaming experiences and cutting-edge industry technology. Behind our progress and advancement lies a strong Culture of Innovation: an organizational community in which every voice is heard. We have built a formidable talent base and a culture of open minds that remain alert to marketplace changes; and we have the courage to heed what we hear and execute with imagination and insight. 1 WL E ISTEN… a thought, a sound, AN IDEA, an image, a story, an evolution of sustainable long-term growth. STORIE S of a Successful IDEA Mark Foster Damon Gura Human Resources, Director, Advanced R&D, Director, Organizational Development Advanced Applications “ There is a genuine sense of “ Our culture feeds on itself. community, teamwork and Ideas are not only encouraged engagement of our people to and appreciated; they drive accomplish more than we our passion.” can independently.” Colleen Stanton Arturo Hernandez Marketing, Senior Marketing Manager Norm Wurz Manufacturing, Production Supervisor Engineering and Technology, Vice President, Hardware Development “ Great products are no accident—they “ Everyone is valued for their contri- result from a systematic approach and “ We deliver innovative,